3 minute read

FINANCIAL FEATURE

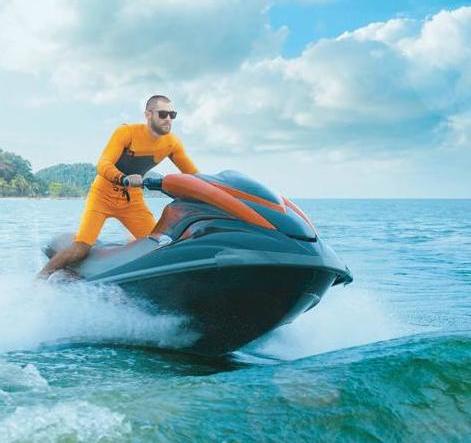

Make a splash!

used vehicle rates as low as 2.25% APR

one-year term

3.25% APR 3.75% APR

two years three years

4.00% APR 4.50% APR

four years five years

Call today or apply online to purchase or refinance your boat or jet ski and

make no payments for up to 90 days!

Subject to credit approval. Restrictions may apply. Rates valid as of 05/01/21. At 4.50% APR, 60 monthly payments of $18.64 for each $1,000 borrowed. Interest will accrue during deferment period. Excludes refinance of existing Southeast Financial loans.

May 6-12, 2021

Subject to credit approval. Rates valid as of 05/01/21. Some restrictions may apply. After the introductory period the 3.25% APR will increase to a fixed rate of 15.25% APR. Earn 2 CU Rewards Points for every $1 spent on travel related expenses such as gas, dining, flights, cruises, lodging, rental cars and more. Points will not be awarded for Cash Advances, Balance Transfers or Convenience Checks.

Picking a Plan

e truth about nancial goals.

One of the rst things a nancial planner talks about with a new client is goals. at makes sense, as planning for something without a target in mind is tough. For most people, expressing goals is actually one of the hardest parts of the process. e goals discussion usually dri s into topics like paying down debt, saving for retirement, and preparing for college. ose goals seem appropriate and are likely to be what the advisor wants to hear, but are side e ects rather than the core of a real goal. Financial planning should support the rest of your life, not exist in an abstract sense disconnected from your true hopes and dreams.

Many people don’t even make it to the point of an awkward conversation about goals with an advisor. e ostrich syndrome is very real — if you don’t look at your long-term nancial plans, then they don’t really exist, right? One way to think about goals is how long you want to work. ese are a few approaches I’ve seen as a nancial advisor.

YOLO: Work Until You Die

A surprising number of people deliberately have no retirement or nancial goals, even a er achieving an income where they could save. ey create a false dichotomy between delaying grati cation until later and enjoying life while they’re young(er). In exchange for a slightly more carefree and extravagant now, those with a You Only Live Once philosophy take on a lot of risk. Unexpected life events happen, and not everyone gets to work as long as they think they can. To me, this seems more about rationalizing a way to avoid a dif cult topic than a real strategy.

Go With the Flow: Work Until Retirement Age

is is the normal approach: Keep down debt, balance saving and spending, get that 401(k) match, accrue Social Security credits, and retire around your mid-60s. Your main nancial goal would probably be: “I don’t know, but more is better.” Any big income advances are met with commensurate lifestyle increase, so retirement around traditional retirement age is a self-ful lling prophecy, regardless of how much money you actually make.

Financial Independence: Work Until … ?

Some people decide to draw a lifestyle line in the sand. As income increases, they don’t spend more. e magic of compounding means that investments can cover living expenses surprisingly quickly. en anything is possible, including travel, volunteering, a new career, or even keeping the current job. is approach creates a lot of resilience and opportunities in the future, but isn’t for everyone.

Where Are You?

Brainstorming your wildest dreams on a piece of paper with no regard to nances is a great way to start guring out what your actual short-, medium-, and long-term goals might be. Your wildest dream might be exactly what you’re doing now, and there’s nothing wrong with that. Just guring out what you want to do and nding the commitment to follow through is the hard part.

ANDREYKUZMIN | DREAMSTIME.COM

Advisors can model a path to almost anything you can imagine, if you just know what you want. If you decide what you want to accomplish and develop a willingness to commit and follow through, your future advisor — and your future self — will nd that planning for it might be the easiest part. Gene Gard is Co-Chief-Investment Of cer at Telarray, a Memphis-based wealth management rm that helps families navigate investment, tax, estate, and retirement decisions.