Shippeo

COO and Co-founder, Lucien Besse, talks defending against disruption

DEUTSCHE TELEKOM

Karim Ouali, VP Procurement at Deutsche Telekom, on future supply chain challenges

COO and Co-founder, Lucien Besse, talks defending against disruption

Karim Ouali, VP Procurement at Deutsche Telekom, on future supply chain challenges

A growth strategy for the future comprising tools, artificial intelligence and the latest tech trends

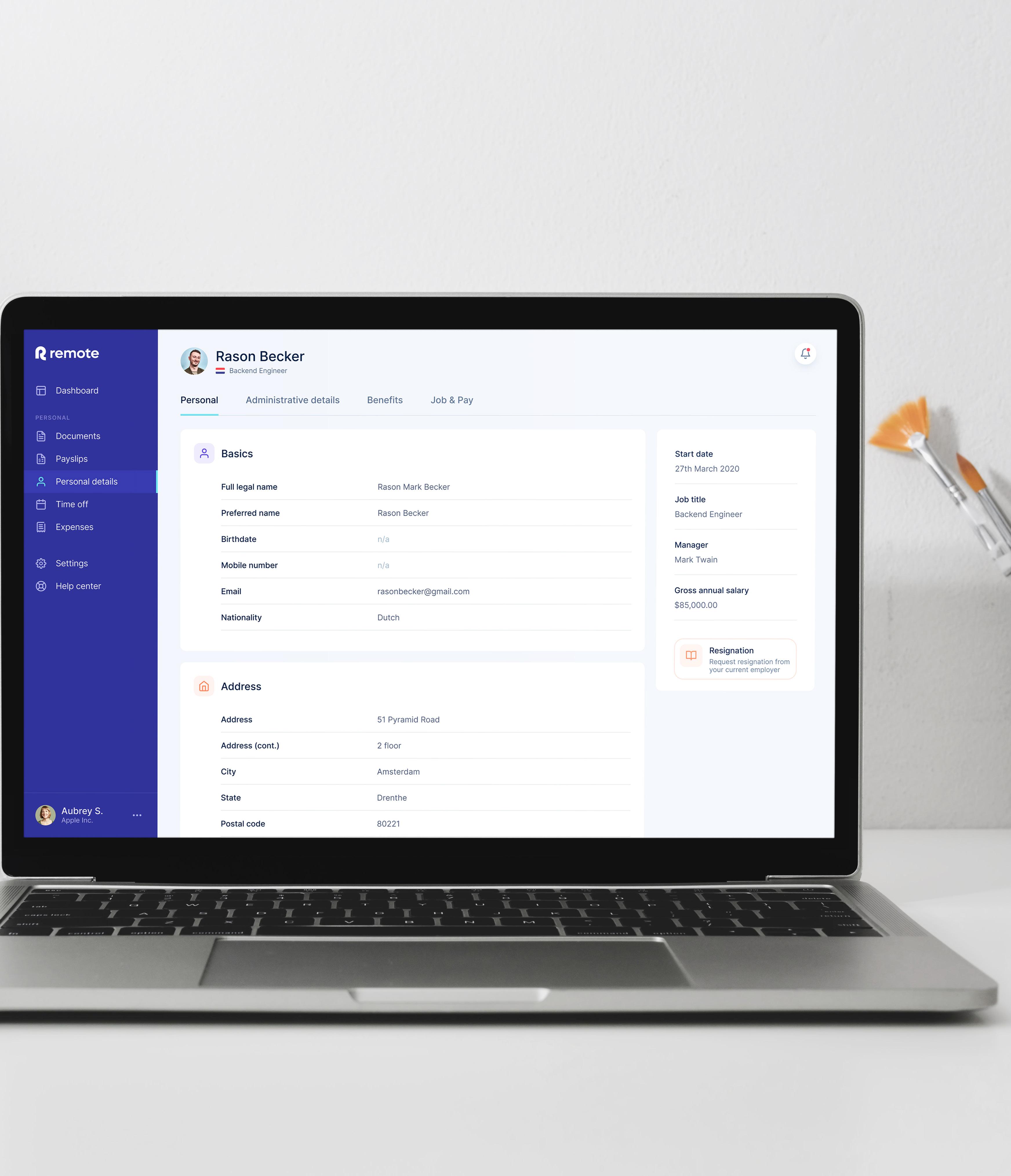

Karen Falenius, Head of Growth EMEA, supports companies in hiring talent remotely

Experian’s Mohammed Chaudhri is passionate about bringing new solutions to the market at pace

IntellectAI offers a full suite of contemporary, AI-first products powered by data insights sourced from thousands of sources – both structured and unstructured - for insurance and wealth markets.

Its products are designed using transformation accelerators like AI, machine learning, agile technology, and data science. These accelerators are coupled with highly skilled teams across core function areas of business and technology to tackle the biggest challenges for financial service institutions across North America and Europe.

The company’s suite of products includes:

• Xponent: An end-to-end underwriting workbench powered by AI, analytical frameworks and tailored workflows for Commercial and Specialty lines insurance carriers and MGAs.

• Magic Submission: The most advanced AI and data-powered Intake and Routing platform for Commercial and Specialty lines.

• Risk Analyst: The largest insurtech data platform with the highest accuracy, Risk Analyst provides comprehensive risk insights, gathered from thousands of structured and unstructured sources and enriched using big data and AI to improve underwriting outcomes.

• iESG: An AI-powered data sourcing solution to provide financial institutions bespoke ESG intelligence and embed it into their business processes.

• Magic Invoice: No touch automated invoice processing system designed with proprietary CDR Graph TechnologyTM to easily handle the variation and complexity of invoices.

The underlying technologies powering IntellectAI’s solutions marry sophistication with simplicity to ensure engaging, insightful, and contextually relevant user journeys. With a team of skilled technical experts and data scientists, IntellectAI seamlessly augments customer teams to accelerate their transformation journey, easily adapting as business models and technology evolves.

IntellectAI is the insurance and wealth practice of Intellect Design Arena Ltd, with cloud-native, API led microservices-based multi-product FinTech platform for the Global leaders in Banking, Insurance and Capital Markets.

www.intellectai.com

We are delighted to bring you your December instalment of Digital Innovation Magazine. As I write, the tree is going up in the office and all manner of Christmas goodies are accompanying our morning coffee break… Don’t you just love this time of year?

As our early Christmas present to you, we have five exclusive interviews guaranteed to inspire. Our cover star this issue is Mohammed Chaudhri, Chief Economist and Director of Market Intelligence at Experian (p6). Mohammed is responsible for helping clients to better understand what’s happening in the credit market today – a role he relishes because he gets to spend lots of time with his clients.

Next up is Lucien Besse, COO and Co-founder at Shippeo (p20). Lucien explains the importance of having full visibility of all freight deliveries to help defend against possible future disruptions.

We also talked to Karim Ouali, VP Procurement at Deutsche Telekom, about the organisation’s successful procurement transformation (p48). Karim says it’s been very much a learning journey for both him and his team.

What’s more, we have insightful interviews courtesy of Karen Falenius, Director of International Growth EMEA at Remote (p62), and St. James’s Place Wealth Management’s Divisional Director, James Frew (p86). Karen and James are keenly interested in exploring the tools and trends that can be leveraged to continue supporting their customers.

Plus, don’t miss our must-read features on sustainability (p76), solar power (p38), and our regular start-up of the month (p104)!

We hope you have a relaxing Christmas.

With very best wishes for 2023.

Danielle Harris Director

d.harris@ithink.media

Director

t.barnes@ithink.media

design@ithink.media

+44 (0) 203 890 1189 enquiries@digitalinnovationeu.com

Digital Innovation is a product of iThink Media Ltd. Company Registration Number: 10933897. Company Registered in England

Wärtsilä has opened a new Sustainable Technology Hub in Finland

countries solar

Remote is a platform making it easier for companies to hire talent from anywhere

Shippeo on defending against disruption of the shipping industry

This issue’s start-up of the month is ODrone

SJP’s Divisional Director, James Frew, highlights the latest financial services trends

We chat to Mohammed Chaudhri, Chief Economist and Director of Market Intelligence at credit reference agency, Experian.

ohammed Chaudhri, Chief Economist and Director of Market Intelligence at Experian, explains, “We help our B2B clients, including the financial services institutions, big banks and challenger institutions, to understand what is happening in the credit market day to day, so they can better serve their customers. A large part of my job involves looking at the trends and insights to get an idea of what is going to happen, giving our clients a forward-looking view so they

can adjust their strategies, always with the end customer in mind.”

Speaking of the market trends, Mohammed says the UK is on the cusp of a recession, with the economy going backwards and inflation at the highest it has been in 40 years. That said, Mohammed prefers to focus on the positives. He continues, “There are some glimmers of hope. If the government had not acted with the Energy Price Guarantee, households would have been facing bills that are

double what they are now. Everyone’s energy bill has significantly increased, but many forecasters expected them to be much higher. This winter is going to be better for all households than what it would have been if the government had not intervened.”

The current situation with interest rates and mortgage rates is a story of two facts, according to Mohammed.

1. Interest rates are going up globally. (In economic theory, the way you combat inflation is to increase interest rates.)

2. In the UK, there was a market reaction to the announcement of the mini-budget. However, we are continuing to see credit markets remaining open, with credit card lending at good pace and personal loans still available. Mohammed adds, “There has been some re-pricing in the mortgage market, but in an era of increasing interest rates, this is to be expected. The fact is that we have not been in this position for almost 15 years. When

you do not know how far interest rates are going to rise, it is prudent for lenders to re-price to make sure they are able to lend on longer products, and that they remain profitable.”

Experian’s depth and breadth of data sets the company apart from its competitors. Mohammed says, “We have a long, established view of the UK credit market, which we continue to supplement with new data. Our ability to be the first in the market with our analytics solution allows us to drive forward with the trends. At a granular level, we help lenders understand where they sit in the market, as well as the benchmarks of banks B, C and D. We are able to provide those missing parts to their market strategy.

“We are the only credit reference agency with an economics team, and the ability to train our models on our world-leading data. Living and breathing that credit data allows us to look more deeply at the key themes of the day, such as affordability, interest rates etc. We are in the unique position of bringing our data and analytics together to set ourselves apart for our customers.”

“Our ability to be the first in the market with our analytics solution allows us to drive forward with the trends”

Within the UK, Experian begins at the top macroeconomic level to set a view for its clients, but it doesn’t just stop there. Mohammed explains, “We want to turn that high-level view into actionable insights that can be used by businesses. We bring it into our regional model, focusing on industries in different parts of the UK, and we then take it one step further by looking at the local areas of employment. Linking the industrial view to local areas gives insights at a town-by-town performance level.”

If you consider the cost of living crisis and increasing energy bills, how does a lender take that headline and apply it to its customer base? Mohammed elaborates, “At Experian, we are able to understand which industries will be hit hardest (such as hospitality and transport, for example), and we know where those sectors are in the UK, so we know which local areas are most likely to be affected. Crucially, we can get a view of the household balance sheets. We are able to understand how much households are spending on energy, and whether they are seeing a pay increase that is larger than this spending. Some households will survive the crisis better than others, so we want to identify them

At UST, we work with our clients to accelerate their journeys to becoming digitised and data driven. This includes developing and implementing data strategy and focusing on the areas in which they need guidance and assistance as they strive to innovate with and leverage their data. And also, helping them to be agile and efficient through automation and digitisation.

Across industry and our wider society today, you don’t have to work in data to appreciate the impact data innovation is having all the time around us. Data underpins AI, and AI is increasingly changing our lives.

We’ve all been told that within a few years, cars will be self-driving, and we will be plugging into the Metaverse to visit people and places. While it may take years for these two things to make a significant impact, they are innovations that will drive big changes and have a major impact on behaviours within society.

Right now, however, the smaller changes AI is continually affecting - helping us complete tasks faster and more effectively - are having a greater impact on our lives Think about when you go through passport control, pay for your groceries, book a table at your favourite restaurant, or make an appointment with your GP

All these are examples of everyday processes that have elements of AI underpinning them, combining the cognitive power of AI with Automation, making them smoother and easier to follow. There are, of course, many more such examples, and they’re increasing in number every day. End to end journeys like customer and employee onboarding are completely being re-imagined, outages are prevented proactively in IT operations and ecosystems are built and managed far more efficiently.

As our society becomes increasingly digital and data-driven, there is an implicit expectation that the products and services we use each day will keep up. These expectations are one of the key drivers of the digital revolution. This was sped up by the pandemic, during which many of us spent more time online. But even as the pandemic steadily wanes, the pressure is still there to digitise, and it is becoming the new normal.

Leveraging data to develop actionable insights and AI is a key element of successful digital transformation. Within any Enterprise, there are a plethora of ways AI and Automation can be used to make operational efficiencies and improve quality and user experience. A data-driven and digitised Enterprise is one that has its data in order and processes fully digitised. Few are fully there yet, but those who have progressed in the transformation journey, have the strategies to develop, use actionable insights, AI and Automation are realising the benefits.

using our forecasts. We are then able to go back to our customers with account-level economics. When they look at the insights, they can identify households at a certain account number that will be hit hardest by inflation etc, and those that will be more resilient. Our clients have limited resources, so we want to help them prioritise where to put them.”

From a sustainability perspective, how is climate risk affecting businesses? Mohammed answers, “Most

is well-protected from the physical part of climate risk, but as the area is largely supported by the oil and gas industry, and with the increased focus on achieving net-zero 2050 targets, the transition risk will be high. Mohammed adds, “The industry must get smaller to fulfil its sustainability commitments, so the area will not be able to attract people beyond its local borders. As the jobs start to dry up or move to other parts of the economy, the transition risk will be a huge factor.”

businesses are facing two key risks. The first is physical risk. As a business, are you located in an area of the country that is more prone to flood risk, subsidence, storm damage, or coastal erosion, for example? Not all businesses will be hit by the physical element of climate risk, but they are all likely to be affected by transition risks. These are changes in the economy or law that businesses must respect.”

Mohammed shares the example of an education firm in Aberdeenshire that

Experian partners with companies that share its values and focus on innovation. Mohammed continues, “Our partners help us to bring new solutions out to market at pace. We have partnered with UST to deploy our market-leading machine learning solutions much quicker than we could have done on our own, which gives us a competitive advantage.”

Mohammed says Experian really believes in creating models that are transparent, so people are able to understand them. He explains, “We

“We have partnered with UST to deploy our market-leading machine learning solutions much quicker than we could have done on our own, which gives us a competitive advantage”

create very sophisticated and advanced models that tick a lot of boxes, but being able to make sure our clients really understand them is a top priority. We bring our faces to our solutions, along with our rationality and explain-ability, so the human touch is upfront and centre for our business, making sure our analytics is something we can stand behind.”

The pandemic, cost of living crisis and war in Ukraine have kept economists on their toes over the last few years. Mohammed says, “It has been a frantic but very exciting time. As we move forward into the future, we are trying to double down on what the market is telling us is working, making sure we continue to have the best data and bringing new opportunities into our eligibility framework. As lenders move into this era of higher interest rates, we need to be able to verify income for mortgage applications. Moving that data into the analytics space, how can we drive the new models? We are looking at launching our AIS (Ascend Intelligence Services) to constantly monitor and report on the data. We cannot simply build a model, deploy it, and then leave it there. The future is all about managing that model, bringing in new information and making sure you are standing up to the macroeconomic risks. We want to

launch a service alongside our model that will continuously monitor it and give clients the option to upgrade seamlessly.”

Mohammed spends a lot of time listening to clients to ensure

Experian’s innovation strategy addresses the market needs. He adds, “Having regular touchpoints drives our innovation pipeline, building those ideas out and allowing them to prioritise our own work so that we are continually seeking solutions.”

“At Experian, we are focusing on what climate risk means for businesses, lenders, consumers and borrowers”

From Mohammed’s perspective, climate risk is the key issue facing credit reference agencies today. He concludes, “I believe for credit risk, sustainability is something that is going to need to be addressed. We know the PRA (Prudential Regulation Authority) of the Bank of England launched in 2019 to stress-test UK banks against climate changes, but a lot has happened since then, so climate risk is getting pushed down the pecking order for some

companies. At Experian, we are focusing on what climate risk means for businesses, lenders, consumers and borrowers. Watch this space for our solution to this market need! We believe it is something that must be addressed and can’t keep getting pushed down the pecking order.”

For further information on Experian, visit www.experian.co.uk

Lucien Besse, COO and Co-founder at Shippeo, defines his company’s unique proposition.

ucien picks up the story; “The observation we made was that when you order something from an ecommerce website, you have full delivery visibility and great service. However, transportation managers in large companies waiting for containers to arrive at their warehouses every day did not have this same level of visibility. Shippeo was launched to bridge the gap between the visibility that consumers have over the last mile and a company’s visibility over the first or middle mile.”

The Shippeo platform helps any company in the world to have real-time visibility on their freight deliveries across all

geographies and all modes of transport including road, ocean, rail and air. Lucien says, “We provide a single interface to our customers to give visibility on all their deliveries, enabling them to bring a better service to their customers. In addition, this visibility increases the operational efficiency of the transportation and logistics teams because they are able to run smoother operations.”

Why is it so important for shippers, carriers and 4PLs to have full visibility? Lucien answers, “I think the main topic is to anticipate disruption. Today, as a company moving products all around the world, the main reason why you cannot fulfil the promise to your customers

LUCIEN BESSE IS ONE OF SIX CO-FOUNDERS OF SHIPPEO, WHICH STARTED LIFE IN 2015.

is disruption in your supply chain. Supply chain had a direct impact on companies’ ability to serve their customers with a product during the recent supplier shortage crisis. Visibility helps our customers to anticipate the impact of supply chain issues every day. Having visibility on your supply chain and transportation is critical because without it, you cannot fulfil the promise to your customers, which is to deliver your product on time. We have a lot of traction on the market today because customers are urgently asking for this visibility.”

When 2020 began and Covid-19 hit, companies started fearing for their businesses, but in actual fact, Shippeo had the biggest growth it has seen. Lucien explains, “Covid has an accelerating effect on the demand from our customers because everyone was working from home and people were increasingly buying products online. The importance of having visibility on your endto-end supply chain was crucial. The supplier shortage meant more congestion in the ports in Europe and Asia, and uncertainty over when products would arrive. Consumers felt the impact of

this supply chain disruption when their products were not available. The last two and a half years have seen a dramatic increase in the need for visibility because supply chains are becoming more global, more fragile, and more interconnected. If one part of the supply chain is not running according to plan, the end customer will feel the effects.”

Shippeo works with a number of different industries including retail, automotive, building materials and pharmaceutical. Lucien continues, “The business case is different for each industry, which makes what we do very rich and interesting. If you take the automotive industry, for example, the ability to have your car delivered to the car dealer at the end of the chain is related to the ability to

“Shippeo works with a number of different industries including retail, automotive, building materials and pharmaceutical”

deliver the car on the last mile, as well as the ability to be able to produce the car on time. There are two legs, which we call inbound i.e. all the supplies coming into the factories, and outbound i.e. the vehicles delivered to the car dealers. Both inbound and outbound are critical to deliver exceptional customer service, which is delivering the car to the customer on time.”

Renault is a customer for which Shippeo manages the inbound and outbound flows. Lucien

explains, “On the one side, you know when the parts will be delivered to the factories, so there is no disruption to production, and on the other side, the car dealer has visibility on the delivery of the cars, so the customers are able to have them on time.”

On the retail side, Shippeo works with Carrefour to track deliveries from the distribution centres to the stores. Lucien says, “One of the reasons for a product being unavailable is the truck not delivering on time. If you give the

store the visibility of what is being delivered and whether there is a delay on any of the products, they can anticipate the impact of the disruption and either bring a new product to the shelf or warn the customer of the delay. This visibility therefore helps the store to fulfil the promise to their customers.”

Lucien adds that all the different examples come down to the same question of ‘Where is my shipment?’. He elaborates, “If you place an order or go to visit a store, you want your product to be available. If it is not

available, you want to know where it is. And if you want to know where it is, you need to have visibility on your supply chain.”

Shippeo employs a range of technologies to build its solution, which is divided into two fundamental pillars – the network part, and the data part. Lucien explains, “To build the network, involving onboarding the carriers and connecting the systems that they are using, we have built an API solution to help us collect in realtime all the new information that is

available in the carriers’ systems. API is a simple way of exchanging information and that is the main technology we leverage.

“Once we have the data in our network, we need to have the necessary intelligence to enrich it. To be able to know when the delivery will arrive, we have developed a unique machine learning algorithm that predicts the estimated time of arrival. We have been working on it for five years, so we are recognised as one of the most advanced vendors when it comes to machine learning capabilities.”

By design, supply chain is collaborative, and so Lucien highlights the importance of Shippeo’s ecosystem of trusted partners. He continues, “You have multiple parties in supply chain taking multiple steps, so you have to make sure that the information in your platform can be transmitted to a different system. If you want visibility on your deliveries, the people in the factories are using a different system, so you need to be able to connect your visibility platform with their planning system downstream. On the upstream, you need to be able to connect your visibility platform with the planning system of the carriers

or shippers. Our transportation management system partners include Tesisquare and Alpega Group, both based in Europe. They push information into the system of Shippeo, as well as taking back information to be able to run dynamic planning. At Shippeo, we have a vision of what is happening in real time, and we can compare this real-time information with the planning information. That is where the magic really starts to happen!”

Transportation management systems are key to enabling

“Tesisquare is one of the leading transportation management systems in Europe. Tesisquare customers are using the platform to manage their transportation planning”

Lucien Besse, COO and Co-founder

Shippeo to be more agile. Lucien elaborates, “Tesisquare is one of the leading transportation management systems in Europe. Tesisquare customers are using the platform to manage their transportation planning. Our customers are using Shippeo to get real-time visibility on the execution of their transport. When we see a disruption, we push this information back into Tesisquare and then the

Alpega Group also has a transportation management system, as well as a slot management system, which Shippeo leverages. Lucien explains, “Slot management systems help the carrier to make an appointment at a delivery or loading site. If you have one carrier

“Alpega Group has a transportation management system, as well as a slot management system, which Shippeo leverages”

customer can start optimising their planning.”

that is late, the other carriers could be disrupted because your theoretical planning is in danger. This real-time information can be pushed into the slot management system of Alpega Group to help customers to start optimising the slots, so the carriers can adapt their delivery schedule to the new planning.”

As for the future of supply chain, Lucien points to three main trends. He says, “Firstly, collaboration between the different systems thanks to the API solution is key, and I think it will become increasingly important in the future. The second driver is predictability. Artificial

“As well as automation in supply chain with robotics, we are also seeing automation of the decision-making process”

intelligence and machine learning algorithms are enabling supply chain data to enrich various other systems. In the future, the system

will not only be able to predict, but also prescribe actions to the users. At Shippeo, we are working towards prescribing actions to

“We can expect to see more automation in the future designed to enrich the decision making of people working across the supply chain”

enrich decision making within the organisation.”

The third and final trend is automation. Lucien concludes, “As well as automation in supply chain with robotics, we are also seeing automation of the decisionmaking process. More and more customers are asking not just to predict an estimated time of arrival, but to be able to automate their

supply chain processes upstream or downstream thanks to this visibility information. We can therefore expect to see more automation in the future designed to enrich the decision making of people working across the supply chain.”

For further information on Shippeo, visit www.shippeo.com

Which European countries are leading the solar revolution?

For example, looking at the percentage of electricity generated by solar in the energy mix, the Netherlands, Germany and Spain come out on top, with 23 per cent, 19 per cent and 17 per cent respectively during summer 2022.

Greece is typically a top performer here too, recently celebrating generating 100 per cent of its electricity from renewables for the first time (albeit for only five hours).

The countries where solar is rapidly taking off tend to be smaller and concentrated in Eastern Europe. Poland has increased its solar generation since 2018 by a whopping 26 times, with Finland and Hungary

also rolling the renewable out at pace.

Surprisingly, the leaderboard doesn't match up to which countries are the sunniest.

Political backing and cultivating the right economic climate for solar is more important than anything else.

Jonathan Bonadio, Senior Policy Advisor at SolarPower Europe, said, “Photovoltaics (PV) is a technology which is applicable up to the southern half of Sweden. Even in the middle of Sweden, it still makes sense, with the decrease of the cost of PV panels, and the overall cost reduction.”

With countries of such varied shapes and sizes, it is hard to

THERE ARE A

YOU

make a comparison. Luxembourg actually has the highest percentage of solar, but with less than 65,000 inhabitants, it is something of an anomaly. Germany, the largest economy in Europe, has the highest solar capacity target in the EU (215GW), aiming for an 80 per cent renewable share by 2030. Other countries including Austria, Denmark and the Netherlands are aiming for 100 per cent renewables by the end of the decade.

Bigger countries also have the best auction results, with Germany, Spain and the Netherlands auctioning the largest quantities of renewables. Denmark is also on this list, and it’s hoped that Norway, Italy, Sweden and Belgium will follow suit.

Ember analyst Harriet Fox said, “Solar is such an easy way to fix the energy crisis or reduce it, especially for next winter – which people are already saying is going to be even more testing than this one, because

we'll probably have run through our gas reserves.

“You could easily get a solar park up and running in a year, if you have the political and social and environmental acceptance.”

Agonising over the trade-off between fertile land and solar sites is pretty unimaginative, given all the new and emerging options out there. Not least agrivoltaics, the practice of using land for both agricultural and solar energy

generation. Panels can provide shade to protect crops during heatwaves, for example.

Germany and France have several projects that demonstrate this dual use. And a new report from SolarPower EU reports how biodiversity can be boosted on these sites, starting with a stocktake of species on previously intensively farmed fields.

Panels are being installed on noise barriers in the Netherlands and

Switzerland, where plans for solar highways could generate as much as 55GW of output.

Plus, railways are getting the solar look too, and not just on adjacent wasteland. Germany’s national train company Deutsche Bahn is experimenting with adding solar cells to the sleepers on the tracks. If rolled out across the whole 60,000km long DB network, the British company behind the scheme estimates it would generate the equivalent power of five nuclear power plants.

Old coal mines are another prime spot for solar; they’ve been getting a new lease of energy life from Poland, Romania and Bulgaria to Spain.

"GERMANY’S

EXPERIMENTING WITH ADDING SOLAR CELLS TO THE SLEEPERS

Then there’s ‘blue’ solar; the reams of panels that are placed on natural and artificial bodies of water. Portugal now has the largest floating solar park in Europe, four football pitches long, on the Alqueva Reservoir.

Even on the water’s surface, solar panels can make a positive contribution to the ecosystem. Bomhofsplas Floating PV plant, located on a reclaimed industrial sandpit near Zwolle in the

Netherlands, is a prime example of this. It has installed 20 ‘biohuts’ at the edges of the floating plant, acting as nurseries for small fish and aquatic microorganisms.

It’s time, rather than space, that presents the biggest challenge in boosting Europe’s solar capacity. Speeding up the permitting process which, though quicker than that for wind, still exceeds the EU limit of two years in most countries, must be a priority.

And there’s a core bit of negotiating to be done too. While the European Parliament and Commission are set on achieving 45 per cent renewables by 2050, some member states are pushing for a lower 40 per cent target.

SolarPower Europe’s Bethany Meban argues that the upper end “is the most cost efficient way to climate neutrality by 2050.”

Source: www.euronews.com

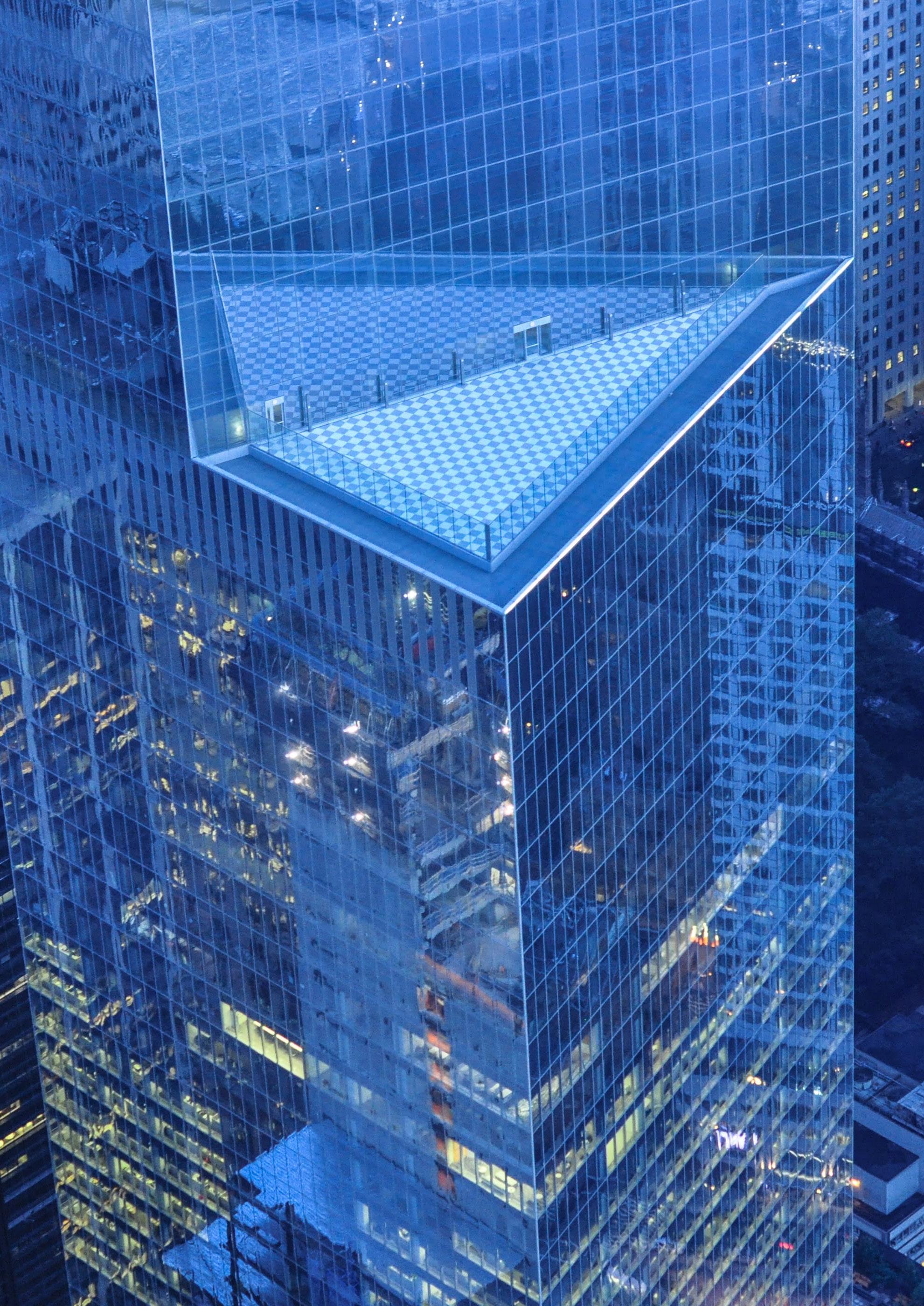

Karim Ouali, VP Procurement at Deutsche Telekom, explores the company’s journey to being more proactive, with a close eye on future supply chain disruptions.

task that was no mean feat for a company of this size, Karim Ouali, VP Procurement, explains, “We defined four stages in our journey. We are confident that we are now at the end of the third stage whilst working in parallel with stage four.”

The four stages are defined as follows:

Stage one

Standardisation of the master data; Stage two

Harmonisation of processes and core systems, implementing

one sourcing suite throughout the entire organisation and defining KPIs; Stage three

The era of data, creating an analytics platform whilst fixing some data topics; Stage four

Data-driven procurement, using the data to get insights, as well as anticipating the future and creating viable use cases.

Karim says, “Stages one and two are focused on bringing efficiency, but stage three is around entering the era of data. This is where we need to get more usage out of

the data, as opposed to simply enabling the creation of structured data. Based on the use cases, we have been able to proceed to the fourth stage.”

Why is it so important for Deutsche Telekom to reach the fourth stage of data-driven procurement? Karim answers, “In the past, there was no anticipation. We waited until there was a business need, such as a contract expiring. The reality is that if we wait for a trigger, we will lose time and money, and we may not even be able to meet the demands. The triggers today are disruptions in the supply chain, so if we can anticipate the future based on the data, this puts us in a better position to negotiate contracts. This is why stage four is so crucial for us.”

Recent disruptions in the supply chain have included suppliers going bankrupt, Brexit, and the Covid-19 pandemic. Karim continues, “We had products stuck in the US when a Chinese forwarder was made insolvent, then Brexit came along. We have around 180 interactions with British or British-based suppliers, so we had to react quickly to deal with potential increases in cost. We are still in the process of tackling the Covid situation whilst looking forward to identify potential future risks. I believe the next huge risk will be an aluminium

shortage because the production of aluminium requires magnesium, and 90 per cent of magnesium is produced in China. With mounting tensions between the US and China, this is a disruption we can expect to happen. The key is to move from being reactive to proactive, so if something like this does occur, we are prepared because we have increased stocks or diversified our supply chain.”

Karim highlights the fact that Deutsche Telekom’s journey is a learning journey, as well as being one of digital transformation. He explains, “We learned how to fix problems quickly, and we showed evidence to prove that we could do it. I don’t want to see the same issues come up again and again in the supply chain. I would like to anticipate the future based on our learnings.”

Agility does not just pertain to the process, but it is a mindset, as Karim emphasises, “For me, the biggest challenge is having agility in the mindset because you need to trust the data, and that is a problem. In stages one, two and part of stage three, if you require data, there is a process for taking the data out of the system, making

sure it tells the story that you would like to tell. But, in the later phase of stage three and stage four, there is no manual preparation of data, and the truth is based on the data only. People still don’t have the level of trust in the data to say that something will happen in the future based on these insights. People want evidence, which a forecast cannot show. This is a real challenge for the mindset topic.”

Karim is responsible for the digital team and the team for sourcing of fibre roll-out services, both within Deutsche Telekom’s procurement. He argues that the development of the people is fundamental

"WE STRIVE TO DEVELOP OUR PEOPLE AND THE RATIO IS HIGH. WE STILL HAVE A FEW POSITIONS WHERE WE NEED TO BRING PEOPLE IN FROM OUTSIDE, WHICH CAN BE BENEFICIAL FOR THE COMPANY"

to each stage of the company’s procurement transformation journey, as outlined below:

Stage one

The digital team is required to have system expertise to define the requirements for standardising the master data;

Stage two The digital team then become

process experts, understanding how sourcing activities are running, while the procurement team is required to enter data into the system capturing all stages of the contract negotiation;

Stage three

Having understood how procurement works, the digital team become data analysts in order to understand the data,

derive insights, and define threats and opportunities, while the procurement team is asked to perform best-fit negotiations to bring their skills to the next level;

The digital team is developed from data analysts to data scientists.

Karim adds, “We strive to develop our people and the ratio is high.

We still have a few positions where we need to bring people in from outside, which can be beneficial for the company. Luckily, though, we have a good rate of internal people who will reach a high maturity level.”

Aside from the people, Karim points out the importance of technology in any modern-day procurement organisation. He

continues, “We work with our own IT infrastructure, as well as the systems of our partners. Stage one and two were all about bringing efficiency and not looking for innovations. When alternative solutions started to enter the market in 2014 and 2015, we were able to integrate digital processes that were previously outside the system. We are now a few years

Scope 3 emissions. Technology is more than just a system – it is a service that comes from a good understanding of the business needs.

“Sievo is our data procurement analytics platform partner. They know that I don’t want to talk to them about structuring the data, but the use cases. They come to

down the line, and technology has overloaded us with new capabilities. It is so mature now.”

These days, Karim does not go to trusted partners to ask them to solve an issue. Instead, the technology companies come to Deutsche Telekom with new opportunities to increase supply chain resilience, reduce risks, and bring about savings, for example. Karim continues, “The role of a partner is to understand our business and to come to us with potential new solutions, such as a solution for reducing our

us regularly with new technical innovations, which is exactly what we need. They have a lot of data from other companies at their disposal, which they can use to identify trends and best practices. Their expertise is invaluable to us.”

Deutsche Telekom’s vision is to automatically create a negotiation roadmap based on correlation between internal demands and external events. Karim says, “We want to achieve the best-fitting solution to the sourcing activity in the

"SIEVO

TO US REGULARLY WITH

IS EXACTLY WHAT WE NEED"

negotiation roadmap. I believe we are on the right path, but we still have a lot of work to do. To complete our vision, the next step will be to anticipate the supply chain developments, as well as the disruptions, to define the negotiation roadmap based on the data.”

The other pillar for the future is to increase the resilience of the supply chain by being more proactive. Karim concludes, “By increasing resilience in our supply chain, a future disruption will not affect us too heavily. It is not only IT development and the digital journey, but the mindset transformation that will be key. Evolving skills requires acceptance, and acceptance means mindset.”

For further information on Deutsche Telekom, visit www.telekom.com

"IT IS NOT ONLY IT DEVELOPMENT AND THE DIGITAL JOURNEY, BUT THE MINDSET TRANSFORMATION THAT WILL BE KEY"

Karen Falenius, Director of International Growth EMEA at Remote, explains the meaning behind the statement ‘talent is everywhere but opportunities are not’.

aren Falenius, Director of International Growth EMEA, has been at the company for just over a year, and is responsible for spreading the word about the benefits Remote can bring. Karen explains, “Imagine finding great talent in Spain, but your company is located in the UK. You would need to open up your own entity to employ the person. Instead, we offer companies the capability with the use of our platform. We help to solve the complexity

of hiring abroad because it is not easy to make sure you are compliant and have taken care of the taxes, among other things.

Remote gives organisations the opportunity to be able to focus on the great talent they want to hire.”

There is a global talent shortage across many industries at the moment, especially the tech space, as well as marketing, sales and HR. Karen says, “If you want to make sure you find the best people as quickly as possible, it is in your own interest to open up your search and

look for someone remotely. Not all companies are at this stage yet, but the pandemic enabled us to get used to this model and see the advantages.”

Karen’s background is in marketing and in leading growth teams, specifically in the technology sector. She highlights, “It is all about finding the possibilities to let people know about the option of hiring remotely, and giving them the best support so

that when they do hire someone, they are able to manage them well. Companies need the right culture and education to be able to do this successfully.”

Remote’s growth strategy includes online marketing, digital advertising and research. Karen explains, “We try to create value, so we have reports that we can provide to potential customers about the advantages of our

platform and how we are able to meet customer needs. There is very interesting data on the increased appetite for working remotely. We also attend some great in-person events, where we are able to share our story and talk to as many people as possible.”

Karen describes Remote’s mission as raising awareness of the reality that people can make a great living wherever they choose to be,

enabling them to have a great life/work balance without missing out on amazing careers. She adds, “Remote working creates opportunities to people in rural areas or in countries that are outside of the big tech hubs. Ultimately, Remote is changing the way people are being employed on a global scale.”

Remote is able to resolve pain points like managing the

onboarding process when hiring talent from any country in the world. Karen explains, “If you hire in France but you don’t speak the language, it is a real obstacle. You would probably need to hire a translator, as well as a lawyer to advise on the employment laws. We have local experts that make sure everything is in place, so the customer can focus on ensuring they have the right person for the job. From an employee’s perspective, people

about the outcome. At Remote, we don’t care how many hours you work, but whether you are delivering on time and getting the work done. At the end of the day, you have been given all the tools to make it work and are responsible for yourself.”

Karen believes you can be trained to work remotely with the support of your company. She says, “We dedicate a lot of time at Remote to

Karen Falenius, Director of International Growth EMEAoutside of big cities are given the chance to have a nice life, career, good pay, and flexibility. Flexibility is perhaps the biggest benefit for people working remotely.”

According to Karen, the data shows that people are just as productive when they work from home – if not more so. She elaborates, “I really challenge the idea that people need to deliver a certain number of hours in their working day. For us, it is all

team bonding, which creates trust and ensures people feel included. Mental health is a big topic for us. As long as we can create the right culture, people will feel a real sense of belonging. We have a policy in place and we live by the values of kindness, ownership and transparency to help create this culture.”

Speaking of transparency, everyone at Remote is encouraged

“I really challenge the idea that people need to deliver a certain number of hours in their working day. For us, it is all about the outcome”

to communicate regularly and transparently, so there are almost no private conversations.

Karen adds, “We try to give every individual the same type of information and we document everything, so people have access to everything they need to do a good job. And we ensure people feel they can always ask for help if there’s something they don’t know.”

Remote puts a lot of emphasis on employing diverse teams, offering some great tips to customers on how to hire inclusively. Karen continues, “Remote working naturally opens up opportunities for diversity. It isn’t hard to be diverse when you hire remotely, because you immediately have more choices. If you are bound to a specific location, you do not have access to the global talent pool.”

One of the advantages of the platform for fintechs lies in ensuring compliance in payroll globally. Karen explains, “First of all, you have to look into every country, and we have specialists in-house who do just that. Our experts make sure the global payroll is accurate and that we are compliant. This is an incredibly complex task, and we are very proud of the dedicated team responsible for this function.”

Karen stresses the importance of people; “People are everything. We

they are doing well. Everyone has access to a learning budget, so they can choose something they want to learn throughout the course of the year. Motivating factors such as unlimited holiday help us to attract the best people. As long as they get the job done, they can choose how many days they want to take off each year, which works rather nicely for us.”

Remote has built a strong ecosystem of trusted partners, as well as joining forces on several

have managed to grow from 100 to almost 1,000 employees in a year. We have been a unicorn for a while now, and we recently closed another funding round of $300 million at the beginning of 2022. A lot of money was invested in making the product better and finding the right team. This was only possible because of the remote structure that we have here at Remote. There is a lot of effort being put in not only finding the right people, but making sure

partner programs. Karen explains, “We have something called a Talent Marketplace. While Remote doesn’t provide the talent, we make sure companies have the right tools to employ people. Hired is a great partner that helps to source talent, particularly in the tech space, as well as assisting in employing talent in a specific country. We make sure our partners are the best, doublechecking them ahead of time to

“Hired is a great partner that helps to source talent, particularly in the tech space, as well as assisting in employing talent in a specific country”

Remote work puts the world of talent at your fingertips. Hired’s 2022 State of Tech Salaries report revealed employers continue to expand talent pipelines and hiring across an increased number of markets and timezones. This gives virtual or remote-first employers a competitive edge in multiple areas, including building teams with diverse points of view and skill sets.

Hired’s recruiting marketplace helps companies efficiently source talent from around in the world while Remote helps companies legally and compliantly onboard and pay employees. Together, they create a powerful global hiring solution to help growing companies source, vet, onboard, and pay the best candidate for the role.

With unbiased insights, DEI tools, skill assessments, and dedicated Customer Success Managers, Hired works with over 10,000 companies around the world to match thousands of active and qualified candidates from more than 100 countries to employ their full potential. With better data, curated matches, and higher acceptance rates, employers save an average of 45 sourcing hours per role with the Hired solutions suite.

Backed by The Adecco Group, Hired is rated by G2 as a leader in Recruiting Automation, Job Search Sites, and Diversity Recruiting. Most recently, Hired earned 20 more G2 awards for Fall 2022, including Leader of Recruiting Automation for Europe.

Demand for remote work has more than doubled in the last year on Hired’s platform. Now, with over 60% of companies on the platform hiring remotely, Hired connects them with qualified candidates from around the globe. Employers have visibility into candidates’ upfront salary expectations, skills, years of experience – and remote and time zone work preferences – to surface the best talent from anywhere.

Hired CEO Josh Brenner praised the move by companies large and small to expand globally. “For a long time, only large corporations had the resources for a global footprint or staff around the world. Now startups and mediumsized businesses can do it, too, with help from Hired and Remote. Plus, this strategy levels the playing field for talent. It provides them with equitable opportunities no matter where they’re located. Supporting global talent and businesses of all sizes is part of our goal to make hiring more equitable, efficient, and transparent.”

Expanding global hiring promotes DEI by incorporating people with diverse backgrounds and thinking, which studies show increases productivity and innovation. For example, one of Hired’s long-standing enterprise customers transitioned to virtual-first early in the pandemic. In one of Hired’s panel discussion events, the organisation shared they quickly discovered how often they sought the same Software Developer degree and career profile over the years.

After opening roles beyond the San Francisco Bay Area, they uncovered a wealth of talent, infusing their teams with fresh perspectives and points of view. Remote work made it possible.

Advocating for global hiring, Hired’s CTO Dave Walters, explains “You have to keep extending your talent pipelines outside the traditional tech hubs and regions. When looking globally… the more you expand across borders, the better off you’ll be. Global used to be primarily a cost savings measure by companies. I look at it now as a necessity to stay competitive and find great talent. Any cost savings you might get are secondary because at the end of the day, if you don’t have great engineering talent…you will impact your top line.”

Committed to building equity in the hiring process through a more representative talent pool, Hired’s platform also offers specific features to promote DEI. This includes bias reduction features, customised assessments, and salary bias alerts to help eliminate unconscious bias.

The hiring landscape remains competitive as companies innovate and diversify their teams through remote work that reaches beyond borders. Hired and Remote’s complementary offerings make this easy by supporting global hiring from sourcing all the way to onboarding and payment.

Learn more about global tech sourcing with Hired

ensure they will bring value to our customers. Hired is a good fit for us because they are a global company and can help with a multitude of roles.”

Alongside this Employer of Record product, Karen is excited to be launching Global Payroll. She

continues, “Based on customer feedback, we are planning to offer Global Payroll to more customers, as well as helping with onboarding and hiring contractors. If you don’t want to hire a person directly but you’d prefer to use a contractor, we can definitely help with that.”

“We are very diverse, so you get to learn something new every day. I am looking forward to becoming even more local, supporting customers in each country with exactly what they need”

So, what’s next for Karen on a personal level? “I love my job and our fantastic team. We are very diverse, so you get to learn something new every day. I am looking forward to becoming even more local, supporting customers in each country with exactly what they need. My goal for the next few years is to become even better at listening to our customers because we want them to be happy, as well as their employees. I enjoy working for a company that is doing something meaningful, giving people around the world the same opportunities in

life; the ability to combine a great career with a family.”

Talent is everywhere but opportunities are not. Karen concludes, “This is a great sentence, and I have heard it a lot from our co-founders Job van der Voort and Marcelo Lebre. It defines our mantra so well, and this sentiment is exactly what I love most about Remote.”

For further information on Remote, visit www.remote.com/about

Wärtsilä has opened a world-leading Sustainable Technology Hub to accelerate marine and energy decarbonisation.

Wärtsilä, global leader in innovative technologies and lifecycle solutions for the marine and energy markets, has recently opened its new technology centre, the Sustainable Technology Hub, in Vaasa, Finland.

he centre will contribute to efforts in advancing the global decarbonisation of marine and energy by fostering innovation, collaboration, and the development of green technologies using sustainable fuels and digital technologies. The opening was attended by invited guests, notably Finland’s Minister of Economic Affairs, Mika Lintilä. Håkan Agnevall, President and CEO of Wärtsilä Corporation, said, “The speed at which the marine

are moving to meet decarbonisation goals is accelerating. The Sustainable Technology Hub (STH), a worldleading centre for research,

today, we can speed up the development of future-proof engines capable of running on sustainable fuels. We can now demonstrate that a carbon neutral future is achievable.”

Wärtsilä already has engines operating on carbon neutral fuels. This year, the company released its Wärtsilä 32 Methanol engine to

the market, and within 2023, an ammonia concept will be ready. A hydrogen concept is expected to be available in 2025.

In his opening speech, Mika Lintilä said, “As we all know, Wärtsilä is a global leader in innovative technologies and lifecycle solutions for the marine and energy markets. Now Wärtsilä is

“BY

making history by having made a significant investment in Finland, and particularly in the Vaasa region, where the company has been a driving force for a long time.”

The construction of the new centre was announced in 2018, with a total investment of around 250 million euros. It features a modern fuel laboratory, flexible technology and engine testing facilities, as well as a state-of-the-art production system with a high level of automation. The centre employs 1,500 people under one roof, providing operational efficiency, plus a reduced carbon footprint in logistics. The centre has advanced energy recovery systems that enable self-sufficiency for heat energy. With the expansion of sustainable fuels, the STH will be a cornerstone for achieving the

INVITING CUSTOMERS, PARTNER COMPANIES AND ACADEMIA TO INCUBATE, TEST AND VALIDATE IDEAS, THE CENTRE WILL ALSO ACT AS A GLOBAL ECOSYSTEM OF COLLABORATION”

company’s 2030 target for carbon neutrality in its own operations.

Innovation and the development of service solutions will be an important part of the Hub’s output. A new, modern Wärtsilä Land & Sea Academy training centre, Customer Expertise Centres for remote operational support, predictive maintenance solutions, and the development of new digital innovations will play a central role in supporting customers to optimise their operations throughout the lifecycle of their assets, and to accelerate their decarbonisation journey.

By inviting customers, partner companies and academia to incubate, test and validate ideas, the centre will also act as a global ecosystem of collaboration.

One major collaboration is the Wasaline ferry ‘Aurora Botnia’. Wärtsilä and Wasaline closely cooperated to establish this vessel as one of the world’s most energy efficient and environmentally sustainable passenger ferries. The collaboration continues with the vessel being used as a floating testbed for Wärtsilä’s future innovations.

For further information on Wärtsilä, visit www.wartsila.com

Danny

Danny

"A highly professional approach"

Andy Brierley, Vice President, Cloud Application Modernisation at IBM

"Digital innovation Magazine is a very flexible and professional team"

Kim Larsen CTIO, T-Mobile Netherlands

"Absolute pleasure working with the Digital Innovation team"

Mun Valiji, Chief Information Security Officer at Sainsbury’s

"The team were professional and diligent throughout"

Leigh Feaviour, CTIO for BT’s Supply Chain

St. James’s Place’s Divisional Director, James Frew, talks about the part technology can play in supporting face to face financial advice.

ithin SJP, James is working on leveraging the next generations of technology to support Advisers.

The key to SJP’s development of their Advice Assistant is the drive to make it easier for their advisers to do business with SJP through embracing technology.

SJP, working with SS&C and Intellect Design Arena, has developed a tool called the ‘Advice Assistant’, aimed at supporting their advice and reducing the time is takes for advisers to create end to end advice documentation. It combines automation and

Artificial Intelligence (AI) to help advisers document and track their advice more efficiently, in line with SJP best practice.

James explains, “AI and Machine Learning (ML) are not well understood as yet, so part of my role is to understand and communicate how these technologies can contribute successfully to the continued growth of our business. This includes helping to build insight into the differences between often competing technologies in the market, including Artificial Intelligence.”

In the year 2000, there were around 100,000 financial advisers in the UK. Today, it stands at around 35,000 active advisers, with SJP having around 4,600. James elaborates, “SJP is the leading player in the market for face-to-face financial advice. Our challenge is to give our advisers more time to see their

clients whilst freeing up their office teams to support them with other services. The face-to-face element is key to achieving good outcomes. Greater technological support with the underlying process is an important addition when it comes to supporting those advisers.”

“While SJP is, and always will be a people business, there is space to innovate with the technology available in the wealth management industry. Our business model will not change. However, advisers want to provide services to their clients, with the checking, administration and process being as efficient as possible. Good financial advice is all about getting to know the client. A fully developed Advice Assistant will offer the opportunity for our advisers to spend more time with their clients and less on administration and waiting for checks to be done, so it is a win for both the adviser and their clients.

James continues, “The Advice Assistant streamlines the production of advice documentation. While ‘the plumbing’ takes care of the majority of the process we are starting to use AI to understand and assess the context of the notes

the adviser has made to help tailor the advice.

SJP has grown rapidly in its 30 years, with the demand for financial advice continuing to increase. This is where technology can assist. James explains, “We have built our AI system to go beyond the simple automation of existing processes. We’re at the early stages of combining the power of face-to-face advice with

“Our

““By reducing the time that advisers and their teams will be able to see more clients whilst continuing level of support, which will help facilitate our strategy

our technology to support the adviser, built on years of data about what good advice looks like. It is designed to reflect on key parts of the Partner’s interaction with the client - to analyse the notes, fact find information, CRM data, for example – to help build the most comprehensive picture.

You cannot simply input all this information into an app; the client needs to have a conversation with a qualified person and an adviser must be able to take their own notes and record them into our CRM system. A tick box approach will not do. Having a human relationship with the adviser is key, with the AI working in the background to help reduce the admin overhead for the adviser. According to those SJP Partners who have been involved in our early-stage testing, the Advice Assistant is able to reduce a 60-90-minute process down to as little as five minutes, which is a significant time saving.”

James says SJP’s Advice Assistant is currently being piloted for ISAs, but there is a plan to develop it for other

SS&C, a global provider of technologypowered solutions and services for the financial services industry is expanding its presence in the wealth management sector. More than 2,000 wealth management firms worldwide rely on SS&C to administer around US$2.4 trillion (£2.12T) in client assets. Over 10,000 advisors leverage SS&C platforms to service some 7 million investor accounts.

Key to SS&C’s rapid growth in wealth management is its ability to plough a significant percentage of annual revenue back into continual innovation – the company invests an average of US$400 million (£353M) in R&D each year. Moreover, SS&C often engages clients in technology initiatives. Earlier this year, Sanlam Insurance Limited, Africa’s largest non-bank financial group, selected SS&C to collaborate in the digital transformation of its subsidiary, Glacier Financial Solutions, an investment platform with more than R400 billion (£19.51Bn) in assets under administration.

In 2022, SS&C added the innovative multiasset, multi-product and multi-currency wealth platform - Hubwise Securities Limitedin the UK to further expand its market coverage and to enable wealth managers to focus their capital spend on serving their individual investors and growing their businesses.

A more recent example of a successful innovation partnership is Advice Assistant, an AI-powered solution developed in concert with St. James’s Place (SJP), SS&C’s largest wealth management client in the European

market. Advice Assistant leverages machine learning to help advisors confirm that their advice to a client is in keeping with best practices while automating the related documentation.

“There was a problem we needed to solve together,” explains Nick Wright, SS&C’s Head of Global Investor and Distribution Solutions. “That’s what you do in a true strategic technology partnership. With the AI and machine learning technologies available today, and the historic case data held by SJP, we created a solution that uses SJP’s best practices and intelligently learns from past cases. We have reduced the time of the process including the production of documentation from 90 to just 30 minutes, a significant saving for advisors.”

There are plans to expand this solution into more complex areas such as retirement planning, applying the same machine learning principles to eliminate laborious manual case checking.

SS&C’s deep relationship with St. James‘s Place includes the administration of £150 billion in AUM on SS&C’s wealth platform. SS&C also provides comprehensive, omnichannel contact centre operations directly in support of over 1000 advisers. SS&C fields around 40,000 calls and 20,000 online chats for SJP on average each month.

SS&C sees further opportunities for innovation with the company’s recent acquisition of Blue Prism Group, a developer of intelligent automation

solutions that help reduce repetitive backoffice tasks. “We are really excited to bring Blue Prism’s RPA expertise to our clients,” Wright says. “As platform fees continue to compress, back-office automation becomes critical to a firm’s survival. We can help clients thrive in the new digital advice world.”

The front office, too, is ripe for automation. SS&C’s Advent Genesis is a cloud-based portfolio construction and rebalancing solution for portfolio managers. It enables portfolio teams to build and manage bespoke client portfolios at scale, automating key tasks while dramatically accelerating the process from portfolio decisions to trading, and freeing managers from time-consuming manual workarounds.

SS&C can help wealth managers shrink their IT footprint, consolidate systems and streamline operations. Our solutions deliver the agility and scale for firms to adapt rapidly to changes in the regulatory and business environment, and to expand their offerings to be more competitive –all while dramatically reducing the total cost of operations. Contact us to learn more about the benefits of automation for wealth management.

Contact us through our website and speak to one of our experts.

www.ssctech.com

areas in the company’s portfolio within the next few years. He adds, “By reducing the time that advisers and their teams spend on admin, they will be able to see more clients whilst continuing to provide the same level of support, which will help facilitate our strategy for growth.”

There are two key processes at work. Natural language processing is used to interpret the notes taken by the adviser in a few key areas. The data is then passed into the Advice Assistant tool, where SS&C algorithms take the natural language and fact-find data and build up an understanding of whether what is being recommended is consistent with SJP’s advice policy. The tool then collates the adviser input with system logic for personalised documentation and downstream STP processing. James adds, “Our extensive testing has given us confidence

that the advice delivered meets our own high standards and is suitably documented.”

SJP outsources almost all its technology to trusted partners, allowing it to focus on what it does best – supporting its advisers to provide face-to-face financial advice. James explains, “We need those partners to be able to develop technologies that fit with our long-term strategy. We work with SS&C and Intellect Design Arena, whose shared focus on emerging technologies ensures we stay ahead.”

James highlights the fact that SJP is lucky to have an executive board that is interested in innovation. He says, “We have a growth mindset, we are open to new ideas and the challenges of proving its worth in the business.”

SJP prides itself on building technology solutions that benefit

“We work with SS&C and Intellect Design

Arena, whose shared focus on emerging technologies ensures we stay ahead”

The past few years has seen a sense of urgency to uphold sustainability in business when providing access to capital and banking services. This urgency is defined by a backdrop of ever-shifting corporate risk profiles, consumer preferences, and regulatory mandates. It is now a priority for institutional investors, asset managers, corporate banks, and insurers to embed sustainability into their corporate practice.

The ESG data landscape, however, is fragmented, imperfect, and inconsistent. How can institutions trust the available information when providers offer differing ratings for the same companies and capture data differently?

iESG is data source agnostic and provides clients tailored ESG intelligence for them to make informed business-critical decisions. The platform uses AI to bring together structured market data with unstructured data and realtime media coverage to address clients’ unique and customized use cases. iESG provides this intelligence with complete transparency and immediately unlocks value within client business operations. The platform integrates with existing core systems using APIs, can be set up as custom dashboards, or can even populate exportable templates.

iESG is built on Intellect’s decades of experience serving clients across the financial services spectrum. This provided Intellect the requisite understanding and appreciation of the real-world challenges faced by the industry at a strategic and operational level. As a result of this expertise, iESG serves one of the world’s largest sovereign wealth funds and a toptier UK wealth manager - collectively overseeing over $1.2tn in assets under management. Rather than compete to be seen as the single source of truth, iESG respects that there are different angles to and sources of ESG data used to inform enterprise level and operational decision-making.

iESG can be composed for several use cases, including:

• assessing product/client suitability and pricing

• understanding ESG exposures across investment portfolios

• informing ESG investment policy

• providing reporting to regulators and auditors

Sustainability is the biggest story of our generation, and iESG enables financial enterprises to craft and live their narrative at both a strategic and operational level. IntellectAI seeks to partner with financial service institutions looking to unlock new avenues for material risk assessment, and direct the flow of money towards making the world a safer, more equitable, and a more pleasant place to live.

To learn more about Intellect AI and iESG, visit www.intellectai.com/iesg/

advisers and their clients, not isolated projects. James elaborates, “It is very easy to have an AI project, but it is not useful unless that solves a business problem. We consulted our Partners throughout the design and build process and worked with them to come up with ideas. From my perspective, the applications for the Advice Assistant will grow and grow and become more

“From my perspective, the applications for the Advice Assistant will grow and grow and become more sophisticated”

sophisticated. It will be built out to deal with different advice scenarios and different investment types. We would look to expand to cover more areas, so we need more data and the ability to build algorithms that can cope with more complex scenarios. This will take time and expertise.

So, what are SJP’s plans for the future? James answers, “The key for us is to continue to support our advisers. We can do this partly through technology, working alongside them to make sure we are building solutions in areas that make a difference. We should be

aiming to use our data in a constructive way to support our Partners in advising clients and get better outcomes for people faster, more easily, and by using single input systems. The Partners’ skills are not in admin but in advice, so they want to spend their time meeting clients and building those relationships.”

For further information on SJP, visit www.sjp.co.uk

“The

ODrone is saving the aquatic ecosystem from plastic debris with intelligent autonomous underwater drones.

Drone is a deep tech start-up with the purpose to protect aquatic life by removing plastic debris with autonomous underwater drones. To save the aquatic ecosystem from toxins, it uses object recognition, computer

vision, and artificial intelligence to retrieve plastic debris efficiently and cost-effectively which can be repurposed and reused.

Headquartered in the northern suburbs of Copenhagen, Denmark, the company was founded in

For further information, visit www.odrone.ai

2022 with a focus on innovation, tech and sustainability. ODrone has great aspirations for future growth, so watch this space!

Its co-founders include Afseh Butt, Haroon Sajjad and Viorica Pogor, who describe themselves as ambitious young entrepreneurs driven by purpose,

talented people and personal development. ODrone is currently hiring exceptional tech talent, so if you feel you would be a good fit, contact the HR department for further details.

To date, ODrone has raised DKK30,000 in soft funding during three months.

“To save the aquatic ecosystem from toxins, it uses object recognition, computer vision, and artificial intelligence to retrieve plastic debris efficiently and cost-effectively which can be repurposed and reused”