Critical Path respectfully acknowledges the Gadigal people as the traditional custodians of the land where the organisation is based. We recognise Australia’s First Peoples continuing connection to these lands and acknowledge the elders past and present.

Front Cover Image: Taiwan and Australia Choreography Exchange Program, C-Lab, Artwork by Wendy Yu.

Back Cover Image: Plant a Promise, CarriageWorks fellowship auspiced by Critical Path, Artist: Henrietta Baird, Image: Sierra Malevich

Welcome Association Information Operations Report Statistics Report Artists Activities Research Fellowships Partnerships & 1st Nations led Regional & International Publications Financial Report 4 6 12 16 19 22 22 28 32 40 45

2022 was a year of much change and forward motion for Critical Path, Australia’s leading centre for choreographic research and development. Details of staff and Board movements, both into and out of the organisation, are detailed within this report. While we ended the year with a substantially different set of faces to those we started it with, the Board and staff are diving into 2023 with renewed focus and energy, propelled by our 17-year mission to support independent choreographers and dance makers in pushing the boundaries of contemporary practice.

We’re thrilled that 156 artists participated in Critical Path’s choreographic practice programs throughout 2022, which included thirty research projects and nineteen developments. An encouraging statistic given our priority areas – 56% of participating artists identified as either Aboriginal and/or Torres Strait Islander, from a Culturally and Linguistically Diverse Background, or with a Disability.

Industry partners and collaborators who made significant cash and/or in-kind contributions to joint programs included Performance Space, PYT Fairfield, Cementa, Dance Nucleus (Singapore), HORSE (Taiwan), C-LAB (Taiwan), and the

Cultural Division of the Taipei Economic and Cultural Office in Sydney. We also continued our leadership of the muchloved March Dance, in partnership with DirtyFeet.

We thank the NSW Government (through Create NSW) for continuing to provide the security of multi-year investment until 2024 alongside one-off funding for our Digital Enchantment project. We were also supported throughout the year by the Australian Government (through the Australia Council for the Arts) and City of Sydney, with project funding for three distinct sector programs. We are especially grateful to Woollahra Municipal Council, who continue to licence the Drill Hall to Critical Path, permitting use of the venue and the provision of office space so it can remain the home of independent dance artists to experiment and develop work.

Our hard-working staff consistently went above and beyond in 2022, demonstrating an unbridled enthusiasm for the projects and programs that the organisation delivers in supporting artists. On behalf of the Board of Directors, I pay tribute to Stephanie Tatzenko (Finance & Administration Manager), Iris Shen (Producer), Matt Cornell (Digital

4

Artist-Curator) and Jasmine Gulash (First Nations Producer) for their courage and commitment.

The Board of Directors also deserves emphatic thanks for their support of the staff and contribution to the development of our strategic plan; I’d especially like to pay tribute to outgoing Chair Travis De Vries, and Acting Chair Jasmin Sheppard, two resourceful and generous individuals who provided us with strong leadership throughout 2022.

Reflecting on the year wouldn’t be complete without acknowledging the tenacious, enterprising, and wonderful Claire Hicks. After seven years as the organisation’s Director & CEO, Claire resigned in late 2022 to take up a curatorial role at Carriageworks in early 2023. Claire’s contributions to the independent dance community throughout her tenure will no doubt continue to impact many artists in the years to come, and while she will be missed as Critical Path’s fearless leader. On behalf of the staff, Board, and artists of Critical Path – thank you Claire, for everything you have done and will continue to do.

And to the many dance artists who engaged with Critical Path through our diverse programs – we do this for you.

Thank you. We look forward to seeing you back at the Drill in 2023!

Brendan O’Connell - Interim Chair

5

ABN AND INCORPORATION NUMBER

ABN: 12 049 903 261

Critical Path Incorporated is an Incorporated Association (NSW)

Incorporation Number: INC9881671

REGISTERED OFFICE & PRINCIPAL PLACE OF BUSINESS

The Drill

1C New Beach Road

Rushcutters Bay NSW 2011

RESPONSIBLE ENTITIES

Auditors

Mitchell & Partners, Chartered Accountants

Public Officer (2022)

Claire Hicks

6

The Committee members of Critical Path Incorporated present their Report together with the financial statements for the year ending 31 December 2022 and the Independent Audit report, covering those financial statements.

The following persons were committee members of Critical Path Incorporated during or since the end of the financial year.

There were 4 general meetings during the year (the AGM was held on 26 April, 2022). In addition, there was a Committee & Team Planning session on 23 October, 2022. Meetings during the year and the number of meetings attended by each member are as follows:

7

Date Appointed Date of Cessation 25/1 26/4 & AGM 15/8 23/10 Planning Day 25/11 A B Travis De Vries (Chair to mid Aug) 01-09-20 15-08-22 1 1 1 0 0 3 5 Jasmin Sheppard (Artist RepresentativeChair from mid Aug) 02-06-20 Stood down from Chair - October, 2022 1 1 1 1 1 5 5 Alexio Chibika (Treasurer) 01-01-22 Continuing 1 1 1 0 0 3 5 Virginia Lee 02-06-20 Stood down due to confirmation of employer permission - August, 2022 1 0 0 0 0 1 5 Catherine Sullivan (Secretary) 25-02-19 Continuing 1 1 1 1 1 5 5 Brendan O’Connell 01-09-20 Continuing Appointed ChairOctober 25 0 1 0 0 1 4 5 Elle Evangelista (Artist Representative) 25-02-19 27-04-21 1 1 0 0 0 2 2 Azzam Mohamed (Aritst Representative) 16-11-21 Continuing 1 1 1 1 0 4 5 Lee Pemberton (Artist Representative) 02-03-21 25-01-22 1 0 0 0 0 1 1 LeeAnne Litton (Artist Representative) 15-08-22 Continuing 0 0 1 1 0 2 3

A: Number of meetings the Committee Member attended B: Number of meetings the Committee Member was entitled to attend

Catherine Sullivan has been Secretary since 8 April 2019. Claire Hicks has been the Association’s Public Officer since June 2016.

Details of Committee Member’ qualifications, experience and special responsibilities can be found below.

TRAVIS DE VRIES

Chair to 15 August

Travis De Vries is the producer and host of Broriginals and the producer of Fear of a Black Planet he is a concept artist and a gamer. He is also the founder and director of Awesome Black and an avid artist. Travis is a trained dancer and fine artist and is alumni of NAISDA Dance College. Travis has a wealth of producing experience having worked as a producer for Sydney Opera House and a range of arts programmes and festivals.

JASMIN SHEPPARD

Artist Representative & Chair (from 15 August 2022 until October 2022)

Jasmin is a contemporary dancer, choreographer and director, a Tagalaka Aboriginal woman with Irish, Chinese and Hungarian ancestry. She spent 12 years with Bangarra Dance Theatre, performing numerous lead roles and choreographed one major work for the company, ‘MACQ’. In 2020 Jasmin created works for NAISDA Dance College, Sydney Dance Company’s PPY program, and Catapult Dance. Her work is passionate, political and has been described as “surreal and highly evocative” (The Australian).

CATHERINE SULLIVAN Secretary

Catherine is a lawyer with extensive law firm and in-house corporate legal experience and is currently Senior Manager & Senior Legal Counsel at ASX Limited specialising in financial markets, corporate, governance and regulatory law. She is a director of Urban Theatre Projects and National Young Writers Festival and former Chair of Critical Stages and director of Brand X.

ALEXIO CHIBIKA Treasurer

Alexio is a Chartered Accountant with extensive audit experience in an international audit firm across five countries. He is currently a Senior Audit Manager and is responsible for the audits of large listed and multinational organisations. He has experience in Audit, Financial Management, Corporate Governance, Internal controls and Financial Reporting. He has also volunteered as Treasurer for various notfor-profit entities.

8

BRENDAN O’CONNELL

Brendan has held senior management, programming and producing roles at Sydney Opera House, City of Sydney, Performance Space, Sydney Festival, Adelaide Fringe, and the Australian Consulate-General in New York working across artforms and genres on a suite of large-scale projects and festivals. Brendan is currently Executive Producer at Lucy Guerin Inc.

VIRGINIA LEE

Virginia is a legally qualified professional with extensive strategic and operational experience in government, think tanks and non-profit organisations. She has a background in international trade relations, Asia engagement and law. Her expertise is in developing sustainable corporate strategy, risk assessment, and governance. She currently works in Trade and Investment within the NSW Treasury and is a Board Member on the Professionals in International Trade.

AZZAM MOHAMED

Artist Representative

Azzam, also known as Shazam, is a dancer, performer, and educator from Sudan. Azzam’s dance practice encompasses a range of styles, from traditional cultural dance through to hip hop styles, he is able to bring these forms together to create a breathtaking original dance fusion that echoes his history and at the same time showcases his incredible ability as a dancer. Azzam’s dance practice involves teaching at studios and festivals, performing and touring in stage shows, competing in dance competitions and judging, organizing events, facilitating workshops, and mentoring and coaching young and emerging Australian dancers.

LEE PEMBERTON

Artist Representative (to 25/01/2022)

Lee has worked as a dancer and choreographer. Her experience, skills and interest lie in regional development and equity in the arts. Lee’s recent works engage with site-specific performance creation, the cultivation of remembering and collecting, awakening in the environment and fostering awareness.

9

LEE-ANNE LITTON Artist Representative (Joined 15/08/2022)

Lee-Anne is a Sydney-based performing artist originally form Perth, Western Australia. She has a strong investigation and passion for Contact Improvisation and has extensive aerial training specialising in elastic rope and harness work along with other static aerial apparatuses. She has choreographed for several large-scale productions and performed nationally and internationally with some of Australia’s leading physical theatre companies, including her own, Strings Attached along with Stalker and Legs on the Wall.

CHANGES TO THE GOVERNING COMMITTEE

In 2022 changes to the Committee are as follows:

Travis de Vries stepped down as Chair (leaving the board due to other commitments) and Jasmin Sheppard was elected into the role 15/08/2022.

Lee Pemberton (Artist Representative) stepped down 25/01/2022 and Lee-Anne Litton (Artist Representative) joined the board on 15/08/2022.

Virginia Lee - stood down in August and is awaiting confirmation of employer permission to continue.

10

PYT LAB, Artist: Bianca Willoughby

PYT LAB, Artist: Bianca Willoughby

ORGANISATIONAL STRUCTURE AND KEY RESPONSIBILITIES

There were changes to staffing arrangements throughout the year, including temporary hires and changes to contracts. Please see next section for full details.

12

STAFFING NOTES

In 2022, Claire Hicks continued in the role of Director (0.8). After 7 years in the position, she gave notice of her leaving the organisation with the aim of ending her tenure by the end of February 2023. The position of Artistic Director/CEO was advertised in late December 2022.

Stephanie Tatzenko continued as Finance and Administration Manager – she gave her notice and will handover the role in January 2023. The new Finance and Administration Manager is Neil Godfrey, who commenced on January 9, 2023, in a part time capacity of 0.8.

Jasmine Gulash continued in the new role of First Nations Producer (0.5) until December 2022. Matt Cornell continued (0.3) as Digital Artist-Curator until December 2022.

Iris Shen took up the role as Producer from January 2022 and finished working with us in early 2023. Critical Path also continued with Karen Steains (financial consultant) on a casual service contract basis.

Contracts with Webgirl (web and e-news support) and QBT Consulting (IT support) continued across the year.

PRINCIPAL ACTIVITIES

Critical Path is a choreographic research and development centre based at the Drill Hall, a large rehearsal space on the harbour in central Sydney, Australia. Our mission is to cultivate a program of research and practice development opportunities for choreographers and dance makers, nurturing diversity and excellence in a supportive critical environment which fosters creative risk-taking.

With a distinct focus on research and innovation, we support Australian choreographers to incubate new ideas and experiments in our studio so that excellent new work can make it to our stages. We aim to nourish a genuinely independent dance company as they push the boundaries of existing practice in relation to local and international fields, enhancing the vibrancy of the Australian dance sector.

We emphasise our role as a hub, a space for the independent artists to congregate, cross fertilise, debate, critique. A place connected into the broader arts sector through a host of partnerships.

13

OPERATING RESULT

The net surplus for the year amounted to $1,253 (2021: $17,091).

Critical Path has been serving the contemporary dance community for 17 years.

2022 ARTISTIC PROGRAM FUNDING

Create NSW

In 2022, we continued to be supported by Create NSW with multi-year funding secured (2+2 years) until end 2024; $280,000 per annum to cover the period January through to December each year. This is a standstill figure on previous year.

From Multi-Year Funds (2021 & 2022) we were able to spend $42,986 on the artistic program.

Critical Path also received Create NSW Project funds of $59,852 for ‘Digital Enchantment’.

AUSTRALIA COUNCIL

14

Funding Name Total Amount Spent in 2022 Carried to 2023 Multi-Year 2022 $280,000 $280,000Multi-Year 2021 Carried Forward $25,080 $25,080Digital Enchantment $59,852 $59,852 Completed Project Name Total Amount Spent in 2022 Carried to 2023 Southern Lands and Skies $99,996 $74,516 $25,500 Re-Imagine – Indigenous Dance Dramaturgies $50,004 $1,525 spent 2021 $34,979 $13,676

LOCAL

Woollahra Municipal Council continues to licence the Drill to Critical Path with use of the Hall and an office. City of Sydney provided a grant of $28,311 for our Amplify Digital Enhancement project commencing 1 July 2021 and running until end June 2022.

PARTNERS

Other partners provided in-kind support or spent cash directly on joint programs including Performance Space, PYT Fairfield, HORSE & C-Lab in Taiwan, Dance Nucleus in Singapore.

OTHER

Other income was generated through:

Donations

Venue Hire

$13,274 (consisting of individual donations and support from the Keir Foundation allocated to March Dance)

$13,320 (rehearsal and development periods for subsidised artists/companies and independent makers)

Other direct in-kind Various professional services and miscellaneous items

Sundries

AUSPICE

A combination of membership fees and interest income

Critical Path auspiced the March Dance by the Independent Dance Alliance (an unincorporated group with a membership consisting of Critical Path, DirtyFeet and ReadyMade Works) which included a City of Sydney grant of $20,000.

The organisation also acted as auspice for First Nations’ artist, Henrietta Baird, for her Australia Council grant of $38,339 ($6,611 spent in 2021 and $31 728 spent in 2022), Create NSW grant $42,000 as well as her Carriageworks First Nations Fellowship of $7,480.

15

OVERALL ENGAGEMENT

324 Total artist participation (156 Unique*)

144 Total live audience for Critical Path activities in 2022

39 Total online audience for Critical Path activities in 2022

449 Digital audience (unique viewers)

514 Digital readership1 of resourcesreports, videos, e-journals

11,663 Online readership2 (including resources from website, Facebook, Instagram, Vimeo, newsletter and Soundcloud)

8,272 Website visitors

22,044 Total pageviews3 on website

RESEARCH

74 Unique artists participated in the research program

105 Artist engagements in the research program

54 Live audience to research sharings

9 Online audience to research sharings

31 Research Projects, including

8 Residencies

21 Space grants

1 Digital project

1 Research Room residency

1. This includes reads of resources (website and issuu) and views of videos.

2. This year’s numbers include page views from google analytics. Page views show how many times people loaded the website after clicking the content. Page views are a far superior metric compared to link clicks because of the depth of information that it can reveal about the success of the content.

3. Pageviews is the total number of pages viewed. Repeated views of a single page are counted.

16

DEVELOPMENT

102 Unique artists participated in our development Program

196 Artist engagements in the development Program

6 Artists contributed to Critical Dialogues

35 Audience to development presentations (including talks)

30 Online audience to development presentations

19 Development programs, including

6 Digital projects

10 Development residencies / labs

2 Space grants

1 Artist development meetings

1 Editions of Critical Dialogues

PUBLIC PROGRAMS

5 Public Events

40 Unique artists participated in our public program

23 Artist engagements in the delivery of our public program

55 Total live audience for Critical Path activities in 2022

0 Total online audience for Critical Path activities in 2022

95 Audience and Participants across Public Program

17

YEAR ON YEAR OVERVIEW

18

2022 2021 2020 2019 2018 Number of Projects Research 31 24 39 33 30 Development 19 36 33 29 31 Public Events 5 12 8 22 25 Number of Partcipants Research 105 76 79 123 89 Development 196 195 99 229 244 Public Events 40 34 23 136 142 Number of Audience Live 144 688 213 604 475 Online Audience 39 528 589 -Digital Readership 514 2,877 1,327 1,266 1,567

Our focus is on those who identify as having and/or are connecting with a choreographic practice. The 156 unique artists Critical Path worked with in 2022 are listed below.

ARTIST DEMOGRAPHICS

Aboriginal and/or Torres Strait Islander Artists

Artists from Culturally and Linguistically Diverse Background

Young Artists Artists with a

19

Emerging artists

and Established Artists Artists’ Locales Sydney Regional NSW Western Sydney Total NSW 20 62 21 6 51 84 83 27 7 117

Disability

Mid-Career

Adelina Larsson

Adrina Petrosian

Alan Schacher

Alejandro Rolandi

Alex Craig

Alice Weber

Alison Plevey

Amy Flannery

Amy Zhang

Angela Goh

Annalouise Paul

Arco Renz

Ashlee Bye

Azzam Mohamed

Beth Lane

Bianca Joanne Willoughby

Brian Fuata

Bridget Baskerville

Brooke Amity Stamp

Callum Mooney

Carla Céspedes

Charemaine Seet

Chen Wu-Kang

Cloé Fournier

Cynthia Florek

Daniel Jenatsch

Daniela Zambrano

David Clarkson

David Huggins

Eisa Jocson

Eliam Etesone Motu

Eliza Cooper

Ella Watson-Heath

Elle Evangelista

Elysa Wendi

Emele Ugavule

Emily Yali

Emma Fishwick

Emma Syme

Gabriela Green Olea

Gemma Sattler + Molly McKenzie

Hanif Patel

Henrietta Baird

I-Chin Lin

I-Wen Chang

Ileanna Sophia Cheladyn

Imogen Cranna

Imogen Yang

Ira Ferris

Jackson Garcia

Jacob Boehme

Jasmin Sheppard

Jasmine Gulash

Jeremy Lowrenčev

Jeremy Santos

Jia-hua Zhan

Jochen Gutsch

Jodie McNeilly

Johanna Clancy

Josh Freedman

Josh Staines

Joshua Twee

Juliet Saito

Justine Shih Pearson

Jye Uren

Kassidy Waters

Kirk Page

Kristina Chan

Laura Osweiler

Leanne Thompson

Lee Ming-chieh

Lee Pemberton

Lee-Anne Litton

Leo Tsao

Lexy Panetta

Lily May Potger

Lily Shearer

Lin Kai-Yu

20

Linda Dement

Liz Lea

Lizzie Thomson

Louise Morris

Luke George

M@ Cornell

Marianna Poghosyan Gordon

Marilyn Miller

Martin del Amo

Matt Shilcock

Matthew Hughes

Maxine Carlisle

Megan Alice Clune

Melati Suryodarmo

Melody Rachel

Merinda Davies

Mica Lynnah

Michelle St Anne

Mitchell Christie

Moemoana Schwenke

Nanako Nakajima

Nasim Patel

Natasha Sturgis

Neville Boney

Nick Power

Nicola Carter

Nicola Ford

Niki Verrall

Nikki Heywood

Olivia Hadley

Padmini Chettur

Patricia Wood

Patrick Meessmann

Peta Strachan

Pichet Klunchun

Rachael Gunn

Rasmus Olme

Raymond Blanco

Reece Jones

Reina Takeuchi

Rhiannon Newton

Riana Head-Toussaint

Romain Hassanin

Rosalind Crisp

Roslyn Orlando

Samuel Beazley

Samuel Free

Sarah Aiken

Sarah Houbolt

Saskia Ellis

Shana O’Brien

Si Yi Shen

Sidney Mcmahon

Skye Etherington

Sophia Ndaba

Sophia van Gent

Stella Chen

Steve Lu

Strickland Young

Su Wei-Chia

Sue Healey

Susannah Keebler

Tas Repousis

Texas Nixon-Kain

Timothy Ohl

Tiyan Baker

Travis De Vries

Trevor Brown

Vicki Van Hout

Victoria Hunt

WeiZen Ho

Wendy Yu

Xiaoke x Zihan

Yeh Ming Hwa

Yuhsin Su

Zi-ping Tian

Zoë Bastin

21

2022 RESEARCH FELLOWSHIPS

Critical Path has supported four artist/artist duos in 2022 in artist-led research residencies. These research projects focused on explorations of new ideas, process or practice development without a pre-determined product outcome.

The research residencies are not available for creative development of new work, though they may allow early terrain explorations or deep digging into particular ideas and concerns. They may lay the foundation of new work.

Alan Schacher & WeiZen Ho

Alan Schacher & WeiZen Ho

The artist-duo inquired how place may be engendered through community engagement and enactment. Their research process focused on ways of devising social choreographies based on symbols that persist in each individual’s memory. Employing walking and conversation as methods for exchange, they engaged with several communities to identify their significant symbols, images, materials and ways of observance and practice. Alan and WeiZen worked with Anthropologist Dr. Phillip Mar (Institute for Culture and Society, Western Sydney University). For the Australia-Asia exchange, they collaborated with Mella Jaarsma, an artist located in Indonesia. Their research counterpart in Yogjakarta was Mira Asriningtyas, an artist, researcher, curator and art writer, who works with LIR Curator Collective.

22

WeiZen Ho and Alan Schacher, Credit by Karlina Mitchell

Alex Craig

Queer Blind dance artist and maker Alex Craig works collaboratively, opening and holding space for a collective experience of dance that is not centred upon visual sight. For their 2022 Critical Path Research Residency, they explored sound-based languages which support non-sighted navigation of space whilst dancing and communication between collaborators when improvising and/or sharing individual movement languages. They collaborated with choreographers and dancers Victoria Hunt, Jeremy Lowrenčev, and musicians Jochen Gutsch and Trevor Brown, as well as: Imogen Yang, Romain Hassanin, Annalouise Paul, Gabriela Green Olea, Samuel Beazley, Saskia Ellis and Emily Yali.

23

Image by Iris Shen

Image by Iris Shen

Independent choreographer and dancer Cloé Fournier collaborated with physical theatre director David Clarkson, dancer and inter-disciplinary artist Imogen Cranna, and digital artist Matthew Hugues to explore the complex relationship between digital technology and artistic performance (dance). They looked at the collision between the digital and the human body. We are very excited to finally move into the real, hyper real, fantastical and the ordinary.

24

Cloé Fournier

Image by Martin Fox

Dr Laura (Amara) Osweiler

Laura’s research explored her lived experience with cataplexy, a neurological sleep disorder, and the new movement languages that emerge from this. She worked with producer and director Paul Osborne and international circus and physical theatre performer and audio describer Sarah Houbolt, They explored themes of isolation, interruption and disruption, Crip Time and Space, body knowledge, types of memory, forms of consciousness and perceptions of the self. Through movement, lighting, dance bungee rigging, music, audio description, autobiographical narrative and live and online audience interaction.

25

Artist Dr Laura Osweiler, Image by Lucy Parakhina

Image by Martin Fox

Image by Martin Fox

EXPERIMENTAL CHOREOGRAPHIC RESEARCH RESIDENCY (ECR)

For the 7th year, we have continued our partnership with Performance Space. The recipient of the 2022 ECR residency was Brooke Stamp who collaborated with sound designer Daniel Jenatsch and dramaturgical chaperones Brian Fuata and Sidney McMahon to develop work under the thematic – ‘The Line is a Labyrinth’.

CRITICAL PATH-PYT CHOREOGRAPHIC LAB

Critical Path PYT Choreographic Lab gathered three artists, Bianca Willoughby, Cynthia Florek and Joshua Twee, to consider digital intimacy, ableism and intersectional identities in their choreographic practice. Together, they explored shared concerns around: digital formats, process and intimacies; crip time and ableism; intersectional identities and form explorations. Guest artists were Eliam ‘Royalness’ Motu and Gabriela Green Olea, alongside Matt Cornell.

28

PYT LAB, Artist: Bianca Willoughby

SPACE GRANTS & BURSARIES

Critical Path offers space grants at the Drill Hall for practice research or development over 3 to 6 days. Across 2022 we offered space grants to: Daniela Zambrano, Nicola Ford, Sophia Ndaba, emma + molly, Sue Healey, Azzam Mohamed, Lexy Panetta. We also supported with space and bursaries Oz Frank’s Suzuki-Praxis workshop. And were one of the many venues who participated in Movement, Movement, Movement – One Day for Dance.

MARCH DANCE

Critical Path is responsible for March Dance in partnership with DirtyFeet. 219 creative participants (artists and cultural workers) engaged with the 2022 Festival. Critical Path provided Space Grants to: Patricia Wood, Sarah Aiken, Brian Fuata, Juliet Saito, The Living Room Theatre, DirtyFeet – Emerging Makers, Adrina Petrosian, Mixed Bill – performance by emerging makers. Bursaries were given to: Lux Eterna, Rakini Devi, Emma Saunders, Amy Zhang, Gabriela Green Olea; and a First Nations bursary to Amy Flannery.

29

Space Grants, Artist: Sophia Ndaba

Space Grants, Artist: Azzam Mohamed

FIRST NATIONS LED PROGRAM

– Producer Jasmine Gulash

Indigenous dramaturgy in dance has created space for action research in the framework of a fully engaged and culturally grounded approach to considering and supporting Indigenous Australian dramaturgies in dance. A series of talks were held online with nation-wide Indigenous contemporary dance practitioners, as well as intensive residencies held at the Drill Hall with emerging and senior choreographers. A detailed report from the findings was collated by Wiradjuri practitioner Tammi Gissell and shared with the wider First Nations contemporary dance community, and other members of arts institutions as a resource document (e.g Australia Council, Sydney Opera House).

Issue 14 of Critical Dialogues, Critical Path’s digital publication, was edited by Jasmine Gulash and titled FIRST NATIONS DIALOGUE: LEARNING INFORMING OUR PRACTICE. It brought into focus Australia’s First Nations dance makers in a revealing and honest dialogue on what informs and inspires their creativity.

A First Nations focused Lab took place at Bundanon with artists Henrietta Baird, Shana O’Brien, Josh Staines and Jasmin Sheppard. Supported by guest practitioner Jasmine Gulash, Critical Path First Nations Producer. Artist worked on their current projects while exploring shared concerns around relationship to the environment. They also engaged with questions and ideas that spark across their diverse making and presentation processes.

31

Shana O’Brien IDID residency, Image: Shana O’Brien

REGIONAL PROGRAMS

Regional Practitioner Gathering @ Bundanon

In April Critical Path hosted a Regional Practitioner Gathering at Bundanon for artists who are all based in the Hunter Valley/Central Coast area of NSW. The residency-lab was part of a series of activities to nurture networks of regional practitioners and to provide professional and sector development activities. The artists participating were Alejandro Rolandi, Lee-Anne Litton and Sophia Van Gent along with Shana O’Brien, Josh Staines and Jasmin Sheppard. This gathering was supported by Critical Path Director Claire Hicks who is also based in the Central Coast region. Jasmin Sheppard, Josh Staines and Shana O’Brien reconnected at Arts House, Wyong in November 2022, to pick up some of the conversations begun at Bundanon.

Art For Here LAB, in Kandos – Partnership with Cementa

Art For Here was a one-week Regional Choreographic Development Lab based in Kandos in October 2022, and organised in partnership with Cementa. The lab explores socially embedded practice or choreography relevant to social context and place. The lab’s focus is sharing, research, reflection, and collaborative exploration. The 2022 lab started with an invitation to consider “art for here”. We have invited Bridget Baskerville, Emma Syme (North East Wiradjuri Co Cultural Centre), Ira Ferris, Leanne Thompson and Jo Clancy to this lab. Claire Hicks, Director of Critical Path, facilitated the lab and Cementa festival Creative Director Alex Wisser was the “guest” provocateur.

32

Art For Here LAB in Kandos

Articulating Practice – Sapphire Coast

Critical Path offered artists a paid opportunity to attend a three-day development project at Gunpowder Trading Post in Wolumla. Artists participating in the project were Beth Lane, Paddy Meessmann, Ashlee Bye, Mica Lynnah, Susannah Keebler, Zoe Bastian. The project was open to artists of any discipline who have a choreographic practice. The group explored how they represent their work and communicate it to others. Claire Hicks facilitated the program, with other guest artists.

34

Articulating Practice – Sapphire Coast

INTERNATIONAL EXCHANGES & DIGITAL RESIDENCIES

Charemaine Seet Residency Singapore

In April 2022, choreographer Charemaine Seet embarked on stage 3 of Sixth Daughter - researching Teochew opera movement in Singapore with local opera artists. This research was funded by Critical Path.

Taiwan and Australia Choreography Exchange Program

This program was a part of our 12 months’ engagement with artist Matt Cornell as Critical Path Digital Artist-Curator. We’ve partnered with The Taiwan Contemporary Culture Lab (C-LAB) and the Cultural Division of the Taipei Economic and Cultural Office in Sydney, Australia, to co-organise the 2022-2024 Taiwan and Australia Choreography Exchange Program. This program supports artists from Sydney and Taiwan with a background in choreography or digital art, and offers them opportunity to deepen their practice, initiate collaborations, and lay foundations for future work.

35

Taiwan and Australia Choreography Exchange Program

Taiwan and Australia Online Residency Exchange

Artist Stella Chen participated in Critical Path’s online residency in partnership with HORSE and Bare Feet Dance Theater (Mauvais Chausson) in Taiwan. Australian participating artists were: Kristina Chan & Timothy Ohl, Stella Chen, WeiZen Ho, and Strange Attractor (Adelina Larsson & Alison Plevey) and from Taiwan: Chen Wu-Kang, Su Wei-Chia, Yeh Ming-Hwa, Lin I-Chin. Stella is taking forward relationships built through this exchange and using an ‘extension’ online residency to make plans for future remote and in-person collaboration with I-Chin Lin (Mauvais Chausson/Bare Feet Dance Theater).

Michelle St Anne – Live and Online Dance Intimacy

Michelle St Anne, Artistic Director of The Living Room Theatre, worked with collaborator Manu Anand (India) and Imogen Cranna, supported by digital mentor Linda Dement. They questioned the filming of live performance and how live and online worlds can co-exist, each with their unique environments, using choreographically approaches.

Ceguva

Ceguva meaning ‘to breathe’ in Vosa Vakaviti was a storytelling digital residency led by Tokelauan Fijian storyteller, Emele Ugavule. Emele worked with illustrator and animator Steffie Yee, and a web developer to create a prototype of an online program that collates time centric data, and creates suggested schedules based on how self, settler and soil time can interact. Dancers Amy Zhang and Moemoana Schwenke collaborated with Emele. This work is foundational for a broader exploration around building a sustainable creative ecosystem that embeds genealogical wellbeing, place specific knowledge, and blood memory into creative process as a proactive – rather than reactive – response to cultural safety and story sovereignty.

Hybrid in-studio and digital research residency: Rosalind Crisp and Lizzie Thomson

In July Rosalind Crisp and Lizzie Thomson took a two-week residency with Critical Path where Lizzie was in person at The Drill and Ros joined on-line. Rosalind Crisp and Lizzie Thomson started dancing together in Omeo Dance studio, Newtown, 25 years ago. After 13 years apart, they returned, together, to the studio; drawn back together through a compelling fascination to work out why they dance(d) and “what the hell we are still dancing for.” This residency was supported by Omeo Dance’s Orbost Studio for Dance Research and Restart Investment to Sustain and Expand (RISE) Fund – an Australian Government initiative.

37

DOING DRAMATURGY ONLINE COURSE

Critical Path provided two places for NSW-connected practitioners, Brian Fuata and Geraldine Balcazar, to join Critical Path First Nations Producer Jasmine Gulash as participants for DOING DRAMATURGY an online course with Lou Cope, founder of CoAD. Geraldine Balcazar, Brian Fuata and Jasmine Gulash, Critical Path First Nations Producer, were supported to participate in the course, delivered virtually across April/ May/June.

DANCE NUCLEUS PARTNERSHIP

Collaboration to support Rhiannon Newton & Elysa Wendi’s A Strange Place and Nick Power & Hwa Wei- An’s exploration towards Singapore & Sydney Street Dance collaboration. Also, bursaries for Artists that Attract to participate in [CP]3 program.

A Strange Place: Rhiannon Newton & Elysa Wendi

Elysa Wendi and Rhiannon Newton‘s collaboration has evolved since they first met in Campbelltown in 2018. Their collaboration is grounded in conversation, which is understood as a kind of choreography that materially connects their different worlds. Meeting face-to-face, at the edges of bodies of water, and via internet cables that join Hong Kong to Sydney, they have been making attempts to synchronise and share embodied experiences. Through the Critical Path Responsive Residency Elysa and Rhiannon have been developing their practice and also working with Dance Nucleus Singapore to share some of the outcomes of their practice in Vector #2 at Esplanade Theatre. They have collaborated with sound artist Peter Lenaerts to produce a live sound and video installation based on their ongoing conversations. They also exhibited artefacts from their 4 years of practice, including video experiments and transcripts of their conversations.

38

A Strange Place, Rhiannon Newton & Elysa Wendi

Nick Power Residency Singapore: ELEMENT #14: STEP INTO A WORLD (ALTERNATIVE PATHS FOR STREET DANCE)

Supported by Critical Path and Dance Nucleus exchange, ELEMENT#14: STEP INTO A WORLD brought together dance artists working between street and contemporary dance in Singapore and Sydney in conjunction with da:ns Festival 2022. Mapping out the needs and interests of the street dance community in Singapore, as a way to propose ideas for creative development or presentation programmes in the near future. Some of the activities and objectives include proposing clear strategies to develop dance practices involving street and contemporary dance in Singapore and explore ideas for longer-term exchanges between Singapore and Sydney.

Critical Practice in Contemporary Performance – online collaborative program

Critical Path combined with ReadyMade Works to support members of Artists that Attract collective (Amy Zhang, Jeremy Santos, Reina Takeuchi) to participate in the [CP]3 program, a distance-learning program for the development of critical praxis in contemporary choreography and performance making, with a focus on the Asian context.

39

PUBLICATIONS

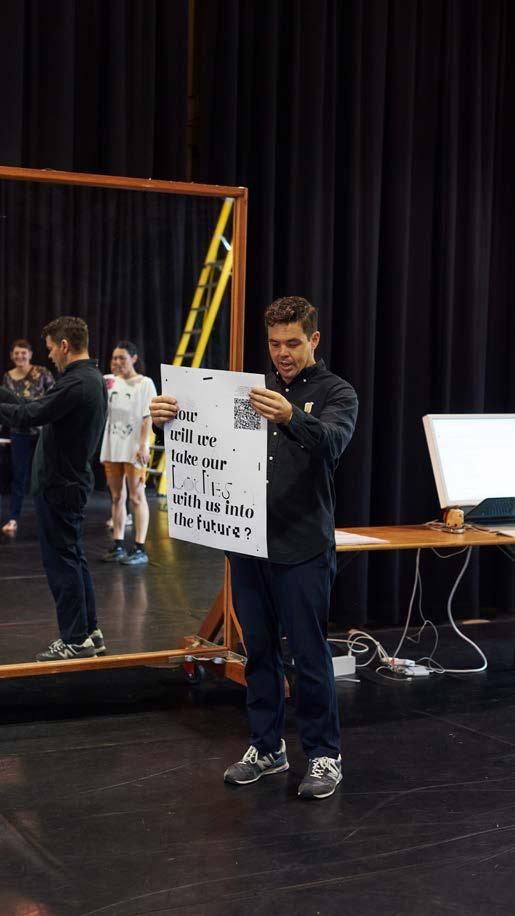

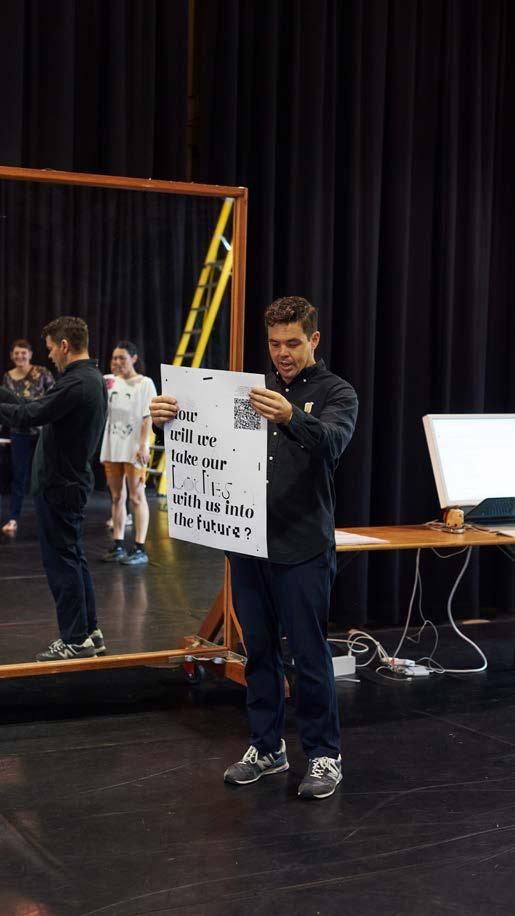

How Will We Take Our Bodies With Us Into The Future?

In this evocation and publication, developed by Critical Path Digital Artist-Curator Matt Cornell, a diverse team of choreographically and digitally involved artists have imagined SciFi futures and subsequent physical realities for our human bodies. Artist drafted their contributions directly into the OpenTab.wiki, iterating in front of each other, editing or adding to each other’s work through permission-less and playful hyperlinking. Launch party for the hyperlinked publication (November 2022) took the form of a dance showing. Some of the texts were generated through dancing.

40

Massaged by the Medium - Inventories of Affect

A book project by Critical Path Digital Artist-Curator Matt Cornell that makes felt the embodied effects of our (chronic) digital condition. It asks: What is what we’re doing, doing back to us?

Critical Path & Matt Cornell Presents

MASSAGED BY THE MEDIUM

Digital is a verb, an action, that has consequences and fallout.

Digitising anything abstracts information into binary data, divorcing it of the context, culture and com munities from whence it sprang. It, then, homogenises and regulates its application.

The name for the world’s most popular beverage when transcoded from english into binary is 01000011 01101000 01100001

Or it’s other common name:

01010100 01100101 01100001

INVENTORIES OF AFFECT

Binary data is the only code that can be directly understood and executed by a digital computer. It is numerically represented above by a combination of zeros and ones. But the characters written above are representations of binary code— Arabic numerals printed in ink on a page, so that your eyes receive the information in the form of light, and your brain may decode it. If you can’t read binary… it is inaccessible and will do nothing for you. The digitally encoded word is not the beverage. Or the ceremony that goes with it. Or the communities who care for it. It is a reference to those things. We can never touch the digital directly.

Dream Cellscapes

A publication by Alice Weber that features reflections and visual remnants from the performance at Cement Fondu which was an outcome of her two-week Research Residency at Critical Path in April 2021 where she collaborated with international artists Vanessa Goodman and Ileanna Cheladyn to explore choreographic practice that plays out in a spreadsheet and IRL. She then performed this project with collaborators Ella Watson-Heath, Juliet Saito and Wendy Yu, with sound by Megan Alice Clune, at the opening of her exhibition at Cement Fondu gallery space.

43

Produced by Artists from across the Asia Pacific

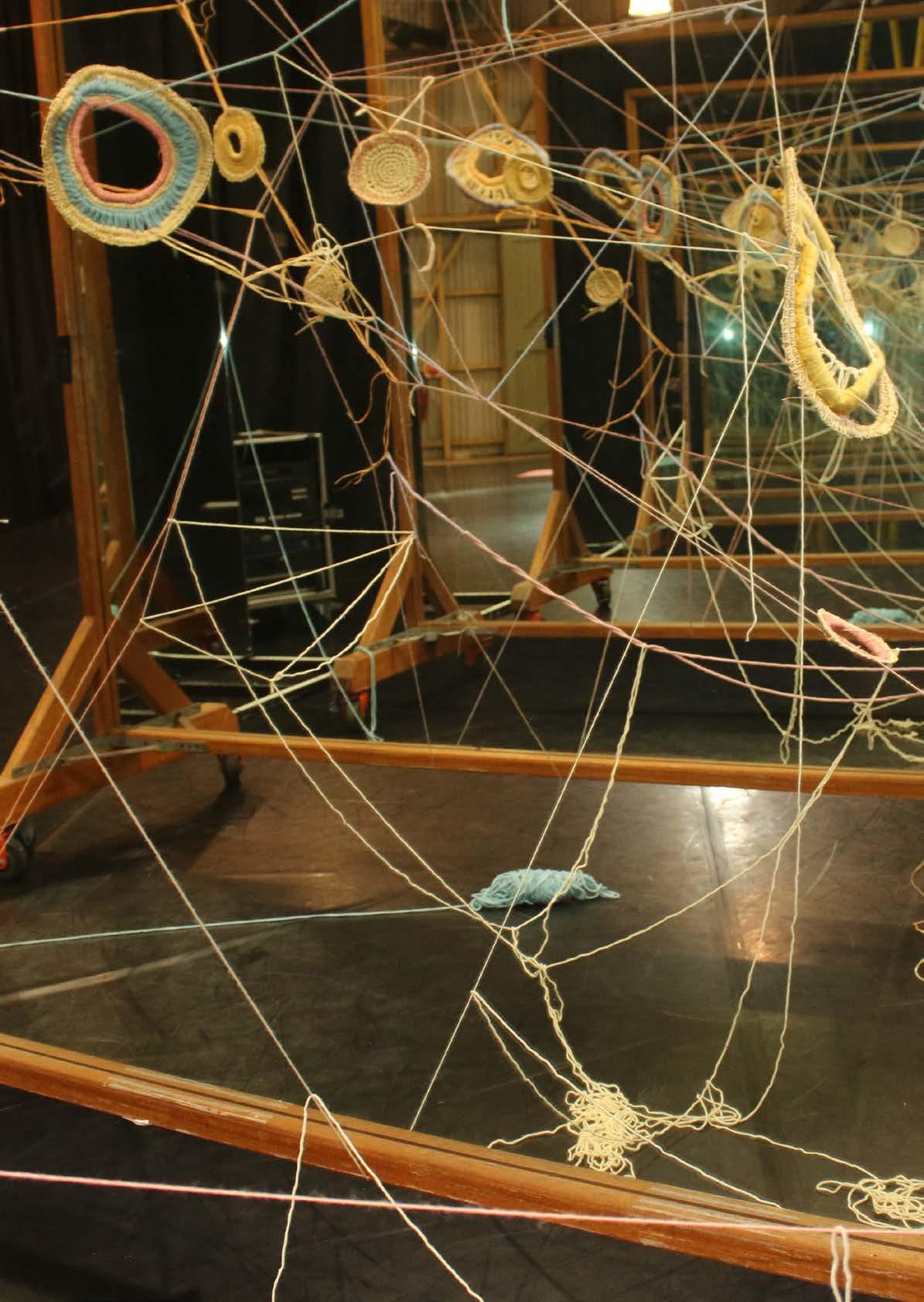

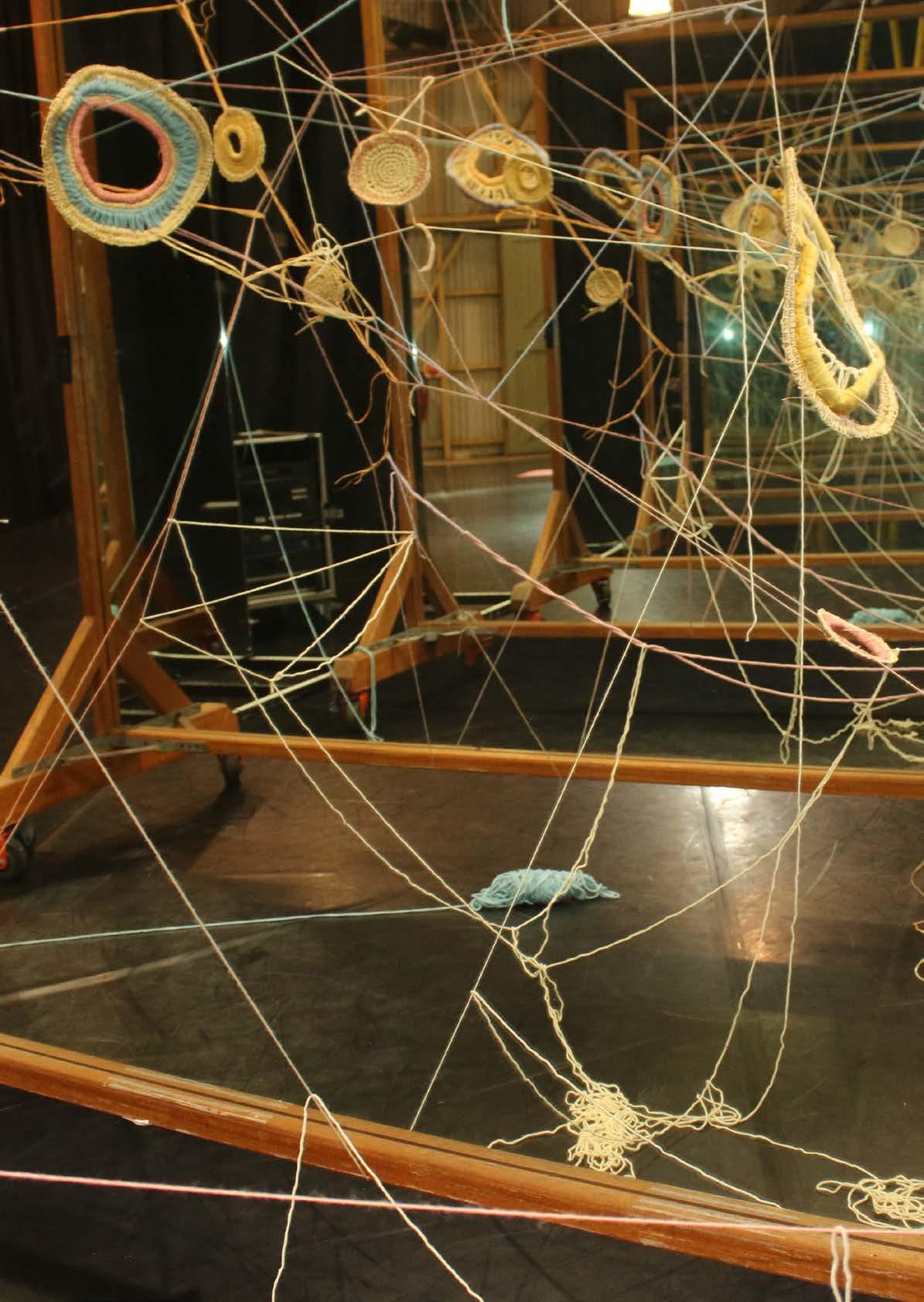

45 46 47 47 48 49 50 52 52 52 52 60 63 64 64 65 66 67 67 68 68 69 69 70 70 70 70 71 72 72 73 74 78 78 79 Auditor Independence Declaration Financial Statements Statement of Surplus or Deficit and Other Comprehensive Income Statement of Financial Position Statement of Changes in Equity Statement of Cash Flows Notes to the Financial Statements 1 General information and statement of compliance 2 Changes in accounting policies 3 Summary of accounting policies 4 Grants, other contributions and other income 5 Cash and cash equivalents 6 Trade and other receivables 7 Other assets 8 Property, plant and equipment 9 Intangible assets 10 Trade and other payables 11 Employee remuneration 12 Grants liabilities 13 Other liabilities 14 Leases 15 Related party transactions 16 Contingent Liabilities and Assets 17 Subsequent Events 18 Members’ Guarantee - Contribution in winding up 19 Charitable fundraising 20 Company details Declarations Committee Members’ Declaration Declaration by the Treasurer INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS Detailed Statements of Surplus or Deficit SCHEDULE 1 - GENERAL OPERATIONS SCHEDULE 2 - GENERAL OPERATIONS Indigenous Dramaturgy in Dance residency phase 1, weaving “web” artwork by Shana O’Brien, Image: Jasmine Gulash

46

STATEMENT OF SURPLUS OR DEFICIT AND OTHER COMPREHENSIVE INCOME

This statement should be read in conjunction with the notes to the financial statements.

47

Note 2022 $ 2021 $ Grants & other contributions Other income Administration and marketing expenses Amortisation expenses Depreciation expenses Employee benefits expense (incl. employed artists) Project expenses Auspice expense 4 4 9 8 11 952,211 20,263 (102,254) (3,330) (756) (240,103) (304,749) (320,028) 784,326 30,427 (50,166) (3,330) (984) (233,468) (247,189) (264,526) Surplus before income tax Income tax expense 1,253 17,091 Surplus for the year 1,253 17,091 Other comprehensive income for the year, net of income tax -Total comprehensive surplus for the year 1,253 17,091

STATEMENT OF FINANCIAL POSITION

This statement should be read in conjunction with the notes to the financial statements.

48

Note 2022 $ 2021 $ Assets Current Cash and cash equivalents Trade and other receivables Other current assets 5 6 7 612,653 1,452 3,317 794,158 66,552 3,223 Current assets 617,423 863,933 Non-current Property, plant and equipment Intangible assets 8 93,340 756 6,670 Non-current assets 3,340 7,426 Total assets 620,763 871,359 Liabilities Current Trade and other payables Provisions Grant liabilities Income in advance 10 11 12 13 76,535 11,922 276,186 1,390 111,106 11,807 484,441 10,530 Current liabilities 366,033 617,883 Total liabilities 366,033 617,883 Net assets 254,729 253,476 Equity Accumulated Surplus 254,729 253,476 Total equity 254,729 253,476

STATEMENT OF CHANGES IN EQUITY

This statement should be read in conjunction with the notes to the financial statements.

49

Accumulated surplus $ Total equity $ 2022 Balance at 1 January 2022 253,476 253,476 Surplus for the year 1,253 1,253 Balance at 31 December 2022 254,729 254,729 2021 Balance at 1 January 2021 236,385 236,385 Surplus for the year 17,091 17,091 Balance at 31 December 2021 253,476 253,476

STATEMENT OF CASH FLOWS

This statement should be read in conjunction with the notes to the financial statements.

50

Note 2022 $ 2021 $ Operating activities Receipts from: • Client contributions • Government grants • Partners • Interest income Payments to employees Payments to suppliers 321,022 310,2892,052 (238,763) (576,106) 402,384 602,289 (3,320) 75 (253,669) (358,951) Net cash provided by operating activities (181,505) 388,808 Investing activities Purchases of plant and equipment Purchases of intangible assets-Net cash used in investing activities -Net change in cash and cash equivalents Cash and cash equivalents, beginning of year (181,505) 794,158 388,808 405,351 Cash and cash equivalents, end of year 5 612,653 794,158

Will We Take Our Bodies With Us Into The Future?

How

NOTES TO THE FINANCIAL STATEMENTS

For the year ended 31 December 2022

Critical Path Incorporated

1. General information and statement of compliance

The financial report includes the financial statements and notes of Critical Path Incorporated.

These financial statements are general purpose financial statements that have been prepared in accordance with Australian Accounting Standards - Reduced Disclosure Requirements and the Australian Charities and Not-for-profits Commission Act 2012.

Critical Path Incorporated is a not-for-profit entity for the purposes of preparing the financial statements.

The financial statements for the year ended 31 December 2022 were approved and authorised for issuance by the Committee members.

2. Changes in accounting policies

2.1 There are no new and revised standards that are effective for these financial statements

3. Summary of accounting policies

3.1 Overall considerations

The significant accounting policies that have been used in the preparation of these financial statements are summarised below.

The financial statements have been prepared using the measurement bases specified by Australian Accounting Standards for each type of asset, liability, income and expense. The measurement bases are more fully described in the accounting policies below.

52

3.2 Revenue

Revenue comprises revenue from the sale of goods, services income, government grants, fundraising activities and client contributions. Revenue from major activities and services is shown in Note 4.

Revenue is measured by reference to the fair value of consideration received or receivable by the Association for goods supplied and services provided, excluding sales taxes, rebates, and trade discounts.

Revenue is recognised when the amount of revenue can be measured reliably, collection is probable, the costs incurred or to be incurred can be measured reliably, and when the criteria for each of the Association’s different activities have been met. Details of the activity-specific recognition criteria are described below.

Government grants

A number of the Association’s programs are supported by grants received from Federal, State and Local governments. If conditions are attached to a grant which must be satisfied before the Association is eligible to receive the contribution, recognition of the grant as revenue is deferred until those conditions are satisfied.

Where a grant is received on the condition that specified services are delivered, to the grantor, this is considered a reciprocal transaction. Revenue is recognised as services are performed and at year–end until the service is delivered.

Revenue from a non-reciprocal grant that is not subject to conditions is recognised when the Association obtains control of the funds, economic benefits are probable, and the amount can be measured reliably. Where a grant may be required to be repaid if certain conditions are not satisfied, a liability is recognised at year end to the extent that conditions remain unsatisfied.

Where the Association receives a non-reciprocal contribution of an asset from a government or other party for no or nominal consideration, the asset is recognised at fair value and a corresponding amount of revenue is recognised.

53

Donations and bequests

Donations collected, including cash and goods for resale, are recognised as revenue when the Association gains control, economic benefits are probable and the amount of the donation can be measured reliably.

Bequests are recognised when the legacy is received. Revenue from legacies comprising bequests of shares or other property are recognised at fair value, being the market value of the shares or property at the date the Association becomes legally entitled to the shares or property.

Interest income

Interest income is recognised on an accrual basis using the effective interest method.

3.3 Operating expenses

Operating expenses are recognised in surplus or deficit upon utilisation of the service or at the date of their origin.

3.4 Intangible assets

Recognition of other intangible assets:

Acquired intangible assets

Website construction costs as well as acquired computer software licences are capitalised on the basis of the costs incurred to acquire and install the specific website and software.

Subsequent measurement

All intangible assets are accounted for using the cost model whereby capitalised costs are amortised on a straight-line basis over their estimated useful lives, as these assets are considered finite. Residual values and useful lives are reviewed at each reporting date. In addition, they are subject to impairment testing as described in Note 3.14. The following useful lives are applied:

54

• Database development: 25%

• Software: 25% - 33%

• Website: 33%

Subsequent expenditures on the maintenance of computer software, brand names and website are expensed as incurred.

When an intangible asset is disposed of, the gain or loss on disposal is determined as the difference between the proceeds and the carrying amount of the asset, and is recognised in surplus or deficit within other income or other expenses.

3.5 Property, plant and equipment

Leasehold improvements, plant and other equipment

Leasehold improvements, plant and other equipment (comprising office furniture and equipment) are initially recognised at acquisition cost or manufacturing cost, including any costs directly attributable to bringing the assets to the location and condition necessary for it to be capable of operating in the manner intended by the Association’ management.

Leasehold improvements, plant and other equipment are subsequently measured using the cost model, cost less subsequent depreciation and impairment losses.

Depreciation is recognised on a straight-line basis to write down the cost less estimated residual value of leasehold improvements, plant and other equipment. The following useful lives are applied:

• Leasehold improvement: 20% - 25%

• Plant and equipment: 15% - 33%

In the case of leasehold property, expected useful lives are determined by reference to comparable owned assets or over the term of the lease, if shorter.

Material residual value estimates and estimates of useful life are updated as required, but at least annually.

55

Gains or losses arising on the disposal of property, plant and equipment are determined as the difference between the disposal proceeds and the carrying amount of the assets and are recognised in surplus or deficit within other income or other expenses.

3.6 Leases Operating leases

Where the Association is a lessee, payments on operating lease agreements are recognised as an expense on a straight-line basis over the lease term. Associated costs, such as maintenance and insurance, are expensed as incurred.

3.7 Income taxes

No provision for income tax has been raised as the association is exempt from income tax under Div 50 of the Income Tax Assessment Act 1997.

3.8 Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and demand deposits, together with other short-term, highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value.

3.9 Employee benefits

Short-term employee benefits

Short-term employee benefits are benefits, other than termination benefits, that are expected to be settled wholly within twelve (12) months after the end of the period in which the employees render the related service. Examples of such benefits include wages and salaries, non-monetary benefits and accumulating sick leave. Short-term employee benefits are measured at the undiscounted amounts expected to be paid when the liabilities are settled.

56

Other long-term employee benefits

The association’s liabilities for long service leave are included in other long-term benefits as they are not expected to be settled wholly within twelve (12) months after the end of the period in which the employees render the related service. They are measured at the present value of the expected future payments to be made to employees. The expected future payments incorporate anticipated future wage and salary levels, experience of employee departures and periods of service, and are discounted at rates determined by reference to market yields at the end of the reporting period on high quality corporate bonds that have maturity dates that approximate the timing of the estimated future cash outflows. Any re-measurements arising from experience adjustments and changes in assumptions are recognised in profit or loss in the periods in which the changes occur.

The association presents employee benefit obligations as current liabilities in the statement of financial position if the association does not have an unconditional right to defer settlement for at least twelve (12) months after the reporting period, irrespective of when the actual settlement is expected to take place.

Post-employment benefits plans

The association provides post-employment benefits through defined contribution plans.

Defined contribution plans

The association pays fixed contributions into independent entities in relation to several state plans and insurance for individual employees. The association has no legal or constructive obligations to pay contributions in addition to its fixed contributions, which are recognised as an expense in the period that relevant employee services are received.

3.10 Provisions, contingent liabilities and contingent assets

Provisions are measured at the estimated expenditure required to settle the present obligation, based on the most reliable evidence available at the reporting date, including the risks and uncertainties associated with the present obligation. Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is determined by considering the class of obligations as a whole. Provisions are discounted to their present values, where the time value of money is material.

57

Any reimbursement that the association can be virtually certain to collect from a third party with respect to the obligation is recognised as a separate asset. However, this asset may not exceed the amount of the related provision.

No liability is recognised if an outflow of economic resources as a result of present obligation is not probable. Such situations are disclosed as contingent liabilities, unless the outflow of resources is remote in which case no liability is recognised.

3.11 Deferred income

The liability for deferred income is the unutilised amounts of grants received on the condition that specified services are delivered or conditions are fulfilled. The services are usually provided or the conditions usually fulfilled within twelve (12) months of receipt of the grant. Where the amount received is in respect of services to be provided over a period that exceeds twelve (12) months after the reporting date or the conditions will only be satisfied more than twelve (12) months after the reporting date, the liability is discounted and presented as non-current.

3.12 Goods and Services Tax (GST)

Revenues, expenses and assets are recognised net of the amount of GST, except where the amount of GST incurred is not recoverable from the Australian Taxation Office. In these circumstances the GST is recognised as part of the cost of acquisition of the asset or as part of an item of the expense. Receivables and payables in the statement of financial position are shown inclusive of GST.

Cash flows are presented in the statement of cash flows on a gross basis, except for the GST components of investing and financing activities, which are disclosed as operating cash flows.

3.13 Economic dependence

The association is dependent upon the ongoing receipt of Federal and State Government grants and community and corporate donations to ensure the ongoing continuance of its programs and fundraising. At the date of this report Management has no reason to believe that this financial support will not continue.

58

3.14 Significant management judgement in applying accounting policies

When preparing the financial statements, management undertakes a number of judgements, estimates and assumptions about the recognition and measurement of assets, liabilities, income and expenses.

Estimation uncertainty

Information about estimates and assumptions that have the most significant effect on recognition and measurement of assets, liabilities, income and expenses is provided below. Actual results may be substantially different.

Impairment

In assessing impairment, management estimates the recoverable amount of each asset or cash-generating unit based on expected future cash flows and uses an interest rate to discount them. Estimation uncertainty relates to assumptions about future operating results and the determination of a suitable discount rate.

Useful lives of depreciable assets

Management reviews its estimate of the useful lives of depreciable assets at each reporting date, based on the expected utility of the assets. Uncertainties in these estimates relate to technical obsolescence that may change the utility of certain assets.

Long service leave

The liability for long service leave is recognised and measured at the present value of the estimated cash flows to be made in respect of all employees at the reporting date. In determining the present value of the liability, estimates of attrition rates and pay increases through promotion and inflation have been taken into account.

59

4. Grants, other contributions and other income

The Association’s income may be analysed as follows:

60

Note 2022 $ 2021 $ Grants and other contributions Donations Net grant income Projects income Auspice income 4.1 13,274 518,544 97,180 323,213 10,845 467,996 48,960 258,526 Total Grants and other contributions 952,211 784,326 Other income Interest income Rent received In-kind donations and audit income (Pro-Bono) Local Government Rental Support in-kind Sundry income 2,051 14,520 3,500192 75 7,759 3,500 17,594 1,498 Total other income 20,263 30,427 Total revenue 972,474 816,753

4.1 Net grant income

4.2 Grants received in advance – 1 January

61 Note 2022 $ 2021 $ Grants in advance – 1 January Grants received during the year 484,441 320,289 352,148 600,289 794,730 952,437 Less: Grants in advance – 31 December Unexpended grants – 31 December (276,187)(484,441)Net grant income 518,544 467,996 Note 2021 $ 2021 $ Create NSW Grant Create Digitak Australia Council – Core funding / Project Funding Carriageworks Fellowship Auspice City of Sydney Grant 221,051 59,852 180,19723,311 196,000115,14841,000 484,441 352,148

4.3 Grants received during the year

Create NSW (multi-year)

• Core Funding

• Project Funding

• Project Funding (Quick - Covid)

Create NSW (project)

• Core Funding

• Project Funding Australia Council

• Core Funding

• Project Funding

• Project Funding (Resilience)

City of Sydney Cultural Grant

• Core Funding

• Project

62 Note 2022 $ 2021 $

Funding International Grants In-Kind Grants 258,075-99,297 1,505 103,92028,311 27,435179,502 70,13272,300 7,700 10,034 106,6393 21,686Total grants received 518,544 467,996

4.4 Grants received in advance – 31 December

Create NSW Grant Create Digital

Australia Council Dance Board 2020

Australia Council Dance Board 2021

Australia Council Resilience Fund

Australia Council Re-imagine

Australia Council SLS

Australia Council Auspice

Woollahra Council Community Grant

City of Sydney Festivals (March Dance) 2020/21

City of Sydney Grant 2020/21

City of Sydney 2021/22

5. Cash and cash equivalents

63

Cash and cash equivalents consist the following: Note 2022 $ 2021 $ Cash at bank Short term deposits 612,653794,158Cash and cash equivalents 612,653 794,158 Note 2022 $ 2021 $

Carriageworks Fellowship 196,000-13,676 26,52914,50018,000 7,480 221,051 59,852-48,473 99,996 31,728-23,311 276,187 484,441

Cash at the end of the financial year as shown in the statement of cash flows is reconciled in the statement of financial position as follows:

Trade and other receivables consist the following:

7. Other

Other assets consist the following:

64

6. Trade and other receivables

Note 2022 $ 2021 $ Current Deposit paid Trade receivables Sundry Debtors 715 737715 65,837Total trade and other receivables 1,452 66,552 Note 2022 $ 2021 $ Cash and cash equivalents 612,653 794,158

assets

Note 2022 $ 2021 $ Current: Prepaid insurance 3,317 3,223 Cash and cash equivalents 3,317 3,223

8. Property, plant and equipment

65

For year ended 31 December 2022 Leasehold improvements $ Plant and equipment $ Total 2022 $ Carrying amount as at 1 January 2022 Amortisation/depreciation for the year756 (756) 756 (756) Carrying amount as at 31 December 2022 - -Balance 31 December 2022 Cost Accumulated amortisation/depreciation 73,271 (73,271) 37,432 (36,432) 110,703 (110,703) Carrying amount 31 December 2022 - -For year ended 31 December 2021 Leasehold improvements $ Plant and equipment $ Total 2021 $ Gross carrying amount Cost Accumulated amortisation/depreciation 73,271 (73,271) 37,432 (36,676) 110,703 (107,948) Carrying amount as at 1 January 2021 2,755 2,755 Amortisation/depreciation for the year (984) (1,015) Carrying amount as at 31 December 2021 756 756 As at 31 December 2021 Cost Accumulated amortisation/depreciation 73,271 (73,271) 37,432 (36,676) (36,676) Carrying amount 31 December 2021 - 756 756

9. Intangible assets

Details of the company’s intangible assets and their carrying amounts are as follows:

66

Database development $ Software $ Website $ Total 2022 $

Cost Accumulated depreciation 7,000 (7,000) 4,811 (4,811) 36,916 (30,246) 48,727 (42,057) Carrying amount at 1 January 2022 - - 6,670 6,670 Depreciation for the year 3,330 3,330 Carrying amount at 31 December 2022 3,340 3,340 As at 31 December 2022 Cost Accumulated depreciation 7,000 (7,000) 4,811 (4,811) 36,916 (33,576) 48,727 (45,387) Carrying amount at 31 December 2022 3,340 3,340 Database development $ Software $ Website $ Total 2021 $

Cost Accumulated depreciation 7,000 (7,000) 4,811 (4,811) 36,916 (26,916) 48,727 (38,727) Carrying amount at 1 January 2021 - - 10,000 10,000 Depreciation for the year 3,330 3,330 Carrying amount at 31 December 2021 6,670 6,670 As at 31 December 2021 Cost Accumulated depreciation 7,000 (7,000) 4,811 (4,811) 36,916 (26,916) 48,727 (38,727) Carrying amount at 31 December 2021 6,670 6,670

As at 1 January 2022

As at 1 January 2021

10. Trade and other payables

Trade and other payables recognised consist of the following:

11.

11.1

67

Employee

remuneration

Employee benefits expense Expenses recognised for employee benefits are analysed below: Note 2022 $ 2021 $ Current: Accrued expenses Net GST payable PAYG withholding Refundable deposits Superannuation payable Trade payables 37,532 17,140 10,658 165 10,400 640 63,789 22,246 9,270 165 13,298 2,338 Total trade and other payables 76,535 111,106 Note 2022 $ 2021 $ Annual leave provided Long Service Leave Salaries and wages Superannuation contributions Workers compensation insurance Employment expenses (1,416) 1,531 213,883 22,648 2,231 1,225 1,706 1,446 208,844 20,267 1,485 120 Total employee benefit expense 240,103 233,468

11.2 Employee provisions

The liabilities recognised for employee benefits consist of the following amounts:

12. Grants liabilities

Grants liabilities can be summarised as follows:

68

Note 2022 $ 2021 $ Current: Annual leave Long Service Leave 5,537 6,385 6,953 4,853 Total employee provisions 11,922 11,807

liabilities Other

Note 2022 $ 2021 $ Grants in advance 276,186 484,441 Total grants received in advance 276,186 484,441 Note 2022 $ 2021 $ Income

advance -Donation to

2022 in

Hall Hire in advance for January 20221,390 9,000 1,530 Total other liabilities 1,390 10,530

13. Other

liabilities can be summarised as follows:

received in

March Dance

advance

14. Leases [7]

Operating leases as lessee

The Group’s future minimum operating lease payments are as follows:

15. Related party transactions

The association’s related parties include its key management personnel and related entities as described below. Unless otherwise stated, none of the transactions incorporate special terms and conditions and no guarantees were given or received. Outstanding balances are usually settled in cash.

Transactions with related entities

No remuneration is paid to Committee member or their related parties for acting as Committee members. From time to time Committee members who are also independent artists may be engaged in our Research and Development program and are remunerated under normal industry terms.

Transactions with key management personnel

Key management of the Association are the Executive Members of Critical Path Incorporated’s Committee and members of the Executive Council. Key management personnel remuneration includes the following expenses:

Total key management personnel remuneration

2022: $79,600

2021: $68,584

2020: $90,258

69

Minimum lease payments due Within 1 year $ 1 to 5 years $ After 5 years $ Total $ 31 December 2022 38,494 - - 38,494 31 December 2021 32,078 - - 32,078

16. Contingent Liabilities and Assets

No contingent liabilities and assets to report.

17. Subsequent Events

No significant events have occurred since the end of the reporting period which would impact on the financial position of the Company disclosed in the statement of financial position as at 31 December 2022 or on the results and cash flow of the Company for the year ended on that date.

18. Members’ Guarantee - Contribution in winding up

The Association is incorporated under the Associations Incorporation Act 2009. If the Association is wound up, the constitution states that each member is required to contribute a maximum of $10 each towards meeting any outstanding obligations of the Association. At 31 December 2022 the total amount that members of the Association are liable to contribute if the Association wound up is $90 (2021: $110).

19. Charitable fundraising

The association holds an authority to fundraise under the Charitable Fundraising Act, 1991 (NSW) and conducts fundraising appeals throughout the year. Additional information and declarations required to be furnished under the Act are as follows:

All funds raised from fundraising activities, net of direct costs, were applied to the association’s normal operations. The association did not conduct any appeals in which traders were engaged.

70

Critical Path Incorporated

is a company limited by guarantee, incorporated and domiciled in Australia.

The registered office and principal place of business is:

The Drill, 1C New Beach Road,

Darling Point NSW 2027

71

COMMITTEE MEMBERS’ DECLARATION

Critical Path Incorporated

In the opinion of the Directors of Critical Path Incorporated (‘the association’)

The financial statements are in accordance with the Australian Charities and Not-for-profits Commission Act 2012, including;

giving a true and fair view of the Association’s financial position as at 31 December 2022 and of it’s performance, for the year ended on that date, and

complying with Australian Accounting Standards (including the Australian Accounting Interpretations) and the Australian Charities and Not-for-profits Commission Regulations 2013; and

there are reasonable grounds to believe that the Critical Path Incorporated will be able to pay its debts as and when they become due and payable.

Signed in accordance with a resolution of the Directors: CATHERINE

72

3 May, 2023 (a) (b) (i) (ii)

SULLIVAN COMMITTEE MEMBER

DECLARATION BY THE TREASURER

in respect of fundraising appeals pursuant to the Charitable Fundraising (NSW) ACT 1991

Critical Path Incorporated

I, Alexio Chibika, Treasurer of Critical Path Incorporated, declare in my opinion:

the Annual financial report gives a true and fair view of all income and expenditure of Critical Path with respect to fundraising appeal activities for the financial year ended 31 December 2022;

the statement of financial position gives a true and fair view of the state of affairs with respect to fundraising appeal activities as at 31 December 2022;

the provisions of the Charitable Fundraising Act 1991 and Regulations and the conditions attached to the authority have been complied with for the financial year ended 31 December 2022; and

the internal controls exercised by Critical Path are appropriate and effective in accounting for all income received and applied from any fundraising appeals.

ALEXIO CHIBIKA TREASURER

Sydney, 03 May 2023

73

(a) (b) (c) (d)

INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS

OF CRITICAL PATH INCORPORATED

A.B.N. 12 049 903 261 (an incorporated association)

Report on the Financial Statements

Opinion

We have audited the financial report of Critical Path Incorporated (the association), which comprises the statement of financial position as at 31 December 2022, the statement of surplus or deficit and other comprehensive income, statement of changes in equity, statement of cash flows for the year ended on that date, a summary of significant accounting policies and other explanatory notes and the committees’ declaration.

In our opinion, the accompanying financial report of Critical Path Incorporated is in accordance with Division 60 of the Australian Charities and Not for Profits Commission Act 2012 and the Associated Incorporations Act 2009, including:

• giving a true and fair view of the association’s financial position as at 31 December 2022, and of its performance for the year then ended ; and

• complying with Australian Accounting Standards, Division 60 of the Australian Charities and Not for Profits Commission Regulation 2013, and the Corporations Act 2001.

Basis of Opinion

We conducted our audit in accordance with Australian Auditing Standards. Our responsibilities under those standards are further described in the Auditors Responsibilities for the Audit of the Financial Report section of our report. We are independent of the association in accordance with the auditor independence requirements of the Australian Charities and Not for Profits Commission Act 2012 and the ethical requirements of the Accounting Professional and Ethical Standards Board APES 110: Code of Ethics for Professional Accountants (the Code) that are relevant to our audit of the financial report inAustralia. We have also fulfilled our other ethical responsibilities in accordance with the Code.

74

We confirm that the independence declaration required by the Australian Charities and Not for Profits Commission Act 2012, which has been given to the committee of Critical Path Incorporated, would be in the same terms if given to the committee as at the time of this auditor’s report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Information Other than the Financial Report and Auditor’s Report Thereon

The committee members are responsible for the other information. The other information comprises the information included in the associations annual report for the year ended 31 December 2022, but does not include the financial report and our auditor’s report thereon.

Our opinion on the financial report does not cover the other information and accordingly we do not express any form of assurance conclusion thereon. In connection with our audit of the financial report, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial report or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

The Responsibility of the Committee for the Financial Statements

The committee members of the association are responsible for the preparation the financial report that gives a true and fair view in accordance with Australian Accounting Standards, the ACNC Act, and the Associated Incorporations Act 2009 and for such internal control as the committee members determine is necessary to enable the preparation of the financial report that gives a true and fair view and is free from material misstatement, whether due to fraud or error.

In preparing the financial report, the committee members are responsible for assessing the association’s ability to continue as a going concern, disclosing, as applicable, matters relating to going concern and using the going concern basis of accounting unless the committee members either intend to liquidate the association or to cease operations, or have no realistic alternatives but to do so.

75

Auditor’s Responsibility for the Audit of the Financial Report

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the Australian Accounting Standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial report.

As part of an audit in accordance with the Australian Auditing Standards, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial report, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal controls.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purposes of expressing an opinion on the effectiveness of the association’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the committee.

• Conclude on the appropriateness of the committee’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the registered entity’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the

76

financial report or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the registered entity to cease to continue as a going concern.

We communicate with the responsible entities regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide the committee with a statement that we have complied with relevant ethical requirements requiring independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

MITCHELL & PARTNERS

Chartered Accountants

Glenn Merchant CA Partner

Sydney, NSW

Dated this 4th day of May, 2023

77

For the year ended 31 December 2022

SCHEDULE 1 – GENERAL OPERATIONS

The above UNAUDITED detailed statement of surplus or deficit should be read in conjunction with the disclaimer.

78

Note 2022 $ 2021 $ INCOME Donations Net grant income Projects income Auspice Income Investment income Interest Rent received Sundry income 13,274 518,544 91,180 323,213 2,051 14,520 3,692 10,845 467,995 48,960 258,526 75 7,759 22,592 TOTAL INCOME LESS: EXPENDITURE 972,474 (971,221) 816,753 (799,662) NET SURPLUS/DEFICIT 1,253 17,091

SCHEDULE 2 – GENERAL OPERATIONS

The above UNAUDITED detailed statement of surplus or deficit should be read in conjunction with the disclaimer.

Note: Studio/Drill hall costs in Project expenses in 2022.

79