A Guide for Buyers on Becoming Homeowners

“First Story Real Estate Company is different. The experiences of buyers and sellers tell our story.

Our approach is on the deeper focus between real estate buyers and sellers.

Our agents are forward thinkers, professional leaders and technology adept.

Our culture is family, customer, and community and we feel we deliver something truly magical.”

**We will not provide advice and guidance until we understand your wants, needs, and capabilities”

1. Why are you buying a home?

2.What experience(s) have you had buying property in the past?

3. What are your main concerns about your process?

1. Timeframe: What would be the perfect day to close on your new home?

2. Do you currently rent or own? What is the status of your lease or sale?

3. Who will be involved and giving you advice in your decision making process?

4. How will you be taking title to the property?

5. Do you plan on paying cash or financing the home?

Have you spoken with/ committed to a lender?

1. Do you have any “must have” thoughts on your new home?

1. Price

2. School zones

3. Neighborhoods

4. Size

5. Amenities (lot features, frontage, pool, specialty rooms, etc.)

2. Do you have an “must not have” criteria of your new home?

1. Fixer-upper issues (move in ready vs. minor repairs)

2. Pools, limitations, etc.

1. We want to complete this process within the timeframe you desire.

2. Steps are taken to insure we make your deadline and find you the right home:

• First, how do we communicate with you?

• Daily updated searches trough TBR MLS

• Flexibility in showing times fit your schedule – Virtual Showings

• Market expertise that is always current and In tune with your needs

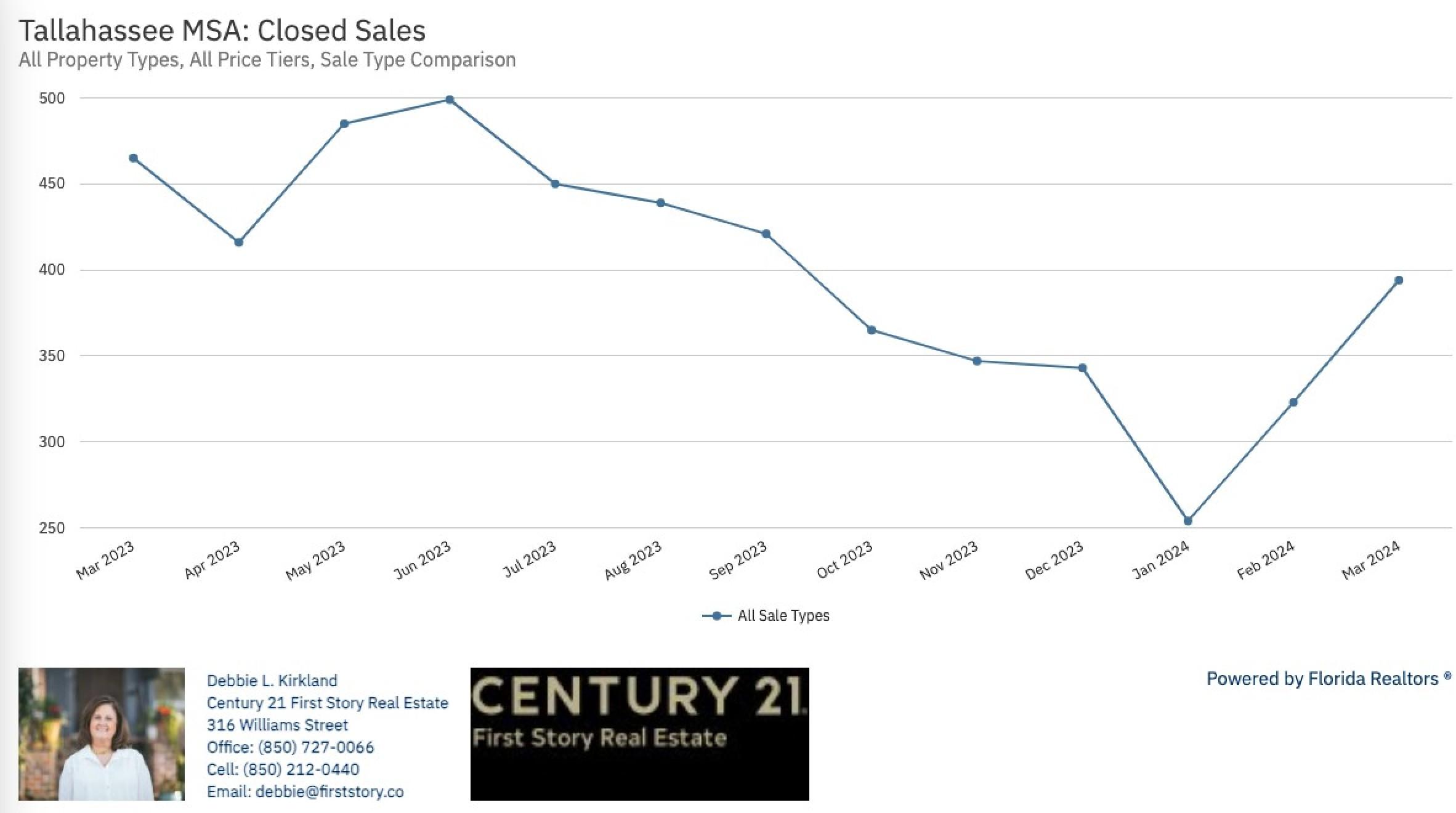

Our Real Estate Market

Value is relative. We know what a home is worth by looking at what else is available and what similar homes have sold for recently.”

We study our Market in Detail.

1. How do you think sellers feel about the market right now?

2. Can you believe what you read online or hear in the news?

3. How well do you understand current market conditions?

1. Interest rates – What makes them change?

2. Home values – Are they rising or falling and why?

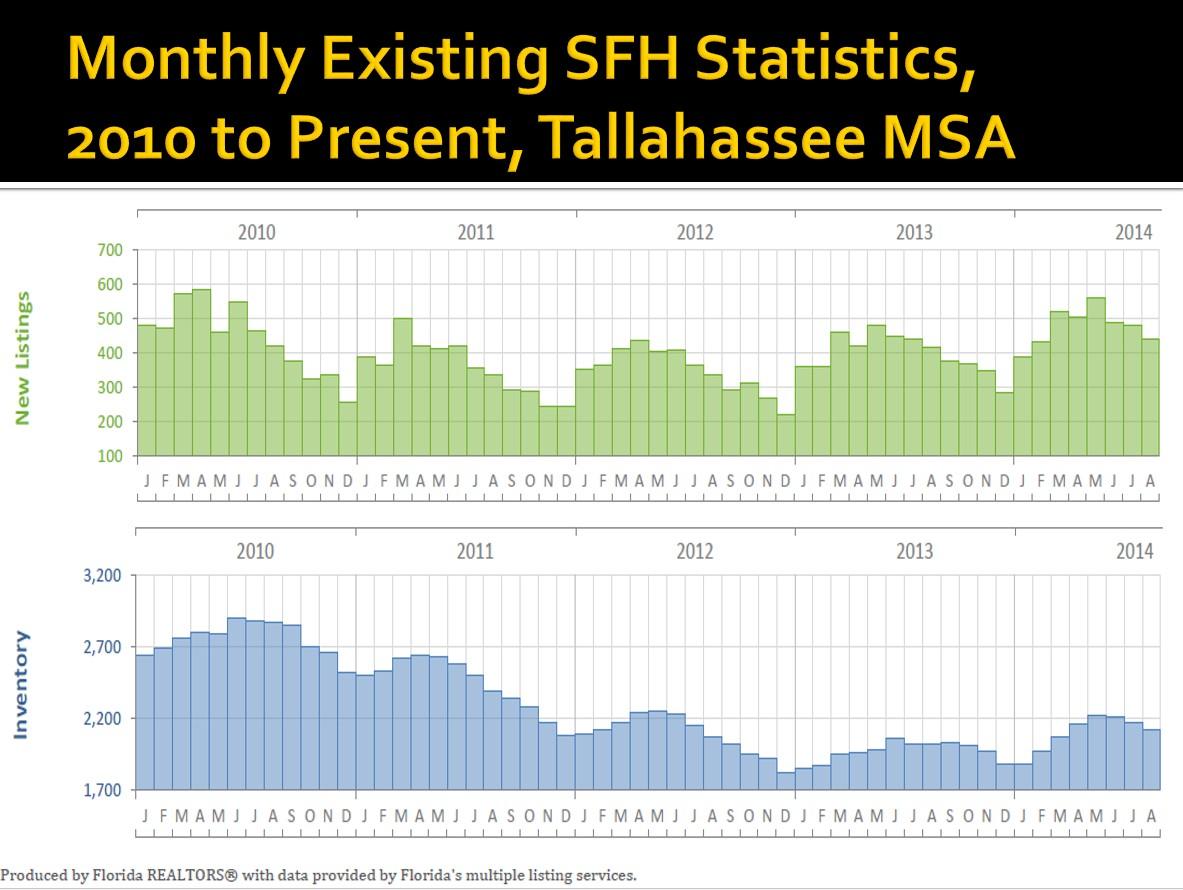

3. Supply & Demand – How does this affect you?

Your Lender will give you accurate, daily rate quotes like this. Interest rates change daily, sometimes twice a day.

We recommend local lenders.

We recommend lenders who will find the right mortgage product for your situation and who offer special programs for specialty professions, first timebuyers, lot loans, etc.

• Rates have been stable, but increases must be considered when home shopping. Prequalifying with a margin for change is critical.

• For two consecutive years home values have shown appreciation in our area.

• More buyers are getting into the market, which means more competition for less inventory. Being prepared to make offers is critical.

Knowing True Market Value is critical when making an intelligent offer which will get you results.

There is no such thing as “a good deal” if someone else gets it first.

• Preparing you before making an offer.

• Evaluating the past sales data

• Evaluating the active inventory

• Evaluating your potential new home’s condition

• How does your needs work with the home?

Will this home become a happy chapter of your real estate story?

• Location and Growth Is Everything

• School Zones Affect Home Value

• Higher Rated Schools = Higher Values And More Buyer Competition.

• Price Ranges are relative to demographics of neighborhoods

• Inventory in different price ranges may be limited or over-abundant

• Values can change from one street to another

• Rental properties do affect values

Financing (If Needed) & Cash Verification if Paying Cash

• Most important step in the process:

1. Shows the seller you are a qualified buyer

2. Pre-Approval assures the seller you are a serious, ready, willing and able buyer.

3. Type of loan (Conventional, FHA, VA, USDA) can Affect the type of home you can buy. Each one has different criteria

4. Without a pre-approval from a quality MORTGAGE lender you are shopping blind or for a property your lender will not approve.

5. You really do have to show a seller you can purchase a home. If you are paying with CASH – be prepared to show your source of funds. It’s just part of this process of proof.

6. I’d love to assist you in this process.

• Having a seasoned professional on your side gives you the edge over competition.

• I do this very well and for a living. I can assure you that when your new home hits the market I take you to it right away.

• Always available to talk/meet if we need to make adjustments to your search criteria.

• My advice is always given with your best interest in mind.

• Realtors® are bound by a Code of Ethics and this is directly related to our dealings with you, the public, and other Realtors®

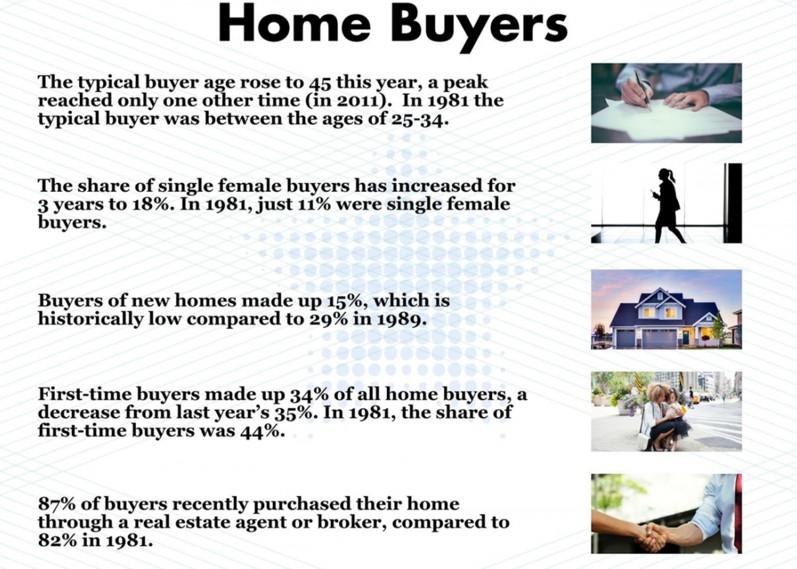

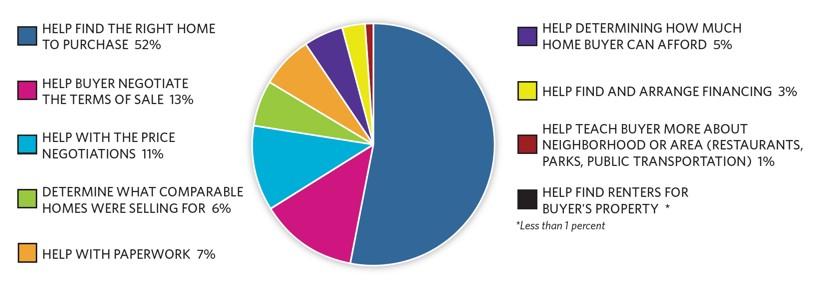

We study what Buyers want and appreciate when choosing a Realtor and we want to earn your Trust.

• Rest assured that I am experienced in this process, and will always be upfront about the probable outcomes.

• Knowing the contract is very important… I use this to protect your interests throughout the process of buying the home.

• Once under contract you will be informed and updated on all steps of the process.

In Negotiating it is important to look for leverage on your behalf. But It is also important to know the market, to make an intelligent offer based on the market scenario.

Supply & Demand Dictate Your Position

• If it’s a Seller’s market – a seller may not be willing to negotiate (very few homes available – a lot of buyers)

• If it’s a Buyer’s market – you have a better chance of negotiating. There are many, many homes to choose from and seller’s compete for buyers.

• Things to consider when making an offer:

Seller Position And Your Leverage

1. Time on the market

2. Strength of marketing plan

3. Have they prepared for buyers and mortgage requirements

4. Strength of their real estate agent (negotiator)

5. Current Market Position (Price to Value Ratio)

Good Deal = Buying Below Market Value?

• What would other buyers pay?

• What would you buy if this was not available?

• Do Seller Terms Have Any Value?

• Are There Intangibles?

• Is There Situational Value?

• If you buy low… what does that do to your property and neighborhood value?

If you walk into a home and it fits your needs, is priced well, has updates, and is getting buyer traffic:

Do you think you would be the only one thinking this home is a good buy?

How will you feel if someone else gets this home before you?

Sometimes it is better NOT to hesitate or wait out a seller… it’s risky.

• Below market prices mostly occurred2009-2012

• Low Market Value-Low chance of acceptance of low offers.

• High Market Value- Successful…. Is it priced too high or are there multiple offers?

• Can the seller resist your offer? Is it a STRONG offer?

• Above Market offers – Will it Appraise?

s

• The Inspector and I are by your side at the completion of inspection to go over any in deficiencies found in the home (PDF report sent).

• Expert advice on what we can do to obtain the maximum amount of repairs for you. I want you moving into your home with as little work to do as possible or at least, informed of work needed.

• Experience and knowing the contract in this stage are also key factors in saving you money.

• Re-negotiations are sometimes required – even on “AS-IS” sales.

• At this step we are through the majority of contingencies, and on our way to closing

• At First Story we have a transaction coordinator that is at your service at no extra charge to you.

• Coordinators Skill Set:

1. Monitors files for deadlines & completion

2. Orders services from vendors on your behalf

3. Makes sure I don’t miss anything

4. Assures a smooth seamless closing

Home Inspection, Wind Mitigation, Radon, Lead–Based Paint, Well, Septic Tank, Roof, Sinkhole, Minerals, Hazardous Materials

• What do you know about home inspections and what your lender will require to be working in acceptable order?

• This is a critical part to buying a home!!!!

• We provide you with quality inspectors to choose from. Giving you the peace of mind of knowing your future home’s story.

• I can identify areas of the home that might be an issue before we write the contract. Writing the contract with these issues in mind can protect you further, and increase your success rate of closing the deal…..saving you money and time.

At First Story Real Estate we are a full service company. We handle all the details for you before you close on your new home.

Other items we will assist you with:

1. Getting home owners insurance

2. Ordering the termite inspection

3. Ordering your survey

4. Ordering Title Insurance ( closing company )

5. Setting up a home warranty

6. Coordination of Closing Day, Documents, Funds, Permit Closures, Last-minute Document delivery, Walk Thru Management, Delivery of Keys and Instructions, Transfer of Utlities, Passing on Warranty Information

• We will set up the closing to fit your schedule.

• We have discounts for you on movers – just ask!

• Settlement statements reviews

• Utility account verification

• After the closing we do not disappear. We want First Story Real Estate to be your agency for life. And we do this by taking great care of our buyers.

Thoughts to consider before adding distressed homes to your list of properties to view

These guys are cute,..

• Time

• Money

• Unforseen Issues

• Lending Limitations

• REO Lender Contracts

But these things are not.

Unless you are experienced, and own a film crew,.. PROCEED WITH CAUTION!

1.Time frames

1. Short sales are long sales

2. Bank owned are usually “normal”

2.Property Condition

1. Short Sales vary greatly

2. Foreclosures are usually below market condition

3.The implication of getting a great deal

1. If the discount only equals the work needed, is this a deal?

2. Do you have time for fixer-upper issues?

3. Are you willing to play short sale roulette?

• Seller is in a hardship, and owes more on the note than what the home is worth

• The Seller and Agent set the price of the home….not the bank!!!

• It Can Take 60-120+ days for a bank to respond

• The Bank will likely counter your offer

• The Seller may not get forgiveness on remaining debt

• If terms are agreeable, remember these are “as is” sales

• Once you have short sale approval you typically have 30 days or less to close.

When working with Buyers in Florida there are

3 Options:

1. Single Agency

• Your agent will explain the differences, but know this, the work does not change, the process does not change,

There is no less professionalism nor no less information provided to you to help you in your decision making process.

2. Transaction Brokerage

There may be a limit as to what we can show you in single agency.

3. Non-Representation

There may be differences in you agents compensation offering or fee.

SellingAgentscannolongeradvertisea Buyer’sbrokeragecommissionthatwouldbe paidorofferedbyaseller.

DoNotAssumeSellerswillpayBuyer’sAgent Fees.

There is no one way agents get paid.

Your Agent will attempt to discover is buyer’s compensation is offered on properties you want to see.

If agent’s compensation is not offered, and can not be negotiated by concession, then Buyer’s will be responsible for their agents compensation.

Brokers reserve the right to delegate how their agents are paid by office policy. This is based on a suite of professional services provided, an expectation of time spent with buyers during a purchase process, as well as the cost of tools and technologies utilized and provided to buyers for communication, and for document compliance and record-keeping, and for the training invested in and experience level of their agents.

You are hiring a qualified, educated, and highly skilled professional for one of the most important and significant financial decisions you will make.

1. A working, professional relationship of trust, confidence and loyalty.

2. When a working relationship begins and ends.

3. What services you can expect from your Agent

4. The timeframe of your agreement to use said Agent

5. How your Agent is compensated and when compensation is paid by you.