2 minute read

Data: Spotlight on productivity

Percentage of construction workers that had received a vaccine booster jab as of December 2021 – the second lowest take-up of any sector, according to the Office for National Statistics 39.8

Inflation pushes sector productivity into the spotlight

Advertisement

Forward planning and investment are key to boosting construction’s lagging figures, writes Kris Hudson

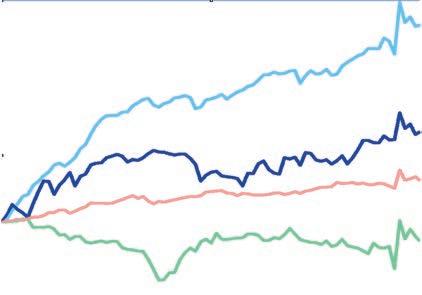

For governments and businesses, improving productivity is a critical measure of success and benchmark of competitiveness. Yet UK construction has long been a poor performer, not just lagging behind other sectors, but actually becoming less productive over time. In the two decades to Q3 2021 the industry’s productivity fell by 9.1% while manufacturing saw an 89.2% increase in the same period.

Unproductive firms limit the sector’s adaptability – making it harder to responded to the sort of demand spikes and supply challenges the past two years have brought. Low productivity also leads to low margins, leaving firms vulnerable at a time when they need to be resilient. The near future will be one of high market unpredictability, and the wider economy will need a strong construction sector as an engine of growth, recovery and the green transition.

Discussion on construction’s poor productivity is longstanding because the

fundamentals of the problem are so entrenched. The sector has a high number of selfemployed workers and small firms, with limited means or opportunity to radically improve performance or benefit from economies of scale. Given major challenges ahead in 2022, helping these firms and contractors needs to be priority.

A general discussion of construction productivity can mask the huge differences within its subsectors. At time of writing, recent market intelligence reporting from Turner & Townsend shows that in nearly 15 years to Q3 2021 civil engineering (infrastructure) productivity actually rose by 12.3%. The area dragging the sector down overall is building construction, with a 6.6% fall over the period.

A key difference is how infrastructure approaches delivery: with long-term programmatic thinking, planning and investment. While it may look hard to translate this to individual building construction, there are lessons to be learned. Transparency and visibility are key – so that firms, big and small, know as far ahead as possible what to expect from the market, and have certainty of cost and schedule on individual projects. The industry must move away from a reactive approach to one focused on planning ahead. This will take cooperation from government, developers and contractors of every size.

Kris Hudson is an economist and associate director at Turner & Townsend.

UK productivity by sector (output per hour worked)

Index (2021 Q3 = 100) Production Manufacturing Services Construction 220

200

180

160

140

120

100

80

60

2001 Q32004 Q12006 Q32009 Q12011 Q32014 Q12016 Q32019 Q12021 Q3

Construction sub-sector productivity

(change over Q3 2007 – Q3 2021)

-10 -5 0 5 10 15

n Civil engineering n Specialised construction activities n Construction of buildings