Autumn 2024 Commodity Report

The market is certainly seeing a softening in food price inflation, meaning that prices are rising at a lower level than previously.

The latest Government data for June 2024, said that food and drink prices in the UK are running at +1.5% versus the same period last year (June 2023). This would be the lowest price change since October 2021, which suggests some normality in commodity markets. Energy prices are increasingly more stable, as is Crude Oil, which is also contributing to this fact.

However, some uncertainties are moving forward, for example rising freight costs (especially those from the Far East to Europe) and proposed EU and UK legislation on raw materials sourced

(impacting pricing on items such as soya, cocoa, palm oil and coffee).

On a global level, the FAO Food Index for June (the latest month available) is also showing a stable situation, averaging 120.6 points in June, the same as its revised figure for May.

Whilst things are more stable than in recent years, geopolitical issues cannot be ruled out as potentially impacting things soon, with global unrest seemingly at a high level.

The FAO Food Price Index tracks monthly changes in the international prices of a set of globally-traded food commodities.

The Consumer Prices Index rose by 2.3% in the 12 months to April 2024, down from 3.2% in the 12 months to March.

The largest downward contributions to the monthly change in both CPIH and CPI annual rates came from falling gas and electricity prices.

Inflation prices of food and non-alcoholic beverages rose by 4% in the year to March 2024 according to the ONS. However, it is at the lowest rate since November 2021.

The bad news is, that after 7 months of decline the food price index ticks up in March, mostly driven by higher prices on vegetable oil and dairy products.

With an annual view, we are positive that the overall food market is trending back up as bad crops, uncontrollable weather, labour costs and motor fuels are pushing prices.

Source: Consumer price inflation from the Office for National Statistics

£1.00 TO $1.30 EURO EXCHANGE RATE

The Pound to Dollar exchange rate hit $1.30 - a welcome break, with hopeful further movements. The Pound Sterling rose following the release of UK inflation data for June, which showed continued strength in the services sector inflation despite the headline rate remaining at the Bank of England’s 2.0% target. It has since dropped to around $1.275 but continues to perform well overall.

“The only major currency to rise against the US dollar this year is... the pound! Sterling hit a fresh year-high above $1.30 on slightly warmer-than-expected inflation data.“

Neil Wilson, Chief Market Analyst

The new ‘further reduced Energy Price Cap’ came into force in July, with a typical household now paying £1,568, a drop of around 7% versus the previous cap and is in place until 30 September. However, this is still a big difference to the price cap of £1,976 cap from the same period last year and a huge difference to the Spring of 2023, where the cap was a massive £3,116 per year.

Whilst nothing in this market is guaranteed, Money Saving Expert predicts an approximate 10% increase for the next cap, starting 1 October 2024, so households will want to look at the best deals available now.

We are also seeing wholesale natural gas prices rise in recent weeks, with the current price of around £90/therm being the highest level in over 6 months. Global tensions and a US slowdown could impact things either way. For context, the highs of 2022 were over £500/therm.

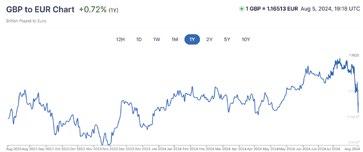

£1.00 TO €1.17

The Pound to Euro is around €1.17 at present. In recent weeks, the exchange was looking good, with the Pound hitting €1.19. However, in recent days, it has started to dip quite fast. The general feeling is that US rate cuts will be followed by further UK interest rate cuts as the Bank of England will cut rates quicker if they see the Federal Reserve doing so. Hence the Pound is starting to lose some strength against the Euro.

In the week ending 24 May, the Drewry index on the route from Shanghai to Rotterdam increased by 20% compared to the previous week.

In just seven days, it went from $4,172 for a 40-foot container to $4,999. Slightly smaller increases were visible on the route from Shanghai to Genoa. In the week of 24 May, prices for a 40-foot container increased by 15% to $5,494.

Moreover, the index does not reflect actual prices at all. A rising demand, an insufficient supply of ships, and a shortage of containers at major export ports in Asia, have all contributed to rising prices in recent weeks.

“When the Drewry index showed approximately $5,000 per container, the actual transaction prices were in the range of $6,000-$7,500. Shipowners claim that prices will reach the level of $10,000 per container.”

Anonymous, The Loadstar

Eye-opening increases in sea freight rates have been ongoing for over two weeks, coming as something of a bolt from the blue. The crisis in the Red Sea, ongoing since December, led to significant increases in rates in the first weeks but then calmed down. So where does the latest price hike come from?

The Red Sea continues to have a massive effect on the prices of everything, as it continues to cause global disruption. Israel and Houthis in Yemen have traded fire for the first time, escalating tensions nine months after commercial ships in the Red Sea started to come under threat from the rebel group.

Shipping groups have diverted vessels around Africa’s Cape of Good Hope since December to avoid attacks, but this has pushed freight rates higher and higher until we have reached COVID-19 price levels. Maersk warned on July 1 that the coming months would be challenging for shipments, especially from Asia/Oceania.

A US

Navy Carrier strike group fired nearly 800 missiles and bombs during its Red Sea fight against the Houthis

Red Sea tensions reach new high as US weighs terrorist designation for Houthis Maersk says Red Sea shipping disruption having global effects

Fuel prices have fallen for the second consecutive month, with Petrol at an average price of 145.08p, down from 148p at the start of the month. Diesel pricing also dropped to 150.25p, the lowest since around early February.

There was an increase throughout the month in barrels of oil, from $80 ending the month on $86, which has pushed up wholesale prices slightly.

Northern Ireland drivers are seeing a better reaction to the price reductions, with average petrol prices at 140.50p and diesel at 142p, which is 4.5p and 8p per litre cheaper than the UK-wide price.

Despite the small decreases, the CMA say’s that the drops are still not enough and that drivers are still being overcharged at the pumps, as detailed in the report here, something which the RAC agrees with.

CMA report shows drivers still overcharged at fuel pumps across the country

Source: RAC Fuel Watch

Many British dairy farmers will receive higher milk payments during July and into August as processors lift farmgate prices in an attempt to secure supplies. Price rises during the summer months have been driven by a combination of increased buyer interest in domestic markets, better retail demand and reduced availability.

Meanwhile, supplies continue to drop back, and the latest industry forecasts suggest that GB milk production could be 1% lower for the 2024-25 milk year at about 12.2bn litres.

“Shortages of milk have sparked fears for buyers who have finally stopped sitting on their hands and started buying, particularly fats. Retail demand has been healthy with sales of cheese up by 5% and yogurt up by 12% in recent months.”

Susie Stannard, Lead Dairy Analyst, AHDB

farmgate milk prices climb despite weaker global markets

Butter prices have increased in recent months. The month of July has stabilised albeit at a high level historically. The prices currently stands at £5,680 for bulk butter, which is a whopping 50% higher than the same point last year (£3,790).

The holiday season generally brings about a quietness, however, there are some concerns about tight availability. Should buyers enter the market again in August/September, this may bring about further change.

Lower milk and fat supplies have contributed to another increase in bulk cream prices in July.

Cream prices are up 54% versus the same point last year and stand at £2,528 per tonne.

The market is said to have firmed by another £100 per tonne during July. This makes bulk cheddar £3,770. Again, there is talk of tight supplies heading towards the end of the year.

Halloumi and Feta continues to stay steady; we are still under the impression that stocks will dry out and the price will go up before the end of the year. The market is in a much better place than 18 months ago. There is also the danger of PDO requirements for Halloumi changing in Milk % by milk type (sheep, goats, etc).

There is confidence that the Egg sector has started to see growth again, with confidence returning after the numerous issues of the last couple of years.

Similarly to Cheddar, trade is quiet, and pricing isn’t changing too much. We would expect the tight milk supplies to maybe affect mozzarella before it hits Cheddar, but we will wait and see in the coming months to what effect this has.

Source: ADHB (prices refer to spot deals agreed between 17 Jun and 21 Jul 2024) £/tonne Jul 24 Jun 24 Jul 23

Grana Padano pricing continues to rocket due to the price of Italian milk. The price difference between Grana and Parmigiano continues to close meaning using Parmigiano Reggiano may allow an easy way to premiumise menus.

Pricing is staying steady, however, as popular items on Christmas menus we anticipate demand to cause some increases. There is no indication that price will move dramatically otherwise, but demand will play a huge factor.

Pricing is up around 11p, approx. 8% YoY, with wholesale free-range prices. As mentioned in previous commodity updates, the bird population was lower than required, which seemingly has been rectified, meaning an opportunity for even more market growth.

Bird flu remains a constant threat as producers are managing on a regular basis.

Pork prices across Europe have generally fallen. The current trend seems to be that of a decline one week followed by a small increase the next week, but overall leading to a decline in prices. Higher slaughter numbers and higher pig weights are contributing to this.

During Q3 2024, the cost price of RSPCA Assured pork meat in the UK reflects ongoing challenges in the pork sector.

The cost of production remains high due to:

• Increased feed costs

• Additional costs to meet higher welfare standards

These are affecting:

• Retail prices – which are expected to remain higher than standard pork products

• Producers - navigating financial challenges from previous losses

• Costs – specifically for increased production costs

Total production from January to March 2024 sat at 5.42m tonnes, a minimal increase of 0.3% (18,200 tonnes) from the same time in 2023. The majority of the gains in production came from Poland which saw growth of 31,000 tonnes to 485,000 tonnes and Germany at 10,400 tonnes to 1.07m tonnes. This was offset by large declines in key producing countries, such as Spain and Denmark.

Authorities are taking measures to contain an outbreak of Newcastle disease on a poultry farm in Brazil’s southernmost state of Rio Grande do Sul. The Government had confirmed that a sample tested positive for the viral disease, saying it came from a commercial poultry farm in the municipality of Anta Gorda.

This could be very detrimental to the Brazilian market but also globally, dependent on what measures are taken by the EU and GB. In recent days, Brazil has confirmed that it has concluded what the issue was. It will most likely make some countries nervous, which may mean switching into different origins, adding pressure to those prices whilst possibly causing Brazilian prices to plummet.

To this point in 2024, beef production in both the EU and UK has been higher year-on-year, with most major EU producers reporting growth. Meanwhile, farmgate cattle prices have generally persisted at historically high levels, pointing to robust consumer demand and competition for cattle. EU beef exports have grown significantly against last year, driven particularly by Turkey, helping to keep product moving through the EU marketplace.

Market drivers in the northern hemisphere have generally supported cattle prices so far in 2024, with the UK being no exception:

• Latest beef market forecasts (AHDB) on UK beef production are relatively stable this year at 903,000 tonnes,

• Slight growth in prime kill and lower cow kill

• Similar trends in the EU and Ireland

• Prime cattle slaughter was up YoY during the first half of the year

• Robust prices pointing to sustained demand

However, data on youngstock populations points to supplies tightening up in the final quarter and into 2025.

at the time of publication, August 2024.

Pricing of Russian-caught Cod processed in China is still on the rise and is showing no sign of slowing down.

Pricing is up around 30% versus last quarter. Norwegian Cod is showing a slight decline, however, it is still up around 27% versus the same period last year.

Unfortunately, the news is not good for Haddock either, up around 7% versus last quarter.

That said, the rising pricing is not slowing down sales, with Intrafish reporting that retailers in the UK sold 11% more Cod in the 4-week period, ending 15th June, versus the same time in 2023. Although, that is not stopping Tesco from cutting out Russian fish from their Own Label.

Norwegian Salmon finally saw a reduction in price in May this year, down by around 40% Q-on-Q, back down to around September 2023 levels. Prices started to rise again slightly in June and continue to do so in July. Experts say that pricing is expected to start rising again, especially as we work towards the Christmas and Easter seasons.

The low-quality Salmon quantities are still at record high volumes. In addition, there are continuing pressures of the Norwegian Salmon Tax and recently reports of ISA virus in a few of the farming sites – it is no wonder prices are starting to rise again.

Another potential impact on the pricing in the future is the new lawsuit from a company specifically created to bring forward claims on behalf of around 44 million U.K. consumers. Allegedly consumers paid inflated prices - up to 20 percent higher - for Norwegian farmed salmon they bought at retail between 2011 and 2019.

Tesco to cut Russian fish from frozen supply chain as cod price pressure increases

Norwegian salmon farmers slapped with another price-fixing lawsuit, this time from UK consumers

Skipjack tuna had been falling steadily since the middle of 2023 into early 2024. Unfortunately, now this trend looks to be heading in the opposite way.

The Bangkok market price (generally the measure for global tuna prices) is usually traded in Dollars. Thankfully, the GBP has risen versus the Dollar in recent months, which will offset some of the increased raw material prices.

FAD bans (Fish Aggregating Devices – enable easier locating of tuna) are now in play in the Western and Central Pacific Ocean (WCPO) which has added further pressure on pricing for July.

There was a decrease in price of approximately 15% in Q2, which goes some way to mitigate the higher-than-predicted 21% increase in Q1. Pricing looks to be stabilising now, but experts are struggling to predict the next move on Cold Water Prawns, especially with the news of the new Greenland Fisheries Act update.

The updated Act has seen its first revision since 1996, which is set to come into place in 2025. This update sets out individually tradeable quotas for the Inland fisheries, but quote caps for the offshore fisheries. There is also the introduction of a 5-year resident requirement for fisherman. This has come as a blow to two of Greenland’s biggest companies, Royal Greenland and Polar Seafood, who have both stated the dire effect this will have on the businesses with proposed facility closures and subsequent job losses.

Whilst the Act does give greater freedom to fisherman, it is going to enact a change in the Greenland Seafood industry which is no doubt going to be affecting pricing in the future.

Greenland’s new fisheries law: ‘day of mourning’ says Polar Seafood Greenland passes fisheries reform

In general, there seems to be no reason why Frozen Fruit should be increasing. There is backlash of the container increases, whilst the Red Sea continues to cause shipping delays/increases, as the most popular Frozen Fruits are grown in countries that will affect this. There are of course usual suspects of rising costs and growing demand in this category which drives the price.

Prices to watch:

At the moment, very similar to frozen fruits – raw material prices are steady but other factors such as weather and shipping delays are having an effect.

Olive prices are seeing one rise after another, and the same can be said for capers. Supply is suffering from the bad crops in Morocco, Olive Oil demand and wage increases in Turkey. Things need to stabilise first before supply improves.

Currently to buy potatoes on the spot market would be expensive and this is unlikely to change until the new crop starts to come through which could be as late as September. At the moment weather conditions seem ok, but the potatoes still need to come out of the ground, which is also key to ensure the quality needed and yield.

The above fruits are more likely to increase in price than European grown products such as strawberries, apples and cherries.

Blueberries have been hit on price, due to a supply shortage of the fruit, caused by extreme heat from El Niño weather pattern. Blueberries require cooler temperatures to grow successfully.

The early season potatoes were a disaster due to wet weather earlier in the year

Due to wet weather, the main potato crop across Europe was planted very late

Supply of potatoes harvested in 2023 now need to last longer, as puts pressure on the market

Chip producers are paying their farmers more for contracted potatoes to secure the amounts they need

Energy is down year on year, which counteracts the higher potato prices to an extent

Pecan pricing has been stable, mainly due to the high pricing pushing customers to switch to cheaper alternatives.

Sunflower seeds are set to increase as the world’s largest exporter, Ukraine, is expecting a much lower crop.

The crop has managed to avoid any serious widespread frost damage and indications expect a 35% increase on last years crop. Since then there have been production and finance cost increases since last year and a blend of last year’s inflated crop will probably mean we can expect no change to the price which would be a result given current circumstances.

The cashew market over the past month has been one of the most volatile periods we have seen in many years with increases approx. 60% up, due to the ban on Ivory Coast exports and the Vietnamese crop being 20% shorter than forecasted. This plus freight means pricing is likely going to increase.

The situation in Turkey remains extremely challenging with no better times in sight, most packers are completely sold out and exports are down by 14% due to a lack of supply. South Africa has now sold out until next year and other origins are very limited, the thoughts are that the pricing won’t ease.

Whilst the market price continues to increase, there is no appetite for the key Brazilian players to drop the price. The market needs an overall drop in demand first to encourage raw material prices to decrease. With the smaller crop it would need to be a big drop in demand or European retailers to do something drastic.

Orange juice prices reach new record high

→ Production is marking a 24% decrease from the previous season.

→ Greening disease and adverse climate conditions, including a heatwave have significantly impacted.

→ Water stress has caused a high rate of drop and smaller fruit size.

→ Brazil (suppliers of over 75% of global orange juice) has almost zero stock left.

→ European manufacturers are trying to minimise exposure by reducing the use in blends and some have even stopped selling.

→ Some manufacturers are replacing orange juice with mandarin juice.

→ According to market players, demand will have to decline further for prices to stabilise.

Wheat prices in the UK could be further hit by heavy rains in France, Europe’s largest grower of the grain. Harvests in the UK are anticipated to be down by up to a fifth due to heavy rain.

Data from the Agriculture & Horticulture Development Board (AHDB) showed the prices of wheat futures have been steadily climbing since the start of March. Disease levels in wheat crops have remained high. They seem well from the roadside, but closer inspection shows that all is not perfect.

Barley seems to have faired better with yields “good so far”, and “better than anticipated”. French crops, however, are below average and disappointing with low yields and poor quality.

It looks like durum wheat prices are on the decline, following significant raw material price increases in the second half of 2023.

Large crops are expected in Canada and the US which would support stability in the market. Canada is always the key player due to the quantities it produces / exports and it is often Canadian Durum Wheat exported to Italy to make dried pasta.

The premium usually paid for Durum Wheat over Spring Wheat in Canada is expected to narrow significantly this year, which are all promising signs for now.

India is likely to cut the floor price for basmati rice exports and replace the 20 per cent export tax on parboiled rice with a fixed duty on overseas shipments. The world’s biggest rice exporter imposed various curbs on exports in 2023 and continued them in 2024 to keep local prices in check ahead of the general elections held in April-May.

New Delhi is expected to lower the basmati rice’s minimum export price (MEP) to $800$850 a metric ton, down from $950 a ton, to boost shipments.

The previous high of $4,854/MT for cocoa bean futures was set in July 1977 on the spot ICE New York exchange. This was surpassed in February 2024, and spot prices have continued their meteoric rise to trade at around $8,400/MT as of the beginning of May, according to Mintec Analytics. On the ICE London spot futures contract, prices traded at around £7,800/MT as of the beginning of May, marking a 220% increase year-on-year.

Over the past year, a number of factors have contributed to higher cocoa bean prices:

Drop in production (2023/24 production 20% lower than 2022/23

Increase of Swollen Shoot Virus (SSV) instances – destroying tree productivity in West Africs

Neglect and lack of fertilizers

Low and delayed farmgate payments to farmers

India and Pakistan are the leading exporters of basmati rice. New Delhi exports more than 4 million metric tons of basmati — the premium long-grain variety famed for its aroma — to countries such as Iran, Iraq, Yemen, Saudi Arabia, the United Arab Emirates and the United States.

New EU deforestation legislation

Robust consumer demand

We are now hearing from many manufacturers and retailers that most buyers have little cover during the second half of 2024, with many having delayed purchasing in anticipation of a price drop. This has forced them to re-enter the market and buy cover in the spot market at substantially higher price levels, which is causing some switching and reformulation away from traditional chocolate products and towards alternatives like compound, where cocoa fats such as cocoa butter are substituted with vegetable oil. “Shrinkflation” is becoming an increasingly common way to mitigate the rising price of chocolate as well.

Global sugar prices are reducing in line with an expected larger crop for the period 2024/2025.

Higher than expected output from Brazil, the World’s largest producer, is contributing to this. There are talks of whether this year will be a global surplus of sugar rather than a deficit which again would support lower prices.

British Sugar has also now agreed its price with farmers for the next crop which will be lower than the previous year, but, not to the levels expected. This is due to beet sugar remaining under threat productionwise from virus yellows disease and that some pesticides are banned for use in sugar beet production. All could have an impact on the crop and creates nervousness among beet farmers.

British Sugar and NFU Sugar agree contract for 2025/2026 sugar beet crop

In recent weeks there has been signs of stability, despite a spike in UK rapeseed, due to coming to the end of the old crop and a lack of available stocks physically in place. Generally, prices are higher than at the start of the year yet have been quite steady since around May.

One view moving forward is that ample supplies of soybean may put pressure elsewhere. For example, sunflower oil prices are already said to be stagnating for similar reasons. The US soybean crop is expected to be a significant one where current weather conditions are said to be good for that particular crop across the Midwest.

Soaring olive oil prices hurt sales of ‘liquid gold in Mediterranean heartland

Olive oil has been one of those commodities in recent years that just seems to go up and up…and up, in price.

Crop issues and shortages in multiple years have exacerbated the situation but just as importantly, demand has remained strong in key demand markets. Supermarket shelves have seen record levels yet seemingly have more olive oil on them than ever.

However, the next crop may offer some respite, providing it doesn’t suffer the same fate as the previous two harvests. Interestingly, demand looks to be falling due to the high prices currently being commanded. Arguably it needs this drop in demand to find a sensible level again.

The situation will become a lot clearer later this year once the final harvest expectations are through but it’s looking more positive than it has done for some time around the price potentially falling.

Pomace oil would naturally follow the same trend, although, demand changes could be affected by how much pomace reduces - should consumers switch back out of seed oils into pomace?

Tea prices are boiling over. Why?

The two main reason that tea prices are increase are due to:

Changing climate

International tensions

Coffee prices are on course to rise further from current record highs as poor harvests, supply chain disruptions and new EU deforestation regulations continue to hammer roasters.

London robusta futures reached a new record high on Tuesday of $4,866 a tonne, surging 60% so far this year. A prolonged heatwave in Vietnam, one of the world’s largest producers of robusta beans, has led to poor harvests, with no sign of improvement in the country for the next crop at the end of the year.

New Legislation: The EU’s new Deforestation Regulation (EUDR) would also contribute to keeping prices high well into 2025. The new rules, which come into effect at the end of the year, will put a stop to all coffee grown in recently deforested areas from being sold in EU member states. However, only 20% of farmers are ready to meet the regulation, with the majority in African and Asian countries yet to map out their plots.

Sustainability continues to be a hot topic and with this in play, it’s increasingly difficult to balance costs vs sustainability.

The packaging index since the turn of the year has done nothing but go up until Q2 where it sat stable and has now begun to trend downwards. Hopefully, it can continue this way and bring a good news story rather than the doom and gloom we are faced with regularly. Cardboard prices have started to stabilise and let’s hope these also come down to encourage more businesses to use sustainable packaging.

PP and PET both suffered meteoric rises at the start of 2024, but both materials are starting to come down. PET has returned to 2023 levels with PP not quite there but trending that way. Any decreases that we will see, will be offset against the freight, if imported.

It was a bad news story for Aluminium pricing last time around as the UK and US blocked Russian metal trading to stop funding its war machine. However, China has now ramped up production and its output is bigger and better than ever to try to help supply outweigh demand and in turn bring the price down. According to the London Metal Exchange we are back at March pricing and trending downwards - but, freight costs will negate the real savings.

FOR MORE INFORMATION ON OUR COMMODITY REPORT, PLEASE CONTACT YOUR CREED ACCOUNT MANAGER OR VISIT OUR WEBSITE WWW.CREEDFOODSERVICE.CO.UK

Staverton Technology Park, Cheltenham Road, Staverton, Gloucester, GL51 6TQ

Manners Industrial Estate, Manners Avenue, Ilkeston, Derbyshire, DE7 8EF

Wooburn Industrial Park, Thomas Road, High Wycombe, Buckinghamshire, HP10 0PE

CreedFS @creedfs

of publication, August 2024.