4 minute read

COVID CAVEAT

VIEWS ON THE PANDEMIC FROM TOP CHANGE AGENTS Part II

By Larry Daniel

As reported by the U.S. Bureau of Labor Statistics recovery. Analysis issued in May by the Boston Consulting (www.bls.gov), unemployment rates coming in April Group (www.bcc.com), for example, conveyed expectations relative to March 2020 shot higher in nearly all sectors. for either a V-shaped recovery or a U-shaped recovery. Some sectors such as hospitality, retail trade, education and business services experienced tectonic shakes, while others In contrast, a poll conducted for analytics website fivethirtyeight such as information services, utilities and financial service (https://fivethirtyeight.com/) demonstrated that economists organizations were less affected. were anticipating a more-drawn out swoosh-shaped recovery.

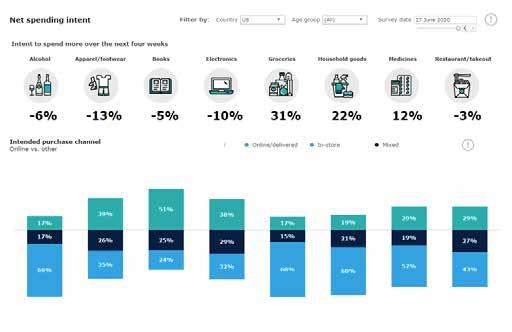

Deloitte’s website (www2.deloitte.com) drills into sectorspecific impacts with excellent commentary and infographics examining how consumers are shifting what they are spending and how they spend it. Greater portion of consumer budgets are shifting into staples such as groceries and household goods, while expenditures in apparel and electronics have trended downward. In many sectors, 30% or more of the purchasing is occurring online. Deloitte’s site has tracked the depth of the COVID-19 impact on different industries, as well as each sector’s prospects for recovery. The Hospitality and Fitness space, for example, is gauged to have severe disruption, while Power & Utilities have been much quicker to return to economic stability.

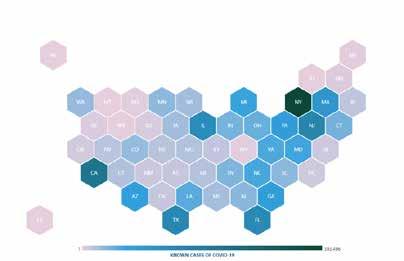

Notably, the degree that sectors have been dealt different challenges with COVID also contributes to different geographic recovery trends, as areas centered around resilient sectors (such as power and utilities) have fared better than those who are most closely tied to the more heavily damaged sectors (such as hotels, restaurants, health & wellness). Coupled with the reality that the virus has migrated around the US at varying rates (as illustrated on usafacts.org through June 30, 2020), conditions have varied considerably for consumers in different geographic markets area the country. Throughout the second quarter, most strategy consultants were generally expressing confidence that a U-shaped recovery was imminent, while research economists tended to anticipate an even longer ranging L or swoosh-shaped It is not unusual for industry pundits to express more optimism for economic futures than economists, and much of the story has yet to unfold, however, economic reports and upticks at the end of May and June have recently reinforced beliefs that a U-Shaped recovery is possible and many are hopeful that a swoosh-shaped recovery can be avoided. Whatever the pace of economic recovery might be, our country’s largest consultants agree that business will forever be changed, and that COVID pandemic has pushed us into a season of faster change.

Leading consulting agencies such as Accenture, Bain, Boston Consulting Group, DeLoitte, KPMG, McKinsey and PriceWaterhouseCoopers are recommending that companies focus especially on strengthening their digital sales channels, analytics and communications to keep pace with rapidly evolving customer dynamics. As business underwent a series of shockwaves this Spring, many consumers were getting their first deep dive into a digital world. Though millions have been on the web managing their finances and travel reservations for years, the degree of digital interaction that occurred this Spring was unprecedented. Many consumers learned to buy staples like groceries and apparel online for the 1st time, and nearly all of us leaned heavily on web conferencing tools to

keep in touch with friends, family, and business colleagues. As a by-product of these cultural and behavioral developments, it is clearly now more important for businesses to chart a fresh course for digital marketing and support communications. McKinsey, particularly, has been outstated recommending to all its readers that they would be wise to re-chart their “customer journeys.”

The strategists’ advice to see the new world through their customers’ eyes seemed poignant for us all. Personally, the circumstances today prompt me to think of one of the classic quotes from Winston Churchill. In the midst of World War II, after battling against Nazi Germany and winning the “Battle of Egypt”, Churchill spoke about the British victory stating “Now this is not the end. It is not even the beginning of the end, but it is, perhaps, the end of the beginning.” Today, his words seem particularly apropos as we ponder the continuity or normalness of the times.

COVID-19 forced us to re-examine lives that we took for granted just months ago and the pandemic has forced a dramatic shift in many consumer behaviors. It may be some time before we’ve gain clear perspective on the range of change that has accelerated around us. After examining the analysis from our nation’s top strategists, though, it’s clear that the world is more susceptible to change than ever before, and we’d be wise to plan carefully how we can change with it.