Advising future CPAs: Strategies for navigating the 2024 exam

11 tips for e ective DEI training

Pay to play: Can pay transparency help CPA firms attract and retain talent?

| APRIL 2024

MARCH

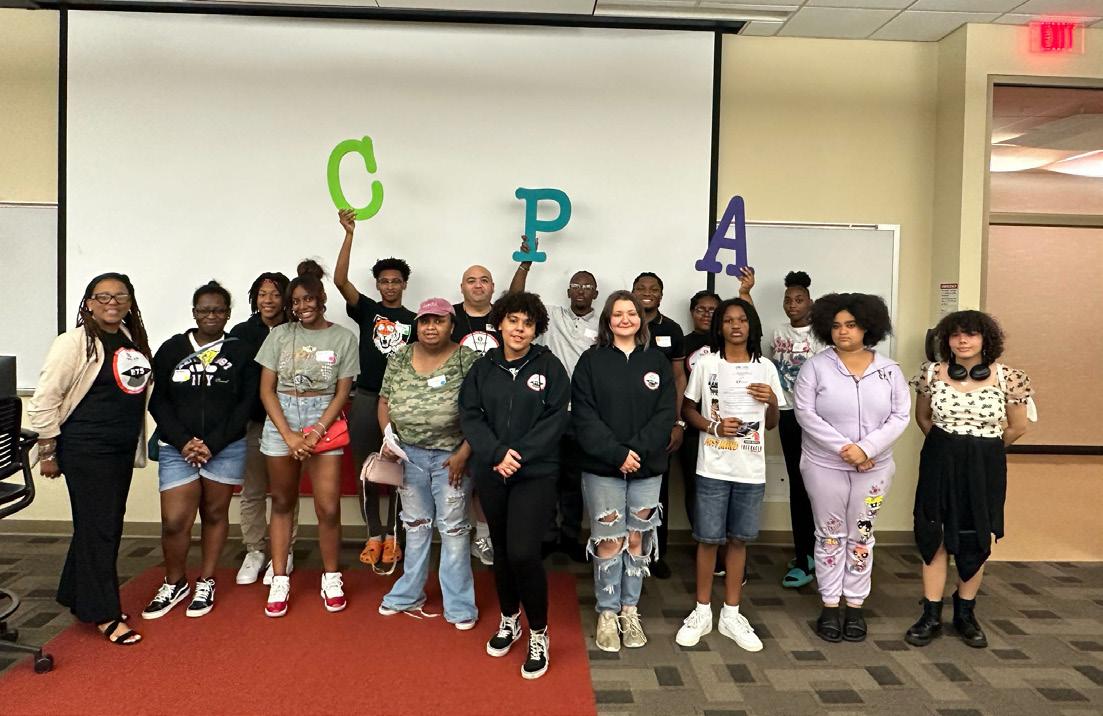

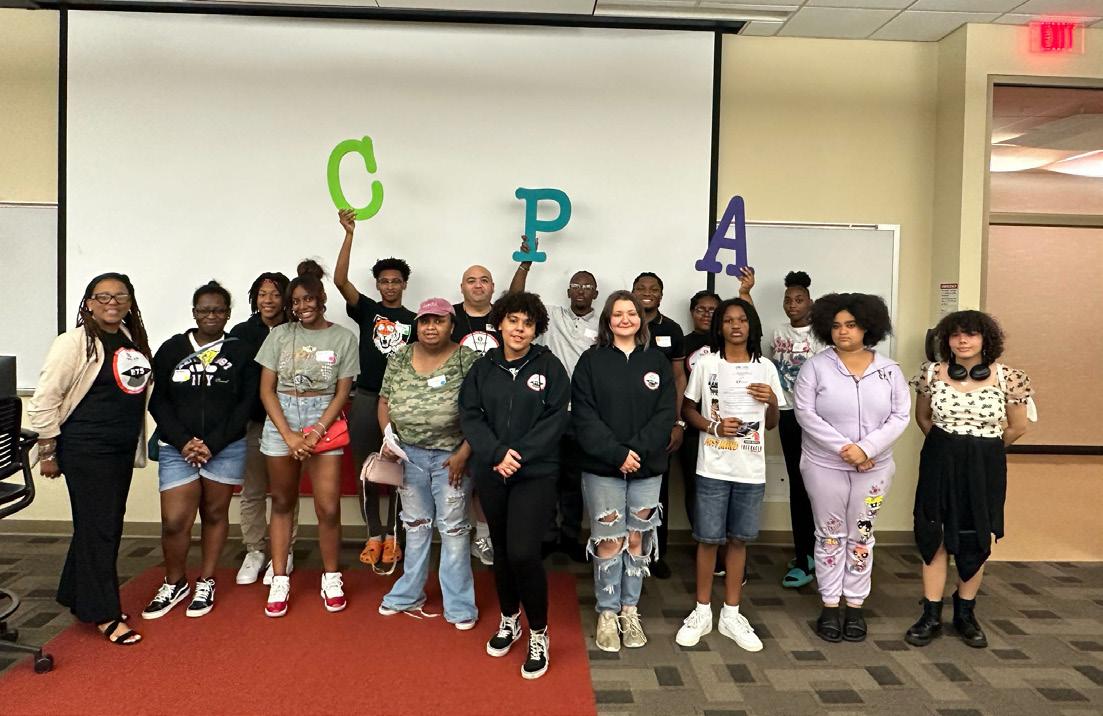

You to the individual donors and members who make the commitment to support today’s accounting students and tomorrow’s CPAs.

Our 2023 programs reached more than 1,700 students in high school and college.

We granted $95,000 in scholarships to promising students.

We’re on 26 campuses with accounting majors as our Student Ambassadors.

We inspire more than 5,000 student members as they prepare for a future in the accounting profession.

Follow this QR code to see the donors who generously supported the future of the profession.

Join your peers with an investment today. Make a gift to The Ohio CPA Foundation at ohiocpa.com/GiveToFoundation

Learn more about our work at ohiocpa.com/Foundation

Thank

CONTENTS

feature

26 Advising future CPAs: Strategies for navigating the 2024 exam

The CPA exam undergoes a transformation and gives candidates more to consider when thinking about their future.

in depth

2 CEO letter

3 Self-assessment exam

Free for members!

4 OSCPA weighs in on Minnesota legislature pursuing alternative CPA licensure path

States across our nation are concerned about the shrinking number of individuals seeking to become CPAs and the negative impact that could have on employers and those they serve.

6 Supporting employees through personal challenges: A guide for leaders

A goal for leaders should be to develop a loyal and long-lasting team, and supporting team members through tough times is part of that.

8 11 tips for effective DEI training

Set workplace expectations and give people the training they need to be successful in DEI.

10 Upping the game on quality

Transitioning from a compliance approach to incorporating the purpose of the standards will improve effectiveness.

14 Pay to play: Can pay transparency help CPA firms attract and retain talent?

To attract and retain more talent CPA firms are considering increasing their pay transparency.

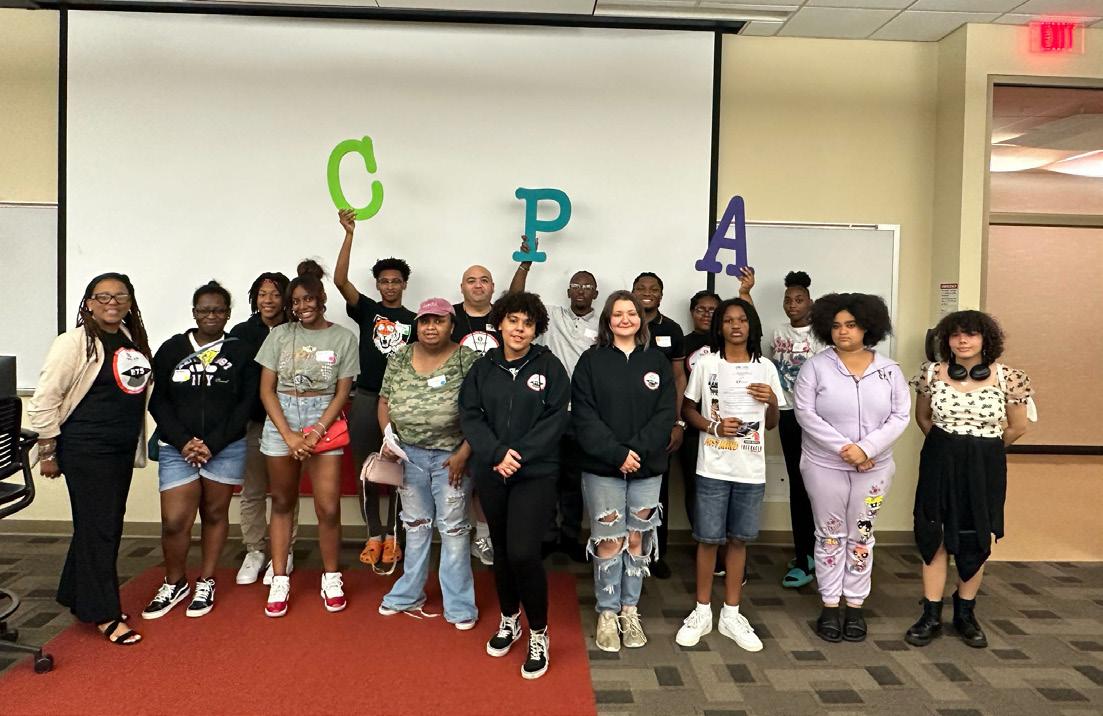

20 Sharing accounting’s story to make an impact

Retelling accounting's story is a critical factor in the sustainability of the profession.

30 Members in motion

VOLUME 16 | ISSUE 2

EDITOR

Jessica Salerno-Shumaker –jsalerno@ohiocpa.com

GRAPHIC DESIGN

Kyle Anderson – kanderson@ohiocpa.com

EDITORIAL OFFICES

CPA Voice

4249 Easton Way, Suite 150 Columbus, OH 43219

Tel: 614.764.2727

Email: CPAVoice@ohiocpa.com

Website: www.ohiocpa.com

ADVERTISING

For our display advertising rates or a copy of our media kit, contact us at sales@ohiocpa.com or call 614.764.2727

ARTICLE SUBMISSIONS

We welcome submissions of analytical articles on issues relevant to Ohio CPAs. Desired length is 800-1200 words. Send an electronic copy with a cover letter to the editor at the email address above. Please note that CPA Voice is not a peer-reviewed journal.

SUBSCRIPTIONS/CIRCULATION

Members of The Ohio Society of CPAs receive CPA Voice as a member benefit. Nonmembers may subscribe for $39.95 annually. To update your mailing address or to subscribe to CPA Voice, contact your Member Service Center at 614.764.2727, option 2.

REPRINTS

To order reprints of CPA Voice articles, or for reprint permission, contact the editor at the address above.

CPA Voice is the official magazine of The Ohio Society of Certified Public Accountants. CPA Voice’s purpose is to serve as the primary news and information vehicle for more than 19,000 Ohio CPA members and related professionals. Articles are reviewed for technical accuracy. However, the materials and information contained within CPA Voice are offered as information only and not as practice, financial, accounting, legal or other professional advice. While we strive to present accurate and reliable information, The Ohio Society of CPAs makes no warranties regarding the accuracy of the information provided herein. Readers are strongly encouraged to conduct appropriate research to determine the accuracy of the information provided and to consult with an appropriate, competent professional adviser before acting on the information contained in this publication. The statements of fact, thoughts, advice and opinions expressed in CPA Voice are those of the authors alone and do not represent or imply the positions, opinions, nor endorsement of The Ohio Society of CPAs or of its publisher, editors, Board of Directors, or members. It is our policy not to knowingly accept advertising that discriminates on the basis of race, religion, gender, age or origin. The Ohio Society of CPAs reserves the right to reject paid advertising in its sole discretion. We do not necessarily endorse the resources, services or products unrelated to The Ohio Society of CPAs that may appear or be referenced within CPA Voice and make no representation or warranties about those products or services or the accuracy and claims regarding those products and services. Advertisers and their agencies assume liability for all advertisement content and responsibility for all claims resulting from such advertisements made against The Ohio Society of CPAs. The Ohio Society of CPAs does not guarantee delivery dates for CPA Voice and disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delivery delays. CPA Voice (ISSN 0749-8284) is published six times per year by The Ohio Society of CPAs, 4249 Easton Way, Suite 150, Columbus OH 43219, 614.764.2727. Subscription price for non-members: $39.95. Copyright © 2023 by The Ohio Society of CPAs; all rights reserved. No part of the contents of CPA Voice may be reproduced by any means or in any form, or incorporated into any information retrieval system without the written consent of CPA Voice Permission requests may be sent to the editor at the address above. While care will be given to all materials submitted for publication, we do not accept responsibility for unsolicited manuscripts, and they will not be returned unless accompanied by a self-addressed postage prepaid envelope. Periodicals postage paid at Columbus, OH and at additional mailing offices. POSTMASTER: Send address changes to: CPA Voice The Ohio Society of CPAs, 4249 Easton Way, Suite 150, Columbus OH 43219. MARCH | APRIL 2024 | 1

A WORD from our CEO

Creating value for the long term

In the January/February issue I encouraged you to embrace a “year of purpose,” where you protect your time and prioritize the areas and opportunities in your life that will make the most impact. As you work toward this effort, you might find yourself looking for the value in your everyday activities to determine what is worth your time.

Continue to search for that value in everything you do, no matter how small or large. You might find yourself confronted with fact that initiatives you thought were helping you meet your goals are no longer a fit, and that’s okay. While it can feel uncomfortable, or even slightly embarrassing, to realize something is no longer creating value, the important part is what you do about it. Beware of the thinking “this is what I’ve always done,” and instead consider how you’ll pivot once you know what is worth your time and what isn’t.

The value might not always be a tangible output you can point to immediately, but rather something that helps you become a more grounded, well-rested individual. While immediate results are exciting and shouldn’t be ignored, creating meaningful value can take months or even years.

OSCPA is joining you in your pursuit of what’s valuable, from addressing the accounting talent shortage to meeting your learning needs. Find the value you’re looking for in our learning events this spring at the Strategic Finance & Accounting Conference, Employee Benefit Plan Audit

2 | CPA Voice

Conference, Spring Advance and the CORECon –Core Skills Conference. Register now at ohiocpa.com/myoscpa

How are you creating value? Reach out to me through my contact information to share how your value creation journey is going.

Self-Assessment Exam

Log in to ohiocpa.com/myoscpa, look up the exam using the product ID number above and answer the 12 required questions based on content in CPA Voice

Cost Members Free

Nonmembers $40

Exams remain available online – and may be completed for CPE – through the same month of the following calendar year.

SCOTT D. WILEY President and CEO

swiley@ohiocpa.com | 614.321.2218 (o ce) | 614.546.9430 (cell)

MARCH | APRIL 2024

Product ID: #59837

Online Instructions

1. Log in to ohiocpa.com/myoscpa

2. Search "CPA Voice" and then find the appropriate exam.

3. If you're a member, click "Enroll." If you're a nonmember, click "Add to cart" and purchase the exam.

4. On the confirmation page click “Go to your learning center.”

5. The exam will be available under the "Current" section. Turn off pop-up blockers, then click "Launch."

Self-Assessment Exam Results

Respondents taking the exam online receive their results immediately. Respondents who pass with a grade of 70% or better receive one hour of CPE credit in specialized knowledge, as approved by the Accountancy Board of Ohio.

Twitter: @ScottDWiley | LinkedIn: www.linkedin.com/in/scottwileycae

MARCH | APRIL 2024 | 3

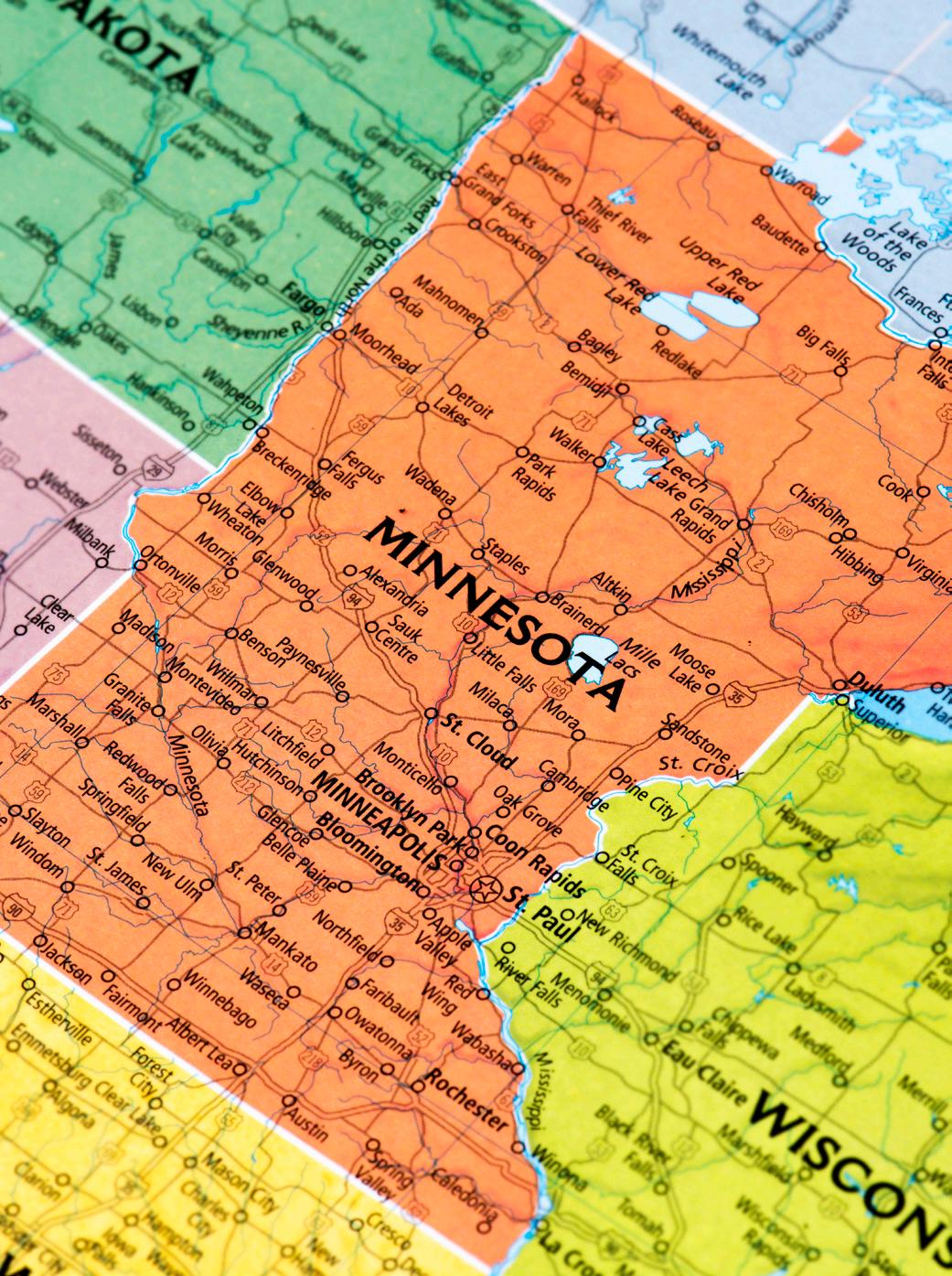

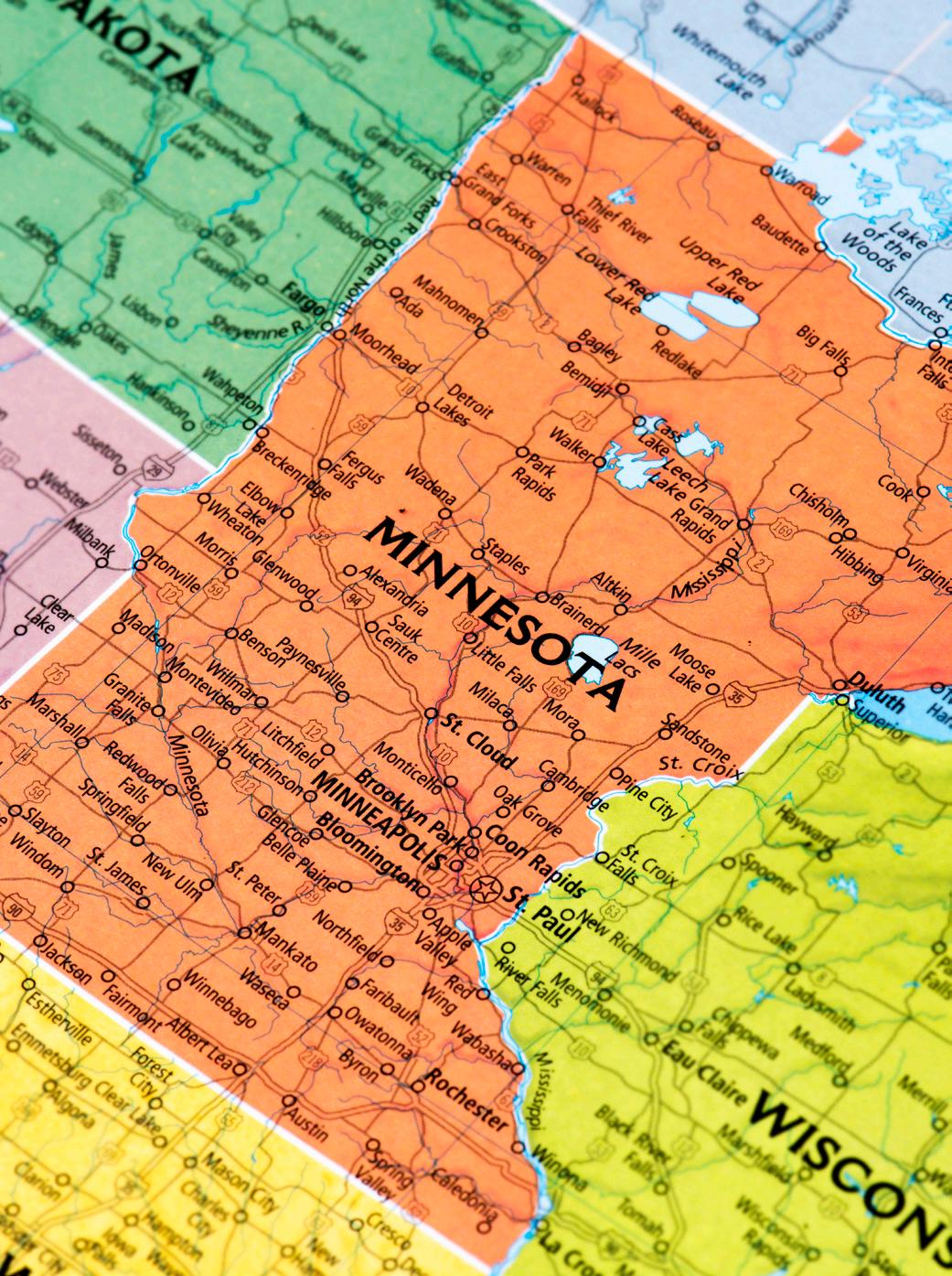

OSCPA weighs in on Minnesota legislature pursuing alternative CPA licensure path

By Barb Benton, CAE, OSCPA senior vice president, advocacy

Like Ohio, states across our nation are concerned about the shrinking number of individuals seeking to become CPAs and the negative impact that could have on employers and those they serve.

Minnesota is the first state to pursue a new legislative solution to their current workforce challenge, and OSCPA shared Ohio’s experience of having two longstanding pathways in addition to the traditional 150-hour licensure requirement.

Legislation being pursued by the Minnesota Society of CPAs received a hearing March 7, and OSCPA weighed in to share existing Ohio law with Minnesota state senators, verifying that Minnesota would not be the first state to offer alternative licensure options.

The Minnesota legislation seeks to retain the current 150hour education and one-year experience requirements and adds a second pathway allowing 120 hours of education and two years of experience for licensure.

The American Institute of CPAs (AICPA) also weighed in on SF 1660, sharing concerns that – should Minnesota law change – current licensees would no longer be eligible for interstate mobility. The CEO of Clifton Larson Allen, the nation’s eighth-largest CPA firm, submitted supportive testimony as did the Minnesota Society of CPAs, the Minnesota State Auditor, and owners of other CPA firms.

ADVOCACY in focus

4 | CPA Voice

The bill was unanimously voted out of the Senate State and Local Government and Veterans Affairs Committee and next goes to the Minnesota Finance Committee for consideration. A companion bill in the Minnesota House is expected to begin hearings soon.

Separately, both AICPA and the National Association of State Boards of Accountancy (NASBA) created task forces that currently are working toward the goal of a national solution states could adopt to address current pipeline challenges and also maintain interstate mobility. NASBA’s leadership recently released the proposed language that allows for an additional path of 120 semester hours and two years of an undefined, off-transcript “Specialized Professional Program”. OSCPA currently is in the process of evaluating the NASBA proposal; AICPA already has expressed concerns about it.

Both task forces have Ohio representation, and both are working toward having detailed, proposed solutions ready for state consideration this summer. At press time, AICPA and NASBA boards must approve a proposed change for it to be included in the Uniform Accountancy Act, which is model language many states use to craft legislative and regulatory changes.

For future legislative updates, continue reading this column in CPA Voice and Legislative Update, OSCPA’s weekly advocacy e-newsletter.

C-Corp and S-Corp contributions prohibited. PAC investments are not tax deductible per Ohio law. Want a voice at the Ohio Statehouse? Help us protect your interests by investing in Ohio CPA/PAC. Every donation—no matter the size—allows us to amplify your voice at the Statehouse and impact the issues that matter most. Your PAC investment helps: • Protect and promote the CPA credential • Limit tax expansion and cut regulatory red tape • Secure a competitive business environment in Ohio • Elect state legislators who share your professional interests Let’s make our voice even louder this year! To donate, visit or call 614.764.2727 ohiocpa.com/PAC

MARCH | APRIL 2024 | 5

Supporting employees through personal challenges: A guide for leaders

By Erin McCormick, member experience strategist, Boomer Consulting

Employees often face personal challenges that can impact their professional lives.

As a leader, no matter how adept you are at handling professional challenges, you may be unsure how to handle personal issues.

While not always easy, supporting team members through these tough times is crucial. Doing so can help your employees feel encouraged and build trust—a goal for any leader looking to maintain a loyal and productive team.

While employees can face various challenges, they often fall into one of a handful of categories.

• Financial difficulties. Economic hardships can arise from unexpected expenses, debt, or a family member's job loss. These pressures can lead to stress that affects an employee's concentration and productivity.

• Health issues. Whether personal or involving a family member, health concerns can be a significant source of stress. This includes chronic illnesses, mental health struggles or acute medical emergencies.

• Family responsibilities. Balancing work with family life, especially for those caring for children or elderly relatives, can be challenging. Family dynamics, such as marital problems or parenting issues, also add to this burden.

Strategies for supporting employees

The type of support that will be most well-received varies depending on

the individual and their situation. It’s always a good idea to talk to any employee you know or believe to be struggling and discover the help they need. However, here are some ideas.

Offer flexible scheduling

Flexibility can be an enormous help to employees dealing with health issues or caring for a family member. Consider options like:

• Flexible hours. Allowing employees to start and end their day earlier or later can help them manage personal appointments and responsibilities.

• Remote work opportunities. If an employee typically works in the office, offer the option to work from home or another remote location. This reduces the stress of commuting and provides privacy and a comfortable environment for those dealing with personal issues.

• Discouraging unnecessary overtime. An employee may work longer hours remotely because work is always accessible. Encourage people to scale back while they get a handle on their situation. In many cases, overtime might be a habit rather than a true expectation. Work with them to set achievable work goals that consider their current situation.

Proactive communication of support

Employees dealing with personal challenges may worry about losing their jobs, which adds another layer of stress to an already difficult time.

Leaders should initiate conversations to reassure struggling employees that their jobs aren’t on the line. These regular check-ins can also help you gauge an employee’s well-being and offer support when needed. Employees may not feel comfortable providing details on their situation, but encourage a culture where people can feel comfortable discussing their challenges without fear of judgment.

Highlight available employee benefits

Many employees are not fully aware of the benefits available to them. Ensure they know about:

• Counseling services

• Health and wellness programs

• Financial planning assistance

As leaders, our role extends beyond managing work; it involves supporting our team members holistically. By offering flexible scheduling, proactively communicating support, ensuring awareness of employee benefits, and reassuring job security, you can help your team members navigate their challenges while maintaining a productive and positive work environment. Remember, a supported employee is more engaged and loyal and brings their best self to work, contributing to the firm's overall success.

Erin McCormick is the member experience strategist for Boomer Consulting, Inc.

Erin McCormick is the member experience strategist for Boomer Consulting, Inc.

CAREER

center

6 | CPA Voice

To ensure you receive information that aligns with your interests and preferences, please update your member profi le to specify where we can reach you and what types of communication you’d like to receive. It’s quick and easy. Just follow these simple steps:

1. Log in to your account on MyOSCPA.

2. Click on your name to access your profi le.

3. Navigate to “Profi le & Account.”

4. Update your contact information and communication preferences accordingly.

Land the perfect professional connection

Whether you’re still basking in the glow of passing your CPA exam, a mid-level manager who needs a change, or a seasoned CFO who wants top talent, the OSCPA Career Center is your one-stop-shop to uncover rewarding careers and discover untapped talent.

Employers:

• Post jobs

• Review resumes

• Screen candidates

• Expand your reach with enhanced posting options

• Explore our recruitment and retention resources

Job Seekers:

• Search for jobs

• Customize your job alerts

• Post resumes anonymously

• Save resumes and cover letters on your dashboard

• Access videos and articles on interviewing, resume writing and more

• Get free interview coaching via email or more personalized coaching for a fee

PROFILE ACCOUNT SETTINGS 100% CONTACT INFO FIRST NAME CONTACT INFO LAST NAME

my.ohiocpa.com

le Today—

to

We appreciate you being a valued member of our community! Update Your Member Profi

Your Inbox Will Thank You! Remember to add OSCPA@ohiocpa.com

your safe senders list.

For more info, visit ohiocpa.com/career-center MARCH | APRIL 2024 | 7

11 tips for effective DEI training

Kaela Sosa, cofounder,

The Diversity Movement

A key component of any successful diversity, equity, and inclusion (DEI) strategy is education and training.

The only way to influence attitudes and workplace behavior is to set workplace expectations and give people the training they need to be successful. After more than three years of conducting transformative DEI training sessions, we’ve found that the most meaningful programs are those customized to fit the needs of each organization and team. Decades of research has also shown that workplace training programs have little impact if DEI isn’t integrated into the company’s culture. One-off sessions and compliance-based training won’t have the lasting impacts necessary to improve employee engagement, retention, innovation, and other bottom-line outcomes.

In our work with more than 100 clients across the world, we’ve come up with 11 tips that will ensure your training doesn’t fall flat.

1) Customize your training.

DEI training should not be approached with a one-size-fitsall mindset. Several factors influence what type of training will be successful in your organization: size, industry, DEI competence, geographic location, previous DEI training efforts, leadership buy-in, roles within the organization, the current sociopolitical climate, and so on.

At the very least, you must consider where your organization is on its DEI journey. If you’re just starting out, DEI training that reviews DEI definitions and concepts such as unconscious bias and systemic racism, might be a good place to start. If your organization already has a companywide understanding of key terms and concepts, perhaps you move past the basics and conduct training on allyship or inclusive language. Ask yourself: What training is the company ready for?

If you have the bandwidth to conduct multiple training sessions, you should consider breaking individuals out based on their role within the organization – are they a frontline worker, middle manager, or senior leader? Based on their role, the training that appeals to – and is most effective for them – will differ. For instance, employees who interact with customers must be proficient in inclusive language, but might not need to understand how to establish a supplier diversity program. In order to gain C-suite buy-in, DEI training for leaders should include the business case for DEI. Finally, middle managers might benefit from training on leading multigenerational teams.

2) Make your training recommended, but optional.

While this may seem counterintuitive, training is most effective when it is not mandatory. In fact, mandatory training often increases resistance and defensiveness. While there may be some instances where training is required, such as for the recruiting team, training almost always should be optional. In order to boost attendance, senior leaders throughout the organization should participate to serve as a model for the rest of the employee base. Additionally, you might consider incentivizing attendance by providing lunch at training events or giving away attendance prizes at each training session.

3) Focus on the human component.

Remind people that despite having different values, beliefs, backgrounds, races, gender identities, sexual orientations, or cultures, we are all human. We are more similar than we are different. When people disagree wholeheartedly on an issue, it’s easy to vilify and otherize each other. Reminding folks of our shared humanity helps increase empathy and understanding.

, equity & inclusion

DIVERSITY

8 | CPA Voice

4) Amplify underrepresented voices.

Make sure to include underrepresented voices in your training, whether the speaker is an employee or outside expert. As stated by disabilities rights activist James Charlton, “nothing about us without us.” In other words, no policy, training, donation, or celebration should be decided or enacted without the full and direct participation of members of the group affected by that action. For instance, if you’re conducting an LGBTQ+ allyship session, hire an LGBTQ+ speaker; if you’re putting on an event for Black History Month, involve Black employees at your company in the planning process.

5) Teach people how to respond when x, y, or z happens.

For instance, not knowing how to respond when a coworker comes “out,” can lead folks to do or say the wrong thing in the moment, perpetuating a non-inclusive company culture. Supply folks with a script and a few actions they can take to respond in this scenario. A simple formula people can use is 1) thank the person for trusting you, 2) ask how you can support them, and 3) depending on the situation, ask who else knows, so that you can protect their privacy and safety.

Some other events you might prepare folks for include witnessing a microaggression, experiencing harassment, and learning that a colleague is undergoing gender transition.

6) Link to organizational values.

As with any DEI initiative, remind participants that the purpose of the training is not to change people’s minds, faith, or political choices. Rather, training sets expectations for workplace behavior. It is conducted so that people can better understand and respect each other while being held accountable for the organization’s mission, vision, and values.

7) Establish learning agreements.

Start any DEI training session by establishing a safe space free of judgment and fear. Some recommended learning agreements include:

• Assume positive intent.

• Engage in dialogue, not debate.

• Hold yourself and others accountable for demonstrating cultural humility.

• Be open, transparent, and willing to admit mistakes.

• Embrace the power of humble listening.

• Create trusting and safe spaces – spaces where a little bit of discomfort is okay.

• Commit to having conversations that matter by speaking up to bridge divides.

8) Share personal stories.

Research has shown that storytelling is one of the most powerful methods to increase empathy, change attitudes, and influence behavior. If you’re conducting a training on microaggressions, have someone share how experiencing microaggressions influenced their perceptions of belonging in the workplace. If you’re hosting a disability etiquette training, have someone from the disability community explain how people’s assumptions about their capabilities affected how they were perceived and treated at work.

9) Make sure the training is extensive.

For example, because of the historical lack of LGBTQ+ inclusivity training in organizations, many employees may enter the training with little to no previous knowledge. As such, it’s critical to cover as much material as possible without overwhelming new learners. A few pieces of information that you should cover in this instance include terminology, pronouns, inclusive language, inclusive hiring practices, and policy and employee handbook updates. We also recommend following up on any training with discussion sessions, reflection guides, or other activities. These follow-up opportunities solidify learning and ensure training doesn’t become a one-and-done approach.

10) Pair concrete information with attainable, actionable takeaways.

Most DEI training is based on disseminating knowledge without providing post-training action items. Therefore, there is a lack of sustainable follow through because participants still have the question, “What do I do?” Make sure that you provide concrete next steps participants can take. For instance, at the end of an unconscious bias training, encourage folks to uncover their personal biases via Harvard’s implicit bias tests. After an allyship training, challenge participants to take one action that week to become a more active ally.

11) Give space for questions and discussion.

As mentioned before, some people may be new to the information you’re providing and need permission to ask what’s on their mind. Others may need space to think aloud and process the information. Another group might want to share their personal stories. Take this opportunity to remind participants of the learning agreements, so people can ask questions and share thoughts openly and without fear of retaliation.

Article provided by The Diversity Movement.

Kaela Sosa is co-founder and Manager, Curriculum and Programming at The Diversity Movement.

MARCH | APRIL 2024 | 9

Upping the game on quality

By Laura Hay, CPA, CAE, OSCPA executive vice president

AUDIT & assurance

10 | CPA Voice

Common audit and attestation matters

Data on matters noted during peer reviews is collected to assist in developing guidance and practice aids for the most common hurdles professionals face. Transitioning from a compliance approach to incorporating the purpose of the standards will improve focus and effectiveness, advancing the profession’s mission of quality.

Risk assessment

The annual prominence of risk assessment on this list underscores that its adoption may center around compliance rather than actual modifications to the audit approach. Common risk assessment matters include:

• Not assessing risk at the relevant assertion level

• Assessing control risk at high without testing controls

• Failure to identify at least one significant risk

• No linkage between assessed risks and procedures performed

• Failure to tailor procedures for risks identified

• No reassessment of risks based on results of procedures

• Missing documentation for assessment of inherent risk below high

• Failure to identify revenue recognition as a significant risk or to document why it would not be a significant risk

Training on how risk assessment connects to and improves the audit will improve the firm’s return on this investment.

Next steps: SAS 145 is here, and it revises how significant risk is defined, how inherent risk and risks arising from IT should be assessed, and clarifies how the auditor should test, respond to risks and communicate them to those charged with governance. Taking steps to update audit processes can improve audit efficiency and productivity.

Accounting and review services

Particularly in review, compilation and preparation engagements, frequent errors in engagements letters, management letters and reports include:

• Not stating all financial statement periods covered

• Not including all language required by the most recent professional standards, including appropriate titles

• Incorrectly listing the statements included in the report

• Not disclosing that substantially all disclosures have been omitted on the face of the financial statements or in the selected notes

• Not identifying all of the non-attest services performed in the engagement letter (or other written agreement with the client)

• Incorrectly disclosing other bases of accounting used

• Not disclosing departures from the financial reporting framework including the omission of the statement of cash flows

• Omitting the statement that at a minimum, no assurance is provided on the financial statements

• Rep letter date not being the same as the opinion date

Also check these frequent review engagement errors: Have review reports and documentation been updated for SSARS No. 25, including documentation of the determination of materiality? Are analytical procedures documented in accordance with standards, including expected results, and a comparison of expectations to recorded amounts?

Not-for-profit organizations

Do the financial statements of not-for-profit organizations reflect the requirements of the most recent professional standards (ASU 2016-14), including reporting of functional expenses?

Employee benefit plan audits

In addition to the matters above, including risk assessment documentation, frequent EBP audit matters include:

• Not updating the auditor’s report, engagement letter and/or management representation letter for AU-C section 703

• Insufficient documentation of the reliance on and evaluation of a SOC1 report, including testing the operating effectiveness of complementary user entity controls

• Insufficient documentation of procedures performed, particularly in a limited scope audit

• Failure to test participant contributions and the allocation of contributions and investment income to participant accounts

• Incomplete documentation of sampling

• Insufficient testing, documentation and disclosure of parties in interest and party in interest transactions

Governmental and Single Audit

As well as properly documenting risk assessment, matters often noted in governmental and Single Audit engagements include:

MARCH | APRIL 2024 | 11

• Not documenting independence considerations required by the Yellow Book, including the evaluation of management’s skill, knowledge or experience to effectively oversee nonaudit services performed by the auditor, or evaluation of significant threats and safeguards applied to reduce threats to an acceptable level

• Not meeting Yellow Book CPE requirements

• Incorrectly identifying, testing and documenting major programs and their compliance requirements, including:

– Failure to properly cluster programs

– Failing to audit the minimum percentage of total federal awards expended as required by the Uniform Guidance

• Failing to test or document testing of the operating effectiveness of internal controls over compliance for all compliance requirements subject to audit that were direct and material

• Not documenting sampling methodology or failing to select an appropriate sample, including due to:

– Inappropriately identifying the population

– Using sample sizes not supported by the risk assessment of material noncompliance

• Insufficient documentation related to the schedule of expenditures of federal awards (SEFA), including omitting required elements, internal controls over the preparation of the SEFA, and a reconciliation of the SEFA to amounts in the financial statements

Other frequent audit matters

Additional frequent matters in audit engagements include:

• Not documenting audit procedures such that an experienced auditor would understand the nature, timing and extent of audit procedures performed - see AU-C 230

• Not documenting the consideration of the impact of revenue recognition standards (ASC 606)

• Failure to implement or to consider the impact of the new lease standard (ASC 842)

• Omitting language in the engagement letter regarding management’s responsibilities in non-attest services

• Not disclosing the date through which subsequent events were evaluated

• Incorrectly classifying long-term debt and cash flows, presenting net amounts instead of gross, and not identifying non-cash transactions on the cash flow statement

• Not documenting sampling methodology

• Omitting references to schedules of supplementary information in the report

Remediation

A peer reviewed firm’s letter of response should address actions the firm has taken or plans to take to remediate nonconforming engagements. AU-C Section 585, “Consideration of Omitted Procedures After the Report Release Date”, addresses requirements of the auditor to assess the effect of omitted procedures on the auditor’s ability to support a previously issued opinion. Remediations may include recalling the report, recalling and reissuing, performing omitted procedures and/or adding documentation to the file. If the firm chooses not to remediate a non-conforming engagement, their justification should be explained in their response.

THREE THINGS

1. Transitioning from a compliance approach to incorporating the purpose of the standards will improve focus and effectiveness, advancing the profession’s mission of quality.

2. The annual prominence of risk assessment underscores that its adoption may center around compliance rather than actual modifications to the audit approach.

Laura Hay, CPA, CAE, is the executive vice president of The Ohio Society of CPAs and the staff liaison to the Accounting, Auditing, Professional Ethics Committee and Peer Review Committee. She can be reached at Lhay@ohiocpa.com or 614.321.2241

3. A peer reviewed firm’s letter of response should address actions the firm has taken or plans to take to remediate nonconforming engagements.

12 | CPA Voice

Read CPA Voice on Issuu.com, and never miss the latest news, best practices, trends in the profession and information on what OSCPA is doing to serve you as a member. issuu.com/cpavoice Follow us at: issuu.com/CPAVoice Read on Issuu MARCH | APRIL 2024 | 13

Pay to play: Can pay transparency help CPA firms attract and retain talent?

By Carolyn Tang Kmet, senior lecturer in Loyola University Chicago’s Quinlan School of Business

BUSINESS management & strategy

14 | CPA Voice

In March 2023, Alex Cheney was laid off from his role as a senior technical recruiter at a global software company headquartered in San Francisco.

Having spent more than a decade in the talent acquisition space, Cheney is a seasoned professional who’s well aware of the latest trends impacting the hiring and recruiting landscape—and now he’s leveraging that knowledge in his own job search. One of those trends is the passing of pay transparency laws, which require companies to disclose salary ranges in job descriptions.

“As a current job seeker, seeing the pay range of a role has saved me from spending a lot of time applying to jobs that don’t align with my expectations, skill level, or needs,” Cheney explains.

Currently, about 20 states have some variation of legislation designed to address wage disparities and promote fair compensation practices in the job market. There is no statewide law in Ohio, but employers with 15 or more employees in Cincinnati, Columbus, and Toledo are prohibited from asking job applicants about their wage or salary histories. Additionally, there are several cities that have passed their own ordinances. One of those cities is San Francisco, where the Parity in Pay ordinance requires employers with 20 or more employees to provide pay ranges in their job listings.

Of course, CPA firms are no stranger to these types of staffing challenges as retaining and attracting new talent continues to be one of greatest issues impacting the accounting profession today. The National Association of State Boards of Accountancy reports that the number of new CPA candidates has decreased by 33% in recent years, dropping from slightly over 48,000 candidates in 2016, to 32,186 candidates in 2021.

As a result, CPA firms have spent time gambling on ways to expand their hiring pool, and for some, that means being more transparent about their pay—whether they’re required by law or not.

The game is changing

Abraham Singer, assistant professor of business ethics at Loyola University’s Quinlan School of Business, believes secrecy turns wage negotiations into a game of poker. “Without pay transparency, job seekers can’t see the hiring company’s cards and must guess how much to wager,” Singer says. “Pay transparency can help turn

everybody’s cards over, so everyone is operating with similar information.”

In today’s climate, where the demand for CPAs outstrips the supply, pay transparency laws provide job seekers with greater leverage. Neil Dickinson, vice president of compensation services and pay equity solutions for OutSolve, an affirmative action consulting firm, says that applicants who have a clear understanding of a job’s pay range are empowered to not undersell their services.

Secrecy has consequences

In the past, discussing compensation was considered taboo, inappropriate, and improper in many workplaces. Unfortunately, this cultural norm resulted in negative consequences for employees, fostering a discriminatory corporate environment that led to significant pay gaps based on gender and race. For instance, employer biases against women and minorities could affect hiring, promotions, and salary decisions. Without accurate insight into pay ranges, female and minority job applicants may be unaware that their salaries are being undercut.

This impact can be seen in a 2021 income report issued by the U.S. Census Bureau, which shows that women who work full-time, year-round jobs earn 84 cents for every dollar earned by men in the same category. In regard to racial inequity, the U.S. Department of Labor found in 2021, for every dollar earned by white, non-Hispanic men, Black women were paid 67 cents, and Hispanic women (of any race) were paid 57 cents.

Singer stresses that lack of pay transparency disproportionately benefits those that have more access and privilege. “It tends to benefit the savvy, seasoned, and confident when it comes to negotiations over pay and salary,” Singer says. “If it’s not clear what the going rate is for a position, then those who have more experience know what to ask for in a way that someone new to the industry might not, including those from working-class backgrounds or recent immigrants. Similarly, those inclined to be more brazen tend to ask for more and are often rewarded for it.”

According to Singer, this method of negotiating pay can also affect wages in a gendered manner, contributing to

MARCH | APRIL 2024 | 15

the wage gap between men and women in the workforce. Recent research conducted by Linda Babcock and Sara Laschever and presented in their book, “Women Don’t Ask: Negotiation and the Gender Divide,” reports 2.5 times more women than men say they feel a great deal of apprehension about negotiating, and about 20% of adult women say they never negotiate.

Is pay transparency the roadmap to equity?

Many experts believe that pay transparency can lead to greater equity in wages by forcing employers to be more thoughtful and equitable about salary decisions.

Jon Hill, CEO and chairman of The Energists, an executive search and recruiting firm, advises companies to consider pay transparency as an opportunity to recognize and address potential biases, and to develop more open communication about equitable compensation across the organization. By doing so, organizations will not only build credibility with current employees, but also with potential new hires.

“In my experience, most companies that have inequitable pay practices didn’t establish them intentionally,” Hill says. “Instead, these practices are the result of unconscious biases and/or a lack of communication between leadership and employees.”

Hill stresses that pay transparency sends a message that a company has nothing to hide when it comes to their

salary rates, giving candidates more trust and faith in the organizations they’re applying to: “Transparency has additional benefits for companies that pay a competitive rate because it can help entice qualified professionals to join your organization when they know you pay your team members in accordance with industry standards.”

Neema Parikh, the recruiting manager at Topel Forman LLC, a tax and accounting firm with a presence in Chicago and Denver, says disclosing a pay range creates more equality between genders and minorities. “It enables you to be as least biased as possible, which opens your potential hiring pool up as much as possible,” Parikh says. “Because when you put in a salary range, you’re not thinking about whether you’re targeting a man or a woman.”

Challenge considerations for firms

Of course, being transparent can present some challenges for firms to consider. One potential challenge is that it could result in a market-wide increase in salaries as workers are more likely to initiate informed negotiations, and as employers start responding to market conditions.

Dickinson says another likely outcome of pay transparency is wage compression, which occurs when higher competition for new talent drives smaller differences in pay between new hires and long-term employees.

Another challenge associated with pay transparency is that it only serves to regulate the quantitative aspect of wages. In

16 | CPA Voice

is your smorgasbord of learning!

Industry experts and thought leaders will share their knowledge and experiences

Get the latest updates on:

• Financial reporting and auditing

• State and local tax developments, including a legislative update

• Professional standards and responsibilities (ethics)

• The economy and what’s ahead in 2024

5-9

May 23 | Aug. 22 | Dec. 13 8:30 a.m. – 4:30 p.m. | Virtual | 8 credits MULTIPLE Stay ahead of the curve and advance your fi nancial accounting, audit and assurance, tax, and ethics expertise.

and

approaches to mastering your core skills,

explore innovative strategies and practical

moving you from compliance to competence.

Call Member Services at 614.764.2727 (option 2) to register your group.

ohiocpa.com/CORECon

attendees = 10% off 10+ attendees = 20% off Register online through MyOSCPA

reality, wages are also tied to an employee’s perceived value or worth within a company or industry. Higher wages may indicate that an individual is more highly skilled or experienced in their field, or that their contributions to the company are particularly valuable. Conversely, lower wages may suggest that an individual is less skilled or experienced. Additionally, wages are more than just a tool for compensation. Wages are also often used to motivate employees, which adds a psychological component to pay transparency.

Firms should also anticipate the potential negative consequences that may arise when salaries are released internally.

Singer says that it can get tricky when firms reward longstanding, loyal employees by increasing their compensation. These wage increases aren’t necessarily tied to their specific skill sets or to the market rate for the position, yet they’ll impact the salary range disclosed in job descriptions, thus driving market salaries higher and making future negotiations with new talent more challenging.

While there are many important implications that companies need to consider when implementing pay transparency, the long-term societal and market benefits certainly outweigh the challenges.

“The equity and efficiency that pay transparency enables is worth these management difficulties,” Singer acknowledges.

“One way to navigate such difficulties is to follow the logic of transparency all the way down. Companies shouldn’t just be transparent about pay ranges, but also with how and why pay can sometimes depart from the market rate.”

Pay transparency laws will undoubtedly shift the balance of power between job seekers and employers and intensify the hiring process in competitive fields like accounting. However, CPA firms willing to play the game may see pay transparency as an opportunity to not only correct systemic bias and create a path to pay parity, but also use it as a beneficial recruiting tool to attract and retain talent.

Reprinted with permission of the Illinois CPA Society.

Carolyn Tang Kmet is a senior lecturer at Loyola University Chicago’s Quinlan School of Business.

1. CPA firms are seeking out ways to expand their hiring pool, and for some, that means being more transparent about their pay.

THREE THINGS

2. Many experts believe that pay transparency can lead to greater equity in wages by forcing employers to be more thoughtful and equitable about salary decisions.

3. There are challenges for firms to consider when it comes to pay transparency, such as wage compression, internal resentment and more.

18 | CPA Voice

Online learning for planners and procrastinators alike. OSCPA’s learning subscription o ers access to over 100 engaging, up-to-date, high-quality on-demand CPE courses vetted and approved by CPAs for CPAs—this isn’t the “check the box” stu you get other places. Take your CPE when and where you want from reputable learning providers—including OSCPA. Save time and money below. ohiocpa.com/AccessPass What’s good and bad in the world of accounting and business isn’t as straightforward as you’d think. Register now for one of our toprated Ethics events and learn to spot unethical antics a mile away. or call 614.764.2727 Register now at: ohiocpa.com/ethics got ethics? Spring Ohio Professional Standards and Responsibilities March 21, 2024 | 8:30 a.m. – 11:15 a.m. | Virtual Summer Ohio Professional Standards and Responsibilities June 13, 2024 | 8:30 a.m. – 11:15 a.m. | Virtual Fall Ohio Professaionl Standards and Responsibilities September 26, 2024 | 8:30 a.m. – 11:15 a.m. | Virtual Winter Ohio Professaionl Standards and Responsibilities December 6, 2024 | 8:30 a.m. – 11:15 a.m. | Virtual Very engaging and worthwhile. This is

good

ethics training gets. – Debra Weber, Kirsch CPA Group, LLC MARCH | APRIL 2024 | 19

as

as

TALENT management & human resources

Sharing accounting’s story to make an impact

By OSCPA staff report

20 | CPA Voice

It is long overdue for accounting’s story to be retold in a way that highlights the opportunities of the career, and that retelling is a critical factor in the sustainability of the profession.

“We gravitate to stories and form perceptions, and we make decisions off of those perceptions,” said Tiffany Crosby, CPA, chief learning officer at OSCPA. “Stories shape our thinking, and in a digital age, those stories are being shared more broadly.”

Unfortunately, how accounting’s story is shared among students and new grads is impacting the profession’s ability to attract and retain talent. To address this, the formation of OSCPA’s Ohio Accounting Talent Coalition last fall listed “messaging” as a key pillar in the work required to change the trajectory of the profession’s future.

That messaging includes changing how accounting’s story is told, where it’s told, and by whom, to shift perceptions of the profession, drive engagement from the most critical stakeholders and refill the talent pipeline.

Aligning the message

For the messaging to be successful, there needs to be alignment among the parties spreading the message, Crosby said. The benefit of the OATC is that key companies and individuals can collectively pool resources to help each other shape the message and then share that unified message with the public.

This messaging will cover the following areas, with “we” referring to the accounting profession:

1. Why we exist

2. Who we serve

What we stand for

Where we are going

The OATC is in the process of creating storytelling assets for coalition members to share, enabling them to tell accounting’s story more quickly and easily than individual members producing assets themselves and potentially spreading conflicting messages.

As part of the strategy, there will be marketing and PR components that will be research-based and data-backed combined with media efforts to create conversation and drive action with the intended audience.

A key part of this work will be partnering with influencers to create positive discussions and challenge misconceptions to reach Gen Z, millennials and Gen X in a way that feels genuine and impactful.

3.

4.

3.

4.

5. How we will get there

MARCH | APRIL 2024 | 21

Recognizing the truths about the profession

Crosby pointed out that sharing the true story of accounting more widely will mean acknowledging some of the less desirable truths of the profession, such as the lack of diversity or the outdated work models still used by some firms.

The disconnect between how the public views accounting and what professionals encounter every day can’t be ignored. In reality, accountants are shaping the business world and are instrumental to the work of entrepreneurs, owners, partners, CEOs, CFOs, founders and many more.

“The challenge with the storytelling here is you have to learn to reckon with those uncomfortable parts while also sharing where we're trying to go and how we’re trying to change some of those truths,” Crosby said.

Getting more people involved will help make the messaging more authentic, she said, because while not everyone has the same path to the profession, this is actually a strength. There are countless inspiring, unique stories to share of accounting professionals in Ohio and it proves this is a profession for anyone with a passion for changing business for the better, and you don’t have to look a certain way or have a certain background to succeed.

How do I become part of the Ohio Accounting Talent Coalition?

To join the coalition, OSCPA has a commitment process with a clear definition of the level of engagement members need to have with the society, the coalition and The Ohio CPA Foundation. To learn more about what’s required to join please contact Tiffany Crosby, tcrosby@ohiocpa.com, or Lori Brown, lsbrown@ohiocpa.com.

22 | CPA Voice

• A U.S. Department of Labor update • Accounting and auditing update • Retirement legislation update • Fiduciary responsibilities, ERISA compliance and best practices

Initial plan audit overview

Peer review update • Form 5500 • Audit technology • Risk management best practices • EBP audit beginner boot camp Hear from the DOL and peer review experts on the latest updates and top audit issues through interactive learning focused on the EBP sector and enhancing audit quality. Learn more at Sponsored by: or call 614.764.2727 (option 2 for Member Services) April 26, 2024 8:30 a.m. – 4:30 p.m. 8 credits Register by 3/29 to save $50 AU ohiocpa.com/EBPA24 2002-2024 CELEBRATING THE REGION’S LEADING INCOME TAX REDUCTION EXPERTS Call Craig Miller ACCELERATE DEPRECIATION AND SHIELD INCOME TAXES NOW OF COST SEGREGATION YEARS •Cost Segregation •Energy Efficiency Certifications (179D) •New IRS Repair v. Capitalization Cleveland 440.892.3339 / Columbus 614.362.3773 Detroit 248.289.4880 / www.costsegexperts.com 22 2002-2024 MARCH | APRIL 2024 | 23

•

•

Sharing those individual stories will make a difference in reaching a wider, more diverse audience. OATC is working to change those stereotypes of the profession and instead shift the focus to the future of the profession.

“We're at the table, we're in the game,” Crosby said. “We're in the room where it all happens. We speak the language of business. There's a disconnect between how we're being described, how we're being thought of and how we actually think of ourselves.”

This is part of an ongoing series to highlight OSCPA’s efforts to help address the accounting talent shortage in Ohio. Read the first part of the series in our January/ February 2024 issue at ohiocpa.com/cpavoice.

THREE THINGS

1. OATC is focused on messaging as a key pillar in the work required to change the trajectory of the profession’s future.

2. The disconnect between how the public views accounting and what professionals encounter every day can’t be ignored.

3. There are countless inspiring stories to share of accounting professionals in Ohio and you don’t have to look a certain way or have a certain background to succeed.

24 | CPA Voice

9:00 a.m. – 3:00 p.m. Virtual | 6 credits PD + 2

Connect with hundreds of peers for a day of insight and motivation at this year’s Women, Wealth & Wellness Conference. Hear from inspirational women leaders as they share actionable strategies to help you on the path to personal and professional success.

Shawna Suckow

Best-Selling Author, Speaker and Coach

Topic: Your Best Year Starts Today

Dr. Ashley Lowe-Simmons, LCSW-C Owner, Conversations With a Clinician

Topic: Fin-Emotions: Ain’t Finance Funny

Dr. Ceara Hintz, Ph.D. Manager, Management Consulting for Accenture

Topic: Numbers Don’t Lie: Women’s Value in Leadership and Where to Go From Here

Sponsored by

Elisabeth Galperin Founder & CEO of Peak Productivity

Topic: Transforming Busy to Productivity

Leslie Graf, CPA Founder & CEO of LFG Consulting

Topic: Your Brain is Human—Give Yourself Grace

Help us celebrate this year’s Power of Change honorees and scholarship recipients at an in-person luncheon on Nov. 21 from 11:30 a.m. to 2:00 p.m. at Columbus State Community College. Be in the room as we recognize the outstanding women who have made an extraordinary impact on the profession and

July 18, 2024

complimentary On-Demand credits

Join us for both events and save! For details and to register, visit:

business community. ohiocpa.com/BestLife

MARCH | APRIL 2024 | 25

Advising future CPAs: Strategies for navigating the 2024 Exam

By Cameron Cockrell, Ph.D., chair and associate professor of accountancy and Timothy Miller, Ph.D. associate professor of accountancy, Xavier University

As the accounting profession navigates a dynamic landscape of evolving skills and technological advancements, the CPA exam is undergoing a transformative evolution of its own.

ESSENTIAL skills & professional standards 26 | CPA Voice

2024 ushers in a new era that embraces specialization and changes its long-held tradition of complete uniformity. While three core sections persist, the exam now invites candidates to choose their own adventure—or rather, their own fourth “discipline” section—tailoring their expertise to align with specific career aspirations.

This departure from the traditionally uniform nature of the exam raises compelling questions for educators and advisors: How can we best prepare the next generation of CPAs to navigate this uncharted territory? What strategic considerations should guide their choices? Finally, how can we ensure these candidates excel in their chosen discipline?

Classic core sections (FAR, AUD, and REG)

The topical coverage of the three “classic core” sections remains largely historically consistent.

Financial Accounting and Reporting (FAR) still covers Generally Accepted Accounting Principles (GAAP), the accounting cycle, financial statements, financial analysis, and other related topics. Acknowledging its rare use in practice, the direct method of preparing the statement of cash flows is no longer on the for-profit entities’ exam. While some GASB material remains in FAR, some moves to the new Business Analysis and Reporting (BAR) discipline section of the exam. Other examples of advanced topics moving to BAR are Goodwill Impairment, Software costs, and R&D costs.

Auditing and Attestation (AUD) remains largely the same. It still covers audit principles, risk assessment, internal controls, and audit opinions. The most notable change is that some material was shifted into AUD from the former Business Environment and Concepts (BEC) section, including elements of business process analysis and internal controls.

Taxation and Regulation (REG) still covers tax compliance and planning for individuals, corporations, partnerships, and other entities at the federal level. The topics previously housed in REG will be split between the new version of REG and the Tax Compliance and Planning (TCP) discipline section. The overall goal of the revised REG section is to focus on “regular and recurring” transactions. Many of the more advanced technical topics, such as multijurisdictional tax issues, move to the TCP section.

Discipline Sections (BAR, ISC, and TAX)

The ever-evolving landscape of accounting necessitates agility and adaptation. Recognizing this, NASBA and the AICPA introduced the three-part "Discipline Sections" within the CPA exam. This pivotal change represents a proactive approach to futureproofing the profession by ensuring new CPAs with deeper expertise in specialized areas. It also acknowledges the exponential growth in accounting

knowledge. Since 1980, the Internal Revenue Code has tripled in size, accounting standards have quadrupled, and auditing standards have quintupled (NASBA 2019). The discipline model addresses this expansion by offering focused areas of study in Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP), allowing candidates to tailor their CPA qualification to their unique career aspirations.

Business Analysis and Reporting (BAR) is the section perhaps most akin to the departed Business Environment and Concepts (BEC) section of the prior CPA exam. BAR is divided into three subsections with different topical focuses which cover (1) business analysis, (2) technical accounting and reporting topics, and (3) state and local governmental topics. Business analysis covers select cost accounting topics, financial modeling and forecasting, non-financial performance measures, capital structure, financial valuation models, and the COSO risk management framework. Subsection two delves deeper into a variety of technical topics such as goodwill, revenue recognition, R&D costs, stock compensation, business combinations, benefit plans, and derivatives. Finally, subsection three is a more detailed assessment of GASB accounting than what is covered on the core FAR exam.

The Information Systems and Controls (ISC) discipline stands as a testament to the digital revolution's influence on accounting. Its three areas: (1) Information Systems and Data Management, (2) Security, Confidentiality, and Privacy, and (3) Considerations for Systems and Organization Controls Engagements, equip CPAs with the tools to navigate the emerging technical ecosystem. The first area explores data structures, querying languages like SQL, and cloud technologies. The second, Security, Confidentiality, and Privacy, focuses on identifying and mitigating common threats, like cyberattacks and data breaches, along with robust control mechanisms to secure sensitive information and the procedures to test these controls. The final area is specifically about Systems and Organization Control (SOC) engagements; this includes the assertions, aspects, and procedures of SOC level one, two, and three engagements. Of the three disciplines, ISC appears to have the greatest amount of new content. This dedicated focus on systems is demonstrative of the discipline's commitment to future-proof the profession.

The final discipline is Tax Compliance and Planning. The content here is divided across four areas (1) tax compliance and planning for individuals and personal financial planning, (2) entity tax compliance and (3) entity tax planning, and finally (4) property transactions. TCP caters to future CPAs who envision careers specializing in any combination of tax planning, individual, or entity, taxation.

MARCH | APRIL 2024 | 27

Advising candidates on their path

Choosing which discipline to take is a candidate-specific decision. Is the candidate taking the exam to (1) simply pass it (2) get deeper knowledge for their current position or (3) be identified as an expert in a specific discipline? Ideally, candidates would make this decision using an interactive process that is initiated before they choose undergraduate elective courses. We believe a bit of honest reflection on these questions can lead to a more constructive choice for the candidate.

Historically, passing the CPA exam has been considered a mark of competency to enter the profession. If a candidate is most driven by just passing the exam, then we would recommend the candidate to reflect on how prepared they are between the disciplines. If they have a technologyoriented double major, the ISC would require the least incremental effort. We could infer from an individual’s masters of tax that the TCP section may be best. Finally, a general master's, or 150 hours with an undergraduate degree, would likely mean that the BAR section would be the best fit for that candidate.

The second question we should ask is if the candidate wants to use their CPA prep to help prepare them for or bolster their knowledge in their current role. For many, it seems that a typical entry-level position lines up quite nicely with the three new discipline sections as defined. The knowledge reviewed in TCP would serve a tax associate well. A

systems auditor would be well served by the ISC section. An accountant entering industry may be best served by the BAR section as an initial knowledge base.

Finally, and something exciting, unique, and unknown, is the impact this choice will have on future career paths. Before this point, the CPA exam was indeed uniform. Everyone who had the CPA qualification over the same period had taken the same four sections of the exam, with identical learning objectives evaluated. Even two candidates taking the exam within a few years of each other were evaluated largely on the same material. From now on, this will not be the case for a quarter of the exam.

This allows for differentiation among professionals with the same certification. Will this be an important distinguishing factor for employers? It is certainly a consideration to reflect on for candidates taking the exam today. Does the candidate want to be known as an expert in taxation? Perhaps having taken a master's of tax, having been employed in a tax position as a graduate, and then having taken the TCP section of the exam will lead to greater opportunity. Perhaps we may see that candidates with more differentiation have additional career opportunities. Future employment and salary data will be interesting, and revealing, and will help inform future decisions.

There are many ways to show competency for a future job, and the CPA exam is far from the only certification available to accountants. However, it is still viewed widely as the “gold

28 | CPA Voice

standard” for accountants (Half 2023; Saint Juste and Reisig 2023). If a given candidate has earned the qualifications to sit for the exam, there appears to be little incremental cost in choosing one discipline section of the exam over another; however, the incremental benefit of sitting for one discipline over another remains to be seen. Choosing to be purposefully reflective in crafting your “gold standard” certification, which will follow you throughout your career, is certainly worth the effort.

Reference List

Cameron Cockrell, Ph.D., is the chair and associate professor of accountancy at Xavier University

Timothy Miller, Ph.D. is the associate professor of accountancy at Xavier University.

AICPA (2022, December 1) Uniform CPA Examination Blueprints - effective date: January 2024. https://www.aicpa-cima.com/resources/article/learnwhat-is-tested-on-the-cpa-exam

Half, R. (2023, December 7). Accounting certifications employers really want to see. English. https://www.roberthalf.com/us/en/insights/career-development/finance-and-accounting-certifications-employers-want-to-see

NASBA (2019, December 10). NASBA and AICPA propose draft “Core + discipline” CPA licensure model designed to future-proof the profession. NASBA (National Association of State Boards of Accountancy). https://nasba. org/blog/2019/12/10/nasba-and-aicpa-propose-draft-core-discipline-cpa-licensure-model-designed-to-future-proof-the-profession/

Saint Juste, G., & Reisig, R. (2023, September 27). Accounting leaders divided over changing 150-hour rule for CPAs. Bloomberg Tax. https://news. bloombergtax.com/tax-insights-and-commentary/accounting-leaders-divided-over-changing-150-hour-rule-for-cpas

THREE THINGS

1. While three core sections persist, the CPA exam now invites candidates to choose their own fourth “discipline” section— tailoring their expertise to align with specific career aspirations.

2. This pivotal change represents a proactive approach to futureproofing the profession by ensuring new CPAs with deeper expertise in specialized areas.

3. Something exciting, unique, and unknown, is the impact this choice will have on future career paths.

MARCH | APRIL 2024 | 29

MEMBERS in motion

AKRON

Bober Markey Fedorovich has made the following promotions:

• Tom Lyons, CPA , and Devon LaRiccia, CPA, to manager

• Sarah Boughton to controller

• Kelly McCaffery to supervisor

Bober Markey Fedorovich has made the following new hires:

• Justine Baker and Kerah Gross as staff accountants

• Arielle Clark as human resources manager

• Katlyn McManus as senior accountant

• Ericka Schempp and Connie Ulich as administrative assistants

• Sarah Werner as supervisor

Marie E. Lenarduzzi, CPA, has joined Bober Markey Fedorovich as a partner.

Bober Markey Fedorovich has won the Best of Accounting Award for the fourth consecutive year.

CANTON

Andy Griffin, CPA and Seth Turner, CPA, CVA have been promoted to partner of Hall, Kistler & Company.

Becky Stumperth has joined Hall, Kistler & Company as a staff tax professional.

Shelly Belcher has taken on the role of billing and front desk coordinator at Hall, Kistler & Company.

CARMEL, IN

YSU Ethics & Economic CPE Day

May 10

Blue & Co., LLC. announced the launch of Blue Value Advisors (BVA), a business advisory and exit planning service line.

8:00 a.m. – 12:00 p.m. | 4 credits

CLEVELAND

Brian Palisin, CPA, MT, has been promoted to principal of HW&Co.

COLUMBUS

Greg Heitkamp, CPA, CIA, was recently promoted to director at Blue & Co., LLC.

Bart Hickey, Ryan Kilpatrick, Jeff Monsman, Sara Robertson, Ed Bannen, Mike Purcell, and Jessica Weeks have been promoted to partner of GBQ Partners LLC.

TOLEDO

William Vaughan Company was recognized as The Blade’s Top Workplace, a recognition that they have now celebrated for over a decade.

Toledo City Councilman Katie Moline, CPA, has been elected to be the next Lucas County auditor.

Greg Heitkamp, CPA, CIA,

Andy Griffin, CPA

Brian Palisin, CPA, MT,

Becky Stumperth

30 | CPA Voice

Seth Turner, CPA, CVA

Register today and fi nd more events at Explore OSCPA competency framework at ohiocpa.com/CBL ohiocpa.com/Events24 4/18 8:30 a.m. – 4:30 p.m. Strategic Finance & Accounting Conference 8 credits MULTIPLE 4/26 8:30 a.m. – 4:30 p.m. Employee Benefi t Plan Audit Conference 8 credits AU 6/20 12:00 p.m. – 1:00 p.m. Town Hall 2024 – June 1 credit MS 8/15 12:00 p.m. – 1:00 p.m. Town Hall 2024 – August 1 credit MS 8/22 8:30 a.m. – 4:30 p.m. CORECon – Core Skills Conference 8 credits MULTIPLE 8/27 8:30 a.m. – 2:30 p.m. Fraud and Forensic Conference 6 credits MULTIPLE 10/23-24 8:30 a.m. – 4:30 p.m. October Accounting Show 16 credits MULTIPLE 11/13-14 8:30 a.m. – 4:30 p.m. November Accounting Show 16 credits MULTIPLE 12/10-11 8:30 a.m. – 4:30 p.m. 2024 MEGA Tax Conference 16 credits TX 12/13 8:30 a.m. – 4:30 p.m. CORECon – Core Skills Conference 8 credits MULTIPLE COMPETENCIES Financial Accounting Audit & Assurance Business Management Technology Ethics & Professional Standards Tax Essential Skills & Prof. Development Risk Management & Fraud Talent MGMT & Human Resources Multiple CREDIT TYPE AC Accounting RE Regulatory Ethics BL Business Law AG Accounting (Government) BE Behavioral Ethics IT Information Technology AU Auditing TX Taxes AV Auditing (Government) CA Computer Software & Applications EC Economics PR Production MS Management Services FI Finance BM Business Management & Organization CM Communications & Marketing ST Statistics HR Personnel/ Human Resources SK Specialized Knowledge PD Personal Development MULTIPLE

events at a glance Quarterly Ethics: Ohio Professional Standards & Repsonsibilities Mar. 21 | Jun. 13 | Sept. 26 | Dec. 6 8:30 a.m. – 11:15 a.m. | 3 credits May 23 | Virtual 8:30 a.m. – 4:30 p.m. | 8 credits CORECon – Core Skills Conference Real Estate Conference Jun. 18 | Virtual 8:30 a.m. – 12:00 p.m. 4 credits Real Estate Conference Women, Wealth and Wellness Jul. 18 | Virtual 9:00 a.m. – 3:00 p.m. 6 credits + 2 complimentary On-Demand credits Mastering the A.I. Wave: 8 Strategies for CPAs to Enhance Productivity On-demand video 2 credits RE MULTIPLE IT PD TX MARCH | APRIL 2024 | 31

LEARNING

Choose from 9 core competencies to help you transform your skill set and compete in today’s crowded marketplace

Audit & Assurance

CLASSIFIED

Selling or Buying a Firm? Selling an accounting firm is complex. We can make it simple!

Accounting Biz Brokers, LLC has been selling accounting firms and tax practices for over 19 years! Let’s face it, you know how to run your business, but it takes a very different skill set to sell a business successfully. Our team of Certified Business Intermediaries is committed to providing personalized business brokerage services to our clients and customers. Selling professional practices like yours is all we do. Using targeted marketing strategies, we have developed a large database of active buyers ready to purchase.

Call or email us today to receive a FREE Market Analysis or to start the confidential sales process. We can help you achieve the “win-win” results you are seeking!

Current Listings:

Northeastern Ohio Bookkeeping & Controller Services

Firm Gross $286k

Kathy Brents, CPA, CBI Office 866.260.2793; Cell 501.514.4928

Kathy@AccountingBizBrokers.com

www.AccountingBizBrokers.com

ADVERTISER

Accelerate your career and enhance your skills with quality learning from OSCPA. by CPAs for CPAs

Ethics

Professional

&

Standards Business Mangement & Strategy

Professional

Tax

Technology

p17 Duffy+Duffy Cost Segregation Services

Financial Accounting, Reporting & Analysis Essential Skills &

Development Talent Management & Human Resources

Risk Management & Fraud

ohiocpa.com/CBL

INDEX

32 | CPA Voice

THE OHIO SOCIETY OF CPAs

CHAIR OF THE BOARD

Libby Cullins, CPA, MBA

JPMorgan Chase Columbus

Brandi Carson, CPA La-Z-Boy Inc. Toledo

Courtney Clark, CPA Deloitte Columbus

Chris Igodan Jr., CPA Nationwide Financial Columbus

Gregory J. Jonovich, CPA, MBA Materion Mayfield Heights

2023–2024 BOARD OF DIRECTORS

PAST CHAIR

Craig Marshall, CPA Ernst & Young Plain City

PRESIDENT AND CEO

Scott D. Wiley, CAE

The Ohio Society of CPAs Columbus

DIRECTORS

Angela Lewis, CPA Crowe Columbus

A’Shira Nelson, CPA Savvy Girl Money Cleveland

Carolyn Smith, CPA, MBA, CRMA Member, Governmental Accounting Standards Board Columbus

Amy Vetter, CPA, CGMA, CITP

The B3 Method Institute & Drishtiq Yoga Mason

LATELY on the podcast

CHAIR-ELECT

Rick Fedorovich, CPA Bober Markey Fedorovich Cleveland

Mark Welp, CPA, CFE Holbrook & Manter Columbus

Ellen Wisbar, CPA Mayer Hoffman McCann, P.C. Cleveland

Episode title:

Upskilling is key to longevity of profession

From the episode:

“Knowing how to do the technical bits of accounting are important. But it’s about knowing how to do that in a way that is efficient, such as using modern technology to analyze big datasets. That is becoming increasingly important in all aspects of what we do.”

Jason Weigand, senior director for North America Tax for Proctor & Gamble

The

CPAs

latest

professionals,

Ohio Society of

podcast “The State of Business” covers the

news impacting accounting

most recently with a series focused on the accounting talent shortage.

Listen to the entire series

you

your

ohiocpa.com/Podcast

wherever

get

podcasts!

Accounting isn’t all ledgers, spreadsheets, and crunching numbers. The profession has evolved, and we need your help to face the unique challenges ahead.

Technology has reshaped the accounting landscape, the skills gap is wider than ever, and a dwindling talent pool has left teams overworked. It sounds overwhelming, but as a distinguished accounting professional, you can help us grow the pipeline, advance your professional goals, and help shape Ohio’s economic future.

• Invest in your professional development that elevates your standing in the fi eld.

• Contribute to building a robust and diverse pipeline for the profession.

• Become an integral part of OSCPA’s mission to create a thriving and sustainable future for accounting in Ohio.

ohiocpa.com/Renew24

Scan the QR code or call 614.764.2727 , and join us in shaping the future of accounting, learning locally, and contributing to the growth and diversifi cation of the profession.

MEMBERSHIP RENEWAL 2024

Erin McCormick is the member experience strategist for Boomer Consulting, Inc.

Erin McCormick is the member experience strategist for Boomer Consulting, Inc.

3.

4.

3.

4.