10 minute read

Fees and charges

The costs associated with living in a retirement village are not the same as owning your home.

There are several charges and fees associated with living in a retirement village and all payments made before, during and after living in a retirement village must be specified in the residence contract.

Each community has its own set of costs, so it is important you are provided with the full details of all applicable charges and what these costs cover. Consulting a financial advisor, accountant or lawyer to assist you in making an informed decision before entering into any agreement, is recommended. There are three types of costs involved which include the entry fee or purchase price, the service or maintenance fees, and exit fees, also known as a ‘departure’ or ‘deferred management’ fee.

If there is any part of the contract you don’t understand, don’t be afraid to ask questions or speak with family members who may be able to help you.

It is important you seek legal advice and have the full details of all applicable charges, what they cover and what you need to pay on exiting before you sign any contracts.

Deposit

Generally, you will need to pay a deposit to secure a unit or apartment. Check with the village how long it can be held for you. Should you change your mind within this specified time, the deposit will be refunded. If you enter into a binding arrangement with the village, the deposit will be part of the purchase price or entry payment.

In some States and Territories, following the signing of a residency contract purchasers are entitled to a refund during a ‘cooling off’ period. Check with the village operator if this cooling off period applies and how long this period is.

You will also need to check whether the village requires an administration fee for refunds.

Templestowe Manor

Your Retirement Living, Your Community

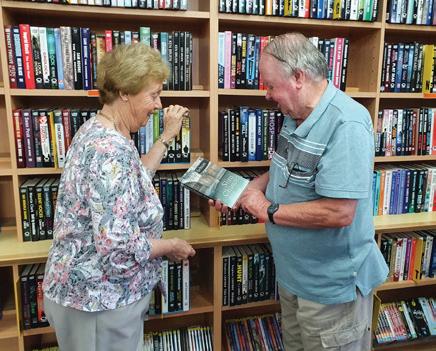

Nestled in the beautiful leafy Lower Templestowe just 17kms north east of Melbourne’s CBD. Templestowe Manor is surrounded by three golf courses, local parks, sporting grounds and neighbourhood shopping hubs including Doncaster Shoppingtown and the Pines shopping centre. The Templestowe Manor community features 20 Independent Living Units with private rear gardens as well as a Signature Aged Care service. Templestowe Manor features: • Newly refurbished units presenting quality internal furnishings and amenities. • Enjoy the self-serve café, library and BBQ terrace, all located onsite. • All meals are prepared onsite by our chef. • Regular happy hours and coffee mornings. • Program of activities which include Allity bus outings, regular film screenings, bocce/putting green, billiards, arts and music. Call to organise a tour of Templestowe Manor at a time which suits you.

Templestowe Manor Retirement Living 410 – 418 Thompsons Rd, Templestowe Lower VIC 3107 t: (03) 9850 8877

Entry payment

Before moving into a village, you will need to pay an entry payment, which is refunded if you move out of a village.

The cost of entering a village depends on the village, its location, and facilities and services offered. Monthly service and maintenance charges also apply and you may be required to pay for extra personal services, such as laundry.

Leaseholds and licence tenures are generally set up so the entry payment is usually the current market value of the property.

Under strata, community and company titles, you generally pay a ‘purchase price’ for the legal title to your property.

Some organisations may refund a proportion or all of the premium/ donation when the resident leaves the unit. Alternatively, this amount may go towards ongoing care.

These financial arrangements are negotiated between the residents and organisations when accepting the conditions of entry. The resident may also be required to pay a weekly maintenance fee.

Deferred Management Fee

Some operators offer a deferred management fee which means the village will deduct a ‘deferred’, ‘departure’ or ‘exit’ fee at the time of settlement of sale or re-occupancy of your home. The fee forms part of the purchase price, but its payment is deferred until the end of the occupancy.

It is calculated at the time of entry and applied on exit. The amount is calculated using a formula that generally involves a percentage of your successor’s entry cost multiplied by the number of years of your occupancy, and may include a proportion of capital appreciation. The deferred management fee must be specified in the entry agreement or residence contract, to ensure you have clarity about the size of this payment should you need to leave the village.

Stamp duty

You will normally have to pay stamp duty if your tenure is strata, community or company title. You will also have to pay stamp duty on leasehold titles if the lease is ‘assignable’ – this is when you can sell the balance of the term of the lease to a new resident when you leave the village.

For other leasehold or licence arrangements, no stamp duty is typically payable, but make sure to check the particular arrangement in your State or Territory.

Recurrent charges/ maintenance fund

Recurrent charges are payable at regular intervals, either fortnightly or monthly.

You should be informed of the expected, regular contributions prior to entering the village.

This fee may also include a contribution towards other village funds which are used to meet capital replacement and/or longterm maintenance costs.

Recurrent charges might cover expenses such as:

◆ Administration (ie stationery, office equipment, phone use)

◆ Wages, salaries and related costs (ie village manager, office person, handyperson or gardener or ‘on call’ overnight support staff)

◆ Property management (ie council rates, insurance)

◆ Food and catering (in the case of serviced apartments)

Capital Replacement Fund

A Capital Replacement Fund is commonly used to fund a planned maintenance program. Over time carpets or major appliances, such as stoves, hot water services or air conditioners in residences, will need

replacing, and this type of fund will ensure those upgrades can take place as required.

Long-term maintenance fund

A long-term maintenance fund, also known as a ‘sinking’ fund, is usually set up to meet expenses which could include maintenance of road surfaces, downpipes and gutters, painting, security and salt damp repairs.

It may also be used for the repair of recreational facilities such as spas and swimming pools.

Personal or additional service charges

If you have any special care or dietary requirements, you will be required to cover these additional services. Personal or additional service charges relate to services specifically provided to you on a personal needs basis, which will also cover residence cleaning. The schedule of services and charges payable by you should be detailed in the residence contract prior to you entering the village.

Fee and charge increases

All fees and charges incurred at retirement villages are subject to increases, however recurrent charges cannot be increased beyond a level deemed reasonable.

Many villages use the Consumer Price Index (CPI) as a budgetary guide. However, CPI cannot be automatically used to justify an increase in fees because the CPI might be higher than the actual cost increase incurred by the village. If you are a new resident at a retirement village, it may be a good idea to check with other residents to find out what the annual increases have been in the past, to get a better understanding of what to expect of future fee and charge increases.

Hillside Gardens

Your Retirement Living, Your Community

There is nothing else quite like Hillside Gardens. Located in the Adelaide Hills and set within a glorious wooded valley just five minutes drive from Stirling, you will find 24 state-of-the-art independent living apartments colocated with Allity Hillside Aged Care. All beautifully designed and appointed, residents are presented with the ultimate in contemporary senior living. Hillside Gardens features: • Private and spacious, overlooking acres of landscaped gardens. • Fully appointed kitchen with Essastone island bench tops. • Ducted air-conditioning. • 24-hour emergency monitoring system, secure ground floor car park with lift access and keyless entry. • Communal library, games room, bowls, billiards and petanque onsite. Call to organise a tour of Hillside Gardens at a time which suits you.

Hillside Gardens Retirement Living 88 Cricklewood Road, Heathfield SA 5153 t: (08) 8339 4815

An annual meeting is held between administering authorities and residents to discuss the financial statements relevant to all funds for the previous year and plan the coming year’s budget.

Depending on when the villages’ annual meeting is held, a period of a few weeks or months may elapse before residents are liable to pay an increased fee.

An administering authority may require the payment of this increased fee to be backdated to the beginning of the financial year.

Special levies

In most States and Territories special levies can only be imposed if authorised by a special resolution and passed at a meeting of the village residents.

While levies are rare, from time to time, a special levy may be charged by a retirement village for budget shortfalls in a particular year which may include, for example, costs to cover road resurfacing due to tree root damage.

Ask the village operator about the last time a special levy was charged, why and how they will be imposed.

Centrelink Assessment

Centrelink considers that your entry payment includes all amounts you must pay when you move into a retirement village, however, it does not include ongoing fees and charges for services and facilities.

The entry payment amount you pay affects whether Centrelink considers you to be a ‘homeowner’, and if you will be eligible to receive rent assistance.

Centrelink compares the amount of entry payment you pay against a figure called the Extra Allowable Amount, which is the difference between the non-homeowner and homeowner assets test thresholds at the time the entry contribution is paid.

The Extra Allowable Amount is currently $214,500 (rate current at time of publication). Whether you are considered to be a homeowner affects the amount of assets you can own without affecting your pension entitlement.

Your entry payment is included as an asset if you are not a homeowner and is not classed as a financial investment, and income will not be deemed.

Financial issues

Moving into a retirement village is as much as an investment decision as it is a lifestyle decision, so asking yourself the hard questions, such as ‘Am I financially prepared for this transition?’, may help prepare you for any financial hurdles which could lie ahead.

It can be costly to maintain your own home, but will you be better off if you move into a retirement village?

There are recommended aspects to consider before moving to a village. For instance, try to take into account the sale price of your current home, the costs associated with selling and moving, new furnishings which you may need to purchase for the new residential unit and consider the ongoing maintenance or service fees associated with retirement living.

If you need to sell your home before moving into a retirement village, it is recommended any contract which is signed should be subject to conditions that meet your sale needs.

Your financial position can be seriously compromised if you do not receive the amount that you need or are expecting from the sale of your home.

Plan ahead to stay ahead

Proper planning of your finances can give you more disposable income, and possibly leave more for your loved ones.

Entering a retirement village often requires a person to move out of their principal home on a temporary or permanent basis.

While there will be a number of practical and emotional considerations, financial questions are likely to be the most complex.