4 minute read

From profits to resilience

w Bugeja

We live in a time in which our very way of life has changed both drastically and abruptly. The global economy was growing at an acceptable rate, although economists and institutions warned that the number of downside risks were both visible and growing. No one, outside of the scientific community, could have foreseen the impact of such an event on our day to day lives.

Imagine being on an underground train which is quite full of people. The train is speeding along, and all of a sudden, it hits the brakes. People, young and old, of all colours and creeds, find themselves flying across the train car, with injuries varying depending on how and where the person landed when the train stopped.

The train in this case is the global economy. The passengers are the countries, companies, employers and employees. Everyone has been hurt simultaneously, but to varying degrees. In the capitalist model, companies are driven by profit, which they use to pay employees, issue dividends to shareholders, and to reinvest into the company to achieve higher growth. The model is a good one (though with its own set of imperfections, which are well-known, and we will not delve into here), but has proven time and time again to be far from resilient from shocks emanating from both within the economy, and outside of it.

This is not a call to scrap capitalism completely and replace it with something else. It is a system which has, for the most part, allocated people, goods and capital quite effectively for a few centuries now. But in times of crisis, the drive to make maximum profits means that companies inevitably invest in products and services that will yield the greatest return for the lowest possible cost. Industries grew according to their profitability, and most Western countries have interfered very little in shaping and moulding key economic sectors as the years went by. As a result of COVID19 and the unprecedented government interventions in national economies, CNN estimated

that towards the end of March, that figure reached some $7 trillion globally between governments and central banks. And it is early days yet.

How can this change going forward? Companies will inevitably evolve and transform their business models in order to cater for the new normal, until, hopefully, there is a viable vaccine. But that may seem to be two years off. Some will survive. Others may not.

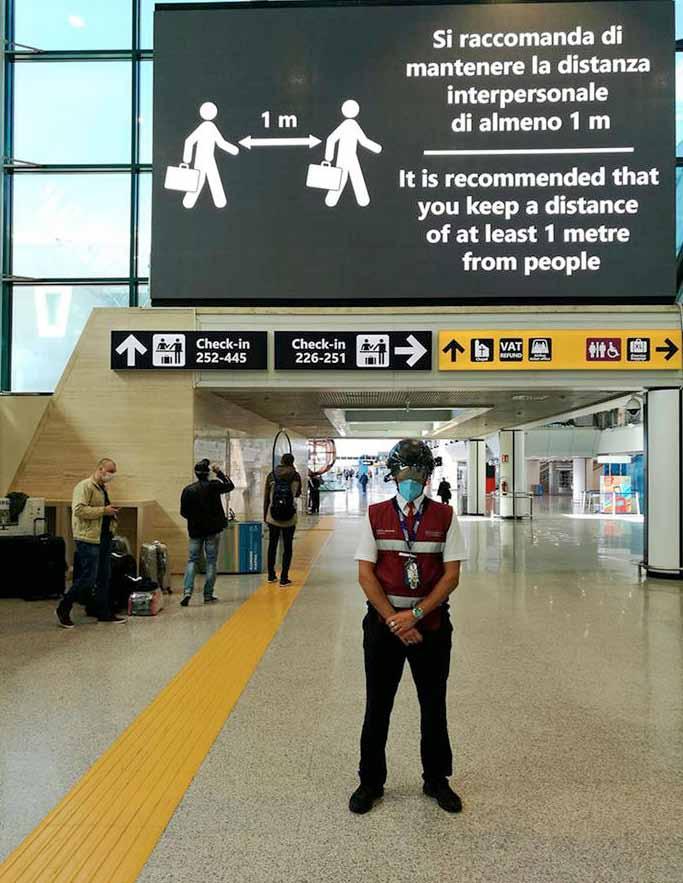

Ending lockdowns will not necessarily stimulate consumer demand sufficiently enough to encourage them to visit shops, restaurants, and hotels. Businesses will inevitably have to find ways to cater for basic human needs in a safe way.

In order to move forward, we may need to look back at older economic models. This may include taking another look at stimulating a sector of the economy that governments the world over have taken for granted for at least a century - agriculture and fisheries. This sector has comprised the lowest share of national gdp for most countries for a number of years. But they are incredibly resilient to shocks for the simple reason that people will always need the nutrition they provide. Some countries would have an easier time of it than others, as some countries, such as Malta, lack the natural resources or space to cater for the size of their populations. However, as time wears on, and it becomes evident that the amount of resilient and essential industries are relatively fewer, investment may well find its way into these underappreciated sectors by both private and public funding.

The state of the global economy at this time would suggest that it is undergoing a rapid transformation. Unemployment has grown at an unprecedented rate in many countries. The United States alone has had 33.7 million people file for unemployment in the period between March 15th to April 30th, which is a 14.7% unemployment rate. The Great Depression of 1929 led to an unemployment rate of 24.9%. If US unemployment continues to grow at the current exponential rate it has been, it may well reach that point by the first week of June, which would be a bleak milestone for President Trump’s reelection ambitions in November.

In order to move forward, entrepreneurs and public policy makers will need to go back to basics, in every sense of the word. Within the context of the means and technology available to us in the 21st century, but with social distancing now in place, what do people still need? Some answers are obvious. Food, water, electricity, entertainment. Then you have to add one more element to the equation: there will be more people with less money for some time to come. So how do you provide a product or service that they will both need and appreciate, and still turn a profit?

One answer may be by tackling those key human needs, and keeping prices as affordable as you can for everyone involved by providing a low cost product for a wide customer base to increase your potential profitability. Agriculture and fisheries, for example, will have less of a problem during the pandemic than high-end clothing shops, for instance. Resilience and adaptability will be key. There are many questions as to how we will survive the pandemic economically. Sometimes, the answers to the future can be solved by looking to the past for how we used to do things before. That may be an avenue worth exploring for the private and public sector alike.