As a valued client and homeowner, we want to make sure you are aware of a recent news story that has received lots of attention locally. A few weeks ago, Joe Hart at News4 had a story on homeowners and Washoe County property taxes. Click here to view that news story.

It was discovered that many primary residence homeowners may be overpaying on their property taxes. This story was primarily about Washoe County but could be an issue in all counties within the state of Nevada.

In order to fully understand, we need to back up a little and explain a few things.

The Nevada State Legislature passed a law to provide property tax relief to all citizens. NRS 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single-family house, townhouse, condominium or manufactured home). Please note, only one property may be selected in the State of Nevada as a primary residence. Also within the statute, a cap of up to 8% on the tax bill will be applied to residences that are not owner-occupied. The up to 8% cap would also apply to land, commercial buildings, business personal property, aircraft, etc.

Lastly, this statute states that you as the homeowner MUST opt in for the lower 3% tax cap. When you purchased your home, you may have received a letter with your tax bill. If you did not “opt in" to receive the primary residence low tax cap and send the card back to the local assessor's office, you could be paying a higher tax cap

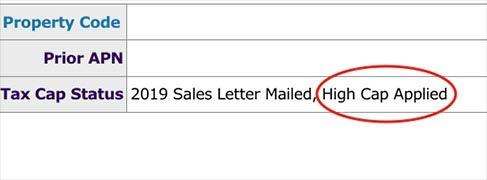

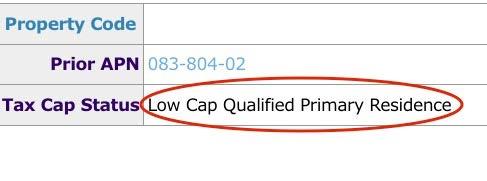

Luckily, this is easy to check and correct. Simply, log into your local assessor's office website. Type in your address, and look for the “Tax Cap Status”. If it says High Cap Applied then you are paying up to 8% on your property taxes. If this is the case for you, see the links below for how to correct this through some of the popular assessor's websites in our area. If it states “Low Cap Qualified Primary Residence” then you have the correct, low tax cap for your property.

• Click here to go to the Washoe County Assessor's page about this with FAQ's and the form itself

• Click here to fill out the form for Carson City

• Click here for property tax info in Douglas County.

As your trusted advisor, we are here to help answer any questions you may have regarding your property taxes or anything else real estate related.