43 minute read

THE REGION IS RISING

The UAE and KSA among the elite in this year’s Agility Emerging Markets Index amid recession worries RISING AGAINST THE TIDE

Moving into 2020, the world faces a tempestuous economic scene. During 2019, global trade growth slowed to an estimated 1.1%, the lowest level since the 2008-09 financial crisis, and a number of factors are combining to weigh on prospects as the new decade begins. Tariffs and tensions between the world’s largest consuming and producing nations; an anaemic European Union economy; slowdowns in key developed and emerging economies; and social and political unrest are just some of the factors causing concern for leaders across the logistics industry.

This is the backdrop against which twothirds Agility Emerging Markets Logistics Index Survey respondents say a global economic recession is likely or very likely in 2020. In the past year, trade growth has fallen and investor confidence has weakened as the future of globalisation, which has played such a significant role in emerging market growth over the last four decades, has been fundamentally questioned.

To assess and understand these trends and their effects on 50 of the world’s most promising emerging logistics markets, the Agility Emerging Markets Logistics Index 2020 examines three key areas for logistics market development: Domestic Logistics Opportunities; International Logistics Opportunities; Business Fundamentals.

Across each, the Agility Emerging Markets Logistics Index methodology utilises a unique set of variables that measure current, short-and medium-term performance across structural

and cyclical factors in each country’s logistics markets and in key vertical sectors. As a result, the Index weighs the current opportunity and future potential a market offers against the operational realities and the openness, robustness and fairness of the market’s business environment. The 2020 Agility Emerging Markets Logistics Index presents a data-driven analysis of 50 of the world’s most promising emerging logistics markets, reflecting the complexity, connectedness and opportunities each market provides.

With the leading six markets unchanged year-on-year, the Agility Emerging Markets Logistics Index confirms that a group of elite emerging logistics markets have established and entrenched their positions through a mix of domestic market strength, international market connectivity and robust business environments.

Leading the way is China. Despite uncertainty over the trajectory of its economy and significant disruption to its trade as a result of the trade war with the US, the world’s second largest economy has distinct structural advantages. The scale, capacity and capability China has developed so rapidly over the last several decades have combined with a vast and increasingly rich population to produce high levels of resilience to the effects of the trade war. China maintains particular strength in the international logistics opportunities subIndex, which propels its overall performance. The market’s export-oriented manufacturing sector remains a global leader while favourable import policies are helping to fuel consumer demand for international brands, resulting in high inbound e-commerce growth. Second placed India, meanwhile, saw much more varied performance. The market faces several challenges. GDP growth is faltering – at 4.5% in Q3 2019, growth has slowed for seven consecutive quarters and is at the lowest level seen since 2013. The country’s automotive sector has slumped as consumer lending has fallen, which combined with slowing economic growth has constrained spending and undermined confidence.

These factors are amongst the reasons India’s business fundamentals rank collapsed, dropping the market eight positions to 18th. The challenges appear manageable, however, with analysts calling the credit squeeze ‘cyclical’. While 2020 may be another tough year, medium- and long-term prospects remain bright. The remaining markets in the top six demonstrate how in 2020 it is possible for smaller economies with highly liberalised and open business environments to compete with structurally larger emerging logistics markets. Not only do the UAE, Saudi Arabia and Malaysia offer highly attractive investment prospects, each continues to build strength through further reforms and incentives, increasing attractiveness for new investors and established operators alike. Elsewhere in the Agility Emerging Markets Logistics Index 2020, there is a greater degree of movement and volatility. Egypt – up six positions to 20th – has made rapid progress as a result of economic growth. The government successfully implemented a first wave of macroeconomic and structural reforms that addressed many entrenched issues and helped to stabilise the economy, spur growth and lay the groundwork for robust private sector participation in the economy. Nigeria – rising eight positions to 35th – is DELIVERING IN A DIFFICULT CLIMATE Logistics providers have a great deal of factors weighing upon them. They are heavily exposed to the increase of trade barriers and subsequent uncertainty that was rife in 2019.

Africa’s biggest oil exporter and has the largest natural gas reserves on the continent.

After the oil price crash of five years ago, Nigeria’s oil sector was thrown into chaos. Yet in 2018, Sub-Saharan Africa’s oil market grew by 6.5%, while the country’s manufacturing PMI reached a one-year high in Q3 2019 to indicate improving private sector growth. This helped drive Nigeria’s domestic logistics opportunities sub-Index rank to 16th, some nine positions higher than last year. Several other markets see notable movements in 2020. The Agility Emerging Markets Logistics Index 2020 also reveals the highly integrated position of emerging markets in the global economy and the extent to which that integration leaves them vulnerable to changes in macroeconomic trends an

GLOBAL UNCERTAINTY IS A KEY CONCERN The World Bank revised down its 2020 global GDP forecast to 3.6%, while the global manufacturing PMI registered negative growth for six consecutive months during 2019, for example – a global recession is clearly a key concern for survey respondents. policy decisions of global partners. For each market subject to sanction or increased trade barriers, theIndex reveals how others find new opportunities for growth.

As uneven economic drivers continue into 2020, crucial questions around the future of the global economic growth and emerging markets’ role in it remain unanswered. Combining all responses that predict a recession shows an almost overwhelming 64% of the 780 survey respondents expect a global recession in the year ahead. Downward pressure on global trade volumes, uncertain growth prospects and the trade war between the US and China, in addition to the wider move towards protectionism, are behind the pessimistic outlook amongst survey respondents.

Logistics providers have a great deal of factors weighing upon them. They are heavily exposed to the increase of trade barriers and subsequent uncertainty that was rife in 2019. With few of those measures forecasting a significant recovery in 2020 – the World Bank revised down its 2020 global GDP forecast to 3.6%, while the global manufacturing PMI registered negative growth for six consecutive months during 2019, for example – a global recession is clearly a key concern for survey respondents. It is important to note that even though the indicators of economic activity for the year ahead forecast slower growth, very few, if any, actually predict a global recession. This suggests that survey respondents’ fears may be overly pessimistic. These mixed messages of forecast data and opinion reflect a fundamental uncertainty that may carry on well into the 2020s.

Over the last several decades the role of

emerging markets in the global economy has changed. Intraemerging market trade has grown and populations have expanded and become increasingly wealthy. Domestic markets have become more dynamic while investments have improved infrastructure and labour markets have benefitted from enhanced skills. Despite these factors driving global emerging markets forward, however, the progress has been uneven, leaving individual markets vulnerable to the fortunes of the wider global economy. In Asia Pacific, selected by survey respondents as the emerging market region most at risk from a global recession, economic activity has been decelerating in recent years. While growth in some regional markets remains robust – including key export markets like Vietnam as well as in more nascent manufacturing locations such as Cambodia – export growth has slowed. Despite efforts by regional exporters to diversify economic activity, survey respondents evidently have concerns about the region’s ability as a whole to withstand further falls in global demand. Perhaps more notably, survey respondents’ selection of Asia Pacific as the region most at risk from a global recession points to a question over the sustainability of intra-regional trade lanes. During the 2010s, as China has moved through the manufacturing value chain and nearby markets – predominantly those in South East Asia – developed manufacturing capabilities and skills to participate in those supply chains, regional trade boomed.

The implication from survey respondents is that regional demand from emerging consumer markets is unlikely to provide sufficient volume to buoy the fortunes of logistics FEW PREDICTING A DOWNTURN Pre-Coronavisrus, indicators of economic activity for the year ahead forecast slower growth but very few, if any, actually predict a global recession.

providers heavily exposed to intra-Asia trade. The South America and the Middle East & North Africa regions come in 2nd and 3rd place, according to survey respondents. In South America, lower commodity prices, economic challenges, and more recently civil unrest, have weighed on growth in recent years. In the Middle East & North Africa, it appears economic diversification programmes have yet to fully convince survey respondents the region as a whole can withstand global shocks to trade or falling hydrocarbon prices. The UAE’s business environment remains the pillar of strength in 2019 as the country moved even further ahead at the top of the business fundamentals sub-Index ranking. The Emirates added to its open financial sector, transparent regulatory system and corruption protection frameworks in 2019 with progress

UAE IN TOP POSITION FOR BUSINESS FUNDAMENTALS

UAE maintains its top position in the business fundamentals sub-Index as it added strength to its business environment with a better regulatory situation, particularly in terms of access to public spending budgets for SMEs. As SMEs contributed less to GDP and created fewer jobs, UAE authorities announced plans to raise cash flows to SMEs via quicker payments of government invoices, cost reductions and increased capital project allocation. These initiatives would provide an increase of more than $800million to the sector. In addition, steps to increase SME access to financing are planned, as is a new insolvency framework. The Middle East once again features heavily at the top of the rankings. Meanwhile, Saudi Arbia is continuing reforms across its economy, opening formerly restricted sectors of its market to increased levels of foreign ownership and investment as well as providing stimulus for private sector job creation. It gained two positions in this year’s business fundamentals sub-Index to rank 3rd. While remaining a top 10 market in the business fundamentals sub-Index, Oman fell three positions to 7th as regulatory frameworks and judicial oversight of the private sector weakened during 2019.

24 APRIL 2020 towards a comprehensive national SME development strategy. SMEs have been drivers of wider growth in the UAE for the last several years, helping to offset lower hydrocarbon revenues and employing some 86% of the non-oil private sector workforce. However, with SMEs’ contribution to economic growth and job creation declining, UAE authorities have announced plans to boost cash flows to SMEs via quicker payments of government invoices, cost reductions and increased capital project allocation. Combined, these initiatives could provide an injection of more than $800million to the sector, while further reforms to promote SME prospects, including increased access to financing as well as a new insolvency framework are planned. An improved international logistics opportunities sub-Index score saw the UAE rise two places to 9th. As a result, the UAE now features in the top 10 of all three individual sub-Indices for the first time. With an extra $1.2billion invested into its pharmaceutical sector to drive export growth to high demand areas like Africa and Asia Pacific, as well as higher imports to support construction for Expo2020, the UAE remains the GCC region’s dominant sea freight hub. The port and its surrounding free trade zone at Jebel Ali are the region’s key gateway for regional and east-west trade. Saudi Arabia’s 6th overall ranking is primarily a result of notable improvement in its business fundamentals, with improvements over the last 12 months that stand out even against regional peers.

The root of the Kingdom’s gains are the transformative plans that comprise Vision 2030, a nationwide economic strategy that aims to open and diversify the domestic economy and integrate it more closely with the global market. Vision 2030’s aim to reduce Saudi Arabia’s economic dependence on oil has become quite apparent in 2019 as World Bank forecasts show annual GDP growth slowing to just 0.8% for the year. This is primarily a result of agreed upon oil production cuts, but also reflects the ongoing lack of diversity in the domestic economy. Meaningful progress is needed to grow the non-oil economy by the targeted ten-fold increase over the next decade. The challenges are vast. Despite pending changes to FDI regulation – including the decision to allow foreign investors to own 100% of business in formerly blacklisted sectors such as warehousing – Saudi Arabia remains a restrictive, if now less prohibitive, market for foreign investors to operate logistics assets and businesses domestically.

The lack of competition has led to underdeveloped logistics operations and services. The transformation process so far has helped to create opportunities for domestic and foreign investors and, assuming progress is maintained, the Kingdom’s potential as a logistics hub for regional operations will continue to develop.

Alongside previously announced plans to increase the capacity and efficiency of Saudi Arabia’s sea ports, through which more than 90% of the country’s trade is transported, Vision 2030 is also spurring the development of free trade zones. The zones at Riyadh’s King Khalid International Airport and King Abdullah Economic City (KAEC) in particular have the potential to allow Saudi Arabia to compete with Jebel Ali. This would not only be as an import gateway for goods destined for the Kingdom but also as a key transhipment and light manufacturing hub for the GCC and the wider region. Development of the free trade zones has been allied with reform in the Kingdom’s customs regime, with clearing time at key gateways for certain goods reduced to hours or days rather than weeks in some cases. This progress has played a central role in Saudi Arabia’s rise of two positions in the business fundamentals sub-Index. Saudi Arabia, ranked 5th in the 2020 Agility Emerging Markets Logistics Index, made strides in domestic logistics opportunities and improved business conditions. The country is in the midst of what might be the most ambitious economic makeover in the world as part of its Vision 2030 drive. As part of that effort, Saudi Arabia has spent more than $100billion on infrastructure and related projects intended to position it as a global logistics hub at the crossroads of Asia, Europe and emerging Africa. Saudi Arabia’s sweeping transformation is yielding results for shippers and others in the supply chain. In just a short time, the country has: Cut customs clearance times to 24 hours, down from 7-10 days; Cut maritime dwell times from 14 days to 4 days; Reduced handling feeds for empty containers by 54%; Boosted to 55% the percentage of cargo declarations submitted prior to arrival. Saudi Arabia soared 30 places to No. 62 of 190 countries in the World Bank’s Doing Business 2020 study. That’s the good news. The bad news is that Saudi Arabia is still 86th in the world when it comes to the time and cost associated with cross-border trade.

Rounding out the top 10 in the Agility Emerging Markets Logistics Index 2020 is Turkey, down one position from last year. Turkey seemingly finds itself in a period of transition as it diverges from the United States, a long-time ally, amid souring relations and inches closer to Russia for military and political support, particularly in reaction to conflicts across the Syrian border. Its economy has faced challenges too – a currency crisis in 2018 saw the lira lose close to one third of its value against the US dollar. This was followed by three consecutive quarters of recession ending in September 2019.

The government’s forecast of 5% GDP expansion in 2020 is ambitious and hinges on confidence returning not only to consumer markets, but to business spending as well. Significant, too, is the underperformance of the domestic construction sector which has provided the basis of economic growth in recent years, but which contracted by 7.8% even as the economy returned to growth, official data shows. Turkey’s international logistics opportunities sub-Index rank remains its strongest, although it does slip two places to 8th in the sub-Index ranking. With 60 countries and 120 destinations within three-hours of Turkish manufacturing hub Istanbul, the market has meaningful potential for rapid improvements. Forecast growth in Egypt’s contract logistics and domestic express markets are relatively low, highlighting the potential for further gains in the coming years. HOLDING ONTO PROGRESS IN SAUDI ARABIA Agility’s view is that Saudi Arabia’s hard-won gains will be tough to build on without three things.

A single supply chain and logistics regulator with the legal and administrative authority to impact change across all government agencies. A sole authority would eliminate confusion, duplication of effort and cost; adds transparency, brings accountability and cuts down on corruption. It would act as an honest broker and single source of truth for the private sector, in addition to freeing government ministries to focus on national-level policy rather than day to day customs and trade administration. Digitisation of all supply chain, business and logistics processes across a common technology platform to dramatically improve capacity to manage change through the supply chain and its extended network of public and private stakeholders. Like other countries, Saudi Arabia has online platforms and single windows. They need to be integrated to be able to allow the public and private sector stakeholders to conduct, process and administer transactions from end to end, 100% online. In addition, it must be small business-friendly.

Pay special attention to landuse policy and administration. This is an area plagued by regulatory ambiguity and uncertainty. It leads to confusion and loss of confidence among investors. Land policy related to logistics should be the purview of a single regulatory entity with the ability to manage a land bank and make strategic, merit-based decisions. Smart land policy also requires careful planning and allocation of space at key entry/ exit nodes of major municipalities for truck checkpoints and yards, and safe loading and unloading between large trucks and smaller ones. Finally, we need better incentives, clearer rules and a more liquid property market, especially when it comes to transformation of agricultural land to logistics/industrial use. UAE, Saudi Arabia and Malaysia offer highly attractive investment prospects”

TOP OF THE RANKINGS The Middle East once again features heavily at the top of the business fundamentals ranking with the UAE and Saudi Arabia leading the way.

Saudi Arabia set to be UD Trucks’ primary focus for 2020 after year of transition THE KINGDOM RULES

The launch of the latest heavy-duty Quester, a ‘series of major fleet deals’ and the securing of a new retail partner in Saudi Arabia helped UD Trucks strengthen its foothold in the Middle East, East and North Africa (MEENA) region in 2019, the Japanese company has revealed.

Described as another positive year despite ‘extremely challenging economic conditions’, the Volvo Group-owned Japanese brand said in a statement that it recorded sales increases in a number of key markets, in particular the United Arab Emirates, Kuwait and Oman. The company said that Saudi Arabia will be a major focus in 2020 after “was very much a year of transition for UD Trucks in Saudi Arabia”. UD Trucks announced in December 2019 that it had appointed Volvo Trucks’ representative Zahid Tractor as its new exclusive importer and distributor in the county following a ‘mutual agreement’ to terminate its longstanding collaboration with Rolaco Group.

“With the start of this exciting collaboration between the two companies, and underpinned by the ambition and professionalism of Zahid Tractor, 2020 is set to be an excellent year for the brand as it seeks to continue its growth and take customer satisfaction to a higher level,” said the company in its latest update. It added that in the UAE, sales were up almost 10 percent year-on-year, ‘despite the overall market shrinking’: “It was a similar story in Oman, with the market down but UD Trucks registering 10 percent growth. As a market, Kuwait bucked the regional

trend with truck sales increasing, helping UD Trucks to an impressive doubling of sales. The company maintained its number one position in Bahrain, while reinforcing its position in Qatar as the number one brand in the Japanese truck segment and number three brand overall, including the European manufacturers.”

The company is continuing its investment into the East Africa region of recent years as it, “seeks to reactivate its presence there.”

The company said it has been rewarded for its reactivation of Ethiopia with a doubling of its market share, while the brand also helped to inaugurate a UN driver school in the country - under UD/Volvo Group’s sponsorship, UD Trucks supplied three Quester models and ran numerous driving school sessions. It also re-commenced activities in Kenya, Uganda and Tanzania over the course of the year.

“2020 will see a continued focus on this region, and particularly in Kenya where a local assembly project will be launched,” said UD Trucks.

The company said the arrival of the New Quester in April had helped to boost its performance in the region: “The new Quester and medium-duty Croner, both of which are designed and engineered especially for the region, have been in high demand and were at the heart of the numerous major fleet deals that peppered the year.” Deals completed in 2019, included Kuwait Municipality purchasing 106 Quester and Croner models for waste management in September. The company also signed its first ever deal for 20 Quester 8x4 Mixers with Oryxmix in Dubai in the same month. The company also revealed that 118 Questers and Croners were sold to waste management specialist Lavajet in the UAE and 25 to Oriental Trading Co, “with many other similar agreements signed across the GCC and East Africa.”

Mourad Hedna, president, UD Trucks MEENA, said the company will continue its strategy to grow by “reinforcing market share in countries where we are already present” and by entering a number of new markets.

“Our objective always has been, and always will be, to deliver the highest standards of customer service because this is the only way to guarantee sustainable growth in the long-term,” he added. “We will continue to do this by collaborating closely with our regional partners while simultaneously remaining focused on that most valuable human capital: our employees. “Having strong partnerships in each FOCUSSED ON SAUDI Mourad Hedna, president, UD Trucks MEENA, said a new distributor deal should boost UD Trucks in Saudi Arabia.

market is critical to our success, so it was a positive reflection on how we are doing that so many of our partners reconfirmed UD Trucks as their brand of choice, over the course of the year, highlighting their pride in working with the company and the very special family spirit that exists among all parties. This essence of close and positive collaboration was strengthened by the bodybuilders conference that was held in August and the annual partners conference that took place in September.” Talking to T&FME ahead of this year’s Truck Book, Hedna said that a key point of the company’s performance in 2019 – in his opinion – was the nature of UD Trucks’ fleet sales across the region.

The company signed major deals with some of the region’s leading companies, including a first-of-its-kind deal with Oryxmix

in Dubai for 20 Quester 8x4 Mixers, and an unprecedented multi-model deal in Kuwait for 106 units for Kuwait Municipality, he said. “This agreement in Kuwait was just one of a number of major contracts in the waste management sector that we have sealed over the past three years, including in Saudi Arabia and the UAE, as we have become a major player in this sector.”

2019 was very much a year of transition for UD Trucks in Saudi Arabia. Following a mutual agreement to terminate our collaboration with Rolaco Group, our previous partner in the Kingdom), its announced Zahid Tractor as the new exclusive importer and distributor of UD Trucks in the country. As a result, in 2020 the company will be very much committed to returning the brand to growth and working ever more closely with its existing customers, Hedna further explained “Across the region, we will continue to further support our business partners and customers to grow their businesses, with a focus on maximising their efficiency and profitability,” he said,

“Customer satisfaction will continue to be a major focus for all of us in 2020. A key driver for our efforts in this field is what we call Quality Customer Pulse - this is a weekly meeting held at UD Trucks’ regional head office, bringing together the Sales, Aftersales and Marketing teams to discuss customers issues and feedback. We will work to solve issues raised by the customer in order to keep their businesses running; listen to feedback from customers across all markets so as to come up with tailored solutions; and communicate best practice to all markets to optimise the use of our trucks.”

A YEAR OF MAKING PROGRESS The past year has seen the Japanese brand make progress across the region, including the sale of 106 units to Kuwait Municipality.

Volvo Trucks’ four new heavies are a product of their time – and that’s a good thing VOLVO JOINS THE PARTY

Hot on the heals of the myriad of new truck generation announcements that we have seen in the past two years, Volvo Trucks new generation of heavy haulers and transporters arrived in early Spring just days after MAN Truck and Bus’ own reveal. Like that launch, the new Volvo FH 16, FM, FMX and FH are very much products of their time, eschewing the electric drivelines and autonomous features that the Swedish giant has been promoting in recent years, and are instead focused on the brand’s core strengths of green-aware tech, safety and productivity. Indeed, Roger Alm, president, Volvo Trucks placed the growing issue of driver recruitment and retention at the forefront of the reveal. A sensible decision given that the company remains a major player in mature markets where finding new drivers is becoming increasingly difficult.

“We are really proud of this big forwardlooking investment. Our aim is to be our customers’ best business partner by making them even more competitive and help them attract the best drivers in an increasingly tough market,” said Alm. “Drivers who handle their truck safely and efficiently are an invaluable asset to any transport company. Responsible driving behaviour can help reduce CO2emissions and fuel costs, as well as helping reduce the risk of accidents, injury and unplanned downtime. Our new trucks will help drivers work even more safely and productively and give our customers stronger arguments when competing to attract the best drivers.” In its launch notes Volvo points to

European statistics that estimate show that around 20 percent of all driver jobs are vacant on the continent. To help customers recruit and retain the best drivers, Volvo Trucks says it has focused strongly on developing the new trucks to make them safer, more efficient and more attractive working tools for qualified drivers. Consequently, the various truck models in Volvo Trucks’ range are available with many different cab models and can be optimised for a wide range of applications. In long-haul trucks, the cab is often the driver’s second home. In regional transport trucks it often serves as a mobile office, while in construction the trucks are robust, practical work tools.

Therefore, visibility, comfort, ergonomics, noise level, maneuverability and safety were key focal points when developing all the new truck models, says Volvo Trucks. The outside of the

BUILT TO HANDLE DANGEROUS CONDITIONS The new FMX comes equipped with a new traction control panel that helps the driver easily and quickly handle potentially dangerous situations, both on and off the road.

IMPROVED SAFETY Safety is improved with the Downhill Cruise Control, which sets a maximum speed to help prevent unwanted acceleration when travelling downhill, and Adaptive Cruise Control (ACC) that now works at all speeds even down to zero km/h.

trucks, conversely, feature exteriors that appear to be upgrades rather than a complete overhaul of the design aesthetic which has served the company well since the turn of the millennium. Packaged together, the tractor heads’ inside and outside share much of the DNA of their predecessors with refinement rather than revolution the order of the day. The changes can wholly be view as quality of life improvements that were needed for drivers. While the new Volvo FM and Volvo FMX have a brand new cab, as well as many of the same instrument display functions as other Volvo counterparts, their interior volume has been increased by up to one cubic meter. This provides better comfort and more working room, says Volvo Trucks, with the visibility much improved thanks to larger windows, a lowered door line and new mirrors. Other improvements include a steering wheel with a neck tilt function allowing the driving position to be individually adjusted to a greater extent. The lower bed in the sleeper cab is now positioned higher up for better comfort and allows for additional storage space underneath. Helpfully, the day cab has a new 40-liter storage compartment with interior lighting on the back wall. Volvo Trucks claims that the cabs’ reinforced insulation will help shut out cold, heat and noise disturbance, while a sensor-controlled climate unit with a carbon filter promotes good air quality in all conditions.

Where there has been significant change is the dashboard and the controls set-up for drivers. This really does look like a break with the past and drivers now have a fully digital instrument display, with a 12-inch screen, to

play with. The focus here has been to make juggling the amount of information modern drivers have to cope with much easier.

Within easy reach of the driver, there is an additional nine-inch side display available for secondary functions. As the emphasis for Volvo Trucks is the driver being as focused on the road as much as possible, it is no surprise to see features such as infotainment control, navigation, transport information and camera monitoring are set to one side. This is compensated by allowing many of the functions to be controlled via buttons on the steering wheel, by voice control, or via the touchscreen and display control panel – now that does sound like a generational leap. Volvo Trucks as a brand has an outstanding record in safety features and the new trucks bring the best technology for

protecting drivers and road users into the new generation, while adding a few more to boot. Adaptive high beam headlights are now loaded onto the Volvo FH and Volvo FH16 (Volvo Trucks is the first truck manufacturer to launch). The system improves safety for all road users by automatically disabling selected segments of the LED high beam when the truck approaches oncoming traffic or another vehicle from behind. The trucks also feature an improved Adaptive Cruise Control (ACC) system for speeds down to 0 km/h and downhill cruise control that automatically activates the wheel brakes when extra brake force is needed to maintain constant downhill speed. The electronically-controlled Brake System (EBS), which is a prerequisite for safety features such as Collision Warning with Emergency Brake and Electronic Stability Control, now comes as standard on the new truck.

However, Volvo Dynamic Steering, with the safety systems Lane Keeping Assist and Stability Assist, only remains an option. A road sign recognition system, meanwhile, detects road traffic signs, such as overtaking restrictions, road type and speed limits, and displays them in the new instrument display. The visibility can be improved further by adding a passenger corner camera which provides a complementary view of the side of the truck on the side display, says Volvo Trucks. Volvo Trucks is launching the new generation with a range of fuel options and several types of drivelines will continue to exist in parallel for the foreseeable future.

The company notes: “In many markets, the Volvo FH and Volvo FM are available with the Euro 6 compliant gas-powered LNG engine that offers fuel efficiency and performance on par with that of Volvo’s equivalent diesel trucks, but with a far lower climate impact. The gas engine can run on either biogas, which cuts CO2 by up to 100 percent, or natural gas which reduces CO2 emissions by up to 20 percent when compared with Volvo’s equivalent diesel trucks. This relates to emissions from the vehicle during usage, known as tank to wheel. “The new Volvo FH can also be tailored with a new efficient Euro 6 diesel engine, which is included in the I-Save package that enables significant fuel and CO2savings. In long-haul operations for instance, the new Volvo FH with I-Save combines the new D13TC engine with a package of features and can deliver fuel savings up to 7%*.”

From a Middle East perspective, there have also been improvements for the Euro 3 and 5 AN ALL-NEW VOLVO FMX Volvo Trucks says its all new Volvo FMX has an entirely new cab, increased payloads and ‘innovative’ safety features.

FACTS ABOUT THE NEW VOLVO FMX

• Cabs: Day cab, Low day cab, Low sleeper cab, Sleeper cab, Globetrotter cab, Crew cab. Exterior and interior trim packages for individual design. • A new steering wheel: With a neck tilt option for a more ergonomic driving position. • Engines: Diesel engines are available with different emission standards. • Gear changing system: I-Shift and I-Shift with crawler gears, with software packages for different areas of application. • Lights: Halogen or LED headlamps.

versions with features like Volvo Torque Assist. Volvo Trucks says it is also setting a new level for vehicle uptime by increasing the engine oil drain interval by up to 50%, and introducing an advanced Real Time Monitoring system. Preventative maintenance has become the main driver of fleet management systems over the past decade and Volvo Trucks explains this system will continuously monitor selected uptime-critical components to help predict potential unplanned stops and turn them into planned workshop visits.

Real Time Monitoring is available as an option for the Volvo Gold Contract, which has been extended with yet another offer; the Volvo Flexi-Gold Contract. Unlike an offthe-shelf solution, the system means enables the new contract to offer a more flexible payment structure, as it adapts to fluctuating

30 APRIL 2020 business tue to changes in workload. Volvo Trucks has also introduced the Volvo Uptime Care Contract, which uses connectivity to follow up selected components and real usage of the truck in order to detect wear-and-tear and based on that continuously adapt the service plan. Connectivity also enables Remote Software Download, which means selected software can be downloaded at the customer’s convenience.

Volvo Trucks says the Volvo Flexi Gold Contract offers the same coverage as the Volvo Gold Contract, at the same predictable cost, but with much greater flexibility to adapt to changing business needs. The monthly fees vary, thanks to a 40% flexibility span for the estimated yearly mileage. This gives hauliers greater flexibility to adapt their operations to seasonal changes and fluctuating demand. “Many transport companies express a need for greater flexibility when it comes to service contracts. We now have the technology to make dynamic and connected solutions like this possible,” says Thomas Niemeijer, Business Development Manager, Service Contracts, Volvo Trucks.

A tougher FMX Volvo Trucks has launched its all new Volvo FMX with an entirely new cab, increased payloads and innovative safety features. With increased front axle loads of up to 20 tonnes and a 38 tonne bogie, the new Volvo FMX is built for the toughest conditions and most demanding assignments.

“Our construction industry customers are facing ever increasing demands to improve in areas such as sustainability, cost efficiency, safety and productivity,” says Roger Alm, President of Volvo Trucks. “With the launch of the new Volvo FMX, we are proving our commitment to supporting these customers by creating robust trucks and innovative services to assist in making their operations easier, safer and more profitable.” The new Volvo FMX is built on an entirely new cab platform, based on Volvo’s long and successful experience of delivering robust and functional construction trucks. “The new Volvo FMX is designed to give a superior combination of agility and durability,” explains Ismail Ovacik, Chief Designer Exterior for Volvo Trucks. “The completely new cab includes a front section with easily replaceable sturdy parts, headlamp protectors and new V-shaped LED headlamps. To make it easy for drivers to enter or exit,

we’ve designed new anti-slip footsteps.”

It comes with increased space in the day cab and storage of up to 800 liters. Drivers also get improved visibility thanks to a lowered door line and new rear view mirrors. The visibility can be improved further by adding a camera on the passenger side which provides a complementary view of the side of the truck. The dashboard has more storage space, new colours and a modern cluster. It includes a dynamic 12in high-resolution instrument display with an interface allowing the driver to immediately see relevant information and select between four different screen views, depending on the driving situation. The instrument display comes ready for future updates and connected services. The driver can gain more traction by engaging the differential locks in an easy way, by turning a knob, viewing the traction status on the instrument display at the same time. The new sleeper cab on the new Volvo FMX comes with improved storage possibilities, including a large storage compartment underneath the raised bed and an upper rear storage with LED panels in the compartment dividers. Moving from the seat to the bed is easier than ever with the new slimmer, ergonomically designed I-Shift gear selector, says Volvo Trucks

The new Volvo FMX features the heaviest addition to Volvo’s chassis range – a 38-tonne bogie that allows for a Gross Combination Weight (GCW) of up to 150 tonnes. In addition, the front air suspension has been updated, allowing for front axle loads of up to 10 tonnes, or 20 tonnes for double front axles. For trucks with a steered tag or pusher axle, the steering angles have been increased, resulting in better maneuverability and reduced tire wear. All these improvements add up to greater productivity and cost efficiencies for construction transportation tasks.

The new Volvo FMX comes with Adaptive Cruise Control (ACC) that now works at all speeds down to zero km/h. Further safety enhancing features on the Volvo FMX include downhill cruise control, which sets a maximum speed to help prevent unwanted acceleration when travelling downhill. The new road sign recognition system increases safety on the Volvo FMX by displaying traffic signs such as speed limits, overtaking restrictions and road type in the instrument display. For particularly rough applications like mining, the Volvo FMX comes with an optional steel roof hatch with an emergency exit handle that removes the entire hatch. The new FMX can carry more

tonnes and manoeuvre more easily, while keeping the driver safe and comfortable.

A driver-centric FH16 The new generation of the Volvo FH16 combines new safety features, a driver centric working environment and the latest technologies to give customers enhanced productivity. The new flagship model belongs to Volvo Trucks’ next generation of vehicles designed with the driver in mind. “By combining a powerful 16-litre engine of up to 750 hp, with improved maneuverability, the latest safety technology and greater driver support, the new Volvo FH16 gives superior productivity for the most demanding transport tasks,” says Volvo Trucks. “The Volvo FH16 is a genuine premium product that can handle all the most demanding

RECOGNISING THE SIGNS The Volvo FH16 features the road sign recognition system. The visibility can be improved further by the addition of a camera on the passenger side that provides a view of the side of the truck on the side display.

FACTS ABOUT THE NEW VOLVO FH16

• Cabs: Low sleeper cab, Sleeper cab, Globetrotter cab, Globetrotter XL and Globetrotter XXL. Exterior and interior trim packages for individual design. • Engines: Diesel engines are available with different emissions standards. The D16K with Euro 6 Step D is available with 550 hp/2800 Nm, 650 hp/3150 Nm and 750 hp/3550 Nm. • Gear changing system: I-Shift with software packages for different areas of application.

applications and, at the same time, give customers and drivers the best of everything,” declares Roger Alm, President of Volvo Trucks. “With the new generation we have created a package that makes no compromises between power and fuel efficiency, comfort and style.” “The Volvo FH16 delivers everything you expect from a Volvo truck, and more, thereby solidifying our position as the brand for heavy, demanding long-haul operations,” he adds. The exterior of the new truck is characterised by V-shaped headlamps which feature crystal like effects to reflect the intelligent technology the trucks are built upon. The strong character and heritage of the Volvo FH16 flagship model is enhanced with the waterfall themed grill, while the headlamp panels have been repositioned slightly outwards to give the vehicle both improved aerodynamics and a confident stance.

“In the new Volvo FH16 we have reimagined the most iconic design elements from our earlier generations and further enhanced them. With the new high tech headlights, for example, we have taken our strong light identity to the next level, while the entire front of the truck has been reworked to convey a more powerful impression,” explains Ismail Ovacik, Chief Designer Exterior for Volvo Trucks.

“Bolder, more sophisticated and confident, the exterior of the Volvo FH16 reflects the fact that this truck is more connected and smarter than ever before,” he says.

Increased front-axle load capacity, and tag and pusher axles with better steering angles, improve both the maneuverability and productivity of the new Volvo FH16. A new 38-tonne bogie is also available for especially demanding operations.

The new Volvo FH16 features industry first adaptive high beam headlamps that improve safety for all road users by automatically disabling selected segments of the LED high beam when the truck approaches oncoming traffic or another vehicle from behind. The high beam is adjusted when the camera and radar detects other vehicles or when the camera detects changes in the amount of light around the truck. The Electronically controlled Brake System (EBS), which is a prerequisite for safety features such as Collision Warning with Emergency Brake and Electronic Stability Control, now comes as standard on the new truck. Volvo Dynamic Steering, with the safety systems Lane Keeping Assist and Stability Assist, is also available as an option.

WORKSHOP JAGUAR LAND ROVER NEW PDC / FPT MAKES POTENZA PURCHASE / SAMOTER SHOW TO COME LATE 2020 / EUT OFFERING FREE TYRE CHECKS

Jaguar Land Rover upping parts presence

JAGUAR LAND ROVER BEGINS WORK ON NEW 19,000SQM PDC

PARTS Construction of new 19,000sqm parts distribution centre (PDC) Jaguar Land Rover in Dubai has begun following a special ground breaking ceremony last month. According to Jaguar Land Rover the PDC will serve customers throughout the Middle East and North Africa (MENA) region.

In a statement, the company said that the facility is currently expected to to be operational during the first quarter of 2021. “This will allow Jaguar Land Rover to meet projected growth in demand for parts and accessories over the next decade and beyond. This demand is driven by an increase in the number of cars joining the region’s roads. The new distribution centre will be located at Dubai’s Jebel Ali Free Zone Authority (JAFZA),” said the company.

Jaguar Land Rover’s current site,

JLR IS DIGGING INTO THE REGION The new distribution centre has been developed to keep pace with the projected growth of the market in the years to come, said MD Bruce Robertson.

which has operated a regional aftermarket Parts Distribution Centre in Jebel Ali, Dubai, since 2014, will begin to be phased out from November this year. The current operation serves nine MENA markets but the new development expands storage capacity and could potentially be expanded to 30,000sqm in the future.

The added space will allow Jaguar Land Rover to hold and distribute approximately 32,000 part numbers, including branded merchandise from the luxury marque, said the company.

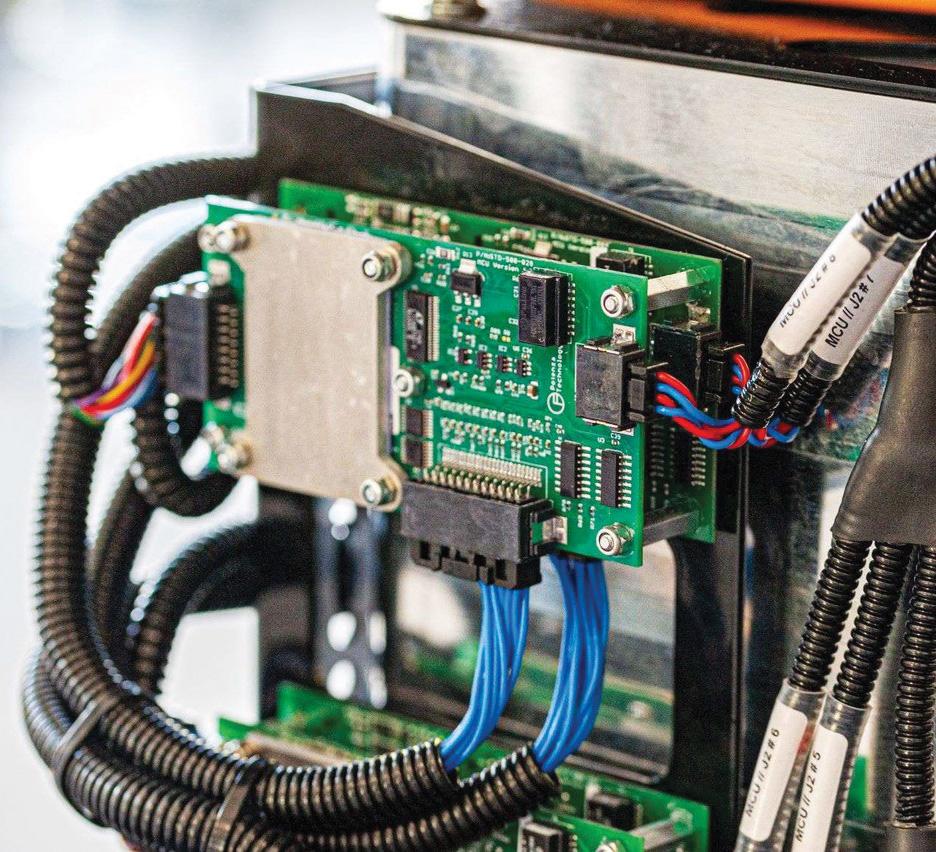

Responsible for all inbound, warehousing, scheduling, and distribution tasks, the new facility will streamline the flow of parts to retail partners across the region, enhancing customer service. “This is a key element of our regional expansion plans as we recognise the importance of offering first-class aftersales service, an essential ingredient of which is rapid parts supply,” explained Bruce Robertson, managing director, Jaguar Land Rover MENA. ELECTRONICS FPT Industrial says the acquisition UK company Potenza Technology represents another step in the firm’s path towards electrification, one of the pillars of its multi-power powertrain strategy.

The CNH Industrial company is known for the design, production and sale of powertrains for on and off-road vehicles, marine and power generation applications and has made a 100% acquisition of Potenza Technology. Based in Coventry, UK, it has been at the forefront of electric powertrain technology since 1999, with expertise in functional safety engineering, battery management systems, and electronic systems design and development.

“Thanks to the sustainability benefits of electrification, the powertrain industry needs to focus on this area to overcome the challenges and make it feasible for all potential applications,” said Annalisa Stupenengo, CEO of FPT Industrial. FPT NABS EV TECH COMPANY

INSIDE THIS MONTH’S WORKSHOP: UPDATE ON HOW CHINA’S AUTOMOTIVE INDUSTRY IS DEALING WITH THE CORONAVIRUS, AUTOMECHANIKA, AND MORE!

EVENTS Veronafiere, the organisers of the SaMoTer construction equipment show in Verona, Italy, have announced new dates for the event which was postponed due to the Covid-19 emergency sweeping the country. According to a statement from Veronafiere, the new dates for the event are 21-25 October this year. Originally taking place in March, the event had already been rescheduled to 16-20 May after the initial lockdown of northern Italy following the outbreak of the novel Coronavirus in the region. The event was to take place concurrently with Asphaltica, also organised by Veronafiere, dedicated to the bitumen and road sector, which will now also be held on the same dates. The two events will now share their dates with ICCX Southern Europe, the precast exhibition-conference, and Oil & non-Oil, the energy, fuel and mobility services trade fair.

Giovanni Mantovani, CEO of Veronafiere, said: “We continue to monitor the scenario, together with the steering committee involving companies, partners and associations such as Unacea and Siteb which co-organises Asphaltica with us. The new postponement agreed upon is consequently the result of realtime listening to the market and careful assessments. We took into account the need to ensure safety in health terms and safeguard the important investments planned by companies taking part. This unity of intent with stakeholders once again highlights the sector’s confidence in the capacity of the trade fair system to support it and be a tool for relaunching the sector, even in times of great crisis such as those we are currently experiencing.” SAMOTER AND ASPHALTICA RESCHEDULED TO OCTOBER

EUT AND AUTOPRO OFFER FREE TYRE CHECKS

TYRES Emirates for Universal Tyres (EUT), Continental’s UAE distributor, is teaming up with AutoPro, to offer free tyre check campaign for the Emirates’ drivers.

At a time of year when drivers face unpredictable weather, resulting in the increased possibility of accidents, the campaign has been introduced to ensure drivers are as safe as possible, the two companies explained in a statement. Each customer will be offered a complete tyre check, which will include tests for air pressure, tyre size, tread depth, wear and punctures. The checks are on offer as part of Autopro’s 10th anniversary. Drivers can stop for he checks between 22nd February and 25th April. “Helping to deliver the safest possible driving environment is a primary focus for both EUT and Continental,” said Shaun Smith, FREE UNTIL THE END OF APRIL The tyre checks are on offer in Dubai, Sharjah and the Northern Emirates as part of Autopro’s 10th anniversary and will be available until the 25th April.

general manager, EUT. “This campaign is perfectly in keeping with this objective, and we look forward to helping as many of the UAE’s drivers as possible.”

Taleb Al Saleh, retail marketing director, ENOC added: “As the operator of the largest network of automotive facilities, AutoPro has a commitment to understanding our customer’s needs and safety. That’s why we deliver the best quality service. For our tenth anniversary celebration, we are implementing a series of tyre safety campaigns, partnering with Continental Middle East and EUT to make sure that our customers drive away safely and that their tyres are roadworthy.” EUT was recently reappointed as the sole UAE distributor for Continental.

ROLLS-ROYCE REVEALS CORONAVIRUS MEASURES

PRODUCTION Rolls-Royce Motor Cars halted production at the company’s Goodwood-based manufacturing plant on 23 Monday March for an initial two weeks. In order to further secure the health and welfare of the employees of the company this suspension will be followed by an already-planned two-week Easter maintenance shutdown, said the company.

The day-to-day operations of the company was assured by nonproduction employees who will remain at work at the company’s head office on the Goodwood Estate in West Sussex or who will work from home on a rotational basis. Social distancing measures were also

A HARD DECISION TO MAKE Rolls-Royce CEO Torsten Müller-Ötvös says the action was not taken lightly but the company had to protect its workforce. introduced throughout the company. “This unprecedented action has been taken following the introduction of additional measures by the UK Government to tackle the Covid-19 pandemic,” said the company in a statement.

“This action has not been taken lightly, but the health and wellbeing of our exceptional workforce is first and foremost in our minds,” said Torsten Müller-Ötvös, CEO, Rolls-Royce Motor Cars. “We are a tight-knit community at the Home of Rolls Royce and I have no doubt that our resilience will shine through during this extraordinary time.” He continued, “As a deeply customer-focused company we are aware that this decision to pause our production will possibly cause some discomfort or inconvenience to a few of our esteemed patrons, for which we apologise while seeking their understanding at this difficult time.”