Asian TV Forum (ATF) 2022 returns to a full in-person event for the first time after the pandemic. And it takes place in a good moment to invest in Asian Pacific region (APAC). This is one of the emerging zones more stable in economics of the world, that stopped a lot of activities for long time during Covid-19. It is very embedded on technology, especially on its main countries. So, digital platforms and all tech developments mature first and better in APAC, with many leading local OTT players gaining vs global titans.

Why is good to stay this year at ATF? The first return from the pandemic always shows the market more open to the players that attend. And though all the capacity of the RX Global organization was sold in Singapore, the movement is still behind 2019 numbers. So, if you attend you come first vs. many others, that will attend only next year, it is a big opportunity.

• It is the rst in person event version after the pandemic

• It takes place in a good moment to invest in APAC

• The recovery from Covid opens strong business inertia

• In APAC, digital platforms and tech developments mature rst and better

• There are many local OTTs leading markets vs global titans.

• 2022 attendees have less competence than 2023 ones

more chances of twisted alliances. Though, global trends are the same everywhere, sooner or later.

All will be AVOD in digital platforms from now? Of course not. Every sector will continue and AVOD growth will refit the content bowl. AVOD is so far a big chance of moving catalogue product, and a great complement to SVOD monetization problems, where original content costs grow faster than subscriber incomes. Some AVODs speaks about starting to produce original content too, but let’s see.

What is the big trend nowadays in the content market to take in mind? In digital platforms development, the milestone is turning from SVOD to AVOD/FAST channels, from subscribers to advertise ment. Now the OTT platforms want to be also exhibitors, as they need to attract content players to generate FAST channels, made around revenue sharing models and advertisement incomes. This trend is a segment on its own: it includes different kinds of OTTs, aggregators, tech providers, content or business hubs, new outputs as TV set manufacturers, luxury cars, etc.

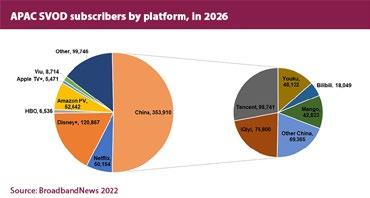

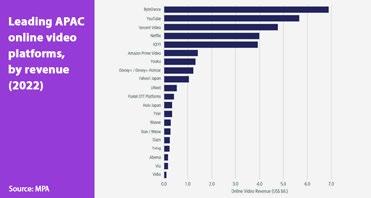

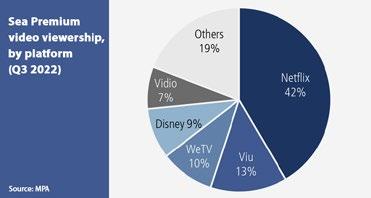

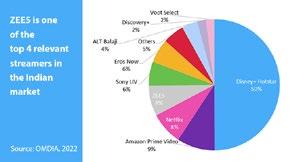

In Asia, do we have the same digital map than international? Not at all, in Asia and Middle East, 7 from 10 leading OTTs are local or regional, vs Europe and the Americas where the global titans —Netflix, etc.— are the heads. Please see our other reports at this ATF edition to precise them. Due to so strong and so many lo cal players, there are more fragmentation in content demand, and

So… which are the big drivers of the international and Asian/ APAC content markets? Mainly three: 1, co-productions, the way for broadcasters to access to high-end product and open abroad mar kets. 2, the original content for SVODs, which now faces a stop in many projects, but continues as the big production hit worldwide.

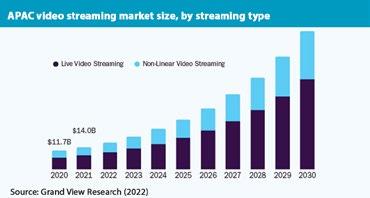

Asia Pacific’s SVOD market is forecast to grow 19% in 2022 to US$24.6 bill, with China contributing 51%. But, how is this mar ket constituted that, despite being part of a unified region, has so much diversity at both cultural and economic levels?

According to Duckju Kang, founder and CEO of ValueChampion, since Netflix’s grew in the industry for over a decade, many entre preneurs in Asia have been launching their own video streaming platforms to recreate Netflix’s success. India has been probably one of the most involved in this, with a OTT video market is in its second growth phase with total revenues of US$3 billion in 2022

expected to more than double to almost US$7 billion by 2027. Five leading platforms – YouTube, Meta, Disney+ Hotstar, Amazon Prime Video and Netflix – will account for a combined 82% of total online video revenues in 2022.

There were some notable local streaming services that closely competed with Netflix, Kang says. For example, Hotstar TV in India was closely behind Netflix in terms of revenue ranking: as the 2nd most popular streaming app, it had an overall revenue ranking of 4.25 behind Netflix’s 1.08.

• Turn to media groups, with free, pay TV and own OTTs

• Make ction co-productions

•

•

•

•

•

Nowadays in the world, the OTT platforms are moving focus from SVOD to AVOD, from subscribers to advertisement. What can we say about broadcasters at this new media scenario?

Last Mipcom, at the FRAPA Formats Summit, there was an inter esting debate between iconic European broadcasters. How do you perform better? Julien Degroote, EVP content development, TF1 France, said: ‘We give priority to unscripted formats, because they always score better numbers.

Content consumption is constantly changing. But that change can sometimes mean going back to basics. In this report, Prensario analyzes the new consumer trend: FAST channels, what they are and what new opportunities they bring to the industry.

Free Ad Supported TV (FAST) channels are, on the one hand, free streaming services with advertising, but on the other, they extend the traditional linear TV service to connected devices such as mo bile phones, tablets or connected televisions.

Unlike traditional linear channels, FAST allows you to offer dy namic ad insertion, giving you the opportunity to establish specific

audience targets for brands, and a more assertive analysis of re sults, with relevant advertising for each user.

The models for creating a FAST channel are split into two: an existing channel can be taken, both Free TV and Pay TV, or an in dependent content catalog can be taken and turned into a chan nel. The second becomes a very useful tool, especially for those producers and distributors who have a niche offer, a significant volume of titles, or who perhaps cannot have a strong penetration in services where the purchase and sale of rights can have a value, established or at least a GM if the model were low revenue share.

As we will see throughout various reports in this edition of ATF 2022, the APAC audiovisual market is in full expansion and on what many highlights as the ‘second phase of the audiovisual ex pansion’, driven mainly by VOD platforms. But what challenges do the territory still have to overcome?

Despite being a region that is analyzed as a whole in many cas es, the truth is that each country has its particularity. In the case of China, for example, being the country with the largest population, to which is added a strong cultural presence, led them to focus on the domestic market.

Appearance of new digital players, the Asian market saw a new opportunity to strengthen its production capacity, and open up to new territories in the West thanks to production with a greater impact, as well as an audience more open to new content.

‘Home to 60% of the world’s population, the 4.3 billion residents of the Asia-Pacific region are contributing tremendously to the en gagement with and development of online-video content and the industry on a whole. With a reported 16% growth in the industry

reaching USD 49.2 billion, SVOD will contribute 50%, user-gener ated content-driven AVOD will contribute 37% and premium AVOD will account for 13%. It is projected that by 2027, growth will reach USD 72.7 billion at an average rate of 8%’, Media Partners Asia says on its special report.

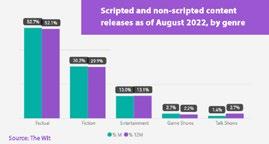

The Wit showcased last MIPCOM Cannes edi tion a new special report with the main trends in formats and scripted, where dating shows with a twist, talent battles and content to feel good, among others, stand out. Factual is the main genre, with 52.7% of new

The proliferation of OTT platforms brought with it an increase in the digital offer that, from the user’s per spective, becomes impossible to cover, and often causes the so-called ‘decision or

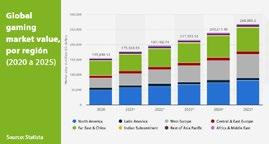

The gaming industry is a business that generates billions of dollars a year, and its growth has been sustained over the last decade, opening opportunities for brands that seek to reach the youngest, including the audiovisual sector.

subscription fatigue’.

The streaming titans have been joined in recent years by hun dreds of local, niche, and public platforms, and now also FAST chan nels, turning an activity that should rest on entertainment, such as consuming audiovisual content, into a tedious and exhausting task. This is where a key player appears: the super-aggregators.

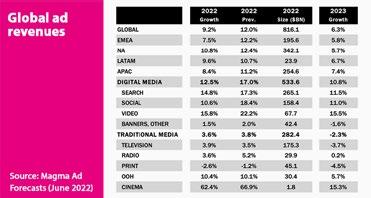

After the outbreak of COVID-19 in 2020 and its impact on some sectors of advertising such as offline, the sector has begun to show notable improvements. Zenith expects that by the end of this year global advertising investment will grow by 8.0%, 1.1% less than the estimate in its previous report, but equally encouraging if one takes into account that the business saw a drop in 17% in 2020 due to the pandemic.

in 2023 and 15.7% in 2024, while spending on advertising in China is expected to rise by 4.0% in 2023 and 5.4% the following year.

‘This year, India (+16.0%), Malaysia (+11.0%) and Hong Kong (+10.1%) have all achieved double-digit growth,’ said Prerna Mehrotra, CEO Media APAC, dentsu international, adding that ‘digital continues to drive growth accounting for 60.7% of all spending in Asia Pacific with Social, video and search predicted to lead digital growth.’

In Asia-Pacific, regional ad spending is estimated in US$35.7 bil lion above the 2019 pre-pandemic level in the region, led by India (+16.0%), Malaysia (+11.0%), and Hong Kong (+10.1%) which have all achieved double-digit growth, according to Dentsu Global Ad Spend Forecasts. The report predicts advertising spending will in crease globally by 8.7% in 2022m with ad spend in the Asia Pacific anticipated to reach US$250.0 billion, with digital making up the majority of spending.

As said, India leads the Asia-Pacific with a growth rate of 16.0% this year and predicted increases in advertising spending of 15.2%

Kids content and animation has become the axis of Netflix roll out in Asia, especially after a report provided by the digital major revealed that 60% of households which have Netflix watch chil dren and family content every month.

A Forbes article highlights that over the last quarter, the stream er released Sea of Love, its first Thai original for pre-schoolers, alongside the success of Mighty Little Bheem: I Love Taj Mahal, or the Korean chil dren’s film Larva Pendant, receiving 3.09 million viewing hours within a week of its release

51 originals titles released, which it plans to grow its subscriber base, that now stands at 101.9 million monthly active users (MAU) globally and about 9.6 million daily active users (DAUs) as of December 2021.

Streaming giant ZEE5 remains steadfast in its commitment to bring the best local content across India as well as to the Southeast Asian diaspora around the world. The service, owned by ZEE TV, launched in 2018 in more than 190 countries and available in 12 languages including English, continues to conquer the world, after landing in the USA last year, where it made available the best content from India, Pakistan or Bangladesh either with Premium subscription or ad-free viewing.

The service assured earlier this year that it planed to double its production of original content, surpassing its 2021 mark of

‘We have grown out to be the leading streaming platform globally when it comes to South Asian entertainment today both in the US, where we carved a very strong niche for ourselves, and across the globe, and we look to consolidate that leadership even further now’, told us

Being one of the largest streaming platforms in the world, with nearly 6 billion hours spent on its service, and 106.2 million subscribers (last year), iQIYI it’s facing emerging markets in Asia. One of its destinations of choice Malaysia, is part of its recent investment plans for its rollout, where the platform sees potential distribution partners due to the growth of its local operation this year.

iQIYI (Malaysia, Singapore, Brunei) country manager Dinesh Ratnam said the platform remained focused on building a broad partner ecosystem in Malaysia to revitalize local and Asian entertainment for international users. ‘Especially in Malaysia, we’ve just seen the rise and dominance of Asia content as a whole. So one of the big things I think we’ve seen over the last year is definitely this opportunity’.

GMA Network, the Philippines’ leading broadcast company, keeps expanding with stronger, wider television coverage across the country as it continues to deliver the Kapuso brand of credible news and quality entertainment to millions of Filipinos and abroad.

While it thrives in the new era, the Filipino TV giant remains re lentless in expanding its reach and signal strength through building new operating stations and upgrades. The Network currently has a total of 93 TV stations strategically placed in various areas nationwide. It is

Posting double-digit ratings each episode and with an estimated 13 million viewers glued to their screens every night, Lolong (Crocodile Whisperer) has been 2022’s most watched TV show in the Philippines

comprised of GMA’s analog and digital TV as well as GTV’s analog TV broadcast stations.

‘We strive to return the favor to our viewers for their support through providing bigger, better, and qual ity service and programs to the best of our ability. Along with the Network’s success, we are continu ously working to ensure that our production and post-production facilities are at par with global technical standards, so we can offer television that emulates cinematic visuals’, indicated Chairman and CEO, Felipe L. Gozon.

‘And with the further expansion of GMA’s reach in the country, this allows us to deliver our brand of objective and truthful public service and quality entertainment to the greatest number of Filipi nos as possible’, he completed.

Seven Network has been investing heavily in its different business units: traditional and digital TV, with 7Plus focused on streaming. The company recently announced a major multi-year deal with NBCUniversal (NBCU), which includes a new free-to-air channel, 7Bravo, launching in January and focused on women’s content.

In addition, the network will use this deal to add even more specialist live channels to its line-up of about 40 TV channels on 7plus

Also new is that it will premiere a series of NBCU films, in the scripted drama and comedy genres, which will premiere on channels associated with the Seven Network and 7Plus in the coming years.

Run under MRTV’s Multiplex Playouts System based in Yangon, Myanmar, Channel K is a Burmese digital Free-to-Air TV channel launched in 2019 by KMA Telemedia Holding Limited. It operates under an advertising business model to finance its program schedule, which is made up of 100% content from an educational perspective for the whole family.

The signal was one of the five tender winners (along to DVB, Mizzima Media Group, Fortune TV and My TV) which were selected by the government in 2018 to broadcast digital free-to-air content and leaders of those organizations said they would vie for market share to ensure longterm viability as the country’s private broadcast space sees an unprecedented opening up in the months and years to come.

Channel K offers educational content for the whole family and free access to all, from any medium, commented Soe Thu Ra, Chief Operating Officer, who commented that the signal is available in linear, as well as digital.

Operating under the umbrella of the Minister of Broadcasting in New Zealand, TVNZ is the state broadcaster that has various FTA channels, as well as dedicated VOD services with an Adsupported business strategy. The company has a strong focus on news, sports, local content, and international event coverage. Launched in 2007 as a catch-up service, TVNZ+ is the streaming service of the conglomerate, which offers free content, such as news updates and programs seen on linear channels. In addition, it offers dozens of local and international titles exclusively available on the platform.

‘Unlike other digital offerings in New Zealand, TVNZ+ has invested in our value proposition for the TVNZ audience, who come to the platform eager to supplement the content they watch on TV’, said Carmen Aitken, GM of Product and Data at TVNZ.

The executive highlighted that since the start of the pandemic, they have focused on entertainment content, highlighting local content in genres such as drama, news and entertainment: ‘Like all media companies, Covid-19 affected us, but In turn, it did not increase with greater digital consumption. That is why we build our content based on empathy with our audience. We also redoubled our commitment to educational content, focusing on prevention content and to keep the little ones informed, as well as more entertainment content for the older ones’, said the executive.

Nomin Chinbat, Minister of Culture of Mongolia, and the Mongolian Na tional Film Council (MNFC) have wel comed several major production stu dios the last month on the country’s capital Ulaanbaatar. The visitors, key executives from Warner Bros. Discov ery, Paramount and Netflix, were able to learn more about the up to 45% cash rebate, film benefits while they visited historical venues.

Five high-level production managers and executives visited Mongolia during mid-September, invited by Nomin Chinbat, Min ister of Culture of Mongolia, and the Mongolian National Film Council (MNFC), which manages the country’s film production in centives, reimbursement, and other legislative measures to support the growth of Mongolia’s film industry.

WeTV, Tencent’s subsidiary streaming platform in China, continues to conquer more countries in Southeast Asia, with more content and adding more distribution players to reach more users. Since 2018, the Asian giant considered facing the streaming platforms from the West, with an aggressive expansion. In Indonesia, the service reaches its third anniversary, presenting

Mandarin content, and local wisdom titles through the WeTV Original benchmark.

‘In Indonesia, WeTV has been at the barefront. Not only as the top platform for Chinese content but also for other Premium Asian entertainment such as Korean and Japanese content for Indonesian audiences’ said Lesley Simpson, Country Manager for WeTV and iflix Indonesia.

In this territory, the service began to produce local original content, which has been widely popular among young people, since due to its socioeconomic condition, Indonesia is a country with a strong mobile consumption, this terminal being one of the most used to consume streaming content.

On the last report by The Trade Desk, the consultancy firm assured that in the Phillipines, OTT has the potential to seriously disrupt broadcast televisión.

Wattpad is a leading social storytelling platform and entertainment company with a global community of more than 94 million people who discover and share stories from science fiction to romance and every other type of story imaginable. Prensario interviewed Jenne “Jenny” Lam, president.

Wattpad: ‘We are democratizing the stories that are told’Jeanne

“Jenny” Lam, president of WattpadJyotirmoy Saha, founder of August Media Holdings and POP TV

For this ATF edition, Prensario International reviews a spe cial survey made by RX into the mindset of top Asian content buyers and commissioners and what they are looking for in the international markets.

• What is your editorial strategy?

• What type of projects/programs are you looking for?

• Acquisition Territory?

• Being one of the video-sharing websites based in Shanghai, Bilibili has been exploring overseas markets for the past year in the hope of providing appropriate content for local audiences.

• We are looking for quality Japanese, Korean, and Taiwanese con tent, especially in the boy’s love genre like animation, comics, and games. Also, distribution-ready series is our top priority.

• Japan, South Korea, Taiwan, and Thailand.

• Cheers Media is a company based in Hong Kong and specializes in li censing programs and products worldwide. As a global acquisition and distribution expert, Cheers Media has successfully built up a strong network and partnership in the entertainment industry and delivered more than 50000 hours of programs to TV channels and platforms across the world.

• We are looking for content in genres such as kids, lifestyle, travel, science, education, and scripted.

• China, India, Japan, South Korea, Taiwan, Austria, France, Germany, Ita ly, Norway, Poland, Sweden, the United Kingdom, Canada, and the USA.

• Youku is a leading online video platform in China. The platform provides multiple types of content, including content acquisition, co-production, PUGC channels, and live broadcasts.

• Kid’s content age target: 0-12, focus on 3-6. Genre/ Theme: all categories, such as nursery songs, comedy, adventure, Children’s sci ence, education, robots, dinosaurs, Girl’s power, and boy mechanical fight. Format: 3D /2D, live-action, mixed format.

• China, Japan, Malaysia, Philippines, Singapore, South Korea, Tai wan, Thailand, Vietnam, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Italy, Poland, Russia, United Kingdom, Australia, New Zealand, Canada, and the USA.

• TRT was set up as an autonomous public TV and radio organization.

• I am looking for different, modern, interesting, and fresh formats and projects.

• Worldwide

• The first Bengali-language children’s cable television channel.

• We look for series, feature films, both animation, and live-action.

• India, Singapore, Belgium, France, Germany, Ireland, Italy, Spain, Switzerland, the United Kingdom, Canada, and the USA.

• We acquire high quality TV movies, mini-series, documentaries, feature films and animations for the Japanese market (DVD, TV, VOD and thea- trical rights). As a distributor, we work with several broadcasters and VOD companies. We are looking for a wide range of programme categories.

• We are looking for completed programmes or programmes in the final stages of production.

• Japan, Canada, U.S.A.

• Astro is Malaysia’s leading content and entertainment company, serving 5.7 million homes or 74% of Malaysian TV households, 8,300 enterprises, 17 million weekly radio listeners (FM and digital), 14 million digital monthly unique visitors («MUV») and 2.8million shoppers across its TV, radio, digital and commerce platforms.

• We are looking for travel & Food, Comedy, Romance, Horror, Suspense content.

• China, Singapore, Taiwan, Australia, New Zealand.

• TRT was set up as an autonomous public TV and radio organization.

• I am looking for different, modern, interesting and fresh formats and projects.

• Worldwide

• Kids content unit in Paramount Global in SEA region has a key focus on Animation titles that will work this región including Korea and Japan.

• We are looking for titles with thematic Gender-Neutral, also comedy-driven.

• Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Thailand, Vietnam.

• Our company aims to provide the best content, mixing between Hollywood types (feature movies, mini series) and Asian contents (premium dramas, asian blockbusters)..

• Kids content for 2-8. TV Dramas. Feature movies.

• China, South Korea, Taiwan, Thailand, Vietnam, France, Germany, Italy, Russia, Spain, United Kingdom.

(India)

• MX Player is an Indian video streaming and video-on-demand platform developed by MX Media & Entertainment. It has over 280 million users globally. The platform currently operates on an adsupported model and has a streaming library of over 150,000 hours across 12 languages including English, Hindi, Tamil, and Telugu.

• We are looking for long-Form Scripted Fiction Drama - Romance, Fantasy, MMA, Historic, and Costume Drama.

• India.

CJ ENM has shown huge performance with production capability and competence in the Asian market. As a leading media company in Asia, CJ ENM, with its production house Studio Dragon, creates over 30 titles of well-made scripted content every year.

The company use its over 20 partners throughout Asia to distribute its cataloge, always bringing huge fandom for each title.

‘Given the kaleidoscopic nature of the market, even with the success in the Asian market already, CJ ENM always seeks something new to give the viewers endless enjoyment and thrills’ expressed Sehee Jang, CJ ENM Global Marketing & PR Manager at CJ ENM.

Audiovisual from Spain is participating in ATF with top Spanish companies like Atresmedia Televisión, DeAPlaneta Kids & Family, Mediterráneo Mediaset España Group, Movistar Plus+ International, Onza Distribution, RTVE and The Mediapro Studio.

GMA Network (Philippines) and its international unit its promoting its recent dramas at ATF 2022. Maria Clara and Ibarra it’s one of the titles on its slate, the series was a success on its signal that received an average of 15.1 % in the people’s rating based on the AGB Nielsen Philippines TAM ratings data.

After completing several agreements at MIPCOM Cannes 2022, Nicely Entertainment attends ATF to cover current needs of the Asian market.

Caracol Televisión is experiencing one of its best moments in terms of international production with El Rey, Vicente Fernández, the title which the company entered the Mexican co-production market and planned to travel around different countries.

RTVE highlights the new season of The Hunt at ATF 2022, whose new story moves to the town of Huelva in Spain

Explore French TV programmes in all their diversity

Come meet 27 French TV content distributors at the Asia TV Forum & Market

GRB Studios (USA) comes to ATF 2022 with one of the strongest offerings in many years, including all-new shows like Icons Unearthed: Star Wars and Music’s Greatest Mysteries.

MADD Entertainment is presenting three of Turkey’s most popular prime time in the international market: the female-focused Twisted Affair, the school day drama One more chance, and the critically acclaimed Our Father.

TV and the success of its bio-series

Highly engaging social

GMA highlights the local hit Maria Clara and Ibarra

Nippon TV continues with news in the international market. At the recent edition of TIFFCOM, the company announced the third season of the adaptation of Old Enough! by Mediacorp (Singapore).

Presenting its new season titles, Inter Medya returns to ATF where the company highlights its international billboard. Among its most notable titles: Another Chance, The Girl of The Green Valley and the drama Aziz...

With novelties in its catalogue, All3Media International, the distribution arm of All3Media group, presents its new products in the Asian market.

Unifrance has launched an office in Tokyo to lead industrial events across Asia, including in Japan, South Korea, Southeast Asia and India.

DW returns to ATF market where the company presents a lineup of the best in factual and documentary content, with its high production values. One of the main titles is Life, the Universe and Almost Everything.

Toonz Media Group has become a truly global player in the field of animation and children’s programming. With a new international team, the India-based company is ready to present an important line up of content for its global clients that includes films fall for the winter 2022.

As one of Turkey’s largest content distributors of all time, Kanal D International atteds to ATF 2022 with a new international structure and new premium dra mas for buyers in the region.

Being a leading global premium unscripted content creator, distributor and programmer, Insight TV attends ATF 2022 to continue its way into the international market. With a target on millennial and gen-z audiences, the company presents its novelties into the Asian market.

Since 2020, Centauro has seen a very attractive demand for dubbing Asian content in English, Spanish and Portuguese. The company have increased their pool of Korean, Chinese, Japanese, and Filipino translators and adapters to ensure that the product’s

Di Sabatino, after presenting his recently acquired new production labels: the British Kindle Entertainment, focused on liveaction, and the Italian animation producer Movimenti Production, continues his journey by attending ATF 2022.

K.M Jeong, VP & COO, KOCCA

Korea is one of the most important con tent producers in Asia, with that continent being the fastest growing in the global me dia content market. KOCCA, the entity that gathers and promotes the Korean business worldwide, is pushing again the boundaries by giving support to more than a dozen of companies at ATF.

Sonia Mehandjiyska, head of international distribution at Electric Entertainment, lnds to ATF to seek new opportunities with her international line-up. The company promotes the second season of Leverage: Redemption and Lost Paradise.

The company led by Luis Fonseca, has already sold some of his content to several Asian territories, such as Timor, Pakistan, Indonesia, Vietnam, Macau and to Mongolia.

Being the a world-class motion picture and television studio operations aligned with the Lionsgate+, its rebranded premium global subscription platform, Lionsgate presents its news titles at ATF 2022. Its international slate is headed by docuseries Paul T. Goldman

The line up of products that Calinos shows at ATF 2022 includes the romantic drama Our Story, a series that was produced by Med Yapım, being one of the company’s highlights in this market.

Being one of the main distributors of independent films for TV and VOD platforms, Vision Films heads ATF market with a slate made up of biopics, suspense films, and romantic comedies.

Calinos wants to add more territories with Our Story

ABS-CBN (Philipines) presents at ATF 2022 market its season novelties. The company highlights the family dramas Flower of Evil and A Family Affair, the light romance 2 Good 2 Be True and the fantasy adventure Darna.

With over 200 entertainment programs produced in Thailand over the past 32 years and exported to various international markets, Workpoint Entertainment Group offers unique and intriguing formats with a twist.

The production and distribution unit of Saran Media Group participates at ATF 2022, where they present its novelties in drama genre to the Asian market.

Over the past few years, GMMTV has become more well-known in the Asian market from many notable projects such as F4 Thailand: Boys Over Flowers, 2gether The Series, The Gifted, Who Are You, Happy Birthday, Bad Buddy Series, 1000Stas, and Sotus The Series

Jojo PhruttisarikornGMMTV is Thailand’s largest and strongest Ecosystem for Borderless Entertainment.