Navigating The Biotech Investment Paradox

The Biotech Investment Paradox THE

Small Companies Gain Ground High Valuations Lead to High Expectations Demand for Rapid Innovation with Good Returns

Key 1: System Integration

Key 2: Process Efficiency

Key 3: Data Monetization

Key 4: Regulatory Readiness GETTING STARTED Optimizing R&D with Dotmatics Platform

INTRODUCTION

NEW NORMAL

A PATH TO SUCCESS THROUGH OPTIMIZED R&D

PAVING

Contents

The Biotech Investment Paradox

As COVID wreaked havoc on our markets, biotech appeared to be an outlier, not just weathering the storm, but emerging stronger than ever with record investments and valuations. But reality soon struck. Assets lingered in early stages. Commercialized products underperformed. Valuations tumbled. Now, a new normal has arrived, presenting a paradox to small and mid-size companies—deliver not just promising innovations, but also low-risk investment options to an increasingly wary market. To rise to the challenge, many biotechs are optimizing their R&D processes and investing in digital and IT solutions that will help them pave a path to success.

Navigating The Biotech Investment Paradox | 1 Introduction

The New Normal

It is perhaps no surprise that an industry built on pushing the boundaries of science and technology would thrive in the face of a global catastrophe and deliver life-saving solutions in rapid and spectacular fashion. The world, and its markets, took notice. Everyone wanted in. Valuations soared to historic highs before entering a downturn in early 2021. But despite the slump, there is some comfort knowing that the same innovative spirit that helped biotech thrive while others faltered will also help it rebound, as it has done time and time again. In fact, in May 2022, McKinsey 1 projected that the biotech market will undoubtedly become favorable once again if companies focus their talent and budget accordingly.

Small Companies Gain Ground

Even before the frenzied growth unleashed by the pandemic, small to midsize biotechs had been gaining ground on their larger competitors, thanks in part to their nimbler adoption of new technologies, faster paced innovation, and partnerships with larger companies hoping to overcome internal stagnation and offset impending patent expirations.

Navigating The Biotech Investment Paradox | 2 The New Normal

As shown in Figure 1, EY 2 reports that new molecular entity (NME) approvals attributed to small biotechs with revenues less than $1 billion were around 10% in 2017. By 2021, their share had grown to 30%. McKinsey & Company3 reports the pace of innovation has also been increasing, with assets passing through early phase trials up to 50% faster than in previous years, though the development of later stage assets has remained flat. They project that innovation will continue to blossom as biological science advances and companies adopt new technologies, such as artificial intelligence.

High Valuations Lead to High Expectations

With already growing momentum and a pandemicfueled boom reminiscent of the 2008 bubble, biotech valuations skyrocketed. With higher valuations, came higher expectations. Many companies simply could not hold their worth, especially those with earlier-stage assets. The market eventual market downturn ushered in a new reality, where biotechs must either travel the unfamiliar path toward commercialization themselves or prove their worth to increasingly trepidatious investors. Investors today hope to ride wave of innovation without the risk, and as a result, things look a bit different than during the boom.1,4,5 For example:

• Big pharmas are more measured in their risk taking, with mergers and acquisitions gradually giving way to joint ventures, partnerships, co-developments, and the like.

• Investors are less willing to jump in early, often delaying their moves until after phase 2 or 3 trials, demanding data-backed validation, and setting strict milestones.

• Biotechs with early phase assets or platforms no longer have an easy path to IPO, but instead face growing demand to differentiate themselves in a sea of similar start-ups.

• Many companies are waiting out the downturn, staying private for as long as possible while stretching budgets and streamlining operations; some are even tempering their R&D efforts or joining scores of competitors focused on indications with well-validated assays and end points—a strategy that some fear could stifle innovation in the long-run.

Fig. 1 New Molecular Entity Approvals by Revenue Class.

Challenges Navigating The Biotech Investment Paradox | 3

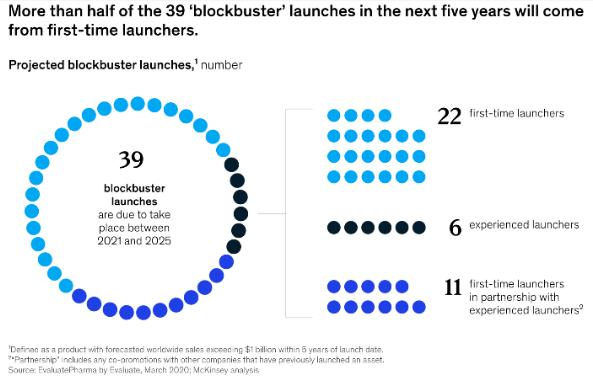

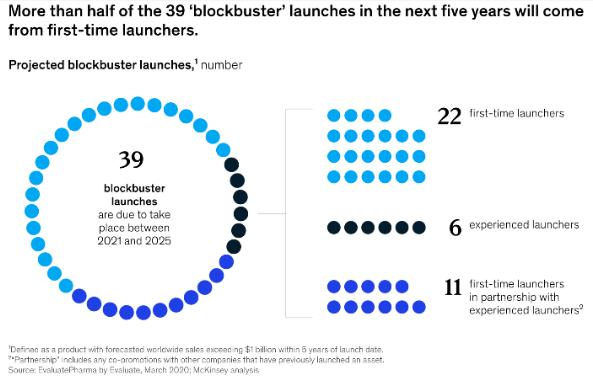

Still, meeting expectations is challenging no matter a company’s size. According to EY 2 , more than twothirds of biopharma products launched since January 2020 have failed to meet analysts’ sales forecasts. The problem is particularly daunting for small and mid-size companies who are less experienced with launches. McKinsey6 reports that while experienced launchers return around 93% of analyst sales projections, firsttime launchers typically return just 63% of expected sales earnings. Notably, these less experienced companies represent a growing portion of launchers; in fact, as shown in Figure 2, McKinsey6 reports that more than half of all blockbusters launches in the coming years will be from first-timers.

Image by McKinsey. https://www.mckinsey.com/~/media/ mckinsey/industries/life%20sciences/our%20insights/first%20 time%20launchers%20in%20the%20pharmaceutical%20industry/ svgz-pharmalaunchers-ex3.svgz

Fig. 2 Blockbuster launches by experience level.

Fig. 2 Blockbuster launches by experience level.

While biotechs face new challenges as the market corrects itself, McKinsey argues, “The fundamentals—increasing regulatory clarity and commercial viability for innovative therapies addressing unmet needs—have not changed.”1

Challenges Navigating The Biotech Investment Paradox | 4

Demand for Rapid Innovation with Good Returns

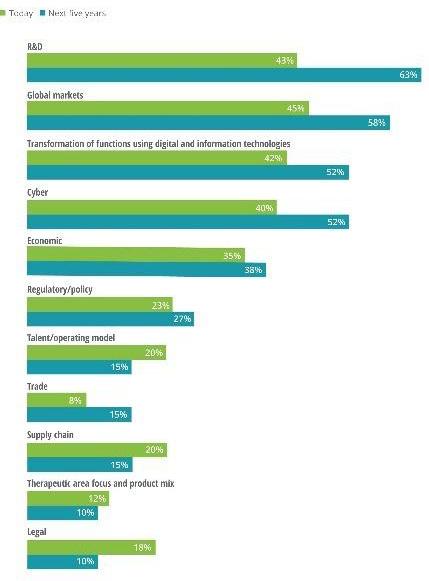

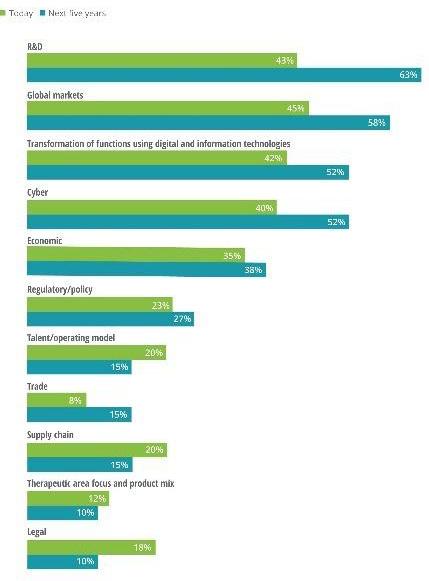

For many biotechs, delivering rapid innovation with good returns seems like an insurmountable challenge when faced with a myriad of other challenges, such as fewer late-stage assets, heightened consumer expectations, new pricing legislation, and increased cyber threats. Therefore, to deliver on the market’s demands, many companies must adjust their strategic priorities. Deloitte 7 recently reported on the key priorities biopharmas have as they fight to stay competitive in today’s market. As shown in Figure 3, aside from expanding global reach, the top two priorities named include strengthening R&D and improving the use of digital and IT technologies.

Many companies noted to Deloitte 7 that issues around R&D and digital and IT technologies have been lingering for a long time, but they were hurried to the top of priority lists when the pandemic illuminated the need for faster innovation, streamlined processes, secure remote collaboration, and improved IP protection. Yet, despite knowing change is in order, less than 10% of the companies Deloitte surveyed identified themselves as “digitally mature.” Instead, most admitted they need to make additional advances by using digital investments to improve factors such as R&D efficiency, costs, safety, and business insight.

Image by Deloitte. https://www2.deloitte.com/content/dam/insights/ us/articles/6808_chs-life-science-ceo-survey-pharma/figures/6808_ Figure4.jpg

Fig. 3 Five-Year Strategic Priorities for Mid-Size Biopharma Leaders.

Fig. 3 Five-Year Strategic Priorities for Mid-Size Biopharma Leaders.

Challenges Navigating The Biotech Investment Paradox | 5

Paving a Path to Success through Optimized R&D

Strengthening R&D and investing in digital and IT technologies must begin in the earliest days of discovery. In the following pages, we review how biotechs can pave a path to success by focusing on four key factors that help optimize R&D: system integration, process efficiency, data monetization, and regulatory readiness. These efforts will be especially critical for companies looking to secure investor financing or stretch their budgets as they step themselves into the later phases of development, launch, and commercialization.

Key #1 to Success: System Integration

As biotechs grow, they often find the systems that sufficed for small teams typically don’t scale well. Before long, solutions that once helped foster innovation and progress research instead start hindering it. Thus, the simple quest of uncovering the right R&D tools evolves into the more complicated mission of getting those tools

Keys to Optimized R&D

1. System integration

2. Process efficiency

3. Data monetization

4. Regulatory readiness

Biotechs must focus on science and cannot afford to waste time, money, and talent on system integration.

functioning in unison. To do this, companies often face a choice of either building an end-to-end cheminformatics discovery platform themselves or finding a partner whose open platform can help them seamlessly integrate the diverse applications, workflows, and data they need, oftentimes at a fraction of the cost of a home-built system.

Navigating The Biotech Investment Paradox | 6 Keys to Success

Recommendation: Invest in a Scalable R&D Platform

The build-versus-buy debate was the focus of a recent Forbes article, Build Vs. Buy: Why Most Businesses Should Buy Their Next Software Solution. 8 The article argues that “buy” is generally the better option because of the benefits it affords in terms of usability, security, support, and ease of data integration and utilization. The article’s author asks:

Why spend countless hours having your best people—or hiring new people— architect a solution that already exists and is proven in the market? Generally, a vendor has already solved the same problem hundreds of times, therefore bringing clients the benefits of best practices based on others’ experiences.

While the Forbes article presents a very general case for “buy,” the sentiment is shared by many biotech experts. Take, for example, Bob Coner, an independent informatics consultant who encourages all his clients to consider buy over build. In a recent case study titled “A Scientific R&D Platform for Start-up Biotech to Large Biopharma ,”9 Coner explains that adopting a flexible, scalable R&D platform reduces the onus of integrating internal systems, such as those used for study capture, compound registration, inventory management, assay design, and data management. As a result, companies are free to focus their time, money, and expertise on what matters most—the science that will help them make better therapies faster and increase their chances of success in an increasingly demanding market.

“

Navigating The Biotech Investment Paradox | 7 Keys to Success

Biotechs should support innovation by investing in technology that optimizes operating models and supports transformational change.

Key #2 to Success: Processes Efficiency

In the face of a demanding market, many biopharma companies plan to optimize their R&D processes in coming years. Deloitte’s report7 indicates that optimizing R&D would be a top strategic priority for:

43% OF RESPONDANTS IN 2020

63% OF RESPONDANTS BY 2025

A key way these executives plan to improve R&D efforts is through technology investment. But the complex problems biotech companies face cannot be solved by simply throwing money at the situation. To this point, Deloitte7 reports that despite increasing investment in R&D to spark innovation, many companies fail to realize a return; in fact, in recent years, returns have instead been on a decline. They conclude,

Recommendation: Support Transformational Change

Transformational change must begin with deep process scrutiny. Biotechs need to analyze their end-to-end R&D workflows and identify changes that will not just impact a few teams’ processes, but will also improve outcomes across their organizations.

“

A transformational change in R&D productivity is required to reverse this trend.

Navigating The Biotech Investment Paradox | 8 Keys to Success

For many drug-discovery companies, a key focus should be investing in technology that frees decision-makers to focus on science, not cumbersome processes. Unfortunately, several obstacles often stand in the way of this goal, including disconnected R&D systems, workflow complexity, compromised data value, high failure rates in small molecule drug discovery, and structural complexity and diversification in biologics discovery. Companies can overcome these obstacles by investing in a united scientific research platform that empowers them to:

Key #3 to Success: Data Monetization

Big data has become synonymous with big possibilities. Companies across industries are looking to obtain value from their data, using it to both gain competitive advantages and generate revenues. Nearly one-third of companies are using data and analytics to improve their R&D processes, according to McKinsey 12 . The biopharma industry is no exception. In fact, Deloitte 7 reports that,

• Streamline end-to-end workflows

• Accelerate research

• Facilitate collaboration

• Improve decision making

• Reduce technical debt and total cost of ownership

A deep dive into the obstacles researchers face, and how a unified R&D platform can help, is presented in the white papers:

• Optimizing Small Molecule Drug Discovery: How to innovate while keeping R&D costs down 10

• Overcoming Barriers to Biologics Innovation 11

“

Artificial intelligence (AI) and machine-learning approaches are raising expectations that therapy discovery and development may not only be more innovative, but also more time- and cost-effective.

Navigating The Biotech Investment Paradox | 9 Keys to Success

Biotechs must create a strong data foundation so that they can leverage AI to enhance their discovery and development efforts

Companies are pouring tens of millions of dollars into AI initiatives each year, according to Deloitte 13 . Unfortunately, many biopharmas face a harsh reality—their data are ill-suited for utilization in AI due to a variety of reasons, such poor access, lack of standardization, inefficient annotation, questionable integrity, and limited traceability. In fact, in a recent survey of biopharma and medtech companies, Deloitte13 found that nearly 30% of life science leaders admit that data struggles negatively impact their AI initiatives. Specific pain points identified include poorquality data and siloed data systems.

Recommendation: Create a Strong Data Foundation

Biotechs must create a strong data foundation to benefit from AL and ML. McKinsey made this necessity clear back in 2017 with their report, “Fueling growth through data monetization.”12

They warned that companies will not be able to reap value from their data unless they set up the fundamental building blocks of a successful dataand-analytics program. They argued:

It is nearly impossible for a company to succeed at creating externally focused data-based businesses while still struggling to get clean, consistent data that are shared internally across the organization. Before companies start down the path of monetization, they should take the time to shore up their data foundations— strategy, design, and architecture—which will help them build the business case and technical platform they need to monetize data effectively.

As reported in R&D World14 , for biotechs, creating a strong data foundation means adopting a solution that will:

• Capture clean and trustworthy research data , such as through automated instrument-data collection, database and application integration, and error-proof data entry via electronic laboratory notebooks (ELNs),

• Remove data silos by seamlessly integrating all the different data types that make up the experimental fabric, such as chemistry, biology, formulation, and physical characterization data, and

• Provision model quality data that is needed for machine learning by breaking away from proprietary data formats, automating QC and QA, and eliminating time-consuming and error-prone data wrangling.

Only after companies establish a strong internal data foundation can they partner with outside AI/ML innovators to put that data to work. Notably, most legacy data and technology infrastructures cannot create a strong enough foundation for fully monetizing data. Towards Data Science 15 suggests that companies instead need a scalable, flexible data platform that brings together all the various applications, algorithms, and data used throughout their R&D process.

“

Navigating The Biotech Investment Paradox | 10 Keys to Success

Key #4 to Optimizing R&D: Regulatory Readiness

A survey of biopharma leaders conducted by Deloitte 7 indicates that more than half of respondents are worried about policy and regulatory issues that could impact the success of their drugs. An increasingly common regulatory issue facing these leaders is data integrity issues, which can greatly impact a drug’s safety, efficacy, and quality. Data-integrity-related violations have become more common over the past several years, as labs have shifted from paper to electronic record keeping. In the FDA’s industry guidance 16 on the matter, they comment on the gravity of the situation, stating:

In recent years, FDA has increasingly observed CGMP violations involving data integrity during CGMP inspections. This is troubling because ensuring data integrity is an important component of industry’s responsibility to ensure the safety, efficacy, and quality of drugs, and of FDA’s ability to protect the public health. These data integrity-related CGMP violations have led to numerous regulatory actions, including warning letters, import alerts, and consent decrees.

“

Biotechs must have regulatory-ready assets for cautious investors or self-commercialization

Navigating The Biotech Investment Paradox | 11 Keys to Success

While egregious offenses like falsifying data make headlines, the FDA’s transparent sharing of warning letters highlights many less-headline-grabbing offenses, such as data loss, missing metadata, uninvestigated sample elimination or reprocessing, data access and security issues, non-contemporaneous documentation, and inadequate audits.17,18

Compliance around data integrity will undoubtedly become even more complex as AI gains ground in drug discovery. Deloitte 13 projects that regulators will likely soon update policies to include considerations for AI and ML; as such, they recommend that companies prepare themselves to face audits that test AI systems for issues related to bias and transparency.

Luckily, as labs transition from paper records to electronic records or look to upgrade their technology infrastructure, they can choose a solution that helps mitigate the risk of violations, such as by automatically recording experiment details and audit trails, requiring signatures, and restricting data manipulation or deletion.

Recommendation: Prioritize Data Integrity and Security

Upholding the integrity and security of data generated throughout a product’s entire lifecycle helps ensure regulatory readiness, while also helping that product become more compelling to investors. As biotechs increase investment in digital technology and IT, they should not only focus on supporting research innovation, but they should also prioritize data integrity and security. Without such focus, companies risk both regulatory issues and damaged reputations.

A recent Pharma IQ whitepaper19 , “ The State of Data Integrity and Data Security in Life Sciences ,” highlights the need for companies to:

• Adopt strategies in data integrity and data security that enhance the digitization of the life sciences industry.

• Improve data integrity and data security through automation.

• Understand how to overcome regulatory challenges in digital transformation.

• Drive digital change in pharma business models by putting data security, data integrity, and encryption at the core of a data strategy.

Navigating The Biotech Investment Paradox | 12 Keys to Success

Optimizing R&D with Dotmatics Platform

Dotmatics has built the most powerful scientific R&D platform in the world. By connecting bestin-breed applications on an open and flexible data-driven platform, Dotmatics Platform helps biotech companies accelerate scientific innovation via better collaboration, automation, and analysis.

Applications: Access best-in-breed software applications from a scalable end-toend R&D platform.

Workflows: Optimize workflows via improved processes and better collaboration.

Data: Unite and prepare all data produced across workflows, teams, and domains.

Insights: Transform deep, contextualized data into rapid, actionable insights.

Applications

Workflows

Data

Insights

Navigating The Biotech Investment Paradox | 13 Problem Meets Solution

Two

Request

million scientists can’t be wrong. Join Dotmatics to become a true Lab of the Future.

a demonstration today to explore how Dotmatics can help optimize your R&D.

Demo

Request

1. Olivier Leclerc, O.; Rehm, W.; The, L.; Wright, P. How biotechs can rethink their strategies after the market downturn. May 11, 2022. McKinsey. https://www.mckinsey.com/industries/life-sciences/ourinsights/how-biotechs-can-rethink-their-strategies-after-the-marketdownturn (accessed October 12, 2022)

2. Schur, E.; Singhani, A; Infante, K. 5 ways for emerging biotechs to launch smarter. EY. April 8, 2022. https://www.ey.com/en_us/lifesciences/5-ways-for-emerging-biotechs-to-launch-smarter (accessed October 12, 2022)

3. Cancherini, L.; Lydon, J.; Santos da silva, J.; Zemp, A. Biotech is riding a wave of growth in funding. What’s next? McKinsey. April 30, 2021. https://www.mckinsey.com/industries/life-sciences/our-insights/whatsahead-for-biotech-another-wave-or-low-tide (accessed October 12, 2022)

4. Fidler, B. ‘The music stopped’: Biotech rout leaves drug startups grounded as demand slumps for IPOs. February 7, 2022. BiopharmaDive. https://www.biopharmadive.com/news/biotech-ipoventure-startup-investors-market-downturn/618205/ (accessed October 12, 2022)

5. Fidler, B. How the biotech downturn is already affecting drug startups. February 12, 2022. BiopharmaDive. https://www.biopharmadive.com/ news/biotech-startup-stock-market-downturn-venture-capital/618823/ (accessed October 12, 2022)

6. Harputlugil, E.; Hayton, S.; Merrill, J.; Salazar, P. First-time launchers in the pharmaceutical industry. February 12, 2021. McKinsey. https:// www.mckinsey.com/industries/life-sciences/our-insights/first-timelaunchers-in-the-pharmaceutical-industry (accessed October 12, 2022)

7. Ford, J.; Blair, A,.; Naaz, B.; Overman, J. Biopharma leaders prioritize R&D, technological transformation, and global market presence. August 24, 2020. Deloitte® Insights. https://www2.deloitte.com/us/en/ insights/industry/life-sciences/pharmaceutical-industry-trends.html (accessed October 12, 2022)

8. Hagler, B. Build Vs. Buy: Why Most Businesses Should Buy Their Next Software Solution. March 4, 2020. Forbes. https://www.forbes. com/sites/forbestechcouncil/2020/03/04/build-vs-buy-why-mostbusinesses-should-buy-their-next-software-solution/?sh=736f32511128 (accessed October 12, 2022)

9. A Scientific R&D Platform for Startup Biotech to Large Biopharma (case study). Dotmatics. https://www.dotmatics.com/case-studies/ scientific-research-platform-for-startup-biotech-to-large-biopharma (accessed October 12, 2022)

References

10. Optimizing Small Molecule Drug Discovery (white paper). 2022. Dotmatics. https://www.dotmatics.com/whitepapers/optimizing-smallmolecule-drug-discovery (accessed October 12, 2022)

11. Overcoming Barriers to Biologics Innovation (white paper). 2022. Dotmatics. https://www.dotmatics.com/whitepapers [in press]

12. Fueling growth through data monetization (survey). December 1, 2017. McKinesy. https://www.mckinsey.com/capabilities/quantumblack/ourinsights/fueling-growth-through-data-monetization (accessed October 12, 2022)

13. Kudumala, A.; Ressler, D.; Miranda, W. Scaling up AI across the life sciences value chain. November 4, 2020. Deloitte® Insights. https:// www2.deloitte.com/us/en/insights/industry/life-sciences/ai-andpharma.html (accessed October 12, 2022)

14. Hall, H.; Boehm, H. The role of artificial intelligence in drug discovery. September 1, 2022. R&D World. https://www.rdworldonline.com/therole-of-artificial-intelligence-in-drug-discovery/ (accessed October 12, 2022)

15. Huygen, W. How leading companies scale AI. July 24, 2020. Towards Data Science. https://towardsdatascience.com/how-leadingcompanies-scale-ai-4626189faed2 (accessed October 12, 2022)

16. Data Integrity and Compliance With Drug CGMP. Questions and Answers, Guidance for Industry. December 2018. U.S. Food & Drug Administration. https://www.fda.gov/media/119267/download (accessed October 12, 2022).

17. Vazquez, M.; Rayser, J. Regulatory warning letters in pharma: What can we learn post-COVID?. July 27, 2022. Cleanroom Technology. https://cleanroomtechnology.com/news/article_page/Regulatory_ warning_letters_in_pharma_What_can_we_learn_post-COVID/202512 (accessed October 12, 2022).

18. Neumeyer, M. Data Integrity: 2020 FDA Data Integrity Observations in Review. June 23, 2020. American Pharmaceutical Review. https://www. americanpharmaceuticalreview.com/Featured-Articles/565600-DataIntegrity-2020-FDA-Data-Integrity-Observations-in-Review/ (accessed October 12, 2022).

19. The State of Data Integrity and Data Security in Life Sciences (white paper). Pharma IQ and Dotmatics. https://www.dotmatics.com/ whitepapers/the-state-of-data-integrity-and-data-security-in-lifesciences (accessed October 12, 2022).

References

Fig. 2 Blockbuster launches by experience level.

Fig. 2 Blockbuster launches by experience level.

Fig. 3 Five-Year Strategic Priorities for Mid-Size Biopharma Leaders.

Fig. 3 Five-Year Strategic Priorities for Mid-Size Biopharma Leaders.