» The science of food and beverage VOLUME 38 • ISSUE 2 • SUMMER 2023 FACILITATING CREATIVITY AND INNOVATION AT THE CANADIAN FOOD INNOVATION NETWORK Enhancing food Packaging for positive returns

PUBLISHER & CEO Christopher J. Forbes cforbes@dvtail.com

MANAGING EDITOR Sean Tarry starry@dvtail.com

COPY EDITOR Mitchell Brown

CONTRIBUTORS

Hugo Fuentes Rafaela Gutierrez Chelsea M. Rochman Roger Tambay

SENIOR ACCOUNT Leesa Nacht

EXECUTIVE lnacht@dvtail.com

ART DIRECTOR Sharon MacIntosh smacintosh@dvtail.com

SECRETARY/ Susan A. Browne TREASURER

MARKETING Stephanie Wilson MANAGER swilson@dvtail.com

PRODUCTION Crystal Himes MANAGER chimes@dvtail.com

CANADIAN FOOD BUSINESS ADVISORY COMMITTEE

Marcia English, Associate Professor, St. Francis Xavier University

Michael Nickerson, Saskatchewan Research Chair and Professor, University of Saskatchewan Hosahalli Ramaswamy, Professor, McGill University

Amanda Wright, Association Professor, University of Guelph

Canadian Food and Business is published 4 times per year by Jesmar Communications Inc.,

205 Riviera Drive, Unit 1 Markham, Ontario L3R 5J8

905.886.5040 Fax: 905.886.6615

www.canadianfoodbusiness.com One year subscription: Canada $35, US $35 and foreign $95. Single copies $9. Please add GST/HST where applicable. BioLab Business subscription and circulation enquiries: Garth Atkinson, biondj16@publicationpartners.com Fax: 905.509.0735

Subscriptions to business address only. On occasion, our list is made available to organizations whose products or services may be of interest to you. If you’d rather not receive information, write to us at the address above or call 905.509.3511.

The contents of this publication may not be reproduced either in part or in whole without the written consent of the publisher. GST Registration #R124380270.

PUBLICATIONS MAIL AGREEMENT NO. 40063567

RETURN UNDELIVERABLE CANADIAN ADDRESSES TO CIRCULATION DEPT.

205 RIVIERA DRIVE, UNIT 1 MARKHAM, ON L3R 5J8 email: biond@publicationpartners.com

BioLab Business, a sister publication of Canadian Food Business, is a proud member of BioteCanada and Life Sciences Ontario.

Publisher of BioLab Business Magazine

Printed in Canada

REDUCING PLASTIC USE WITHIN THE FOOD INDUSTRY

Petroleum-basedplastics have, in their short history, quickly become one of the biggest scourges of the planet, polluting soil and water and posing health risks to humans that have not yet been realized. As a result, and in an effort to begin reversing the negative impacts that plastics have had on the environment, momentum is building within the food industry toward reducing, and ultimately eliminating, the use of plastics within food packaging.

Within this issue of Canadian Food Business magazine, we delve into the significant effects of plastics on the current and future health of the planet, while presenting some solutions that can help contribute toward the overall goal of enhanced sustainability across the food sector.

Rafaela Gutierrez and Chelsea M. Rochman of the U of T Trash Team provide their insights related to the many challenges around plastics, including those of the single-use variety, highlighting the need for businesses to shift their practices toward a more circular approach to their production and use of plastic packaging.

The Founder and CEO of Canadian biomanufacturer BioShur Roger Tambay, shares his views on the current and future state of plastic food packaging, clears up some common misconceptions within the industry when it comes to plastics, and offers ways in which the food industry can enhance its contribution toward a cleaner and healthier future for the planet.

Addressing the business case for companies to reduce their use of plastics, Hugo Fuentes, CEO of The Owl Solutions, highlights the economic benefits of doing so, the enhanced brand reputation that results, and the opportunity for companies to improve their environmental impact while appealing to mounting consumer demand.

In addition, we speak to the Canadian Food Innovation Network’s Alex Barlow about her appointment to VP of Programs, as well as CFIN’s plans to enable further food innovation throughout the coming years.

When considering the future health of our planet, it only stands to reason that we exercise caution when removing or adding anything to it, making the reduction of plastic packaging a top priority for the food industry moving forward. And, with the help of innovators across the country, coupled with increased adoption of the latest technologies and developments, it’s an objective that the sector can surely achieve.

Sean Tarry EDITOR

In 2022, the Canadian Institute of Food Science & Technology (CIFST) and Canadian Food Business magazine launched a partnership to create a platform for leading experts, innovators, and scientists to showcase the latest trends, knowledge, and developments that are changing the face of Canada’s food industry today. For further information, contact sbrowne@dvtail.com.

EDITOR'S NOTE CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 34

FOSTERING CANADIAN FOOD SECTOR INNOVATION AND GROWTH

Canadian Food Innovation Network intensifying its offering with appointment of Alex Barlow as VP of Programs

46 inside standard GUEST EDITORIAL 36 NEWS BITES 38 FOODWARE 49 feature

FUTURE

PLASTIC FOOD PACKAGING

Composting

WHY FOOD 43 COMPANIES NEED TO CUT PLASTIC PACKAGING WASTE FROM THEIR SUPPLY CHAINS

FEATURES THE

OF 40

Recycling,

and the Lies People Tell

Changing our food packaging habits to protect our planet

By Rafaela Gutierrez and Chelsea M. Rochman, U of T Trash Team, University of Toronto

GUEST EDITORIAL CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 36

Everyyear, global citizens take to the streets to pick up plastic littering our environment. People bend down to collect plastic straws, chip bags, cigarette butts and bottles, among other items—many of which are food packaging. In fact, for the first time, plastic food wrappers became the top item picked up during Ocean Conservancy’s International Coastal Cleanup in 2020. Volunteers tallied a total of 4.8 million plastic food wrappers, which does not include the 1.9 million plastic beverage bottles, 1.5 million plastic bottle caps, and 942,992 plastic straws and stir sticks.

If not collected, littered plastic items break down into microplastics (i.e., < 5 mm), which are ubiquitous in rivers, lakes and oceans—including in the Canadian Arctic and in our Great Lakes. Microplastics are recorded in the stomachs of Arctic seabirds and freshwater fish—with reports of 900 pieces of plastic in a single fish from Lake Ontario. Moreover, we are consuming microplastics via drinking water, seafood, and the house dust that falls onto our food as we eat.

How did we get here?

Increasing plastic production used in nearly every sector, combined with unsustainable use and insufficient waste management, has facilitated our current situation. Plastic is a useful material, but we have been overusing it and treating it as an invaluable material when it becomes waste.

A look at the packaging industry

In Canada, single-use packaging accounts for almost 50 per cent of our plastic waste. This includes a lot of materials used within the food and beverage sector, including items that are used for a few minutes and then discarded. Think plastic straws, stir sticks, cutlery, takeout containers, and those plastic toppers added to your coffee cup lid to keep your drink warm for a few minutes longer.

To reduce plastic waste, Canadian governments are focused on reducing single-use foodware. The federal government introduced a single-use regulation that bans plastic cutlery, stir sticks, straws, bags, and non-recyclable takeout containers. The City of Toronto also introduced it's a SingleUse and Takeaway Items Reduction Strategy that aims to reduce plastic and non-plastic single-use foodware. This municipal program, currently in a voluntary phase, encourages food service businesses to only provide accessories (e.g., straws, utensils, condiments) upon request and to allow customers to bring their own reusable cups and containers. To reduce plastic food packaging pollution, these policies need to be successful. Success includes a cleaner environment, but also prosperous businesses and happy customers. To inform effective strategies, we (at the University of Toronto Trash Team) are evaluating businesses and customer practices, as well as increasing our understanding of the challenges and opportunities for decreasing single-use items and shifting to reusable alternatives.

What we’ve learned

So far, we have learned that businesses are interested in and willing to shift to reusable foodware, and that customers support actions to reduce single-use. We asked businesses what support they needed to participate. Local businesses want more access to information and guidance on public health, and they want resources to guide affordable alternatives. Additionally, businesses want practical help to purchase reusables, train staff, and educate customers.

Customers want businesses to do more to reduce waste and support practices that conveniently incentivize their use of reusables on-site and allow them to bring their own cups and containers. Customers also want information about actions they can take to help.

To demonstrate the value of shifting practices, we calculated how much single-use foodware can be avoided (and money saved). Our model includes 45 restaurants and cafes in Toronto, and we assessed several different actions to reduce. For example, if all 45 businesses only distributed accessories upon request, they would reduce their annual single-use foodware by more than two million items and save roughly $60,000. The use of plastic packaging in the food sector is significant, and moving away from single-use items can decrease waste and save money—a win-win.

Circular transition

We need businesses, governments, and the public to work together to shift to a circular economy, where less plastic waste is produced and thus available to be littered. For food service businesses, there is willingness to act. To facilitate this transition, we must support cafes and restaurants to help them scale up reusable options while sustaining their businesses and customer loyalty. Reducing single-use foodware can make a positive difference for people, the planet, and profit.

Founded in 2017 in collaboration with the Rochman Lab, part of the Department of Ecology and Evolutionary Biology at the University of Toronto, The U of T Trash Team is a science-based community outreach organization made up of undergraduate and graduate students, postdocs, researchers, local volunteers and staff, all working together with a common goal to increase waste literacy in our community while reducing plastic pollution in our ecosystems.

GUEST EDITORIAL

CANADIANFOODBUSINESS.COM 37

Heather M. Rochman and Rafaela Gutierrez

Detecting adulterated maple syrup

Researchers at the University of Guelph have developed a method by which adulterated maple syrup can be identified. Led by food science professor Dr. Maria G. Corradini and Dr. Robert Hanner, Department of Integrative Biology, along with food science PhD candidate Maleeka Singh and Sujani Rathnayake, a research assistant in the Hanner Lab, the research team have discovered an innovative fluorescence fingerprinting technique—a method that involves identifying certain molecules through exposure to UV and visible light—that helps to distinguish pure maple syrup from fraudulent mixtures.

Study: fresh produce contaminated by toxic labels

A recent study conducted by researchers at McGill University reveals that Canadians are exposed daily to hormone-disrupting chemicals found on food packaging materials. Though steps were taken in Canada to reduce the use of Bisphenol A (BPA)—a toxic chemical commonly found in plastics, food can linings, water bottles, and paper receipts that’s linked to prostate and breast cancer—it has been replaced with similar hormone-disrupting chemicals, like Bisphenol S (BPS).

The study titled Food Thermal Labels are a Source of Dietary Exposure to Bisphenol S and Other Color Developers by Ziyun Xu, Lei Tian, Lan Liu, Cindy Gates Goodyer, Barbara Hales, and Stéphane Bayen, examined an assortment of packaged fresh food sold in Canada, including meats, cheeses, vegetables, and bakery products, finding relatively high concentrations of BPS in thermal food labels, like price tags and stickers, where heat is used to print bar codes or unit prices.

Although there aren’t any current controls in place in Canada to regulate BPS, the study’s researchers found that the amount of BPS contained in the foods studied significantly exceed the European Union’s regulated limit.

Facilitating a circular Canadian food economy

The SMART Training Platform—borne of a collaboration of the cities of Guelph and Montreal, the Town of The Pas, and the Opaskwayak Cree Nation—is working with student researchers across the country in an effort to facilitate the creation of a more resilient Canadian food system. Enjoying ongoing support from the Canadian Institutes of Health Research, Natural Sciences and Engineering Research Council, and Social Sciences and Humanities Research Council, the SMART Training Platform team is working through collaborations in the city of Guelph to create the very first circular food economy in Canada. Its ultimate aim is to increase access to affordable nutritious food by 50 per cent by considering waste as a resource, creating 50 new circular businesses and collaborations, and increasing circular economic revenues by 50 per cent by 2025.

For more information about the SMART Training Platform, visit https:// smart-training.ca.

NEWS BITES

Dr. Maria Corradini

Dr. Robert Hanner

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 38

Let them have 3D cake

A group of scientists at Columbia University recently achieved a food science milestone by 3D printing a piece of cake, potentially changing the future of food. The piece of cake, created by Jonathan David Blutinger, Christen Cupples Cooper, Shravan

Karthik, Alissa Tsai, Noà Samarelli, Erika Storvick, Gabriel Seymour, Elise Liu, Yorán Meijers, and Hod Lipson, contained seven ingredients, including Skippy peanut butter, Smucker’s jam, Nutella chocolate spread, Betty Crocker frosting, Krasdale cherry

drizzle, and a hand-mashed banana. In an open-access article titled “The future of software-controlled cooking,” the team shared their ground-breaking experiences and insights concerning the impacts of the experiment on the future of food science.

Reducing and replacing plastics in the food sector

Funding recipients are:

Food Cycle Science Corp. (Ottawa, Ontario)

Food Cycle Science (FCS) and its partners, Weaving Baskets Group and Bridgehead Coffee, are applying enzymes to the FoodCycler (FC) system to rapidly degrade biodegradable plastics and transform them, along with food waste, into a beneficial soil amendment that reduces reliance on artificial fertilizers and contributes to a circular food economy.

Copol International Ltd. (Sydney, NS)

The Canadian Food Innovation Network, as part of the organization’s Food Innovation Challenge Program, recently awarded more than $2.5 million to help fund innovative projects focused on reducing and replacing plastics within the Canadian food sector.

Collaborating with The Verschuren Centre Inc., Farnell Packaging Limited, and GN Thermoforming Equipment, Copol International Ltd. will produce optimized biopolymers that are compostable in municipal compost facilities and validate their use in the food sector.

For more information about the Canadian Food Innovation Network’s Food Innovation Challenge Program, visit www.cfin-rcia.ca/funding/fic.

NEWS BITES

CANADIANFOODBUSINESS.COM 39

Brand Crepeau, CEO, FCS.

THE FUTURE OF PLASTIC FOOD PACKAGING

Recycling, Composting, and

By Roger Tambay

Reducing our environmental footprint is an enormous task. Every year, an estimated metric: 227 million kg of plastic food packaging is sent to Canadian landfills. And over 56 million tons of greenhouse gases are generated annually by food waste in Canada, the equivalent of 17 million gas-powered vehicles, or two-thirds of the registered road motor vehicles, in Canada. Consequently, the food packaging industry, like all industries, needs to contribute to a cleaner transition economy.

Unfortunately, the public has a difficult time navigating misleading claims and statements about plastic. Terms like green, eco-responsible, and guilt-free make it difficult for consumers to decipher what is real. This damages the industry’s overall credibility and makes it more difficult to implement real and positive change. A recent survey conducted in the U.S. showed that about 50 per cent of Americans don’t believe in environmental plastic packaging claims. Public policy is desperately needed to harmonize and regulate the relevant terminology in order to improve consumer confidence in the circular system. Without consumer participation, these efforts will simply fail.

The food industry has the opportunity to play an important role. There are at least two ways in which the food industry can reduce emissions. The United Nations Environment Program (UNEP) reports that globally, if food waste could be represented as its own country, it would be

the Lies People Tell

the third largest greenhouse gas emitter, behind China and the United States. According to UNEP, one-third of all food produced in the world—approximately 1.3 billion tonnes—is lost or wasted every year. But advances in food packaging can further preserve food, thereby reducing food waste and their emissions. A 2020 CBC report says that, by keeping food fresher longer, advances in food packaging may reduce food waste by $50 billion nationally each year, or by about 22 Mt CO2 eq., the equivalent of removing 6.5 million gas-powered vehicles from roads. Active and antimicrobial packaging and the use of blockchain technology are new and exciting means of further reducing food waste, extending production runtime, and reducing emissions. Eight per cent of the emissions reduction target could be achieved by reducing food waste—some of this could happen through strategic changes in packaging.

The second way the food industry can contribute to reduced emissions is by rethinking which materials are used to make packaging. Materials originating from low-emissions inputs (e.g., plant-based plastic or recycled plastic), and which are easy to compost or recycle need to play a major role towards reaching the net zero greenhouse gas targets and the elimination of plastic pollution. These include flexible and rigid plastic packaging articles that are turned circular in one of three ways: synthetically, through human intervention by entirely recycling used

FEATURE

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 40

petroleum-based plastic articles into new petroleum based plastic articles of equal or better quality; by using nature’s carbon cycle to repurpose naturally derived flexible or rigid compostable plastic packaging articles into soil; or by recycling used naturally derived plastic packaging articles into new ones. According to the Organization for Economic Co-operation and Development (OECD), switching to naturally based compostable or entirely recycled plastics would reduce global emissions by about eight per cent, not to mention solid waste reduction.

Deciphering misconceptions from reality

There are so many common misconceptions related to plastic food packaging. Here are the top five:

1. We will recycle our way out of the plastics problem

No, we won’t. In 1950, the world generated two million tons of plastic waste per year. We now produce over 450 million tons per year. In the 1990s, the plastics industry introduced the notion that plastic manufactured articles were infinitely recyclable. Yet, some experts predict that plastic waste and emissions will triple by 2060 and the announced increases in nameplate capacity further support this prediction.

Today, only about 10 per cent of the plastic we make is recycled: the rate for rigid packaging is about 20 per cent and about 1 per cent for flexible packaging. Several reasons explain the difference. Rigid containers are easier to recycle because part walls are thicker and easier to pick out, identify, sort, densify, transport, clean, and process. On the other hand, bales of flexible bags often consist of several different types of plastic film mixed altogether and therefore more difficult to transport, sort, and clean. Flexible food packaging films generally exhibit a high degree of ink coverage, or comprise a dissimilar barrier layer, or a metallized surface coating for improved gas barrier. These can only be downcycled into low end commercial uses, if at all.

The most ambitious recycling rate goal in North America is 65 per cent, the target set by California for single-use plastics. Even if we were to achieve this recycling rate,

more production capacity of new virgin resin would still be needed to fulfill the expected demand growth. If production truly triples by 2060 and 65 per cent of that plastic is recycled, then net production will increase from 450 million metric tons (MMT) to 472 MMT, a net gain of 22 MMT. Ambitious recycling goals, incentives, and financial programs are much needed. But even these will be insufficient to solve the plastic GHG emissions and solid waste problems we experience today.

2. The amount of recycled content advertised on packaging is accurate and trustworthy

Consumers are frequently misled by the amount of recycled content displayed on packaging because of something called the mass balance method, often used to quantify the amount of recycled content in a plastic article. Zero Waste Europe, a European network of communities, leaders and change agents defines the mass balance method as a set of rules for determining the use of recycled content in a final product such as plastic packaging when both recycled and virgin feedstock have been used in the process. Simply put, the total inputs should balance with the outputs. In other words, the mass balance method assigns the recycling rate to a process, not to an article.

Take, for example, a process that uses 50 per cent of recycled plastic and 50 per cent of virgin plastic to make two different types of containers: 500,000 units of 12 oz containers weighing 30 grams each, and 250,000 units of 24 oz containers weighing 60 grams each. In this situation, the producer could ascribe a recycled content rate of 100 per cent to the smaller size, so long as the larger size has no recycled content. What matters is that the total inputs be equal to the total outputs, not the actual or true amount of recycled content in any given article. While the mass balance method can accurately portray the total amount of recycled content for a process, it can also give rise to misleading information at a product level. In other words, the container made of so-called 100 per cent recycled resin may in fact not contain any recycled resin at all.

Additionally, there are no ISO or ASTM standardized audit rules and guidelines to govern how independent

FEATURE

CANADIANFOODBUSINESS.COM 41

third-party certification organizations perform audits. In other words, audit results vary depending on the certifying body. This combination allows companies to intentionally mislead the public and further undermine credibility.

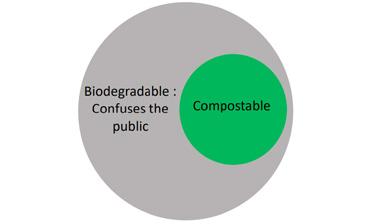

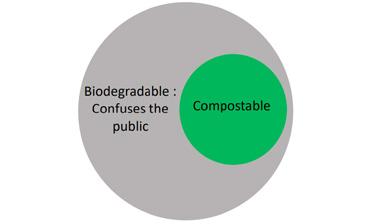

3. Compostable vs biodegradable vs biobased vs green vs guilt-free packaging

Admittedly, this is genuinely confusing. And consumers are being intentionally misled with these terms. But consumers really do want to understand and make informed decisions, which is why understanding these terms is so important.

Compostability defines a process, not an article or its composition. The process of composting means that an article is capable of being decomposed into carbon dioxide, biomass and water by commonly found microorganisms in a given environment and in a set amount of time. Compostables don’t define a product. Instead, the term sets out a series of environments in which an article may decompose through natural processes. Compostability has nothing to do with the material’s origin. There are both naturally based compostable plastics and petroleum-based compostable plastics.

By contrast, there is no time limit and environmental condition required for an article to be considered biodegradable. Consequently, a plastic article that takes 500 years to turn into biomass, causing micro-plastics along the way, is arguably biodegradable.

Biobased, in other words a biological plastic packaging, means that its original inputs come from organic and new carbon-like plants, not fossil carbon coming from ancient deposits. Biobased plastic has nothing to do with compostability.

Some argue that arable land shouldn’t be used to grow plants for biobased materials and packaging because it competes with food agriculture. That is false. According to Constance Ißbrücker, Head of Environmental Affairs at the European Bioplastics Organization, in 2022 only about 0.02 per cent of all arable land was used to produce biobased plastics. So even if the consumption of biobased plastic were to increase a hundred-fold, only two per cent of the world’s arable land would be used for biobased plastics. Biobased plastics do not compete with food production for arable land.

Green packaging and guilt-free packaging are marketing terms used to ascribe a moral value to a packaging article. These are misleading because they fail to communicate any factual information. They confuse the public and negatively affect credibility. Some companies are now involved in class action lawsuits because of consumer protection laws which govern misleading tactics of this kind.

4. Paper is better than plastic

It depends. If you are comparing recycled paper to new plastic and if the consumer goes on to compost or recycle the recycled paper, then yes, paper is better. But producing new paper generates 40 per cent more GHG emissions than producing new plastic and consumes 20 times more water. And using recycled

paper instead of new paper usually fares worse than using recycled plastics or biobased plastics because these plastics generate fewer emissions than even recycled paper does. Also, paper that is waxed, oily or greasy, or coated with plastic is difficult if not impossible to recycle and may not be compostable, either.

5. When comparing recycled plastic, biobased plastic, and compostable plastic, one is better than the other

Recycled, compostable, and biobased plastics don’t oppose one another. We need multifactorial solutions to reduce plastic waste and greenhouse gas emissions, and each of these plastics has a role to play. The best alternative often depends on how the article is used. A rigid pail might be better suited for the recycling stream whereas a flexible barrier packaging for cheese, proteins, or condiments might be better suited for plant-based compostable flexible packaging.

A persistent plastic can only be recycled, but a biobased compostable plastic can be recycled or composted—just because it’s compostable, doesn’t mean it isn’t also recyclable. Plastic recyclability isn’t about whether the plastic bag or bottle can be melted into a given shape and then remelted and formed into a different shape—it depends on whether there exists a robust end-use market for the recycled plastic.

Moving Forward

There is a growing awareness around greenwashing and misinformation about plastic. This has already resulted in positive advancements such as the government rethinking labelling laws—the federal government is in the process of updating labelling laws to better regulate terms like compostable, degradable, and biodegradable, and the use of the chasing arrows symbol. Better labelling policy is needed for the system to work and to build consumer confidence.

The food industry can play a key role in helping Canada reach its double objective of zero carbon emissions and the elimination of solid waste. Reducing food waste and wrapping food in cleaner packaging also aligns perfectly with the industry’s own goals of improving production efficiency, reducing cost, and better meeting the evolving needs of consumers. Food industry stakeholders need to be strategic in their investigation of packaging material choices so they can make informed decisions based on accurate information. Contributions of this kind from the food packaging industry could lead to a meaningful shift in how we think about materials packaging, affecting positive change in our efforts to reduce emissions, and strengthening consumer confidence.

As founder of Montreal's BioShur, Roger is a thought leader in compostable biopolymers, bioplastics, and carbon-neutral biobased materials."

FEATURE

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 42

WHY FOOD COMPANIES NEED TO CUT PLASTIC PACKAGING WASTE FROM THEIR SUPPLY CHAINS

By Hugo Fuentes, CEO of The Owl Solutions

By Hugo Fuentes, CEO of The Owl Solutions

FEATURE

CANADIANFOODBUSINESS.COM 43

Packaging

waste is a significant problem for the environment and for companies operating in the food industry. In 2022, the federal government said that 2.8 million tonnes of plastic waste end up in landfills in Canada with only 9 per cent of plastics being recycled.

Packaging materials such as plastic, paper, and metal are often used to protect and transport food products, but these materials can have negative impacts on the environment. The accumulation of packaging waste in landfills, oceans, and other natural habitats can lead to pollution, harm wildlife, and contribute to climate change. As a result, food companies are under increasing pressure to cut packaging waste from their supply chains. Here are some of the reasons why cutting packaging waste is so important for food companies.

Environmental Impact

Reducing packaging waste is crucial for protecting the environment. Packaging materials that are not recycled or reused often end up in landfills or the natural environment, where they can take hundreds of years to decompose. It can take anywhere from 20 to 500 years to decompose depending on the material and structure. This leads to the accumulation of waste that pollutes the soil, air, and water. If soil is polluted, this can have harmful effects on plant growth and the healthcare of the ecosystem. Similarly, air and water pollution can have severe effects on human health as well as economic impacts. Additionally, the production of packaging materials requires significant amounts of energy and resources, leading to greenhouse gas emissions that contribute to climate change. By cutting packaging waste, food companies can reduce their environmental impact and help preserve natural resources for future generations.

Reputation and Brand Image

Today’s consumer is increasingly aware of the environmental impact of the products they purchase. Food companies that are seen as not doing enough to reduce packaging waste may face negative publicity and a damaged reputation. On the other hand, companies that demonstrate a commitment to sustainability can enhance their brand image and appeal to consumers who prioritize environmentally friendly products. Over the past five years, according to research conducted by Kerry, 85 per cent of global consumers have shifted to more sustainable shopping. For food and beverage purchases, 62 per cent of North American consumers say sustainability is a strong influencer.

The IMB Institute for Business 2022 Value survey found that 49 per cent of consumers paid a premium—an average of 59 per cent more—for products labeled as sustainable or socially responsible. There continues to be a growing demand for sustainable brands amongst the younger generations, and they are willing to pay more for eco-friendly brands. By cutting packaging waste, food companies can improve their reputation and differentiate themselves in a crowded market.

FEATURE

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 44

Packaging materials that are not recycled or reused often end up in landfills or the natural environment, where they can take hundreds of years to decompose. It can take anywhere from 20 to 500 years to decompose depending on the material and structure.

Cost Savings

Cutting packaging waste can also be a way for food companies to save money. Packaging materials can be expensive to produce, transport, and dispose of. By reducing the amount of packaging used, companies can lower their costs and increase profitability. Additionally, cutting packaging waste can lead to other cost savings, such as reducing transportation costs by using smaller, lighter packaging or reducing waste disposal fees.

Compliance and Regulations

Governments and regulatory bodies are increasingly introducing laws and regulations that require companies to reduce their environmental impact. In some cases, failure to comply with these regulations can result in fines, legal action, or damage to the company’s reputation. For example, Canada claims to be moving towards a circular economy for plastics by pursuing zero-plastic waste and improving beyond the estimated 89 per cent of total plastics destined for landfills, incineration, or leakage into the environment. There will likely be more laws introduced in the future aimed at helping reduce plastic packaging. It will no longer be an option for organizations but a mandatory order. By cutting packaging waste, food companies can get ahead by demonstrating compliance with environmental regulations and avoiding legal and reputational risks.

Customer Demand

Customers are becoming increasingly aware of the environmental impact of the products they purchase. Studies have shown that a growing number of consumers are willing to pay a premium for products that are environmentally friendly or sustainable. Consumers care more about sustainability with each passing year as they see the impacts of climate change. Some are also concerned with the health risks associated with certain products or materials, such as toxic chemicals in food packaging.

Prolonging solutions to reduced plastic waste is a detriment to supporting Canada’s transition towards a zero-plastic waste future. By cutting packaging waste, food companies can meet customer demand for sustainable products and potentially increase sales. In fact, cutting packaging waste from supply chains is important for food companies for several reasons. It can reduce the environmental impact of packaging materials, improve brand image and reputation, save costs, ensure compliance with regulations, and meet customer demand for sustainable products. But it’s hard to get started, especially with poor data. Companies looking to get started could consider working with third-party solutions providers.

Additionally, if they want to start internally, they should conduct packaging waste audits, utilize predictive analytics, collaborate with suppliers, implement recycling programs, and optimize packaging design. By doing so, they can achieve both environmental and business benefits.

HUGO FUENTES CEO of The Owl Solutions

Fuentes is a passionate supply chain professional with a wealth of experience in driving performance and efficiency. Having held various roles in the supply chain for manufacturing companies across North and South America over the past 20 years, he has developed a deep understanding of the challenges and opportunities inherent in the industry. It was during this time that he observed supply chains operating in a state of data chaos, resulting in inefficiencies throughout the process that negatively impacted both the bottom line and environment.

Determined to create a better way forward, Fuentes founded The Owl Solutions—a supply chain performance platform that is committed to helping food manufacturers achieve their desired business outcomes while promoting sustainable practices for people, profits and the planet. By leveraging the latest cloud-based software and insights from his team of experts, Fuentes is empowering companies to streamline their supply chains and drive greater efficiency at every step.

FEATURE

CANADIANFOODBUSINESS.COM 45

Fostering Canadian food sector innovation and growth

CANADIAN FOOD INNOVATION NETWORK INTENSIFYING ITS OFFERING WITH APPOINTMENT OF ALEX BARLOW AS VP OF PROGRAMS

By Sean Tarry

Whenit comes to stimulating innovation within the Canadian food sector, few can attest to doing it more effectively or bearing more significant impact than the Canadian Food Innovation Network (CFIN). Connecting the Canadian food ecosystem with game-changing resources, including cutting-edge technologies, compelling perspectives, and unique ideas and approaches, CFIN aims to help enhance business practices, optimize operations, and elevate the entire industry, increasing its innovation capacity. And, as the organization sets its sights on taking its programming to another

level, CFIN recently announced the promotion of Alex Barlow to VP of Programs.

Facilitating innovation

Serving as CFIN’s Programs Director since 2021, Barlow brings a depth of experience to her role, in addition to a passion for economic development and expertise concerning government incentives. She also possesses an unmatched enthusiasm for Canadian innovation and has worked to support the efforts of hundreds of homegrown food businesses across the country,

FEATURE

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 46

helping to secure more than $300 million of federal funding throughout her career. She’s proud, she says, of the work that she’s dedicated toward facilitating growth and the success of the industry, and the innovation that drives it, recognizing the opportunities that have yet to be realized around the confluence of business and innovative technologies.

“The technologies being developed today, and companies developing them, are extremely important with respect to the future health of the food sector in Canada," she asserts. “These firms have some fantastic innovations that can make our food system more sustainable, resilient, and secure. Unfortunately, many food firms under-invest in technology, so helping to break down barriers to adoption by supporting research and demonstration is critical. Beyond our own industry, there is also a massive opportunity to capitalize on our reputation globally and take these innovations to export markets.”

Intensifying services and offering

The organization has amassed more than 2,800 members and has approved an astounding $10.4 million of funding for 34 different projects across the country since its inception in 2021. These are numbers that are representative of the incredible growth that CFIN has experienced and the extraordinary impact that it’s made on the industry in such a short time. And, although the progress is recognized by Barlow, she admits that in order to continue the same trajectory, it’s become critically important for the organization to further intensify and expand the breadth and scope of services that it offers.

“We’re on the right path,” she says. “We’ve awarded more than $10 million in funding to 34 foodtech projects and we’re on the lookout for collaborators and partnerships that can help us fund more Canadian food innovators. As we continue to grow, we’re constantly looking for new ways—through our funding, partnerships, Regional Innovation Directors, and YODL—to bring the food community together, facilitate collaborations, and inject much-needed capital into the ecosystem. I encourage anyone in the post-farmgate food industry to join CFIN and get connected. We are constantly looking to connect innovators to those with challenges to solve problems and validate solutions.”

Bringing the industry together

In addition to bridging connections between the developers of innovative technologies and those operating within the country’s food sector, CFIN also serves an incredibly meaningful purpose in ensuring that each piece of the food ecosystem is connected, bringing the entire industry closer together. And, as Barlow points out, it’s all in an effort to help solve for the challenges that many within the industry face and to build momentum and growth through strategic collaborations.

CANADIAN FOOD INNOVATION NETWORK PROGRAMS

Innovation Booster

The Innovation Booster is a program that provides flexible and rapid support on a cost-shared basis to enable small or medium-sized enterprises (defined as a business with 499 or fewer employees and less than $50 million in gross revenue) to advance their food innovation and research outcomes.

Food Innovation Challenge

The Food Innovation Challenge is a unique funding opportunity for Canadian food industry collaborators who want to spearhead transformative improvements that will propel the food sector forward and generate significant economic impact.

FoodTech Next

FoodTech Next is a unique funding opportunity for early-stage Canadian technology firms who seek to be part of—or sell to—the wider food industry. The program allows companies to demonstrate and pilot their innovation in operational environments to prove their solutions and validate the return on investment for the food sector. The overarching goal of FoodTech Next is to accelerate the commercialization of Canadian innovation by generating first demonstration opportunities.

For more information about CFIN’s programs, including participation guidelines and application dates, visit www.cfin-rcia.ca/funding/ programs-overview.

FEATURE

CANADIANFOODBUSINESS.COM 47

CONNECTING WITH YODL

In order to ensure greater access to and connectivity between food professionals and the invaluable resources that can help them flourish, CFIN developed and introduced YODL—an interactive, self-serve platform that connects CFIN members to an entire ecosystem of new ideas, partners, funding, and resources to help grow their business and increase their innovation capacity. Members are also provided with access to daily content and opportunities to discover valuable resources they might not find anywhere else. In addition, YODL houses information concerning CFIN programs, events, members and staff, too, including its five Regional Innovation Directors who are located across the country and ready to serve the organization’s members.

“Our food sector is big, diverse, and segmented—which poses significant challenges to quickly and easily find the right partners for your food business,” she explains. “Through our programming, Regional Innovation Directors, and YODL, we’re breaking down these silos and bringing our national food community together under one digital roof. For Canada to take its place as a global food innovation leader, the key lies in our ability to form strategic partnerships and leverage our collective abilities to bring new products and processes to market. It is not easy; collaboration in practice can be extremely challenging, and so I encourage companies to consider how they can set up their operations and teams to support collaborations.”

Further growth ahead

Aided by the rate of change and evolution that’s currently occurring throughout the Canadian food sector, and driven by the overwhelming need for its services, CFIN continues to grow, adding more manufacturers, processors, retailers, distributors, foodtech companies, researchers, and funders to its membership every day. And, although Barlow admits that the organization is extremely happy with its progress to date and excited about the companies and projects its funded, she promises that any previous accomplishments achieved by CFIN are only the beginning.

“CFIN members can expect a whole lot of ‘more’. This year we have about $6 million to move through all three of our programs, while simultaneously managing our current projects. We’re launching more features and content on YODL on a regular basis; and we’re on the lookout for more partners who we can run new funding programs with. We know how important our funding is to early stage foodtech companies and we’re constantly exploring new ways to inject capital into these promising businesses. And, we’re also always on the hunt for what is emerging or what is next, or how to best solve food innovation challenges for all players in the sector, including under-represented groups and the small enterprises.”

For more information about the Canadian Food Innovation Network, the services it provides, and how to become a member, visit www.cfin-rcia.ca/home.

M CM MY CMY AWB-Lab-BioBusiness-one-third-Feb2023-outline.pdf 1 2023-02-17 10:25:13 AM FEATURE

VOLUME 38, ISSUE 2 • 2023 48

CANADIAN FOOD BUSINESS

Superior weighing performance

The JBT C.A.T. Indexing Scale is comprised of a stainless-steel weigh hopper with stainless-steel buffer hopper and equipped with 113 kg load cells. Providing an incredible solution for those operating in the red meat, poultry, and seafood markets, the C.A.T. Indexing Scale offers superior all-around performance that allows users to simplify operations while increasing output and bottom line.

www.jbtc.com

Under pressure

MP&C’s designed, fabricated, and certified pressure vessels are high-quality stainlesssteel solutions designed for specific client applications. Unlike many other companies that

fabricate stainless steel pressure vessels in facilities and on equipment also used for carbon steel fabrication, MP&C only fabricates using stainless steel to avoid potential cross contamination and to provide clients with the highest quality product possible. With diameters ranging from 10 cm to 3.7 m, it’s ideal for most pressure vessel applications.

www.membranepc.com

Double the mixing, blending and dispensing

Detecting metal contaminants

The CEIA THS/21THS/MS21 Series Metal Detection is the

world’s only multi-spectrum metal detector providing unique detection capability and extreme sensitivity of magnetic, non-magnetic, and even stainless-steel metal contaminants. Exclusively developed by CEIA, the world's largest manufacturer of metal detectors, multi-spectrum technology uses many frequencies simultaneously to optimize sensitivity to all metal contaminants and reduces product waste by minimizing product effect errors. www.heatandcontrol.com

Enhancing mixing efficiency

Reading Bakery System’s Hydrobond Technology instantly hydrates dry materials, speeding up the continuous process allowing for the use of a shorter mixer, which means a smaller footprint, lower equipment costs, and lower energy costs. This cutting-edge equipment can be used with a continuous mixer to make the mixing process more efficient or with a pre-hydration system to mix flour, minors, and water directly into a brew holding tank.

www.readingbakery.com

The PPM Twin-Tank System provides mixing, blending, temperature control, storage, and uninterrupted dispensing of liquid and slurry mixtures to spray applicators. Utilizing multiple closed recirculation loops, it helps to avoid product solidification while ensuring that the product remains in suspension even when the solution is not being sprayed. Mix and use tanks are available in single-wall or double-wall insulated designs, and come in various standard sizes.

https://ppmtech.com

Carbonation nation

The Mojonnier Meter-Based Mix Processor produces carbonated beverages with metering syrup, deaerated water, and CO2 . The mixed product is cooled by a plate heat exchanger with glycol. Instruments, automatic valves, and controls with electronic processors adjust the parameters according to the selected recipe. The mixed product is delivered to a filler via a transfer pump that is tuned with the filler. The Mojonnier Meter-Based Mix Processor also includes remote technical support functionality.

https://mojonnier.com

FOOD WARE

CANADIANFOODBUSINESS.COM 49

Infeed automation

The AES Garnet Smart Infeed features a hygienic, wash-down design for easy clean-up. This highquality infeed ensures the automatic repositioning of products into single files and boasts 94 per cent system efficiency per Smart Belt. Because it operates using direct magnetic drives rather than gearboxes, it’s easy to swap belts. And, offering a robust, stainless-steel construction, it’s ideal for food processing and packaging applications.

www.aes-atlas.com

It’s like butter

The AC Horn Nut Butter Mill is a highly versatile, single-disk attrition mill that can be used in multiple production and laboratory applications for both food and industrial products. It can grind a wide variety of peanuts and tree nuts with a precision unmatched by other mills. Its food processing performance is secondto-none with the capability to produce smooth, easy-to-spread nut butter, perfectly blending stabilizer, salt, dextrose, etc., to produce a mix of creamy smooth consistency.

www.achornmfg.com

Product treatment

The Della Toffola Hot Filling FHP uses gravity, allowing the system to treat products with temperatures ranging from ambient up to 90°C. The excess product, after selfleveling, is sent back to the preparation and filtration plant, with product flow to the filler adjusted by means of a modulating valve in order to grant a constant control of the flow itself.

www.dellatoffola.us

Increased centrifugal acceleration

The GEA Centrifuge Separator for beverages has a hygienic design that allow for the reliable separation of the finest solid particles possible by the increased centrifugal acceleration. The gentle product feed results in optimized treatment and clarifying effect, particularly for sensitive products. Oxidation pick-up is prevented by the hydrohermetic seal which is completely wear-free and fully CIP-compatible.

www.gea.com/en

FOOD WARE

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 50

The future of global food systems

Report identifies the trends impacting the world’s food systems today and tomorrow

By Sean Tarry

There’s no debating the seriousness of the challenges facing the preservation and optimization of today’s global food systems. Ranging from shifting consumer demand and production and supply alterations to economic instability and environmental changes, to name a few, the factors influencing the health of global food systems are plentiful, and their impacts immense. In light of the critical need to develop solutions meant to address these challenges in a move toward a climate-smart, healthy food system, S2G Ventures recently released a report titled Trends Shaping the Future of Food in 2023, highlighting the 10 most significant potential drivers of positive change.

1. Robotics

While many industries have been experiencing labour shortages over the past couple of years, few have been harder hit than the agricultural sector. And, looking ahead, it doesn’t seem likely to improve. In fact, according to a recent report from RBC, current labour shortages aside, an estimated 40 per cent of Canada’s farmers will retire within the next 10 years. To combat the issue, and to provide a much-needed bolstering of necessary field work, the use of advanced technologies is on the rise, leveraging innovations in computer vision, navigation, artificial intelligence, robotics, and chemistry, as well as soil and plant sciences, to support the future of crop production.

2. Digitization

In addition to their use in augmenting and enhancing field work through the digital execution of manual labour tasks, advancements in technology are also presenting the agricultural industry with the opportunity to not only increase yield and return, but to better manage their impact on the environment. And, with the introduction of ground truth measurement tools, including sensors, satellites, and GPS systems, paired with modeling, prediction, and estimation applications, farmers are provided with greater visibility into their operations every day, enabling precision strategy and optimized production.

3. Alternative Inputs

The negative impact

of synthetic fertilizers and pesticides

has been understood for some time, making it a priority for many within the industry to move away from their use toward a range of alternative inputs. Currently, resulting from a combination of skyrocketing prices for synthetic fertilizers and pesticides and increasing public demand for safer, environmentally friendly products, the use of alternative inputs, from biofertilizers to chemical stimulants, has increased significantly. And, as government regulations meant to protect the environment continue to tighten, the use of alternative inputs is expected to rise accordingly, sparking greater innovation and product effectiveness.

INDUSTRY REPORT

CANADIANFOODBUSINESS.COM 51

4. Optimization

The global supply chain is complex enough on a good day. But, when considering the disruptions that have occurred over the past couple of years, including intermittent port congestion and closures, military conflict and unprecedented inflation, to name a few, the need for a rethink is obvious. By leveraging the latest advancements in machine learning, artificial intelligence and predictive analytics, agricultural producers have the opportunity to access an incredible amount of data and information that can be used to optimized their supply, from farm to fork. And, in doing so, the industry can dramatically reduce negative impacts of the global supply chain on the environment.

5. Decentralization

As food insecurity continues to become a bigger concern around the world, the need to ensure a more resilient food system is increasingly required. And, with the threat of agricultural food shortages becoming more commonplace, often dependent on environmental conditions, many throughout the industry are considering the decentralization of their production. Several types of technology-enabled growing systems, including cellular agriculture, controlled environment agriculture, and land-based aquaculture are allowing farmers to diversify their yields with output that’s much less susceptible to environmental conditions, thus helping to alleviate food insecurity.

6. Food Waste Solutions

Given the direct and obvious correlation between food insecurity and food waste, the development, introduction, and adoption of food waste solutions are becoming critical in order to solve a host of problems and challenges that we all face. It’s another area presenting huge opportunities to leverage data fuelled by machine learning and artificial intelligence to tighten and hone buying practices, thereby providing greater control over production and the amount of food that’s wasted.

7. Sustainable Packaging

As the petroleum-based non-biodegradable plastics that are used within the majority of today’s food packaging continue to present detrimental impacts on the environment, increasing pressure is being placed on food manufacturers and their suppliers to rethink their packaging choices. As a result, a range of different bioplastics have emerged as much more sustainable alternatives to their petroleum-based predecessors. In addition, many companies throughout the industry are now beginning to form partnerships in efforts to start upcycling plastics for circular applications, reducing the industry’s reliance on plastic and improving its impact on the environment.

8. Novel Ingredients

There remains rising consumer interest and demand around plant-based foods as alternatives to meat. But many producers of plant-based products still struggle to offer the taste, smell, and texture that consumers are used to with respect to animal proteins. In addition, long ingredient lists and questionable nutritional content are eliciting criticism. However, the fusion of food science, molecular biology, and powerful artificial intelligence is enabling the discovery of natural ingredients, formulations, and the ability to reverse engineer foods from the molecular level, resulting in the advancement of novel ingredient development and continued upward trajectory of food innovation.

9. Cultivated Protein

According to the World Economic Forum, the global demand for meat is expected to double by 2050. Given the state of today’s livestock system, which has resulted in resource depletion, land degradation, exorbitant GHG emissions, and animal welfare issues, it seems unlikely that farmers will be able to produce enough product to meet consumer demand. It’s a situation that’s leading to a rise in the development of lab-grown products that are, by all accounts and purposes, biologically identical to animal products without requiring the slaughtering of animals. Currently, the cost associated with the development of lab-grown product remains a significant barrier to mass adoption. However, as momentum behind the technology and the need for its use builds, cultivated proteins will slowly move from trend toward general practice.

10. Convergence of Food and Healthcare

The COVID-19 global pandemic accelerated and facilitated a number of trends, including an intensified focus and concern around personal health among consumers. As a result, there has been a concurrent rise in the notion of food as medicine. As consumers show an increasing penchant to improve and optimize their health, it’s resulting in increased investment into research related to the discovery of new foods and the uncovering of previously unknown compounds and health benefits, positioning food front and centre when it comes to measures and efforts to prevent chronic disease and improve health outcomes.

As we move forward, the challenges that the agricultural sector face are clear. What’s just as clear, however, is the fact that the resources, innovations, and ideas that are necessary in order to help address and overcome these challenges are readily available. And, backed by advancements in technology, they could lead to an industry that’s more efficient, profitable, and sustainable than ever before imagined.

For more information about S2G Ventures’ Trends Shaping the Future of Food in 2023 report, visit www. s2gventures.com.

INDUSTRY REPORT

CANADIAN FOOD BUSINESS VOLUME 38, ISSUE 2 • 2023 52

CANADA’S TRUSTED ORGANIZATION OF FOOD AND BEVERAGE PROFESSIONALS.

LIMITED TIME OFFER LIMITED TIME OFFER LIMITED TIME OFFER

The purpose of the Canadian Institute of Food Science and Technology (CIFST) is to advocate and promote the quality, safety and wholesomeness of the food supply through the application of science and technology by linking food science professionals from industry, government and academia.

If you join CIFST by August 31, 2023, you will receive up to 18 months membership for the price of 12. This offer applies to NEW members only.

Some of the benefits included in your membership

Professional development and networking opportunities through our national and local events

FREE webinars

FREE Copy of Canadian Food Business Quarterly Magazine

FREE job posts on our CIFST job board

Certified Food Scientist (CFS) discount though IFT

...and more!

Who Qualifies?

PROFESSIONALS: Individuals working professionally in the food sector in industry, government and academia.

The one-year membership fee for the CIFST Professional Membership is $215 25

ASSOCIATES: Individuals connected to the food industry.

The one-year membership fee for the CIFST Associate Membership is $215 25

STUDENTS: Proof of enrollment with a recognized academic institution is required.

The one-year membership fee for the CIFST Student Membership is $45

SCAN TO EXPLORE, JOIN OR SUBSCRIBE

JULY 2023

www.cifst.ca

By Hugo Fuentes, CEO of The Owl Solutions

By Hugo Fuentes, CEO of The Owl Solutions