8 minute read

PROPERTY MARKET with Upstate

MARKET UPDATE } PETER MOSEDALE UPSTATE REAL ESTATE

It’s been another busy, yet exciting couple of weeks for all of us here at Upstate. As we bid farewell to the holiday period and look towards the year ahead, let’s summarise what’s happening on the ground in the Northern Beaches property market.

Advertisement

THE NORTHERN BEACHES PROPERTY MARKET CONTINUES TO HOLD STRONG

Right now, the Northern Beaches auction clearance rate is hovering around 74%, which is still considered quite strong.

Between Boxing Day and New Year’s Eve, we launched several properties live to market, which helped get the jump on that traditional boost in supply that comes around Australia Day and this generated a huge amount of enquiry and interest early on.

“We’ve seen enquiry across the Sydney Metro market down about 28%, however on the Northern Beaches, we’re only down about 3%, once again showing the resilience of our market,” says Peter Mosedale –Upstate Director.

IT’S STILL A GREAT TIME TO ENTER THE SYDNEY REAL ESTATE MARKET

Here at Upstate, we’ve got a wide selection of property stock across all sectors and property types.

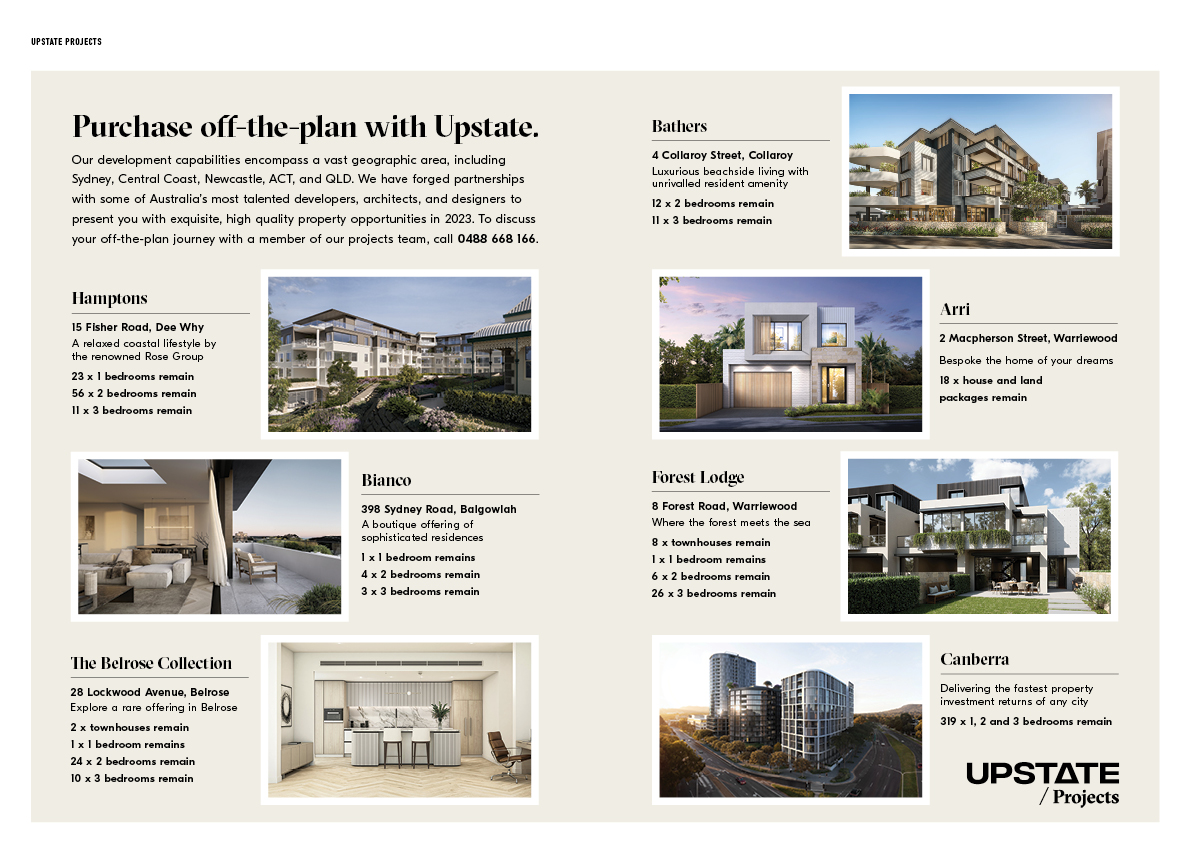

As it stands, we’ve currently got more than 76 properties on the market between our residential and commercial divisions. We’ve also got 610 properties being sold off the plan across 18 projects spread between Canberra and the Gold Coast.

“We’ve put these real estate initiatives in place to help more people get into the market and build their wealth,” says Peter. “So, if you are thinking about entering the property market at what is ultimately a great stage to buy, then come and talk to us. We’ve got a property for you.”

THE SECOND ANNUAL UPSTATE CONFERENCE

In early February, we held our 2023 Upstate Sales Conference, and it was another enormous success.

We had over 40 of our staff kick off the day with personal training, before sitting down to listen to several key speakers to keep them informed, get them engaged and train them in the best techniques to help our clients maximise their real estate results.

It was another inspiring day for our team at Upstate and a fantastic way to begin another stellar year ahead in 2023.

So, what does the future hold for Upstate?

Recently, our entire team sat down with a prominent market economist to gain a better understanding of the real data in the Sydney property space right now and keep up-to-date with what’s going on around us.

We were told that the majority of the Australian real estate adjustment has already taken place, and there may only be a little more to go at the worst.

This would explain why we continue to see huge volumes of enquiries about our open homes.

“Last week, we had 76 groups through a single property, and on average, we’re seeing 22 groups through every open home inspection. This indicates it’s still a strong market,” Peter tells us.

Of course, where the market is going to go from here, no one truly knows. What we do believe, however, is that interest rate rises are slowing. This is helping to bring confidence and optimism back into the market and tells us that there are blue skies ahead.

UPSTATE IN 2023

At Upstate, we’re keeping a strong focus on our growth mentality while bringing several key digital initiatives to market this year, and we’ve got more staff joining our team. This means that we’re excited for a very positive 2023.

“We’re looking forward to a strong year of sales and some great opportunities, especially for those people either entering the market or looking to upgrade,” says Peter.

As always, if there’s anything we can do for you concerning Sydney residential real estate, Northern Beaches commercial real estate or any of our Upstate property projects, we’d love to hear from you. •

Peter Mosedale Licensee/Director in Charge 0408 177 207 / peter@upstate.com.au

COMMERCIAL REVIEW } VINCENT WEST UPSTATE REAL ESTATE

Let’s recap on the year that was and our predictions for 2023.

We had a very busy year at Upstate Commercial, with more than 250 completed sale and lease transactions plus substantial growth of our asset management portfolio. Our highest sale price for 2022 was $26 million.

The average sale price for Commercial property in 2022 was $2,275,000 and the average lease price was $46,500 + GST.

Domain/Commercial realestate.com reported to Upstate that we were the number one agency for listings, with 3 times more views than their number 2 agency. This proves the size of our business, and the way we present properties is benefiting our owners that list through Upstate, with faster transactions and a greater choice of buyers and tenants. With over 35% market share across the Northern Beaches, we’ve identified the latest movements and trends for commercial property markets.

WAREHOUSES

The year remained strong for warehouses across the board with the big end of town being a little more cautious but still transacting with realistic vendors. The main buyers are owner occupiers with quite a few being downsizers who were selling their family homes to move into an apartment and keep their toys.

Other buyers are businesses that are doing well and expanding. With a distinct lack of stock, these buyers are paying more than investors to secure a place for their business as they know it will give the business security and will be a long-term hold.

Investors needing to borrow were not so successful in securing warehouses as they were unable to justify the yields against commercial lending rates and seeking circa 5% Net. On the flip side, investors who are cash buyers are still seeing value at 0.5 – 1% below cap rates of borrowing investors.

For investments with shorter lease terms that an occupier could access within a year or so, warehouses are being sold on even tighter yields of 1.25 – 1.75% less that average investment yields depending on the tenancy duration.

RETAIL

Tenanted Retail is still attracting investors around the 5 – 5.5% Net range depending on the price point, type of tenant, term of lease and location. Strong retail locations including places like Manly, Dee Why and small suburban retail centres are performing well and still have interest with a wide array of investors. Historically the case has been a mixed bag for the owner-occupier market for retail. Some businesses are keen to secure themselves a position, but typically in smaller suburban retail centres whereas main retail centres are still dominated by investors and tenants.

OFFICES

For the smaller investors, offices were popular as they attracted buyers that couldn’t afford to get into the residential market. These were being sold at around 5% – 6% Net returns. The higher the yield of course, the greater the risk, and it has been slower on the leasing side for these properties in areas like Belrose, Frenchs Forest and Warriewood. However, strata office vacancy rates in Dee Why and Manly are at all time lows with a big uptake on space getting people out of bigger offices in the CBD and out from working at home.

THE OUTLOOK

Savvy vendors wishing to sell are seeing the benefits of listing now to reduce the amount of competition with potential for more listings coming on with interest rates still rising. The first half of 2023 may see a high number of transactions. If you wish to do the same, call today for an obligation free appraisal and advice on the right sales methodology for your property. •

DA APPROVED } Bilgola Plateau // 1 Bilambee Lane

Upstate, as the exclusive selling agents, is pleased to offer this outstanding DA approved development opportunity situated in the leafy suburb of Bilgola Plateau. The DA approval consists of seven large residential apartments with a mix of two and three bedrooms and two wellproportioned retail spaces.

A rare opportunity to acquire an approved site in this tightly held pocket of the Northern Beaches is available, providing astute developers and investors with an amazing opportunity to purchase, develop and either rent or on-sell apartments to cater for the shortage of similar stock in the area.

• Land size: 930m2

• DA approved for seven residential apartments and two retail lots

• Site boasts an excellent corner position

• Tightly held residential suburb with limited development opportunities

• Well-designed apartments with four 2 beds and three 3 beds

• Strong population and demographic trends for the region

• Convenient position being close to the city, all local amenity and pristine beaches

• Excellent asset for your development pipeline with exponential price growth in the local real estate market

• Unique asset in key Northern Beaches location

VINCENT'S COMMERCIAL SELLING SUCCESS

Lindfield: Lot B Lady Game Drive: 6.17ha

SOLD

Elanora Heights:19A Wesley Street: 5.184ha

SOLD

Belrose:22 Narabang Way: 1.589ha

SOLD

Brookvale: 40 Orchard Road: 969.2m2

SOLD

Vincent West Commercial Licensee/Director in Charge / 0403 444 000 vincent@upstate.com.au