13 minute read

The Global Impact of Crypto Innovation

Despite the downturn in the crypto market, innovation is taking place around it all over the world. In addition to that in the retail market, which is considered as regular everyday crypto investors. The market has never slowed down even after the recent crash. It’s the wholesale market that has suffered a loss of investors. The retail market is not keeping up with that yet but who`s to say one day it won’t?

Below I list the biggest markets in the world and inform you about some of the current trends that are occurring in these geographically diverse points of the globe. Latin America

Advertisement

Although El Salvador's Web3 efforts haven't been successful - a recent article in Rolling Stone speculated that it might be the first country bankrupted by cryptocurrency - there is a lot of interest in the space throughout the region. According to a report from blockchaindata firm Chainalysis, Brazil, Colombia, and Argentina have the highest adoption rates of crypto. Bitso is the major player in the market, which was created to serve the unbanked in Mexico City and provide easier access to financial instruments such as money transfers. Inflation, like the 70% rate in Argentina, can also be hedged against with crypto investments.

U.S.

Digital art has exploded in the past two years. In earlier incarnations of the tech universe, Kevin Rose founded Digg, one of the main curators in the space. Recently, he debuted Moonbirds, a collection of pixel-art owls, the cheapest of which cost over $20,000. It aims to be the "Wine Spectator" of digital art with its "Proof" podcast. What is the process he uses to decide what to collect? Take a moment to consider how it makes you feel. "Even in the worst bear market, I wouldn't sell it because I love it," Rose said.

Africa

Crypto is most commonly associated with investing, but Africa is exploring new uses across the continent on a daily basis. With blockchain technology, Mazzuma offers a suite of payment and remittance options. Over the past three years, FlexID has verified more than 1 million bank credentials in Zimbabwe, all using WhatsApp.

Ejara's CEO and cofounder, Nelly ChatueDiop, was raised in Cameroon. Morgan Chittum of Insider reported that Chatue-Diop wanted crypto access to be leveled so that consumers outside the very wealthy could invest in it. By doing so, users could also hedge against fluctuations in state currencies.

Luno Expeditions CEO Jocelyn Cheng told April Joyner that cryptocurrency streamlines the entire payment flow. "It eliminates the need for providers to hold enormous cash reserves in destination countries if you want instant settlement or very quick settlement.", said the venture capitalist.

Asia

Crypto is popular in Singapore. Parisa Hashempour was told about BBH Singapore's survey of 1,000 investors in May and June. The study found that nearly two-thirds of investors would remain invested despite the downturn. Cryptocurrencies are the future of money, according to 69 percent of respondents. In Southeast Asia, Finblox operates out of Hong Kong. After graduating from Harvard Business School, Peter Hoang founded a gaming company and a socialnetworking company before launching Finblox. —Crypto Weekly

Online-Only MultiGender Crypto Expert Shares Everything You Need to Know About Ethereum 2.0

By the time this magazine reaches newsstands, Ethereum’s transition to Proof-ofStake should be complete. To get an idea of why that matters, CryptoMag reached out to consensus algorithm expert Eric Wall, or maybe we should call him (her?) Erica (more on that later. Until then, we’ll use masculine pronouns to refer to Eric).

Who is Eric Wall?

If you’ve never heard that name before, allow me to introduce you. Eric is a staple in the bitcoin/ cryptocurrency space. He’s been involved since 2011. In 2016, he wrote his Master’s Thesis about Using Blockchain Technology and Smart Contracts to Create a Distributed Securities Depository. In the world, there are less than ten experts in consensus algorithms. The most well-known is Vitalik Buterin. The second most well-known is Eric Wall. He’s also an infamous Twitter troll known for his sarcastic remarks and quick wit. This conversation splintered in ways I didn’t anticipate, and I’m struggling to organize it cohesively. Nevertheless, I’ll do my best.

By Nicole Grinstead

The Merge

Ethereum’s long-awaited “Merge” is scheduled for around September 15th, 2022, but when I first bought ETH in 2016, I thought it would transition from PoW to PoS later that year or maybe the next. “ETH 2.0 is only 2 years away” has become a meme. So first, I asked Eric if Ethereum 2.0 would really launch this time.

“Ethereum’s launch has never been formally scheduled before, so technically, you can’t say it has ever been delayed. This is the first and only time it has been tried and tested on multiple testnets and scheduled for mainnet activation.” In short, Eric does think Ethereum’s transition to PoS will happen in September 2022.

When you read this magazine, you’ll know if he was right or not.

Why does the Merge matter? What does that mean for me? The answer to those questions depends on who you are and what you care about.

ETH Price

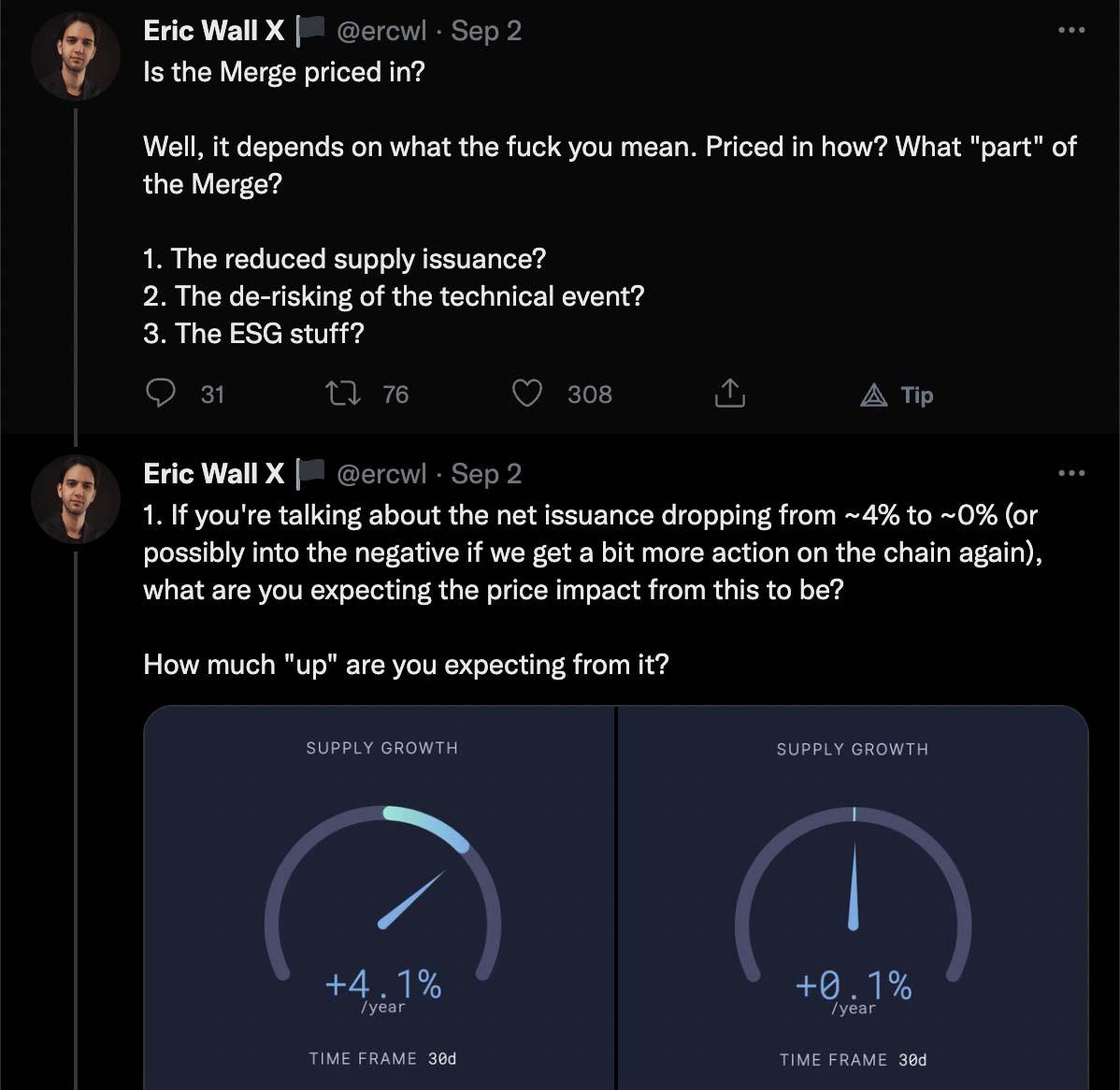

If you’re wondering about ETH’s price, Eric did a Twitter thread breaking down the various components and timeframes.

Not giving financial advice (NGFA), but if you’re hoping to cash in on ETH, the former fund manager suggests, you might not want to hold your breath.

Short-term

“I’m leaning towards up because short positions that have been opened might close, but that’s only if that can overpower the ‘sell the news’ sell-offs. Either way, it’s a shortterm fluctuation that has nothing to do with the Merge per se. Rather, it’s how players have positioned themselves before it. I have no strong opinions, and I don’t plan to trade it.”

It’s worth noting that large institutions have been accumulating ETH for at least five years. What they plan to do with their bags is unknown. Their ability tomanipulate the marketis not.

Long-term

But that doesn’t mean that speculators should abandon hope of retiring on their ETH bags, at least not those with a long enough time horizon. Eric

writes that regardless of what you think about the importance of environmental sustainability or ESG compliance, investors care about that stuff, and that’s all that really matters. “Long term, it’s the right positioning for Ethereum, and it will benefit the price.”

Mid-term

For those with a slightly longer time horizon, though? Eric says, “macrowill still dominate.”

While Ethereum’s Merge could result in an increased number of speculators, global macroeconomic circumstances are the direst they’ve been since before Ethereum’s inception. As a result, Wall concludes that positive investor sentiment will not be powerful enough to penetrate the overarching macro forces at play.

Transactions on the Ethereum chain

For those who transact on the Ethereum Network, though, ETH’s price may not be their primary concern. Instead, the cost of gas and transaction speed could be more pressing. Moreover, since interest in cryptocurrencies and NFTs has declined in recent months, so has the cost and time it takes to complete a transaction. Still, anyone who tried to mint an NFT, stake a token, or trade on a DEX during 2021 will remember the pain. This is why many look forward to the Merge. Yet, in August, the Ethereum Foundation clarified that their transition from PoW to PoS won’t reduce gas fees or increase throughput.

So, we asked Eric, what’s the point? “PoS is needed as scaffolding so you can build various forms of sharding on top of it that Ethereum researchers are interested in, so it is laying the groundwork to reduce fees in the future.”

Got it! So the Merge won’t decrease fees in the short-term, but it could someday. Environmental Impact That’s great for future Ethereum users and researchers, but why does the Merge matter for the average person? Eric says, “The only real significance to a casual person is that when you buy an NFT on Ethereum and get attacked on social media for destroying the environment, you can now say ‘actually Ethereum uses Proof-of-Stake, so your argument is invalid.’”

“So the ability to virtue signal?” I asked.

“Yep!” Eric replied.

Classic! This ties to a larger issue about the environmental sustainability of PoS versus PoW, and ESG, which Seth Estrada wrote about elsewhere in this issue. Seth wonders if minting an NFT on a proof-of-work chain is really tantamount to setting the Amazon rainforest ablaze. “Unlikely,” he concludes. For his part, Eric has also done a deep dive weighing the pros and cons of PoW vs. PoS. He doesn’t “want to be perceived as glossing over PoW miners’ potential of acting as a so-called ‘load balancer’ on the energy grid while using mostly renewables.” Still, in the end, he concludes that “Proof-of-Stake is less wasteful.” If you’re interested, you can read it on his Medium blog.

Censorshipresistance

Price, cost, speed, and environmental impact are shallow, surfacelevel issues compared to censorship. Indeed, freedom of speech is central to the Cypherpunk Manifesto, the U.S. Constitution, and the United Nations' Universal Declaration of Human Rights. In 2021, a particular crypto group even sacrificed nearly $1 billion to say, "we believe in freedom of speech, and code is speech," to support an upcoming Ethereum fork. So, I asked Eric, is there anything to the concern that PoS Ethereum won't be censorship resistant?

Eric said, "There's a very real chance that many validators won't include particular transactions on the OFAC blacklist. But many validators will include those transactions. Thus, the odds of impenetrable censorship are pretty low. The dangerous censorship scenario being discussed is a theoretical scenario where the validators perform a so-called 'evil softfork' on the network, meaning they only allow compliant transactions on the chain."

He further explains that for any of this to be possible, validators would have to not only control billions of dollars in Ether (which corporate and government entities most certainly do), but they would also need to navigate technical hurdles and be willing to risk the network slashing their Ether as punishment.

"Altogether," Wall concludes, "the chance of censorship is indeed elevated in ETH2 due to many regulated entities controlling a lot of stake, but the probability is still less than 5%, I'd say."

So there you have it. Ethereum’s transition to PoS carries an increased risk of transaction censorship, but Eric thinks that risk is low. Government Overreach & Privacy Coins

It's worth noting that while Eric is an expert in consensus algorithms, he isn't an oracle, and he can't predict the future. On that note, I asked Eric if he was surprised at the recent sanctioning of Tornado Cash and if he thinks that indicates future trends. Indeed, he didn't foresee that outcome.

"This isn't something that has ever happened to our industry before. It's understandable when someone gets in trouble for running a mixing service, but Tornado Cash was running on Ethereum, so the only 'crime' was writing code. It's a very dangerous legal precedent to set that writing code could

be illegal. It seems like the authorities are engaging in some kind of overreach, and they need to be contested in a court of law."

I couldn't agree more, but when the laws are corrupt, you have to wonder about the courts, too, right?

Women in Cryptocurrency Now what you've all been waiting for: the topic of gender in cryptocurrency. Just kidding, I saved this part for last so those who want to read it would have to read through everything else first and so that those who don't want to read it can stop reading now.

Believe it or not, this is one of the most divisive issues in cryptocurrency. Even the women who work in crypto can't seem to agree. At the protocol level, cryptocurrency doesn't gaf about your gender, but crypto holders certainly do.

As a woman who owns and works in cryptocurrency, people often ask what kind of challenges I face that men in my position do not. Unfortunately, I have to tell them I'm not qualified to answer that question because I'm limited by my own experience. Eric/a, however, can provide some unique insight. Introducing Erica On top of everything else, Eric is an infamous Twitter troll. He's been known to bait enthusiastic crypto communities against one another, just to see which will make themselves look dumber. His sarcastic tweets, coupled with genuine market insights and so-called alpha drops, have garnered almost 100k followers. In January, Eric took trolling to a new level when he used a photo of himself that was altered to look like a woman to create EricaDAO. He raised the stakes further by continuing to switch backand-forth between Eric and Erica in the following months. So I asked if he was experimenting with gender biases or if this was something else?

"I don't know. It started as a joke, but now I think I'm 'exclusively-onlinemultigender.' It means I am basically multi-gender but only online because I'm too lazy to care about it IRL," Wall explained.

Eric has said he created EricaDAO to raise crypto's profile and bring blockchain to the mainstream by leveraging the vast audiences who flock to serve crypto queens. However, he may have been surprised to learn that it isn't entirely accurate. "I don't get followers any faster as a woman vs. a guy, For what it's worth…. I actually lose followers turning female because people will look at my sarcastic tweets and think, 'why am I following this dumb bitch?' instead of getting the humor… People will attack your womanhood if they get a chance, but I've never had my manhood attacked. People assume you get all your followers for free because you're a woman, and automatically assume you're undeserving of your success. So if you say something stupid, they'll love that and weaponize it against you immediately. I'd say when you're a woman, people assume the worst about you. If you try to make crazy jokes, people will just assume you're a dumb bitch or literally insane. So it is easier to be sarcastic and playful as a guy."

This explains so much!

"It also changes how much engagement I get. Contrary to what most people think, I usually lose followers and engagement when turning female." So much for the theory that a male persona on Twitter is hard mode.

That said, every disadvantage carries an equal and opposite advantage. Eric continues, "Online life as a controversial figure in many communities can be quite mentally tolling. I use the different genders as tools to get by in that extreme climate when everyone is at everyone's throats. Sometimes I just use it to confuse the hell out of my enemies. Sometimes I am cornered, and suddenly I switch, and it looks like a bunch of guys are ganging up on a chick, which is funny to me."

Eric's candid responses about weaponizing his online gender fluidity could get him canceled among crypto's more woke crowd, but I doubt he would care. He's explaining a dichotomy that the women of crypto Twitter have long since experienced. While his humorous experiment answers the question about how women experience CT differently, a larger issue still looms: Does gender bias extend to the professional sphere and bar women from meaningful participation? Perhaps another time…

Call to Action

Eric is a verified expert in consensus algorithms. We're satisfied with his answers about Ethereum's transition from PoW to PoS and how that will affect us. Still, now that Ethereum's Merge is complete, maybe Vitalik himself will be able to set some time aside to talk to CryptoMag. If that's something that you'd like to read, let him know by tagging him (@ VitalikButerin) and us (@ cryptomagz) on Twitter.

of the week

NFT

Breaking the "Proof of Work Rulebook: Crypto About To Go INSANE!!