9 minute read

MARKET REPORT

TP-LINK CONTINUES TO DOMINATE INDIAN WLAN MARKET WITH 33.2% MARKET SHARE

PCs AND PHONES IN USE TO REACH 6.2 BILLION UNITS GLOBALLY IN 2021: GARTNER

Advertisement

Indian networking market is one of the fastest-growing markets due to the increase in demand for connectivity. In recent times, especially post-pandemic, the demand for internet connection has increased due to WFH & LFH trends. This lead to gaining good momentum in demand across the major markets. According to IDC’s Worldwide Quarterly Wireless LAN (WLAN) Tracker, the Indian WLAN market had a YoY growth of 8.8% during Q4 2020. The market stood at USD 61.7 million (by Vendor Revenue) majorly contributed by consumer gateway routers. While enterprise-class WLAN took a significant decline of 26.3% YoY, the consumer gateway router demand picked rapidly by 57.8% YoY to support the growing demand of employees and students working out of their homes.

Despite a growth of 8.8% in the WLAN segment, the enterprise class WLAN segment continues to remain the most affected networking segment with a significant decline of 26.3% YoY owing to the slowdown in campus investment caused by COVID-19. However, the sluggish enterprise class market was compensated by the growth of consumer gateway routers with a staggering 57.8% YoY growth during Q4 2020. The growth in the consumer gateway routers was due to the remote working and online schooling requirements. With a market share of 33.2%, TP-Link was the market leader in the WLAN segment during Q4 2020, followed by D-Link due to the rapid increase in demand for consumer gateway routers. Cisco and Hewlett Packard Enterprise were the key vendors driving the market for enterprise class WLAN during Q4 2020.

Enterprise class WLAN remains to be most affected segment since the COVID-19 driven lockdown owing to the drop in campus investments. However, the market is opening with multiple enterprises looking out to adopt cloud-driven WLAN that will enable management efficiency. Manufacturing and professional services are the top verticals contributing to the enterprise WLAN business with investments coming from automobiles, and pharmaceutical enterprises. Business from other key verticals like government and education remained slow.

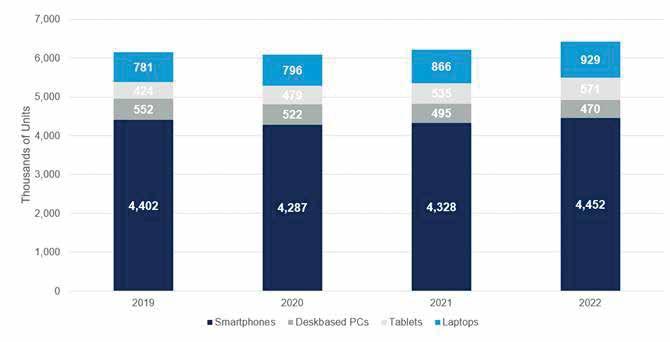

The number of devices (PCs (laptops and deskbased), tablets and mobile phones) in use globally will total 6.2 billion units in 2021, according to Gartner, Inc. In 2021, 125 million more laptops and tablets are expected to be in use than in 2020.

“The COVID-19 pandemic has permanently changed device usage patterns of employees and consumers,” said Ranjit Atwal, senior research director at Gartner. “With remote work turning into hybrid work, home education changing into digital education and interactive gaming moving to the cloud, both the types and number of devices people need, have and use will continue to rise.”

In 2022, global devices installed base is on pace to reach 6.4 billion units, up 3.2% from 2021 (see Figure 1). While the shift to remote work exacerbated the decline of desktop PCs, it boosted the use of tablets and laptops. In 2021, the number of laptops and tablets in use will increase 8.8% and 11.7%, respectively, while the number of deskbased PCs in use is expected to decline from 522 million in use in 2020 to a forecasted 470 million in use in 2022. Smartphone Installed Base Set for Upturn in 2021

Users’ confidence is returning in the smartphone market. Although the number of smartphones in use declined 2.6% in 2020, smartphone installed base is on pace to return to growth with a 1% increase in 2021. “With more variety and choice, and lower-priced 5G smartphones to choose from, consumers have begun to either upgrade their smartphones or

upgrade from feature phones,” said Mr. Atwal. “The smartphone is also a key tool that people use to communicate and share moments during social distancing and social isolation.”

The integration of personal and business lives, together with a much more dispersed workforce requires flexibility of device choice. Workers are increasingly using a mix of company-owned devices and their own personal devices running on Chrome, iOS and Android, which is increasing the complexity of IT service and support.

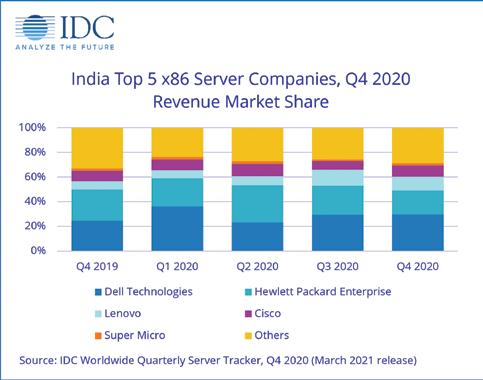

DELL TECHNOLOGIES RANKS NO. 1 IN INDIAN X86 SERVER MARKET

The overall server market in India witnessed a year-over-year (YoY) decline of 11.2% in terms of revenue to reach $266.1 million in Q4 2020 (Oct-Dec) versus $299.6 million in Q4 2019, according to the latest IDC Worldwide Quarterly Server Tracker, Q4 2020 (March 2021 release). The x86 server market contribution grew to 92.9% in terms of revenue, a growth of 4.8 percentage points over last year same quarter.

The highest contribution in the x86 market mainly came from the professional services, telecommunications, and manufacturing verticals. In the professional services vertical, original design manufacturers (ODM) and new-age IT companies witnessed positive YoY growth with respect to the server spend. At the processor brand level, AMD witnessed YoY revenue growth of 4.7 percentage points claiming a revenue share of 8.4% at the end of Q4 2020.

The x86 server market in terms of revenue declined YoY by 6.3% to reach $247.2 million in Q4 2020 from $264.0 million in Q4 2019. The contribution largely came from the custom-built server category with revenue growth of 28.7% YoY. Hyperscalers continues to spend towards building robust data centers and support the global and local customer demands. The General-purpose server revenue declined by 13.4% due to the weakening demand across different industries. During Q4 2020, verticals such as utilities, resource industries, and securities and investment services witnessed the highest YoY growth in terms of revenue at 331.5%, 218.7%, and 160.6% respectively.

The non-x86 server market declined YoY by 47.1% to reach $18.9 million in revenue in Q4 2020. IBM continues to dominate the market accounting for 49.4% of revenue share, during Q4 2020 with a revenue of $9.3 million. HPE came at second position followed by Oracle with a revenue share of 27.8% and 8.3% respectively.

In Q4 2020, Dell Technologies emerged as the top vendor in the India x86 server market with a revenue share of 29.6% and a revenue of $73.1 million. Top three verticals for Dell Technologies were professional services, banking, and discrete manufacturing. HPE came at second spot with a revenue share of 19.5% and a revenue of $48.2 million. Key verticals for HPE were telecommunications, discrete manufacturing, and professional services. At number three is Lenovo with a revenue share of 10.9% and a revenue of $27.0 million. Cisco came in fourth accounting for a revenue share of 9.1% and a revenue of $22.6 million.

The adoption of Smart TVs has dramatically increased due to the array of great features and unlimited entertainment options. However, the TV manufactures are working on bringing more innovative and customer-friendly features to offer unmatched experience. In line to know more about the Smart TV market in India, Rajeev Ranjan, Editor, Digital Terminal spoke to Avneet Singh Marwah, Director and CEO of Super Plastronics Pvt Ltd, a Kodak brand licensee. Avneet Singh Marwah elaborated upon all the aspects and gave deep insights about the Indian Smart TV market. Read below the excerpts:

RAJEEV: WHAT DO YOU THINK ABOUT THE CURRENT SCENARIO OF THE INDIAN SMART TV MARKET? HOW IS THE MARKET PICKING UP GROWTH MOMENTUM IN 2021?

AVNEET SINGH: With an increase in panel pricing, there has been a major shift in the market. This has slowed down the demand of televisions. Currently, the price for a 32-inch has gone up by 350%. Therefore, there is a shift towards the sale of larger screens.

RAJEEV: HOW DO YOU LOOK AT THE COMPETITION FROM BRANDS LIKE ONEPLUS, REALME AND MI? WHAT HELPS YOU TO ACHIEVE SUSTAINABLE GROWTH DESPITE TOUGH COMPETITION IN THE MARKET?

AVNEET SINGH: The brands mentioned above, all come from the phone ecosystem and are all non-Indian manufacturing brands. We are one of the few Indian manufacturing brands that are giving tough competition to the existing names mentioned above. I think, last year has been good as the consumer sentiments were running high toward non- Chinese brands. We became the first Indian brand to get a Google android license for our televisions. This year we will be launching TVs with new innovative technologies, customized especially for the Indian customers.

RAJEEV: PM MODI INTRODUCED THE VOCAL FOR LOCAL INITIATIVE TO PROMOTE LOCAL MANUFACTURING SO WHAT STEPS ARE YOU TAKING TO SUPPORT THIS INITIATIVE? PLEASE TELL ABOUT YOUR EXISTING AND UPCOMING PRODUCTION FACILITIES WITHIN INDIA.

AVNEET SINGH: For the last 30 years, we (SPPL) are manufacturing TVs in India. We have a complete backward integrated system. The COVID-19 pandemic has been a blessing in disguise for the Indian manufacturing industry. It taught us to be more dependable on our very own home-grown raw materials. But when it comes to TVs, there is no alternative other than China to manufacture panels because of which 7080% of the cost comes from there. Currently, we are trying to achieve more value editions in India. Kodak TV is investing more than 300cr in the next 3 years. We are setting up a new manufacturing plant with the help of the UP government and will be increasing our capacity to over a million units.

RAJEEV: WHAT ARE YOUR OUTREACH AND EXPANSION PLANS FOR TIER II AND III CITIES? PLEASE SHED SOME LIGHT ON YOUR DISTRIBUTION STRATEGIES FOR CY 2021 AND BEYOND TO STRENGTHEN YOUR PRESENCE ACROSS INDIA.

AVNEET SINGH: In the last one-year, despite a spike in online, we have established an effective offline network as well. We have more than 10,000 billing counters offline. In the last 6 months, we have introduced TVs in 16 different odd states, and we are working on all major LFRs. In the next 6 months, 90% LFRs will be covered by Kodak as the offline market has realized that there is a vacuum for an Indian budget manufacturing brand with the kind of technology we are offering. We are delivering in both tier 2 and tier 3 cities. To name a few cites where our market is increasing at a rapid phase, are Jalgaon, Nagpur, Agra, Vijayawada, Vishakhapatnam, Ludhiana, Chattarpur, Indore Bikaner, Ranchi, Hugli, Bhatinda, and Ayodhya. These are some of the cities where we’ve seen Kodak grow significantly. By end of this year, we will be able to sell in more than 3000 cities and towns in India.

RAJEEV: WHICH NEW PRODUCTS WE CAN SEE THIS YEAR FROM BRAND KODAK? HOW DO YOU HARNESS THE NEXT-GEN TECHNOLOGIES TO DEVELOP CUSTOMER-CENTRIC TVS?

AVNEET SINGH: One of the biggest disruptions for TV industry has been AI, we are working with an android team to streamline more Indian languages in Google assistant. I feel the new U.I will be a voice command as the biggest screen of your home will be now connected to your smart home devices. We will now be developing new televisions keeping work from home in mind. Apart from the content, the TVs will be business-tool friendly as well. The main concept is that our customers can work in the daytime and in the evening, our customer can enjoy their favourite OTT content.