Northamptonshire Law Society Bulletin www.northamptonshirelawsociety.co.uk Summer/Autumn 2022 Northamptonshire Law Society Annual Awards Friday 23rd September

We look after your internet services, so you can focus on your clients. Connectivity Future-proof fibre Firewall Comprehensive network security Router Managed router for life Antivirus Including ransomware defence Monitoring IP protection & staff well-being VoIP Internet-based telephony Fast. Reliable. Secure. Powering businesses with ultrafast connectivity Exa Networks Limited.

Published by East Park Communications Ltd.

Unit 27a, Price St. Business Centre, Price St., Birkenhead, Wirral, Merseyside, CH41 4JQ

Tel: 0151 651 2776 simon@eastparkcommunications.co.uk www.eastparkcommunications.co.uk

Managing Editor: Carolyn Coles

Advertising: Simon Castell

Key Account Manager: Denise Castell

Design: East Park Studio Accounts: Tony Kay Media No. 1111

Published August 2022

Legal Notice

© East Park Communications Ltd.

None of the editorial or photographs may be reproduced without prior written permission from the publishers. East Park Communications Ltd would like to point out that all editorial comment and articles are the responsibility of the originators and may or may not reflect the opinions of East Park Communications Ltd. Correct at time of going to press. Bird Entry British Wills Probate Awards Remember A Charity on legal advisers to talk Charitable Wills Remember A Charity appoints Lucinda Frostick as new director Rallying wider adoption of Carolyn Coles

www.northamptonshirelawsociety.co.uk 3 Contents Northamptonshire Law Society Personal Property Specialists • Probate and inheritance tax planning valuations • Inheritance planning • Identification and valuation of personal property • Advice for sale by auction and private treaty • Comprehensive house clearance service gildings auctioneers Telephone : 01858 410414 | Email: sales@gildings.co.uk | www.gildings.co.uk Gildings Auctioneers, T he Mill, Great Bowden Road, Market Harborough LE16 7DE A magnificent imperial yellow-ground famille rose floral vase, Yuhuchunping. Qianlong four-character seal mark (1736-1795) Identified for a local client and sold successfully for £338,500 GILDINGS.CO.UK 4 Landmark Information - Data Insights Report 6 Council Member Report - Linda Lee 8 Marsh - Risk Dimensions Newsletter Issue 6 10 The Economic Crime (Transparency and Enforcement) Act 12 Ground Hazards: Due Diligence for Today and the Future 14 New guide tackles lack of empathy in law 15 Reducing the cyber risk exposure of legal practices 18 Expert Witness Institute Online Conference 2022 Report 21 Early

for

and

2022 22

calls

22

24 Book Reviews 26 LSSA announces appointment of new vice chair 27 LSSA publishes white paper to help law firms procure legal software! 28

cry for

UPRN 31 And Finally...

Summer/Autumn 2022

Law Society

Northamptonshire

Data Insights Report

Landmark Information has announced the publication of its Data Insights Report for property and land professionals, which this time delves into the history and origin of land contamination across England and Wales.

The report provides an insight into land contamination risk that is today regulated under Part 2A of the Environmental Protection Act 1990. This includes past industrial processes, waste disposal practices, military activities or accidents that may have released substances on or in land, which has the potential to be harmful human health, damage property, impact ecosystems or pollute coastal, surface and ground water.

It also offers an insight into the ten local authorities with the most Recorded Landfill Sites, all of which are located in the South East of England – with Spelthorne Borough Council leading the ranking with 20% of its land designated in this category. This is followed by the London Borough of Hounslow, Thurrock Borough Council, London Borough of Havering and London Borough of Barking And Dagenham.

The report also considers Historic Land Use, taking into account manmade risks as well as naturally occurring land contaminants. Blaenau Gwent County Borough Council (18%), Kingston upon Hull City Council (17%), Sandwell Metropolitan

Borough Council (16%), Stoke-on-Trent City Council (16%) and Wolverhampton City Council (15%) have been identified as having the highest percentage of land covered by Potentially Infilled Land.

Download Contaminated Land Insights Report at https:// go.landmark.co.uk/contaminated-land-insight-report

RESEARCHERS

We are Fraser and Fraser, a professional team of genealogists and international probate researchers, dedicated to tracing missing beneficiaries to unclaimed estates worldwide. With over 90 years of experience, we assist the legal profession with every element of estate administration. Contact us today 020 7832 1400 | legal@fraserandfraser.co.uk

Law Society

Northamptonshire

Council Member’s Report, Aug.‘22

Writing this report at the end of July, with the August holidays looming, I thought you might benefit from a summer reading list[i], to pack for the beach.

Latest Law Society guides: Probably a good idea to sort out your personal Law Society account before you fly out as Practice Notes are accessible only by those with a Law Society account (available to anyone who signs up) and it now has to be updated to permit a twostage authentication requirement.

Register of overseas entities (ROE) Property lawyers acting in property transactions involving overseas entities are no doubt fully prepared for the requirement to register overseas entities from 1 August 2022. Over the period to 31 January 2023 there is also work for your in-tray upon return with a requirement for retrospective registration of transactions from 1999.

However, at the time of writing neither the Department for Business, Energy and Industrial Strategy (BEIS) nor HM Land Registry had produced their technical guidance. It is hoped that this will be available shortly.

The Law Society have produced an ‘Interim note for real estate/property lawyers: New register of overseas entities (ROE)’ which gives guidance to property lawyers acting for: • overseas entities in property transactions, or • clients based in England and Wales buying or leasing property from overseas entities

It should be noted that the Republic of Ireland is an overseas jurisdiction for the ROE.

The Law Society has also prepared guidance entitled, ‘Register of overseas entities: what solicitors should know about verification’[ii] which leads to the detailed guidance, ‘Economic Crime (Transparency and Enforcement) Act 2022 – communication for solicitors when undertaking verification responsibilities’

Solicitors are not obliged to verify an overseas entity purchasing UK property.

However, it is anticipated that clients may well ask their solicitors to verify the entity. If solicitors do choose to verify but are not compliant with the law, they will leave themselves open to criminal prosecution and may be professionally negligent. Property lawyers involved in such transactions will be well advised to keep an eye on the Register of overseas entities in force on 1 August: how property lawyers can comply page[iii] on the Law Society website for the latest developments in advice and guidance.

Undertakings:

For those who prefer a lighter read, you may recall that back in August 2021, I reported on the case of Harcus Sinclair LLP & Anor v Your Lawyers Ltd[iv] which caused consternation in some circles with calls for urgent parliamentary intervention to ensure that undertakings given by incorporated law firms, particularly Limited Liability Partnerships (LLPs) and Alternative Business Structures, could also be enforced summarily by the courts.

Not surprisingly, there are no plans to legislate, but the Law Society has produced a practice note, ‘Professional undertakings’[v] which is estimated as a twenty-seven-minute read. It is a thorough review of the law and regulatory issues relating to undertakings and serves as a good reminder that the processes and systems surrounding the giving and receiving of undertakings needs to be kept under regular review. It reminders readers that even if the firm which gave the undertaking no longer exists, any individual who gave that undertaking will still be bound, a ‘must read’ for all solicitors. The position regarding undertakings given by corporate entities requires careful consideration case by case.

Consultations:

‘Increasing the use of mediation in the civil justice system’

For those who like to plan their autumn months early, this consultation[vi] was

published on the 26 July 2022 and closes on 4 October. Parties will have to attend a free mediation appointment with HMCTS’ Small Claims Mediation Services before their case can progress to a hearing. It will be possible to apply for an exemption, but this is discouraged. This will apply to cases worth less than £10,000, other than in Housing disrepair and Personal Injury cases, where lower limits will apply. The intention is that it will ultimately extend the requirement to mediate to all County Court users, although it does not appear at this stage that free mediation will be available to higher value cases. A short consultation at only 26 pages with 16 pages, you may want to consider responding or alternatively looking up training courses to become a mediator!

Civil Justice Council - Costs Review

This consultation[vii] opened on 30 June 2022 but does not close until 30 September.

The Civil Justice Council is conducting a wide-ranging review of civil costs, including costs budgeting, guideline hourly rates, the wider impact of fixed recoverable costs, and the impact on costs of pre-action protocols and digitalisation.

The consultation will also consider the distinction between “party and party” costs and “solicitor and own client” costs. At present, the assessment of solicitor and own client costs is governed by section 70 of the Solicitors Act 1974 (“the Solicitors Act”) and by CPR 46.9. These provisions are due to be considered by the Court of Appeal at an adjourned hearing of the appeal against the decision in CAM Legal Services Limited v Belsner.[viii]

This concerned a low value RTA case pursued through the RTA portal which settled pre-issue. Costs recoverable from the RTA Defendant were limited to fixed costs plus disbursements. Ms Belsner had signed a conditional fee agreement

6 www.northamptonshirelawsociety.co.uk

(CFA) with a 100% success fee. The costs payable by Ms Belsner were potentially greater than the sum of damages she would recover. The matter was adjourned by the Court of Appeal to hear specialist evidence on costs and is due to return to the court later this year.

Question 3.3 at Annex B asks, ‘is there a need to reform the processes of assessing costs when a claim settles before issue, including both solicitor own client costs, and party and party costs?’ The consultation also seeks views on whether the distinction between noncontentious and contentious costs should remain but with no indication of where this will ultimately lead.

SRA website

After a busy year, the SRA has wound down for the summer with the announcement that they will be commissioning research[ix] by Frontier Economics, a leading economic insight consultancy.

The aim of the research is to: better understand the size and scope of the market for unreserved legal activities – as provided by both regulated and unregulated providers

identify potential risks and opportunities the unregulated sector may present for consumers

It is hoped this will assist the SRA to, ‘develop future thinking on how best to improve access to legal services while still ensuring the proportionate levels of public protection are maintained.’

The SRA also announced[x] that its plans to increase its fining powers from £2,000 to £25,000 for solicitors, traditional firms (recognised bodies or recognised sole practices) and the individuals who work in them would take effect from 20 July 2022. This has had a mixed reception. There is the view of those who hope that the increased fining powers will ensure that cases are dealt with by

the SRA, rather than be referred to the Solicitors Disciplinary Tribunal, and lead to speedy resolution and lower costs. Others question the increased power of the regulator as investigator, prosecutor and judge (and express concern that admissions may be made by the innocent because of their fear and impecuniosity) and in the case of small entities the pressure to settle in borderline situations.

In order to enable Solicitors Indemnity Fund (SIF) to stay open to new claims for a further year, until September 2023, the SRA has resolved the question of the guarantee[xi] and will not be calling on the Law Society to provide the guarantee as happened last year. The SRA is planning further engagement in coming months to determine SIFs long term future.

Finally:

You may prefer the advice of Mark Twain who said, ‘“Drag your thoughts away from your troubles – by the ears, by the heels, or any other way you can manage it. It’s the healthiest thing a body can do.”

Reject my holiday reading list, there are lots of uplifting reading lists available online.

Happy summer!

Committee and a member of the Policy and Regulatory Affairs Committee, the Regulatory Processes Committee and Access to Justice Committee.

She is current Chair of the Solicitors Assistance Scheme.

Linda is an experienced litigation solicitor and is a Consultant at Radcliffesle Brasseur where she specialises in solicitors’ disciplinary, compliance and regulatory work. She can be contacted by email at: lindakhlee@aol.com

Linda Lee Council Member March 2022

Linda Lee has been Council Member for Leicestershire, Northamptonshire and Rutland since 2003. She is a past President of the Law Society of England and Wales and is the current Chair of the Professional Indemnity Insurance

[i] Regulatory solicitor style

[ii] https://www.lawsociety.org.uk/topics/ property/register-of-overseas-entities what-solicitors-should-know-about verification

[iii] https://www.lawsociety.org.uk/topics/ property/register-of-overseas-entitiescoming-into-force-on-1-august-howproperty-lawyers-can-comply

[iv] [2021] UKSC 32

[v] https://www.lawsociety.org.uk/topics regulation/professionalundertakings#sub-menu-dy13

[vi] https://consult.justice.gov.uk/disputeresolution/increasing-the-use-ofmediation

[vii] https://www.judiciary.uk/related-officesand-bodies/advisory-bodies/cjc/ working-parties/costs

[viii] [2020] EWHC 2755 (QB).

[ix] https://www.sra.org.uk/sra/news press/research-unregulated-legal market-provision-unreserved-legalservices

[x] https://www.sra.org.uk/sra/news/press statement-fining-powers/

[xi] https://www.sra.org.uk/sra/news/press/ sif-extension-july-2022

www.northamptonshirelawsociety.co.uk 7 Northamptonshire Law Society

Northamptonshire Law Society

Risk Dimensions Newsletter Issue 6: April 2022

In the latest edition of our Risk Dimensions newsletter for solicitors, John Kunzler and Victoria Prescott from Marsh’s Risk and Error Management team discuss the powers of the Health and Safety Executive and the potential implications for law firms who fail to protect employees from work-related stress. There is also an article from Clare Hughes-Williams, a partner at DAC Beachcroft, considering the Solicitors Regulation Authority’s proposed changes to the rules of conduct impacting workplace culture and comments on the firm’s own “Flex Forward” approach to working.

Law firms can face criminal sanctions for work-related stress

Authors: John Kunzler and Victoria Prescott, Marsh

Both criminal and civil law apply to workplace health and safety. Law firms must protect their employees from getting hurt or ill through work. If they do not, then the Health and Safety Executive (HSE) or local authority may take criminal action against the firm. [1]

The duty of firms to protect employees from getting hurt or ill through work includes the duty to identify risks and agree ways to prevent work-related stress and support good mental health.

The HSE defines work-related stress, depression, or anxiety as a harmful reaction people have to undue pressures and demands placed on them at work.

In 2020-2021, work-related stress, depression, or anxiety accounted for 50% of all work-related ill health. In the HSE’s recent analysis published on 16 December 2021, it highlighted that professional occupations were found to have higher rates of stress, depression, or anxiety. The main work factors cited by respondents as causing work-related stress, depression, or anxiety were workload pressures including tight deadlines, too much responsibility, and a lack of managerial support. [2]

The HSE launched a new Working Minds campaign in November 2021 calling for a cultural change across Britain’s workplaces, to ensure psychological risks are treated the same as physical ones in health and safety risk management. Sarah Albion, the HSE’s chief executive said:

“Work-related stress and poor mental health should be treated with the same significance as risks of poor physical health and injury. In terms of the affect it has on workers, significant and long-term stress can limit performance and impact personal lives… The pandemic has highlighted the need to protect the health of employees who have faced unprecedented challenges; the Government is committed to building back better and we want to make sure good mental health is central to this.” [3]

The HSE’s Working Minds campaign is aimed specifically at supporting small businesses by providing employers and workers with easy-to-implement advice, including simple steps in its “5 Rs”: Reach out, Recognise, Respond, Reflect, and make it Routine. Employers and workers wanting to know more about the Working Minds campaign, including the legal obligations, advice, and tools available, can visit this website.

There is no doubt that the HSE is focused on giving employers a clear reminder of their duties and could be gearing up for potential prosecutions of organisations failing to manage work-related stress, with inspectors receiving training in the stress management standards and how to enforce them.

Obviously, not all stress is bad, and there is research by psychologists that suggests a certain level of stress can actually promote optimal levels of performance in employees.

In order to meet changing expectations, firms need to be aware of the following issues and points:

• When stress goes beyond a certain level for a sustained period, not only will performance suffer but also the health of an employee. Consequently:

• The historic long-hours culture of law firms and the required “can do” attitude must be challenged where health may be at risk.

• In line with HSE’s campaign, a new philosophy of work-life balance needs to be promoted, where employees work to live, rather than live to work. This needs to be a top-down policy with junior lawyers seeing senior management highlighting the importance of a healthy working environment.

• High hourly targets set by firms may have negative implications in relation to work-related stress policies in place.

• There may be an increased risk of lawyers arguing workrelated stress as mitigation when mistakes/claims and wrongful acts occur. The need for records demonstrating the effective management of employee stress will be paramount in rebutting such allegations, as previously highlighted in our solicitors supervision webinar

Over the years, there have been a number of highly-publicised incidents of workplace stress associated with law firms, such as in the cases of SRA v Sovani James and Other and the unfortunate suicide of David Latham in 2013.

Going forward, with increased focus on law firm workplace environment by the Solicitors Regulation Authority and numerous studies identifying suicidal thoughts in lawyers as a result of work, law firms need to be alive to the possibility of criminal sanctions where there has been a significant failure in dealing with stress in the workplace.

[1] Health and safety at work: criminal and civil law (HSE)

[2] Work-related stress, anxiety or depression statistics in Great Britain, 2021

[3] HSE launches Working Minds campaign to encourage employers to promote good mental health in work

8 www.northamptonshirelawsociety.co.uk

Setting the standard for culture

Author: Clare Hughes-Williams, DAC Beachcroft

On 8 February 2022, the Solicitors Regulation Authority (SRA) launched a consultation in relation to its proposed changes to the rules of conduct which, if accepted, will impact on law firms’ obligations to ensure that they maintain a positive workplace culture.

The proposals include specific requirements on firms to provide a safe environment for their staff, to treat them with dignity and respect and to ensure that their firms are places where equality and diversity matter. The proposals also set out the requirement to have effective systems of control and supervision for all staff.

The new rules are not by any means a completely new concept. The 2019 Standards and Regulations contained, for example, obligations to supervise and manage staff and to implement proper systems of governance which we interpreted at the time as a move towards greater regulation in this area.

The SRA seeks to introduce two important changes.

First, the SRA’s proposals include the obligation on the part of all staff to challenge behaviour that contravenes the code. This is an efficient way for the SRA to ensure that a positive culture is embedded in firms and that it is “policed”.

Second, the SRA has for the first time explicitly focused on fitness to practise issues partly in response to the growing number of lawyers who are the subject of professional disciplinary proceedings and unfit even to attend the tribunal hearing.

The SRA recognises that the role of a solicitor can be stressful. It is inherently deadline driven and many of the pressures that we face as a profession have increased rather than abated since the pandemic took hold. The immediacy of remote meetings has increased the pace, and supervision has proved to be a challenge for all law firms, with some responding more effectively than others.

The SRA is concerned that solicitors who are unsupported and experiencing stress cannot deliver their best service to clients. While the proposals for change are undoubtedly, in part, aimed at protecting lawyers from stress, at the heart of the new rules is the SRA’s desire to protect the public from the difficulties that arise when a solicitor’s well-being is compromised.

At DACB we identified the need to adapt to the changing workplace environment and to support our colleagues to an even greater extent. We try hard to get this environment right

and recognise that we learn and grow from our efforts. While we do not claim to be perfect, we are trying to meet this challenge, and thought it might be useful to share some of the changes we have implemented.

We try hard to promote a culture that enables our colleagues to enjoy their work and their life outside work, and with this in mind we consulted with all of our colleagues to try to define what it means to work at DACB, as we recognised the need for change.

We also responded to the changes that came with the pandemic and associated lockdowns by introducing Flex Forward, which is about when, where, and how we work.

At the heart of this philosophy is the ability for our colleagues to plan their days to accommodate their needs as individuals while being guided by our core principles — supporting our clients and each other, acting with determination, pursuing creative and sustainable solutions, and being clear in everything we say and do.

As we adjust to post-COVID-19 life, it will take time for our colleagues to find the balance between working at home and in the office that works for them. There are so many reasons to come to the office — to collaborate and interact with your team and to take advantage of the support of senior colleagues. At the same time, it is quite clear that many of us work as effectively from home.

This new hybrid way of working depends for its success on mutual trust. It is a two-way street and we hope that it reflects the SRA’s requirement that we all treat each other with respect and dignity.

Meet the authors

John Kunzler Managing Director United Kingdom

Victoria Prescott Senior Vice President United Kingdom

Clare Hughes-Williams Partner, DAC Beachcroft United Kingdom

Victoria Prescott Senior Vice President United Kingdom

Clare Hughes-Williams Partner, DAC Beachcroft United Kingdom

www.northamptonshirelawsociety.co.uk 9 Northamptonshire Law Society

Northamptonshire Law Society

The Economic Crime (Transparency and Enforcement) Act

Summary

The Economic Crime (Transparency and Enforcement) Act (the Act) received Royal Assent on 15 March 2022. The Act provides for the setting up of the Companies House Register for beneficial owners of overseas entities that own UK property. The Act forms part of the UK Government’s strategy to combat economic crime and to crack down on overseas criminals using UK property to launder money.

After the Register has gone live, there will be implications for overseas entities that are, (or are entitled to be), the proprietor of land registered at the Land Registries for England/Wales, Scotland or Northern Ireland, or for parties dealing with them.

Failure to comply with associated obligations under the new legislation will seriously impact on the overseas entity’s ability to sell, let or charge its land and it is a criminal offence for the entity and its officers at fault, with fines and/or imprisonment. Overseas entities should consider their UK land ownerships (or proposed acquisitions) to understand the implications of the legislation for their organisations. The Act contains tighter timeframes in certain respects relating to real estate compared to the original published Bill.

Act gains Royal Assent Parliament subsequently made some changes to the Bill prior to gaining Royal Assent and this briefing highlights the key changes from a real estate perspective.

The Act provides for the creation of a new Register of Overseas Entities at Companies House. Its primary objective, through the greater transparency created by the Register, is to prevent the use of UK land by overseas entities to launder money or invest illicit funds. This Register will for the most part be available to the public and as well as applying prospectively, will also apply retrospectively to property

bought by overseas owners up to over 20 years ago in England and Wales and since December 2014 in Scotland.

The Act applies to an “overseas entity”, which is defined in the Act as a body corporate, partnership or other entity that is a legal person governed by the law of a country or territory outside the United Kingdom. This would include for example a Jersey or Guernsey entity.

The legislation does not affect overseas individuals owning UK property directly or through a UK entity. Most of the Act is not yet in force and further timings are awaited.

Key real estate changes

From a real estate perspective, the key changes in the Act from the original published Bill are:

The timing has changed for HM Land Registry to enter a Restriction on the relevant title of the overseas entity. HM Land Registry, where applicable, must enter the Restriction as soon as reasonably practicable and before the end of a new transitional period.

The Transitional Period is 6 months from the date that the section of the Act relating to Companies House’s Register of Overseas Entities comes fully into force.

Although the Restriction will appear on the title, it does not take effect until the end of the transitional period. This is a tighter timeframe than under the original Bill.

There is another tightening of the timing in the Transitional provisions mentioned previously. The overseas entity has until the end of the Transitional Period mentioned above to become a “registered overseas entity” at Companies House (having complied with the registration and updating obligations at Companies House or there is a pending application for registration). So it is a 6 months’ period rather than the 18 months specified in the original Bill.

There are new transitional provisions in the Act at sections 41-43 in terms of the overseas entity’s application to Companies House to be entered on the overseas entities Register and the information that needs to be provided in that regard about land transactions entered into from 28 February 2022.

The provisions also include an offence for the entity and officers of the entity if the entity has made a relevant disposition of land (i.e. transfer, grant of a lease for more than 7 years or grant of a legal charge, with certain exceptions) in the period after 28 February 2022 until the end of the transitional period mentioned above, but by the end of that transitional period the entity is not registered as an overseas entity (and there is no pending application for registration) nor is exempt and has not delivered certain information to Companies House.

This provision seeks to capture an overseas entity which disposes of its UK land during the Transitional Period and would otherwise avoid disclosure of relevant information to Companies House. The offence is punishable by a fine.

All of the new timings relate to a period starting from the date that the section of the Act relating to Companies House’s Register of Overseas Entities comes fully into force. It remains to be seen how long that will take and perhaps in that regard how well-progressed Companies House is, with the new Register.

Article by Euan Temple

10 www.northamptonshirelawsociety.co.uk

www.northamptonshirelawsociety.co.uk 11 Northamptonshire Law Society Request a sample report and ask your provider to add DevAssist to your conveyancing package. www.devassist.co.uk t: 01342 890010 e: orders@devassist.co.uk PROTECTING BUYERS, SOLICITORS & LENDERS Not all views are safe. Our reports educate property buyers about development risk. Don’t find out when it’s too late. Guaranteed Conveyancing Solutions Limited is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales no. 3623950. Registered office: ECA Court, 24-26 South Park,Sevenoaks, Kent, TN13 1DU gcs-title.co.uk 01435 868050 underwriters@gcs-title.co.uk Find out more: www.gcs-title.co.uk/NH Pack BespokeOnline Direct Introducing... Our 7th Edition Legal Indemnity Insurance Policies! IMPROVED ‘Building Regulations’ cover 3 brand NEW policies Competitive premiums - remainingunchanged Supported by experienced underwriters Cover for ALL property types Multiple issuing methods available Here are just some of the many highlights:

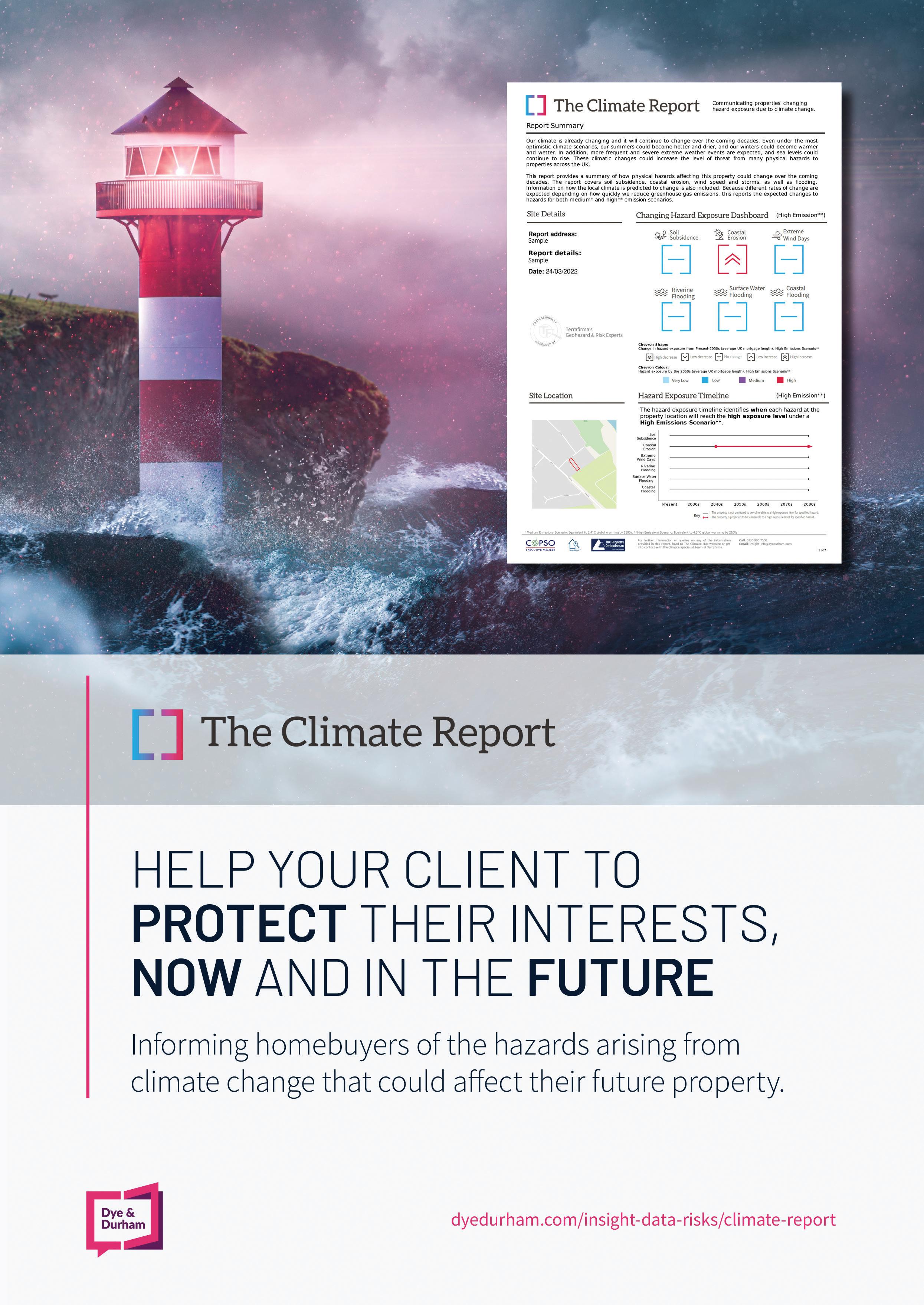

Ground Hazards: Due Diligence for Today and the Future

To ensure that home buyers have a clear understanding of possible hazards or restrictions that have the potential to affect their future home, a diligent property professional will always recommend undertaking a variety of searches for every residential transaction.

A contaminated land or flood search are often routinely undertaken by many, regardless of location, property type, size, proposed use or client.

Yet, other well-known environmental issues such as subsidence, which has the potential to create a problem with lending and insurability if identified, are not always a go-to search. While this hazard may not be an issue everywhere in the UK today, we do believe it is an issue that should be taken seriously, particularly as we look into the future.

We know that subsidence can be caused by a number of issues, including the shrinkage and swelling of soils in response to changing moisture conditions, the impact of trees, aging infrastructure or manmade disturbances. To date, subsidence searches have looked at historic data to understand if such risks pose a threat to a property address, however with the changing climate, we believe it is vital to instead look forward to model future hazards.

Modelling Future Hazards for Homebuyers

We have undertaken some analysis of our National Ground Risk Model (NGRM): Climate™, which models future climaterelated environmental hazards, and identified that more than 7.65 million properties in Great Britain could be exposed to medium or high risk of soil subsidence by the 2080s. This is an increase of over 1.89 million individual properties, and is as a result of climate change*1.

With all climate models projecting hotter, drier summers in the future, there is increasing likelihood of soil shrinkage, which can create downward movement in buildings located on vulnerable soils. This shrinkage is worse in clay soils, which are commonly found across the south east of England, and has the potential to move foundations, cracking walls and ceilings, resulting in expensive insurance claims and repair bills.

Our data suggests that more than 5.76 million properties in Great Britain are today exposed to medium or high subsidence risk. This increases to approximately 6.64 million in the 2030s. Specifically, just over half a million more properties (547,317) could be at high exposure in the next 60

years, compared to today’s figures.

Looking at Worcestershire, our data shows that almost one fifth (19.6%) of the county’s area will see soil subsidence hazard risk increase to high by the 2050s.

In fact by the 2050s, our data shows us that over 80 counties across the UK are likely to experience an increased risk of soil subsidence hazard to some degree, moving from low to moderate, moderate to high, or high to very high, as a result of our changing climate. In particular, additional parts of Middlesex, Hampshire, Berkshire, Hertfordshire and Surrey could move to the highest subsidence hazard classes by the 2050s*2.

Future Insights from the Climate Report Last October, the Law Society published a Climate Change Resolution*3 that outlined the role solicitors can play in addressing the climate crisis, which included a call to action to develop a climate-conscious approach to legal practice.

But what does this mean for property lawyers and conveyancers? We believe there is the potential to help clients understand climate change impacts by providing data insights as part of the conveyancing due diligence process.

Dye & Durham’s market leading Climate Report launched to help property lawyers and conveyancers protect homebuyers’ best interests and make informed, futurefacing decisions.

In addition to subsidence, the Climate Report models a range of hazards for individual properties, including coastal erosion, flood risk exposure and extreme winds, over the next 60 years.

The report has been designed to cover both physical hazards and delve into how extreme climate conditions could affect properties over time.

Ultimately, robust climate science indicates that we will see more hotter, drier summers and wetter winters as a result of our changing climate. These conditions are of real concern as they are likely to result in an increase in both the severity and frequency of climate-related impacts to our homes, infrastructure and,

more worryingly, the health of vulnerable members of our communities.

In conveyancing, there is a tendency to look backwards to determine risk levels, however it is time to start using insight and data to look forward:

If we, as an industry, can increase awareness of climate change and its potential impact on our homes and communities, more people will become engaged and want understand how this may affect their property in the future and take steps to help mitigate risks posed by the changing climate.

If you would like to discuss this topic with me directly, you can connect via LinkedIn: www.linkedin.com/in/timothyfarewell-26557116/

To learn more about the Climate Report or to obtain a free sample, email Insightsales@dyedurham.com or visit https://dyedurham.com/insight-data-risks/.

References:

1. Climate change data has been calculated for Unique Property Reference Numbers (UPRNs) in Great Britain, based on a Medium Emissions Scenario (RCP:4.5 Equivalent to 2.4°C global warming by 2100s)

2. Climate change data has been calculated based on a High Emission Scenario (RCP 8.5, Equivalent to 4.3°C global warming by 2100s)

3. https://www.lawsociety.org.uk/topics/ climate-change/creating-a-climateconscious-approach-to-legal-practice

Article by Dr. Tim Farewell, Head of Science, Dye & Durham

Article by Dr. Tim Farewell, Head of Science, Dye & Durham

12 www.northamptonshirelawsociety.co.uk

New guide tackles lack of empathy in law

As data reveals UK legal firms often fail to deliver the personal touch1 – a new guide has been launched to help improve client care and service delivery with empathy.

Leading outsourced communications provider Moneypenny has compiled the free guide to help lawyers improve their reputation for client care, build more valuable relationships with clients, reduce client churn and maximise profits.

Calling on its experience handling 2 million customer interactions for more than 1,000 UK legal firms each year, Moneypenny’s guide includes include practical tips to improve empathy in legal practice and ensure employees’ use of language hits the mark. It also addresses the importance of active listening and the need for empathetic leadership, plus it also includes a short quiz to help firms ascertain just how empathetic they are.

Joanna Swash, CEO of Moneypenny said: “This guide reminds lawyers of the commercial necessity for empathy and shows how they can engrain it into their practices and service delivery – reassuring clients that they’re not only being heard but also listened to and understood.”

“The pandemic has changed the relationships we have with each other – our peers, colleagues, and clients – and it’s

made human connection more appreciated than ever. The legal business winners of the last two years prioritised empathy and have reaped the financial rewards for doing so. But as the world returns to normal we have to make sure we don’t forget the importance of these behaviours.”

Bernadette Bennett, head of the legal sector at Moneypenny said: “As a business that handles inbound and outbound communication around the clock, we know first-hand that empathy shapes client experience. It underpins how we connect with others and has the power to transform reputation. Actively listening and displaying empathy not only puts nervous and vulnerable clients at ease but offers valuable insights that can shape service delivery, and put you at the forefront of your market.”

The guide was developed with insight from emotional intelligence expert and founder of the EI Evolution, Sandra Thompson. Sandra is the first Goleman emotional intelligence coach in the UK and an experienced customer experience management consultant.

Sandra Thompson said: “Neuroscience tells us that it’s impossible to know exactly how someone else is feeling, yet the value of demonstrating that you’re doing your best to understand is huge – particularly when it comes to business. Brilliant client

service experiences are built on empathetic interactions. That’s how you keep your clients loyal and make your employees feel empowered.”

The guide is available to download for free on Moneypenny’s website, at https://www. moneypenny.com/uk/resources/blog/freeresource-putting-empathy-at-the-heart-ofcustomer-care/

Moneypenny’s 95-strong team of dedicated legal receptionists provide firms with outsourced switchboard, managed live chat and outbound calling support –delivering scalable solutions that help legal practices remain agile, protect reputation and deliver a first-class client experience.

Established in 2000, Moneypenny is the world’s market leader for telephone answering, live chat, outsourced switchboard and customer contact solutions. In total, more than 21,000 businesses across the UK benefit from Moneypenny’s mix of extraordinary people and ground-breaking technology.

For more information about Moneypenny’s work with the legal sector, visit www.moneypenny.com

1 Research from Insight 6’s Professional Services Client Journey Report

Northamptonshire

2021 14 www.northamptonshirelawsociety.co.uk

Law Society

Reducing the cyber risk exposure of legal practices

The professional indemnity market continues to be challenging but there are signs that the steep increases legal practices have experienced during their professional indemnity renewal will not be felt quite so widely across the marketplace.

Whilst potentially welcoming news, it does not mean that premiums will lower. Instead there is an expectation that a much more stable rating environment is on the horizon. Unfortunately, this is not the case for the cyber insurance market, which is currently experiencing an unprecedented claims environment across all sectors.

The Claims Environment

A dramatic rise in both frequency and severity of loss has been experienced across the cyber market, which has curtailed the appetite of insurers significantly. Numerous insurers previously active in this space are now exiting from underwriting the class entirely, making the availability of coverage quite scarce. Those insurers that remain active are increasing premiums and policy excesses as a result, whilst sometimes also reducing limits of indemnity, and sub-limiting and/or restricting coverage.

Given the vast sums of money that pass through the legal professions’ client accounts, along with the volume of data typically held, the legal profession continues to be an attractive target for criminals. The scams are becoming increasingly sophisticated and even the most diligent and careful business can find itself a victim to attack.

Recent examples include Simplify Group’s cyber-attack in November of 2021 which caused significant disruption in the property market with many transactions being delayed significantly as a result, causing huge stress on impacted clients. In April of this year the Bar Council advised that it was a victim of a malicious cyber-attack.

These are just two examples affecting the legal profession that have hit the headlines recently but there are hundreds of incidents that do not make the headlines, notwithstanding the considerable cost and significant distress to impacted businesses and their clientele.

Looking more broadly across all industries, our Cyber Claims Team has reviewed data from the last 5 years of claims that show:

• claims frequency increasing at an average of 13% year-on-year BUT

• , Severity, (the total loss amount) has increased at an average of 80% over this same period.

As a proportion of all claims that our Cyber team has witnessed, those arising from external factors, such as data theft, malware, and social engineering have increased 59% between 2019 and 2020.

Ransomware-specific claims were the cause of about 5% of claims notified to Lockton in 2018, accounting for 10% of the total incurred. By contrast, in 2020, ransomware claims accounted for 17% of all claims, and for more than 80% of the total incurred.

Expected Standards and Underwriting Approach

The barrier to obtaining cyber coverages has historically been quite low, with some insurers offering coverage without the requirement to provide any specific risk related information. These practices are now obsolete with insurers undertaking a more comprehensive risk assessment. As a result they are requesting much more detail about the specific risks associated with businesses before they will even entertain providing any cover, however restricted this coverage may be.

The appearance of zero-day vulnerabilities in the last 12 months (e.g. the log4j/log4shell zero-day vulnerability identified in November 2021) reminded the insurance market of how cyber risks do not always come in the form of targeted attack and can arise from what many would have considered to be simple, non-risk software.

What would constitute a vulnerability?

A vulnerability is a weakness or flaw in computer software that could allow an

attacker to use the software in a way not intended by its creator. Usually, the attacker exploits the flaw to perform malicious and unauthorised actions within the computer system. When vulnerabilities are discovered, they are generally added to a public list of Common Vulnerabilities and Exposures (CVE) and given a CVE ID or number, in the format CVE-2021-12345.

Regardless of the industry, sector or profession, there is an expectation from insurers that their insureds will continually improve all their risk procedures over time; the speed of evolution is expected to be much quicker for cyber-related risks,and what was acceptable in 2020 may no longer be so. It is not that these measures implemented are no longer “en vogue”, but unfortunately these alone offer little defence to the criminals of today.

What Should You Do?

Whilst many practices may outsource their IT function(s) and infrastructure to third parties in full or part, it is likely that the burden of responsibility remains with the law firm. The regulators, whether that be the Information Commissioners Office (ICO) or Solicitors Regulatory Authority (SRA) may well come knocking.

Recent history has shown us that no practice is too big or too small to be a target for these criminals; it is therefore incredibly important that practices take stock and address cyber risk fully and in a timely manner, to avoid becoming an unfortunate statistic.

Whilst we advocate the transfer of risk and therefore encourage firms to investigate obtaining appropriate cyber coverage if they do have this already, a cyber policy should only complement strong business resilience measures that are in place. Once implemented, it is important to evolve and upgrade these measures regularly.

The disruption caused by experiencing a cyber event is one thing, but the

www.northamptonshirelawsociety.co.uk 15 Northamptonshire Law Society

Reducing the cyber risk exposure of legal practices

reputational harm to your business should not be underestimated.

The minimum cyber requirements of a law firm today include:

• MFA (Multi Factor Authentication): Required for ALL remote access, administrator/privileged account access, Remote Desktop Protocol, third party access (e.g. vendors) and online backups. Ticket-based MFA is becoming the market minimum standard and requires a randomly generated code to be inputed into the application before access is granted. This code is either sent to a user’s phone or generated by an application, removing the sole reliability on a username and password.

• Backups: Data must be backed up at least weekly and stored offsite/offline/ in the cloud and protected via MFA, encryption and separate credentials. If backups are not adequately segmented and protected, they could potentially be encrypted during a cyber-attack making them useless for restoring encrypted/lost systems.

• Training: All employees must undergo annual cyber security training including phishing. People are still considered the weakest link in cyber security and regular training helps keep this matter at the forefront of their minds and is proven to reduce the rate at which phishing links are clicked on.

• Email filtering tools: Required to be implemented on any form of email and is used to pre-screen emails for potentially malicious attachments and links. This helps reduce the number of malicious emails that are sent to employees, further reducing the likelihood of a successful phishing attempt.

• Anti-Virus / Firewalls: In place and updated on at least a quarterly basis. Anti-virus software constantly scans to detect and record any malware whilst a firewall filters incoming and outgoing information by creating ‘blocks’ which filter the data.

• Patching: Critical patches must be implemented within 30 days; however,

many insurers are now requiring this within 7 days. If a software provider releases a patch, which looks to remove a potentially exploitable vulnerability, then insurers require their clients to install this quickly to reduce their potential exposure to this vulnerability. This includes handheld devices too such as an iPhone it would be using the latest iOS (which is version 15.5 at the time of writing this).

• End of Life: End of Life Systems, where no further software updates are being released, must be segregated to prevent full network spread of malware.

• Business Continuity plans and Incident Response plans: These plans are required to be reviewed and updated regularly and reassure insurers that the insured knows how to react if they are a victim of a cyber-attack.

• Endpoint Protection for all servers and workstations: This software examines files, processes and system activity and provides a centralised management console for administrators to monitor and investigate potential incidents.

• Removal of local administrator rights from staff and separate credentials for domain administrators: Administrator rights can allow users to change vital computer settings, therefore, if one of these accounts were compromised a threat actor would be able to change security settings which allowing them potentially to move undetected.

• Network segmentation: Segmentation implementation, with a special focus on protecting critical information and services. Segmentation helps prevent a threat actor moving laterally across a network, reducing the likelihood they can access sensitive data.

Gold Standards

In addition to all of the above being implemented, the following are currently recognised as the “Gold Standards”:

• Privileged access management tooling: This software is the gold standard for protecting privileged accounts. Locks access to administrator accounts behind MFA,only releasing their use for

a short period of time (e.g. 30 minutes).

• SIEM (security information and event management) monitored 24x7 by a SOC (Security Operations Centre): The SIEM software collects and analyses aggregated log data, whilst the SOC operator looks at the aggregated data to spot any potential anomalies.

• Intrusion Detection and Prevention systems (IDS/IPS): Devices which can detect and prevent intrusions into the network.

• Secured PC and server builds: Computer/Server builds which only allow specific services which are required on the devices to run and do its particular job.

• Security policies and procedures: Policies and procedures which explain an insured’s baseline security controls, and which must be adhered to. These can provide insurers further comfort that the insured has as strong understanding of the potential cyber risks.

If you have any questions relating to cyber or your professional insurances, please do not hesitate to contact myself or a member of the Lockton Solicitors Team. Boehmer Tel: 0781 401 4655 brian.boehmer@uk.lockton.com www.locktonsolicitors.co.uk

Northamptonshire Law Society

16 www.northamptonshirelawsociety.co.uk

Brian

Partner

E

continued

Puzzled by your PII? We’ll help you solve it Lockton Companies LLP. Authorised and regulated by the Financial Conduct Authority. A Lloyd’s broker. Registered in England & Wales at The St Botolph Building, 138 Houndsditch, London, EC3A 7AG. Company No. OC353198. T: 0330 123 3870 | E: solicitors@lockton.com W: locktonsolicitors.co.uk In a challenging market, securing the right cover takes skill, expertise, and a little imagination. As an independent broker, Lockton’s dedicated solicitors’ practice is driven solely by the needs of our clients. Harnessing decades of experience and direct access to leading insurers, we source targeted, flexible insurance solutions that are up to the task of protecting your firm. That’s why over 97% of clients renew with us.

The Modern Expert: Relevant, Current, and Evolving ANOTHER ZOOM CONFERENCE BUT YOU NEXT YEAR IN PERSON FOR A PROPER

An by Elizabeth Robson Taylor MA and Phillip Taylor MBE of Richmond Green

We know the Expert Witness Institute (EWI) is the true voice of the expert witness community. Its aim is to champion experts from all professional disciplines and the lawyers who use their services.

So, this annual conference was an excellent way to network even virtually. EWI’s mission supports the proper administration of justice plus early resolution of disputes through high-quality expert evidence from specialists. And this year, we were very fortunate to hear from Lord Hamblen from the Supreme Court. He gave an absorbing, erudite, informative, and positively compelling keynote speech, excellently chaired throughout by Saba Naqshbandi, whom we welcome to the role.

It remains a somewhat surreal experience for 2022 without the face-toface chats, the nattering, and meeting up with old colleagues: coronavirus still hung around our thoughts.

Hamblen’s Keynote Speech

Of great interest to the attendees, the Conference really began with Lord Hamblen offering up a summary of his professional background, and what a background. This included the various kinds of expert evidence which he had encountered, both as a barrister and judge. He described how he used to work with experts as counsel, what he had found particularly useful in terms of expert assistance, and how he would seek best to deploy that assistance.

When discussing his experience as a judge, he suggested how an expert can best assist judges, including some key ‘do’s and don’ts’ based on his general experience. And then he raised current issues relating to expert evidence from recent cases which can be seen in the recording of the speech from EWI.

Over his career, Lord Hamblen has encountered a great variety of different areas of expertise and experts. And his distinguished career surprised some of us!

The Do’S: Understanding

Working with experts as counsel, Hamblen suggested the key issue was “understanding”. “To think on their feet in cross examining an expert a barrister needed to be able to think like an expert”, he said. Other key “Do’s” included clarity, structure, reasoning, building trust and confidence.

EXPERT WITNESS INSTITUTE ONLINE CONFERENCE 2022 Friday 20th May 2022

Sponsored by MLAS, Redwood Collections, and Bond Solon ANOTHER YEAR,

–

SEE

CONFERENCE!

appreciation

Chambers ONLINE CONFERENCE 2022 The Modern Expert: Relevant, Current, and Evolving 18 www.northamptonshirelawsociety.co.uk Northamptonshire Law Society

The Number One Don’t Number one “Don’t” was to ensure that the expert is avoiding anything which might compromise their independence and impartiality. Secondly, avoid being an advocate. “It is counsel’s job to argue the case”, he said, and we are sure all advocates attending would agree. “It was not the role of the expert”, in his view, “because they make points, explain points, but do not argue them.” Sound advice, we think, and probably one of the most important messages we took away from the day.

The third, related “Don’t”, according to Lord Hamblen was: “know the limits of your expertise”. Which we are sure, everyone does.

Hamblen illustrated the importance of all these “Don’ts” from recent cases regarding his view of the proper approach to expert evidence. “Despite the basic rules regarding expert evidence being well known, and the applicable principles changing little in recent times”, he noted that “there has been a notable recent uptick in cases expressing concerns about inadequate expert evidence”. And, he said, he “lamented the fact that recent case law

suggests that the principles set out in the ‘Ikarian Reefer’ (now summarised in CPR 35) are frequently not being adhered to”. Ruefully adding, “the principles are being duly recited, but not acted upon”.

Lord Hamblen also referred to Mr Justice Fraser’s list of points to be considered by experts and those instructing them, taken from the ICC case. His discussion of cases was always going to be another main point for those watching when he referring to these specific areas: partiality, relevant expertise, conflicts of interest, and failure to comply with expert duties highlighted relevant quotes from the judgements.

Hamblen concluded with the hope “that the personal insights he had provided”, plus recent cases “offered a helpful basis for thought and discussion at the conference”. Indeed, it did! And such insights would provide some guidance to those in the important role that they perform as experts before the courts. He commented that “more and more cases seem to involve experts of one kind or another and that they play a very important role in dispute resolution, whether that be through settlement, mediation, arbitration, or litigation”.

As always, it is a pleasure to hear from the EWI Chair, Martin Spencer, concluding proceedings. We all welcome the launch of the EWI’s Core Competency Framework for Expert Witnesses as the final plans for the re-launch of Certification is awaited.

It has been a long time as we have reported on the need for certification for some years. Sage advice as always from Martin ending the virtual performance on a high note. So, another virtual “au revoir” until 2023. Perhaps we can all meet up together in person once more to enhance the detailed panel discussions and future breakout sessions! Society

www.northamptonshirelawsociety.co.uk 19 Northamptonshire Law

Mr Andrew Wojcik MD , FRCS Consultant Spinal Surgeon Speciality • Spinal deformity • Degenerative disorders • Microsurgery of the intervertebral disc • Spinal decompression stabilisation & fusion • Spinal trauma Tel: 01733 203332 Email: rjwheeler1@aol.com Spire Cambridge Lea Hospital, Impington Avicenna Clinic, Peterborough Clinics available at: • •

Congratulations to all of those Shortlisted

Youssef Labib

Early Bird Entry for British Wills and Probate Awards 2022

Entries for The British Wills and Probate Awards 2022 have opened today as excitement starts to build toward the event on 20th October 2022. This year’s event will see headline sponsor Executor Solutions return in a new guise as the re-branded Property Solutions Group.

Launched in 2018 to recognise the work of businesses and practitioners up and down the country in the Wills and Probate sector, the awards are now in their fifth year. 2022 sees the ceremony return to the suitably named “Grand Hotel” in Birmingham on 20th October.

Following the success of The British Wills and Probate Awards 2021, which saw an audience of c.800 people coming together in-person and online to celebrate, the awards will again be hybrid with an in-person ceremony alongside the live stream available through the awards’ website.

Alongside some well-established favourites, 2022 sees the introduction of a range of new categories designed to capture changing work environments, new technologies and innovation, and industry collaboration.

New categories include recognising excellence and best practice in charity and probate collaboration and celebrating the work being done to improve employee experience and customer experience as the sector continues to get to grips with the challenges of working in the “new normal”.

To view the full list of categories CLICK HERE to visit www.britishwillsandprobateawards.co.uk

2022 will see the return of The Today’s Wills and Probate Industry Champion, a category nominated and voted for by the industry. 2021 crowned inaugural winner Michael Culver after an extensive nominations process. Nominations this year will open in July.

Discussing the return of the awards, Managing Director at Today’s Media, publishers of Today’s Wills and Probate, David Opie said:

“After the successful return of the in-person ceremony last year, 2022 promises to be even bigger and better.

The grandeur of the venue really typifies what The British Wills and Probate Awards is all about and we look forward to celebrating with our friends and supporters from around the industry.”

On returning as headline sponsor, Group Managing Director of Property Solutions Group Barry Mattock commented:

“We are delighted to be returning as the headline sponsor of the Oscars of the Wills and Probate industry!

We cannot wait to celebrate with you all again and shine a spotlight on so many incredible individuals and firms across the sector.”

A new judging system has been adopted to make the entry and submissions process easier and early bird entry (firms can enter up to 3x categories) is now available at a rate of £129.00 +VAT, available until Friday 24th June 2022.

CLICK HERE to see highlights of the 2021 ceremony

www.northamptonshirelawsociety.co.uk

21

Northamptonshire Law Society

Law Society

Northamptonshire

Remember A Charity calls on legal advisers to talk Charitable Wills

With charities across the country facing urgent funding needs and rising costs, national consortium Remember A Charity, is calling on legal advisers to make Will-writing clients aware of the option of leaving a charitable gift in their Will, after taking care of their loved ones.

Wills are a vital funding stream for charities and the consortium estimates that just a 4% increase in the proportion of people leaving a gift in this way could raise an extra £1 billion for good causes each year. Every day 100 people write a charity into their Will1, and within the next decade alone, that income is expected to bring in over £40 billion, 2 but there are still many people who are unaware they can leave a donation in this way.

Remember A Charity is on a mission to normalise charitable gifts in Wills, working with over 800 solicitors and Will-writers across the UK, who have signed up to its Campaign Supporter scheme. Earlier this year, it3 found that one in five (22%) Wills

handled by UK legal advisers now includes a charitable beneficiary.

Lucinda Frostick, Director of Remember A Charity, says: “Solicitors and Willwriters play a crucial role in building understanding around gifts in Wills among their client base. Even the simplest of references to the option of leaving a gift to charity from a client’s Will can double the chances that they will do so.

“For more and more people across the country, their Will is not just an opportunity to support loved ones, but a chance to leave a legacy. This income stream from gifts in Wills has never been more critical or valued.”

The appeal comes in the build-up to the consortium’s annual Remember A Charity Week (5th-11th September), which serves as a springboard to raise the topic of Willwriting with clients.

Will-writers and solicitors who join Remember A Charity’s Campaign Supporter Scheme are listed in the consortium’s online directory of legal advisers and are issued with a resource pack to help them open up conversations with clients about charitable Will-writing during and beyond Remember A Charity Week. This includes logos, social media images, web banners, information sheets, press releases, templates and much more.

Lucinda Frostick, adds: “Remember A Charity Week is a celebration of the huge impact of charitable bequests, ensuring that all clients are aware that they have the opportunity of leaving a gift in their Will, no matter how big or small.”

To find out more or join Remember A Charity’s Campaign Supporter Scheme visit: https://www.rememberacharity.org. uk/about-us/for-solicitors-will-writers/ join-us/

Remember A Charity appoints Lucinda Frostick as new director

Remember A Charity has today announced the appointment of Lucinda Frostick as its new director, to lead the 200-strong charity consortium in its aim to grow the legacy market and normalise gifts in Wills.

Since its inception Remember A Charity has lobbied government and the legal sector, and communicated with the Willwriting public through a mix of consumer advertising, marketing, public affairs and strategic partnerships.

Lucinda will pick up the reins from director Rob Cope, who is stepping down after leading the organisation for the last 12 years and moving to a new role within the Chartered Institute of Fundraising, as Executive Director of Membership and Charitable Giving.

Allan Freeman, chair of Remember A Charity stated: “Rob has been instrumental in the campaign, he has truly transformed it into what it is today with the support of 200 charity members

and almost one in five people in the UK are leaving a gift to charity in their Will. We thank him sincerely and wish him the best in his new role.

“As we enter a new strategic phase, Remember A Charity is stepping up in terms of how we reach consumers all-year-round, working closely with financial advisers and on Will-writing guidance. We’re at the cusp of the biggest intergenerational wealth transfer of all time, which will provide a golden opportunity for legacy giving, so it was vital that we appointed someone with strong communications experience as well as a robust understanding of the legacy field, who can build on our existing work.”

Rob Cope said: “Lucinda brings with her a huge amount of communications, PR, campaign and legacy sector experience, which will be invaluable in growing legacy giving further and leading Remember A Charity’s new strategic plan. I’m so pleased to be passing the baton to someone who is so passionate about legacies and the massive impact this type of giving can have for charities.”

Since 2008, Lucinda has been an Associate Director at Turner PR, a specialist trade PR

and communications agency for the charity sector, where she managed accounts for several sector bodies and campaigns, including; Remember A Charity and the European Fundraising Association. Leading both strategic communications and key collaborative research projects, Lucinda has built significant specialist knowledge of the legacy giving market.

Prior to this, Lucinda was Head of Communications at CIOF (which at the time was the Institute of Fundraising) and Communications Manager at The Giving Campaign.

Lucinda said: “For more than 20 years, charities have worked together –through Remember A Charity – to protect and grow legacy giving. The dial has shifted hugely over that time with more dialogue around legacies, greater understanding of their importance and, critically, more gifts reaching more good causes.

“The campaign really is a fantastic example of what can be achieved through sector collaboration and I can’t wait to join the team, working with members and partners in our shared mission of normalising such a vital form of giving.”

22 www.northamptonshirelawsociety.co.uk

Northamptonshire you remember the horses at Redwings Horse Sanctuary?

www.northamptonshirelawsociety.co.uk 23

Law Society As the registered charity for Northampton General Hospital (NGH) and the Northamptonshire Healthcare NHS Foundation Trust (NHFT). We exist to make things better for patients, their families and staff. We provide funding for equipment, research, training and all of those extras that help to comfort people when in hospital. Northamptonshire Health Charitable Fund Springfield, Cliftonville,Northampton General Hospital, NN1 5BE Tel: 01604 626927 Email: greenheart@nhcf.co.uk www.nhcfgreenheart.co.uk registered charity no: 1165702 Will

Remember Redwings in your Will and save the lives of hundreds of horses in desperate need for years to come. Call 01508 481030 or email legacies@redwings.co.uk to find out how to leave a legacy today. Thank you If you love horses, remember them! Untitled-1 1 06/10/2020 09:51

Northamptonshire Law Society

Much Needed In ‘A New World’ -- The Latest Edition of ‘The Law of Company Liquidation’

Be you lawyer or accountant -- if you are in any way involved in matters relating to insolvency, you need this long-established and highly regarded work of reference -- out now in a new fifth edition from publishers Sweet & Maxwell.

Company liquidation is referred to in the Foreword written by the Chief Insolvency and Companies Court Judge Briggs as ‘an important part of the insolvency landscape.’ ‘It is axiomatic,’ he adds, ‘that the law of insolvency continues to evolve and world events such as the UK leaving the European Union and the pandemic have contributed to or hastened legislative change that requires the practitioner to understand new practices and procedures in what looks like a new world.’

While looking very much to the future, the book does illuminate, with admirable

clarity and thoroughness, all aspects of company liquidation, including the “winding up” of solvent, as well as insolvent companies. (Note here that editor Andrew Keay points out that the terms ‘liquidation’ and ‘winding up’ are used interchangeably throughout the text.)

‘A purpose of the winding up of both solvent and insolvent companies,’ he states, ‘is to prepare companies for the end of their existence by eventual dissolution” -- and to do so fairly and equitably, particularly in cases in which there is a public interest factor.

In the words of Judge Briggs, this specialist text ‘explains the nature of winding up in all its forms and takes the reader on a journey through the intricacies (and there are many) of its processes.’

An appreciation by Elizabeth Robson Taylor MA of Richmond Green Chambers and Phillip Taylor MBE, Head of Chambers, Reviews Editor, “The Barrister” and Mediator TALE The CEDR Story of Better Conflicts Eileen Carroll 978 Law www.bloomsburyprofessionallaw.com/online

Certainly, the book excels as a work of reference, rendered easily navigable via a very detailed sixteen-page table of contents, (covering eighteen chapters) and a thirty-six-page index. Also note the 160 pages of tables of cases, statutes, and statutory instruments.

As “a part of the insolvency landscape” company liquidation is no one’s ideal of a desirable outcome of business activity. But for lawyers advising clients who have taken risks (particularly in the current post-pandemic ‘new world’ of business), this new fifth edition of McPherson & Keay provides a comprehensive and indisputably authoritative guide to this difficult area of law.

The date of publication of the fifth edition of this hardback was 27th September 2021. The law is stated as 1st May 2021.

Brilliant Personal and Professional Insights Into Modern Mediation

An appreciation by Elizabeth Robson Taylor MA of Richmond Green Chambers and Phillip Taylor MBE, Head of Chambers, Reviews Editor, “The Barrister”, and Mediator

“The Mediator’s Tale” has been published by Bloomsbury Professional “to celebrate the 30th anniversary of CEDR’s emergence as the world’s leading independent disputes consultancy”. The book arrives at a particularly pivotal moment for the

future of mediation as an alternative dispute resolution option in view of the massive build-up of unheard cases in the courts. But mediation is not to the taste of all litigants, or “participants” as we call them! However, you may change your mind when you read this tale.

The authors, Eileen Carroll QC and Dr Karl Mackie give us a fresh light on the personal motivations and strategy behind what they describe as “a unique example of disruptive innovation in the legal system, while sharing their professional insight into how we can achieve better

24 www.northamptonshirelawsociety.co.uk

McPHERSON & KEAY The Law of Company Liquidation Fifth edition By Andrew R Keay ISBN 978 0 41408 920 4 | Sweet & Maxwell/Thomson Reuters | sweetandmaxwell.co.uk BOOK REVIEWS

THE MEDIATOR’S

By

QC (Hon) and Dr Karl Mackie CBE ISBN

1 52651 583 4 | Bloomsbury Professional

|

conflict management in our personal and professional lives”.

In their own words, Carroll and Mackie begin their tale by charting “the personal and organisational drivers behind the success of CEDR in the UK and internationally, drawing out important insights for other innovators and campaigners for change to a traditional system”. Don’t you just love the description of how they describe their task- “very mediation”, but don’t be put off!

The main part of the book then draws on experience spanning thirty years to illustrate key insights in “a matter

of fact” way as to how the mediation process, and other independent conflict intervention techniques which deliver results. The book explains how such techniques can be made to work “most effectively”; and how one can adapt these skills and systems for old and new dispute contexts, with the “challenges for the future of better conflict management” (as they put it).

This splendid work also offers tips to assist the reader analyse their own personal experiences in conflict and dispute resolution. The purpose is to offer suggestions on what they can learn from “the insights of leading practitioners,

while becoming familiar with a fascinating and unique lifetime’s professional practice, and the diverse experiences of a leading independent institution in the field”.

Without doubt, this important and readable book is one which any mediator or potential mediator should include in his or her library as ADR continues its upward journey as a realistic way of resolving disagreements without recourse to the courts.

The date of publication of this new paperback edition is cited as 7th December 2021.

The 30th Anniversary Edition of This Important Statement on Medical Negligence

An appreciation by Elizabeth Robson Taylor MA of Richmond Green Chambers and Phillip Taylor MBE, Head of Chambers, Reviews Editor, “The Barrister” and Mediator

Michael Jones offers us a “comprehensive and authoritative analysis of the potential legal liabilities of healthcare professionals and hospitals arising out of the provision of healthcare” in the sixth edition of “Medical Negligence.”

The principal focus is on the law of negligence as it applies in the medical context, but the book also includes extensive coverage of consent to medical treatment, defective products, confidentiality, the liability of hospitals, defences and limitation, the principles applied to the assessment damages, and procedural issues.

This sixth edition remains as a comprehensive statement of the law of medical negligence in England and Wales, with appropriate reference to Commonwealth jurisdictions.

Jones gives us a 30th anniversary edition which is fully up to date, including discussion of relevant statutory provisions

and Commonwealth case law such as Barclays Bank Plc v Various Claimants (2020) from the UK Supreme Court; Schembri v Marshall (2020) from the Court of Appeal and Bell v Tavistock and Portman NHS Foundation Trust (2020) from other Courts to name a few

There is a detailed discussion of developing caselaw on the Mental Capacity Act 2005, plus the following areas depending upon what you might be looking for: a discussion of the emerging tort of misuse of private information; full reference to relevant professional guidance issued by the General Medical Council (Decision making and consent, 2020); useful Appendices on NHS Indemnity, Pre-Action Protocol for the Resolution of Clinical Disputes, and a detailed glossary of medical terms,

The key features of “Medical Negligence” for 2022 provides us with a thorough analysis of the tort of negligence as it applies to the provision of health care. There is a discussion on the liability of doctors as well as dentists, nurses, and pharmacists.

Michael Jones also covers the general principles of medical negligence and covers specific areas such as consent to medical treatment, defective products, confidentiality, and the liability of hospitals; emerging issues related to medical negligence practice, access to treatment, patient autonomy and complaints; thorough coverage defences and limitation; and explanation of the general principles as they apply to medical negligence.

Jones goes on to expand on the general principles by applying them to specific areas such as consent and confidentiality. He analyses current case law authorities and interprets applicable legislation, giving us a clear, concise analysis applicable to generalist and specialist practitioners. You cannot be without this excellent new edition if you practise any area of medical negligence claims.

The date of publication of this new hardback sixth edition was 22nd September 2021.

MEDICAL NEGLIGENCE Sixth edition By Michael Jones ISBN 978 0 41408 909 9 | Sweet & Maxwell/Thomson Reuters | sweetandmaxwell.co.uk

www.northamptonshirelawsociety.co.uk 25

LSSA announces appointment of new vice chair to support drive towards digitalisation of legal industry API frameworks

scale IT platforms and is responsible for the strategic direction of TM Group.

When asked why he had decided to take on the role Paul says:

data streamlining processes and save time for all involved.”

The LSSA is excited to announce the appointment of Paul Albone, COO of TM Group, as vice chair. Paul’s role will involve working with the chair, Tim Smith and the leadership team to set and maintain professional standards within the industry and manage areas of mutual interest between lawyers and software providers.

Paul has over 30 years’ experience of leading tech teams in developing large

“This role will allow me to bring my experience, specifically in conveyancing, to the LSSA to help drive digitalisation of processes and the development of robust API frameworks so organisations can interact cross-platform on the same housing transaction.”

He adds:

“I’ve always believed that integration between platforms and how we can better serve our shared customer base is fundamental to reducing the amount of re-keying that takes place. My technology background and experience will enable the LSSA to lead the agenda on how we can drive

“This is what’s great about being a member of the LSSA and is the exciting opportunity for the future. I’m looking forward to working with Tim to champion the benefits of digitalisation in the industry.”