How to Spot a Bargain

to maximising income?

How to Spot a Bargain

to maximising income?

At My Home Move Conveyancing, we know how stressful moving home can be, and we know how confusing it can appear. That’s why we’re here to guide you through your home-moving journey and make your move as simple as possible.

Combining the ease of a digital service with the personal touch of a dedicated Move Specialist, we’ll take the time to understand what’s unique about your move, so we can give you a personalised conveyancing quote. Once you’re happy with that, our tailored approach means we’ll place you with a dedicated conveyancer from one of our CLC or SRA regulated partner firms that fit your specific requirements. We can also help arrange a RICS survey, sorting insurance for your new home, and even with removal van hire and change of address services. And if things don’t work out as planned, we offer a no-move, no-legal-fee guarantee.

We know how important it is for you to have complete transparency and have control over your move. That’s why all of our partners have online conveyancing journeys, so you can track the progress of your case whenever you like. And you’ll have 24/7 support from us via phone, email and messaging services.

Thousands of movers have trusted us to help them move, and with transparency, care, and innovation at the heart of everything we do, we’ll ensure that your home move journey starts with ease and ends with confidence.

Hi, it’s Martin Roberts - him off the telly! - welcoming you to Property & Home, your unmissable guide to buying, renovating, improving and selling property.

There’s nothing more certain than uncertainty, what with new governments in the UK and US, a budget which raised lots of questions about businesses and inheritance, and bizarre weather conditions threatening properties all over the world!

The good thing about the property market is that people will always need somewhere to live - in my work on Homes Under the Hammer, a programme I have been privileged to be associated with for over 20 years, I still see opportunities everywhere. Many first-time investors are finding that with hard work and some expert knowledge, they can make the property market work for them.

So, whether you need advice on property law, how to cope with changes in the energy market, how to refurbish your property or where to find finance, you’ll find useful advice in this fact-packed

issue of Property & Home with Martin Roberts!

Since the increase in energy costs I have been inundated with people wanting to find ways of reducing their bills by making their property more energy efficient, so in this issue we are taking a special look at important money-saving measures such as insulation and double glazing, as well as all the choices available in heating technology.

Read my end column for the latest news on my property ventures, and how getting involved in the business can benefit both yourself and the people around you – it’s just another way of showing that the property business is one I still love, through all the ups and downs!

Cheers, Martin

12 Interview

Martin Roberts tells Chris Jenkins about his latest projects, how you should think about heating your property, and what are the best renovations for adding value

PROPERTY

18 Property Trends

All the news about new products, services and issues a ecting the property market

22 Fruits of Your Labour

With Labour now in government, change is certainly in the air for the UK property market. But what will the new policies mean for property investors

26 Managing the Split

Charles Knapper LLB answers our questions about the legal complexities of property transactions – this time, title splitting

29 The Second Charge

What is a second charge mortgage, why would you need one, and how do you go about getting one?

32 Conveying the Facts

Choose your conveyancer carefully, as a poor job could result in you losing out on a property purchase

35 Lie of the Land

Are your land and property in good shape? A site investigation could reveal all sorts of nasties

38 That Sinking Feeling

So, you’ve had your site survey, and identified subsidence – what can you do about it without major disruption?

41 Building Bridges

Sometimes you need a quick solution to raising finance for a property purchase –could a bridging loan be the solution?

43 Stake Your Claim

The steps we take a er making an insurance claim for property damage can be tricky. Why not have an expert do the job for you?

45 Split to Succeed

Title splitting is the process of dividing the title deeds of one building into two or more. It can be a smart property strategybut how does it work?

46 Baguettes and Bureaucracy

The allure of buying property in France is o set by the prospect of confusing bureaucracy. We take a taste of la vie en

48 Home Trends

All the news about new products, services and issues a ecting the home market

54 The Future of Heating

As gas heating is phased out, we will all have to look at more modern heating technologies, such as the heat pump

58 Get Ahead With a ZEB

What is a Zero Emission Boiler and what can it do for your home? We look at the latest heating technology

61 Finding Thermal Comfort

Heating your home comfortably isn’t just about whacking the thermostat up to maximum. Find out how the idea of ‘thermal comfort’ works

64 Subscribing to the Sun

There are many advantages to solar energy systems, but all come with an initial installation cost. Is there a good way to spread the expense?

67 Cooking With Style

There are many styles of kitchens to choose from, reflecting your personal taste and way of living. We look at some of the most popular

71 Lightbulb Moment

How smart technology can put you in control of your home’s systems without having to install complicated systems

74 Monitoring Mould

Mould, damp and other environmental problems can beset a landlord’s business. What are the risks and how can they be controlled?

79 Vinyl’s Back in Fashion

In fact, vinyl was never out, if you’re talking about flooring. Impressive for its durability and style, it’s the go-to solution for all sorts of flooring challenges

83 Seizing Power

It’s one thing installing solar panels, but another handling the power they produce. We look at some of the associated technology

86 Just Push to Fit

Push-fit plumbing fittings are becoming popular with professionals and DIYers –what’s the appeal?

91 Stay Calm and Insulate

Getting insulated is crucial for both energy e iciency and indoor air quality in buildings. So what do you look for and how do you fund it?

95 Conserve and Protect

Is your conservatory an asset or a worry?

An upgrade to a solid roof might make all the di erence

97 Locked and Loaded

How secure is your house? Insurers, the police and technology companies are all there to help you keep it safe and sound

102 Who’s Watching Your Home?

Security systems are getting more sophisticated, yet easier to install. We look at the latest in CCTV technology

107 Seeing the Light

How can you change the mood of your home using modern lighting? There are all sorts of options to set the scene

109 Getting in a Flap

Fitting a pet flap should be possible even in the most challenging situations. We solve some pussy problems and doggie dilemmas

110 All the World’s a Stage

If you are trying to sell or rent a property, looks are everything. Now a trend known as ‘staging’ makes it easier for you to present your property in a good light

112 Five Top Interior Trends for 2025

Looking for a way to zhuzh up your home and give it an up-to-the-minute interior design style? Here are five suggestions from top interior experts to perk up your parlour and brighten your bathroom

115 Drying Out

Leaks and flooding can be destructive to both property and health. What are the best ways to stave o damp, mould and water damage?

118 What is Your Home’s Interior Design ‘Superpower’?

Every home has an interior design ‘superpower’ – so what’s yours? Some superpowers are obvious, others don’t jump out at you and need to be encouraged.

122 We Are the Robots

They’re not exactly the clunky mechanical men of science fiction, but domestic robots are making their way into many households

126 The Heart of the Home

The kitchen is more than just a place to cook—it’s the heart of family life. How could you make better use of your kitchen?

130 Garden Trends

140 Unwanted Guests

All the news about new products, services and issues a ecting the garden market

132 The Winter’s Harvest Gardening in the winter is no easy feat. Look into why this is and how best you can take on the challenge

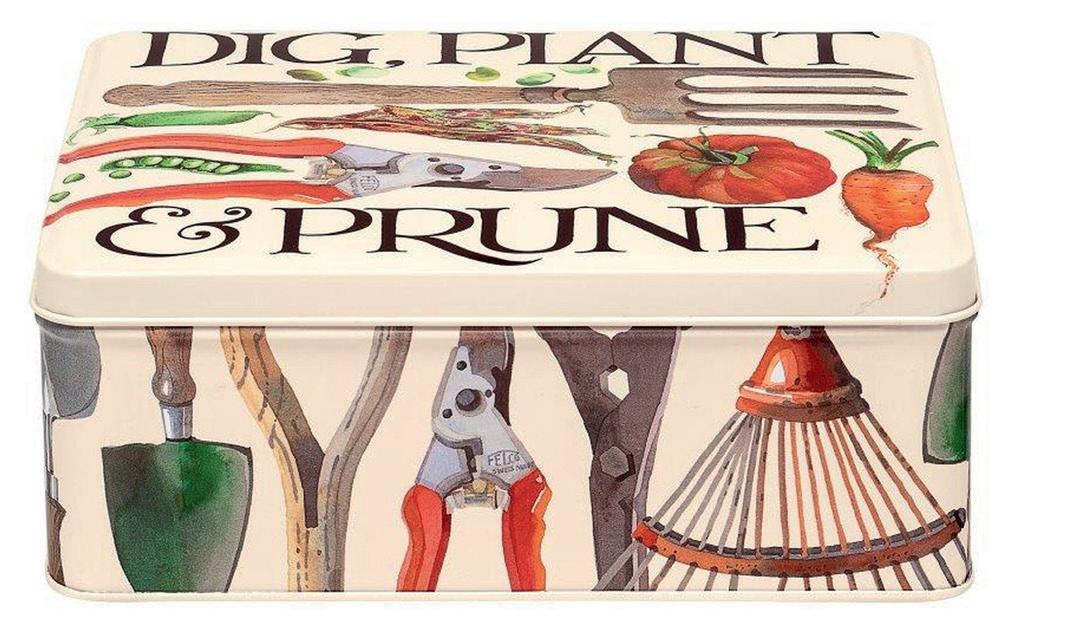

134 Gi s for Gardeners

Looking for a gi for the gardener in your life? This assortment of goodies would be welcome for Christmas, birthdays or anniversaries – or just to show you care

You can’t always choose who you have to visit you in the holiday season, but the last thing you want is an invasion of pests

142 Greener Living

A garden room can add value and utility to your property. How are they constructed and how could you use them?

144 Firm Foundations

This time, Martin’s plans to rope in his son on some building work turn into a practical idea for starting up a business

PUBLISHER & CEO

Kevin Harrington

EDITOR

Chris Jenkins

SUB EDITOR

Emmanuel Berhanu

CONTRIBUTORS

Grace Bower

Margo Lane

Richard Benson

DESIGN

Joanna Harrington

PRODUCTION

Ray Walsh

PUBLISHED BY

COPYRIGHT © 2024, CELEBRITY ANGELS ALL RIGHTS RESERVED

COVER IMAGE

Martin Roberts

Property & Home with Martin Roberts

Celebrity Angels 143 Caledonian Road

London N1 0SL Tel: 020 7871 1000

For sales enquiries call: 020 7871 1000

All material in Property & Home with Martin Roberts is wholly copyright and reproduction without the written permission of the publisher is strictly forbidden. Products and services included in this publication do not imply endorsement by Martin Roberts. The views expressed in this publication are entirely those of the writers and do not necessarily represent those of Celebrity Angels. The information in this publication is carefully researched and produced in good faith, however, neither the Publisher nor the Editors accept responsibility for any errors. The Celebrity Angels Series is published in the UK under licence by Damson Media Limited. Damson Media Limited is registered in England and Wales under registration no. 07869300.

We are thrilled to announce that Contact Solar has officially joined the EDF Energy family! This acquisition marks an exciting new chapter in our journey, enhancing our ability to provide innovative solar solutions and sustainable energy options to our valued customers.

Founded on the principles of sustainability and innovation, Contact Solar has been a pioneer in the renewable energy sector for 10 years. Our mission is to empower individuals and businesses to harness the power of solar energy, reducing their carbon footprint and achieving energy independence. We pride ourselves on delivering tailored solutions that meet the unique needs of our customers, ensuring they enjoy the benefits of clean, renewable energy.

Our dedicated team of experts works closely with customers to design and install solar systems that maximise efficiency and savings. From domestic homes to small commercial installations, we have successfully completed a wide range of projects, earning a reputation for quality and reliability in the industry.

As the demand for renewable energy continues to grow, solar power remains at the forefront

of this revolution. Solar energy not only reduces electricity bills but also lowers carbon footprints, contributing to a more sustainable future. With the addition of battery storage systems, we can maximise energy efficiency by storing excess energy generated during the day for use during peak hours or when the sun isn’t shining. This combination ensures that our customers enjoy reliable energy, even when grid power is unavailable.

As we integrate our operations with EDF Energy, we are excited about the opportunities that lie ahead. Our goal is to continue delivering exceptional service and innovative solutions that empower our customers to embrace renewable energy.

We look forward to embarking on this journey together and appreciate your continued support as we expand our offerings and capabilities.

www.contact-solar.co.uk www.edfenergy.com www.sunsynk.com

At Contact Solar, we are committed to providing our customers with the best products on the market. That’s why we’ve chosen to work with Sunsynk, a leading manufacturer known for their high-quality inverters and battery storage systems. Sunsynk’s innovative technology ensures optimal performance, durability, and efficiency, allowing us to tailor solutions that meet the specific needs of our customers.

We are proud to offer a range of Sunsynk inverters and battery storage systems designed to enhance energy management and provide peace of mind. With features such as real-time monitoring with push notifications and MPPT (Maximum Power Point Tracking), which allows the inverter to handle a solar array up to twice its size, these products deliver not only energy savings but also a seamless user experience.

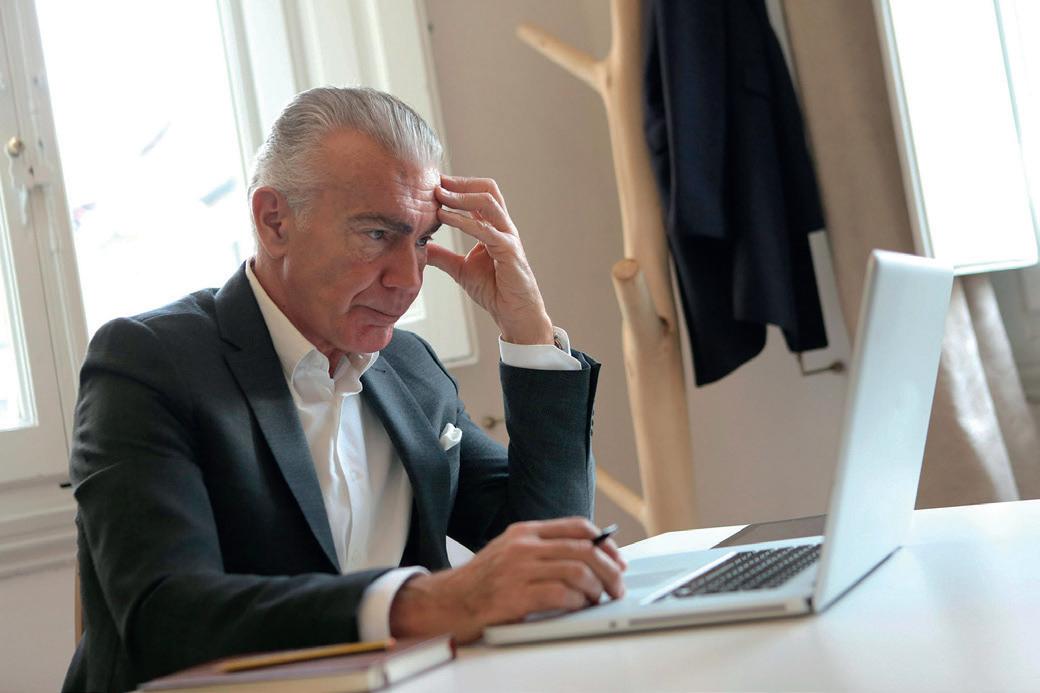

Martin Roberts, celebrity guest editor of Property & Home, talks to Chris Jenkins about the best ways to heat your property, how to tackle mould and damp, and the importance of understanding a renovation job – before you start knocking down walls!

From Homes Under the Hammer to I’m A Celebrity – Get Me Out of Here!, Martin Roberts is a familiar presence on TV, radio and online, with his property advice heeded by millions. So what’s his advice for renovating and maintaining a property, and how are his own projects going? Chris Jenkins asks the questions…

WHAT’S THE BEST WAY TO HEAT A NEW PROPERTY OR AN OLDER PROPERTY? IS IT TRUE THAT IT CAN BE HARD TO RELY ON THE CLAIMED HEAT OUTPUT OF SOME RADIATOR SYSTEMS?

If you can start from scratch, there are lots of options available to you, and building regulations mean that insulation will have been installed to the very latest standards,

which will reduce the amount of energy you’re going to have to put into keeping a place warm at the outset.

Obviously, sustainable, renewable and self-generated energy must be a preferred choice and thankfully the cost of those technologies has reduced in recent years. Coupled with an increase in efficiencies they are now a very viable alternative to traditional heating methods. Solar panels can now be linked with battery back-up to give power even when the sun isn’t shining. Air source heat pumps coupled with underfloor heating can provide a sustainable background warmth. If it’s an older property, then your priority should be trying to upgrade the insulation wherever possible and getting rid of sources of heat loss such as draughty windows, large gaps under doors

etc. However, bear in mind that older properties were designed to ‘breathe’ and if you seal these kinds of properties up completely, you may well create other problems such as condensation and damp - so there’s a balance.

Obviously solar power is always an option but replacing older existing boilers for the very latest energy efficient ones can have a dramatic effect on energy consumption. Flushing out radiator systems to make sure that they are free flowing is good practice but be aware that this can also unclog self-sealed leaks, so watch out and check for water loss immediately following any system flushing.

When it comes to heat output, I would always rely on the calculations of a good heating engineer who will take everything into consideration. »

ARE SMART HOMES A GOOD ENERGY SAVING IDEA? DO SMART HOME SYSTEMS ADD VALUE TO A PROPERTY?

The energy performance of a property forms part of the sales particulars and with increasing energy prices, the prospective costs of heating is a big consideration for many buyers so that the higher up the F to A scale your property can be, the better. Smart control systems give the ability to control the heating and therefore the cost of a home in a much more targeted way. They can learn which rooms you spend most time in, be linked to your actual time in the house - switching systems on just

before you come home and switching them o when you leave - in an automated and easily controllable way that can either happen automatically or via an app on your phone.

Clearly, the more control you have the more likely it is that you’ll only be heating the house or part of the house when it’s needed, and the cost savings should o set the costs of installation very quickly.

WITH MOULD AND DAMP IN A PROPERTY?

The first thing is recognising the di erent types of mould and damp that exist because this should be your starting point on the journey to eradicating it. The most serious damp and mould will be caused by significant maintenance or structural issues. That’s not to say that it’s necessarily something complicated.

A huge proportion of these issues are caused by a simple lack of regular maintenance of rainwater goods - such as gutters and downpipes that are blocked, or drains that are clogged with soil and leaves. The basic premise to follow is that the quicker and more e iciently you can get water away from a property, the less

likely it is to cause any serious damage. Such structural damp generally comes either down, across or up. Leaking roofs, failing flashing - especially around chimneys - and the rainwater goods generally result in the downward damp.

Inward or ‘penetrating’ damp can happen on any level of the house and is o en the result of the failure of the exterior coating such as rendering that might have a crack in it, facias that might have cracked or flat roofs where they adjoin the house and where the flashing has failed.

Damp that comes up (o en called Rising Damp for obvious reasons) is the result of the natural wetness of the soil and ground not being blocked from rising upwards. Houses are generally built with a damp proof course which is literally a layer of impermeable material which stops the water rising any further. If this layer of protection fails or isn’t in existence, you need to look at replacing it, which can be done retrospectively with the likes of injection damp proofing.

The above said, a large percentage of damp problems are caused by condensation, and this can be the case in homes of any age, but ironically a serious issue in very modern houses. Inhabitants,

be they human or animal, naturally create moisture either from breathing or bathing, showering or putting on the kettle. This moisture will settle on walls, ceilings and especially anywhere that is slightly cooler than the room temperature. After time this will lead to damp.

The simplest answer is to create a natural air flow which is why building regulations now insist on Trickle Vents in double glazing, having realised that a perfectly sealed house is only storing up trouble. So, in effect, you need to find ways to replace the naturally damp air with fresh, dryer air. Dehumidifiers can help but just letting in some warm outside air can often be a simple solution.

The need for title splitting can occur for various reasons. If you have a large house, say that you want to convert into flats, then each of those subsequent flats will need its own unique reference with the land registry i.e. its own title if the flats are going to be sold or mortgaged individually. Another example could be building or renovating an outbuilding or barn in the

grounds of an existing building. Again, if this new property is to be sold separately or remortgaged it will need its own title.

There are specific rules and regulations regarding title splitting that a good solicitor will be able to guide you through. It’s not necessarily complicated but it does have to be done correctly otherwise you’ll be storing up legal issues for the future.

(See Charles Knepper’s expert column in this issue for more information)

WHAT’S THE MOST POPULAR FORM OF FLOORING FOR VARIOUS TYPES OF PROPERTY? WHAT ARE THE MISTAKES TO AVOID IN CHOOSING FLOORING?

The most important thing to consider when choosing flooring is fitness for purpose. Consider your lifestyle and the inhabitants of your home and think what parts of your property need a floor that is the most resilient and what parts warrant the maximum comfort. I’m a huge fan of, as a first step, finding out what is already in existence once you’ve peeled back the various layers.

To me, with my three dogs and two children, easy maintenance and

durability is a priority, so I’m a fan of stripped floorboards wherever they are of a condition where that’s feasible. The great thing about stripping floorboards is that hopefully they’re there already, so it’s just the time and effort that’s required to renovate them to a usable condition. Obviously stripped floorboards in a modern house may not be an option or desirable from a design point of view.

Floor tiles come in all shapes, sizes and materials but one overriding consideration is whatever you choose must be that whatever they’re being fitted to cannot move or vibrate. You should consider backer boards or specialist matting which you lay underneath the tile to absorb any movement or vibration. Try to pick colours and materials that will not quickly go out of fashion because replacing a tiled floor is never going to be an easy job.

Vinyl floors now come in a wide variety of styles and if laid properly, can look incredible and almost indistinguishable from their natural alternatives. It’s worth getting in the professionals to lay certainly the more sophisticated vinyl flooring, as it can be quite a structured process to ensure longevity. »

Finally, there are certain rooms where you still can’t beat a carpet - most obviously bedrooms. It’s also worth remembering that carpet so ens the noise of walking in any upstairs rooms.

WHY IS IT IMPORTANT TO GET AN INDEPENDENT SITE SURVEY FOR NEW DEVELOPMENTS OR IN CASES OF SUBSIDENCE?

The more professional advice you can get before you make a purchase or in the process of resolving any issues, the better. The independent view of somebody who does this all the time and will have remedies and words of warning at their fingertips is invaluable. A structural surveyor should be able to o er solutions to even the most severe building issues and will set out a clear process of remedial works that are required.

Even though you might think that a new build property doesn’t require any kind of viewing by an independent observer, sadly that’s not necessarily the case and even with the guarantees that the builder of the

new property should provide, I’d rather walk away from a property where potential future issues have already been highlighted.

DO SECURITY SYSTEMS ADD TO THE VALUE OF A PROPERTY?

I don’t think a valuer would consider the existence or otherwise of a security system. However, it’s something that will potentially save you costs further down the line. A lot of insurance companies will insist on a certain quality of alarm system being installed even if that alarm system isn’t utilised on a regular basis. It’s a ‘nice to have’ and certainly something that would provide peace of mind.

IS IT WORTH INSTALLING A NEW KITCHEN BEFORE SELLING A PROPERTY?

The old adage is that kitchens and bathrooms are the two parts of a property above all others that will influence its saleability, so they should be your priority if you’re looking to maximise sales value. It wouldn’t be unreasonable to suggest that

a kitchen that costs you £7000 to supply and install could add £15-20,000 onto the sales value. It’s also a very quick way to modernise a property and give the feeling that it is up to date.

There’s a huge choice of kitchens available these days obviously from display models that you might find at hugely discounted prices on the internet to professionally designed kitchens that are o ered by the big kitchen supply companies.

Fitting a kitchen is not a particularly easy job and shoddy workmanship will stand out like a sore thumb and could actually be detrimental to the first impression of the property, so if you’re not up to doing it yourself, employing the services of a respected kitchen fitter is money. Clearly somebody like that will also be able to do the job in a fraction of the time it might take you, and bear in mind that since during the refurbishment process you will be without an important part of your home, the quicker it can be done, the better.

HOW MUCH VALUE CAN A GARDEN STUDIO ADD TO A PROPERTY?

WHAT ARE THE CONSIDERATIONS IN SPECIFYING ONE?

Any extra live/work space in a property is highly desirable and if your options for extensions or enhancements to the main building of the property are limited, then a garden construction can be a viable option.

This can range from something that you throw together with a few bits of old timber and a corrugated iron roof to a fully insulated, purpose-built building which is as warm, cosy and liveable as any other part of your property.

O icial valuations may not take into account the full cost of a particularly

elaborate garden studio but there’s no doubt that such a space would add hugely to the saleability and potential sales price of your property.

HOW ARE YOUR VARIOUS PROPERTY PROJECTS GOING AND WHAT PROBLEMS HAVE YOU HAD TO OVERCOME?

My main project currently is renovating an old pub and hotel in the Rhondda Valley in South Wales. It turns out the Hendrewen Hotel had not really been maintained properly for about 150 years, which I didn’t fully understand until I started taking the plaster o the walls to discover all the rotting woodwork and lintels underneath. I also didn’t seem to notice some of the

walls at the back being a bit wonky if you were finickity about vertical angles, but no matter - it all adds to the characterunfortunately also the budget!

However, we are ploughing on and with the help of my trusty team we have completely ripped out and partly refurbished the interior and are soon to commence building the kitchen and toilet extensions.

My biggest problem at the moment is a huge retaining wall at the rear of the property which isn’t doing what the name would hopefully suggest and requires rebuilding, probably at massive expense. So, if you happen to know any Incas or Aztecs that can help (I think they were good at building walls) please get in touch! ■

From modular housing to the state of sales, the latest news and services from the property sector

In 2023, 104,510 people in England were in temporary accommodation, and an estimated 3,898 people slept rough. This is a 27% increase in rough sleeping from the previous year, and the sharpest rise since 2015. With housebuilding failing to keep up with the demand for new properties, what is the solution to the homelessness problem?

In Chelmsford, a project from The Hill Group is suggesting one answer. A new collection of 24 modular DuoHaus homes that will provide accommodation for homeless people is being installed near Chelmsford. DuoHaus homes are innovative, low-cost modular homes designed specifically to support and protect vulnerable residents. The concept was developed by award-winning housebuilder, The Hill Group, as a follow-on housing solution to help address the homeless crisis. Hill is installing the DuoHaus homes to replace an obsolete motel in West Hanningfield near Chelmsford, which CHESS Homeless has been running as a homeless hostel since the start of the COVID-19 pandemic. The project was made possible through support from the government’s Single Homelessness Accommodation Programme (SHAP), Chelmsford City Council, various trusts, grant-makers, individuals, and pro bono

contributions from the teams involved.

Designed with a 60-year lifespan, each DuoHaus home is designed for up to two residents and is built to meet Future Homes Standards, exceeding building regulations for energy-e ciency and sound insulation. They come fully furnished and equipped including a fitted kitchen and white goods, providing a safe, comfortable environment for residents before they find somewhere more permanent.

The 24 DuoHaus homes will be stacked on two levels and each home arrives ready for installation as they are prefabricated by Hill’s manufacturing partner, Volumetric Modular Ltd. The homes are set to be complete and ready for new residents to move in by late spring 2025, just 18 months since this project was first initiated. The development gained planning permission recently and demolition of the former motel building and site groundworks are already underway.

To date, Hill has delivered over 200 SoloHaus and DuoHaus homes to local authorities and charities across the UK, from Su olk to Cornwall. This initiative not only addresses immediate housing needs but also sets a sustainable and replicable model for tackling homelessness nationwide.

More than one in four property sales fell through in England and Wales between July and September 2024, according to new figures. Property company Quick Move Now suggests that 29 percent of property sales fell through before completion in the third quarter of this year. With each failed sale costing an estimated £3,370, the company estimates that failed sales could cost the public as much as £900 million each year. Apparently, the main cause of unsuccessful property sales has been the buyer having di culty securing a mortgage. This accounted for 40% of collapsed sales. A further 27% of failed property sales were caused by the buyer changing their mind or unsuccessfully attempting to renegotiate the agreed sale price. The remaining lost sales were attributed to chain break (14 percent), gazumping (12 percent) and survey issues (seven percent).

Quick Move Now’s managing director, Danny Luke, commented: “People may be surprised by the high number of property sales impacted by di culty securing a mortgage, but there is good reason for it. When sales volumes were lower, only those in a very strong financial position were moving. Higher mortgage interest rates meant much of the market was being driven by cash purchases. Now mortgage interest rates have started to fall, and sales volume is beginning to increase, a greater number of sales are reliant on mortgages…lenders are vigilant to several external factors that have the potential to impact future inflation and buyer a ordability, such as current foreign political uncertainty and global conflicts.”

Looking to make home improvements, consolidate some debt or complete a project? Interbridge Mortgages is a lender that o ers a range of second charge mortgage options, via a network of broker partners, that could help you achieve your ambitions.

www.interbridgemortgages.com/ propertyandhome

GetGround is the all-in-one property investment platform for landlords seeking higher buy-to-let returns with minimal e ort. Access limited company services, accounting and tax, vetted properties, financing solutions, lettings, management, and personalised analytics – all in one place.

www.getground.co.uk

Indomie is one of the world’s most popular brands of instant noodles and has become a leading household name in many countries around the world since its launch in 1984. Products are made from high quality flour, spices and herbs and are fortified with essential vitamins and minerals. chadhaorientalfoods.co.uk/brands/indomie

With Labour now in government, change is certainly in the air for the UK property market. But what will the new policies mean for property investors?

In July 2024, the Labour Party won a general election for the first time in 14 years, promising a change in policies with the end of a long period of Conservative rule. But with the world economic situation making it difficult to forge new pathways, what can the property market really expect in the way of change? Whether it’s to do with housebuilding, inheritance tax, rental laws or building safety, there’s much to anticipate for all property buyers, renters, landlords, sellers and investors.

One of the new government’s more ambitious but top-priority promises is to address the current UK housing crisis by building a total of 1.5 million new homes over the next five years. This sets a target of 300,000 each year. The proposed focus will be on affordable and social housing, particularly addressing the imbalance between supply and demand as the UK’s population continues to grow - currently sitting at just over 69 million people. But property developer Ritchie Clapson says:

“The target of 300,000 new homes per year looks light. The complexity of the issue requires a nuanced approach to meet targets, address public sentiment, and leverage alternative solutions, such as brownfield redevelopment.”

For first-time property buyers, an increase in availability of affordable homes would certainly be a key opportunity to enter the market. In contrast, with more variety and an increase in choices for buyers, it may take sellers longer to sell their properties. The

The need to save up for a deposit is only one hurdle: prospective buyers also need to have a sufficiently high income to take out a (bigger) mortgage and afford the repayments.

private property rental market could also face potential loss when buying a home instead is made a lot more affordable. With refined infrastructure and amenities however, more opportunities to invest in the newly improved areas could arise.

Labour further intends to more strictly enforce and regulate the protection of renters’ rights. Their proposed Renter’s Charter will end Section 21 evictions, which enables landlords to evict tenants without a specific reason. It also aims to extend tenancy agreements, cap rent increases and encourage more transparency within the residential property market. To do so, more severe penalties against agencies and developers not meeting the new standards may be put in place. As a result, landlords may be required to invest more into property maintenance. At the same time, their returns could also potentially be lowered due to the new rent caps. Nonetheless, better-maintained properties are likely to prove beneficial to all parties in the long run.

Existing homes are set to be upgraded to become more energy-efficient and ecofriendly. In line with Labour’s commitment to environmental sustainability, it’s proposed that landlords and homeowners

Labour Prime Minister Keir Starmer; “The dream of home ownership is out of reach for too many hardworking people”

will be given grants and incentives to make the changes. The idea of these proposals is not only that energy bills drop, but that property value will rise, and doors will open to more buyers prioritising eco-friendly homes. With increased demand for sellers of these upgraded properties, higher selling prices could be commanded,and for investors, sustainabillity is a growing influence on property valuation.

There are proposed changes to taxes concerning first and second home buyers,

as well as non-UK residents. As of October 31st, 2024, Stamp Duty tax rate for second homes increased from three percent to five percent. The rate for non-UK residents to purchase residential property is also set to increase by one percent. Set to come into effect in March 2025, the stamp duty exemption threshold for firsttime buyers will drop from £450,000 to £300,000. With higher tax rates on second homes and the investments of non-UK residents, a more stable market seems slightly closer on the horizon. First-time buyers are sure to appreciate the benefits of potential tax reliefs. »

Labour also proposed a key ‘Freedom to Buy’ scheme, which UK Prime Minister Keir Starmer described as being able to “clear the way for the opportunity to own a home.” The scheme aims to encourage more young people onto the housing ladder, with a target of 80,000 within the next five years. To do so, the government will incentivise lenders to offer high loan-to-value (LTV) mortgages. This way, they intend to increase the affordability of deposits, which many young people struggle to come up with, whilst also lowering mortgage costs.

‘Freedom to Buy’ will be the Labour Party’s permanent version of the Conservatives’ ‘mortgage guarantee scheme’, set to expire in June 2025.

When discussing the Labour manifesto and prior to winning, Kier Starmer said: “After 14 years of Conservative government, the dream of home ownership is out of reach for too many hard-working people. Despite doing everything right, they can’t move on and up. A generation face [sic] becoming renters for life.

“My parents’ home gave them security and was a foundation for our family. As prime minister, I will turn the dream of owning a home into a reality.”

The non-partisan Institute for Fiscal Studies (IFS) - the UK’s leading independent economic research institute, believes the scheme has “potential” to prove beneficial to first-time buyers. However, it isn’t clear whether this potential extends to solving the current case of too few young people being homeowners.

David Sturrock, the senior research economist has said: “The need to save up for a deposit is only one hurdle: prospective buyers also need to have a sufficiently high income to take out a (bigger) mortgage and afford the repayments.

“As a result, potential buyers who are in their 30s and from better-off backgrounds, and who are looking to buy outside of London and the southeast, are more likely to be able to take advantage of this scheme.”

Other key players in the property market, however, have viewed this scheme in a positive light. On the matter, Zoopla executive director Richard Donnell said: “Policies to support people to buy their first home are always welcome. One of the greatest challenges facing first-time buyers is the deposit needed to fund a purchase.”

CEO at Barratt Developments - one of the UK’s largest residential property development companies - David Thomas had a similar perspective: “We welcome proposals that could help more people buy their first home in a challenging market.

“In order to support more people to buy their first home, it is also important that we improve the current planning system, which includes setting housing targets in local plans and recruiting more

Labour’s Chancellor, Rachel Reeves: “Only six percent of estates will pay inheritance tax this year.”

skilled planners, so local authorities and housebuilders can build the muchneeded, high-quality and energy-efficient homes the country needs.”

On the subject of inheritance tax, which the first Labour budget was expected to increase, the surprise was that those most affected were farmers; Chancellor Rachel Reeves announced that 20 percent inheritance tax would apply to farms worth more than £1m from April 2026, where they had previously been exempt.

It’s still early days for the Labour government, but it has set out its stall and made clear some of its intentions for the property market. Whether its plans can be carried through is another matter; international developments may well cause economic disruptions which are currently impossible to predict. ■

Charles Knapper LLB answers our questions about the legal complexities of property transactions – this time, title splitting

eople o en want to split the legal title for their property so that separate parts are on di erent legal titles. There are many reasons to do this - you may want to develop a section of a large garden by building another house, or you have a large building converted into flats and want to create the leases for the flats so that you can raise money on the individual

Charles Knapper has 24 years of legal experience in property, disputes, family and children’s law, wills and probate, and is a Consultant Partner of Curtis Whiteford Crocker Solicitors, 247 Dean Cross Road, Plymouth, Devon, PL9 7AZ. See the website at https://cwcsolicitors.co.uk

units. These two examples are really quite di erent even though they may appear similar.

Let’s look at the first scenario, and how this form of title splitting can be achieved. The first thing you must do, if there is a mortgage over the whole of the property, is to get the consent of the lender to remove the charge over the part you want to split o . This sounds straightforward, but many

lenders will simply refuse to allow the charge to be removed from part of the land. Even if you convince them that you would be happy with retaining the charge over both of the new titles, many lenders will consider that the splitting of the title makes it more of a commercial venture. Be prepared to have to refinance the property with a new lender if you want two separate charges over the two new titles.

As to the actual splitting of the title, once you have sorted the finance, there are two ways to go about it. One way is to transfer one of the parcels out of the original land, using something called a transfer of part. The other way is to make an application to the Registrar for permission to split the title and to give the piece being hived o a new title number.

When making this type of application, a detailed explanation as to why the split is required must accompany the application and remember that it is possible that the Registrar can refuse. The reason for adopting the second procedure is because both titles can be in the same name. There is a problem with executing a transfer of part, if it is to the same landowner, as you cannot transfer a property to yourself as a matter of law. If the land is owned by two or more people, then a transfer of part

could be transferred to one or more but not all of the landowners.

In either instance, something called a Land Registry Compliant Plan needs to be drawn up, and for this you are likely to need the services of a surveyor.

Now, let’s look at the building in terms of converted flats. The problem here is similar to the transfer of part, except you will need to grant leases, and again you cannot grant a lease to yourself. If just one person owns the building with the flats, it may be necessary to create a temporary trust so that the building is owned by more than one person, and they can then create a lease just in the name of the original owner. A er the lease has been created, the trust can be brought to an end, and the freehold property transferred back to the original owner.

Splitting a title of a parcel of land can be greatly advantageous if you want to raise finance, and you have a large garden with planning permission for another house that you want to sell o , or just refinance so that you can build it yourself.

Creating leases on the developed flats in a building you own can enable you to raise money on each individual lease, whereas raising money on the freehold converted into the flats, but without the leases having been granted, will be very limited.

The simple thing to remember is that you can’t transfer a part of the land to the same landowner, and you cannot create a lease to the same landowner. There are ways of overcoming these problems by creating a trust and transferring the land from the trust to the original owner, or making the application to split the title to the registrar. In the case of granting leases, again you can create a trust, or simply grant the lease to just one of the landowners as opposed to all of the original owners. ■

We’re sorry to report that our regular contributor Philip Gambrill FCCA, senior partner at PG Lemon LLP Chartered Certified Accountants in London and Kent, passed away in June. His contributions to Property & Home were always appreciated, and we would like to o er our condolences to his family, friends and colleagues.

What is a second charge mortgage, why would you need one, and how do you go about getting one?

While the majority of mortgage applications are for a straightforward purpose – buying a residential property, or sometimes a commercial property – other types of mortgages are available for different types of property transactions.

In the case of a ‘second-charge’ mortgage, for instance, a secured loan is made using the equity you hold in an existing property as security. The loan is made based on the value of your property, minus what you still owe on your first mortgage, but is carried out completely separately from the initial mortgage. For that reason, it is sometimes known as a ‘homeowner loan’.

So why might you want a second charge mortgage? You may want to consolidate a debt, paying it off at a lower rate; you may

want it to make improvements on your existing property, or perhaps you want to put money into another renovation project, with the aim of eventually selling at a profit. You could even use it to finance something entirely unrelated to property, such as paying for a holiday or a wedding.

The best way to approach getting a second charge mortgage is to talk to a specialist broker who can assess your needs and suggest the best options for your circumstances.

There are a lot of factors to consider –generally you can borrow anything from around £15,000 to £500,000, pay it back over a period from 5 to 30 years, and select various fixed or variable repayment rates.

Of course, there are obvious issues to consider with a second charge mortgage,

the main one being that you will have to repay it while still repaying your initial mortgage. Your second charge mortgage specialist will help you to work out if this is practical considering your income and prospects.

Other factors to consider are the advice fee, an amount charged by your broker or introducer for the mortgage advice given to you during the application process; the APRC, or Annual Percentage Rate of Charge, the total yearly cost of the second charge mortgage considering all the charges included in the mortgage; and the requirement for a valuation survey to determine whether your property is suitable for a second charge mortgage.

A specialist advisor will guide you through all the options and help you to decide whether a second charge mortgage is right for you. ■

John E Jones, Head of Residential Property at Jackson Lees

Someone once described to me that conveyancing is a “tortuous process, deliberately created to inflict maximum harm on one’s mental well-being”.

It is true that anyone today reading the press, LinkedIn posts, or watching the news on television, will think that the housing market and the role conveyancers play in it, is unnecessarily complex and overly bureaucratic, and not fit for purpose in the 21st century. Why is it not easier, quicker, and slicker, is often the cry.

Conveyancing is evolutionary. It has moved from a paper-heavy process to a more online, digital approach, however, the basic tenets of land law, contract law, regulation and legislation still sit there (and increase year on year), meaning that the conveyancer must traverse miles of regulatory jungle to get to the end.

That is why it is crucial when finding that property you wish to buy that you

appoint a conveyancer who understands the jungle, has experienced it over time, and knows how best to traverse it.

If you are renting your property, it is also helpful to find a firm that can support you past your purchase. At Jackson Lees, we provide the following services for landlords:

Service of notices

Possession actions

Defending cases brought by tenants

Nuisance and anti-social behaviour

Disputes with neighbours

Professional negligence of advisers

So, when looking for the right conveyancer for your sale or purchase you should follow the rule used by a 17th century Samurai warrior, being his four-point key to successful living – and swordsmanship! That rule being ‘No Doubt, No Fear, No Surprise, No Hesitation’.

Ensure the conveyancer you choose meets the following criteria:

Membership of the Conveyancing Quality Scheme (‘CQS’) or a Licensed Conveyancer.

The firm has Lexcel, ISO9001, or some other reputable quality mark. That they are on the panel of every major mortgage lender.

That they have full professional indemnity insurance. Ask them to prove this by showing you the policy. They will be happy to do so.

That your research into them demonstrates that they really do specialise in conveyancing. Check their website, speak to other referrers of work to them, read their vetted feedback comments and check their disciplinary record.

The conveyancer understands you and you understand them.

Make sure they are willing to communicate with you as you prefer. Check that you will receive regular updates or be given access to the case history of your file. You will want to see how your transaction is progressing. Ask to see their ‘client engagement letter’ and ‘terms of business’. You will want to keep them to any service levels stated. Ensure that any reports, letters, or literature you receive from them is concise, to the point and easily understandable.

Check that you can meet with the conveyancer as suits you best, or that you can visit their office.

They have relevant experience, and knowledge, of both national and local conveyancing procedures. They can deal with all forms of conveyancing work wherever the specific property is situated.

They have a common-sense, pragmatic, and commercially minded approach. They have personal responsibility and accountability for your sale or purchase. They are willing to discuss your transaction before and after completing it.

You have full transparency over the fees and disbursements to be charged. Obtain quotes from two or three firms, compare if you must, but remember that a great, effective, and specialist conveyancer will cost you more, however, the trip through the jungle will be quicker and more efficient.

The firm itself has other specialists within it that can help you with your transaction especially if a hiccup occurs eg, if you need to evict a defaulting tenant if selling an investment property then the firm should have a Landlord & Tenant specialist on hand.

Whilst recommendations from family, friends or your estate agent are all worthwhile, you must make your own checks. Selecting the wrong conveyancer will delay your transaction or worse still, completion may never happen! If the conveyancer you are looking at meets your criteria, weigh up the odds and get on with it. That’s the secret. You will have picked the right conveyancer.

f you are buying or selling a property, you will certainly come across the term ‘conveyancing’. In theory, you could do your own conveyancing, which is the process of legally transferring ownership of property from one person to another. But because there are so many legal complexities involved, and professional conveyancers have decades of experience in anticipating possible pitfalls, it would be very foolish not to have the work done by a professional.

“Conveyancing is o en seen as a ‘tortuous process’, inflicting mental strain. Despite evolving from a paperheavy to digital process, the basic tenets

of land and contract law, regulation and legislation still make it complex. Thus, choosing a conveyancer who knows the regulatory jungle is crucial. Follow the Samurai’s rule: ‘No Fear, No Surprise, No Hesitation, No Doubt’ for successful conveyancing” says John E Jones of conveyancing solicitors Jackson Lees (www.jacksonlees.co.uk/services/ residential-property).

Choose your conveyancer carefully, as a poor job could result in you losing out on a property purchase

out on anything essential, and you could lose that property purchase you had your heart set on.

At the end of the conveyancing procedure, all legal requirements will have been taken care of, and importantly, both parties will be protected against possible legal action in the future, so it’s essential to choose a conveyancer who can guide you through the process – miss

So what does conveyancing involve and why is it essential to have it done by a professional?

The conveyancing process can take anything from 6 to 14 weeks, depending on whether the property is freehold, leasehold, or a new build. During the process, the buyer’s solicitor will raise enquiries on subjects such as the legal title to the property, documents supplied by the seller, or issues raised by legal searches submitted on the property.

These issues are dealt with between the buyer’s and sellers’ solicitors and aid in the decision-making process.

The most common terms you will hear in connection with a conveyancing transaction are Exchange and Completion. ‘Exchange’ is the exchange of contracts that makes the transaction legally binding between the parties, and ‘Completion’ is the agreed upon date when the parties physically move.

As part of the conveyancing process, a survey reporting on the physical condition of the property is usually carried out by the mortgage provider. Other reports, sought by your conveyancer, will include local authority permissions, water and drainage, environmental, and chancel repair liability (a requirement to contribute towards the costs of local church repairs. Yes, despite Henry VIII’s best e orts, this still exists in some parishes).

without a mortgage to manage exchange and completion within seven days, though there is usually an additional charge for this from the conveyancing solicitor because of the large amount of work that needs to be done in a short time.

The conveyancing process is somewhat di erent in Scotland, where a solicitor will be the first point of contact for someone planning to sell, and many solicitors’ firms are also estate agents, so they play a more prominent role in selling homes.

The conveyancing solicitor is also required to carry out checks under

The survey can be carried out to various levels - a basic ‘home buyer’s’, a complete structural, or a valuation survey. A complete structural survey is only required on properties in need of significant restoration.

Another check carried out by the conveyancing solicitor is for covenants, legally binding promise attached to the land. Your case manager may also identify defects such as missing title documents with the land registry or absent planning or building regulation certificates.

Another vital part of the conveyancing process is that the conveyancing solicitor usually holds a deposit of 10 percent of the purchase price from the buyer, to compensate the seller if the buyer fails to complete financially. Following exchange but before completion, the conveyancing solicitor supplies a final statement of account showing the balance of funds required to complete. Once these are cleared the conveyancing process can proceed to completion.

It is sometimes possible if you are selling or buying a property with or

the Anti Money Laundering (AML) regulations. For instance, if any amount of money is being contributed to the cost of buying a property that is not from the buyers themselves, these “gi ” or “third party” funds have to be checked for AML purposes, and this too could involve a charge.

In most cases, original documents such as bank statements and identity documents have to be supplied to support this process - photocopies and scans are o en not accepted. Again, it is the job of the conveyancing solicitor to obtain and verify these documents, so it’s best to disclose if this is to be the case early in the transaction to avoid lastminute delays. ■

Are your land and property in good shape? A site investigation could reveal all sorts of nasties

Any new build project or renovation may need a site investigation, mainly to check for the possibility of subsidence, which could cause expensive problems. A site survey using technology such as soil testing, hydraulic testing of pipes and measurement of crack movement can head off a lot of issues in the future.

Subsidence is a very common problem; it can have a number of causes including shrinkage of clay soil when dry (and expansion when wet), undermining of buildings by tree roots, and water leaks causing softening of the ground. Even the weight of buildings themselves can cause settling, as can mining activity.

A site survey can detect many of these problems. Usually taking a few hours to complete, a site survey often involves

drilling bore holes, either externally or internally, collecting samples, and using cameras to investigate pipework. Hydraulic testing can be done by blocking off a drain run with an inflatable bag or bung and filling it with water, so any leakage and the rate that the water is seeping into the ground can be seen and recorded.

Before building work is done, soil testing can determine the properties and bearing capacities of the soil such as water content and compressibility so foundations can be designed correctly, including for instance the best class of concrete to use.

In existing buildings, measuring equipment can be fitted to check levelling and crack expansion. Often a year of data will deliver seasonal variation data which will suggest how remedial work could be carried out.

It’s often a good idea to carry out this

sort of work after flooding to check that the ground has stabilised.

A geotechnical survey carried out before building work can reveal the presence of any ground contamination which may require remedial work before building commences. Investigating the history of the site will often suggest the possibility of contamination, but a second phase of intrusive investigation is often needed to confirm any contamination, and suggest methods of remediation and monitoring.

A site investigation can include various levels of reporting from the strictly factual to the interpretive, and can include plans, logs, testing results and assessment. Your surveyor can work with loss adjusters, insurers and developers, as well as individual homeowners, structural engineers and architects to deliver the facts about the land and property you really need to know! ■

So, you’ve had your site survey, and identified subsidence –what can you do about it without major disruption?

Subsidence is a problem caused by ground sinking under your property, due to ground conditions such as clay shrinkage, damage from tree roots or problems with foundations. As the walls and floors of the property move from their original groundwork, cracks open up in walls and ceilings, often around doors and windows. At worst, this can make a property uninhabitable, and at least, subsidence can affect the value of your property.

Some areas are particularly prone to subsidence as there is a lot of clay in the ground. If your doors and windows are loose or sticking, use a postcode checker to find out if you are I a subsidence area.

In general, narrow cracks, while still important to monitor, are little to worry

about, but if you observe several cracks clustered in the same area or along the same wall, or the cracks are wider than 3mm, this is a strong indicator that these could be subsidence cracks and should be a concern.

If you are concerned about subsidence, you should call in a specialist company. Initially, monitoring any cracks should show whether the problem is increasing, or whether it is historical and may be addressed by simply filling the cracks. If it proves to be a worsening problem, it may be necessary to address the root of the problem.

Neglecting subsidence-related signs can jeopardise the structural integrity

of your home and potentially lead to costly repairs.

So what do you do if subsidence is confirmed in your property and the situation is likely to get worse? The problem is that repairs to the underpinnings of a building involving excavating beneath the foundation and installing new support structures like concrete piles are highly effective, but an expensive and disruptive undertaking. The modern solution is a resin injection system which stabilises foundations so that repairs to cracks can be made without worries about any further subsidence.

The resin injection process is usually complete in one day, makes little or no mess, and comes with a warranty for a number of years. It begins by drilling

small holes in the affected area. The resin compound is injected directly into the affected areas through the holes, and hardens quickly, providing a firm and reliable support similar to concrete. As well as stabilising foundations immediately, the resin injection method can even lift the property. By bonding with existing concrete, the resin reestablishes the integrity of the foundations, makes it easier to make cosmetic repairs to cracks, and helps to realign doors, windows and sinking floors.

Laser levelling equipment can be used to monitor progress as the work is carried out, and drains can be checked both to make sure that they are not the cause of subsidence, and that they are not affected by the injection of resin.

A clean, simple and mess-free solution, the resin system can often be applied from outside the property, without excavation work needed for traditional solutions. Sometimes flagstones may have to be lifted to expose service pipes for checking.

It’s important to note that a qualified surveyor or structural engineer should assess the situation and recommend the most suitable repair method, considering the cause and extent of damage, and your property’s specific needs. It’s worth checking whether your house insurance policy covers subsidence - many do, and may even go as far as covering alternative accommodation while remedial work is being carried out – but there is often an excess to pay, and sometimes insurers are wary about covering properties where subsidence may return – so check for a guarantee on remedial work. ■

Subsidence can be a real problem because you don’t know until you get a structural survey how much it might cost to remediate.

I can’t tell you the number of times I have looked at promising-looking properties with suspiciously low prices, and found signs of subsidence!

A few years ago on Homes Under the Hammer I looked at a former registry office in Ilkeston, Derbyshire. With the property up for auction with a fairly low guide price of £70,000 to £85,000, alarm bells were already ringing!

It didn’t take long to find the problems, including a massive crack in the ceiling on the stairway – you could get your fingers into it! Worst case I thought it’s subsidence, best case it’s historical - the building’s been moving in the past but has now settled. The only way to really know that would be to do some tests.

A good structural survey would definitely be required before you go too far on this - that maybe explained the low guide price. The property was snapped up by first-time property developers, but they agreed they were going to get a structural survey. They talked to the neighbours and were told that all the houses in the street had historic issues - apparently, the whole street was slowly moving downhill. The good news is that they were at the top of the hill!

ASometimes you need a quick solution to raising finance for a property purchase – could a bridging loan be the solution?

bridging loan is one which tides you over for a short period, as opposed to a long-term loan like a mortgage. The common circumstance in which a bridging loan is needed is when you are buying a property, but haven’t yet sold another property or asset on which you are relying for funds. So the bridging loan may be for a large amount, but for a short term. Once you have realised the value of your other assets, you repay the bridging loan.

A bridging loan should be capable of being put in place much faster than a mortgage, and so can o en remove problems caused by property ‘chains’.

The bridging loan specialists at Roma Finance say “We absolutely love to lend… but we are more than just a lender. We are dedicated to providing the ‘borrower first’

experience, we build long term relationships with property investors, developers in order to help them create wealth through property. If you want to work with a lender focused on your property goals, contact us on 0161 817 7480 or email rm@romafinance.co.uk.

There are two main types of bridging loans, regulated and unregulated. The regulated type is monitored by the FCA (Financial Conduct Authority) and is usually extended to homeowners. The unregulated type is normally used by intermediaries, property investors and property developers to secure an investment or buy-to-let property or commercial real estate, and as such is not covered by the FCA, so you will need to consult an experienced specialist to find a suitable lender for this sort of bridging loan.

A specialist bridging lender will be used to the idea of having to work quickly, and will normally be able to complete an arrangement within a few days. As well as speed, cost is of course also a factor: make sure that the lender is transparent about repayment structure, costs and the time involved.

Bridging loans are normally priced monthly rather than annually, and of course are relatively expensive, typically from around 0.5 percent to 2 percent per month, or 5 to 24 percent APR, much more than a conventional mortgage. There will also be a setup fee to consider, usually around two percent of the loan, and possibly an exit fee if you repay early, so it’s essential that you know before you go into a bridging loan arrangement, when and how you will be able to pay it o . ■

The steps we take after making an insurance claim for property damage can be tricky. Why not have an expert do the job for you?

After suffering property damage, making an insurance claim is definitely the first step in the right direction. These claims are simple enough to make, and depending on your insurer, possible for a broad variety of cases, from damages caused by fire, flooding and storms to vandalism, impact and theft.

But it’s the steps that follow this that will often leave a claimant uncertain, questioning their own capability of seeing their claim through to its end. Experienced loss assessors and claims negotiators exist to fill this role, all on your behalf.

A claims negotiator will work to ensure the best possible outcome for you as their client. Once given the permission to represent your case, they will first ascertain the validity of your insurance claim, determining its extent and the

exact reparations that can be made, in accordance with their expertise. They will then liaise with your insurer, do the additional chasing, and come to an agreed settlement that is made with the benefit of their client in the foreground.

In the UK, insurance claims negotiators are required to be authorised and regulated by the Financial Conduct Authority (FCA). This ensures that the standards and ethical practices of the FCA are upheld, and their work is to a satisfactory and worthwhile calibre. When set against an insurance company, with experts and strict standards of their own, having an experienced claims negotiator and their level of expertise is a simple enough means to level the playing field. Their

experience can be determined with a look through their client reviews, as well as their transparency about said past client satisfaction. A good claims negotiator will be honest with you, first and foremost, striving to prioritise their client and a high satisfactory end result.

An added benefit of some claims negotiators is their protocol to see clients through to the completion of a claim and the necessary property repairs. This will often minimise, or avoid overall, the long-windedness of insurance company repair works many are familiar with. In some cases, claims negotiators may take up a certain extent of the reparations themselves. To that end, they are nothing if not proactive, and their specialised skill sets will prove most beneficial to clients through to the timely conclusion of a claim. ■

Our whole of market mortgage brokers can advise you on bridging finance, limited company buy to let and residential mortgages.

How can our one-stop shop help you?

A successful title split relies on the co-ordination of your mortgage application, your tax strategy and the creation of your leases. Without this integration, there will be an imbalance between these essential components causing costly delays and mistakes.

Are you interested in splitting the legal title of a property but do not know where to start? Are you put off by upfront costs or concerned about legal requirements or finance options? We can help! Call 020 8037 4027 for a free consultation

We have a successful track record in helping freeholders split their titles. Working under the same roof as Starck Uberoi Solicitors allows us to provide a streamlined and regulated ‘One Stop Shop’ service.

We offer:

✔ No upfront fees

✔ No training Course Jargon

✔ SRA Qualified & Regulated Solicitors

✔ FCA Regulated Mortgage Advisors

✔ Property Tax Advice

Title splitting is the process of dividing the deeds of one building into two or more. It can be a smart investment strategy - so how does it work?

The most common scenario in enhancing the value of your property portfolio by title splitting is to buy a large property, o en one in need of refurbishment, and to split it into several properties. The most suitable subjects for this strategy are usually tenements, or former nursing homes, hostels or guest houses.

Of course, in this sort of project, the cost of the refurbishment work has to be added onto the purchase price in order to work out whether you can make a profit. Perhaps the easiest option is to purchase a property which has already been split, such as an HMO (House in Multiple Occupation). Here some of the renovation work would have been done for you, and you might be able to continue

renting the property out partially while you get on with redevelopment work. But title splitting need not necessarily be done with an existing building - you can also do it by purchasing a plot of land and building not just one, but more houses on it. Each house is then recorded separately with the Land Registry.

Another potential scenario is that you could buy a house with a large gardeno en a corner house - and split it to build a second house on the garden.

Of course, there are complications to property splitting, whichever route you take. For instance, if you sell individual flats as leasehold, you may still want to hold on to the freehold for the property.

Other considerations when title splitting

are that you will have to get an extensive survey done, as well as obtaining planning permission, which can be time-consuming.

A successful title split relies on the co-ordination of your finance, your tax strategy and the creation of your leases, which is why a specialist advisor o ering collaboration with wealth and tax experts as a ‘one-stop’ title split solution is worth seeking out.

Raminder Singh Uberoi of solicitors Starck Uberoi (www.starckuberoi.co.uk), says; “Our experienced solicitors and financial advisors work collaboratively to provide comprehensive legal, financial, and tax solutions. By combining expertise under one roof, we ensure that every aspect of your title split is approached with precision, e iciency, and a focus on delivering meaningful financial outcomes.” ■

The allure of buying property in France is offset by the prospect of confusing bureaucracy. We take a taste of la vie en rose

For many in the UK, buying property in France is an appealing prospect, either as a holiday or retirement option or as a business investment such as managing a gîte or small family hotel. But there are pros and cons involved in buying French property.

Property prices in many parts of France are still comparatively lower than in the UK, especially in rural and smaller cities. Areas

like Normandy, Brittany, and even parts of the south offer substantial properties for a fraction of the cost of homes in the UK. This affordability is a significant factor for those looking for a holiday home or a retirement retreat.

Many UK residents are drawn to France’s lifestyle, which emphasizes work-life balance, leisurely meals, and a slower pace. With a reputation for excellent

healthcare, well-developed infrastructure, and a focus on fresh local produce, France offers an attractive setting for those looking to improve their quality of life.

France’s proximity to the UK means that it’s easy for families, retirees, and remote workers to stay connected. Budget airlines, ferry crossings, and high-speed trains like

the Eurostar allow for convenient travel back and forth, which is ideal for holiday homeowners or frequent travellers.

Close to the UK and featuring picturesque coastal areas, Normandy and Brittany are popular among those looking for a home within a short travel distance. The property market here is more a ordable than in other parts of France, and the local culture and cuisine make it a rich experience.

You’ll find a one-stop-shop for help and advice at the French Property Exhibition in January, the largest exhibition in the UK dedicated to French property, bringing together experts from the UK and France who can help you on your journey to buying a French property. Attendees can browse a wide range of properties, attend free seminars on essential topics, and receive a complimentary copy of French Property News. Find out more at www.frenchpropertyexhibition.com

Known for its Mediterranean climate and vibrant lifestyle, Provence is a favourite among those looking for a sunny escape. The south coast, while more expensive, o ers luxurious properties, stunning beaches, and proximity to the French Riviera.

Inland France has some of the most a ordable and idyllic countryside. The Dordogne, in particular, is renowned for its beautiful landscapes, charming villages, and historical sites, making it a favourite among retirees.

The French property market di ers from the UK’s in terms of pricing, process, and taxes. Buyers need to account for extra costs like notaire fees, which cover legal and registration services. These fees can be around 7–10% of the purchase price. Property taxes and maintenance costs should also be budgeted for.

With the UK’s exit from the EU, British citizens now have di erent rules around property ownership and residency. If staying for extended periods, UK residents may need a visa or long-stay permit. It’s essential to consult with an immigration

lawyer to understand the specific requirements for long-term residency or frequent stays.

UK residents can secure French mortgages, though lending criteria di er between the two countries. Generally, French banks o er mortgages of up to 70-80% of the property’s value, so buyers should be prepared for a substantial down payment. Mortgage brokers who specialize in overseas property purchases can provide valuable guidance through the financing process.

Currency fluctuations between the British Pound and the Euro can a ect the purchasing power and ongoing costs of owning a property in France. Many UK buyers open Euro accounts to help manage these fluctuations, especially for recurring payments like mortgage instalments or utility bills.

In practical terms, your first step would be to identify the type of property and region you are interested in - a city apartment, rural farmhouse, or coastal villa. Each type of property will come with di erent maintenance levels and seasonal benefits.

Engage a local notaire. Unlike in the UK, where solicitors act for either buyer or seller, in France, the notaire is a neutral party. They are essential for handling the legal aspects of the sale, from confirming ownership to completing the final registration.

Secure your finances early on, and don’t forget to budget for notaire fees, property taxes, and any necessary renovations. Working with both a French mortgage broker and currency exchange service can make this step easier.

A er finding the right property, you’ll need to make an o er and sign a preliminary contract known as the compromis de vente This contract binds both parties to the sale, though there is a ten-day cooling-o period for the buyer.

A er all conditions are met and final payments made, the sale is completed with the signing of the acte de vente (final sales agreement). At this stage, the property o icially transfers to the buyer, who can now enjoy their French home. ■

From decorative arts to heating and insulation to moving house, the latest products and style ideas for your home

London’s Decorative Fair has, over its 35 years, built a powerful reputation amongst the decorating trade and private buyers. Some 130 specialist dealers showcase every discipline of antiques, fine and decorative art and 20th century design, dating from the 1700s to the 1970s at a wide range of price points. Exhibitors are resourceful in finding unique and special items to create and finish an interior scheme or garden room. Many exhibitors present room-sets, providing further inspiration on how to imaginatively display items.

The Winter Fair is the perfect source for interior sparkle to brighten up your home, from modernist or period lighting and mirrors, to cheerful contemporary paintings and colourful works of art such as studio glass, crystal, and silverware. Winter is also when The London Antique Rug & Textile Art Fair (LARTA) takes place on the mezzanine, with 15 specialist dealers in rugs and carpets, tribal weavings, and a huge variety of antique textiles for decorating with, and collecting. If you are searching for a rug, or original

textiles for the wall such as embroidered panels or tapestries, you’ll find a great range to choose from.

Packing, delivery and export services are available on site. The restaurant on the Mezzanine provides allday refreshment, and there’s a courtesy coach service between Sloane Square and the Fair. The event is dog-friendly.

Venue

Evolution London Battersea Park London SW11 4NJ

Admission

Tuesday 21 January – £20 p/person

Wednesday 22 – Sunday 26 January – £10 p/person Free entry after 4pm