2022 Car Buyer Journey Study

Cox Automotive has been conducting the Car Buyer Journey Study for the past 13 years to determine key changes in consumer buying behavior. The extensive study is based on a survey of over 10,000 consumers who were in the market to purchase or lease a vehicle in 2022. Highlighted here are the main insights revealed in this year’s Car Buyer Journey Study.

Satisfaction with the experience is down to pre-pandemic levels

Used car buyers experienced a sharper decline vs. new buyers

70%

INSIGHT 2

Completing all steps of the financing journey online saves 2 hours at the dealership

More steps completed online = higher satisfaction and less time at the dealership

Total Time Spent at Dealership

1 2 4 6 3 5 7 3hrs WITH 1-3 FINANCIAL STEPS COMPLETED ONLINE

© 2022 by Cox Automotive, Inc. All rights reserved. Arrows indicate significant difference between years at the 95% confidence interval 1 Research & Market Intelligence

INSIGHT 1 74% 72% 54% 56% 58% 60% 62% 64% 66% 68% 70% 2016 2022 2021 2020 2019 2018 2017 60% 61% 62% 60% 72% 66% 61%

2021: 65% USED

58%

2021:

71% NEW

Looking up credit score Comparing interest rates Pre-qualifying for loan Applying for credit Calculating monthly payment Pre-approval for a loan Signing paperwork

<1hr WITH ALL 7 FINANCIAL STEPS COMPLETED ONLINE Average of new and used buyers

Online research increased due to inventory shortages

4 89% YEAR OVER YEAR

Nearly 1 in 5 new vehicles purchased in 2022 were pre-ordered, an 89% yearover-year increase

© 2022 by Cox Automotive, Inc. All rights reserved. 2 Research & Market Intelligence Arrows indicate significant difference between years at the 95% confidence interval

INSIGHT 3 33% 17% Third-Party Dealership* OEM Online Used Vehicle Retailer 2016 2022 2021 2020 2019 2018 2017 76% 60% 79% 79% 61% 79% 52% 24% 79% 59% 34% 75% 56% 25% 78% 61% 56% 25% 26% 27% 25% 29% 11% 7% 3% N/A 69% 2021: 65% SITE USED Automotive Website Category Usage Average Supply New Vehicles Used Vehicles 2020 2020 2022 2022 Decline Decline 3.0M 2.6M 1.1M 2.5M -1.9M -100K Increased Cross-Shopping (new and used) Vehicle selection was limited 56% 39% 2021 Considered both new and used vehicles 64% 56% 2021 *Source: Cox Automotive Car Buyer Journey – 2022. +Dealership includes CarMax.

INSIGHT

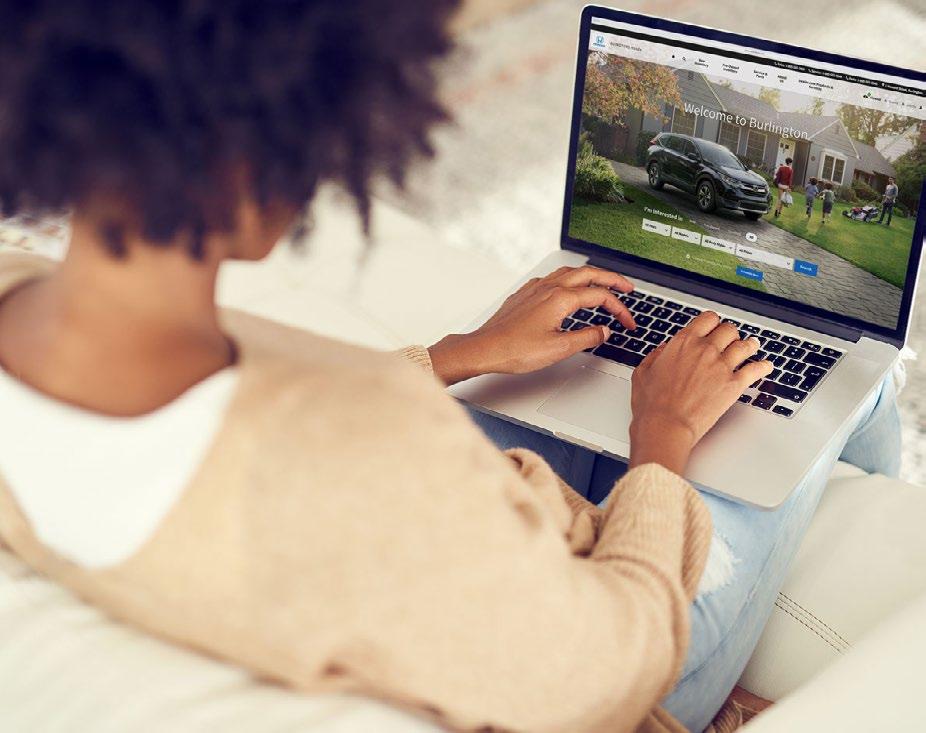

Consumer preference for online purchasing continues to climb

68% of shoppers would do most or all of the purchase online in the future, and 80% are open to buying entirely online (both metrics up significantly in the last year).

Omnichannel and e-commerce will grow, and buyers will seek out websites with these capabilities

Dealer website is the top site consumers envision themselves using to purchase a vehicle entirely online in the future, with OEM and third-party sites on the rise

Sites Consumers Could See Themselves Purchasing/Leasing from Online in the Next 1-2 Years

(Among those who would consider buying completely online in next 1-2 years)

© 2022 by Cox Automotive, Inc. All rights reserved. 3 Research & Market Intelligence Arrows indicate significant difference between years at the 95% confidence interval

INSIGHT 5 68% 54% 2021 80% 76% 2020

Method for completing purchase process

8% 28% 64% 53% 8% 39% All in person Mix All online 45%

ALL IN

What buyers did in 2022 What shoppers will likely do next time *Source: Cox Automotive Car Buyer Journey – 2022 // 2022 Cox Automotive Digitization of End-to-End Retail.

*

OF

PERSON

6

Dealership

69% Directly from the OEM 46% Third party automotive website 40% Online dealership 39% Vehicle finance lender 30% Car buyer service 28% Another online retailer 15%

INSIGHT

website

INSIGHT

EV buyers purchase online to save time, while new ICE buyers do so to avoid feeling pressured or rushed

80% of EV buyers (vs. just 61% of new vehicle ICE buyers) are likely to do all or most of the purchase process online in the future, primarily because they want convenience, control, and ease.

80% EV BUYERS LIKELY TO PURCHASE ONLINE IMPLICATIONS

61% NEW VEHICLE ICE BUYERS LIKELY TO PURCHASE ONLINE

2022 Car Buyer Customer Journey

2

1

Dealers can pacify shopper pain points by leveraging online tools that enable real-time inventory and price transparency

OEMs can benefit from increased crossshopping by targeting conquest audiences through online channels

3 Meet consumers where they are by delivering a digital strategy that includes omnichannel and ecommerce

4 Dealers can increase adoption of F&I products by providing product descriptions and pricing online

5

EV online purchase experiences should deliver to the buyer a feeling of control and confidence

6 Include pre-order language and content on websites and target pre-order campaigns to consumers further out from purchase

7 Enhance pre-order process with vehicle tracking and more touchpoints during wait period

© 2022 by Cox Automotive, Inc. All rights reserved. 4 Research & Market Intelligence

7