The NIMBY problem

> When infrastructure is being blocked, how can you deploy renewable energy at scale?

PPAs at a crossroads

> Can data centers keep using traditional PPAs, or is it time for change?

Just capture it

> The intoxicating promise of carbon capture isn’t all it’s cracked up to be

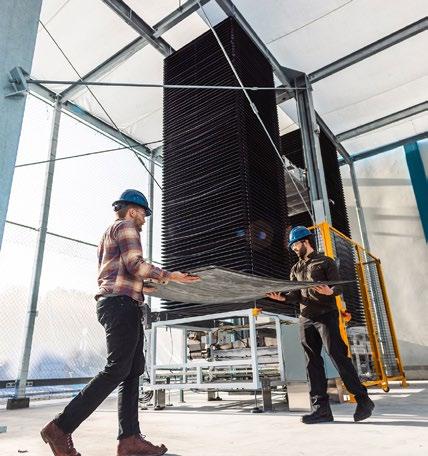

Fast, scalable, reliable power.

Is the grid unstable? Unable to cope with demand? Or is the wholesale electricity price too high?

Our flexible off-grid generation solutions deliver demand-side response for data center construction, commissioning and operating power.

n Best-in-class low emissions generation and energy storage technologies

n Short-term to multi-year solutions

n Tailored, scalable and right-sized power projects

n Backed by technical expertise and dedicated teams

4. NIMBY lessons from renewable developers

How renewable developers are coping with local opposition to energy projects

10. Do PPAs have a future in the data center sector?

The power purchase agreement market is evolving, presenting fresh challenges for digital infrastructure providers

13. Capturing the attention Is carbon capture technology ready to become a central part of data center net zero strategies?

4

13

The futures of the digital infrastructure and energy industries are intrinsically linked.

On one side you have the wave of power-hungry AI data centers, with operators looking for electricity wherever they can get their hands on it. On the other you have the grid operators, frantically trying to meet demand from this increasingly important sector as interconnection queues for new power projects grow longer and longer.

ChatGPT maker OpenAI’s recent admission that it had pitched the economic benefits of 5GW data centers at a meeting at the White House indicates the direction in which the industry thinks it is heading. Quite where such massive amounts of power can be found, particularly as both end users and energy companies transition away from fossil fuels, is an open question.

With so many massive problems to solve already, the last thing that power companies and data center operators need is NIMBYs. But both often face opposition from residents and local councils who do not want to see massive developments take place in their backyards. With data centers enjoying a higher profile than ever before, they have become a magnet for campaigners concerned about the impact of massive server halls can have in small towns and rural communities. In this issue, we take a look at some of

the common opposition to data centers and energy projects, and asks the companies involved how they build bridges with communities and extol the virtues of their facilities.

Deals between energy companies and data center operators often take the form of power purchase agreements, which see big businesses buy up large amounts of renewable energy which they then put back into the grid to offset their emissions. Data center companies are big fans of PPAs, with Amazon claiming to be the largest corporate buyer of renewable energy in the world, and its rivals signing deals with renewable energy providers all over the world.

PPAs have become central to many companies’ net zero plans, but the market is in something of a state of flux as demand grows and the value of certain types of PPA is queried. What does the future hold for PPAs, and what role they might play for the data centers of the future?

Elsewhere, carbon capture is a technology that has long promised to help cut emissions. Scooping up the carbon generated by data centers and other industrial processes and disposing of it safely has become an industry all of its own, with companies pursuing various methods including burying the carbon deep under the ocean.

How renewable developers are coping with local opposition to energy projects

Dan Swinhoe Senior Editor

Historically, renewable energy developers had long been jealous of the data center sector’s relative anonymity in the eyes of the public.

While data centers could until recently get projects through the planning process with relative ease, those wishing to build solar and wind farms have had to fight tooth and nail to get projects approved, despite on paper being more beneficial to the world at large.

But as data centers have grown in size and their power demands have increased, their days in the shadows have been replaced with headlines in national newspapers, and organized opposition has grown in kind

Renewable energy project developers still see local opposition, and as demand for more and more green energy continues to grow - driven in no small amount by digital infrastructure - the success of both sectors has become increasingly intertwined.

Data center operators might be busy fighting their own battles. But if renewable companies can’t overcome similar - or even greater - challenges when it comes to getting local residents on-side with new developments, data center firms can kiss their renewable power goodbye and say hello to more capacity issues.

A Berkeley Lab survey of large-scale wind and solar project developers from January 2024 found around one-third of wind and solar siting applications submitted in the last five years were canceled.

Community opposition was among the top three leading causes of project cancellations and delays for both wind and solar – alongside grid connection issues and local ordinances or zoning restrictions. Most agree that the public has “substantial control” over whether a project will be built.

“We faced a tremendous amount of NIMBYism in the energy sector and the projects that that we're developing,” says John Wieland, chief development officer for renewable energy firm Leeward Renewable Energy. “I think the NIMBYism that we may face may be a little stiffer [than data centers face].”

Leeward has 3GW of renewable power

in operation across 26 projects – a mix of wind, solar, and battery storage –with another 2GW in development, and supplies the likes of Microsoft and Digital Realty.

“I think data centers are typically welcomed with warmer receptions just because of the dollar signs that are attributed to those large hyperscale campuses,” Wieland says.

More than half of respondents to the Berkeley Lab survey said community opposition was “very likely” to get in the way of decarbonization goals. Developers were seeing average delays of about 11 months for solar projects and 14 months for wind due to opposition efforts.

There is “no question there are challenges in some communities,” according to Matt Kisber, co-founder and chairman of the board at solar farm developer Silicon Ranch. But he says: “I have found that when you are transparent and you communicate, we've been successful in overcoming many of those challenges. and actually making supporters out of many doubters.”

Silicon Ranch operates more than 150 solar projects across 15 states, with 5GW in operation and development. Data center customers include Meta, Microsoft, and Tract.

Kisber previously served ten twoyear terms in the Tennessee House of Representatives and was commissioner of the Tennessee Department of Economic and Community Development during the governorship of Phil Bredesen. He tells DCD that experience in public life helped to shape the company’s strategic approach to the question of outreach.

“Be open and honest with community partners,” he says. “Bring them in from the very beginning of the development of a project so that they know what we're trying to accomplish, and that they can help us make it a good long-term partnership.”

Less than one third of developers say that opposition is easy to predict before a project is made public. Most do agree that larger projects are more likely to encounter opposition - though claim most is from a vocal minority. More than half said they were at least somewhat less likely to attempt development if “substantial” opposition is expected, with approximately 12 percent of respondents report their companies are now pursuing more solar because of concerns about greater

community opposition to wind.

Like with data centers, NIMBYism can come in different forms, from different sources, for different reasons.

Visual concerns to be the most likely root cause of community opposition for both wind and solar, according to the Berkeley Lab report. Other leading concerns for wind are sound, community character, and property values; while for major issues are loss of agricultural land, community character, and property value.

“The biggest issue that folks will throw out is’ we don't like the aesthetics or we're afraid of the leaching of toxic chemicals,” says Wieland. “But underlying most of the concern, is change. And we're talking about significant change to these communities. It really about community partnership and genuinely understanding those concerns.”

early, engage widely

Most developers in the Berkeley Lab survey agreed that increased engagement results in fewer project cancellations. More than three-quarters said community opposition is more of a problem today than it was five years ago, with a similar proportion saying company spending is gone up to address and mitigate opposition in the same time frame.

Perhaps because of this spending uptick, most (66 percent) companies also said local concerns are adequately addressed before project construction. Though the ongoing opposition – and the fact most expect community opposition to be more of an issue in the future – suggest perhaps more could be done.

Leeward’s Wieland says his company “invests heavily” in community stakeholder engagement.

“We really pride ourselves on early engagement, early investment in the communities,” he says. “Sitting down with all the interested stakeholders – not just the direct neighbors, but other key constituents within the communities – to understand what really matters to them, and how we can interweave ourselves within the fabric of that community.”

He says the company also provides “references” from other communities in which it operates: “Don't trust what we're saying, talk to other folks that have done business with us in the past.”

Most importantly, though, Wieland

says, is just being there and listening, and looking for “opportunities to genuinely find win-wins for the community above and beyond just that tax revenue.”

Kisber says Silicon Ranch has around eight people on its economic and community development team.

“Their role is to work from the very start of the development of a project with the community, with the neighbors, with the local and state officials so that we're communicating and incorporating their feedback into the development plan through its execution and its ongoing operation,” he explains.

“I think too many in our industry don't take the time to develop in the same manner. And that's what causes opposition and pushback because trust is the currency of development. And if you haven't earned that trust, you're going to fai.”

Despite spending an average of around $700 per megawatt for solar and $1,100 per MW for wind in community engagement, most developers disagreed with the idea they actually spend more on community engagement than they save in reducing delays or cancellations – suggesting the efforts are worth the cost.

The Berkeley survey suggested in almost all projects (98 percent), community engagement started after land had been secured – weighing slightly in

“I think data centers are typically welcomed with warmer receptions than renewables just because of the dollar signs attributed to those large campuses.”

>> John Wieland Leeward Renewable Energy

favor of some land being secured versus all land. However, when asked if there was anything they would have done differently on canceled projects, most answers indicated starting engagement earlier would have helped – though a minority said engaging too early allowed opposition to form.

One remorseful respondent suggested they should have planted trees around the border of a planned project so that “by the time we got to the permitting stage, viewshed concerns would hold less weight.”

“But there's probably nothing anyone can do in the face of well organized, well funded ideological local opposition to a project regardless of how well conceived or designed,” they said.

Typically, developers initiate community engagement after securing site control for a project, according to the Berkeley survey. Most developers (77 percent) said the public should provide input on proposed projects, but not recommend or make decisions about projects.

Project timelines were ranked as the biggest barrier to improving community engagement – though still a fairly minimal barrier. With grid connection queues now reaching years in many regions in the US and Europe, “we didn’t have time to reach out” is unlikely to wash with any agitated locals.

Most likely changes resulting from community feedback include changes to site layouts and screening, greater setbacks, adding neighbor compensation, and excluding certain properties from projects. Unsurprisingly, adding any kind of community ownership to such commercial projects was seen as unrealistic; electricity bill discounts were also described as unfeasible by the vast majority.

In-person local meetings with stakeholders, project open houses in communities, virtual/phone meetings with locals, and attending community events and fairs were cited as the most effective methods of outreach in the survey.

Outreach via mailings, brochures, and local press; project websites and

“Too many in our industry don't take the time to develop in the same manner. Trust is the currency of development, and if you haven't earned that trust, you're going to fail.”

>>Matt Kisber Silicon Ranch

social media; organizing visits to similar nearby projects; visiting local constituents, maintaining a local office, local opinion polls, and using third-party facilitators were other methods used by developers.

Wieland says his company spends time and money on providing visual simulations of projects and incorporating buffering landscape buffering when practical.

“We really pride ourselves on our land stewardship and the amount of time and energy and dollars that we put into our layouts to ensure that they blend as best possible with the community,” he says.

Many renewable projects are in greenfield sites that were previously use for agriculture, so being sensitive there can help. In the same way some data centers use beehives, living walls, or have dedicated wildlife areas at their sites, some renewable developers look at incorporate grazing into the facilities.

“We have apiaries at some of our facilities, and we're exploring other types of agrarian implementation on and within our facilities so that we blend in and really weave ourselves into that fabric,” says Wieland. “We’re also looking at deer fencing (aka cattle fencing) that is more aesthetically pleasing than, say a chain link fence with barbed wire.”

Opposition to wind and solar farms is unlikely to go away any time soon.

And with the increasing interest on using nuclear power to meet both renewable targets and demand for

growing data center demand, we’re likely to see more organized opposition to energy projects in the future.

Some data centers will likely be colocated at the same locations as some of these energy projects as behind-themeter deals become more common amid grid connection woes. So data center developers and operators should look to prepare properly and dust off those community engagement playbooks.

When asked for any advice he would give to data centers on dealing with NIMBYism, Leeward’s Wieland says: “To the extent that they're not not already doing it, early engagement, partnering with the community, and making sure that folks' voices are heard.”

“Getting local and really developing the trust and the relationship with the folks in the community is paramount. Whether you're developing a data center or a large wind facility or solar facility.”

We live in an era of fake news. And while data centers are often misunderstood, rarely do they have to deal with outright misinformation about their impact.

Spare a thought then for the renewable developers, who often have to deal with low-level conspiracy theories almost as tiring as the idea that 5G cell towers spread Covid-19.

A classic example is the number of birds killed by wind turbines. Some estimates suggest it could range from as little as four to as many as 300 birds per turbine per year, which can be extrapolated to millions of animals each year globally – and its not hard to find such scaremonger headlines in certain press outlets.

What these reports often leave out is that studies suggest poor siting decisions – i.e major migration routes and important feeding, breeding and roosting areas – can increase bird fatality rates, while well-located are though to have little effect. They also leave out the fact far more birds are thought to be killed by power lines, cars, buildings, and cats than turbines. Buildings alone are thought to kill nearly 600 million birds annually in the US – while cats are thought to kill close to 1.4 billion annually. Similar studies suggests similar ratios of difference when it comes to bat fatalities as well.

“There's a lot of misinformation out there about toxic chemicals that may be leaching into the ground from the solar modules, which is nonsense,” says Leeward’s Wieland, “and glare from

from the modules causing headaches to neighbors.”

“I do find it frustrating,” adds Silicon Ranch’s Kisber. “You can go on the Internet and find out any kind of information, whether it's accurate or not, that you want to. There's a lot of misinformation on the Internet, especially by groups who are trying to fight.”

He notes that he often has to pushback against claims that rain runoff from the panels are going to pollute the water or they put out electromagnetic fields that will harm their health – both of which he says are “totally false.”

“In order to find common ground to compromise, you have to operate from a set of facts that everybody can agree to. And when you have the misinformation that is out there and people come to believe it as fact it becomes much more difficult to find common ground and find areas that you can compromise and agree on.”

He says his company spends “a lot of time” trying and provide the factual information and the sources when confronted with misinformation so that they can do their own research and come to a different conclusion than before.

“We try to do that calmly, methodically, using facts and resources that people can go to and verify for themselves, and hopefully come around to a common set of agreedto information so that we then can work together to find solutions and compromise.”

What happens when the grid can’t keep up with a data center’s power needs?

Data centers are a vital component of companies’ daily operations as they are the central location for IT operations and equipment, and they help form the backbone of critical internet infrastructure. Email, cloud document storage, e-commerce transactions, backup data, streaming media, mapping – practically everything that people go to the internet for daily requires data centers to process information. The recent embrace of artificial intelligence for generative AI and an increasing variety of applications is also going to lead to increased power demands in the years ahead, as remote computing performs much of the processing power for algorithms.

All this data requires power – and the expansion of AI means significantly more power than previously required. A report earlier this year from Newmark found that while data centers typically required 10-14 kW per rack, server racks with powerful enough GPUs for accelerated AI adoption will require 40-60 kW per rack. With data

center power consumption expected to reach 35 GW by 2030, nearly doubling the power needed in 2022, a huge increase in power supply will be needed to ensure data centers can continue uninterrupted.

It’s not simply power that data centers need, either, as the high concentration of sensitive electrical equipment also requires a constantly regulated, cooled environment. Electrical distribution equipment, uninterrupted power supplies, transformers, bus bars, generators, cooling equipment – all are critical to ensuring a data center operates as needed.

Data centers may be a linchpin for the bleeding edge of technology, but how they get their power is in most respects stuck in the past. In the United States, we by and large still depend on technology developed in the 19th century to get electricity, with large generating facilities

sending a finite amount of power to the grid based on what it can handle. What happens when the grid can’t keep up with the needs of the digital revolution? Electrical utilities determine how much power individual building lots can receive from the grid, but what if a building’s power needs are rapidly increasing – as is often the case lately with data centers?

Off-grid, temporary, modular power is the answer, and it is an area where Aggreko is a world leader. Aggreko’s bridging power solutions can effectively and reliably support data center operations and growth in cases where the grid is unstable, unable to cope with demand, or when the wholesale electricity price is too high. The company’s technologies are some of the most advanced in the world, and now, North American customers can deploy them for demand-side data center applications across construction, commissioning and operational stages alike, including:

• Hybrid power plants: With Aggreko’s on-site gas-powered systems, data

centers get reliable, sustainable, and lowcost energy on demand. Designed to be a source of continuous power, this solution can be configured with battery storage, connection to the grid, or integration with other renewable sources, and with the option to leverage virtual pipelines to displace other more carbon-intensive and expensive liquid fuels.

• Low emissions power generation technology: With the latest EPAcompliant Tier 4 Final engine technology, able to also run on alternative fuels such as HVO, this power generation alternative provides constant, reliable, and efficient power, while reducing carbon emissions. Coupled with a load on demand system configuration, the generators can automatically power up or down according to demand on site, leading to more cost savings, maximized efficiencies, and reduced emissions.

• Genset loading with battery storage: By using battery storage as the spinning reserve, systems can handle the same load, but with fewer generators. For Data Centers, this means that battery storage helps to compensate for any disruptions to supply or frequency drops, leading to improved reliability, carbon emissions reduction, significant fuel savings, and enhanced efficiency across all generators that make up the on-site system.

In addition to power, Aggreko’s capabilities extend to other technologies for mission critical applications:

• Loadbanks for data center testing, early commissioning, OEM delays, maintenance, and breakdowns. Aggreko’s testing technologies and specialist commissioning teams support testing of a data center’s critical infrastructure to guarantee reliable power supply and climate control

• Cooling and Heating: Aggreko provides a range of efficient temperature control options that

use the latest technology and help maintain the optimum environment, achieve comfortable temperatures, and support any need, from concrete pouring, OEM delays, maintenance, and breakdowns.

• Moisture Control: Heating & drying for restoration, renovation, or new builds.

In addition to the leading technologies Aggreko offers, contractors, operators and hyperscalers alike can rest assured knowing that their specific needs will be matched with a tailored solution for every stage of the data center's life cycle:

• Construction: Mobile, modular temporary power, climate control, and testing solutions to enable onschedule, on-budget and reliable project delivery.

• Commissioning: Support for robust L1-L5 testing, providing consistency and reassurance of infrastructure resilience.

• Maintenance: Assurance of peak performance and operational reliability during maintenance with fit-forpurpose power and HVAC solutions.

• Upgrades: Uptime security and on-time, on-budget project delivery through fast, modular, end-to-end solutions.

• Emergencies: Back-up & recovery solutions for critical infrastructure. Contingency plans for server protection and to ensure continuity. Choosing Aggreko for data center power needs means getting the best of

what the company has to offer in terms of meeting specific customer needs. This includes:

1. Industry-leading technologies

2. Fleet diversity and speed of deployment

3. Versatility with solutions for short-term and multi-year needs

4. Technical expertise & dedicated data centerfocused teams

5. Modular and scalable solutions and project right-sizing for ultimate efficiency

6. Long-term capital investment avoidance

7. 24/7 Remote monitoring and fuel management capabilities

More power doesn’t have mean more emissions

As with all their sectors, Aggreko’s energy solutions for data centers adhere to the company’s commitment to helping customers realize their energy transition. Aggreko’s data center products include technology from the company’s Greener Power Packages lines such as battery storage, electrical distribution, and Tier 4 Final generators, all of which deliver enhanced efficiencies, reduced emissions and improved costs.

For whatever your data center power needs may be, Aggreko has a customdesigned solution that will bridge the gap between the growing amount of power needed for data processing and the limited grid infrastructure they're forced to rely on. The world’s need for data processing will only continue to grow exponentially in the years ahead –and Aggreko's advanced off-grid power capabilities stand as a testament that power limitations will not hold back the digital revolution.

The power purchase agreement market is evolving, presenting fresh challenges for digital infrastructure providers

The demand for digital and data services continues to grow at an unprecedented rate. According to the International Energy Agency (IEA), the number of internet users globally has more than doubled since 2010, while internet traffic has surged 20-fold.

Despite major efficiency improvements, workloads handled by large data centers have increased energy consumption by 20-40 percent annually since 2020. As artificial intelligence (AI) adoption accelerates, overall data center power usage is expected to increase by 200TWh per year between 2023 and 2030. This raises the question of how will data centers cope with the increased

energy demand while adhering to their ambitious net zero targets?

In recent years data center operators have increasingly turned to power purchase agreements (PPAs) to help achieve their green ambitions. These deals see large users of fossil fuel-based electricity buy an equivalent amount of renewable power to put back into the grid and offset their emissions. Data center operators are some of the biggest exponents of PPAs: Amazon claims to be the biggest corporate buyer of renewable energy in the world, and says it has backed more than 500 projects generating 77,000 GWh of clean energy each year. Microsoft, Google and Meta are among the other tech companies active

Zachary Skidmore Senior reporter, Energy and Sustainability

in the PPA space.

But in recent years the PPA market has become increasingly volatile, with factors including tariffs, supply chain disruptions, and growing competition driving up costs. This shift has turned what was once a buyer's market into one that favors sellers, forcing data center operators to adapt by developing new PPA contract structures, supporting innovative energy technologies, and implementing smart solutions to better manage their energy consumption. These challenges could call into question the long-term viability of PPAs in the data center sector.

For data centers, PPAs are essential in securing renewable energy to displace fossil fuels on the grid, a key part of their carbon reduction strategies. With large data centers now requiring upwards of 100MW of power, PPAs in the sector are often larger than in other industries, frequently exceeding 100-200MW of procured power.

Not only are PPAs getting bigger, but the volume signed by data center operators is rizing rapidly. Notable deals inked during the last couple of years include Amazon signing several PPAs with Spanish developer Iberdrola to source energy from two offshore wind farms in Germany — 476MW Baltic Eagle and 300 MW Windanker — which will provide Amazon with 1.1TWh of energy annually, indicative of the volume sought by operators.

Most PPAs signed within the sector are tied to wind and solar projects, as they are the most cost-effective renewable energy sources in major markets. However, as Andrew Webber, CEO of Digital Power Optimization (DPO), contends, most data centers often do not actually receive power directly from renewable assets. He says: "Many data centers use virtual PPAs (VPPAs) to buy wind or solar power, but the actual energy used often comes from fossil fuels, as the wind or solar energy is generated far from the facility."

DPO’s business model is to colocate data centers with stranded renewable projects throughout the US to support "smoothing out low or negative pricing, boosting the overall revenue for the producer."

Webber sees this as a win/win situation for both parties, bceause "if there's already a wind or solar asset in development, it's worth considering building a data center nearby, especially in remote areas where land and substations are available, as long as fiber can be run in at a reasonable cost." Doing so reduces the concerns attached to VPPAs that operators often rely on fossil fuels to power their facility despite adding green energy to the grid.

For Webber, PPAs remain a key component in data centers' push to acquire green power generation. But, he says, there “isn't one right solution for meeting data center energy demands.”

He explains: “We need a combination

"If there's already a wind or solar asset in development, it's worth considering building a data center nearby”

>> Andrew Webber, DPO

of strategies, including renewable assets, government action, and even nuclear, to address these challenges." As a result, rather than putting all its eggs in the PPA basket, data centers should look at a range of solutions to power their sites, from onsite generation from renewable assets to the deployment of emerging technology.

The major concern about PPAs is that they derive the majority of their power from wind and solar assets, which are intermittent by nature. As a result, operators have begun to explore alternatives like geothermal and hydropower, which offer more consistent energy flow. For example, Microsoft signed a 10-year PPA in May 2023 to procure geothermal energy for its New Zealand data centers.

These sources, though, are geographically constrained, limiting their availability to certain regions. As a result, operators have increasingly sought to place their operations in areas most likely to benefit from a stable renewable resource, leading to the proliferation of data centers in areas such as the Nordics.

In addition, data center operators

have begun to explore small modular nuclear reactors (SMRs) as a potential alternative to traditional renewable PPAs. SMR developers claim they can offer a more cost-competitive solution than renewables, though the technology has yet to come to market.

Although traditional renewable PPAs remain the dominant tool for securing clean energy, these emerging technologies could reshape the market.

The structure of PPA contracts within the data center sector has evolved significantly in recent years, with longerterm contracts becoming more common. Aaron Binkley, VP of ESG at Digital Realty, sheds further light on this, stating, "You used to see shorter-term deals, like 10 or 12 years, when the market was more favorable to buyers. Now, terms of 15 to 20 years are much more common as developers have less flexibility to offer shorter contracts." A recent example was in September 2023, when Microsoft secured 323MW of capacity from Shell's Witznitz Energy Park under a 15-year agreement.

Most data center PPA market suppliers are established utility firms like EDP,

EDF, AES, Clearway, and Dominion. This strategy allows developers to partner with companies with strong credit profiles and a solid energy infrastructure base, which helps optimize procurement costs and streamline agreements for the offtakers.

In addition, tech companies have begun forming partnerships to address supply chain delays and permitting obstacles. Amazon recently signed its first PPA for a brownfield project, converting a coal mine site in Maryland into a solar farm. By investing directly in project development, data center operators can secure more reliable power for their

The PPA market faces several challenges, starting with regulatory inconsistencies across regions that complicate renewable project development. Despite efforts to streamline processes, projects often face supply chain constraints, land-use limitations, and prolonged waits for grid connections, with many permitted projects taking 5-10 years to become operational.

These delays have contributed to rising PPA costs, which are further exacerbated by tariffs, disruptions

interconnection process has become a critical bottleneck", Binkley notes, stressing the challenges utilities face in connecting new renewable projects to the grid.

Furthermore, most data centers are located far from renewable resources, raising the need for enhanced urban renewable planning or relocating data centers closer to power sources. For Webber, this is a significant issue: "Adding solar to existing data centers is challenging because there often isn't enough land nearby for large-scale solar installations, and even if it's close,

facilities without relying on third-party developers, who may face delays in getting their projects approved and connected to the grid.

This approach is gaining traction. In May 2023, Microsoft entered into a long-term CPPA with SSE Renewables and FuturEnergy Ireland to support the development of the Lenalea Wind Farm in Ireland.

These shifts in PPA structures and partnerships highlight data center operators' evolving strategies to secure sustainable energy amid a more competitive and constrained market. However, the sector still faces significant challenges, including rising energy costs, grid limitations, and regulatory hurdles, which could impact their longterm energy procurement and broader sustainability goals.

in the supply chain, and increased competition. "In the data center industry, we are seeing issues not only with getting new renewable projects interconnected but also with meeting the increasing load demands as data centers continue to grow rapidly," states Binkley.

Additionally, aligning PPA structures with evolving corporate sustainability and decarbonization goals adds complexity to contract negotiations. Some argue that while PPAs facilitate the expansion of renewable energy assets, the more significant challenge lies in integrating these resources into the grid and adapting energy consumption to mitigate the intermittency of renewable energy sources.

As baseload consumers, data centers require a constant energy supply, which is difficult to ensure with intermittent renewables. "The permitting and

“The permitting and interconnection process has become a critical bottleneck” >> Aaron Binkley, Digital Realty

transmission remains an issue,” he says.

As data demand grows, it is crucial to develop a coherent strategy to secure sufficient green energy while maintaining net-zero commitments.

Rapid data growth, increased energy demand, and corporate sustainability goals are transforming the PPA market for data centers. While PPAs remain a crucial tool for data center operators, emerging technologies like SMRs, onsite generation, and the need to overcome regulatory and supply chain bottlenecks are reshaping the market landscape. In the future, securing reliable, renewable energy will be vital to sustaining the growth of data centers while meeting their ambitious decarbonization targets. Data center operators will have to deploy a highly flexible approach in order to meet both growing power targets and their lofty decarbonization goals.

After several false dawns, is carbon capture technology ready to become a central part of data center net zero strategies?

Carbon Capture and Storage (CCS) technology has garnered increasing attention as a critical technology in reducing carbon emissions globally.

According to the International Energy Agency's (IEA) 2024 report, 45 CCS facilities are already operational. It is expected that capture capacity will increase 35 percent by 2030, with storage capacity going up by 70 percent.

Despite these advances, debates persist regarding CCS's effectiveness and financial viability. While some see it as a key part of future decarbonization efforts, others have questioned its scalability and economic feasibility. For data center operators, some of these key questions will need to be answered before CCS can become a central part of their net-zero strategies.

Over the past five years, major economic powers have begun to invest heavily in the CCS, especially in its deployment in hard-to-abate sectors, those that are finding it difficult to lower their carbon emissions. In March 2023, the UK government committed £20 billion ($26.7bn) to scale up CCS projects, while the US Department of Energy allocated $131 million to support 33 research and development projects.

These investments highlight the expected value of CCS, says Eadbhard Pernot, secretary general of Zero Emissions Platform. The organization advises the European Union on carbon management, and Pernot said the fact that “carbon capture can be integrated with existing industrial processes makes it a more feasible and immediate solution

Skidmore Senior reporter, Energy and Sustainability

in many cases."

One of the most promising applications of CCS is in hard-to-abate industries such as cement, iron, steel, and chemicals, which produce high direct emissions and are challenging to decarbonize using conventional methods. In the cement industry, for example, CCS is viewed as the most effective technology for emissions reduction, given the lack of alternatives for deep emissions cuts. Similarly, CCS remains the most advanced and cost-effective low-carbon option in iron and steel production.

"CCS will play a pivotal role in decarbonization, particularly of hard-to-abate industries,” says Dan Paterson, head of transactions at energy consultancy Xodus. “You see a lot of movement, particularly in Europe and the Far East, where CCS can support

decarbonizing industrial centers."

But the potential for CCS extends beyond just decarbonizing existing industries. Paterson believes there is “a big opportunity, not only for projects in terms of developers and governments but actually for the supply chain as well, being able to balance declining oil and gas production in basins like the UK North Sea with new services in CCS or hydrogen."

As a result, CCS could play a key role in transforming the energy landscape by providing a pathway for traditional energy companies to transition into low-carbon technologies.

In the data center industry, where companies are under pressure to reduce emissions as demand for energyintensive services like generative AI spikes, CCS is gaining traction. The likes of Google, Microsoft, and Meta are making sizeable investments in carbon removal technologies.

Microsoft, which has been the biggest support of CCS among the hyperscalers, has partnered with Climeworks to remove 10,000 tons of carbon over the next decade and is working with direct air capture (DAC) firm Heirloom, as well as on a host of other projects around the world.

Meanwhile, Alphabet, Google's parent company, has supported its carbon capture startup, 280 Earth, securing a $40 million deal to fund CO2 removal. Pernot notes, "DAC offers a unique advantage because it can, in theory, be deployed

anywhere, allowing for CO2 removal in locations best suited for storage or utilization." It is building a plant next to Google's Oregon data center, and will likley use its waste heat.

In April, DCD exclusively reported that Meta was also looking to use data center waste heat as part of the DAC process.

The hydrogen economy, which aims to produce hydrogen using renewable energy (green hydrogen) and natural gas (blue hydrogen) is closely linked to CCS. To maintain blue hydrogen’s low carbon status will require the deployment of CCS to capture and store CO2 emissions generated during production.

"Emitters are finding CCS the only solution to abate those hard-to-abate sectors. This realization is driving the objectives of certain governments with ambitious stated targets," says Paterson, highlighting the critical role CCS plays in meeting low-carbon standards for blue hydrogen.

In the UK, CCS is expected to be vital in advancing blue hydrogen projects. By capturing emissions from natural gas or coal, CCS can facilitate the introduction of low-carbon hydrogen into new markets which could provide a transitional pathway, supporting the hydrogen sector while green hydrogen projects scale up and become more costeffective.

“It's challenging to make the economics work"

>> Eadbhard Pernot, Zero Emissions Platform

Despite growing momentum and investment, CCS faces several hurdles. Historically, the technology has been closely associated with large-scale oil and gas companies operating and investing in existing CO2 storage projects and pipelines. These companies, including Chevron, BP, and Shell, have ambitious plans to develop more than 200 new capture facilities by 2030, aiming to capture more than 220 million tons of CO2 annually. However, according to the IEA, these developments will still fall short of the 1.2 billion tonnes of CO2 per year these companies would need to capture to reach net zero by 2050.

Carbon capture companies themselves are not all thriving. Earlier this year, Running Tide, a company that promised to capture and hold carbon deep below the ocean, shut down blaming a lack of demand. The firm had counted Microsoft among its early customers.

Paterson believes the biggest challenge for CCS is “uncertainty on the business model.” He says: “A large number of first-of-a-kind projects need government intervention to provide support, and there is uncertainty in how a merchant market will be realized without higher CO2 ETS prices.

“CCS, as a business or an industry, has not done a great PR job historically when it is a key enabler to decarbonize. There have been several false starts in the last decade, but there is now momentum,

and the next 24 months will be pivotal, particularly in Europe, to deliver and create confidence in the sector."

Critics also point to some pilot projects' high costs and underwhelming performance.

Zero Emissions Platform’s Pernot says: "The upfront costs are high, and without significant subsidies, regulations, carbon pricing, or ideally a combination thereof, it's challenging to make the economics work." The complexity of CCS projects, which require coordination across different sectors like energy, chemicals, and heavy industries, can also lead to delays and increased costs, especially for first-of-a-kind initiatives.

Countries like Norway are leading the way in the CCS market with projects such as Northern Lights, the first commercially licensed CO2 storage facility on the Norwegian shelf, which is expected to become operational in the next two years. This project, alongside various bilateral agreements with European countries, positions Norway as a significant importer of CO2 in Europe.

to shift positively as more projects are successfully implemented, Pernot argues. "I think that as we build more projects and people see that they work and they're safe, the public perception will shift in a positive direction,” he says.

Paterson says Norway is “pushing ahead” in the CCS market, and notes: “The Northern Lights project is targeting commercial operation this year and has also signed several bilateral agreements with European countries to be the biggest importer of CO2 in Europe. The UK, whilst has cost-competitive stores, is lagging behind in bilateral agreements to enable cross-border transport."

The potential of CCS extends beyond national borders and into global markets. "You're seeing emitters really find CCS as the only solution to abate those hardto-abate sectors,” Paterson says. “This realization is driving the objectives of certain governments who have ambitious stated targets. The UK is targeting 20 million tons per annum (MTPA) by 2030, the EU is targeting 50 MTPA. Yet, we don't have any operational projects, and we are almost halfway through the decade." Public perception is likely

While the hyperscalers have provided the funding for many projects around the world, interest in CCS and carbon sequestration isn't solely in the minds of the biggest players in the market. "CCS is definitely something we are looking at, but it needs to make business sense and be available in a timely manner to support our decarbonization objectives,” says Aaron Binkley, vice president of ESG at Digital Realty. This demonstrates that data center operators are exploring all the opportunities available to support their operations' decarbonization.

These initiatives reflect growing confidence in carbon capture and removal technologies, complementing the data center sector's broader efforts to mitigate emissions. Their increasing adoption suggests that industry leaders believe in their potential to support their

"CCS will play a pivotal role in decarbonization”

>> Dan Paterson, Xodus

net-zero goals. This sentiment aligns with the broader industrial application of CCS, as Xodus’s Paterson points out: "There have been a number of false starts in the last decade, but there is now momentum."

CCS holds significant promise for reducing emissions, particularly in sectors with less viable solutions. Its role in the hydrogen economy and potential applications in hard-to-abate industries underscore its importance in the push towards global decarbonization. However, for CCS to fulfill its potential, it must overcome substantial economic, logistical, and perception challenges.

As investment and development continue, the technology's future will hinge on proving its effectiveness and scalability in real-world applications, building public trust, and creating viable business models. As Pernot puts it, these projects are “inherently complex, involving coordination between different sectors like energy, chemicals, and heavy industries, which can lead to delays and increased costs, especially for first-of-akind projects."

The next few years will be critical in determining whether CCS can meet its promise and play a vital role in achieving long-term climate goals.

Fast , scalable, reliable power.

The power you need, when you need it .

Is the grid unstable? Unable to cope with demand? Or is the wholesale electricity price too high?

Our flexible off-grid generation solutions deliver demand-side response for data center construction, commissioning and operating power

Best-in-class low emissions generation

Short-term to multi-year solutions

Tailored, scalable and right-sized

Backed by technical expertise and dedicated teams