Wingtips, meet Jumpman

BY JOE SCALZO

e trendiest dress shoes in America aren’t wingtips, but you can buy them with wings. ey aren’t designed for tuxedos, but you can get them with patent leather.

ey’re made to be worn on maple, but they’re increasingly found underneath cherry, oak and walnut.

ey’re called Air Jordans. And while millions of Americans have suited up with them since 1985, it’s increasingly likely they’re doing so while wearing a suit.

C-suiters, meet Js.

“Living in these times, people aren’t so uptight about the rules of out ts,” said Jevon Terance, an international fashion designer (and lifelong sneakerhead) from Lorain. “You can still be respected and still make CEO moves wearing a sneaker under a big desk.”

Of course, mixing sneakers and suits isn’t exactly new. Converse’s Chuck Taylors have always had a retro appeal, Will Smith was wearing Jordan 5s with a tuxedo jacket on “ e Fresh Prince of Bel-Air” as far back as 1990, and companies like Cole Haan have made a mint from selling dress sneakers. But dress sneakers are just that: sneakerized versions of dress shoes.

Air Jordans are di erent. ey were made for basketball courts, not boardrooms. While those two di erent arenas sometimes intersected during Jordan’s playing career, it was more niche, something you saw in hip-hop or skater culture.

MAGNET’s new headquarters aims for more

BY RACHEL ABBEY MCCAFFERTY

BY RACHEL ABBEY MCCAFFERTY

e heart of MAGNET’s work has long been manufacturers.

But with the opening of its new headquarters in Cleveland’s Hough neighborhood, MAGNET’s scope is broader.

The new center is more than just a space for manufacturers to problem-solve and innovate. It’s a place for the community to gather, for children to play and for students to learn, for adults to train for new careers and for, yes, manufacturers to explore new technologies.

MAGNET: e Manufacturing Advocacy and Growth Network secured the space for its new headquarters at 1800 East 63rd St. in the fall of 2020. Ground broke on renovations at the building, the former Margaret Ireland school, in August 2021. MAGNET moved in to the new building this October, with formal opening events held the last week of the month.

Personal View: Ethan Karp, MAGNET CEO and president, explains vision behind new headquarters. Page 8

A changing of the guard at the 5th Street Arcades

BY MICHELLE JARBOE

e local developer who transformed a pair of moribund retail arcades in downtown Cleveland into an eclectic business incubator has handed over the keys, passing control of the property to global real estate giant CBRE Group Inc.

In September, developer Dick Pace ended a decade-long run as the master lessee and manager of the 5th Street Arcades. e 60,000-square-foot property is a rare retail bright spot in a downtown where shopping, particularly at malls and other indoor centers,

has struggled. Now tenants are wondering what the future holds.

“I had a 10-year master lease at the arcades, and it expired,” Pace said. “I could have done a renewal for 10. But I’m 66. I just didn’t see myself doing it when I was 76.” e conjoined corridors, historically known as the Colonial and Euclid arcades, run between Euclid and Prospect avenues at the north end of the Gateway District. e property, owned by Summit Hotel Properties Inc. of Austin, Texas, also includes a 175-room Residence Inn hotel.

VOL. 43, NO. 40 l COPYRIGHT 2022 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSCLEVELAND.COM I OCTOBER 31, 2022 REAL ESTATE Krueger Group, RHM form joint venture for two Rocky River development projects. PAGE 2 CANNABIS : Market downturn highlights growing pains in marijuana industry. PAGE 10

New England Patriots owner Robert Kraft is known for wearing Nike Air Force 1s everywhere he goes, from the White House to his own wedding, while actor Jason Sudeikis wears Air Jordans with his out ts, from the Jordan 11s he wore at the Golden Globes to the Jordan 1s he wears on Ted Lasso. | ALAMY PHOTOS

JORDANS SNEAK THEIR WAY INTO BUSINESS ATTIRE

The 5th Street Arcades are a rare retail success in downtown Cleveland, which has struggled to repopulate its shopping centers. | MICHELLE JARBOE/CRAIN’S CLEVELAND BUSINESS

See JORDANS on Page 16 BRAD STARKEY/UNSPLASH See RETAIL on Page 15

See MAGNET on Page 17

JOINING FORCES

Realty rms form joint venture for two big-ticket Rocky River developments

BY STAN BULLARD

When real estate developer Bobby Krueger, president of the Krueger Group of Cleveland, was a teenager, he often worked in a building in downtown Rocky River that was owned by his father, Robert Krueger, the chair and founder of Krueger Group.

Now the younger Krueger — along with the family-owned building and development rm — has formed a joint venture with John Joyce, CEO of RHM Real Estate of Lyndhurst, to put their own mark on the suburb’s historic downtown.

rough a series of a liates named Ingersoll I, II and III, the companies in September acquired a small one-story industrial building on Ingersoll Drive, parking lots and a grassy piece of property to make up a 6-acre parcel for redevelopment in downtown Rocky River. Public records do not include a sale price for the transactions, which are between Linda Street and Smith Court.

Krueger and Joyce said in a Zoom interview they are still kicking around ideas for the nal plan for the property but have some ideas in mind. Meantime, construction is starting on another collaboration, a 96-unit apartment complex on Center Ridge Road in Rocky River.

“We’re excited to nd the highest and best use for this site, which has so much upside,” Krueger said.

Joyce said, “We have discussed a mixed-use approach with residential, commercial and o ce use.”

Other elements of the project could incorporate a gastropub, a

restaurant and a food hall.

Krueger noted the business zoning of the site allows the duo to have great exibility in planning the project.

“We know what will work,” Krueger said. “What (Joyce) and I are thoughtful about is how we serve the community at large. We want to work with the city and major stakeholders to develop a plan bene cial for everyone. e area has parking problems. We are not just developers but long-term holders of property. It’s going to be an iterative process.”

e West Side suburb’s master plan identi es the parcel as a signicant opportunity in the city.

she tells constituents complaining about the condition of the road that the city cannot repair a private street.

e parcel is close to Old Detroit Road, a grouping of trolley-era buildings regarded as the historic downtown in the suburb, but the area considered downtown Rocky River has expanded through the years with additional retail and o ce uses spanning multiple blocks. It is also close to Beachcli Market Square, an upscale shopping center that includes the repurposed former Beachcli movie theater.

A long-term proposal in Rocky River city plans calls for eliminating the Marion Ramp to the Clifton Road Bridge and replacing it with a more pedestrian-friendly street network. at would boost connectivity within what the suburb dubs its downtown area, especially for the Ingersoll-Linda area.

“We have construction and development expertise,” Krueger said, “and we needed apartment management and leasing expertise, which RHM has, along with development expertise.”

Meantime, Joyce said he wanted to move RHM Real Estate, which owns 10,000 apartment units in 13 states, into the real estate development side of the multifamily business. e two were introduced by their mortgage broker, Jim Doyle, a principal of the Bellwether Enterprise mortgage banking and brokerage rm based in Cleveland.

As they discussed and decided to proceed together on the ground-up apartment project, the two realized they were also both weighing a quite di erent sort of project in downtown Rocky River.

access to outdoor space off their units in the event another pandemic hits and they are locked in their apartments/homes,” Krueger said.

“All the units will have walk-out balconies in case there is a quarantine. They will include dedicated workspaces and an on-site fitness center.”

e complex will include a pool, outdoor grilling areas, a gazebo and a walking trail, Joyce said. e building’s lobby will also serve as a lounge area for tenants who want to relax outside their suites.

Rocky River Mayor Pam Bobst said in an interview that she and others in the city are excited to see what the developers “envision for the site.” She noted that the prior owner, who held the parcels under T2 Rocky River and Smith Court Lot LLC, had accomplished a feat by assembling the adjoining properties over several years.

“One of the reasons the site is so large is that Ingersoll Drive is not a public street,” she said.

“It is privately owned and part of the potential project site.” She noted

e Krueger-RHM Ingersoll site’s immediate surroundings are an eclectic mix of commercial and residential buildings repurposed as restaurants, o ce buildings and shops. Bobst noted the city’s former service garage on Linda Street now serves as the home of the Market restaurant.

Ironically, both real estate developers had sized up the site separately, which they learned as they started on a potential joint venture to develop a 96-suite apartment complex on western Center Ridge Road in the suburb.

Although the joint venture on Ingersoll is nascent, construction at the so-far-unnamed apartment complex at 22591 Center Ridge is ramping up. Pride One Construction Services of Medina has put its construction trailer on the site along with fencing to secure the building site.

Designed by Dimit Architects of Lakewood, the brick rst building will rise four oors and consist of 54 units. Completion is expected in spring 2024. e second building will be the same height and consist of 42 suites and will be constructed later.

e COVID-19 pandemic will give new purpose to some typical design features of apartments.

“What we learned from the quarantine is we need to give residents

Although Northeast Ohio has had more apartments constructed recently than in decades, the Rocky River apartments may have hit a particular sweet spot. No new apartments have been built in the suburb since 2012, and that project was the rst since the 1970s.

“Occupancy in the west suburbs is 98%,” Joyce said.

e two will not disclose the projected rent range for what they described as an upscale multifamily community, nor a proposed cost for the Center Ridge apartments.

“We’ll be careful not to price ourselves out of the market,” Krueger said.

Bobst said Rocky River is pursuing long-range plans to make ve-lane Center Ridge more desirable as a walkable area by modernizing the right-of-way.

“Every fourth step on sections of the road crosses a driveway apron,” she said.

Stan Bullard: sbullard@crain.com, (216) 771-5228, @CrainRltywriter

2 CRAIN’S CLEVELAND BUSINESS | OCTOBER 31, 2022 REAL ESTATE

A joint venture formed by RHM Real Estate of Lyndhurst and Krueger Group of Cleveland is starting to build an apartment project in Rocky River. | DIMIT ARCHITECTS

“WHAT (JOYCE) AND I ARE THOUGHTFUL ABOUT IS HOW WE SERVE THE COMMUNITY AT LARGE. WE WANT TO WORK WITH THE CITY AND MAJOR STAKEHOLDERS TO DEVELOP A PLAN BENEFICIAL FOR EVERYONE. ”

—Robert Krueger, chair and founder of Krueger Group

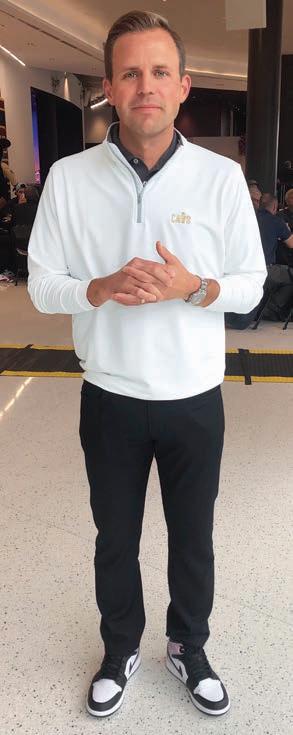

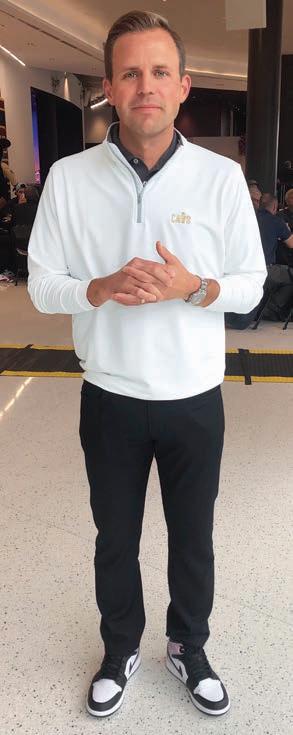

Welty’s In-Site unit gets a new president

For more than a decade, Sean Joyce has been a steward of North east Ohio’s past.

Now he’s probably going to be shaping its future.

After an 11-year stint at Stan Hywet Hall & Gardens in Akron, including three as president, Joyce is set to be come president of Welty Building Co.’s In-Site Advisory Group on Mon day, Oct. 31. It’s a role that will have him working with public and private entities as they seek new locations and manage their real estate and de velopment projects.

He gures he’s up for it.

“I really enjoy working on projects, helping organizations build and make improvements that will help them be successful,” Joyce said. “I’ve had a lot of experience with nonprof its and at Stan Hywet I helped build a for-pro t construction company called ARRC (Architectural Resto ration and Renovation Consultants).”

His new boss, Welty CEO Don Tay lor, also thinks Joyce has what it takes to manage what Taylor said is an im portant, growing component of his business. It’s also the unit that serves as Welty’s starting point for major de velopment and construction proj ects.

“ is is a big deal for us,” Taylor said.

Joyce is taking on a position that’s been vacant since Jennifer Syx left to form her own rm, J6 Advisors in Cuyahoga Falls. It’s also a role Taylor said he’s expanding at a business unit that is growing in scope.

In-Site recently began o ering owners-representation services, which Taylor said it has recently em ployed with Goodyear and some oth er major clients. It will be adding sta to help it further work with owners to manage their development projects, and In-Site will be growing generally, Taylor said.

“ e intention is that we will prob ably triple the size of In-Site,” Taylor said.

e unit, which now has four pro fessionals, will add another nine or 10 people, most of them devoted to its owners-rep business under Joyce, according to Taylor.

In-Site is not a huge portion of Welty’s total business, but it punches above its weight in terms of its overall e ect on the company, Taylor said. It not only brings big projects to Welty but is instrumental in helping major companies expand in the region or to build new headquarters and other fa cilities that will keep them here, Tay lor said.

“Traditionally, it has not been a great revenue generator, but the business makes a tidy little margin ... it’s small, but it’s a nice little busi

ness,” Taylor said. “It’s a nice contact with people who are thinking about building, so it’s a gateway. … It’s the very rst opportunity we have with a client.”

Taylor said In-Site was Welty’s doorway to handling CBIZ’s new headquarters in Independence, a project for which In-Site helped the developer with nancing and in which Welty has taken a leading role.

“Now we’re building a 150,000-square-foot building for CBIZ that Welty will ultimately own,” Taylor said. “If it were not for In-Site’s work, Welty probably wouldn’t have been involved.”

In-Site has worked with Dealer Tire in Cleveland, helping the city to keep the company at a new location in Midtown. It also has worked on projects like the Kay Pavilion at Ak ron Children’s Hospital, employing lean construction and integrated project development strategies.

“We ended up bringing in millions (of dollars) of savings,” Taylor said of the Kay Pavilion project.

Taylor said he’s seen that more and more owners and end-users are look ing for consultants and developers that can do more than just build — and they want both advanced con struction techniques and help with overall project management.

e Welty CEO, who can seeming ly not have a conversation without

using the term “horizontal integra tion,” said he’s continually working to adapt his company to ful ll a larger role and meet more of its clients’ needs.

Joyce and Taylor know each other through Jerry Welty, the company’s past president and Taylor’s original partner at the company. Both Welty and Joyce were active with Goodwill Industries in Akron, Taylor said.

at’s part of the reason Taylor is comfortable with his new hire, but he said his con dence also comes from Joyce’s broad background in con struction and nance.

Joyce said several of his past posi tions have given him experience he plans to bring to his new job.

At Stan Hywet for 11 years, Joyce worked on maintenance and con struction projects, as well as helping launch and then run the ARRC con struction business, he said.

Before that, he managed facilities and nance for Goodwill in Akron, and in the ’90s, he was chief nancial o cer for APCOA Parking in Cleve land, where he worked on national projects, including a $50 million outof-state garage development, Joyce said.

“I’ve been fortunate in my career to pick up a broad skill set and some knowledge,” Joyce said. “I got to see a lot. I also got involved with a lot of ga rage construction projects and the -

nancing for those … so I got a well-rounded education in what it takes to put a project together and get it done.”

He plans to hit the ground run ning, he said, and answered the phone in his new o ce nearly a week before his o cial start date.

“We’re working on some bids right now,” Joyce said. “And (I) have a few projects I’m bringing in on my side of things, too. … It’s a great opportunity. Don, the way he looks at things is not just as a business, but as a way to im prove things in the community, so I think we’ll have some interesting projects.”

Dan Shingler: dshingler@crain.com, (216) 771-5290

OCTO BER 31, 2022 | CR AIN’S CLEVE LAND B USIN E SS 3

Now, the local health insurer you know and trust can offer you superior dental benefits with one of the largest networks in the country.

Learn

how Ohio’s health and dental experts can keep your employees smiling. Visit MedMutual.com/Together, call 1-800-409-2595 or talk to your broker.

AKRON

DAN SHINGLER

Sean Joyce will succeed Jennifer Syx as president of Welty Building Co.’s In-Site Advisory Group. CONTRIBUTED

Walter Haver eld to drop some practice groups amid refocus

BY JEREMY NOBILE

An economy-wracking health crisis prompted some soul searching for Cleveland’s 90-year-old Walter Haver eld that will culminate in some big changes for the law rm in 2023.

“I think the pandemic caused a lot of things to come into focus,” said Ralph Cascarilla, Walter Havereld’s managing partner for the last two decades. “ ese things cause you to start to think through what it is that you are doing and whether you can do it better.”

E ective Jan. 1, Walter Haver eld will release its public law and education law practice groups.

at action is expected to impact roughly 40 employees, including 25 attorneys, said administrative partner Kevin Murphy. He and Cascarilla characterized the move as an amicable split.

Some leaders of those practice groups invited to weigh in on the move did not immediately respond to a request for comment.

e departing personnel amount to about 30% of the rm’s attorney bench in the local market, according to Crain’s research.

e business reported 94 attorneys rmwide, including 84 in the Cleveland market, for the Crain’s 2022 law rms list, ranking Walter Haver eld as the ninth-largest law rm in Northeast Ohio.

Separating from those people and practices is not a decision that was taken lightly, Cascarilla said, and is driven by a strategy for what practice areas the rm wants to focus on moving forward, namely those centering on corporate work and private entities.

While the rm’s roots have historically been in labor and employment with some public entity representation, its public education practice in particular is one that developed under Cascarilla’s tenure as managing partner.

But as the rm’s dual work in public and private arenas has grown in tandem, that has presented some con icts between the two.

“As we expanded representation, and as you get larger and have a bigger footprint in the marketplace, these things start to be in con ict,” Cascarilla said. “ at was one of the major precipitating factors in why

we talked about this idea of a transition.”

“ ese are very good lawyers in their practice areas,” he added. “We just assumed, as we looked at it, that what would be better for both sides if there were clarity for their practices in a di erent format.”

e rm has, in fact, placed a greater focus on work in the private sector in recent years.

is is underscored by the rm’s 2019 acquisitions of Hurtuk & Daro , a real estate and nance rm in May eld Heights, and Nardone Ltd., a tax planning and business services rm in Columbus. Both roll-ups marked the rm’s rst and only acquisitions since its founding in 1932.

“ is decision is really an outgrowth of our focus and expansion over the years,” Cascarilla said. “We have made a concerted e ort to develop the corporate tax and commercial litigation components of the rm. And as we have expanded our real estate practice as well, we bump up to some issues with public entities, and con icts develop.”

Lawyers, of course, charge higher rates in the private sector than they do for public entities.

But the dropping of these practices is not a re ection of any need to cut costs or cut loose underperforming groups, Cascarilla said. He emphasized that Walter Haver eld — which has certainly garnered a reputation in the market for its scally conservative approach to business — is “doing well nancially” and the impacted personnel have made meaningful contributions to the rm.

“I look at this rst and foremost as an issue about the focus of representation, our ability to represent a certain type of client and what that means to us as a rm,” Cascarilla said. “ e needs of the di erent practices combined with the inherent con icts that can come about are the factors that really compelled and in uence the decision-making process internally.”

Where the departing lawyers go from here is to be seen.

But observers of the legal market are con dent they’ll be in demand.

“ is is the rst I’m hearing about it, but I can think of a couple law rms that, when they hear this, I think they’ll want to go after those lawyers,” said Rebecca Ruppert Mc-

Mahon, CEO of the Cleveland Metropolitan Bar Association. “I think there will be some excitement in the marketplace to pick up these practice areas.”

“ ese are great lawyers,” added Murphy. “We like working with them. It just became a matter of t and focus and the path forward. We are determined to focus on commercial real estate, tax and corporate litigation practices that have been some of the biggest drivers of our growth the last 10 years in attorneys and revenue.”

e rm is an aggressive lateral hirer and will continue looking to add people to its practice areas of focus in the private sector.

As far as other moves in store for the rm, Cascarilla notes that he will not run for another term as managing partner after his current term ends March 1.

As administrative partner, Murphy could be in line for that role. But partners will ultimately vote on their rmwide leader next year.

Cascarilla, who has no immediate plans to retire, said he’s looking forward to devoting more time to his own practice areas, which include a combination of commercial and environmental litigation.

“I have indicated to the partners that I am happy to do whatever in terms of management that they might need me for,” Cascarilla said. “But I have missed having the amount of time that I would like for my personal practice.”

e rm is also reconsidering its o ce needs as it looks to the future, which has been a common theme among professional services businesses in the wake of the COVID-19 pandemic.

It was less than two years into Cascarilla’s rst term as managing partner that Walter Haver eld set up shop at the Erieview Tower in downtown Cleveland.

But with a moderate downsizing in store and the rm’s lease expiring in November 2023, management is considering a move — though there is every intention to remain headquartered in Cleveland.

“We’re looking for something a bit smaller that is more e cient and modern,” Murphy said. “So there will be some cost savings there. We also have more people working from home, which is part of it, too.”

Nobile: jnobile@crain.com, (216) 771-5362, @JeremyNobile

4 CRAIN’S CLEVELAND BUSINESS | OCTOBER 31, 2022 FOR SALE PRIME 5.3 AC REDEVELOPMENT SITE Southwest corner of Aurora Rd & Cochran Rd 32,000 SF building 16 condo units included Zoned Industrial (I-2) Potential for change of zoning to include highway services and restaurants Priced for Sale at: $5,500,000 430’ x 445’ 216.861.5349 tonyvisconsi@hannacre.com Tony Visconsi 29500 Aurora Road, Solon, OH 44139 PROPERTY OVERVIEW RATE DIMENSIONS Personalized Service! Loans up to $30 Million • No Prepayment Penalties Investment & Owner-Occupied Commercial Real Estate DON’T BE SPOOKED BY INTEREST RATES YOUR LOCAL CREDIT UNION IS HERE TO GUIDE YOU THROUGH YOUR COMMERCIAL REAL ESTATE LOANS CONTACT JONATHAN A. MOKRI 440.526.8700 • jmokri@cbscuso.com www.cbscuso.com Straight Talk, Smart Deals ®

Walter Haver eld is reconsidering its o ce needs as it looks to the future, which has been a common theme among professional services businesses in the wake of the COVID-19 pandemic. | CONTRIBUTED

LAW

Jeremy

Cascarilla

Drilling into the data pays o as workforce plans align in region

KIM PALMER

KIM PALMER

Earlier this year, Lorain County Community College (LCCC) sat down with Team NEO to develop a program that would help the school’s sta better explain and steer students toward the region’s high-in-demand jobs and careers.

With around 90% of LCCC stu dents choosing to remain in North east Ohio, those potential workers are an integral component of mis alignment in the region’s talent pipe line, said Marisa Vernon White, LC CC’s vice president of enrollment management and student services.

“We want to be better at having those important ca reer conversations with students, upfront about where the jobs actually are, so they are making in formed decisions.”

Working with the data from a suite of Team NEO annual and quarterly re ports, including the sixth annual “2022 Aligning Op portunities in Northeast Ohio,” a tal ent report on the region’s overall workforce supply and demand im balance released ursday, Oct. 27, White and her colleague omas Jay Benjamin, LCCC’s director of institu tional research, together developed “Careers by Design.”

e 12-hour, ve-part professional development program was rolled out to about 40 sta ers working directly with students and focuses on best practices in advising and guiding po tential workers to careers in three main industries. ose are health care, which, according to Team NEO in 2021, had total demand for nearly

WEEK

AIMING FOR $100M: A waterfront apartment building at the Flats East Bank in downtown Cleveland is hit ting the market, as a mezzanine lender on the project takes steps to foreclose. e future of the 240-unit apartment building, called the Flats at East Bank, is in ux in the wake of developer Scott Wolstein’s death. Wolstein, who was 69, died in May, six months after being diagnosed with an aggressive cancer that quick ly robbed him of his ability to speak. Now Institutional Property Advisors Midwest, a division of the Marcus & Millichap real estate brokerage, is preparing to list the Flats at East Bank for sale. Meanwhile, a lender is moving to assert its right to take con trol if a compelling purchase o er doesn’t materialize. ere’s no for mal asking price for the property, which also includes indoor parking and 60,000 square feet of groundoor retail. But IPA Midwest is aim ing for close to $100 million. at would be enough to repay $96 mil lion in rst-mortgage and mezza nine debt listed in public records.

CHANGE AT THE TOP: Jennifer A. Parmentier will become the next CEO of Parker Hanni n Corp. on Jan. 1, 2023. e May eld Heightsbased motion and control technolo gies company announced Parmen tier will succeed omas L. Williams, who has served as the company’s CEO since 2015. Wil liams will continue to serve as exec utive chairman of the board

50,000 workers; followed by manu facturing, with nearly 27,000 jobs; and IT, with a need for more than 15,000 workers.

e workforce data in the most re cent report has no big surprises, ac cording to Jacob Duritsky, vice pres ident of strategy and research at Team NEO. Northeast Ohio is still in need of more skilled talent, and the region continues to see declines in both population and the labor force, which was only further exacerbated by pandemic losses.

But there is some good news.

After more than half a decade of digging into the workforce problem, the reports continue to contain better data based on robust community in put, resulting in key nd ings. ose ndings are helping shape a broader regional discussion about how to bring more skilled candidates into the work force and create a consen sus of partners all working together and “moving in the right direction,” he said.

“ e mismatch between supply and demand has not really changed, but what is continuously changing is the development of higher educa tion and workforce programs work ing on this across the region,” Du ritsky said. “Six years later, we’ve helped elevate the conversation and, more importantly, created a lot of strategic alignment.”

LCCC became part of that conver sation when, as White explains, the school wanted a broader, quanti able view of the region’s employ ment needs. e career program that as a result was created and im

plemented in less than a year has been “transform a more diverse population of students into those programs.

“We recognized we need to give our advisers, career counselors and outreach specialists different words to be able to describe to students what these jobs really look like,” White said.

One value of all the granular data in the Team NEO reports — which, over the past six years, have ex panded to include underrepresent ed populations in the region’s workforce — is the quantifiable numbers about job demand.

The Team NEO reports give ad visers the ability to point to hard data, Benjamin said. Pointing out that there was a need for more than 9,700 nursing and home-aid work ers in 2020 — and only a third of that number, 2,600 students, gradu ated that year with degrees or cre dentials to fill those jobs — makes it easier to convince students those health care jobs are actually a sta ble, long-term career choice, he said.

Melding the data with career planning is also transforming how LCCC works with students around education required for new IT ca reers in the areas of cybersecurity, data visualization or micro me chanical engineering, which is re lated to semiconductor chip manu facturing, which most people do not know even exist.

Case in point, since the comple tion of the career training series, LCCC experienced double-digit percentage growth in computer maintenance and networking, cy bersecurity, data analytics and mi

cro electrical mechanical systems program enrollment for the 202223 academic year.

LCCC advisers are also better able to talk about matching up a student’s interest or passion and a career or job in the IT field.

make more than $50,000 a year and do not require a four-year degree. Some of those jobs need only a one-semester class, White points out, and many are good entry-level jobs with room for advancement. The goal is to work with employers to identify what training is neces sary to get some body in the door. From there, schools can offer training and cer tificates to help enhance skills without keeping employers wait ing for workers, White said.

“Advisers now are able to really laser-focus in on what a student might want to pursue — for exam ple, a creative arts degree can have skills that apply to robotics or com puter process design,” Benjamin said. “Also, some of our advisers who work closely with social sci ence students now point to data an alytics as something that would po tentially resonate with them.”

The newest Team NEO report also highlights the region’s top 20 jobs that require an associate’s de gree or less; are expected to be in high demand for the next five years; and pay a more than self-sustaining wage in Cuyahoga County, which is at least $32,531 a year.

In the region, light truck drivers; industrial machinery mechanics; plumbers and pipefitters; insur ance sales agents and adjusters; heavy equipment mechanics; heat ing and cooling mechanics; and electricians are all in high demand,

“Short-term training is some thing that resonates with people, that immediate return on invest ment. The ability to take that shortterm certificate or that short-term credential and then add to that as they’re working is very popular,” White said.

The LCCC program has been so successful White and her team have modified the sessions for those in and outside of the school.

“We realized how valuable the information was around talent gaps, so we condensed the infor mation into a highlight session last ing about 90 minutes for faculty and staff not working directly with students, like marketing and com munication, and we have also start ed including some of our other higher education partners,” White said.

Kim Palmer: kpalmer@crain.com, (216) 771-5384, @kimfouro ve

throughout 2023, and he will retire from both the board and the com pany at the end of that year. Par mentier became Parker’s chief oper ating o cer in 2021, having previously served as the company’s vice president and president of the motion systems group from 2019 to 2021 and of its engineered materials group from 2015 to 2019. Andrew D. Ross will take on the COO role when Parmentier becomes CEO. Ross also has a long history of leadership with the company, including his current role as vice president and president of the uid connectors group, which he has held since 2015.

KEEPING BUSY: SITE Centers, the Beachwood-based real estate invest ment trust, shed 15 plazas for $451 million and continued its “buy

small” campaign by purchasing ve convenience centers for $31 mil lion. e disposition and acquisi tion updates were included in the shopping center owner and manag er’s nancial report released Tues day, Oct. 25, covering the third quarter ending Sept. 30. Typical of the sales side of the ledger, SITE Centers sold Perimeter Center, a 136,000-square-foot shopping cen ter in Columbus, for $35 million, ac cording to the company’s nancial supplement. On the buy side, the company bought Parkwood Shops in Atlanta for $8 million, and a port folio of four plazas in Phoenix for a total of $23 million. e ve centers in total added just 52,000 square feet to SITE Centers’ portfolio and ranged in size from 4,000 to 20,000 square feet.

OCTO BER 31, 2022 | CR AIN’S CLEVE LAND B USIN E SS 5 GOVERNMENT

THE

The Flats at East Bank apartment building is being put up for sale in the wake of developer Scott Wolstein’s death. | MICHELLE JARBOE/CRAIN’S CLEVELAND BUSINESS

Vernon

“THE MISMATCH BETWEEN THE SUPPLY AND DEMAND HAS NOT REALLY CHANGED, BUT WHAT IS CONTINUOUSLY CHANGING IS THE DEVELOPMENT OF HIGHER EDUCATION AND WORKFORCE PROGRAMS WORKING ON THIS ACROSS THE REGION.”

—Jacob Duritsky, vice president of strategy and research at Team NEO, Northeast Ohio

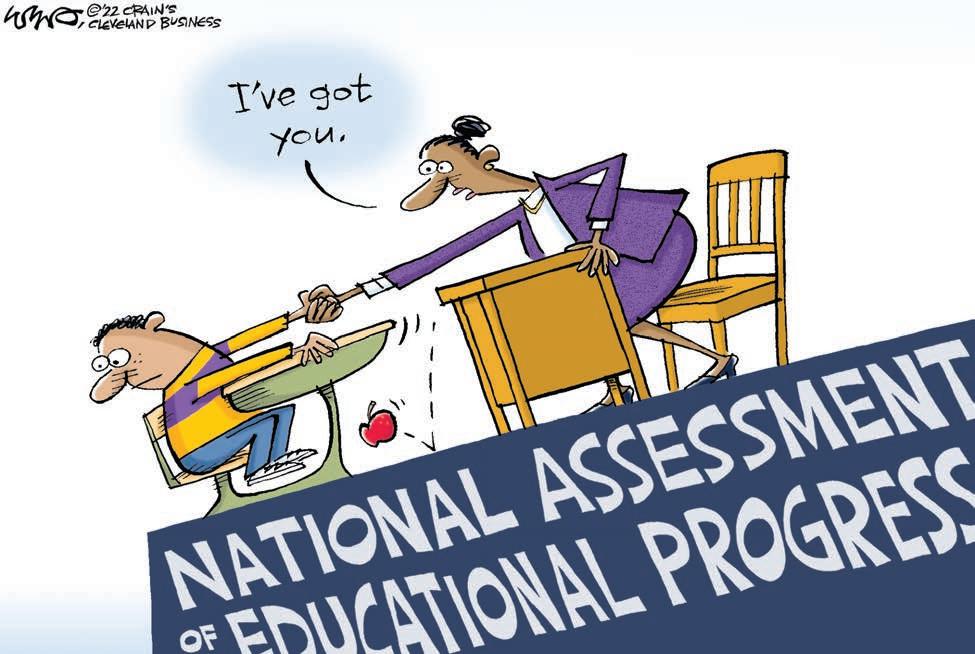

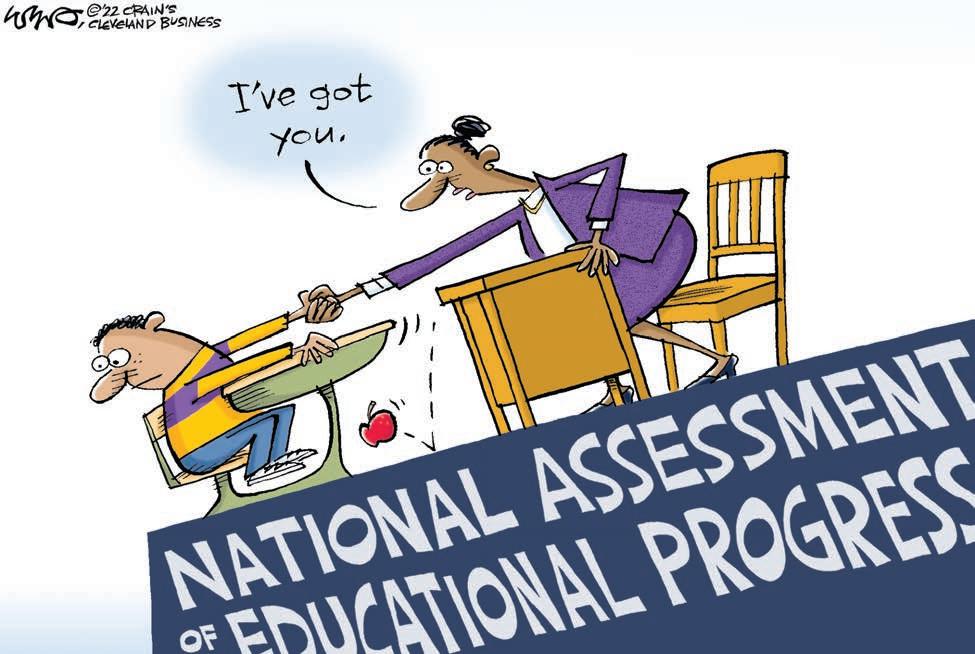

Lessons learned?

For some truly scary late-October reading, check out the re sults of the new National Assessment of Educational Prog ress, a national report card on how U.S. students are doing.

e 2022 NAEP was the rst time the test had been given since 2019, so it provides a glimpse of the pandemic’s impact on learning. Its results, released last week, were awful, with math scores recording their largest decreases ever, and read ing scores dropping to 1992 levels.

e Associated Press noted that “several major districts saw test scores fall by more than 10 points.” Cleveland saw a drop of 16 points in fourth-grade reading. Declines of even a couple points are considered cause for concern. Students with dimin ished reading skills present a particularly vexing problem be cause they tend to have di culty learning other subjects.

Eric Gordon, the outgoing CEO of the Cleveland Metropolitan School District, told the AP the report was “more con rmation that the pandemic hit us really hard.” He added, ruefully, “I’m not concerned that they can’t or won’t recover. I’m concerned that the country won’t stay focused on getting kids caught up.”

One report isn’t everything, but mounting evidence makes it clear that pandemic lockdowns that prevented in-person learning in some places for too long had signi cant educa tional and social consequences for children. From an equity standpoint, it’s important to note that kids in city schools were far more likely than students from the suburbs to have to try to learn remotely. Workers might have made peace with Zoom; for kids, it’s mostly no good.

Over the long haul, those setbacks could have serious impli cations for the preparedness of the workforce, both in terms of their skills and their emotional preparedness for work. Given the struggles many companies already have in nding the em ployees they need, this is not a good sign for what lies ahead. e past can’t be changed, but districts can use it to draw better lessons for the future, starting with the preparation of plans to keep schools open as much as possible if/when the next pandemic (or some other calamity) hits. Cleveland beefed up summer school and added after-school training to help students make up lost ground, but Gordon’s successor should be pressed to detail how the district over time will help erase these serious learning losses.

Teachers have incredibly di cult jobs, and you won’t nd us criticizing them. But teachers unions heavily in uenced decisions on closures, and while we understand their interest and duty in keeping members safe, their discussions with dis tricts on future safety measures have to be predicated on ed ucating kids in person to the largest degree possible.

We all hope there’s no follow-up pandemic to manage. But if there is, schools have to manage the risk so we don’t doom generations of students to inferior educations that set them back a lifetime.

Change in motion

PERSONAL VIEW

Medicare’s annual wellness visits are underused. at needs to change

More than 10 years after it was es tablished as part of the Affordable Care Act, fewer than 20% of Medicare pa tients are getting an annual wellness visit (AWV) — that dedicated primary care encounter that focuses on sched uling preventive services such as vac cinations, bone density tests and screening tests for cancer, chronic con ditions and cognitive problems.

Patients are missing out on some clear benefits, including greater use of preventive services to detect or stave off disease and lower personal Medi care spending. Data on the effective ness of annual wellness visits contin ues to emerge. In fact, just this past summer, researchers from the Univer sity of Virginia reported results show ing that patients with diabetes who get one of these free visits are 36% less likely to need major lower-extremity amputations.

With such a significant upside for patients, what accounts for the low numbers when it comes to these free preventive care visits? Confusing cov erage rules under Medicare may be partially to blame. Medicare does not cover an annual physical exam, where the provider surveys the body for dis ease, measuring height, weight and blood pressure and listening to the pa tient’s heart and lungs. But it does cov er an annual wellness visit, which is more of a conversation and less of an exam.

P

arker Hanni n Corp. will get a new CEO on Jan. 1, 2023, putting a new executive in charge of a multibillion-dollar advanced manufacturing powerhouse. e move also will grow the small ranks of Ohio’s largest public companies that are led by women.

e May eld Heights-based motion and control technologies company announced that Jennifer Parmentier will succeed omas Williams, Parker’s CEO since 2015. Parmentier has worked at Parker since 2008 and became its chief operating o cer in 2021. She previously worked at Ingersoll Rand Trane Resi dential Systems and Magna Corp.

When Parmentier becomes CEO, she’ll be the fourth woman at the helm of one of Ohio’s 50 largest public companies, based on 2021 revenue. e others, according to Crain’s Ohio Public Companies list published Aug. 1, are Progressive Corp.’s S. Tricia Gri th, Bath & Body Works Inc.’s Sarah Nash (she’s interim in the role) and Fran Horowitz of Abercrombie & Fitch Co. We point this out not to praise or second-guess speci c decisions on CEO hir ing, but to underscore that everyone bene ts when companies are casting the widest net possible when looking for executive talent — including (and maybe especially) at the top. e num bers suggest that still doesn’t happen for women in CEO posts.

It would help Parker and all of Northeast Ohio if Parmentier is great in this job, as we expect. And it would be great for Ohio corporations to make more progress in opening up the C-suite to those traditionally excluded.

Executive Editor: Elizabeth McIntyre (emcintyre@crain.com)

Managing Editor: Scott Suttell (ssuttell@crain.com)

Contact Crain’s: 216-522-1383

Read Crain’s online: crainscleveland.com

For patients and most clinicians, the distinction may seem meaningless — until patients get the bill for an un covered physical exam. The resulting sticker-shock may turn them off of preventive care entirely no matter what it’s called, further depressing the number of patients tak ing advantage of annual wellness visits. Patient education on the differences between the two kinds of clinical en counters can help. However, knowing to ask for an annual wellness visit and not a physical exam is asking a lot for even the most savvy Medicare patient.

Hospitals and health systems have also failed to make Medicare annual wellness visits a priority. In an industry known for innovation in quality improvement, health care has produced just two small efforts to boost the numbers.

Where does that leave us? Changing the narrative on annual wellness visits will require taking the onus off pa tients to navigate the complexities of Medicare and in stead putting responsibility on hospitals and health sys tems to build systems to be proactive in getting their Medicare patients scheduled for this vital service.

At our institution, we launched a multifaceted quality im provement e ort to boost annual wellness visits for our Medicare patients in 2018. Like many hospitals and health

Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Cleveland Business, 700 West St. Clair Ave., Suite 310, Cleveland, OH 44113, or by emailing ClevEdit@crain.com. Please include your complete name and city from which you are writing, and a telephone number for fact-checking purposes.

Sound o : Send a Personal View for the opinion page to emcintyre@crain.com. Please include a telephone number for veri cation purposes.

6 CRAIN’S CLEVELAND BUSINESS | O CTOBER 31, 2022

EDITORIAL

RICH WILLIAMS FOR CRAIN’S CLEVELAND BUSINESS

DR. PETER PRONOVOST, DR. TODD ZEIGER AND DR. SONA KIRPEKAR

Pronovost, Zeiger and Kirpekar are University Hospitals medical doctors.

See MEDICARE, on Page 18

meet future

BY MARCIA BALLINGER

BY MARCIA BALLINGER

As Manufacturing Month spans the month of October, our region is perfectly poised to lead the future of manufacturing, a future fueled by opportunities in semiconductors, microelectronics and increased automation.

Intel’s new, leading-edge semiconductor manufacturing plant represents one of Ohio’s greatest economic opportunities, as its presence is certain to drive unprecedented supply chain growth throughout the state. It’s not just about one company coming to Ohio — it’s an entire industry embedding itself in Ohio, creating the Silicon Heartland.

Long before Intel’s historic groundbreaking ceremony near Columbus, Lorain County Community College (LCCC) was ready. For more than a decade, LCCC has been developing unique expertise in semiconductor and microelectronic manufacturing education and training. LCCC o ers Ohio’s only associate of applied science and bachelor of applied science degrees in microelectronic manufacturing, preparing students for work in the exploding semiconductor industry.

Both programs have boasted 100% job placement rates for our graduates, in part because of innovative earn-and-learn paid internship opportunities built into the curriculum working with over 80 Northeast Ohio

WE ARE READY FOR THIS MOMENT BECAUSE LCCC HAS DONE WHAT COMMUNITY COLLEGES ARE UNIQUELY DESIGNED TO DO — COLLABORATE WITH EMPLOYERS TO ANTICIPATE FUTURE TALENT NEEDS AND RESPOND SWIFTLY TO MEET THEM.

employers. ese types of integrated solutions led Harvard University’s Project on Workforce to pro le LCCC as one of ve exemplary community colleges in a forthcoming publication: “America’s Hidden Economic Engines: How Community Colleges Can Drive Shared Prosperity.”

As serendipitous as it all might seem, we are ready for

Ballinger is president of Lorain County Community College and co-chair of TeamNEO's Talent Development Council.

this moment because LCCC has done what community colleges are uniquely designed to do — collaborate with employers to anticipate future talent needs and respond swiftly to meet them. We will continue to forge partnerships to realize the full potential of this opportunity.

Intel recently named LCCC as one of eight higher education institutions in Ohio to lead its workforce investments. LCCC also joined the Midwest Regional Network for Semiconductors and Microelectronics, teaming up with institutions such as Ohio State University, Case Western Reserve University and Purdue University, among others, to address the broader, national e orts to promote U.S. leadership in semiconductors and microelectronics.

is proactiveness ensures residents have the opportunity today to train for and excel in the jobs of tomorrow.

LCCC’s innovative bachelor of applied science degree in microelectronic manufacturing and the college’s newly launched bachelor of applied science in Smart Industrial Automated Systems Engineering Technology will serve as a core curriculum for our Silicon Heartland’s training needs. And both build upon the success of LCCC’s longstanding University Partnership.

Now celebrating its 25th anniversary, the University Partnership delivers more than 100 bachelor’s and master’s degrees from 15 Ohio colleges. ese degree programs are o ered on the LCCC campus and save students an average of 70% on the cost of a bachelor’s degree. And after graduation, LCCC and University Partnership students nd career success right here in our region, as 90% of our graduates live and work in Northeast Ohio.

To secure the momentum of the University Partnership and all LCCC’s programs and services, we are asking voters to support Issue 10 on the Nov. 8 ballot. Issue 10 is a renewal levy and will not increase taxes. Issue 10 is an investment in our region’s future; it’s an investment that fuels this momentous transformation that’s unfolding here in Ohio.

Crain’s got it wrong with endorsement

Crain’s endorsement of Mike DeWine for governor is shockingly dismissive of his role in two recent scandals that a ect every single Ohioan and of which we should all be aware.

First, the FirstEnergy/House Bill 6 bribery scandal was unlike anything this state has seen in recent history. DeWine was, of course, involved in negotiations and passage of this disaster of a bill, and he signed it into law. He was responsible for appointing the head of PUCO (Public Utilities Commission of Ohio), who accepted millions from FirstEnergy and was raided by the FBI. e details of this whole saga are appalling, and, as governor, DeWine was in the midst of it all. Ohioans remain on the hook for millions in subsidies to energy companies and coal plants in Indiana as a result of his mismanagement.

Second, DeWine has done nothing to respond to the mandate from 70% of Ohioans to x gerrymandering in our state, and he has further ignored multiple orders from the Ohio Supreme Court to adopt constitutional maps. In fact, he called the maps “unconstitutional” but voted for them anyway. is is a agrant violation of his oath of o ce, yet such a tedious topic, I don’t blame most Ohioans for failing to pay attention. But we must.

His dereliction of duty cost Ohioans $20 million for an August primary that we did not need. Furthermore, the legislative extremism that results from gerrymandering like arming teachers (HB 99); forced “internal genital examinations” for child athletes (HB 151); and forced birth for victims of rape and incest (HB 258) is destroying our state’s economic outlook. Not surprisingly, Ohio’s brain drain has accelerated and young people are leaving in droves. Much of the responsibility for this lies at DeWine’s feet.

ese scandals are a result of a state where one party controls the politics to an extreme degree. Luckily, there is an alternative. Nan Whaley is running for governor and is a competent, level-headed leader who believes in representing the majority of Ohioans who just want the return of common sense and decency. Nan, like most of us, supports economic policies that will entice workers and new industries, help homeowners, make our schools and communities safer, and keep the government out of our private decisions. I urge voters to support Nan Whaley and reject Mike DeWine and the damage he has done to Ohio’s economy and prospects.

Jackie Godic Pepper Pike

OCTOBER 31, 2022 | CRAIN’S CLEVELAND BUSINESS 7

PERSONAL VIEW OPINION LCCC ready to

talent needs of employers

HOW TO FLY WITH SKY QUEST: » On-Demand Charter » Jet Club Memberships » Aircraft Ownership Opportunities 216-362-9904 Charter@FlySkyQuest.com FlySkyQuest.com Private Travel Made Easy Zoned PDD • 10,500+ VPD 2 Miles From I-70 • 20 Minutes From Downtown Columbus 11 Miles From the New Intel Factory Directly in Front of Heritage Town Center Apartments GROUND LEASE OR 7200-7256 Hazelton-Etna Rd, Pataskala, Ohio 43062 Lot 1: 1 Acre • Lot 2: .35 Acres BUILD TO SUIT Nichole Booker, PhD. Senior Advisor 330.475.5500 nichole.booker@svn.com Aaron Davis Senior Advisor 330.221.7297 aaron.davis@svn.com

LETTER

TO THE EDITOR

Why we’re creating the Disney World of manufacturing

ETHAN KARP

As the story goes, Walt Disney dreamed up Disney land while sitting on a bench in Los Angeles watching his daughters ride the carousel. He decided right there to build a park that transcended any single ride — a place for community, a place to learn something, a place where people would dream and be inspired.

If you could humor me, 70-odd years later I believe we’re doing something with a similar goal for manu facturing.

Last week, we o cially opened the Manufacturing, Innovation, Technology and Job Center, a facility that, like Walt and the carousel, is much more than a build ing. It’s a place to architect our industry’s destiny. e one envisioned in MAGNET’s Blueprint for the Future of Manufacturing in Northeast Ohio. Our goal is to transform the region into a global center for smart manufacturing, creating 30,000 jobs and boosting our GRP by $40 billion by 2032. e Manufacturing Center is where, together, we will make this happen.

It’s a place unlike anything else in the country. It’s a prototyping lab, a factory, a park, a museum, a workspace, a school, a technology accelera tor, and a gathering space. We’ll bring in more than 3,000 K-12 students every year, plus loads of current and prospective manufacturing employ ees to experience and learn what makes the industry not only vital for our country but a fun and rewarding career choice. Manufacturing is no lon ger reserved to dark and dingy warehouses — these are now high-tech ca reers earning quality pay. Here, students and companies can get hands-on experience interacting with the latest in Industry 4.0 technology, engaging with collaborative robots, real-time data monitoring, augmented reality, and the Internet of ings. And so can you — tours of our facility are free and open to the public.

NOT ONLY ARE WE EXCITED ABOUT THE PROSPECT OF BRINGING MORE VISIBILITY AND ACCESS TO MANUFACTURING VIA THIS HIGH-PROFILE SPOT, BUT WE ENVISION OURSELVES EMBEDDING WITHIN THE NEIGHBORHOOD IN A WAY THAT IS SYMBIOTIC.

So many manufacturers plant their roots far away from the inner city, but we have placed our building smack dab in the middle of Cleve land, in the up-and-coming Innovation District inside the historically disadvantaged Hough neighborhood. Our reasoning is two-fold. Not only are we excited about the prospect of bringing more visibility and access to manufacturing via this high-profile spot, but we envision our selves embedding within the neighborhood in a way that is symbiotic. We have, for instance, revitalized a long-abandoned school and built a massive STEM-themed playground to draw people in.

Hough is a predominately Black neighborhood, providing access to a talent pool that manufacturers have long failed to attract. By welcom ing our neighbors into our new home, we hope to create enthusiasm for our industry while placing more people of color in manufacturing jobs — great jobs that pay an average of $70,000. These can and should be the future leaders of our industry, and it starts with opening our doors.

And the state-of-the art machines and the building aren’t just for show. The facility has been built with a 20,000-square-foot prototyping lab so that small- and medium-sized manufacturers can access ad vanced equipment to build and launch new companies and products, with our engineering expertise to help along the way. What Silicon Val ley incubators are for tech startups — that’s what we are for manufac turers, bringing their ideas to life and to market, helping them scale their businesses.

Why is this all so important? We are at a critical turning point for American manufacturing. With the pandemic and geopolitical unrest wreaking havoc on our supply chains, there’s momentum to bring more manufacturing back to the U.S., as well as to build in additional capacity to handle surges in demand through advanced technology. Incoming federal grant dollars in the form of the Chips Act will help. The end goal is to become less dependent on other countries and cre ate more supply chain resilience here at home, steeling ourselves against future disruption. Northeast Ohio is positioned to play a funda mental role in this future. But it will only happen if we provide the manufacturing ecosystem with the tools and resources to create thriv ing, viable companies.

And it all starts with getting more people excited about manufacturing and seeing how it could make their lives better. We didn’t put in a roller coaster like Walt, but we could certainly build one if we wanted to.

O ces better for mingling than focusing

SARAH GREEN CARMICHAEL BLOOMBERG OPINION

e rise of remote work might be the best thing to ever happen to the o ce.

Until the COVID-19 pandemic up ended our work lives, the o ce func tioned as a do-it-all, be-everythingto-all-people space, balancing desks for individual work with conference rooms for team meetings and social areas for chit-chat. As a result, it did none of these jobs very well.

We ended up with open-plan spaces where sound carries freely — and with a lot of employees wearing headphones to block out the clamor.

ere are never enough conference rooms, so employees commute in just to meet over Zoom. It’s a space where it’s hard to be e cient, yet also hard to be collaborative and creative.

Fortunately, there is a way out of this morass. Embracing some degree of remote work eliminates the need for so many desks, freeing space that can be prioritized for what o ces do best: providing co-workers an oppor tunity to mingle.

It will take a di erent mindset on management’s part, but if leaders can embrace the idea that remote work is for concentrating and head quarters is for cooperating, o ces might become very di erent, and vastly superior: more meeting rooms, more social spaces, more natural light, more greenery. Executives might not be able to shorten the long commutes remote workers are des perate to avoid, but they can rethink what their o ces o er employees and, in so doing, make those treks more worthwhile.

e o ce of the future will be smaller, but nicer, says Diane Hoskins, co-CEO of design and ar chitecture rm Gensler, who is al ready seeing some clients adopt this type of layout. She says rms are pay ing more attention to amenities that really support social interaction among colleagues — Wi-Fi-enabled terraces, co ee bars, pool tables. Common areas with sofas, soaring ceilings and walls bedecked with

plants.

e o ce itself might be relocated to a part of town that’s closer to tran sit or near bars and restaurants where employees go after work. Relying on a communal fridge to foster employ ee interaction is out. Making the of ce feel like an upscale hotel lobby is in.

To really get employees to interact with each other, companies that pro vide food and drink should rethink how it’s presented, says Ben Waber, CEO of talent analytics rm Hu manyze. Rather than o ering premade co ee, an espresso machine gives people a chance to chat as they wait for the machine to do its work. Serving food bu et-style encourages employees to sit and linger over their meal, as opposed to pre-packaged lunches that workers can easily (and antisocially) bring back to their desks.

plans to repurpose its 500,000-square-foot Milwaukee headquarters, even as the company continues to bring employees to gether for speci c purposes like product development.

SIMPLY SEATING PEOPLE NEAR EACH OTHER AND TEARING DOWN ALL THE WALLS DOESN’T FOSTER COLLABORATION.

e o ce will become a place workers return to willingly, if less fre quently, if it o ers something they can’t get at home: camaraderie.

Yes, a workplace still needs to have some areas for heads-down tasks. But that shouldn’t be rows of cubicles or even assigned desks; a better model for many companies would be a library-like room where people sit with their laptops when they need to work quietly between meetings. ( ere was just such a room at one of my old jobs, and it was beloved for o ering a silent refuge where we could work uninterrupted.)

Prioritizing social interaction is why Salesforce decided to reduce its footprint in San Francisco and take a long-term lease at a luxury ranch in the California redwoods; employees are more likely to form meaningful bonds in a space that’s actually con ducive to socializing. It’s also why Harley Davidson has announced

Companies like these have recog nized — at long last — that simply seating people near each other and tearing down all the walls doesn’t foster collaboration. at was always “a fantasy,” says Jennifer KaufmannBuhler, a Purdue University historian and author of Open Plan: A Design History of the American O ce. (In fact, research shows that open o ces lead to fewer interactions between colleagues.) ey’ve realized that collaboration and team culture are too important to be left to chance. at’s one reason that Zapier, a work ow automation company with an all-remote workforce, invests in quarterly o sites. e entire purpose is to socialize over team lunches, group hikes and games, says Raj Choud hury, a Harvard Business School professor who has studied the rm. Choud hury found that employ ees who interact at the o sites are more likely to help each other when back in the virtual world — an e ect that’s especially pro nounced for the women on the team. Companies investing in nicer headquarters are hoping that onsite is the new o site. While this may seem like a contradiction — why in vest in a place people go less often? — it’s the viability of remote work that frees up the o ce to become pri marily a social gathering space.

Of course, it’s possible to go too far in compelling workers to fraternize. ere’s a ne line between fostering the connections that improve morale and destroying professional distance. A friend recently confessed that after her company announced a team-building exercise at a water park, she started Googling “work-ap propriate bathing suits” — a horrify ing oxymoron. Maybe stick with the nice sofas and fancy espresso ma chines.

8 CRAIN’S CLEVELAND BUSINESS | O CTOBER 31, 2022 OPINION

Workers arrive at Goldman Sachs headquarters in New York. The pandemic caused companies to re-think o ce spaces. | BLOOMBERG

Karp is president and CEO of MAGNET, the Manufacturing Advocacy and Growth Network.

PERSONAL VIEW

Opportunities and challenges for banking institutions in the cannabis industry

By Conner Howard, Crain’s Content Studio-Cleveland

By Conner Howard, Crain’s Content Studio-Cleveland

As voters and legislators across the 50 states move medicinal and recreational marijuana use cases into the mainstream, regulations are constantly evolving to keep up. For lenders and creditors, this presents an expanding eld of potential clients in the form of growers, processors and dispensaries. However, a fast-moving industry also comes with its fair share of risk. Chris Pratt, vice president and customer experience of cer with The Middle eld Banking Company, spoke with Crain’s about the upsides and downsides of pursuing banking relationships with the burgeoning cannabis industry.

Q: How did Middle eld rst get involved in this developing industry?

A: “When medical marijuana was on the ballot and later eventually approved, we listened to our current clients and businesses in our markets as they asked questions regarding the business opportunities that state legalization of medical marijuana could create. As they got interested in (investing) and they came to us and said ‘would you be able to bank us,’ that’s when we put our due diligence in and invested a lot of time and resources into working with banks that had an existing (cannabis) program to design a like program at Middle eld .

With that level of expert opinion, we knew we designed a strong program from the start. We’ve just stayed close with those partners through the maturation of the program and really, it’s business development 101: Listen to the needs of your communities and clients and always be looking for solutions to those needs.”

Q: How does Middle eld stay informed on this industry and build its base of knowledge?

A: “Self-education; reading up on and staying in touch with the legislation that’s going on as well as the emerging challenges in the industry. The potential for money laundering is a big concern of banks, so we’ve got to make sure we’re staying up to date on the

rules and requirements that are in place with all of the payment processors and card issuers. There are payment conferences that we attend that keep us informed of those requirements as well as keeping us up to date on emerging solutions. There are also more speci c cannabis conferences which we attend that help us understand the long term trajectory of the market. Everyone we work with in the space is really on the cutting edge of this industry. That’s really where our expertise comes from: just staying educated, attending seminars, aligning ourselves with reputable partners and consultants who have come in to help banks and cannabis business make sure they can continue to grow by being ef cient while at the same time remaining a safe and sound business venture.”

Q: What would you say are the biggest challenges and opportunities present in the cannabis industry from the perspective of Ohio banking entities?

A: “Access to credit is a challenge right now. Most (banks) are content with handling the deposit account piece of the business but not the credit. However, a positive I see is that you’re seeing vendors come into the space that have experience in providing these solutions. These vendors are really getting good at making sure they’re checking the boxes on everything they need to in order to make sure their solution is sound and compliant with all of the regulatory requirements within the market. As a bank, we need to take a look at those vendors too, before we onboard a marijuana business to make sure that we are comfortable with their solution as well. So, it’s nice to know that we’re dealing with some vendors who have been consistent and that we’re comfortable with our

clients partnering with. I really feel a sense of synergy developing at all levels of the industry, which is reassuring.”

Q: No one can see into the future, but it looks as though the cannabis industry isn’t going anywhere and will likely only continue to expand in the future. How can a banking institution set itself apart in this fast-paced industry?

A: “From the bank’s perspective, I think that’s the way we’re thinking of it right now; is to take the long view on the industry. It’s going to be more competitive in the market, but what we hope we can do that other banks can’t do is talk about our longevity in the market and how we’ve supported and advised our clients upon entry into the market by providing them with deposit relationship and then the lending options for them to achieve their ultimate growth objections. We understand that competition is going might start to normalize the cost of doing business, but we want to take the long view so we can say ‘our program has been through regulatory examinations in which we’ve received high marks. There’s no risks in you banking with Middle eld because you know we have a strong program.’ When you’re looking for a banking partner in this space, you have to do your due diligence, you have to see what the options are, and nd a bank that’s willing to understand your business model and provide you tools so that you can continue to grow.”

SPONSORED BY:

MB IS OHIO GREEN

With

cannabis business

agricultural

Here is what our clients are saying about us:

At the time we began construction on our facility in 2017, MB was the only bank in town that was willing to work with us. As a cannabis company, one of your biggest challenges is finding a banking partner. MB stepped up for us when no other bank was willing to do so. They have been a great partner for us as our business has continued to grow. They understand our business and the challenges we face. They are well-prepared to service the cannabis industry.

Serving Northeast and Central Ohio

middlefieldbank.bank/green 888.801.1666

— Sean McKiernan, CPA, Chief Financial Officer

our rich history of supporting

businesses, MB is uniquely qualified to be your

banker. We

provide cultivators, processors and dispensaries with a

fast

service approach and comparatively lower monthly fees.

Learn more today by calling 440.632.8206

to

speak

with

Chris Pratt,

Customer Experience Officer.

SPONSORED CONTENT

This advertising-supported section/feature is produced by Crain’s Content Studio-Cleveland, the marketing storytelling arm of Crain’s Cleveland Business. The Crain’s Cleveland Business newsroom is not involved in creating Crain’s Content Studio content.

Chris Pratt, VP, customer experience of cer, The Middle eld Banking Company

Challenging macroeconomic environment contributes to marijuana industry woes

BY JEREMY NOBILE

BY JEREMY NOBILE

After years of slow and steady growth, the legal marijuana industry is grappling with a downturn amid surging levels of in ation and the potential for a recession.

A number of plant-handling businesses, dispensaries and the tech companies serving them are retrenching as a result of a more challenging and increasingly competitive operating environment where consumers’ discretionary income is shrinking — in ation has risen by 8% in the past 12 months, while groceries are up by roughly 13%.

Spending on legal marijuana has curtailed along with that.

According to New Frontier Data, customer spend per dispensary transaction dropped by 7% on average across all U.S. markets between the rst two quarters of this year.

“It’s crazy out there,” said Kevin Murphy, a co-owner and board member for expanding Northeast Ohio-based multistate operator (MSO) Standard Wellness Co. “I’ve seen a couple different cycles over the last decade-plus, and we are de nitely in one of those down cycles.”

Ohio’s relatively young marijuana industry, which has been serving medical customers since just 2019, is feeling the growing pains, echoed Standard Wellness CEO Jared Maloof. He said that he feels the state is being “impacted pretty signi cantly.”

10 | CRAIN’S CLEVELAND BUSINESS | OCTOBER 31, 2022

Workers tend to plants at Standard Wellness Co.’s Gibsonburg cultivation facility. STANDARD WELLNESS CO.

BUSINESS OF CANNABIS HEMP REMAINS HIGHLY REGULATED While businesses that deal in hemp-derived products are able to sell their wares, these entrepreneurs still must comply with state and federal regulations. PAGE 12 GROWING

PAINS −20% 20% New Jersey Missouri Virginia Nevada Pennsylvania Arizona Arkansas California Maryland Michigan Washington Massachusetts Alaska Illinois Colorado Maine Ohio Montana North Dakota Connecticut New Mexico New York Oregon Florida Hawaii Oklahoma Vermont Rhode Island Delaware Utah DC CRAIN’S CLEVELAND BUSINESS GRAPHICSOURCE: NEW FRONTIER DATA Through the rst half of this year, U.S. consumers’ average spend per transaction was down signi cantly across most legal cannabis markets, indicating that tightening economic conditions are impacting spending.

neighbors like Michigan and Pennsylvania,

nesses are laying o sta or closing.

Large, publicly traded marijuana companies and related investor funds have seen their stock values fall amid broader economic factors.

a marijuana ETF tracking a basket of U.S. cannabis stocks, for example, is down 55% on the year.

One element seemingly bene ting the Ohio market is its nite number of marijuana business licenses and caps on cultivation space. It’s a di erent dynamic compared with states like Michigan that have an unlimited number of licenses available to just about anyone able to apply for one, plus no strict prohibitions on production output, which is contributing to a dense and oversupplied market.

Murphy and Maloof say their company has chosen to expand Standard Wellness into only limited-license states — like Utah, Missouri and Maryland — because of such concerns.

How much an industry downturn impacts players in Ohio, though, is to be seen.

Market plateaus, prices drop

Andy Rayburn, CEO for Eastlake-based vertically integrated marijuana company Buckeye Relief and president of the Ohio Medical Cannabis Industry Association (OMCIA), said his company started noticing cart purchases by customers dropping on average around 15% between the spring and summer.

is may be due in part to price

drops on the retail side.

Ohio’s average per-gram price for marijuana ower, which is far and away the most popular cannabis product, is around $8.33, according to the latest state gures. at’s nearly half as much as the per-gram price of $17 logged in February 2019, according to a September report by Ohio State University’s Drug Enforcement and Policy Center.

ese drops have come as the industry has developed, the product supply has increased and competition has grown.

Prices will likely continue to come down as these trends continue and more retailers open.

It's a dynamic that’s good for consumers — especially considering Ohio consumers are still frustrated by high dispensary prices, according to DEPC — but not so much for wholesalers, who say they are spending more to grow or make products today that they must then turn around and sell for less than they have been.

at is an acute challenge in a region like this, where there’s cheap

weed easily accessible in Michigan’s adult-use market with no limits on how much someone can purchase.

Compare that with Ohio’s medical market, which has seemingly arbitrary caps on how much marijuana someone can buy during a 90-day period.

On average, ower sold in Michigan is almost half the price compared with Ohio, according to DEPC.

e rule of thumb is that marijuana retailers typically mark up products by about 100% over the wholesale price, which is trending down.

“Margins can be very thin, even in a rec market,” Murphy said. “But if you have too many licenses out there, it is a race to the bottom, and that is not good for anybody.”

Meanwhile, the number of active medical marijuana patients in Ohio is hovering around 162,000.

But growth in patients has plateaued.

Industry stakeholders like Rayburn projected a medical customer population in the Buckeye State could reach at least 200,000, but that has yet to come to fruition.

“Our patient count is tiny for a state like Ohio,” said Geo Kor , CEO for Akron-based Level 2 cultivator Galenas, which also has a large cultivation operation in Michigan. “Michigan had more than double that by the time they passed their rec bill.”

Ohio’s patient count is expected to increase as access to medical marijuana grows and prices trend down with new dispensaries coming online.

But the growing pains may continue until that potential customer pool expands.

“You’re not getting more patients. You’re just getting more product,” Murphy said. “ at makes shelf space that much more di cult to occupy. If you’re not vertically integrated, it is tough to get spaces on those dispensary shelves.”

Growing pains — but they could be worse

Rayburn and other industry ocials said that there are some marijuana businesses in Ohio quietly letting people go to rein in costs, though there doesn’t seem to have been any mass layo events so far.

OCTOBER 31, 2022 | CRAIN’S CLEVELAND BUSINESS | 11 FOCUS | BUSINESS OF CANNABIS How to Grow Your Business BROUGHT TO YOU BY: POWERED BY: CRAIN’SCONTENTSTUDIO CLEVELAND A WEBINAR SERIES FOR ENTREPRENEURS EVENT #5 Marketing for Small Businesses NOV10 | 11am EST. TO REGISTER: crainscleveland.com/grow-your-business As a small business owner, your employees are an invaluable resource now more than ever. Engage with experts in this free webinar and hear strategies to maximize marketing for small businesses. For over thirty years, the team at Sequoia Financial has been assisting clients craft personal financial plans that achieve their unique goals. Simply put, we’re here to help. SEQUOIA-FINANCIAL.COM | 440 473 1115 Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC-registered investment advisor. Registration as an investment advisor does not imply a certain level of skill or training. More information about Sequoia can be found here: https://adviserinfo.sec.gov/ SCAN THIS TO SCHEDULE A MEETING However, the situation here is not as bad as it looks in other markets — at least not yet. at includes states like California, Arizona, Colorado, Oregon and even

where some marijuana busi-

MSOS,

Matt Herhuth, a cultivation agent with Standard Wellness Co., tends to marijuana plants at the company’s Gibsonburg grow facility. | JEREMY NOBILE/CRAIN’S CLEVELAND BUSINESS

See WOES on Page 13

Hemp retailers navigate complex regulations

DOUGLAS J. GUTH

e 2018 Farm Bill was not a typi cal piece of agricultural legislation. Alongside boilerplate extensions around farming and nutrition, the Trump-era bill was headlined by le galization of the regulated produc tion of hemp. No longer would hemp or hemp seed be categorized as a Schedule I substance under the Drug Enforcement Agency’s Controlled Substances Act.

What the bill didn’t do was pro duce a system in which people could cultivate hemp as they could toma toes or strawberries. Hemp remains highly regulated for both personal and industrial production, creating a tricky balance for companies touting the health and wellness bene ts of the plant.

While businesses that deal in hemp-derived products like CBD are able to sell their wares, these entre preneurs still must comply with state and federal regulations regarding le galized hemp.

Companies o ering products for stress reduction, pain relief and treat ment of various disorders must steer clear of aggressive medical market ing, with failure to do so potentially resulting in unwanted attention from the federal Food and Drug Adminis tration. Attorney Harry Bernstein of Verde Compliance Partners said the 2018 bill allowed each state to devel op rules around goods containing hemp, including personal care prod ucts, food and beverages, and vari ous supplements.

Bernstein’s Cleveland-based team of senior-level specialists partner with growers and processors on the registration of their businesses. Even with national regulation looming, would-be distributors as well as con

sumers themselves need education on the current policy environment.

“It’s the Wild West,” Bernstein said. “Hemp is legal, and the products you can sell from hemp are legal. But the FDA is not letting people sell these products under federal law. Compa nies still have to comply with labeling and not make medical claims.”

Following the rules

In the simplest terms, hemp does not have the ability to get you high.

Federal legislation states that hemp cannot contain more than 0.3% of tetrahydrocannabinol, or THC — the chemical in marijuana that produces psychoactive e ects.

In contrast, CBD is a compound derived from the Cannabis sativa plant for its numerous health and wellness bene ts. Prior to 2018, fed eral law prohibited the cultivation, possession or distribution of both hemp and CBD.

Today, hemp and CBD businesses are thriving in jurisdictions where

such products are legal. In the U.S. last year, cannabidiol products gen erated about $5.3 billion in sales, a gure expected to triple by 2026. CBD-related goods include tea, va pes, soaps and vitamins. Organic Plus Brands, a licensed hemp com pany based in North Ridgeville, of fers edibles like gummies along with hemp-derived tinctures and lip balms. Product lines are sold in bulk to retailers, wholesalers and online distributors.

Co-owner and chief science o cer Joshua Gray helped launch the com pany in 2020 with founder and CEO Alex Huska and co-owner and chief visionary o cer Lenny Berry. Gray had been using cannabis and CBD products to treat Crohn’s disease, an in ammatory bowel disorder that causes chronic in ammation of the GI tract. ough data on CBD use for Crohn’s remains scattershot, Gray said his quality of life improved upon self-treatment.