Summa Health’s $84M behavioral health facility will be open to patients later this month, aims to encourage integrated care.

WASTELAND NO MORE

After decades of inactivity, developers are moving dirt on Scranton Peninsula

BY MICHELLE JARBOEFor decades, the western side of Scranton Peninsula has been a wasteland, a forgotten stretch of Cleveland’s winding riverfront across the water from Tower City.

Now workers are moving dirt for the rst of two apartment projects

that will bring more than 600 homes, and upwards of 1,000 residents, to the former industrial site. Public ocials and private landowners are talking about public access, a waterfront path that will connect the emerging neighborhood to a growing network of trails and parks.

And Great Lakes Brewing Co. is

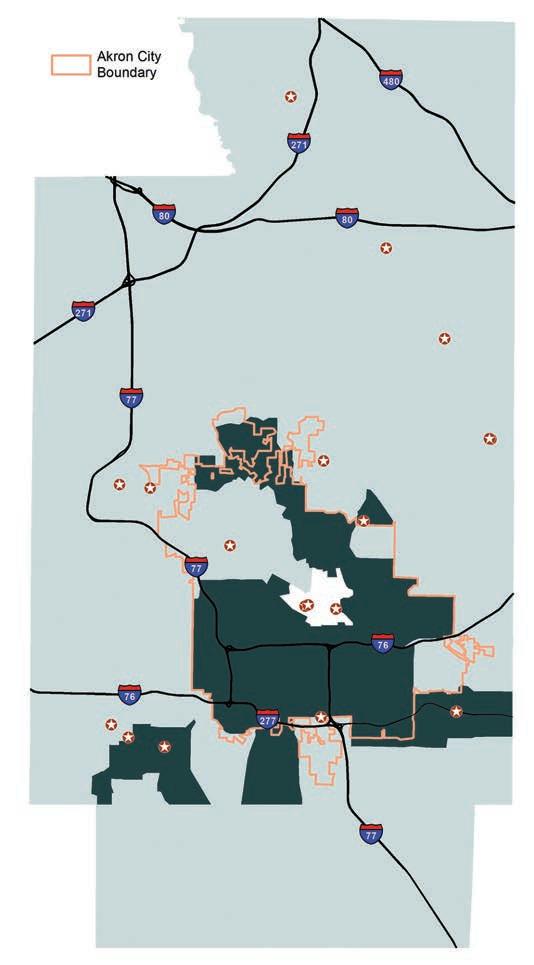

Ohio outpaces nation in bank branch closures

BY JEREMY NOBILEIn Ohio and across the country, regional banks continued consolidating their physical branch networks at an accelerated pace in 2022, raising concerns over the equitable impact of those closures.

“Branches in (low- to moderate-income) areas are already less

common,” said Jason Richardson, senior director of research for the National Community Reinvestment Coalition. “Even a small number of closures leaves sections of many cities without banks, and those tend to be in minority, LMI tracts.”

readying land for development near the peninsula’s base, on both sides of Carter Road. Portions of that property eventually could host a taproom and a relocated or expanded production facility.

at mix of uses isn’t exactly what Fred Geis, Jesse Grant and Matthew Weiner imagined in 2017, when they

partnered to buy 25 acres from longtime owner Forest City Realty Trust Inc. But it’s not a total departure from their vision of bringing people back to a place that’s so close to — yet feels so far from — the core of downtown.

DAN SHINGLER/CRAIN’S CLEVELAND BUSINESSTressel re ects on his time as YSU’s president

BY RACHEL ABBEY MCCAFFERTY

For Jim Tressel, serving as a university president has been an “unexpected detour” in his career, rather than a pre-planned destination.

To many, Tressel is known as a high-pro le football coach, having led Youngstown State University and Ohio State University to national championships. But the past decade of his career has been dedicated to leading people in a di erent way.

After 38 years of coaching, hav-

ing left OSU during the tattoo scandal, Tressel spent some time at the University of Akron in an executive vice president role. In 2014, he took on the role of president at Youngstown State during a time of transition. He was the university’s fourth president in ve years.

ings have changed. Today, after nearly nine years at the helm, he’s one of the longest-serving public university presidents in the state.

Tressel will step down as Youngstown State’s president at the end of January. He spoke with Crain’s about his academic career, advice for his successor and what’s next for the Tressels.

e following conversation has been edited for length and clarity.

Summa’s new facility aims to encourage integrated care

BY LYDIA COUTRÉSumma Health’s $84 million behavioral health facility on the system’s main campus in Akron will be open to patients later this month.

e system will begin its inpatient transitions from their current location at St. omas Hospital to the 159,000-square-foot Juve Family Behavioral Health Pavilion on Jan. 24, with the outpatient and other o ces to follow by February.

ough the move is just a couple of miles down the road, placing behavioral health services in the heart of Summa’s campus is meaningful, said Dr. Joseph Varley, chair of the Summa Health Department of Psychiatry.

For one, it sends an important message and a visual reminder that mental health and mental well-being are part of health care. And more practically, by co-locating the behavioral health pavilion with other services on the main campus, providers can collaborate and integrate care in a more comprehensive way.

“We have the opportunity to integrate and work collaboratively with our medical and surgical colleagues,” Varley said. “For them to help us manage the medical concerns and problems that arise in our patients, and for us to be more integrated in helping patients who are admitted to the hospital for more traditional medical reasons, who have emotional behavioral concerns, as well as addiction issues.”

No decision has been made about the future of the St. omas building. Once patients are moved, Summa plans to evaluate the space.

e Juve Family Behavioral Health Pavilion was named in honor of a $10 million gift supporting the project from Northeast Ohio philanthropists Sharon and Richard Juve.

e $84 million pricetag for the seven-story facility included $60 million in construction costs, with the remainder for equipment and furnishings. It was funded through a combination of cash and bondnancing.

Building the facility from the ground up allowed the unique needs and safety of behavioral health patients to be factored into the design, such as angles of hallways in units to increase observations from nursing stations, said Jaimie McKinnon, vice president of behavioral health services for Summa. is isn’t possible when renovating an existing medical building.

e facility has 64 private, inpatient psych beds across four adult units on the top four oors: geriatric psychiatry, acute psychiatry, dual diagnosis (for those with substance use disorder and psychiatry needs), and a sub-acute or step-down unit.

ere also are 14 single-occupancy detox beds now located in the main hospital facility. St. omas Hospital had 14 detox beds and 69 psych beds in semi-private rooms.

ough the capacity is ve fewer beds, the fact that all of the rooms are single-occupancy is an important distinction, said Varley, who also holds the Jim and Vanita Oelschlager Endowed Chair in Psychiatry and Behavioral Health.

“In our current location at St. omas, on any given day, we have ve to 10 beds that are blocked because patients can’t accommodate a roommate,” he said. “So we have to

make it essentially a single occupancy room, but it decreases our capacity.”

Having every room private will add exibility, and also simpli es visits

for providers who need to meet with patients in the units. At St. omas, providers were often competing for conference rooms to spend time with their patients. In the Akron campus

Additionally, last February Sum-

ma Health opened 12 designated psych beds with added safety features and higher observation in its Akron campus emergency department, which is connected to the behavioral health pavilion, McKinnon said. is o ers ease and convenience for a patient and their care team if it’s determined they need to be admitted.

e rst oor of the behavioral health pavilion was designed with the public in mind, Varley said. It houses the Heritage Center (to preserve the history, including that of Alcoholics Anonymous, currently at the chapel in St. omas), a re ection center, a garden, café, re ection center and space for the partial hospitalization program and intensive outpatient programs.

Outpatient o ces for psychiatry, psychology and the Traumatic Stress Center are all on the second oor, which is connected to the parking deck. Inpatient check-in and access for patients and visitors is also on the second oor. Floors four through seven hold the inpatient units. e third oor is mechanical.

“At St omas, we’re scattered in di erent parts of the hospital and it never was an intentional design. It was always putting things where we could put them,” Varley said.

e new facility is thought-out, organized and should better facilitate communication among sta not only within the building but across the system, he said.

at translates to better coordination for patients, McKinnon said: “ ere’s e ciency and hando s from one level of care to the next.”

Lydia Coutré: lcoutre@crain.com, (216) 771-5479, @LydiaCoutre

Aging Rocky River o ce building set for apartment conversion after sale

BY MICHELLE JARBOEA 1960s o ce building in Rocky River is slated to become 100 apartments, as residential conversions of obsolete workspaces spread from downtown Cleveland into the suburbs.

Multifamily investors Kenny Wolfe and Agostino Pintus bought Westgate Plaza, an eight-story o ce building, in December. A company tied to the real estate syndicators, who pool cash from other investors for acquisitions, paid $2.3 million for the property.

Located at 20325 Center Ridge Road, Westgate Plaza sits just east of Westgate Shopping Center, near existing apartments, condominiums and an assisted-living facility. e area already is zoned to allow multifamily projects, and the developers won approvals for modest variances — related to unit sizes and on-site storage — this month.

Park, near Cleveland Hopkins International Airport, a former NASA ofce building reemerged last year as an 87-unit apartment project called the Centaur.

Westgate Plaza is the rst suburban transformation e ort for Wolfe, who is involved with eight other o ce overhauls in Ohio, Texas and Georgia.

In downtown Cleveland, he and Pintus still are trying to line up nancing to revive the Rockefeller Building, at West Sixth Street and Superior Avenue, as apartments over rst- oor retail. And Wolfe, a Texas-based developer, is part of a separate joint venture tackling a residential revamp of 45 Erieview Plaza, at East Ninth Street and Lakeside Avenue.

e partners, with older apartment buildings scattered across the region and a growing roster of ground-up construction projects in Cleveland, aren’t targeting suburban conversions.

e Rocky River acquisition was unique because of the building’s location in an afuent area and its proximity to shopping, dining, parks and public transportation.

tunity.

Mayor Pam Bobst said the project will clean up a tired piece of real estate while helping Rocky River diversify its housing stock.

“ ere’s a great deal of apartments in the city,” she said, “but apartments that provide easily for one- oor living are highly desirable. And we’ve seen those projects take o .”

e Rocky River police department was a tenant at Westgate Plaza from 2019 to 2021, while the city was building a new police station. O cials cited the property for code issues, raised concerns about deferred maintenance and, at one point, urged Cuyahoga County to initiate a foreclosure against the seller over unpaid property taxes.

“It was a building that needed attention,” Bobst said.

If Wolfe and Pintus are successful, Westgate Plaza might serve as a template, instead.

“I think there are o ce building owners that are looking at this to see how viable this is, as a project,” Bobst said. “It will be interesting to see if this will be a catalyst.”

ey received nal approval from the city’s planning commission on ursday, Jan. 19.

Plans prepared by the Geis Cos., the design-builder on the roughly $30 million makeover, show a mix of studios and one- and two-bedroom units. e developers expect to replace part of the parking lot with landscaping. In the basement, tenants will have access to about 5,000 square feet of amenities, such as a gym, a dog-washing station and, perhaps, a golf simulator.

Such o ce conversions, which are common in Cleveland’s central business district, are popping up increasingly in the suburbs as investors take a fresh look at aging buildings.

Even before the pandemic jarred the o ce market, the Brutalist Lakewood Center North tower in Lakewood reopened as apartments. In Beachwood, the early-1980s Commerce Park IV o ce building is set to become housing. And in Fairview

“Wherever there’s density, there’s money. ere’s activity. And that’s what we like,” said Pintus, who lives in Cleveland.

“It’s suburban, but it’s not,” Wolfe added. “You can walk to all that retail, and restaurants.”

e developers hope to start construction in late 2023 or early 2024, depending on how long it takes them to secure a loan from a U.S. Department of Housing and Urban Development program for market-rate projects. e apartments could open in 2025.

e o ces are 20% to 30% occupied today, Wolfe said. He and Pintus bought the property from a Canadian dentist who had owned it for a decade, public records show.

“We were under contract within two weeks. We had a lot of interest, and I mean, a lot,” said Jamie Dunford of the CBRE Group Inc. brokerage, who marketed the 92,500-square-foot building as a redevelopment oppor-

e developers are not seeking incentives from Rocky River, but they’re exploring other potential sources of nancial assistance.

“ ere are a lot of infrastructure costs that go into an o ce conversion,” said Brandon Kline, director of design development for Geis.

He mentioned adapting o ce corridors and stairwells to modern residential codes and softening the appearance of the property by carving out landscaping beds from the roof of the underground garage. e site includes more than 300 parking spaces today — far more than the apartments will need — and will have 236 once the renovations are done.

“ e big di erence, obviously, is trying to have that sense of residential scale. … We’re trying to ensure that there’s a good blend,” Kline said, “making sure we create a strong residential environment while still making sure that the project stays vital.”

“WHEREVER THERE’S DENSITY, THERE’S MONEY. THERE’S ACTIVITY. AND THAT’S WHAT WE LIKE.”

—Agostino Pintus, investor

Trailblazing independent living property in Westlake sold

STAN BULLARDOur House, a congregate care facility in Westlake for people over age 62, has been sold by its founding family to an out-of-town senior living company that plans to convert it to assisted living from independent living and change its well-known name.

When contractors hired by Our House’s founder, the late Mattie Maran, started building the 76-room property with a common dining room, an item in the May 11, 1977, Plain Dealer reported it was the rst ground-up congregate care facility in Ohio.

As of year-end 2022, the 9-acre, six-building property with a pond and walking trails at 27633 Bassett Road was acquired by Westlake ALF LLC, a Columbus-based a liate of the Burgess-Miller Ventures adult living company, for $3.2 million, according to Cuyahoga County land records. e county assigns it a market value of $2.7 million for property tax purposes.

e sale comes as senior living facilities in the region are recovering occupancy from a downturn in 2020 due to multiple properties being built and the advent of COVID-19. Area occupancy climbed to 79.4% as of the end of 2022 from 77.9% a year earlier, according to the National Investment Center for Senior Housing Care, an Annapolis, Maryland, nonpro t that tracks the sector.

Our House is Burgess-Miller’s rst acquisition, as it was formed in 2022 by Brent Miller of New York City and Eamon Burgess of Columbus to invest in assisted living facilities in underserved communities in Ohio and Indiana. Burgess owns three assisted living facilities separately, one in Ohio and two in Florida, and provides the operations background. Miller, who handles capital formation and nancing, also brings a background as a management consultant to the operation.

e two have not yet established a

corporate o ce, Miller said.

“We feel Our House is a really good opportunity with a lot of potential,” Burgess said in a phone interview. “We were impressed by the longevity of sta , as many people have worked there for 20 years. Knowing the current owners have done a great job, there’s not a lot to change.”

But change is planned. Burgess-Miller plans to convert the independent living concept to assisted living, which requires obtaining a new state license. ey will also o er a Medicaid waiver program for residents, which not all privately owned assisted living facilities do.

e biggest change is that they have renamed the facility Westlake Assisted Living to suit its assisted living focus. However, the familiar Our House street sign has not been replaced yet.

Burgess-Miller will not ask independent living residents to exit, Miller said. e facility also has some empty one-bedroom suites. Occupancy is 65%.

e duo’s concept, as the Medicaid availability re ects, is to focus on providing lower-cost alternative living than is typical in the industry. Miller declined to disclose asking rates.

Burgess-Miller is adapting the kitchen to meet assisted living requirements and making some cosmetic improvements such as new ooring in the lobby. Miller said it plans to make no changes to the grounds with an expansion, even though there might be room to do so.

ey retained all the 50-some sta ers who chose to remain and are looking to hire another 10 workers. ey also hired Jodi West, the daughter of the prior owner, as the property’s executive director.

Marguerite Zitello, founder Mattie Maran’s daughter, who just retired as CEO of Our House, said in a phone interview she sold to Burgess-Miller because they are smaller

operators who share her family’s values.

“It’s time to bring in new blood,” Zitello said. “You’re really on call 24 hours a day. I lived in a trailer onsite while Our House was being constructed and was the rst leasing person. I always said we didn’t have the brass and glass of other operations, but we had what counts, comfort and good food.” at was always the centerpiece of the concept.

“My mother loved old people,” Zitello said. “She always said we were operating a happy house for old people.” To gain funds to help launch Our House, she recalled, her mother bought an old, high-vacancy rst- oor retail and upper- oor apartment building in Lakewood, xed it up, rented it out and sold it.

Increased competition from more than a half-dozen newer facilities in the area and di culty lling job openings also factored in her decision to sell. She noted the location in a residential area without main-street visibility also posed a visibility challenge as new operators entered the market.

Westlake Mayor Dennis Clough said in a phone interview that when Our House opened, it was the suburb’s rst senior-focused independent living facility, although it now has to compete with a half-dozen other companies in the area.

“It’s another case of things getting harder for mom-and-pop operators,” Clough said. “For its time, it was a very progressive idea. e rst time I heard Mattie Maran talk about it, I thought, ‘What a new idea.’ I’ve enjoyed walking its grounds over the years.”

For Burgess-Miller’s part, Burgess said he considers the level of competition in the West Shore area typical.

Miller said Miller-Burgess hopes to land more assisted living properties in the region.

Stan Bullard: sbullard@crain.com, (216) 771-5228, @CrainRltywriter\

O ce market pain continues as industrial market notches gains

STAN BULLARDe bottom line in 2023 will be that Cleveland-area companies needing o ce space will continue to bene t from a buyers’ market, as the pandemic-era growth in working from home lingers. Meanwhile, those needing industrial space will struggle with a sellers’ market.

e tale of two markets in Northeast Ohio is shown by the numbers.

Newmark’s Cleveland o ce reports that as of the end of 2022, metropolitan area vacancy climbed to 19.8% — the highest in 20 years — from 18.9% a year ago. And that is with the o ce market shrinking by 1 million square feet over the year to 38 million square feet from 39 million a year ago, as o ce buildings ranging from e Rockefeller and 45 Erieview downtown to the Westgate O ce Plaza in Rocky River are earmarked for apartments.

Meanwhile, vacancy in the industrial sector fell to 4.2% as of year-end 2022 from 4.8% a year ago. And that drop occurred as the industrial market — primarily large, tall properties used by e-commerce companies — grew. At the end of 2022, there was 291.6 million square feet, up from 290.4 million at the end of 2021.

David Hollister, a managing director in Newmark’s Cleveland o ce who works in both o ce and industrial space, sees the di erence on an almost daily basis.

“In the o ce market you have these strong headwinds, with these large subleases or o ce-building sales, respectively, from American Greetings Corp. and Progressive Corp.,” Hollister said in a phone interview. “Meantime, most tenants with more than 20,000 square feet are delaying decisions. Why tie up space for ve or 10 years when you are not sure how this will work out? Yet the small moms and pops are out there doing deals for 5,000 square feet or so, because they know they need the space.”

By contrast, he said, “in the industrial market, there’s just nothing

available. You deal with a sellers’ market. e sellers and property owners are holding their prices. Meantime, the company wanting to buy industrial space is having its buying power eroded by the actions of the Fed.”

Although the o ce vacancy statistic is the highest in 20 years, Chandler Converse, a managing director and tenant representative at CBRE’s Cleveland o ce, declined to say he considers it the worst he has seen.

“It’s a bifurcated o ce market and a continued ight to quality,” Converse said. “If your building has amenities and you have made improvements, you’ll generally be doing pretty well. But for the older buildings without improvements, it’s very di cult, and you’ll see more of them go the way of 1100 Superior Ave. (also known as the Oswald Centre) and going back to the lender. On the other hand, Key Tower is 95% leased due to the quality of the building and improvements the owner has made to the building.”

e one plus is that Cleveland has had success over the years in converting o ce space to residential or hotel use, Converse said, while that is new ground, but a growing endeavor, in other markets.

However, the ux of di erent market conditions, with soaring construction costs and rising interest rates, means bargains are scarce.

e result of the strong appetite for industrial property means rents are up. e JLL Inc. Cleveland industrial market report notes that asking industrial rents have reached “a new peak at $5.60 a square foot, up 13.8% in a single year.”

Newmark reports Cleveland-area asking o ce rents inched to $18.82 a square foot at the end of 2022 from $18.60 a year earlier.

Hollister said the o ce asking rent hike is likely due to companies taking better, more expensive o ces — although they are shrinking their o ce requirements to push down total outlays from when they were in larger, but less-expensive, o ces.

Expense increases outpace revenue growth for health systems

LYDIA COUTRÉLabor shortages and in ationary pressures continue to weigh on Northeast Ohio health systems’ bottom lines, according to third-quarter nancial reports.

For Cleveland Clinic, University Hospitals and Summa Health, increases in expenses — including in labor, pharmaceuticals and supplies — outpaced growth in revenue, resulting in each reporting an operating loss through Sept. 30, 2022.

“Some hospitals are losing money on operations because of increased labor costs or the di culty in obtaining other personnel and perhaps some reduction on the revenue side and other increased expenses for patient care,” said Allan Baumgarten, a Minnesota-based health care consultant who studies the Ohio market.

MetroHealth, which also saw growth in both revenues and expenses, reported an operating income of $24.3 million on $1.2 billion in revenue for the rst nine months of 2022, compared with an operating income of $76.8 million during the like period in 2021 on $1.1 billion in revenue.

“On the heels of the COVID pandemic and with a national workforce shortage, MetroHealth faces the same challenges experienced by hospitals and health systems across the nation: increased expenses and tightening margins,” Craig Richmond, MetroHealth’s executive vice president and chief nancial and system services o cer, wrote in response to emailed questions. “Rising in ation has notably impacted labor and supply expenses.”

Operating losses for the Clinic in the rst nine months of last year were $316.3 million on $9.5 billion in revenue, compared with an operating income of $549.4 million for the like period in 2021 on $9.1 billion in revenue.

e Clinic’s operating loss for the entire year is expected to come in at more than $200 million, its president

and CEO, Dr. Tom Mihaljevic, said during his annual State of the Clinic address on Wednesday, Jan. 18.

e Clinic is working to reduce costs and carefully manage resources, according to a statement from the system, which notes that “our history of nancial stewardship puts us in a solid position to face these challenges.”

For the rst nine months of 2022, UH reported an operating loss of $226.1 million on $4 billion in total revenues, compared with the year prior during that time, when it had an operating income of $68.2 million on $3.9 billion in revenue.

Moving into its 2023 budget planning, UH embarked on some revenue improvement strategies combined with “some fairly signi cant cost reductions,” said Mike Szubski, UH chief nancial o cer. ese include: purchase service renegotiation, taking a close look at discretionary spending, third-party relationships, workforce reductions (including laying o administrative employees and eliminating unlled positions) and rethinking how to do its business with less.

Szubski said he expects UH to see “signi cant improvement” over 2022.

“I would not say we’re all the way there yet; (there are) still things in process that we’re working on,” he said. “But the picture for ’23 certainly looks better — at least on paper — than what we experienced in 2022.”

He also noted that S&P recently informed UH that it a rmed the system’s credit rating as A, with a stable outlook.

“S&P noted the extraordinary effort by UH’s management team to address historic challenges facing the health care industry,” Szubski said. “Challenges remain, but we are pleased that the changes we have im-

plemented position us to ful ll our mission and provide quality care to our community.”

For the rst nine months of 2022, Summa posted an operating loss of $20.8 million, compared with income of $32.6 million during the like period in 2021. Its operating revenue through Sept. 30, 2022, was $1.3 billion, up slightly from $1.2 billion a year prior.

e system faced higher pharmacy expenses and increased costs for materials and supplies, plus signi cant growth in labor costs (spending $52.5 million more in the rst nine months of 2022 compared with 2021) despite roughly the same employee count. Summa spent nearly $40 million on agency or contracted labor just in nursing last year, said Dr. Cli Deveny, Summa president and CEO.

UH similarly saw staggering costs in these travel nurses. Szubski said UH went from spending $1 million a month on contract nurses in 2021 to spending $16 million or $17 million in payments to these agencies for some months in 2022.

He said there’s “no question” that the premium paid to travel agency nurses is the “predominant component of our labor cost increase.”

Other factors contributing to the growth in labor costs are overtime pay, supplemental pay premiums to employees and the April 2021 addition of Lake Health, which means that part of comparable period in 2021 doesn’t include the workforce of Lake Health.

Patient volumes are another ongoing challenge for the systems, as well as the complexity of care they need.

“Our acute side has continued, with much sicker people, with higher

resource needs, higher labor needs to take care of them,” Deveny said.

Meanwhile, elective and ambulatory volumes remain down and haven’t come back, which Deveny attributes to a few factors. One may be a nancial decision for patients a ording their copay. ere have also been “disruptors” in the market where patients can seek care, which has added competition to the ambulatory and elective space.

“And then we’re also seeing, I’d say, a continued distrust of health care,” he said. “We’ve got a lot of people that, because of the vaccinations, and a lot of the concerns with big business, just haven’t reengaged like they did. And so what we nd is, people who put stu o — especially if they have other medical issues — they tend to show up in the emergency room very sick.”

Szubski also said he’d like to see some recovery in patient volumes, which have been “relatively at” as patient behavior has shifted and the economy has forced some folks to put o health care needs for the time being.

“We’re still trying to make our way back up to pre-COVID levels, and we’re getting closer,” he said. “I think once we get back to pre-COVID levels, we’re going to be in good shape, but I think most everybody is trying to work their way back up to 2019 levels.”

UH’s Accountable Care Organization has been very engaged, and the system and clinical leadership have been working to ensure an easy, patient-friendly experience accessing the system. “ e problem still remains: As long as you have this nursing shortage and this labor shortage, how much can you re the engine up? I think everyone’s still facing that issue,” Szubski said. “I think there’s still demand there. But we’ve got to get this labor issue corrected.”

Over the last two years, MetroHealth has implemented overtime and premium incentive programs

with the goal of retaining its workforce “and ensuring we can continue to provide our patients with the care they need,” Richmond wrote. “Although we have seen an increase in wages and bene ts as a result, the system has been able to continue delivering excellent care, and even open new facilities.”

While MetroHealth has experienced a decline in volumes in some clinical services, Richmond wrote that improvements to the payor mix and case mix have minimized the impact to net patient service revenue.

In its statement, the Clinic noted: “While demand for patient care is strong, we are experiencing high costs for supplies, pharmaceuticals and contracted workers. Our non-operating loss of $440.9 million in the third quarter of 2022 was primarily due to lower investment returns compared to the same period in 2021.”

e region’s other health systems also saw investment losses in their non-operating incomes.

Health systems were blessed to live o investment gains in their balance sheets, “and that paid for a lot of capital; that paid for a lot of strategic opportunities,” Deveny said. “Going forward, we will have reduced capital.”

Fortunately, he said, Summa nished its master facility plans, with major upgrades to its Akron city and Barberton campuses, transitioning to its own instance of the Epic electronic medical record system and, this month, opening the new Juve Family Behavioral Health Pavilion.

“We will be tight on capital for the next couple of years — probably like everybody else,” he said. “But I think the big issue is how long this goes on, and it really does point back to, you know, if you can’t depend on the investments like we did in the past, you’ve got to generate it through operations.”

Lydia Coutré: lcoutre@crain.com, (216) 771-5479, @LydiaCoutre

DOWN YEAR: Northeast Ohio home sales slid 10% last year, as rising borrowing costs priced buyers out of the market and a persistent inventory shortage locked existing homeowners in place. Sales were o by nearly 5,500 homes across the 18-county region tracked by MLS Now, a real estate listing service. e housing market started 2022 on strong footing, but transactions fell swiftly as the Federal Reserve raised interest rates to quell in ation. Meanwhile, new listings dwindled as prospective sellers decided to stay put. Prices kept climbing, but at a slower pace. And the typical listing period for a house ticked up as consumers adjusted to an uncertain landscape.

PLAY ON: A new nonpro t will make sure Highland Park Golf Course is up to par. e city selected the Highland Park Golf Foundation (HPGF) to lead the revitalization, operations and management of the only public course near Cleveland’s East Side. e city requested proposals from vendors in September and chose HPGF over ve other submissions. HPGF’s proposal includes a ve-year timeline to make course and clubhouse improvements, build a driving range, construct a chipping and putting cen-

ter, become certi ed in the Audubon Cooperative Sanctuary Program and host a dedication ceremony of the revitalized course by its 100th-year cele-

bration in 2028.

prominent development sites worth? More than $8.3 million an acre, according to public records. at’s what Bedrock, the real estate arm of Dan

Gilbert’s Rock family of companies, paid for the former NuCLEus site in the Gateway District, just north of Rocket Mortgage FieldHouse. Documents that popped up in Cuyahoga County records on Tuesday, Jan. 17, show a Bedrock a liate shelled out $26.5 million for the property. e transaction closed Jan. 6, but lings related to the deal took more than a week to appear online. e site, between Prospect Avenue and Huron Road, on the east side of East Fourth Street, spans 3.17 acres. It includes a 250-space parking lot, a shuttered garage and a modest brick retail building at 612 Prospect Ave.

TEAMING UP: Cleveland-Cli s Inc. and the United Steelworkers have come together to le for trade protections on tin- and chromium-coated sheet steel products. e steel and iron ore pellet producer and the union led antidumping and countervailing duty petitions against eight countries they believe are unfairly trading the aforementioned “tin mill products.” e parties are seeking antidumping duties on the following countries: Canada, China, Germany, the Netherlands, South Korea, Taiwan, Turkey and the United Kingdom. Additionally, they are looking for countervailing duties on imports of the products from China.

Clevelanders for Public Transit wants more riders on RTA’s board

BY KIM PALMERHalf of the seats on the Greater Cleveland Regional Transit Authority’s board of trustees need to be lled in 2023, and the advocacy group Clevelanders for Public Transit (CPT) is looking to extend its already substantial in uence to get a slate of transit users in those roles.

Members of the RTA’s 10-person board are appointed equally by the city of Cleveland’s mayor and the Cuyahoga County Executive. One of the seats is currently un lled, and as of March, the terms of four other board members will expire. ree of the appointments are the responsibility of the new County Executive, Chris Ronayne, and the other two are the responsibility of Cleveland Mayor Justin Bibb.

With half of all the board seats up for grabs, CPT released a list of 15 candidates — all public transit advocates and riders — that it would like to see considered for the positions.

“As the ultimate seat of authority for GCRTA, the board of trustees must be lled with members who understand the needs of riders. Riders need more buses on the streets and new trains on the tracks. We need to get to where we’re going quickly, reliably, safely and a ordably,” said CPT spokesman and chair Chris Martin.

According to Martin, RTA is “in a period of precarious transition” as some of the crucial federal and state COVID-19 rescue and recovery funding that helped with operating de -

cits disappears, and new tax revenue sources have not been formally pursued. e combination could leave the agency with a de cit.

RTA board seats, which pay $4,800 annually for the three-year term, traditionally have been lled with business and labor leaders, plus a small group of suburban mayors. e mayors of Bay Village, Seven Hills and Shaker Heights currently serve on the board.

St. James AME pastor emeritus the Rev. Charles P. Lucas, a paratransit rider, currently serves as president and is part of a slow move toward seating board members who are reliant on public transit.

e push by CPT to add non-traditional board members brought bus rider Roberta Duarte, nominated in 2021 by then-Cuyahoga County Executive Armond Budish, to the board to ll the spot held previously by then-Cleveland mayoral candidate Bibb.

Duarte resigned in 2022. e seat remains un lled after the failed nomination of North Olmsted City Councilman Chris Glassburn, who once served as Budish’s campaign manager and drew criticism from CPT that he was not a regular public transit user and would not be a good representative for other public transit riders.

CPT’s advocacy, in addition to inuencing new board appointments with the city and county, can be seen in some of the policy spearheaded by RTA CEO India Birdsong Terry, who was hired in 2019.

Birdsong Terry, according to a statement from an RTA spokesman, does not weigh in on appointments to or removals from the RTA board. But two new programs can be directly linked to issues taken up by CPT.

RTA’s Transit Ambassador Program was launched in 2022, partly in response to a 2017 legal decision heralded by CPT and other advocates that found patrols by armed guards on RTA’s rail lines unconstitutional. e program aims to decrease the presence of law enforcement by adding rider ambassadors and crisis intervention specialists alongside RTA police, with the goal of de-escalating and mediating potential con ict.

lic complaints of alleged misconduct.”

In less than a week after the application portal for the Oversight Committee opened, the site has received heavy amount of unique visitors, and a number of forms were downloaded, according to RTA spokesman Robert Fleig.

Bibb, who during his mayoral campaign said he would appoint public transit advocates to the RTA board, made good on his promise by nominating two CPT-sponsored candidates — Lauren Welch and Je Sleasman — for seats in early 2022.

Welch, an Edgewater resident, a regular transit rider and assistant director of communications for Say Yes Cleveland, was seated in February. Sleasman, though, was not, after Valerie McCall, an appointee of former Mayor Frank Jackson since 2006, refused to give up her seat.

mands or complaints.

“I’m a big proponent of meeting people where they are. I would look to meet one-on-one with existing trustees to understand the nuanced, behind-thescenes way things work,” he said. “It is important, if you want to e ect change, to understand the whole situation.”

Steirer is on board with CPT’s calls for more frequent bus service and an increase in revenue from a stable funding source — including a possible increase in the share of county sales tax.

“As an oversight board, members would have an obligation to investigate and work on the consistent stream of nancial support for the agency,” Steirer said.

Another program, the Civilian Oversight Committee, is in part the result of calls by CPT leaders for less policing on RTA lines and stops. e creation of a seven-member group with oversight of RTA’s transit police department is, as Birdsong Terry described it in a statement, “a voluntary and proactive e ort that seeks to give voice to the community and enhance accountability through an independent review and investigation of pub-

For the 2023 round of appointments, CPT leaders again are recommending Sleasman and Jonathan Steirer, a Cudell-area resident who uses public transit to travel crosstown to his job as managing director of the Great Lakes Energy Institute at Case Western Reserve University.

Steirer said he believes having transit riders “at the table” is critical to bolstering service.

“It is easy to be siloed if you are not regularly using the service advocating on the behalf of riders,” Steirer said.

He also brushes o any idea that CPT-endorsed candidates will disrupt the work of the board with de-

If seated on the board, he also would look to make RTA’s crosstown routes more e cient and support a marketing and branding campaign that reduces the stigma against bus and rail travel.

Neither the Bibb or Ronayne administration would commit to nominating a speci c member of the CPT slate to the board, but a spokeswoman for Bibb told Crain’s that he is exploring several names, and one of the potential picks is on the CPT list.

A county spokeswoman said Ronayne is looking at the board process and evaluating candidates. Ronayne took part in a candidate forum co-hosted by CPT and Bike Cleveland leading up to the November election.

Kim Palmer: kpalmer@crain.com, (216) 771-5384, @kimfouro ve

Managing your restaurant’s food costs to withstand in ation

By Dirk Ahlbeck, CPA Principal and national restaurant practice lead, Apple Growth Partners

By Dirk Ahlbeck, CPA Principal and national restaurant practice lead, Apple Growth Partners

Maintaining a successful restaurant while in ation is increasing the costs of goods and services is no easy task, especially after navigating a pandemic which closed restaurant operations in early 2020. The rising costs of food supplies can create an unstable environment without an annual forecasting and budgeting strategy to control these costs. To grow a restaurant’s margins for continued growth, owners and operators should practice forecasting for food supplies which allows better decision making throughout the year and can identify opportunities for business changes.

Restaurants’ food costs are also known as Cost of Goods Sold (COGS) and food costs are a percentage of the restaurant’s percentage of sales. The establishment’s COGS can be both actual and theoretical, based on forecasting and seasonal menu changes.

For eateries to maintain an accurate COGS forecast; recipe costing is key. This process is when a restaurant breaks down menu items with the correct cost for portion sizes and individual ingredients (cost out menu). The restaurant should have up-to-date information on vendor pricing for ingredients and supply costs. When this information is combined with standardized recipes, owners can properly

forecast the COGS for a 12-month period, assuming all menu items are consistent. A signi cant bene t of recipe costing is ensuring employees are responsible in managing food and ingredients with minimal waste, spoilage, shrinkage and improper portioning. Owners and operators should ensure all employees are properly trained on menu portioning and enact internal controls to ensure consistency throughout.

Another best practice for restaurant operators is understanding the difference between actual inventory and recipe costs. This practice reveals the source of unexpected costs and could create opportunities for savings. The rst step is identifying the theoretical food costs as a

percentage of total sales. Theoretical food costs are calculated assuming all menu items are made in perfect portion sizes, including no waste, mistakes or theft. Establishing the menu’s theoretical food cost will provide a blueprint for actual inventory and recipe costs; the theoretical food cost acts as a baseline for production and added costs will cover assumed waste, mistakes, theft and going over set portion sizes.

Once the restaurant’s food prices are understood and tracked accordingly, the next step is ensuring menu pricing is aligned with food costs in mind. For healthy margins, restaurants should aim to keep food cost percentage around 28-32%. Percentages will differ between the type of restaurant, such as quick service or ne dining, as well as location and hours of operation (i.e.: only open for breakfast and lunch, etc.). Accurate menu pricing will ensure each menu item contributes to the pro t margin, along with identifying plates to be phased out or discontinued if they are not contributing to the nancial success of the eatery. Menu engineering may be required to ensure each option is pro table and not wasting both menu space and inventory costs in the current state of in ation.

An innovative strategy to support forecasting and offset increasing supply spend is to increase the restaurant’s overall revenue. Begin by exploring options with takeout and delivery services to evaluate whether additional revenue streams can be achieved in the quarter, which could potentially double sales with additional meals ordered without taking up a valuable table for in-person dining.

Annual forecasting and budgeting are critical components of controlling food costs and can pave the way for better margins and continued growth. Evaluating different methods for consistent ordering, waste control and increasing revenue can establish a healthy outcome for restaurants in 2023 and beyond.

Dirk Ahlbeck joined AGP as a tax principal and national restaurant practice lead in 2021, with more than 20 years of public accounting experience. Dirk’s expertise consists of servicing restaurants, including breweries and wineries, and other industries such as distribution, construction, and professionals in the service sector. A frequently requested presenter, Dirk provides business owners within the food industry best practices for tax planning, accounting, and most recently, navigating the changes brought on by the pandemic and in ation for restaurant owners. He has also provided extensive consulting services to assist his clients with improving pro tability and performance by utilizing benchmarking and related metrics, developing more streamlined accounting systems and other best practices from the restaurant industry, and identifying tax-saving opportunities. Dirk holds a Bachelor of Arts in Accounting from Michigan State University. He is an active member of the AICPA, ILCPAS, and Illinois Craft Brewers Guild.

This advertising-supported section/feature is produced by Crain’s Content Studio-Cleveland, the marketing storytelling arm of Crain’s Cleveland Business. The Crain’s Cleveland Business newsroom is not involved in creating Crain’s Content Studio content.

“IT IS EASY TO BE SILOED IF YOU ARE NOT REGULARLY USING THE SERVICE ADVOCATING ON THE BEHALF OF RIDERS.”

— Jonathan Steirer, a Cudell-area residentRICH WILLIAMS FOR CRAIN’S CLEVELAND BUSINESS

EDITORIAL

Seeing the light

It’s both the right thing to do, and the right thing for the workforce, to expunge low-level marijuana convictions.

An e ort spearheaded by Cleveland Mayor Justin M. Bibb and state Sen. Nathan Manning, a Republican from North Ridgeville who chairs the Senate Judiciary Committee, is helping to advance such a change in Ohio.

An amendment to the Manning-sponsored Senate Bill 288, which Gov. Mike DeWine signed into law in early January, enables city and county prosecutors to request the sealing or expungement of fourth-degree or minor misdemeanor drug o enses. (Previously, only individuals could initiate a sealing/expungement process. SB 288 enables government entities to do so on individuals’ behalf, thus making it available to those unfamiliar with the legal process or unable to pay.) e process requires a judicial hearing that takes into account factors including the rehabilitation of the o ender and whether that person faces other pending charges.

Getting this far required a fair amount of political maneuvering. Signal Cleveland noted, for instance, that Bibb in December spoke with Senate President Matt Hu man and then-Speaker Bob Cupp, on the heels of submitted testimony in November from Cleveland law director Mark Gri n arguing that a change in the law would give many Cleveland residents a “fresh start” at joining the workforce.

As Bibb told Signal Cleveland, “I think that they saw the economic argument of what we were trying to do. ese low-level marijuana convictions should not be a barrier to folks to get good quality housing, to apply for a student loan to go back to school, to apply for a loan to start a business.” ere’s ample evidence that Americans with a criminal record — even minor misdemeanors — nd it harder to get a job, which compounds the challenges of most aspects of daily life. We are, as the Federal Reserve reported last week in its Beige Book, still in a time when companies have “di culty in lling open positions,” and many “hesitated to lay o employees even as demand for their goods and services slowed.” ere’s an opportunity here to remove a signi cant barrier to employment for some people who have made a mistake earlier in life. Take it. is is one of those rare moments when Republicans and Democrats have come together to do something that o ers economic relief to people under pressure.

e Ohio legislation goes into e ect in early April. e city of Cleveland is working on a process to analyze and prioritize potential expungement cases to help people as quickly as possible. We hope jurisdictions throughout the state take a close look at doing the same.

Changes

Add another institution to the huge leadership change underway in Northeast Ohio.

In less than three years, we’ve seen new leaders take the helm of the city of Cleveland, Cuyahoga County, the Greater Cleveland Partnership, the United Way of Greater Cleveland, Case Western Reserve University and Cleveland State University, among other places.

Soon, too, there will be a new person at the top of the Cleveland Foundation, following the Jan. 12 announcement by Ronn Richard that he plans to retire in the second half of 2023, after the organization’s board identi es his successor.

Richard, who will be 67 at the end of January, has been president and CEO of the Cleveland Foundation since July 2003, making him the longest-tenured current leader of a giant Northeast Ohio institution.

A 20-year run at the top of any organization is impressive; it’s remarkable at one with the breadth and complexity of the Cleveland Foundation. In that time, the foundation’s endowment has doubled to more than $3 billion. Grantmaking has topped $100 million in each of the last six years. e foundation soon will begin moving into its new headquarters in Midtown, in a project aimed at further bolstering that busy area east of downtown.

Changes at the top of such a place come with challenges as well as opportunities. e next leader of the Cleveland Foundation, whether it’s someone from within or an outsider, as Richard was when he took the job, has a chance to be part of an exciting changing of the guard.

e foundation’s two-decade track record during Richard’s tenure isn’t awless, but the organization’s ambitions are vital to helping Cleveland get to where its new generation of leaders hopes to go.

Executive Editor: Elizabeth McIntyre (emcintyre@crain.com)

Managing Editor: Scott Suttell (ssuttell@crain.com)

Contact Crain’s: 216-522-1383

Read Crain’s online: crainscleveland.com

PERSONAL VIEW

Time to air dirty laundry? Bad earnings season could be good

JONATHAN LEVIN/BLOOMBERG OPINIONA bad earnings season just might be good for stocks. Consider this scenario: Companies air their dirty laundry, analysts cut their 2023 outlooks and perhaps the S&P 500 Index takes another detour back toward 3,600. Suddenly, expectations aren’t as hard to beat, and a foundation might be built for a new bull market. Crazy? Maybe just a little.

e past couple of months have bolstered the “soft landing” bulls, who think that the U.S. can defy history and emerge from a fast and furious round of interest-rate increases with in ation curtailed and real output still growing.

Indeed, the latest consumer price index report was so encouraging that it seemed to open the door for the Federal Reserve to stop raising rates after March and maybe even consider cuts in the latter half of the year before the economy goes o a cli . Improbably, that’s happened with unemployment at a ve-decade low and household cash cushions that remain remarkably strong. Clearly, nobody can say for sure whether the progress is durable or how badly the lags in monetary policy will bite in the months ahead. But if there were a path to the soft landing, this is what it would look like. So what, then, should we make of the coming earnings season?

Quarterly reports are, of course, highly choreographed a airs in which company executives go to great lengths to deliver positive “earnings surprises.” In practice, that usually means telegraphing low expectations so they can comfortably beat them. at they’ve had a harder time of exceeding their own bars is a sign of just how dicey the environment has been and how close the economy has skated to a downturn. e third quarter featured one of the highest rates of negative earnings surprises in the past decade, and investors won’t like it if that happens again.

But mostly, the focus will be on the 12 months ahead, and companies should — and, with all likelihood, will — manage expectations even more aggressively than usual. Since mid-July, analysts have cut 2023 consensus earnings-pershare estimates by nearly 8%, with the lion’s share coming during the two most recent earnings seasons. Each quarter, the cuts have become progressively deeper.

is has not been the typical “window dressing” and has veered toward a wholesale realignment of investors’ understanding of the business atmosphere. Fortunately, it has happened methodically, not all at once. Executives have managed to walk expectations lower without triggering a crisis of con dence of the sort that can itself contribute to the start of a recession.

How much further will management jawbone down expectations this time? If the trend continues, analysts’ downward revisions this quarter should be expected to be even steeper than they have been in the past, translating into consensus 2023 EPS outlook cuts of as much as 5% to $215 by the end of February. Expectations are already within spitting distance of assuming that this will be a down year, and we may get there over the next six weeks.

To be sure, these outlook tweaks will prove much too modest if the U.S. economy is indeed heading toward a recession. Earnings typically fall 20% to 30% from peak to trough in a recession, and the median odds for such a downturn are 65% in the next 12 months, according to economists surveyed by Bloomberg. Another quarter of cuts doesn’t necessarily translate into catharsis and the start of a new bull market, but it’s probably a precondition for one.

Of course, everyone is just making educated guesses about the economy, and all you can do is balance out your risks. A rough stretch of quarterly reports — a “take your medicine” type earnings season — may just establish a more favorable symmetry between the market’s risks and rewards, perhaps encouraging a few brave souls to take a ier on the soft-landing dream. If that’s the case, the feared fourth-quarter earnings season may not ultimately be judged so harshly after all.

Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Cleveland Business, 700 West St. Clair Ave., Suite 310, Cleveland, OH 44113, or by emailing ClevEdit@crain.com. Please include your complete name and city from which you are writing, and a telephone number for fact-checking purposes.

Sound o : Send a Personal View for the opinion page to emcintyre@crain.com. Please include a telephone number for veri cation purposes.

After 30-year mortgage rates surged past 7% in October, a decline to near 6% in recent weeks has made the start of 2023 look less awful than some had feared. So what does this mean if you’re looking to buy a house?

If you read between the lines on what homebuilders are saying about their plans for the year, they’re telling buyers to wait a few more months if they’re looking for a deal.

is is straightforward strategy on the builders’ part, based on dynamics related to their order backlogs, the rapidly evolving cost environment and what makes the most sense for them from a pro t standpoint.

Take the case of Toll Brothers Inc., a luxury homebuilder. Toll’s situation is unique in the sector. Its buyers put down large, nonrefundable deposits when they go under contract on a new home — on the order of $75,000 — resulting in cancellation rates in the low single digits. So Toll’s backlog is as close to a sure thing as it gets. Since the company had a large backlog that would keep pro ts owing well into 2023, and because Toll didn’t think its prospective buyers were responsive to small changes in pricing, it was content to wait and hope that demand would improve later in the year. At that point, Toll would also be more motivated to generate sales.

November.

Similar to Toll, KB Home executives said they still aren’t cutting prices on homes as much as they would need to match demand, but their reasoning is di erent. In communities where they have a lot of sold but uncompleted homes in their backlog, they are reluctant to cut prices to goose sales for the next batch of homes because the buyers of already purchased homes would then demand a similar price cut. If cutting the price by $25,000 to sell ve additional houses means having to give that same $25,000 price cut to 50 customers who were already committed, it doesn’t take an accounting wizard to realize that’s bad business. Better to work down the order backlog before offering discounts to new buyers.

Meanwhile, builders are nally getting some relief on the cost side. KB mentioned that its cost to build a home fell by $10,000 in the most recent quarter, and the company believes it is “still in the early innings of the cost reduction e ort,” expecting more relief in 2023 from lumber, other building materials and labor.

Put it all together and there is a message the homebuilders are sending to analysts and investors that would-be buyers can use as well. Because of still-elevated order backlogs, builders either don’t need to or can’t a ord to cut prices yet as much as they would in a more-normal operating environment. At the same time, their costs are now coming down rapidly, which will make it easier to cut prices later on while still providing an acceptable pro t margin. It’s just going to take a little more time before they’re willing to do so.

KB Home, which reported earnings in early January, is a homebuilder with a di erent customer pro le and a di erent business model than Toll. e average selling price of their homes is closer to $500,000, about half that of Toll’s. And because it can’t get away with the huge nonrefundable deposits that Toll can, its buyers are more sensitive to changes in market conditions. So when mortgage rates spike or the market softens, as occurred this past quarter, its buyers pull out or renegotiate. at has resulted in an eye-popping cancellation rate of 68% for KB in the three months ended in

So if you’re looking to buy a new home in 2023, I’d wait a few more months, particularly in some of the more imbalanced markets in the West such as Boise, Phoenix, Las Vegas, Sacramento and Austin that boomed the most. Note that this advice doesn’t apply to the existing home market, which has its own dynamics and where supply and pricing levels aren’t being distorted by corporate incentives.

In the new home market I’d expect pricing to fall more substantially and sales to pick up by the middle of this year even if market conditions don’t change, which should be welcome news for buyers and provide at least somewhat of a boost to overall economic activity.

NET POSITIVE

JOE SCALZOLast year, when the Junior Volleyball Association (JVA) opened registration for the sixth annual Rock ‘N Rumble tournament in Cleveland, the organization was able to ll more than 350 available spots.

In ve hours.

With a waiting list of more than 200 teams.

“We were like, ‘Hey, there’s a lot of teams that aren’t given the opportunity to compete in this event,’” said Briana Schunzel, the JVA’s director of marketing, education and partner development. “A lot of teams were upset they weren’t able to get in.”

So, the JVA opted to add a second tournament in 2023, bringing roughly 500 total teams and 8,000 spectators to the Huntington Convention Center over the rst two full weekends in January.

ose tournaments, along with the inaugural Nike North Coast Cup volleyball tournament over Presidents’ Day weekend, will provide an estimated $8.6 million in economic impact during a season when cities like Cleveland struggle to attract tourists who aren’t holding a bucket of bait and an auger.

Overall, the Greater Cleveland Sports Commission (GCSC) will host nine major sporting events in 2023, providing an estimated $17.875 million impact. e three volleyball tournaments will account for nearly half of that total.

“Success breeds success,” GCSC

president and CEO David Gilbert said. “We got the Junior Volleyball Association to say yes to Cleveland (in 2016), and their event went so well they’ve doubled the number of teams and weekends. en you add this new Nike organization. Not only are those tournaments bringing in millions and millions, but they’re doing so at times of the year when our hotels and restaurants are largely empty.”

ese smaller events are especially important during a year when the GCSC doesn’t have a marquee national event like the NBA All-Star Game (2022 in Cleveland), NFL Draft (2021) or MLB All-Star Game (2019). NBA All-Star 2022 alone provided the region with $141.4 million in direct spending and a total economic impact of $248.9 million, the GCSC said, but those events are outliers for midsize cities.

Consequently, it’s crucial for the GCSC to nd opportunities in sports such as volleyball, which in 2017 surpassed basketball as the No. 1 girls team participation in the country. At the high school level alone, volleyball had 454,153 participants in 2021-22, just 2,500 behind track and eld for the No. 1 overall participatory sport for girls, according to the National Federation of State High School Associations (NFHS). at’s creating a trickle-up e ect at the college level, where volleyball attendance and viewership numbers (particularly on the Big Ten Network) are both on the rise.

“Our sport is booming,” said Schunzel, who grew up in Solon but now lives in Atlanta. “It’s fun, it’s elegant, it’s graceful, it’s exciting, it’s fast-paced. A lot of girls — and boys

— are gravitating toward the sport. If we can get more exposure on the main channels of communication, like prime TV and not ESPN+, and get more support from the NCAA, I

think the ceiling is really high for how popular the sport can get.”

While high school volleyball is traditionally a fall sport, the top players typically play during the winter as well, which is a source of frustration for girls basketball coaches, who understandably hate losing tall, athletic players to a rival sport. at creates opportunities for organizations like the GCSC.

“ ere is erce competition for youth athletes in all sports and you’re seeing more kids play year-round,” Gilbert said. “Sports like soccer and lacrosse and volleyball are vying for athletes because they mean really big dollars. ankfully, our community is starting to see more of its share of those dollars.”

e Rock ‘N Rumble tournaments were the rst of seven planned events for the JVA in the rst half of this year, with all but one of those tournaments taking place in the Eastern time zone. Consequently, the JVA had to schedule the rst Rock ‘N Rumble (for teams 12-under to 15-under) on Jan. 7-8, which was a little early for some clubs and explains why it drew “only” 192 teams. e second weekend (16-under to 18-under) drew about 300 teams.

JVA plans to continue the two-weekend format, Schunzel said.

“ e sports commission, they are an absolute gem to work with,” said Schunzel, who interned with the GCSC years ago. “It’s really a joy to be in Cleveland. e support has been so good from the community, the convention center and the outside groups that we work with. It really allows us to feel like if we need something, we only need to ask and that everything will be taken care of. It’s really one of our favorite events of the year.”

Woodside Health, Heitman form joint venture

Recapitalize 10 properties for $140 million

BY STAN BULLARDWoodside Health, a medical ofce building investment and management rm in Independence, has recapitalized 10 of its properties with Heitman LLC, the Chicago-based global real estate investment rm, to seed a joint venture between them.

Terms of the recapitalization were not disclosed. However, the Health Care Real Estate Insights newsletter valued the transaction at $140 million. e recapitalization includes properties in Arizona, Florida, Georgia and Texas with 94% occupancy and a total of 420,000 square feet of rentable space. e deal does not include Woodside’s Northeast Ohio portfolio.

Ted Barr, founding principal of Woodside, said in an email, “ is gives us the ability to grow and take on much larger projects. We sold a small part of our portfolio into this venture to ‘seed’ it.”

e joint venture is Woodside’s rst endeavor with an institutional real estate company. Heitman has $53 billion in assets under management. It has been in the medical o ce building space for 20 years and has a portfolio with 250 assets with a gross value of $4.3 billion.

Brian Pieracci, Heitman managing director of acquisitions — North America said in a release announcing the deal, “The new joint venture with Woodside creates the opportunity to aggregate a portfolio of assets in highgrowth markets with strong health care fundamentals. The seed portfolio’s granular rent roll provides stable current cash flow with the ability to mark rents to

VOLLEYBALL

From Page 10

e three volleyball tournaments are proof of the value of the 10-yearold Huntington Convention Center, Gilbert said. (Cleveland’s old convention center couldn’t host volleyball events because the ceilings were too low.) If anything, Gilbert believes the convention center is still too small compared with those

market in an inflationary environment.”

Woodside was launched 14 years ago to provide a focus in the medical o ce building category. It included holdings in the category owned by several of its principals long before medical o ce buildings became a much-sought-after investment in the past few years.

Other principals in Woodside are Joe Greulich, Ben Sheridan and Ben Barr.

e recapitalization was announced by Newmark, the global real estate brokerage, and its Cleveland o ce, which represented Woodside in the recapitalization and found Heitman as a joint venture partner.

Jay Miele, a senior managing director in Newmark’s Health Care Capital Markets team who worked on the transaction, said, “Woodside has successfully executed a value-add strategy that has solidi ed its dominant position in the medical o ce building sector.” He said the agreement would also allow Woodside to pursue transactions across a larger geographic footprint.

Aside from the 10 properties in the new joint venture, Woodside has holdings in about 30 other properties.

Woodside in early 2022 sold ve properties, including two buildings in Middleburg Heights, to an unidenti ed investor group for $75 million.

Barr said he and some Woodside associates will continue to operate the Crescendo Commercial Realty brokerage, which also is in Independence.

Stan Bullard: sbullard@crain.com, (216) 771-5228, @CrainRltywriter

(tournaments) start to show that the return on investment is absolutely there for the community.”

Gilbert, of course, has an inherent interest in seeing Cleveland’s infrastructure grow, which is why he’s excited about Cleveland State’s plan to replace the Wolstein Center with a smaller venue, as well as the Cleveland Soccer Group’s hopes for building a soccer stadium for the MLS Next Pro team coming to the city in 2025.

in cities such as Columbus (which has twice the exhibition space) and Indianapolis ( ve times).

“We could host bigger events if we had more space, but it shows the value of having really good infrastructure,” he said. “Sometimes people wonder whether facilities like the convention center or stadiums or other things, asking, ‘Is it worth the public dollars?’ ese

“We’ve always taken the view that our job is to play the cards we’re dealt and make the most out of them for Cleveland,” Gilbert said. “If we can add additional cards to our hand with those types of new facilities, in every one of those cases there’s a lot more we can do.

“We have the reputation as one of the best sports events cities in America. We punch way above our weight in attracting and creating those types of events. With new facilities would come lots of opportunities for Cleveland.”

Joe Scalzo: joe.scalzo@crain.com, (216) 771-5256, @JoeScalzo01

HEALTHCARE IS ABOUT MORE THAN MEDICINE.

It’s about hope, equity, and a healthier community.

“SPORTS LIKE SOCCER AND LACROSSE AND VOLLEYBALL ARE VYING FOR ATHLETES BECAUSE THEY MEAN REALLY BIG DOLLARS. THANKFULLY, OUR COMMUNITY IS STARTING TO SEE MORE OF ITS SHARE OF THOSE DOLLARS.”

—David Gilbert, Greater Cleveland Sports Commission president and CEO

Cavaliers connection helps Il Rione make some dough

On Monday, Dec. 19, when former Cavalier Lauri Markkanen returned to Cleveland for the rst time since being traded to the Utah Jazz, he said the only hard feelings he had against the city stemmed from the Gordon Square pizza shop Il Rione being closed on Sundays and Mondays. What was Il Rione’s reaction?

“We were just like, ‘Holy (smokes)!’ We should really try to open more days!” co-owner Brian Holleran said, laughing. “We’re just a mom and pop operation. Mondays are spent here making dough and doing prep work for the week. On Sundays, I do absolutely nothing. I lay on my mother-in-law’s couch and watch TV while she watches the kids.”

What will he do if Markkanen’s next Cleveland game is on a Sunday or a Monday?

“I will do whatever he needs me to do,” he said. “I will get out of my pajamas and get down here.”

Holleran, a New Jersey transplant who has lived in Cleveland for 15 years, opened Il Rione with his business partner, Brian Moss, in 2017. It’s a small shop (1,500 square feet) with a small menu (New York-style pizzas and salads, although you can get a meat and cheese plate) and a huge following, with customers often facing (and accepting) a two-hour wait. (For the record, Il Rione hopes to open on Sunday “in the near future,” he said.)

“Our customers are really easygoing,” he said. “We’ll say, ‘It’s an hour and 45 minutes for a table’ and they’ll be like, ‘ at’s cool.’ I’m like, ‘What? I’d be at Burger King already.’”

e friendly — and extremely quotable — Holleran recently spoke by phone about the restaurant’s Cavs connection, his love for New Jersey transplants and whether Il Rione will ever expand to more locations.

e interview has been lightly edited for length and clarity.

What was your reaction when you saw Markkanen’s comments?

It was awesome. He’s such a nice dude. Those Cavs guys are the nicest, most normal guys. They’re all freaking millionaires, but they don’t think they’re hot stuff or too cool for school. It’s really flattering for those guys to come in and say they love the pizza. It’s fun.

Kevin Love, in particular, seems like a big fan. I’ve seen him praise Il Rione in interviews and he’s posted a picture on Instagram of him and some teammates inside the restaurant.

Yeah, he’s kind of been the catalyst for a lot of our support. Back when we first opened, I met a guy from New Jersey. I’m from Jersey, and any time I meet someone from Jersey or even New York, I call them expats. They miss the pizza from home, which is one of the reasons why we built this place.

— Joe Scalzo

So, anyway, I ask this guy what he was doing in Cleveland and he said, “I’m one of the coaches for the Cavs.” And I was like, “Oh, cool.” So we became buddies. He’d come in once a week and sit at the bar. One day, he says, “Would you mind if I brought some people from work here?” And I’m like, “Yeah, I don’t care, whatever.” So he slowly started bringing players, and they started falling in love with the place.

Because the other thing is, we don’t blow up anyone’s spot. It’s not like we say, “Hey, the great Kevin Love was here last night!” I don’t ask for pictures.

All our customers are super chill. No one is really annoying or goes out of their way to say, “Oh, I’m your biggest fan!” So I think they feel like normal people here, which is awesome and what you want. It’s what I love about this town. It’s this big city and you have these superstars here, but this is also their neighborhood pizzeria.

Do you see a spike in orders when someone mentions you on social media or in an interview?

When Kevin Love mentioned us on the Jumbotron at one of the games, the next day, there were all these people we’d never seen before. The rst time the Cavs came here — and this was years ago — it was a preseason dinner kind of hang. There was like eight of them who stayed until like 1 in the morning. Just hanging out. It was so fun. And, again, they were just normal, fun, regular guys. They all wanted to get a picture of each other together as a team and they posted that online and they tagged the location and Il Rione. Once they did that, we de nitely saw a spike. And LeBron’s been here twice. Any time he’s here, I’ll get like 38 text messages saying, “LeBron’s at the pizzeria!” And it gets around the neighborhood. So we’ll de nitely get residual business, but no one really asks us about it. I think just because of their social media presence, any time anyone mentions anything about us, there’s a spike. Just because of the sheer volume of followers they have. It’s fun.

Who was the assistant coach that started it all?

Steve Frankoski. Frankie Bones, they call him. (Note: He now works with Washington State’s men’s basketball team.) He’s hilarious. He’s just a character. He is Jersey as the day is long. He’s the guy who introduced some of the players (to Il Rione). But then the players tell the players. With the Browns, one

night a guy came in and I was like, “Oh, sorry, there’s a two-hour wait. What’s your phone number?” So he says, “201” and I was like, “201? Are you from Jersey? What are you doing here?” He said he was a coach for the Browns. So I started talking to him and he falls in love (with the pizza) and he tells everyone with the Browns. (Head coach Kevin) Stefanski comes here with his family. The athletic trainers have their rehearsal dinners here. They love it. So a lot of it has to do with expats who work for the Browns or work for the Cavs. They go back to Berea or go back to Quicken Loans or the Q or whatever you call it.

of place. We try to be as hospitable and cool and easygoing as we can with everyone who comes in here. I think people feel that. When the food is good and the pizza is good, it makes for a really fun night.

Do you guys have plans to franchise this?

We’re passively looking to see what we could do, but there’s so much magic in this room, you know? The last thing you want to do is be Applebee’s. You want it to have that authenticity. We’re de nitely going to do something; there’s no question. But whatever we do has to be as cool, as authentic — if not cooler — than what we’re doing right now. We want to feel like we’re not just, “Hey, look how cool we are! Let’s open 50 of these!” So we sit back and count our money, but then it’s like, “Ah, that place used to be cool and now it’s lame.” So many times that happens, where you open a few and it’s like, “Eh, not as good as the original.” Like Frank Pepe’s in New Haven (Connecticut). That’s like the original New Haven-style pizza. They have like 18 locations and anyone can go to one of those 18 locations and it’s like, “Eh, not as good as New Haven.” But it’s also for nostalgia and the whole thing. You hate to do that. I mean, I love money, but I also value integrity. I want to make sure I’m not making some cheesy chain place.

Yeah, it’s a di cult balance.

Yeah, because, obviously, I have three kids and I want to make as much money as I can. (Laughs.) But it’s also my life. But I guess I could. We could open like, 20 of them or whatever and say, “Give me my money.” But it’s super fun (here). It’s like a dream come true. Our sta is cool as (heck). They’re so chill. A great bunch of people work here. Every time I’m here — and I’m here right now — I love being here. It’s such a fun environment. We’re just trying to make sure the wine list is super tight, the pies are coming out as great as they possibly can and that people are enjoying themselves as much as we are. I have a pie once a week and I can’t believe I still love this (stu ). I never get sick of it.

100 Park Avenue, Suite 200 | Orange Village, Ohio 44122 (440) 720-1100 www.nppmcorp.com

Rocket Mortgage. (Laughs.) Rock and Roll Mortgage whatever fieldhouse. They go back and tell everyone and it just becomes a thing. But we’re literally trying to make the best food we possibly can. We’re trying to make it as nice as humanly possible and have an experience that’s cool and interesting. I love this place, too, because you can come in for a can of Pabst and a margarita and you and your lady are out the door for, like, 25 bucks or 30 bucks. But if you also want to sit down and have a meat and cheese plate and a $200 bottle of Grand Cru and wear a sport blazer, you can have a beautiful date night as well. I think we’re a place that’s comfortable enough where you can come here in jeans and a T-shirt and feel comfortable and sit next to a couple that just came back from Playhouse Square all dressed up. And everyone fits and belongs and doesn’t feel out