11 minute read

A success story of newcomers – BitAlpha and partners 50 The rise and rise of altFINS

Best NFT Consultancy & Development Company in the Middle East. BitAlpha. Crypto Expo Dubai, 2022.

A success story of newcomers – BitAlpha and partners

Advertisement

No doubts that Crypto Expo in Dubai each year attracts more and more visitors, generating new business opportunities in the crypto sector and serving as an incomparable place for networking for crypto community members and investors. This year was no exception, and numerous international crypto companies have presented their services and innovations. One of them - BitAlpha, a Dubai-based crypto investment, and development company, exhibited with its partner companies as a Platinum sponsor. Although newly established and present on the UAE market recently, the number of its visitors and interest in its services and business activities exceeded initial expectations. BitAlpha and its partner companies have been recognized as significant crypto innovators. Partner company, Dubai-based crypto exchange YBETA, presented the first crypto vending machine in the UAE and numerous instant crypto services. Besides fast and low fees crypto to fiat and fiat to crypto transactions, YBETA enables its customers to make any purchase instantly with crypto, including purchasing real estate with crypto. In partnership with Modern Living, a specialized real estate brokerage company that offers high-end and luxurious properties around Dubai, offers fast and secure property purchase with crypto through fully compliant blockchain transactions.

Crypto Weekly

The interests of BitAlpha`s visitors were both concentrated on investing in different areas and securing the funds for new projects around its Crypto Incubator operations. Unique interest visitors have shown in NFTs. The questions ranged from building NFT from scratch to the market placement of already created artworks. Managing NFTs is one of three key business areas of BitAlpha`s operations, and the company takes great pride in supporting NFT artists to place their art on the market. As recognition for its continuous effort to support NFT artists and their art, Crypto Expo Dubai awarded BitAlpha with Best NFT Consultancy &

Development Company in the Middle

East prize. This recognition strengthened BitAlpha`s position as a prime place for NFT artists for mentoring, financing, and market placement.

Ongoing NFT project supported by BitAlpha – Booty Heaven will have a presale on 28th of March and two more sales on 4th and 11th of April. BitAlpha investors are selecting the most promising projects, and Booty Heaven stood up as a unique piece of art worth raising funds and being brought and presented to the NFT fans and community members. It’s a unique 100/100 NFT collection, portraying inspiring motives and a variety of vibes. Created by crypto portfolio manager David Czibulka, who extended his crypto passion to its artistic skills, Booty Heaven opens a new perspective of perceiving and assessing the value of one NFT project. Booty Heaven promises a lot to its stakeholders - from numerous and exciting utilities to the added artistic value of the NFT industry. Therefore, beyond the exclusive power of possessing a unique piece of art, given to its future owners, each Booty Heaven artwork resembles an inexhaustible source of inspiration, positive emotions, and a variety of pleasant and dynamic vibes. For more information about the collection, visit www.bitalpha.io and www.bootyheaven.io.

An essential part of BitAlpha`s organizational culture is striving for excellence through networking and the circulation of ideas and capital. Therefore, all BitAlpha`s business endeavors are guided by this principle, positioning the company as a unique place where individuals can raise funds to develop their projects or, on the other hand, the ultimate place where investors can place their capital and see its growth

Crypto Weekly

The rise and rise of altFINS

Sourcing the right Trading and analytical platforms have always been a bit complicated for traders of different pedigrees, and in the Crypto space, this issue has tended to be magnified. Whilst there are more platforms to execute trades than you can frankly swing a stick at, analytical and trade discovery providers have been rather sparse on the ground. Many professional mid-level traders simply do not have the analytical tools they normally use when working with analytical tools used for trade discovery on traditional assets classes such as Equity, Bonds, Stocks, commodities, FX and alike.

One barrier to entry has been the 100,000’s of hours of development time and extremely specialist knowledge needed to create such a feat.

That was until one day a man decided to devote every fibre of his being, intellect

By Philip Greenwood

and energy into tackling this obviously, and some might say, embarrassing problem that exists for traders in the crypto space. Meet Richard Fetyko, a man who is ahead of the curve and providing a platform that simply isn’t available on the market. A man that has stayed the course over the last 5 years to bring a platform to the Crypto space that is currently in a league of its own.

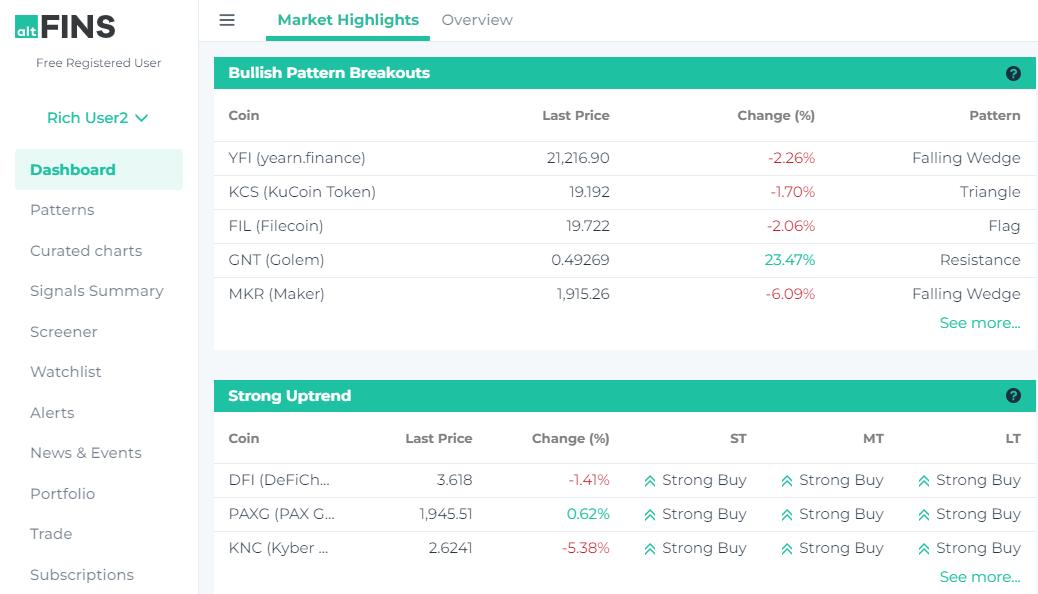

As I sit down to talk to Richard, a calm, quiet yet engaged and relaxed man, I begin to pour over questions to understand exactly who he is, why altFINs is developing an almost cult like following with crypto trading geeks, elites, intellects and plain old “when Lambo” fanboys alike! Ok Richard, just what is altFINS? I spent 14 years on Wall Street as an equity research analyst at investment banks like Janney Montgomerry Scott, covering Internet and Tech sectors, and then 7 years as a portfolio manager at a family fund, Twin Capital. Launched in 2020, altFINS is a cloud-based platform for retail and institutional investors to conduct technical and fundamental investment analysis, trade and track digital assets across exchanges and wallets. It is now used by tens of thousands of active crypto traders to discover trading ideas and strategies.

Do you have a story or anything to say about who and why altFINS was created, also is there a backstory to that story? When was the PLATFORM founded and Why? I caught the crypto bug in 2017 during the ICO craze. Frustrated with a lack of robust analyt-

Crypto Weekly

ical tools that I was used to working with (Bloomberg, etc.), I and a team of local developers decided to develop one. altFINS launched in August 2020 after two years of development.

What is the ultimate business goal of

your Platform.? Like the big vision. altFINS platform will focus on pre-trade analytics, becoming an indispensable tool for crypto traders and investors seeking information about crypto projects and their digital tokens. We will keep adding data and analytics, both off- and on-chain analytics, but also research content.

What made you come to the Crypto

space? After years spent analysing emerging tech trends and companies, I was itching to create a start-up and go through the entire process from an idea to product design, development, product launch, funding, marketing, partnerships and building a team. It’s been a rewarding experience, albeit as volatile as the crypto market itself. It’s a challenge building a business in an entirely new technology space that is rapidly evolving.

How much experience did you have

when you created the platform? This is my first start-up but I’m leveraging years of knowledge accumulated while researching emerging tech sectors and startups. Admittedly, I’m learning a lot on the go.

How does altFINS stack up against market

competitors? Most fintech providers in the digital assets space focus simply on trade execution or just asset tracking, but they neglect the pre-trade analysis that is required to answer investor’s key question: “which digital asset should I own, why and when?”. altFINS is building a tool that covers the entire investment workflow from pre-trade analysis to trading and post-trade analysis and tracking of digital assets.

How long did it take to develop the platform and what were some of all the challenges and hurdles of development in the early stages and what development challenges do you see today?

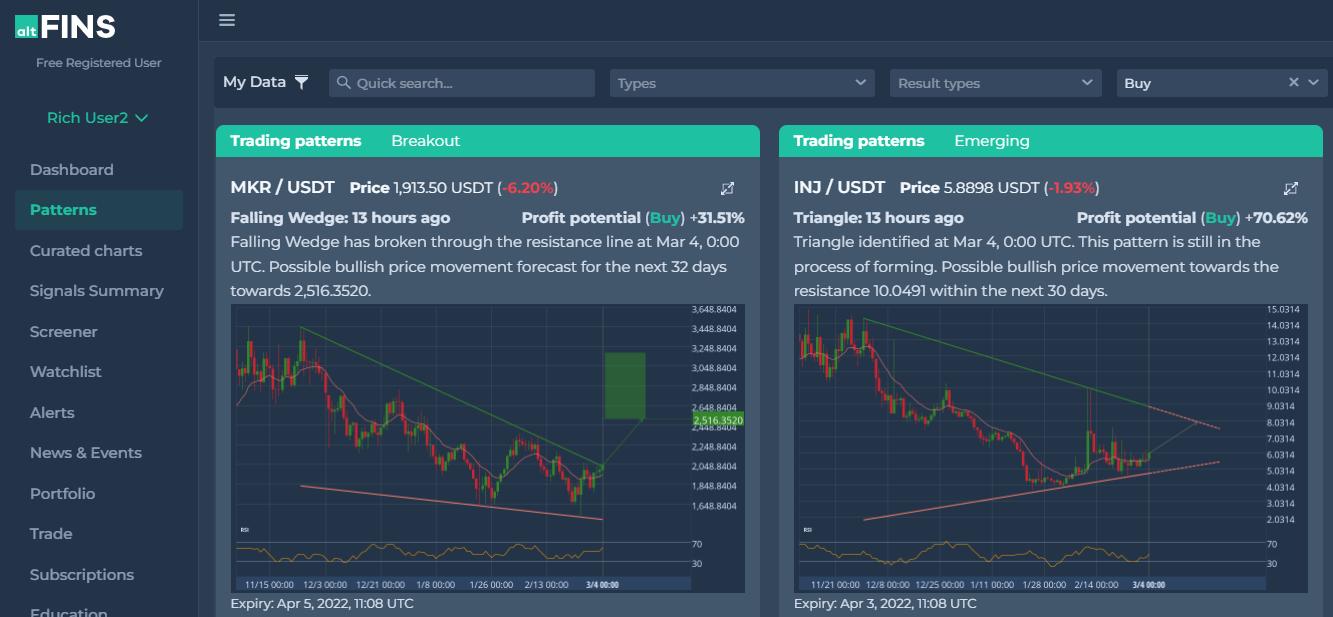

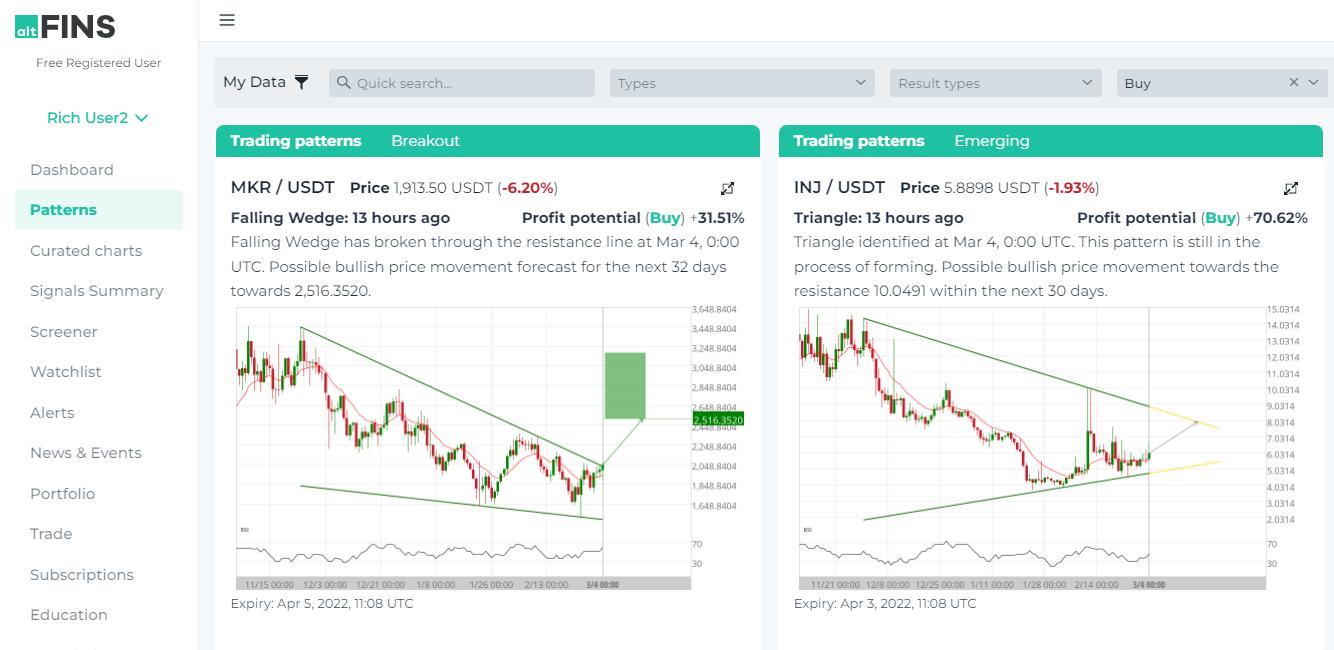

The platform took twice as long (2 years) and was 2-3x more costly than we initially expected. It took us a lot of time because it is really data intensive. One of the big challenges that exist in our ecosystem is that it is very fragmented – there are perhaps as many as 400 crypto exchanges. This makes the price data for those coins very fragmented as well. The platform is ingesting market data from 30 exchanges and that means that we are ingesting around 600 million data records a day. After ingesting the data, the platform calculates around 120 different types of analytics in 5 different time frames across 6,000+ assets. What all that means is that our platform is doing well over 1 billion calculations a day, which has to be stored and backed up. The result, however, is that the users can screen the market quickly and easily and find the coins that fit their investment criteria.

What are the current features of your offering and what new features do you

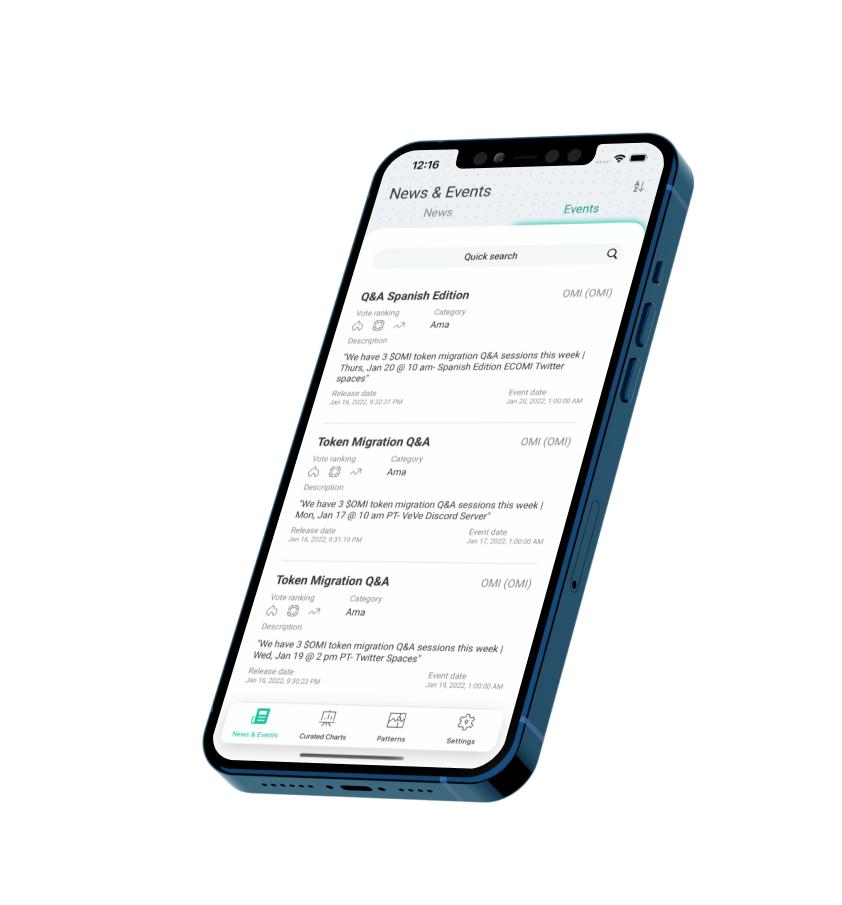

have planned for the future. altFINS seeks to bring efficiency into the investment process in the digital assets space by covering the entire workflow from 1) pre-trade analysis (investment idea generation, technical indicators, fundamental data, screening, charting, alerts, news, research), to 2) trade execution across exchanges, and 3) post-trade analysis (asset tracking, P&L, NAV, risk analysis). We still have a lot of wood to chop on the latter two areas. Need to add more exchange connectivity and tools for users to analyse and track their trading performance.

In 2022, altFINS will launch a Community-Driven Research Marketplace. There is a dire need for research coverage of the growing list of altcoins. Centralised research providers cannot keep up. Instead, our Research Marketplace will empower and reward all users to contribute their research and insights. Both contributors and readers will need to stake altFINS, our native token, to participate in the Marketplace. This will align participants’ interests to benefit the entire investor community and create a more equitable mechanism for users to share in the value they create.

What things do you do to keep the platform relevant or connected with your customers? for example a newsletter or holding contests or rewards? During 2022, altFINS will be launching its native token, altFINS. The intention of the altFINS token is to stimulate adoption of the altFINS platform among the crypto community. By

Crypto Weekly

rewarding our community for the use and contribution to the platform, the community awareness and utility value of the platform will grow, attracting additional users. Growing user base and fee revenues should drive more demand for AFINS tokens through staking and buy-backs / burns, which could exert upward pressure on token price, further rewarding our community and ecosystem.

What do you see as the current state of the trading analytics platforms Exchange market landscape, in terms of the general state of current offerings on

the market? Our closest competitor on the trading analytics and market screener solution is TradingView, although it appears a bit of an afterthought for them since their bread and butter is their charting app and mostly in equities. altFINS has created a workflow for traders that is unmatched in the crypto space currently. In terms of on-chain data, there are many emerging providers including Dune Analytics, Glassnode, Coinmetrics, Sentiment and Nasen. The problem is that their data and analytics are overwhelming the users, it is unclear what is actionable and what is just noise. We will integrate on-chain analytics into our platform this year but we will focus on a subset that is most valuable to the traders and investors.

Is altFINS aimed just at private traders and retail, or does altFINS seek to offer its services to institutions and trading houses/prop desks/investment fund and

investor clubs etc? Well, to answer this, we need to break the landscape in accordance with what segment of the users is the app targeting. Let us think of the user base as a pyramid. At the bottom of the pyramid, there are the investor novices – these are the people who are just learning how to invest in cryptocurrencies, exploring various strategies and technical indicators. Next, we have intermediate investors, who are used to trading; they’re not day traders but are actively managing a portfolio of cryptocurrencies. At the top of the pyramid are the very advanced users some of whom even code their own strategies.

There are various competitors for each segment of the user base. At this stage of our development, I would say that we are aiming at the bottom and middle segments of this pyramid. In fact, there are a lot of platforms that provide automation of trading and algorithmic trading and that are intended for the top segment of the pyramid, so for now we are targeting the other two segments, which make up the majority of the estimated 200 million crypto investors worldwide currently.

Do you offer altFINS a white-label service for other businesses looking to enter

the space? This year, we will be launching plug-in widgets that 3rd party websites (crypto media sites or trading apps) can easily integrate. These widgets will include some of our analytics and content, such as coins in an uptrend, or with strong momentum, or coins that are breaking out. These are essentially trading ideas and building blocks for traders.

Does your platform also provide Liquidity reports on the exchanges they are integrated with? NO

What exchanges are you integrated

with? For trading, we have integrated seven exchanges: Binance, Binance US, Kraken, Bitfinex, Bittrex, HitBTC, Poloniex. For analytics, we ingest data from 30 exchanges. To see for yourself how altFINS can elevate your trade discovery on the alternative coin market take a free trial and see for yourself BY using the barcode below or code: 154 on the website.