14 Garden View

We look at how to plant your garden to ensure you have the best chance of growing your own peaches!

Robotic Hip & Knee Surgery astronomy

Welcome to the Spring Equinox

12

14 education

The dangers of social media garden view

All about a passion for peaches!

In this issue we look at the history and science behind the Spring Equinox (p10), the mental health issues affecting young people (p12) as well as how to grow fantastic peaches in your garden this Spring (p14).

There’s also a fascinating look at an innovative new treatment for hip and knee replacements (p8).

I hope you all enjoy this issue and I’ll see you again in May. Best wishes,

Architecture

Insight Planning Services: p5

Bathrooms

Chris Smith Plumbing: p5

Country Bathrooms: p11

Blinds

Associated Blinds: p16

Builders & Contractors

Country Roofing & Building

Contractors: p14

Mitre Oak: p3

SJP Builders: p15

Eco Windows & Doors: p15

Children’s Services

Cotswold Tutor: p12

Clearances

Oxfordshire Clearances: p2

Education

Cotswold Tutor: p12

Sibford School: p3

Electrical Services

Aerial Solutions: p10

Finance & Legal

Wise Investments: p6-7

Flooring

Country Tiles & Flooring: p11

Furniture

Amanda Hanley By Design: p1

Andy Bennett Upholstery: p10

Bob Dadge Carpentry: p10

Gardening & Outdoors

Heavenly Trees: p14

Mossinator: p5

Stockwell Davies Tree Contractors: p14

Tom Negus Tree Care: p14

Gifts

Alain Rouveure Galleries: p13

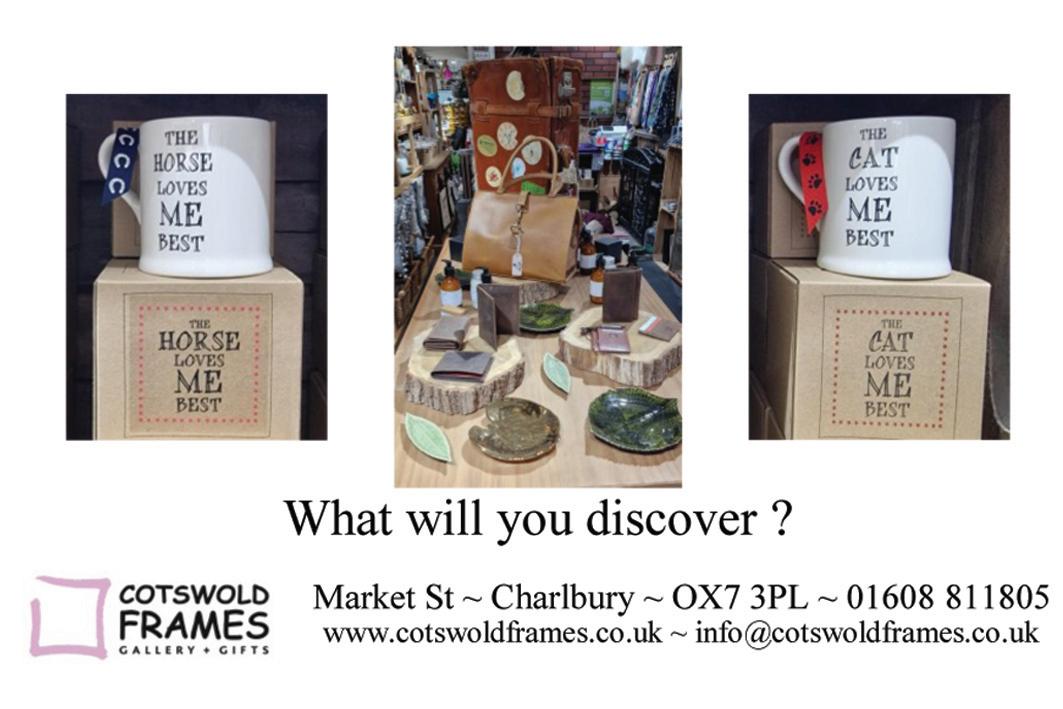

Cotswold Frames: p10

Glass

Chips Away: p5

CN Glass: p1

Healthcare & Wellbeing

Alain Rouveure Galleries: p13

Cotswold Deep Tissue

Massage: p13

Cotswolds Foot Clinic: p13

Footworx Clinic: p13

Worcestershire Knee & Hip Clinic: p8-9

Home & Interiors

Alain Rouveure Galleries: p13

Amanda Hanley By Design: p1

Andy Bennett Upholstery: p10

Associated Blinds: p16

Bob Dadge Carpentry: p10

Country Bathrooms: p11

Country Tiles & Flooring: p11

Paul Dadge: p11

Kitchens & Bathrooms

Country Bathrooms: p11

Country Tiles & Flooring: p11

Motoring

Chips Away: p5

Painting & Decorating

Cotswold Wallpaper

Hanging & Decor: p4

Paul Dadge: p11

Stephen McNally Painting & Decorating: p10

Plumbing

Chris Smith Plumbing: p5

Gas & Oil Heating: p4

Property Maintenance

Country Roofing & Building

Contractors: p14

Eco Windows & Doors: p15

Mossinator: p5

Security Opalstone Group: p2

Sport & Leisure

GLL/Better: p12

Tree Surgery

Stockwell Davies Tree

Contractors: p14

Tom Negus Tree Care: p14

Tuition

Cotswold Tutor: p12

To be fair to them, no one knew at the time that Russia would invade Ukraine causing chaos in global energy markets. We will never know what inflation would have been today had the invasion never taken place. However, it’s likely this aggression simply added fuel to a fire that was already well alight.

It is now impossible to tune into the news without hearing about inflation and the cost of living crisis. Strikes by public sector staff are prevalent. This is a direct result of

The last period of serious inflation in the rich world was during the 1970s, triggered by two oil shocks, one in 1973 and the other in 1979. The first happened when the forerunner of OPEC imposed an oil embargo on nations, including the US and UK, that had supported Israel in the Yom Kippur war. The price of oil quadrupled from $3 to $12 per barrel (compared to $100 today). Western economies were more manufacturing-based then, so the higher oil price affected economic activity more directly. As these events took place nearly 50 years ago, to remember them you need to be over 60 years old, which many current commentators and decision-makers are not. It seemed obvious in the 1970s that you should buy whatever you needed as soon as possible before its price went up. By the early 1980s inflation and interest rates subsided to a level we would recognise today, and have stayed at low levels apart from a brief aberration in the late 1980s. The recession of the early 1990s killed inflation, seemingly once and for all.

The main reasons why experts believed that inflation wouldn’t return, as recently as last year, were globalisation along with ‘the three

Gradually the quality of China’s manufactured products improved and the West duly migrated the bulk of its manufacturing to China. In this way China exported deflation – everything you could buy from the Chinese would cost vastly less than you were paying before.

30 years on and Chinese workers have seen a tenfold increase in wages combined with shorter hours. The move from the countryside to the cities has slowed. Meanwhile China’s rulers have become less business-friendly and relations between China and the West have turned frostier. The cost of transporting goods is also rising. The great inflation-busting era of globalisation appears to have come and gone.

Some have argued that the world has become so indebted that most spare money is consumed in interest payments, leaving little to generate the kind of robust growth which could lead to inflation. The world is indeed more indebted today than ever – at the end of 2021 global debt had risen to a new record of $300 trillion or $37,500 for every person alive.

However, borrowers pay interest to their lenders and the money is therefore

When the first signs of inflation appeared back in 2021, the monetary authorities and commentators described it as transitory.

This won’t always be the case of course. If the lender is a bank, as it often is, it will use its income to pay employees and shareholders, who will probably spend it. For the UK government, with its roughly £2trillion of debt, 10% annual inflation knocks a massive £200billion hole in the real value of government debt, an amount equivalent to putting income tax up by 30p in the pound. However, the quarter of UK government debt that’s linked to inflation will still rise in value as inflation goes up, and cost more money to service, partly offsetting the inflation windfall.

Inflation increases the government’s income. As salaries rise, income tax and National Insurance payments rise, all windfall income for the Government unless unemployment rises high enough to offset it. Similarly as prices rise VAT on goods rises, unless spending on goods falls by a greater extent.

The generally agreed rule is that older people save and invest, which is deflationary, while younger people borrow and spend, which is inflationary, so the effect of the rising average age of populations tends to be deflationary overall.

However, driven by the pandemic, it’s possible that the long, seemingly inexorable rise in life expectancy may have peaked, at least for the time being. This might be a factor reducing the deflationary effect of an aging population.

Technology increases productivity and that reduces inflation. Computers do much that used to be done by people but computers do it much faster and more accurately. As they grow more powerful, they also get cheaper. The smart phone you could buy today may not cost less money than the one you could have bought a year ago, but it will contain features that weren’t available then. If today’s phone had been available a year ago, it would have cost more than today, so on a like-for like basis the price has dropped, as you are buying a more sophisticated piece of equipment for the same money. This is a small element in the inflation calculation, but difficult to capture in the numbers, meaning that headline inflation always tends to be a little overstated.

During the summer, forecasters were falling over each other to predict ever higher inflation numbers. Goldman Sachs predicted a hefty 22% on August 31st.

Today’s inflation is primarily caused by externalities – global events pushing up the prices of energy and food, and in the UK by the weakness of Sterling, which makes all imported goods more expensive. This type of inflation acts as a tax on the consumers of those products. Central banks are raising interest rates – another tax on consumers –in a bid to curb inflation. This appears to be an attempt to offset the effects of a series of factors which have put pressure on incomes, by putting further pressure on incomes. We are already seeing the start of a period of economic contraction – a recession – at least in the UK. Everyone is concerned at what lies ahead, and spending patterns are being adjusted accordingly. House prices, in a strongly rising trend since the pandemic, are cooling and the number of transactions are falling. All of this is before the effect of higher interest rates has been fully felt in the real economy.

The above is an abridged version of fourth and final article in a series written by our founder, Tony Yarrow. The full article, along with the preceding three can be found on our website if of interest.

Joe Cooper FPFS Chartered Financial Planner

Joe Cooper FPFS Chartered Financial Planner

November 2022

Mr Aslam is the leading MAKO Robotic Surgeon in Worcestershire, being one of a few Orthopaedic Surgeons in the UK currently performing this technique.

“My patients who have so far opted for this technique have seen great results. Their stay in hospital was shorter, recovery time quicker & they walked unaided within days. The implant positioning is very accurate and the preoperative planning is extremely useful”

It all begins with a CT scan of your joint that is used to generate a 3D virtual model of your unique anatomy. This virtual model is loaded into the Mako system software and is used to create your personalized pre-operative plan.

In the operating room, I will use Mako to assist in performing your surgery based on your personalized preoperative plan. The Mako system also allows me to make adjustments to your plan during surgery as needed. When I prepare the bone for the implant, the Mako system guides me within the pre-defined area and helps prevent me from moving outside the planned boundaries. This helps provide more accurate placement and alignment of your implant.

After surgery, my Medical Team and Physiotherapists will set goals with you to get you back on the move. They will closely monitor your condition and progress.

Your joints are involved in almost every activity you do. Movements such as walking, bending and turning require the use of your hip and knee joints. When the joint becomes diseased or injured, the resulting pain can severely limit your ability to move and work.

The hip and knees are amongst the largest joints in the body and are

central to nearly every routine activity. A smooth plastic like lining called cartilage covers the ends of the bones and prevents them from rubbing against each other allowing for flexible and nearly frictionless movement (Figure 1, right).

Cartilage also serves as a shock absorber, cushioning the bones from the forces between them. Finally, a soft tissue called synovium lines the joint and produces a lubricating synovial fluid that reduces friction and wear. Each patient is unique and can experience knee or hip pain for different reasons.

The main cause of hip/knee pain is osteoarthritis

This is sometimes called degenerative arthritis because it is a wearing out condition involving the breakdown and of cartilage and formation of bone spurs (Figure 2, right). With osteoarthritis, the cushioning cartilage at the end of the femur may have worn down making walking painful as bones rub against bone. Once the bone ends are exposed the joints become more painful on weight bearing.

Another common cause of knee and hip pain is rheumatoid arthritis which is an inflammatory condition . Rheumatoid arthritis produces chemical changes in the lining of the joints or synovium that causes it to become thickened and inflamed. In turn the synovial fluid destroys the cartilage, the end result is cartilage loss pain and stiffness (Figure 2). Because the primary problem is the synovial inflammation this causes damage to multiple joints, including non weight bearing joints in the hands and feet.

The 2023 Vernal or Spring Equinox welcomes the beginning of Spring. This year the Sun appears overhead on the equator on Monday 20th March at 9.24pm.

The complexities of how our ancestors worked out how to find this point in time is most interesting and not without its mishaps. They were aware the Earth rotated the Sun every 365 and one quarter of a day and this is the reason why we add an extra day (Feb 29th) every four years. If this was not done our calendar would slip out of synchronisation with the seasons.

You will note from the diagram that as the Earth continues its journey towards the Summer Solstice on June 21st the Northern Hemisphere becomes more prominently visible to the Sun thus the days become more warmer and longer as we head towards the summer.

For more detailed information on the Vernal Equinox go to: www.weather.gov/cle/Seasons www.almanac.com

John Harris

There are so many issues affecting education today examples being:

Pupil Mental Health, Post Covid Recovery, Funding, School Discipline, Teacher Retention, Teacher unrest and even Teacher Mental Health, the list goes on.

Yet there has never been available the support we now have at our fingertips in the form of virtual instant communication by modern technology – unheard of decades ago. We can access charities and groups for advice and information. Each person will have their own priorities and my personal concern is that of the mental health of our children; the future generation.

It is only in recent years that mental health issues have been freely debated in public. Prior to this people “hid” behind their problems with feelings of guilt, being fearful that they were unusual in being the only one with such problems and not realising they were not alone.

In a recent survey conducted by the NHS several alarming figures were found:

• 18% of children aged 7 to 16 and 22% of young people aged 17 to 24 had a probable mental disorder.

• 12.5% of 11 to 16 year old social media users

reported of being bullied online.

• Those with a probable mental disorder were less likely to report feeling safe online.

Bar Chart showing the increase in the mental health issues of children from 2017 to 2022

The NHS report showed that parents seeked advice from a variety of sources these included in order:

• Education Services e.g. schools

• Health services e.g. local doctor

• Friends or family

• Online or telephone support

The Education services were generally the first port of call followed by the Health Services. Surprisingly not all referred their children to the Health Services. What is important is that if your child has Mental Health problems, seek advice preferably from your doctor.

Note the dramatic increase in the 17 to 19 years age group from 2021 to 2022

Further research has been carried out by a number of institutions and Sir Peter Lampl the founder and chair of the Sutton Trust who carried out a joint research project with University College London stated, with reference to Covid and Mental Health “… the after effects are far from over for our country’s youngsters”

John Harris

When we rented a house in the South of France one summer, there was a peach tree in the garden and the owner invited us to help ourselves. We have never eaten so many sweet, ripe peaches. Nothing in the supermarkets here has ever compared to those fat globes of nectar.

A few years ago, I discovered that it was possible to grow peaches in this country too, with a few caveats. In the far South it’s possible to grow them against a south, or south-west-facing wall. Further up the country we need the help of a conservatory or a large greenhouse. The reasons for this are threefold: peach trees tend to flower very early, around February, when the UK can still suffer sharp frosts in the mornings; they also develop fungal diseases if the weather is too cold and damp and finally, our short summers generally don’t give enough time for the fruits to ripen. But if you have that south-facing wall or conservatory and would like to have a go at growing peaches (and who wouldn’t?) read on.

‘Peregrine’ is a white-fleshed peach quite wellsuited to the English climate (the above warnings notwithstanding) though generally best grown under cover. ‘Rochester’ is a very reliable yellow

variety that gives good harvests of large fruits in August. It also has the advantage of being a late bloomer, making it less susceptible to frost damage. If space is limited, which it often is in a conservatory, choose a plant grafted on to dwarf rootstock. Peaches are best grown as a fan. Fasten horizontal wires to the wall at 30cm intervals to allow the stems to be tied in and spaced out evenly. The plant should be positioned about 25cm from the wall with branches sloped towards it, and if planted directly into the soil, this should be enriched with well-rotted manure or compost. If planted into a pot, make it as large and deep as the space will allow. When the flowers appear, cover the plant with a light fleece at night to protect the blossom. Because of the lack of natural pollinators early in the year you can help things a long by using a long dry paintbrush to dust pollen from one flower to another. Then water the plant regularly and

feed with tomato food through the summer to keep it healthy. Prune any branches that grow out away from the wall, and also remove any that overcrowd the framework. Cut some old and fruited lateral shoots out each year to allow new ones to take their place.

It might take a couple of years but with a little care and attention and a smidge of luck you will be able to reap the reward of harvesting your own peaches. There are few activities quite as delightful!

Happy gardening.