Our magazines are must-reads for key executives in core corporate competencies.

• Create a strong financial structure and healthy economic ecosystem to ensure capital and cash flow keep their engines running?

• Determine who their customers should be, how they can reach them most effectively, and how they can turn data-driven marketing into profitable sales?

• Build efficient and effective financial systems to enhance payments and billings between their companies and their customers and vendors?

• Convert all the data and information they collect from every contact point into tangible benefits that increase revenue and reduce costs?

• Equip their companies with the tools, technology, systems and hardware needed to manage their operations, to create new services or products, and deliver them to their market?

• Manage their customers with smoothly functioning support departments that are properly staffed and equipped to solve problems, foster loyalty and retain customers?

• Make any or every step in that chain better, faster, cheaper, and more profitable?

To advertise or get more information and media kits: Steve Lloyd 905-201-6600 ext 225 | 1-800-668-1838 | steve.lloyd@lloydmedia.ca

We can help you tap into the ecosystem at the points that will drive your campaigns.

The Canadian Finance & Leasing Association’s (CFLA) 2024 Annual National Conference returns this September in St. John’s, Newfoundland - a vibrant, historic, colourful, and contemporary city - 500 years young. A New World of Opportunities, with Equifax as the title sponsor. One keynote speaker is singer/songwriter Alan Doyle, hailing from Petty Harbour, Newfoundland and Labrador. Doyle is also a composer and actor. He is known for Robin Hood (2010), Winter’s Tale (2014) and State of Play (2009). The other keynote is Tareq Hadhad is telling his story. He was a Syrian refugee and now living his new life with his entrepreneurial family in Canada’s east coast. He is the founder and CEO of Peace by Chocolate.

The CFLA is the only organization in Canada representing the asset-based finance, vehicle, and equipment leasing industry’s interests. It represents more than 200 member companies and more than 3,000 persons working directly in the industry. A professional, engaged board of directors oversees the CFLA to continue ensuring it serves the industry’s best interests. The organization supports, informs, and advocates for members to advance the asset-based financing, vehicle and equipment leasing industry. The CFLA’s three pillars are: Industry advocacy to amplify the industry’s voice and influence legislation and regulation; Industry intelligence—to provide research and information to help members make informed business decisions; and professional development—to offer exclusive education and networking events to help members connect and succeed.

The CFLA organizes several high-profile events throughout the year including The Annual National Conference which brings over 450 industry leaders together from companies across the industry; and networking and informational events organized by the Women in Asset Finance Committee and Future Leaders Committee. The corporate members range from large multinationals to national and smaller regional domestic companies, crossing the financial services spectrum: Manufacturers’ finance companies, independent leasing companies, banks and credit unions, brokers, insurance companies, and suppliers to the industry like law, accounting, or software firms.

Moneris Solutions Corporation, the Canadian leader in innovative solutions for mobile, online, and in-store commerce, has partnered with Wix.com Ltd., the leading global SaaS platform to create, manage, and grow an online presence1, to introduce Moneris Total Commerce, an omnichannel point of sale solution. Moneris’ partnership with Wix is built on the idea of a simple and easyto-use solution for Canadian businesses. Last year, Moneris partnered with Wix to introduce Moneris Online, an all-in-one ecommerce solution. Now, with the launch of Moneris Total Commerce, Moneris’ partnership with Wix continues to evolve, closing the gap between online and in-store transactions with a fully integrated and unified commerce experience for merchants and their customers.

“For many businesses, taking the next step means expanding into new ways of serving their customers, whether that’s online or instore. As a trusted partner to business owners, we know managing a physical and online presence can be complex and daunting at first,” said Patrick Diab, Chief Product and Partnership Officer at Moneris. “As an omnichannel solution, Moneris Total Commerce helps make things easier by giving retail businesses a unified view and control of their operations through one intuitive solution, a solution that’s able to grow with their business.”

Merchants purchase the hardware, which includes a Moneris Go smart terminal and a tablet with merchant and customer display preinstalled with all the tools businesses need to accept payments – merchants simply plug in the device and log in to their Wix account. In addition, businesses also have a range of accessories to complement their setup, including a scanner, receipt printer, and cash drawer, to create their ideal retail experience. Once up and running, the solution helps businesses consolidate store operations in an easy-touse and flexible omnichannel platform to create a seamless customer buying experience. Business owners save time with the solution’s unified product catalog, which makes items available in-store and online. Meanwhile, inventory, orders, customer profiles and analytics are automatically synced across channels in real-time.

Additional features are also available through Wix to help businesses attract and engage customers, provide exceptional personalized customer experiences, and make more informed business decisions. To help ensure businesses are set up for success, Moneris’ dedicated support team is also there to help business owners build their online store or migrate their existing one at no additional cost. The service includes setting up their payment processing, as well as a one-on-one learning session to get them up to speed and selling faster.

Summer 2024

Volume 3 Number 2

Publisher / Corporate Sales

Steve Lloyd steve@totalfinance.ca

Contributors

Sandrine Garin, Chief Product Officer & M&A Growth Strategy, Intix

Kellie Johnson, SVP of Payments in the Americas, RedCompass Labs

Christopher Juneau, Head of Market Strategy, SAP Concur LexisNexis Risk Solutions

Creative Direction / Production

Jim Moschos, Director of Technology Finance, Mitsubishi HC Capital Canada.

PwC Canaada

Megan Smith, Head of HR, SAP North America

David Udy, Founder & CEO, WealthCo

Jennifer O’Neill, jennifer@totalfinance.ca

Photographer Gary Tannyan

President

Steve Lloyd, steve@totalfinance.ca

For subscription, circulation and change of address information, contact: subscriptions@totalfinance.ca

Publications Mail Agreement No. 40050803

Return undeliverable Canadian addresses to:

Circulation Department 302-137 Main Street North Markham ON L3P 1Y2 t: 905.201.6600 • f: 905.201.6601 info@totalfinance.ca www.totalfinance.ca

Twitter: @totalfinancemag

Subscriptions available for $40.00 year or $60.00 two years. ©2024 Lloydmedia Inc. All rights reserved. The contents of this publication may not be reproduced by any means, in whole or in part, without the prior written consent of the publisher. Printed in Canada. Reprint permission requests to use materials published in Total Finance should be directed to the publisher.

The Payments Canada Board of Directors appointed Susan Hawkins to President and CEO of Payments Canada.

“We are thrilled to appoint Susan Hawkins to lead Payments Canada as President and CEO,” said Garry Foster, Chair of the Payments Canada Board of Directors. “Susan is an expert in the industry and her experience spans domestic and international retail and commercial payment leadership. Her passion for payment innovation and proven collaborative leadership will support our drive forward as we modernize Canada’s payment systems.”

For over five years, Hawkins was the Global Head of Enterprise Payments and Executive Vice President of US Payments at TD Bank Group, where she led the modernization and governance of payment infrastructure and payment products working with teams in the US and Canada. In her position, Hawkins also played a pivotal role in building and commercializing a real-time payments solution. Throughout her career, Hawkins also held executive roles with Fidelity Global Information Services and Metavante Payment Solutions. Hawkins served as a board member for Payments Canada from 2020 to 2023, and has been on the board of The Clearing House Payments Corporation since 2019.

“I look forward to leading the Payments Canada team and working collaboratively with our members and stakeholders to continue to build on the momentum of Canada’s payment innovation journey,” said Susan Hawkins, incoming President and CEO of Payments Canada. “It’s a pivotal time for Payments Canada and the industry with advances to broaden access to Canada’s payment systems through the recent Royal Assent of The Canadian Payments Act changes, which will expand Payments Canada’s membership, and as Payments Canada leads the final phase of

a ‘made for Canada’ Real-Time Rail (RTR) payment system. I am excited to support Payments Canada to build the future of payments for Canada in partnership with the payment ecosystem.”

Upon Susan’s commencement of her new role, interim co-CEO Kristina Logue will resume her full role as Chief Financial Officer (CFO) and interim co-CEO Jude Pinto will resume his full role as Chief Delivery Officer (CDO).

“On behalf of the board of directors, we extend our deepest gratitude to Kristina and Jude for their exceptional leadership during this transition period,” said Foster. “Payments Canada has an excellent leadership team that will work closely with Susan to align its critical work of safely and securely operating Canada’s national payment systems and the delivery of the Real-Time Rail (RTR) with the vision she brings. Susan’s appointment marks the beginning of an exciting next chapter for Payments Canada.”

Payments Canada makes payments easier, smarter and safer for all people living in Canada by providing the infrastructure where payments are cleared and settled between financial institutions. We are a public purpose organization that owns and operates Canada’s payment systems, Lynx and the Automated Clearing Settlement System (ACSS), and are responsible for the bylaws, rules and standards that support these systems. In 2023, our systems cleared and settled over $112 trillion — more than $450 billion every business day. Some of the transactions that pass through our systems include debit card payments, pre-authorized debits, direct deposits, bill payments, wire payments and cheques. Payments are an essential part of our economy and way of life. From a down payment on a home, an invoice paid to a local business or a first paycheque payments keep Canadians and the economy moving forward.

LifeSpeak Inc., the leading whole-person wellbeing solution for employers, health plans and other organizations, appointed Lee Dabberdt as its new Chief Financial Officer. Dabberdt brings to LifeSpeak more than 25 years of financial and capital markets experience, including recently as

Chief Accounting Officer at EverCommerce Inc., a leading provider of SaaS solutions for small and medium-sized business. At EverCommerce, Dabberdt was part of the company’s leadership group for its IPO in 2021, and made ongoing, significant contributions to the company’s organic growth and its M&A execution, resulting in substantial revenue expansion. Dabberdt also focused on driving the company’s financial strategy and optimizing its operational efficiency.

Prior to EverCommerce, Dabberdt excelled in increasingly senior roles for a number of technology companies including Vertafore and Rogue Wave Software. She also spent 14 years at KPMG U.S. auditing public and private companies. Dabberdt is a Certified Public Accountant (U.S.) and earned her MBA in accounting from the University of Colorado Denver.

“Lee’s appointment strengthens our senior leadership team and will augment our ability to scale our business,” said Michael Held, founder and CEO of LifeSpeak. “We believe that her deep and diverse experience will be crucial for the Company as we pursue growth initiatives that have the potential to create long-term shareholder value.”

Lee Dabberdt commented, “I was drawn to the opportunity at LifeSpeak because I believe in the value that the Company’s digital wellbeing services provides to its clients across the world. LifeSpeak has grown to become a world-class, trusted provider of mental, physical and family wellbeing solutions for employers, health plans, and other organizations. I am excited to become part of the team and contribute to LifeSpeak’s success going forward.”

Spin Master Corp., a leading global children’s entertainment company announced that Executive Vice President and Chief Financial Officer, Mark Segal, will retire as CFO in the first half of 2025. The Company is conducting an external search for a successor. Segal will assist in the transition and will subsequently continue at the Company in an advisory capacity.

Segal originally joined Spin Master in 2001 and spent 10 years as CFO. He rejoined the Company in 2015 as Executive Vice President & CFO to lead its Initial Public

Offering and has since been instrumental in the Company’s international growth, numerous acquisitions and expansion into digital games. During his second term, Spin Master’s revenues grew from $983 million in 2015 to $1.9 billion in 2023.

“In his distinguished 20 years as CFO with Spin Master, Mark has steadfastly guided the Company forward by applying his exceptional financial leadership to maintain a strong balance sheet and cash flow, which in turn has helped to provide a platform for our growth ambitions,” said Max Rangel, Spin Master’s Global President & CEO. “He has been an invaluable strategic advisor to me during my time with the Company, consistently demonstrating his integrity, financial discipline and commitment to our strategic goals, while also establishing a strong finance team. On behalf of Spin Master’s founders and the Company, I want to thank Mark for his incredible contributions that have furthered our leadership within the children’s entertainment industry.”

“Spin Master is a remarkable Canadian and global success story fueled by passion, entrepreneurship and innovation and it’s been my privilege to have contributed to the Company’s evolution and growth journey,” said Segal. “I’m extremely proud of what we have accomplished together and look forward to continuing to contribute in an advisory capacity.”

Spin Master Corp. (TSX: TOY) is a leading global children’s entertainment company, creating exceptional play experiences through its three creative centres: Toys, Entertainment and Digital Games. With distribution in over 100 countries, Spin Master is best known for award-winning brands PAW Patrol®, Hatchimals®, Bakugan®, Kinetic Sand®, Air Hogs®, Melissa & Doug®, Rubik’s® Cube and GUND®, and is the global toy licensee for other popular properties.

BlackBerry Limited announced a series of leadership changes designed to streamline its finance organization as it executes on its strategy to establish two distinct divisions (Cybersecurity and IoT).

Tim Foote has been appointed as the Company’s Chief Financial Officer. Foote will report to BlackBerry CEO, John J. Giamatteo. Foote joined the Company

following BlackBerry’s acquisition of Good Technology in 2015 and brings more than 20 years of experience across a number of senior finance leadership positions. While at BlackBerry, Foote’s roles have included managing the Company’s international finance operations, Vice President of Investor Relations and, most recently, CFO for the Cybersecurity division. Foote holds an MBA from Imperial College Business School, London and is a Chartered Accountant.

Foote will succeed Steve Rai, who has decided to pursue other opportunities outside of the Company. Giamatteo, and the rest of the BlackBerry Board, thank Steve for his contributions to the Company since 2014 and wish him well in his future endeavors. Rai will remain with BlackBerry until September in a consulting role in order to help facilitate a smooth transition.

“We are pleased to appoint Tim as our new CFO,” said Giamatteo. “Tim is a strong, respected and trusted leader within our finance organization, and he brings a wide range of experience from over two decades of senior finance roles in both public and private multinational companies. Tim’s deep knowledge of BlackBerry’s business, strong relationship with the investment community, and demonstrated leadership made him an ideal choice for the task ahead.”

“I am proud to be given the opportunity to lead the BlackBerry finance team at this pivotal time,” said Foote. “BlackBerry has made tremendous progress in establishing two standalone divisions and driving towards profitability, and I’m excited about partnering with the executive team to deliver greater shareholder value.”

In addition, BlackBerry has appointed Jay Chai as the Company’s Chief Accounting Officer. Chai has been Vice President and Corporate Controller at BlackBerry since May 2019 and will leverage his deep expertise in financial reporting and

operations for this new, expanded role and responsibilities.

Fraser Deziel has been promoted to the role of Corporate Controller. Deziel has been with BlackBerry since November 2009 and was most recently Senior Director of Financial Reporting and Treasury.

BlackBerry (NYSE: BB; TSX: BB) provides intelligent security software and services to enterprises and governments worldwide. The company’s software powers over 235M vehicles on the road today. Based in Waterloo, Ontario, the company leverages AI and machine learning to deliver innovative solutions in the areas of cybersecurity, safety, and data privacy and is a leader in the areas of endpoint management, endpoint security, encryption, and embedded systems. BlackBerry’s vision is clear - to secure a connected future you can trust.

Aimia Inc. announced leadership appointments aimed at fast-tracking the rollout of the Company’s strategy recently endorsed by shareholders at its annual general meeting, naming James Scarlett as Chair of the newly-formed Strategic Review Committee and Steven Leonard as President and CFO. Aimia’s strategy and near-term priorities are focused on unlocking value and returning capital to investors in a responsible and expeditious manner. The appointments are effective immediately.

“With the outcome of our AGM now behind us, optimizing the leadership team that will execute our strategy for unlocking value is a key to success,” said Tom Finke, Executive Chairman. “Our decision to move forward with a streamlined, cost-effective leadership model that best utilizes the expertise of our Board members and the depth of experience of our management

team was based on a number of factors, including the effectiveness and level of collaboration we have been able to achieve to date, minimizing executive compensation expenses, and avoiding delays inherent in a period of ramp-up typically associated with the hiring of a new CEO from outside the organization. I look forward to continuing my close working relationships with Jamie and Steve for the benefit of all Aimia shareholders.”

James Scarlett, ICD.D., one of Canada’s most respected senior legal advisors with more than 40 years of experience in complex merger and acquisition, capital markets, and other transactions and named to Aimia’s Board in June 2024, has been appointed as Chair of Aimia’s Strategic Review Committee. The newly-formed Board committee, which will include Aimia Directors Robert Feingold and Jordan Teramo, will work closely with management to drive Aimia’s strategic review process and identify the best options for returning capital to shareholders. These options may include the potential sale of Aimia’s core holdings, the potential spinoff of core holdings, the potential recapitalization of the Holdco or core holdings or the potential merger of core holdings with other entities to take advantage of the Company’s cumulative tax losses. Among its initial priorities, the Committee will work to identify the external advisors best qualified to assist Aimia in its strategic review process in the coming weeks. Aimia expects the identification of best options for value creation to be completed in the third quarter of 2024.

Steven Leonard, CPA, CA, who brings more than 35 years of finance and executive leadership experience, has been appointed Aimia’s President and CFO. In addition to his current responsibilities as Chief Financial Officer, Mr. Leonard will oversee all of Aimia’s day-to-day operations including oversight for the Company’s core holdings, Bozzetto and Cortland International. Mr. Leonard will also work with the Strategic Review Committee to identify and execute on strategic priorities aimed at unlocking value for all shareholders.

Leonard joined Aimia as Vice President and Corporate Controller in June 2010 and

was named Chief Financial Officer in May 2019. Prior to joining Aimia, Leonard held leadership roles at Air Canada, Vivendi and Seagram gaining financial, operational and international experience. He has experience in all areas of finance with particular specialization in corporate transformations, strategic planning, financing, taxation, and mergers and acquisitions. During his tenure with Aimia, Leonard has overseen the implementation of a number of major financial and transformational initiatives, including the sale of the Company’s equity stake in PLM for $570 million including the recently completed earn-out, the sale of Aeroplan for $516 million, the execution of $278 million in substantial issuer bids, and the recent acquisitions of the Bozzetto and Cortland businesses.

Aimia Inc. (TSX: AIM) is a diversified company focused on unlocking the growth potential of its two global businesses, Bozzetto, a sustainable specialty chemicals company, and Cortland International, a rope and netting solutions company. Headquartered in Toronto, Aimia’s priorities include monetizing its noncore investments, returning capital to its shareholders, and efficiently utilizing its loss carry-forwards to create shareholder value.

Tucows Inc., a global internet services leader, has named Ivan Ivanov as its new Chief Financial Officer (CFO). Ivanov assumes the role from Dave Singh — who has been with Tucows since 2017 — as he steps down to pursue other opportunities.

“I am excited to welcome Ivan to the Tucows family. Ivan is an accomplished business leader with highly-relevant financial expertise, including strategic capital management, which will make him an excellent addition to our organization,” said Elliot Noss, CEO of Tucows. “I also want to sincerely thank Dave for his impact on the business over the years. Under his stewardship, Tucows has navigated significant changes in both our business and industry and I am grateful for all of the contributions he has made.”

“I’ve thoroughly enjoyed my time as part of the Tucows leadership team and am proud of the many contributions we made to build the company,” said Mr. Singh. “I look forward to continuing to champion

Tucows’ trajectory from the sidelines.”

As new CFO, Ivanov will report to Elliot Noss and brings over 22 years of industry experience to this role. Prior to Tucows, he served as Executive Director and business unit CFO at Verizon, where he led both consumer and business finance teams.

Ivan began his career at Verizon on the M&A and Corporate Development team, progressing to a variety of other financial specialties, including cash flow planning, network and IT capital allocation, and commercial finance, where he led Verizon’s fiber deployment program.

“I am delighted to assume the Chief Financial Officer position at Tucows,” added Ivan Ivanov. “The company is at a pivotal moment, and what’s compelling to me is the great opportunity to leverage my skills and experience to advance Tucows’ mission and drive long-term growth and value for our stakeholders.”

Ivanov has a Master of Accounting from Seton Hall University and is a Chartered Professional Accountant with New Jersey State Board of Accountancy. He is also a graduate of Drexel University with a Bachelor of Arts in Finance.

Tucows helps connect more people to the benefit of internet access through communications service technology, domain services, and fiber-optic internet infrastructure.

Altis Recruitment & Technology Inc. revealed the appointment of veteran business, finance and transformation leader Andie Andreou as its new Chief Executive Officer. With this appointment, Kathryn Tremblay, the organization’s co-founder, sole owner and former CEO, moves into a strategic, new role aimed at growth and innovation.

“I’m thrilled to welcome Andie Andreou

to the team as our new CEO and work alongside her to propel our organization into the future,” said Tremblay. “With this appointment, Altis gains a visionary leader with proven experience executing complex business transformations that result in exponential growth.”

Andreou brings to Altis strategic thinking, business acumen and deep expertise in compliance and governance gained through more than 20 years of experience in roles spanning finance, technology and business enablement in both the private and public sectors.

Most recently, Andreou was the Chief Financial Officer of SkipTheDishes, which she joined in 2019. Amid the surge in demand for food delivery services during the pandemic, Andreou applied her strategic and financial acumen to help drive exponential growth at Skip. Following this achievement, she was recognized with a Report on Business Best Executive Award in March 2023, an honour that showcases Canada’s top 50 non-CEO leaders who go above and beyond for their organizations.

Prior to SkipTheDishes, Andreou held numerous senior roles, including VP, Corporate Affairs and CFO at the Canadian Air Transport Security Authority (CATSA); Executive Director & Corporate Controller at CBC; Partner at Deloitte and more.

Since joining Altis in September 2023 to consult on the organization’s growth strategy, Andreou has familiarized herself with the business, its key stakeholders and main industry verticals, and is excited to assume the organization’s leadership.

“I’m pleased to join a company with such a strong focus on humanity and look forward to leading Altis through its next phase of growth, especially at a pivotal time, when new technologies

are changing the world of work, creating entirely new roles and demanding new skillsets,” said Andreou. “Together with Kathryn Tremblay and the executive team, I’m keen to continue strengthening Altis’s foundation, including streamlining our processes, governance model and service delivery, as well as continuing our digital transformation, so we can connect even more employers with qualified candidates nationwide.”

In her new role as the Co-Founder & Owner of Altis, Tremblay will focus her energy and expertise on building the brand, mentoring and developing leaders, growing careers and providing strategic advice to the executive leadership team. She remains fully vested in the business and is the sole shareholder.

“Since co-founding the business over 35 years ago, I’ve worked with my team to grow Altis into one of Canada’s largest independent recruitment firms,” said Tremblay. “And as I looked to take that next step forward, I sought a dynamic, new leader with both a business and growth mindset — and ideally a woman, since Altis is a certified woman-owned enterprise. I’m confident that Andie Andreou has the right combination of skills and experience to help Altis achieve sustainable growth in today’s ever-evolving employment landscape.”

Founded in 1989, Altis Recruitment & Technology Inc. (“Altis” — formerly excelHR) is one of Canada’s largest independent staffing firms and remains 100% Canadian-owned and operated, with offices in Ottawa, Toronto and Vancouver. Through its two sister brands, Altis Recruitment and Altis Technology (for all IT staffing), Altis supports more than 3,500 client organizations across industries and sectors nationwide, helping them thrive by connecting them with highly skilled, qualified candidates. Every year, our team of specialized recruiters places more than 8,500 qualified candidates in meaningful roles from coast to coast. Altis is recognized as one of Canada’s Best Managed Companies (Platinum Club Member) by Deloitte and has received Women Business Enterprise certification from WBE Canada.

Neighbourly Pharmacy Inc., Canada’s largest and fastest growing network of independent pharmacies appointed J.P. Arcand as Chief Financial Officer. Arcand is a seasoned retail finance executive with over 20 years of experience. He joins Neighbourly from Helly Hansen, a leading designer and retailer of sports apparel owned by Canadian Tire Corporation, where he most recently served as CFO in Norway, overseeing its global operations across 40 countries and multiple channels.

Skip Bourdo, Neighbourly’s Chief Executive Officer, said, “We are excited to welcome JP to the Neighbourly team. His extensive retail experience and strategic vision will be a tremendous asset as we continue to execute our growth strategy and serve more communities across Canada.”

At Neighbourly, Arcand will oversee all aspects of Neighbourly’s financial operations, including financial planning and analysis, accounting, and treasury functions. He will work closely with the rest of the executive team to support Neighbourly’s long-term growth objectives.

“I am honored to join Neighbourly and excited about the opportunities ahead,” said J.P. Arcand. “I look forward to working with Skip, the executive team and the over 3,000 talented team members at Neighbourly to build on the company’s strong foundation and drive continued success.”

Arcand succeeds Billy Wong who is leaving Neighbourly for another opportunity. “On behalf of the entire team, I’d like to thank Billy for his leadership and significant contributions to Neighbourly’s growth. We wish him the very best as he transitions into his next opportunity,” concluded Bourdo.

Neighbourly is Canada’s largest and fastest growing network of community pharmacies. United by their patient first focus and their role as essential and trusted healthcare hubs within their communities, Neighbourly’s pharmacies strive to provide accessible healthcare with a personal touch. Since 2015, Neighbourly has expanded its diversified national footprint across 7 provinces, reinforcing the Company’s reputation as the industry’s acquirer of choice.

BY JIM MOSCHOS

Artificial intelligence in its many evolving forms will be the most important area of technology in coming years, according to a global survey recently taken of chief technology officers and IT directors. The AI infrastructure market, which was valued at $23.5 billion in 2021, is expected to soar to an astounding $309.4 billion by 2031, growing at a compound annual growth rate (CAGR) of 29.8 percent from 2022 to 2031.

Advanced AI applications are already optimizing data, automating complex tasks, and facilitating decision-making, according to the study findings. And not surprisingly, organizations of all sizes are increasingly recognizing the need to invest in AI models in order to stay competitive. However, integrating AI, whether this is done by leveraging cloud-based platforms, API-driven architectures, or on-premises installations, comes with considerable challenges. In fact, 90 percent of IT leaders in a large survey said that difficulty in integrating AI is holding their companies back.

AI algorithms and models require significant computational power, leading to infrastructure and skilled staffing demands that many organizations are not able to meet. Being able to access massive amounts of quality data is also paramount for companies since AI models learn based on insights generated from large data sets. AI integration therefore requires efficient data storage, processing, and retrieval systems. Ultimately, streamlined, high-quality data allows for companies to spend less time on data management and more time analyzing the insights generated from AI.

With the rise of AI driving the need for increasingly sophisticated cloud-based capabilities, companies are forced to evaluate their tech stack to determine

if it is holding the organization back. Historically, organizations have leveraged the cloud to address the limitations of their on-premise infrastructure and have used the cloud to add or expand applications in their tech stack. But AI’s huge data storage requirements are forcing companies to reassess their cloud-computing bandwidth. It is becoming clear that both the opportunities and the challenges that come with AI necessitate significant investments in new infrastructure, solutions and skills. Companies need scalable financing options to deal with this rapidly evolving tech landscape. To avoid being hindered by outdated solutions or saddled with debt that could prevent them from innovating, more organizations are therefore seeking new financing solutions that will allow them to grow their infrastructure capabilities and their business without liquidity constraints or the need for added capital.

This is especially true for solution providers, including technology resellers, telecom providers, logistics service providers, diversity-owned businesses, and many others serving the technology industry. For example, value-added resellers (VARs) that provide additional hardware, installation services, consulting, troubleshooting, or other related products or services on top of core products, need flexible financing options to manage their entire supply chain from start to finish.

To meet these needs, cost-effective, vendorneutral approaches are now emerging to

provide financing models that are supportive of both solution providers and vendors. Compared to traditional lending institutions, which provide credit support based on the credit worthiness of the solution provider, these differentiated solutions can provide credit support based on the credit worthiness of the end customer. With these types of customized solutions, organizations across industries can leverage lease and loan options that enable them to finance IT products, from computers and servers to software, to address a company’s unique situation and need.

Assignment financing is another option that enables customers to improve their cash flow by monetizing existing contracts. This process, which can work within an OEM’s or vendor’s existing contract set, pays for products and services upfront, without disrupting existing selling processes. Customers can then enjoy seamless user experiences, with no need for additional contract documents.

As AI rapidly transforms industries, companies will need flexible and tailored financing options that help end-users acquire the latest in hardware, software and services at manageable costs. Creative financing models will enable companies to accelerate the development of innovative projects. End-user customers, as well as OEMs, dealers and value-added resellers will benefit from having these innovative new financing solutions as they look to improve their business performance.

JIM MOSCHOS is Director of Technology Finance at Mitsubishi HC Capital Canada.

BY CHRISTOPHER JUNEAU

The most recent SAP Concur CFO Insights report tackles the emerging theme of CFOs taking increasing responsibility for managing uncertainty in their organizations.

The CFO role continues to grow and evolve as their analytical skills and insights become even more valuable in a climate of economic turmoil. Our global survey found that an emphatic 90 percent of senior finance leaders agree their key task today is to prepare business for the unexpected. Only a mere 2 percent disagree.

Businesses need certainty to plan and grow, but they rarely get it these days. Instead, the IMF’s World Uncertainty Index has trended clearly towards growing economic instability since 2000, pushed by events such as the dotcom crash, the Global Financial Crisis, Brexit, and the COVID-19 pandemic. Since 2022, the Ukraine war has sparked yet another surge in economic upheaval, with supply chain disruptions, rampant inflation, and higher costs of capital.

In this report, we investigate how CFOs’ increased responsibility for managing risk and uncertainty impacts their role. We look at the

challenges and opportunities, considering how they should respond and position themselves and their teams.

The ripple effects will be felt across the organization, from forecasting and analytics to innovation, artificial intelligence, and their relationships with other senior leaders, such as chief human resources officers (CHROs). Though managing instability is a tough job, we believe it will ultimately propel well-equipped CFOs to greater heights.

The research covered the USA, Australia, Canada, UK, Germany, Brazil, and Mexico during 2023. It included a wide range of sectors from financial to healthcare, utilities, consumer and industrial. Amid economic turmoil, businesses are turning to the CFO to manage risks and navigate uncertainty. Four of their top five external challenges relate to economic turmoil. Ninety percent of senior finance leaders say their main task today is to prepare business for the unexpected.

Investment in forecasting is rising. CFOs’ biggest investments are in data analytics and reporting, as they address their top internal challenge — rising complexity in financial forecasting. Fifty-seven percent of CFOs are adapting to change by increasing monitoring of market conditions. Forty percent are investing in innovation and one-third are investing in technologies such as automation and artificial intelligence.

AI will be a threat and critical partner. Though nearly all finance leaders are worried about the threat from artificial intelligence, many also see it as an essential tool for managing the unexpected. Ninety-eight percent of CFOs believe AI threatens them or their team while 61 percent say it will be essential in managing the unexpected.

Mid-sized firms need help with innovation and forecasting analytics. CFOs in mid-sized firms are focused on tightening budgets and upgrading their finance function to compete with larger peers. But they also need help with forecasting and investment in innovation. Forty-two percent of CFOs in mid-sized firms say forecasting is hindered by lack of analytics capabilities, compared with 30 percent in large companies. Sixteen percent of mid-size firms are investing in cuttingedge technologies such as AI compared with forty percent of larger firms.

Investors are pushing for sustainability

reporting. Climate change is low on the list of external challenges for CFOs, but investors still push companies towards sustainable practices. The associated focus on environmental, social and governance (ESG) reporting can transform CFO roles further. But they need accurate, transparent, and consistent reporting and integrated data.

CFOs also need a closer relationship with HR (see sidebar story, page 20). Finance leaders acknowledge that they must collaborate more effectively with HR leaders, especially on business performance metrics and common databases. This reflects their changing relationship as more HR heads report to the CEO rather than the CFO. Eighty percent of CFOs believe they must work more effectively with HR heads.

As CFOs respond to growing economic instability, risk management, forecasting and budgeting are the top challenges. As economic turmoil continues to grow, CFOs are increasingly responsible for managing uncertainty in their organizations. This critical new part of the finance role involves focusing more proactively on identifying and mitigating risks in the business.

Our global research with CFOs shows four of the top five external business challenges

relate to global economic turmoil. Geopolitical tensions, worsening financial conditions, rising costs of capital, and increasing operating expenses all rate in the top five, alongside regulatory compliance.

Business uncertainty has climbed for some time, as factors such as Brexit, the COVID-19 pandemic, and the Ukraine war have disrupted the certainty that businesses need. Uncertainty measures, including those from the IMF, show a clear upward trend over the last 10 to 20 years, and the perception of instability has accelerated since 2016.

Finance leaders are the front line in managing this reduced predictability and preparing businesses for the unexpected. This responsibility will elevate their already critical role in organizations as they take charge of managing risks around heightened inflation and interest rates, digital disruption, and international trade wars, among many others.

The other big external issue for CFOs is regulatory compliance, which 50 percent cite as a top risk. While CFOs have often played an important role in compliance, this responsibility has grown as regulators across sectors have introduced an everincreasing number of rules and stricter penalties. Fines are increasingly linked to

company revenues; in some cases, they have no upper limit. An example is the EU’s strict General Data Protection Regulation (GDPR). Fines for breaches are capped at €20 million or 4 percent of revenue and have reportedly totalled over €4 billion so far.

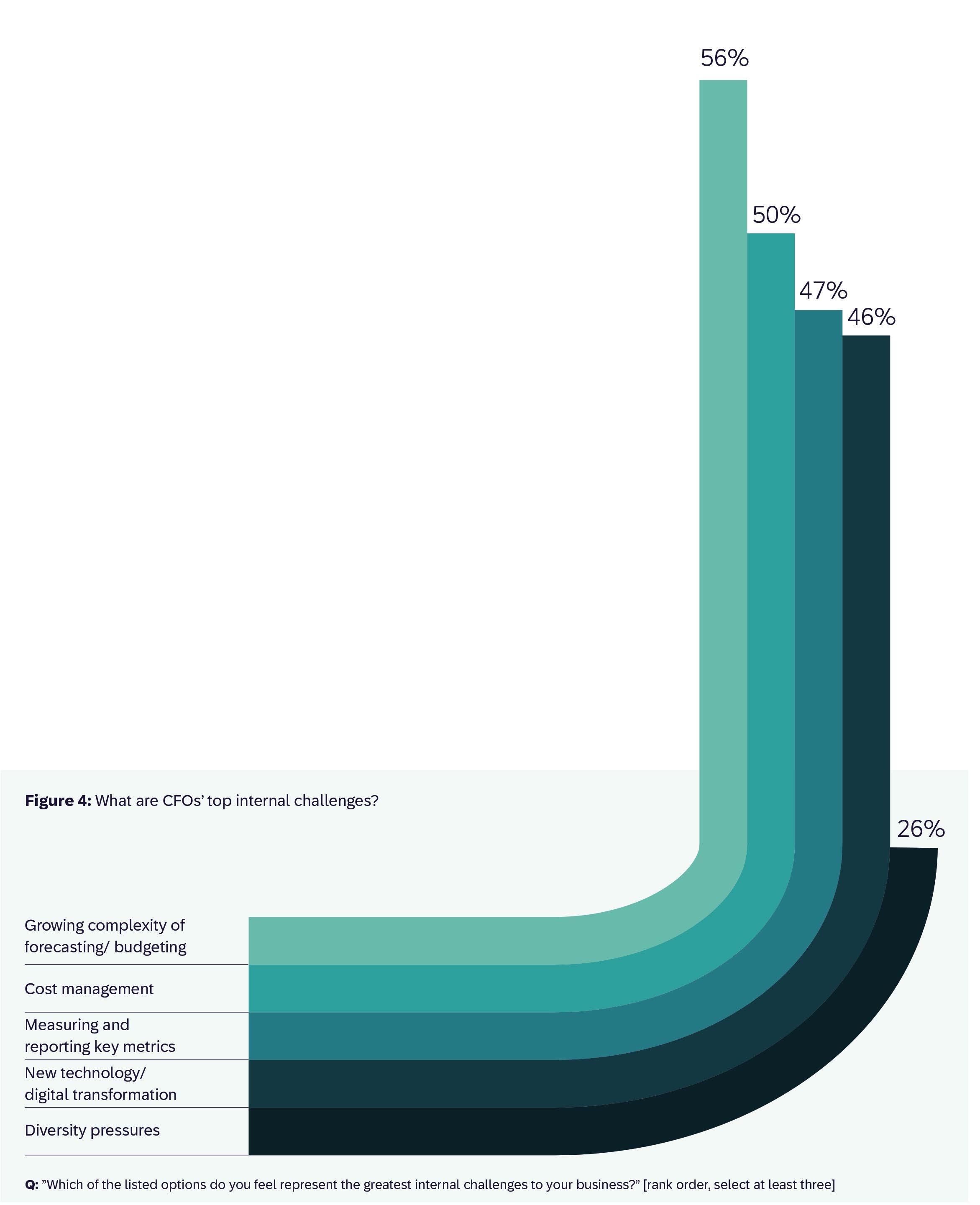

The CFO’s augmented role in managing risk also feeds into their top internal challenge — the growing complexity of forecasting and budgeting. This was closely followed by cost management, measuring and reporting key metrics, and managing new technology and digital transformation. Economic conditions are so uncertain that previous priorities such as climate change, increasing customer expectations, and talent shortages have been pushed off the list of most-pressing corporate issues.

The CFO’s augmented role in managing risk also feeds into their top internal challenge — the growing complexity of forecasting and budgeting. However, there are variations. In the UK and Germany, 51 percent said increasing cost of capital is a top three challenge versus just 30 percent in the U.S. CFOs in northern Europe are more troubled by the cost of capital than those in Mexico and Brazil, where interest rates are above 10 percent.

And in the U.S, many companies are wrestling with other issues, such as diversity or hybrid working, reflecting an elevated spend on collaboration

tools. Accurate forecasting is hindered by multiple challenges, including unpredictable economic conditions, difficulty pricing risk, and data and analysis issues. We drill down into these challenges. In the U.S, many companies are wrestling with issues such as diversity or hybrid working, reflecting an elevated spend on collaboration tools.

CFOs’ investment priorities are data analytics and reporting, but many still lack the right tools and data. Data analytics and reporting tools are the biggest areas of investment for CFOs in their new role as uncertainty-reducer-in-chief. In stormy seas, a map and compass are even more important than strong sails and a watertight hull.

Fifty-five percent of all CFOs are investing in data analytics and reporting tools right now. And most of the 10 investment areas mentioned in our global survey relate to increasing reliance on data and technology to drive down risk and ensure business stability. These investments include expenditure management systems (42 percent), collaboration tools (37 percent), digital transformation of finance processes (35 percent), learning management systems (29 percent), predictive analytics and advanced modeling (24 percent), and artificial intelligence (15 percent).

Many CFOs still face a challenge to update their forecasting systems and improve data accuracy. Even when a company’s analytics infrastructure has been upgraded, its value will only be realized when its data feeds are robust and accurate. For those who have been working hard on improving data analytics, the results have been exciting.

The key is combining financial information with non-financials, such as market, sales, operational, and people data, which can all be leading indicators of financial impacts. By combining both in a sophisticated model, finance can help the business understand what drives performance and provide insights to improve decisions.

With the right data strategy, technology, and skills, CFOs find they can use analytics to improve almost any aspect of the business, from supply chain efficiency to sales forecasts and risk management.

Practical applications include anything from improving loan approvals to reducing customer churn, measuring effectiveness of user incentives, managing supply and demand, reaching new customers, identifying fraud, monitoring competition, predicting orders, adjusting pricing, and measuring product profitability.

Conversely, as companies rely more on data to drive performance in these ways, using poor-quality data has become one of the biggest threats to their reputation.

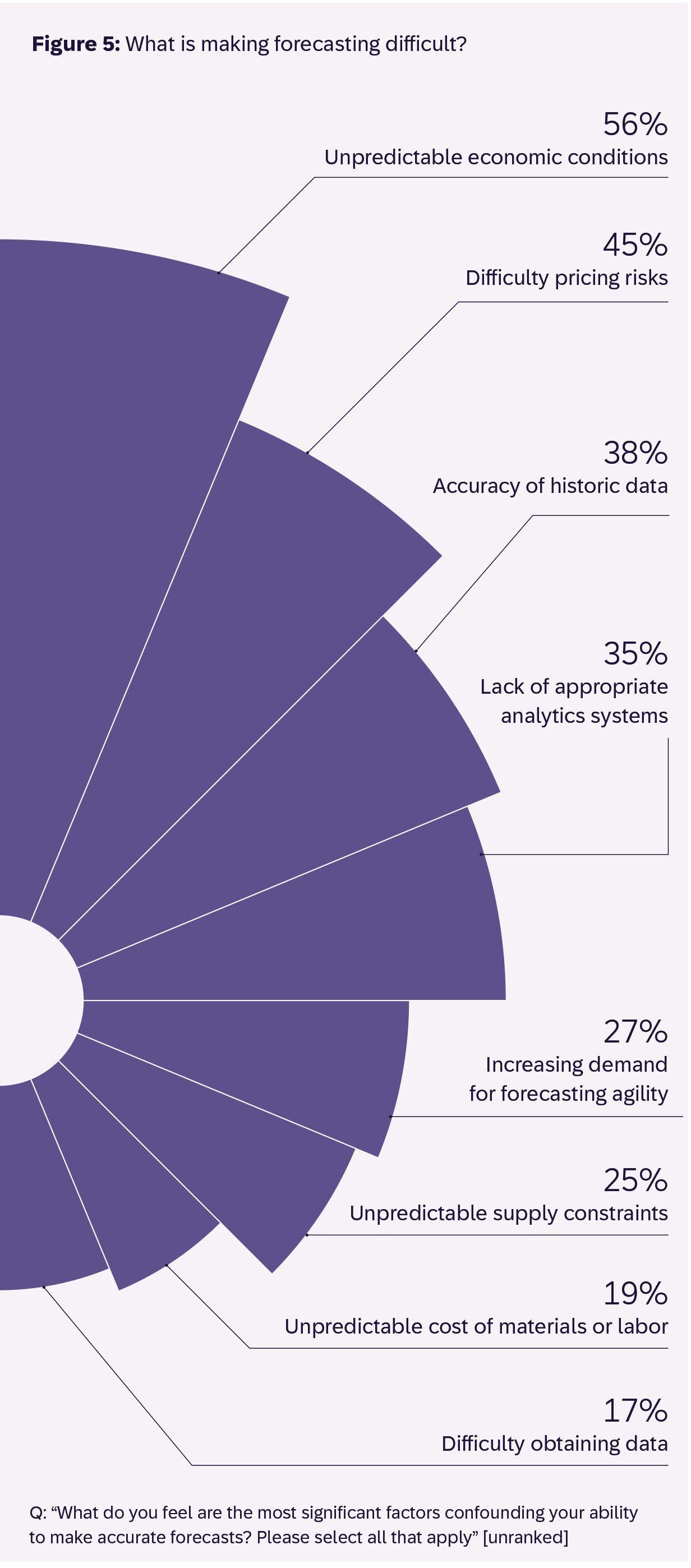

This is reflected in our survey. While the biggest factors affecting CFOs’ ability to forecast accurately are unpredictable economic conditions and difficulty pricing risks, the next most pressing challenges are accuracy of historic data (38 percent) and lack of appropriate analytics systems (35 percent).

Assessing the financial impact of risks is related to improved data and analytics, as the latter should help CFOs assess and price risks better in forecasts. These are critical issues for finance leaders, as many boards and investors now expect them to have superior forecasting abilities to help navigate unprecedented economic conditions. Some 27 percent of CFOs said they face increasing demands for forecasting agility.

Their focus on investment should help. For example, investing in systems that allow multiple modelforecasting scenarios enables faster adjustment to changing conditions. Providing they are based on robust data, these systems can enable better evaluation of opportunities and resources, and more dynamic improvement of processes and workflows. For example, finance leaders can analyze historic trends; look for new emerging marketing techniques; and include a wider range of factors to improve forecasting accuracy. These technologies also work better when linked with efficient automation processes.

The SAP Concur global CFO survey also looked at the issue of managing uncertainty by asking CFOs about their firm’s strategies for adapting to change. In this economic environment, it would be easy to assume their go-to strategy is slashing costs. Instead, CFOs say they are adapting by increasing monitoring of market conditions (57 percent). They are also investing in innovation (40 percent) and cutting-edge technologies such as automation and artificial intelligence (33 percent). Budget tightening didn’t make the top three.

One caveat is that budget tightening is a priority in smaller firms - second only to greater monitoring. Investing in innovation is much higher (56 percent) in larger companies compared to smaller ones (35 percent). We discuss the differences between firms of various sizes in more detail in article five of this report, which analyzes the issues facing mid-sized firms.

Though the proportion of CFOs investing in artificial intelligence (AI) is currently small at 15 percent, this area has enormous potential. AI can help finance leaders in many ways, from improving financial analytics to tracking performance and spotting growth opportunities. CFOs can also combine AI and analytics to adapt to change in multiple ways, such as improving risk management and forecasting speed and accuracy. The next article looks at these approaches in more detail.

CFOs view artificial intelligence as both a threat and a critical partner in helping manage uncertainty. So, say hello to your new frenemy: artificial intelligence (AI). Though many CFOs are concerned about the threat from AI, they also believe it will be an essential part of their new role in managing the unexpected and a tool for driving broader business goals.

Several of the top impacts of AI mentioned by finance leaders in our survey are outward facing, rather than narrow internal wins such as cutting costs. Given a list of 10 areas AI is likely to influence, task automation came only ninth. Instead, CFOs hope AI will spot data patterns to

drive improved efficiency and reduce risk. They expect it will provide more and betterquality insights (28 percent), more accurate forecasting (24 percent), and better risk management (66 percent).

But overall efficiency will be a crucial goal, with 82 percent of CFOs believing AI will make business operations leaner.

How AI can optimize tax

AI’s potential for optimizing tax payments also generates a buzz — some 47 percent of finance leaders believe AI can significantly impact this area. It could help tax functions save time, optimize operations, keep up with changing regulations around the world, and reduce the risk of fraud and errors — another way to cut business uncertainty. CFOs view artificial intelligence as both a threat and a critical partner in helping manage uncertainty.

For example, indirect taxes like VAT in the UK make spend management and compliance extremely complicated to manage with manual processes alone. Concur Tax Assurance solutions by Blue dot uses AI and machine learning to automatically identify VAT-eligible expenses, validate receipts, and optimize reclaim potential. Concur Benefits Assurance solutions by Blue dot also uses these technologies to help tax functions automatically track, report, and calculate taxable employee benefits.

Countering the threat to the CFO role

Despite the optimism about AI’s potential, CFOs feel nervous. Sixty-eight percent believe AI threatens their own position, and only 2 percent think it poses no risks to themselves or their team. One way to counter this threat is to demonstrate understanding of the opportunities and risks in AI and use it as a partner. As AI and analytics evolve, they will offer CFOs many opportunities to revolutionize financial operations, enhance decision-making, and gain a competitive edge.

For example, AI and analytics can be used to:

◉ forecast in near real-time

◉ simplify compliance and reduce errors

◉ support demand planning by analyzing external factors and market monitoring

◉ automate data entry, such as inputting invoices and tracking receivables

◉ improve invoice matching and devise payment and collection strategies

◉ respond to threats and opportunities more quickly by automating risk assessment

◉ generate tailored financial plans.

But AI also comes with wide-ranging risks and challenges, including around data

privacy, cybersecurity, copyright, bias, and hallucination — wrongly presenting something as fact. CFOs must, among other things, implement strong security and privacy measures, and promote ethical AI practices.

It’s also critical to ensure finance software has AI embedded, allowing users to easily activate intelligent solutions

and apply them to existing data to tailor applications. These measures will help to unlock the full potential of AI, using it as a powerful ally for the benefit of the organization. Rather than threatening the CFO role, it could elevate it further.

Continued on page 22

BY MEGAN SMITH

CFOs and chief human resources officers (CHROs) must work together more effectively. That’s the resounding message from our global CFO survey, reflecting the significant change to their relationship over recent years. HR leaders often reported to CFOs in the past. But as finance leaders shift focus towards risk management, it is prompting many firms to create a CHRO position, typically reporting to the CEO.

The latest research on this topic shows just 13 percent of HR heads report to the CFO, with the remainder reporting directly to CEOs. That number has likely fallen further due to postCOVID talent shortages and increasing focus on employee concerns, boosting the CHRO role. This change means the CFO and CHRO need to forge a new relationship. Some 80 percent of respondents in our survey believe they must work more effectively with HR heads. But clarification is needed around how it should work and where the boundaries and responsibilities lie as 87 percent of CFOs say the crossover between finance and HR is more significant than ever.

Deeper understanding of HR HR has evolved from the back office into a strategic function over the past decade. Employee experience Forging a new relationship with human resources CFOs say they need to collaborate more effectively with HR leaders, especially on business performance metrics and common databases. CFOs and CHROs have a duty to work more effectively together. 80 percent said the crossover between finance and HR is more significant than ever. 87 percent is increasingly recognized as a factor in corporate success; it must be managed from a people perspective.

Now the CFO is responsible for financial accountability and the CHRO for people strategy. But these two are tightly interwoven because HR is a nonrevenue generating cost center that needs to run efficiently. People practices are not always easy to measure tangibly or communicate on a balance sheet. It’s about understanding long-term strategy. So there must be a tight relationship to ensure the CFO understands HR investments and what the returns look like.

CFOs have recently deepened that understanding. For example, I have close conversations with our North America CFO about why investments in our benefits are worthwhile. They cannot be solely measured on mass usage. It’s also important to support the diverse needs of our employees so they feel included and that the organization sees their needs.

This conversation is about personalization and supporting individuality and the whole self. That type of support doesn’t cater to everyone, and it comes with a different price tag. These investments are highly strategic as they say a lot to employees about the type of company they work for.

Finance leaders in our survey see some jobs as the responsibility of the CHRO or CEO. More than 87 percent of CFOs do not believe providing human explanations

behind business data, talent acquisition strategy, or understanding of HR performance metrics are part of their role. However, they say they could improve working with HR through more:

◉ collaboration on business performance metrics

◉ common databases

◉ involvement in strategies that boost employee satisfaction.

HR leaders are investing strongly in HR systems and that’s a huge conversation with finance to measure the functionality required, affordability, scope, and return on investment. We need a strong connection with the CFO because they have to understand that to see the value. There must be a tight relationship to ensure the CFO understands HR investments and what the returns look like.

CFOs’ understanding of HR performance metrics has also grown but must be enabled through data-driven conversations with the CFO. Common data plays a role. For example, it is important to measure usage and outcomes when it comes to benefits.

Does it help employees do their best work? How does that compare to industry trends and what we hear from employees directly? Common data across these conversations is helpful, but a challenge for many organizations. They are different data points and you have to figure out a way to marry them.

HR uses people metrics to establish value, while finance uses budgets and financial metrics. I may think it’s a clear-cut business case. However, using different metrics, they may come to a different view. So this collaboration needs to marry fiscal responsibility with enabling employees to optimize performance.

And when the business is transforming — for example, from on-premises to remote and cloud-based technologies — behaviors and metrics can change. Collaboration must be ongoing and iterative to ensure all parties understand how changing motivators drive performance.

As labor markets have cooled slightly, talent shortages have dropped down CFO agendas — just 3 percent say they are a top three external challenge. But finance leaders still want to understand employee thinking, as 81 percent agree workers have more power to dictate corporate activities than ever.

Employee concerns highlighted by CFOs in our survey focus on pay, work-life balance, and benefits. There is also an emphasis on human rights, for example around ethical supply chains and modern slavery; this is a particular focus in the U.S. However, diversity is an issue almost everywhere.

Employees want to work for companies where they feel connected to the purpose and reputation. Brands need to reflect this to attract the best talent, and CFOs need to understand why this matters.

Diversity, equity and inclusion (DEI) are examples. If only 1 percent of employees have taken up a benefit, it may seem that you should not invest in it. However, it could still be a good choice if supporting diverse talent boosts your reputation as an employer.

Socially, we’re evolving so much at SAP and SAP Concur to reflect the communities we serve and operate in. How people feel about the decisions companies make has changed. So that decision could have a lasting impact on your organization’s culture. Conversation about work-life balance has also evolved to talk about problems such as mental health and burnout, and how companies are supporting these issues. Setting culture is important; while the CFO is not always central to these conversations, they must agree with the necessary investments to support that culture. The CHRO therefore needs to bring them along in that strategy. The CFO must share this vision. A great example is the cost-benefits decision around how much physical office space to keep, given the moves towards remote working since the pandemic.

Continued from page 19

Sustainability-related pressures on CFOs are growing — especially from investors, who are pushing for more ESG reporting. In our survey, only 11 percent of CFOs said climate change was a top three external challenge, and it ranked below traditional CFO challenges such as regulation, cost of capital, and rising costs. This likely reflects the growing urgency of economic issues such as inflation and supply chain disruption over the last two years. But the need to report on environmental, social, and governance (ESG) issues is still firmly on the agenda. CFOs say investors are pushing hard on sustainability issues — harder than customers, governments, employees, or regulators. Forty-two percent said the greatest pressure to transition to sustainable practices comes from investors. This compares with government and regulators (35 percent), consumers (12 percent), local communities (6 percent), and employees (only 2 percent).

The associated pressure to step up ESG reporting could further transform the CFO role. It could give them the opportunity to focus on impacts far beyond financials in guiding their company towards a more certain and sustainable future. But they need accurate, transparent, and consistent reporting to meet regulatory rules, satisfy investors, and explain progress towards sustainability goals.

They must also integrate data across the business to ensure ESG is embedded in business strategy. And they need smart systems to help them gather the right data to support ESG reports and avoid errors. Integrated accounting systems with sophisticated auditing functions will avoid exposure to compliance, reputational, and financial risks.

Stakeholders’ top two demands focus on reporting on physical risks associated with ESG — such as supply chain disruption or environmental disasters — and transition risks, such as the cost of moving to net zero greenhouse gas emissions. Initiatives such as using sustainable materials or improving

diversity are further down some investors’ priorities, and phasing out or divesting unsustainable businesses is bottom of the list. However, there are large geographical differences. Nearly three times as many U.S. investors are pushing on diversity issues compared to those in the UK and Germany. In contrast, finance leaders in the UK and Germany experience much more pressure for physical risk reporting. A growing number of studies evidence the link between corporate performance and diversity, equity, and inclusion (DEI). Global frameworks such as the Principles for Responsible Investing encourage shareholders to invest with DEI in mind.

The geographical differences in DEI focus may be due to the slightly more diverse population in the U.S. compared to the UK and Germany. The Me Too and Black Lives Matter campaigns have also thrust issues around gender equality and racism into the public consciousness globally, but particularly in the U.S., where they originated. Expectations on how companies should respond to such societal topics are high in the world’s largest economy. CFOs are grappling with other non-financial issues, such as talent management and human resources; this field demands a detailed analysis, which we provide in part six of this article. But first, in article five, we look at how CFO roles vary in different-sized companies.

CFOs in mid-sized firms are focused on tightening budgets, but they also need help with forecasting and investment in innovation. The tough reality is that midsize companies play in the same playground as their bigger peers — global economic pressures apply to everyone. But if they can sort out their internal challenges, mid-size firms can compete effectively.

CFOs at mid-sized companies, which we define as having between 500 and 2,000 employees, face similar external challenges to larger firms. For both categories, regulatory compliance, geopolitical tensions, and increasing costs of capital are the top three outward-facing issues.

Medium-sized firms have prioritized upgrades to their finance function to help them compete with their larger peers in all

these areas.

However, the internal issues in mid-sized firms are different. While large firms want to innovate out of their problems, their smaller peers are keener to cut budgets. Let’s look in more detail at the three toughest inward-facing challenges for CFOs in mid-sized firms.

CFOs in all companies are thinking about how they can enhance their ability to react to changing circumstances. In our global CFO survey, the chief focus is on greater monitoring of market conditions, at 59 percent of mid-sized firms and 51 percent of larger firms. But nearly twice as many mid-sized firms are also tightening budgets compared to larger companies.

This links to the fact that mid-sized firms also feel strongly that operational inefficiency is a major internal test for the business — 38 percent ranked this as a top three challenge versus 12 percent at larger firms. There is one exception, however — more midsize firms want to increase remuneration to retain staff, perhaps reflecting the slightly larger issues they face with talent shortages.

CFOs in mid-sized firms want to invest in innovation but are struggling and need help. Just 16 percent say they are investing in cutting-edge technology such as automation and artificial intelligence (AI), versus 42 percent in large firms. Consequently, 20 percent of CFOs at mid-size firms say lack of innovation is a top-three internal challenge versus only 6 percent of large-firm CFOs.

Integrated, cloud-based finance platforms can often be a key step towards the innovation they need by helping them streamline spend processes, cut costs, and make smarter business decisions. Some systems also now integrate AI to automate and streamline finance processes further. For example, these systems can innovate by helping finance connect and analyze seemingly unrelated pieces of information, to drive more powerful insights or dive into the details uniquely relevant to each business.

Medium-sized firms need help with forecasting. One benefit of being a smaller

firm is that they can escape some of the worst effects of complexity. Only 43 percent say the growing complications of forecasting and budgeting are a top three internal challenge to their business, compared with 63 percent of CFOs at larger firms. However, CFOs in mid-sized firms say their forecasting is hindered by their lack of analytics capabilities, with 42 percent citing this as a problem. Again, integrated, cloud-based finance platforms can help. They include powerful, intelligent analytics to help take forecasting to the next level, make better strategic decisions, and add value to the business, all via easyto-use interfaces. This can help mid-sized firms quickly catch up and compete with peers in larger companies.

The challenges and opportunities of managing uncertainty

The CFO’s new role as chief manager of uncertainty creates a host of challenges and opportunities. CFOs today must quickly pivot and take on new skills and capabilities, from redefining the relationship with HR to boosting the company’s focus on analytics, AI, and sustainability. Managing heightened risk isn’t easy. But with the right skills and technologies, finance leaders can grasp exciting new opportunities. By its nature, it will never be easy to manage growing levels of risk. But with the right aptitude and technologies, finance leaders can overcome the challenges and enter an exciting new world of opportunity. Those who make the right moves and position themselves carefully, as laid out in this report, will reap the benefits with upgraded roles and careers. They will gain the platform they need to help guide their organization towards a more sustainable, profitable, and stable future.

CHRISTOPHER JUNEAU is head of SAP Concur, Market Strategy.

You can download the full report of this search by visiting their website at https://www.concur.ca/resourcecenter/reports/cfo-insights-report-newrole-managing-uncertainty and the page also shows links to the other research. This report is copyright of Sap Concur and is reproduced in part here as a guide for our readers.

How companies grow their business more safely by navigating the growing risk of fraud

This research from LexusNexus provides a snapshot of current fraud trends in the U.S. and Canadian financial services and lending markets, including key pain points related to adding new payment mechanisms, transacting through online and mobile channels, and expanding internationally. Data collection occurred as part of a larger commissioned global study conducted by Forrester Consulting.

Many of the survey questions reference the past 12 months and for the purposes of this study, the research refers to fraud as: Fraudulent transactions due to identity fraud, which is the misuse of stolen payments methods (e.g., credit cards) or personal information; fraudulent requests for refunds/returns, bounced cheques; fraudulent loan applications (i.e., purposely providing incorrect information about oneself, such as income, employment, etc.); account takeover by unauthorized persons; and the use of accounts for money laundering.

This research covers consumer-facing fraud methods and does not include insider fraud or employee fraud. The cost of fraud is more than the actual dollar value of a fraudulent transaction. It also includes additional costs related to labor/ investigation, fees incurred during the applications/underwriting/processing stages, legal fees and external recovery expenses. Therefore, the total cost of fraud is expressed by saying that for every $1 of

lost value due to fraud, the actual cost is higher based on a multiplier representing these additional costs. For a common base of comparison between the U.S. and Canada, all currency is in USD.

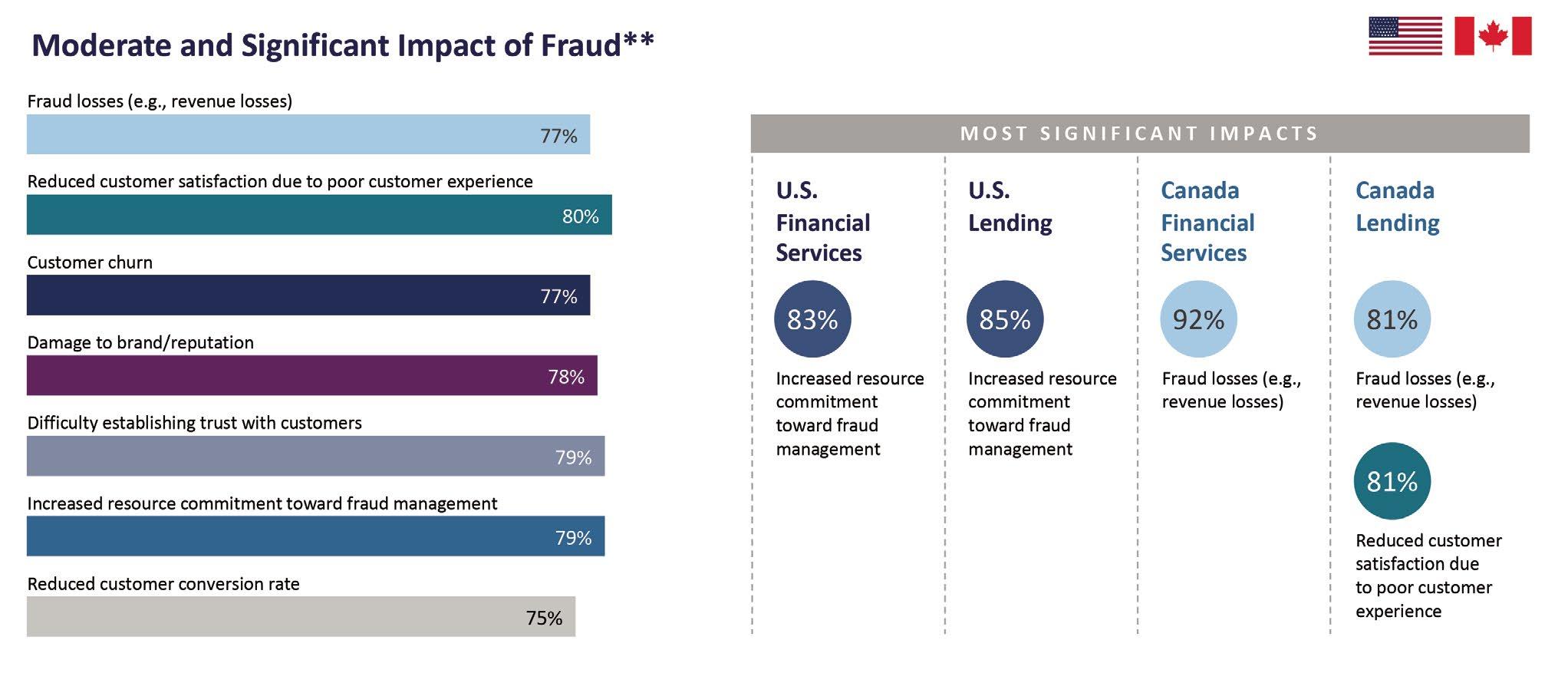

Physical branches generate the most revenue of any single channel, though twothirds of revenue comes through remote channels. Traditional transaction methods, such as cash, checks and gifts cards, rebound. Digital wallets and payment apps hold ground while crypto softens. Credit and debit transactions combined continue to represent the majority of transaction volume, especially at U.S. Banks. U.S. firms report needing to allocate more resources toward fraud management while Canadian firms report greater impact due to direct revenue losses.

Nearly two-thirds (63 percent) of financial firms report overall fraud increasing at least 6 percent in the prior 12 months. Canadian firms were nearly twice as likely as U.S. counterparts to report an overall increase of 21 percent or more. Synthetic Identity Fraud afflicts the entire Customer Journey, causing the greatest impact at distribution of funds for U.S. firms and Canadian financial services. Scams stand out for U.S. financial services at that customer journey stage but rank highly for other groups at new account creation.

Customer experience tops the list of concerns for most financial firms, though slightly less so for U.S. financial services.* Widespread difficulty establishing trust with customers and concerns over customer churn could pose long-term challenges.

U.S. firms report needing to allocate more resources toward fraud management while Canadian firms report greater impact due to direct revenue losses.

a

** Percentages are the sum of those who responded either “moderate impact” or “significant impact.”

Challenges discerning legitimate humans from malicious bot transactions, and the emergence of new/varied transaction methods, complicate the mandate to provide customers with a positive experience across touchpoints. Widespread expectations for increased budgets align with progress in conveying the commercial impact of fraud prevention to the business overall.

Scams are still a major contributor to fraud losses, despite efforts to educate consumers. Over half of financial institutions report scams increasing 6 percent or more, with 21 percent of firms reporting at least a 21 percent increase. About 35 percent of fraud losses in the region are now attributed to scams. Almost half (48 percent) of financial institutions report undertaking efforts to educate customers about how to protect themselves. Over 40

percent have nudged customers to take actions with personalized or contextual recommendations.

The LexisNexis® Fraud Multiplier™ variable rose for all financial services segments, more so in Canada than in the U.S. - For every $1 of fraud loss, it costs Canadian firms $1 more compared to last year: $4.45 in 2023 versus $3.49 in 2022, a 28 percent increase on average. U.S. investment firms and credit lenders reported a 9 percent increase yearover-year, noticeably higher than U.S. banks and mortgage lenders. Fraud losses in the phone channel spike across the industry, in line with widespread increases in scam attacks and losses due to scams.

Risk Mitigation Smart Practices: Findings show that firms using a multi-layered solutions approach that is integrated with cybersecurity and digital customer experience operations can lower their

cost and volume of successful fraud while improving identity verification and fraud detection effectiveness. Organizations who build a more robust posture against fraud throughout customer journey stages report 41 percent lower fraud losses compared to the least mature organizations.

Increased digitalization affords fraudsters more opportunities to exploit both consumer identities and accounts. However, strong in-branch transaction volume and value, and prioritization of customer experience, indicate the need for robust omnichannel fraud prevention capabilities. Although approximately two-thirds of revenue comes through remote channels, physical branches generate the most revenue of any channel.

Use of traditional transaction methods, such as cash, checks and gifts cards, rebounded, doubling for U.S. firms and more than tripling in Canada. The increase reinforces the importance of omnichannel

Synthetic identity fraud afflicts the entire customer journey, causing the greatest impact at account login for Canadian firms.

Friendly fraud impacts Canadian firms, financial services more than lending. Concurrently, scams consistently ranks as a top challenge across the customer journey.

identity verification and fraud risk assessment strategies.

Among business functions impacted by fraud, customer experience tops the list of concerns for most financial firms, though slightly less so for U.S. financial services.

Widespread difficulty establishing trust with customers and concerns over customer churn point to potential longterm challenges.

Thousands of fraudulent transaction attempts flood into financial institutions every month. More identity-related fraud occurs at account logins, especially via synthetic identity fraud for U.S. financial services and Canadian firms. Scams challenge all industry segments at all customer journey stages, especially for financial services firms.

Nearly two-thirds (63 percent) of financial firms report overall fraud increasing at least 6 percent in the prior 12 months. Canadian firms were nearly twice as likely as U.S. counterparts to report an overall increase of 21 percent or more.

Scams stand out as a top fraud vector for US banks at the point of distribution of funds, while ranking highly for other groups at new account creation. Friendly fraud consistently ranks as a top challenge across

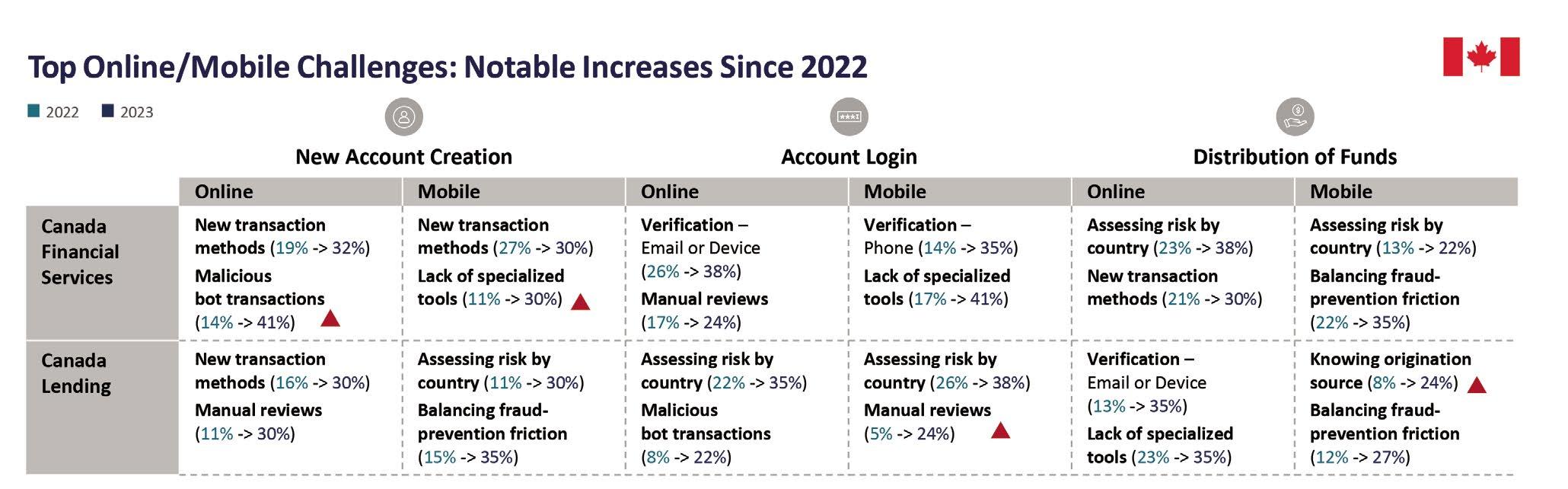

Canadian firms cite challenges with the emergence of new/varied transaction methods at new account creation, assessment of fraud risk by country or region, the lack of specialized fraud prevention tools for international transactions, and the imperative to balance fraud-prevention friction with positive customer experience.

New account creation has also become a significantly larger threat for Canadian financial services firms, while Canadian lenders must contend with incremental increases in fraud at both account creation and distribution of funds.

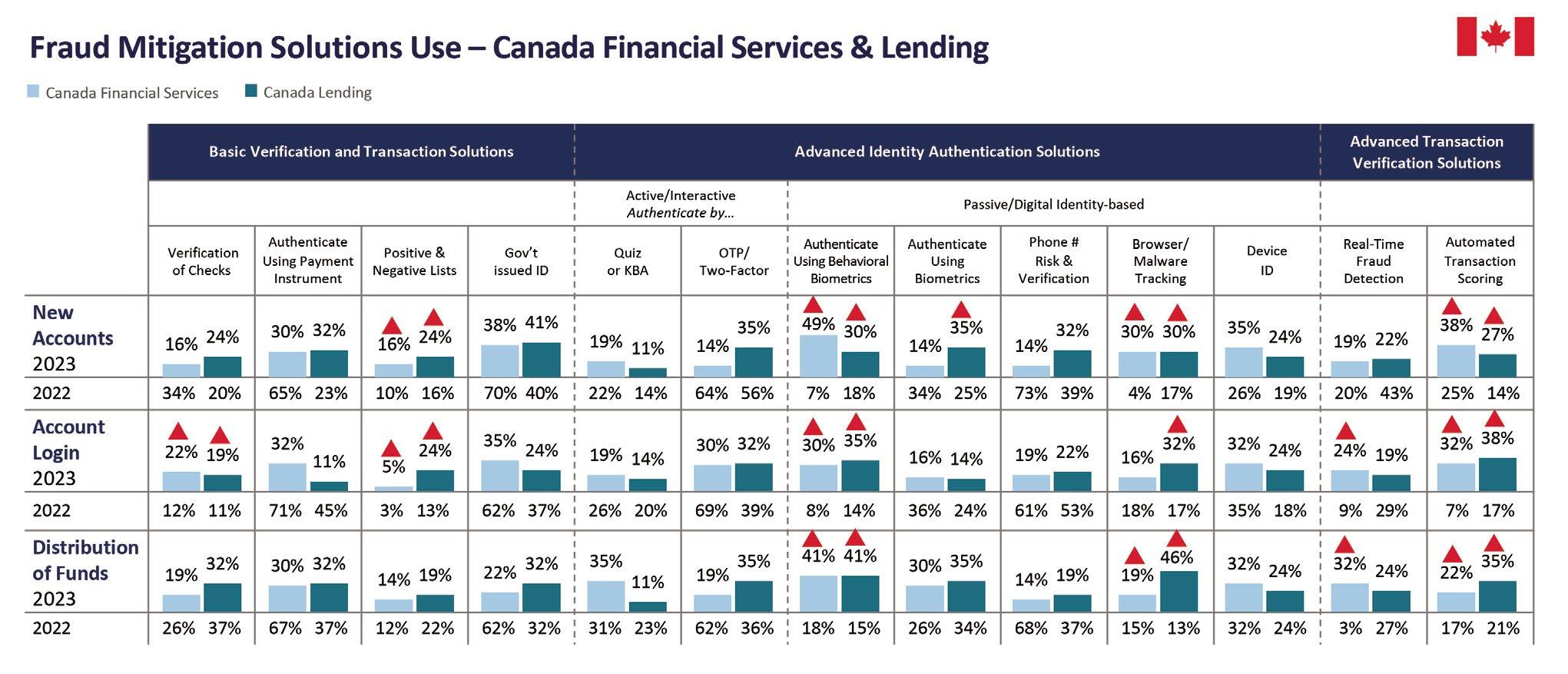

Canadian institutions report using more passive and digital Identity-based authentication solutions, particularly behavioral biometrics and browser/ malware tracking, as well as automated transaction scoring. Positive

the customer journey.

Account logins overtake new account creation as the stage of the customer journey with the most identity-related fraud, except for US Lenders for whom distribution of funds is more problematic.

The average number of successful fraudulent transactions per month grew across the industry. This is driven by larger firms, as in 2022.

Key Finding 3

Financial institutions continue racing to keep ahead of evolving threats and scams while balancing customer experience. Notable increases in online and mobile challenges across the customer journey, especially at new account creation, add urgency to instill greater robustness and flexibility into fraud detection and mitigation plans.

Financial organizations report struggles with evolving threats and payment methods, and balancing fraud prevention with customer experience. The top challenge for financial services firms was staying current and defending against new, more sophisticated payment frauds. Lenders most often ranked the inability to manage/ prevent fraud for new transaction methods.

U.S. firms recognize the opportunity to balance customer experience with precautionary measures via improved digital identity verification across online and mobile channels. Malicious bot transactions and the emergence of new/ varied transaction methods complicate the mandate to provide customers with a positive experience across touchpoints.

The most widespread efforts to mitigate and prevent scams focus on education, either directly to consumers about their security, or to employees about customer security and privacy. Third-party data and insights are also commonly applied to scam detection and mitigation. Scams put financial institutions in a difficult position.

Key Finding 4

Every dollar of direct fraud loss costs financial institutions more than at the time of last year’s study. Over one-third (35 percent) of fraud losses in the region are now attributed to scams, which are increasing in frequency also. Across the region, fraud losses spiked in the phone

channel, the channel most frequently used by fraudsters to target consumers in the U.S. for authorized transfer scams.* Firms are succeeding at defending account logins and distribution of funds, but fraudsters are finding new ways of attack at account creation.

International fraud spiked for U.S. firms. The increase aligns with widespread challenges assessing fraud risk by country or region, and a lack of specialized fraud prevention tools for international transactions. Scams are a major contributor to fraud losses, despite efforts to educate consumers. Although 48 percent of financial institutions say they have undertaken efforts to educate customers, roughly 6 in 10 financial institutions report an increase in scams over the last year.

The Fraud Multiplier™ variable rose for all financial services segments, more so in Canada than for U.S. firms. For every $1 of fraud loss, it costs Canadian firms $1 more compared to last year: $4.45 in 2023 versus $3.49 in 2022, a 28 percent increase on average. U.S. investment firms and credit lenders reported a 9 percent increase yearover-year.

Organizations that build a more robust, multi-layered approach against fraud through the customer journey report lower fraud losses. Across industries, geographies and customer journey stages, firms have implemented more advanced identity authentication and transaction verification solutions, especially behavioral biometrics, device identification, physical biometrics and browser/malware tracking solutions.