Awards

Magazine of the Norfolk & Norwich Law Society - www.nnls.org - Autumn

Magazine of the Norfolk & Norwich Law Society - www.nnls.org - Autumn

President’s Report

As we come into the later part of the year (and as my tenure as President comes to an end), it is always good to reflect on the events over the past few months. Although the summer is historically a quieter time for NNLS events, the Committee were exceptionally busy behind the scenes preparing for the Annual Dinner, and we also held our first networking event specifically for in house lawyers (sponsored by Flagship Group), which saw a fantastic turnout of lawyers working in-house trying (and succeeding) in becoming pizza chefs!

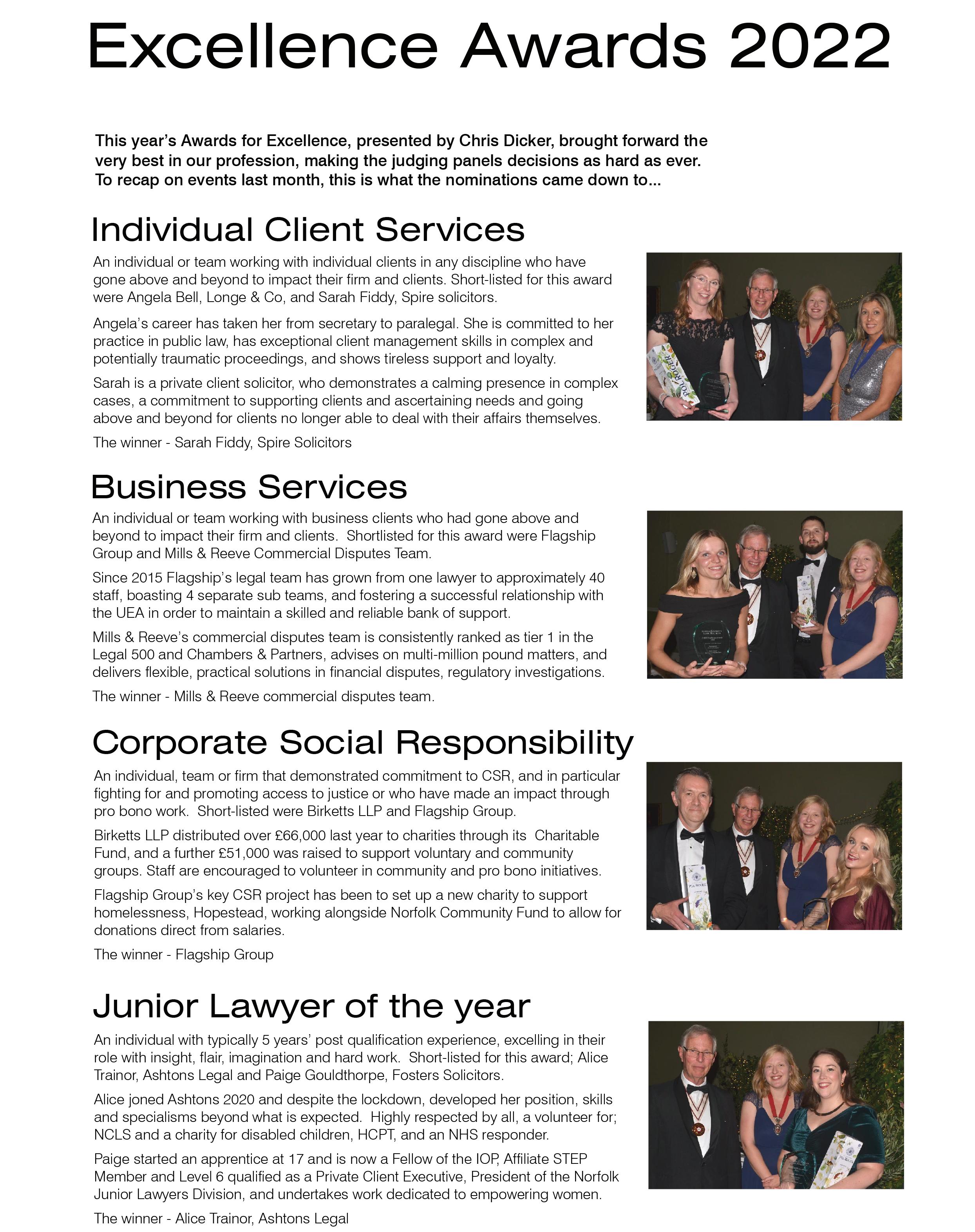

The Annual Dinner held on 6 October 2022 was a brilliant event and enjoyed by all who attended. The food was (as always) fantastic by the Assembly House team, the local legal community dressed to impress, and a wonderful evening was held by all. Congratulations once again to our Excellence Awards nominees and winners, who you can read more about later in this edition of the magazine. At the beginning of November we are due to have our UEA and NNLS Joint Law Lecture, with a panel discussing mediation

in an ever unequal world, and I hope many of you will be able to join that event.

As we look forwards there are some exciting times ahead for NNLS – we are investigating ways of becoming “greener”, in particular in relation to this magazine, and looking to develop our links more deeply with the students of this city, and with practice groups that are not typically attending our events. As ever we remain dedicated to providing a strong programme of training and social events for all members as we move into 2023.

It has been an honour and privilege to lead this Society this year, and whilst we are facing as a nation and profession ongoing challenges I know that the NNLS Committee remains dedicated to best promoting the interests of local legal practitioners as we move forwards. Many thanks to all of you for your ongoing support.

Jessica Piper President, Norfolk & Norwich Law Society

Events for the Autumn

Public appetite grows for leaving gifts in wills to charity

In the UK, charitable bequests are exempt from the 40% Inheritance Tax and, when clients donate 10% or more of the value of their estate, the IHT rate is reduced to 36%.

Lucinda Frostick , Director of Remember A Charity – a consortium of 200 charities, says: “Legal advisers play a crucial role in helping the public understand all the options open to them when they write a Will. Our research shows that even the simplest of references to the option of leaving a gift in a Will to charity can double the chances that a client will choose to do so. And those gifts really can be transformational for UK charities. Today, that income is more critical than ever.”

A record number of people in England and Wales are supporting charities with gifts in Wills. 10,670different charities received a gift from a Will last year and 37,242 charitable estates were identified – a 10.7% increase on the previous year. This reflects the growing appetite for legacy giving and the key role the legal sector plays in providing impartial information for clients about how to go about it, while ensuring that people’s wishes for family and friends are met

Poppy’s

This news came at the start of Remember A Charity Week (5th –11th September 2022), the nation’s annual public awareness campaign for charitable gifts in Wills. It echoes recent research showing that more than 1 in 5 Wills handled by UK legal advisers (22%) now include a donation to charity.

The public supports a wide spectrum of charitable causes, from researching treatment for cancer and dementia to supporting vulnerable children and adults, taking care of pets and animals, mental health support, rescue services and many others. Over a third (37%) of charitable Wills named just one charity, but more than one fifth (21.7%) contained two.

When it comes to location, the areas with the highest concentrations of charitable Wills in 2021 include Brighton, Birmingham, Portsmouth, Bournemouth and Exeter. Areas that have seen the most annual gains in charitable estates are Brighton, Kingston-upon Thames and Ipswich.

Gifts in Wills are a critical source of funding for charitable services across the country, raising more than £3 billion for good causes annually. Generous tax reliefs make gifts in Wills one of the most efficient ways of donating.

The consortium works all year round to normalise charitable Will-writing across the UK by raising awareness of legacy giving among legal professionals and the public.Through its free campaign Supporter scheme for solicitors and Willwriters, it offers promotional resources and useful guidance for referencing gifts in Wills with clients.

To find out more or join the existing network of campaign supporters, see: https://www.rememberacharity.org.uk/advisers

Norfolk & Norwich Hospitals Charity

Cromer, helping to provide non-invasive earlier diagnosis for eye conditions.

If you would like to leave a legacy gift to benefit local NHS patients, your solicitor simply needs to know our registered charity number – 1048170. A general gift to the charity will allow us to use your legacy where it is needed most across our hospitals, particularly in areas where direct donations are not usually received, but if you would like your gift to benefit a particular department we ask that this be expressed as a wish in your will so that no restriction is created.

please visit www.nnhospitalscharity. org.uk.

The Norfolk & Norwich Hospitals Charity provides grants to help fund improved facilities, state-of-the-art medical equipment, ground-breaking research and support for NHS staff at the Norfolk & Norwich University Hospitals NHS Foundation Trust, helping them to provide the best care for every patient.

earlier treatment for NHS patients.

• £1.6m towards additional MRI scanners for a new Diagnostic Assessment Centre to be built on the Norwich Research Park. This development will provide additional scanning capacity, providing earlier diagnosis and assessment for local patients.

• £60k to provide exciting artwork for the new Children’s surgical theatres at the Jenny Lind Children’s Hospital, making the hospital environment more welcoming for children undergoing treatment.

• £230k to provide additional OCT scanners for Eye Clinics in Norwich and

Almost one in two of the grants we provide are thanks to gifts in wills ranging from £500 to over £1 million. Every gift, large or small, makes a real, lasting difference for local patients at the Norfolk and Norwich, Cromer and Jenny Lind Children’s Hospitals, and we are always incredibly grateful to receive legacy gifts on behalf of our hospitals.

Recent legacies have allowed our charity to provide funding for these projects:

• £2m for state-of-the art equipment for a new Orthopaedic Centre, providing two additional elective surgical theatres and 21 extra in-patient beds at the N&N Hospital. This will provide a dedicated elective surgery unit, helping to provide

To find out how you can help us do more to support your local hospitals

Direct Payments to Pay for Social Care Support

Local authorities, after a care assessment has dcided that an individual is entitled to care support, they can either be offered the care support or they have the choice to receive a direct Payment. Direct Payments enable a person or their family to use the DP funding to arrange their own care provision.

To receive a Direct Payment, talk to your local Social Services department.

Direct Payments give a person flexibility to to chooses their care provider, to communicate directly with them and to change to another provider if they are not satisfied with the one they have. Control is with the person or their family.

It also gives the opportunity to ‘shop around’ for the best value for their budget.

Direct payments also give the opportunity to hire your own care support. This may be that you become an employer, which does have responsibilities, but many people prefer to have wages, tax, NIC etc. managed for them by an outside broker, accountant etc.

If a person is already receiving practical support from their Council but would like to change to a Direct Payment, then contact the Direct Payment Support Service at your local Council.

Able Community Care Ltd.

www.ablecommunitycare.com

Opposite: Able Community Care’s office

Family relationship DNA testing as we emerge

from a period of darkness…

must take some credit for their prompt action in the early days of the pandemic, when we simply did not know what kind of virus we were dealing with. Lockdown caused a precipitous drop in demand across all sectors and of course then necessitated a substantial government intervention.

After a few years of unprecedented change, we are hopefully on the path to repairing society and a semblance of normality. So, rather than our usual in depth article on a “DNA testing” subject we thought it would be a good idea to discuss some of the causes and changes relevant to the professional services sector.

We must first offer some context by discussing firstly the effect of Covid-19 and then secondly, the war in Ukraine. The stresses caused by these events have caused heightened anxiety in the population and of course, significant changes in behaviour which are exacerbated by the use of social media channels. Tolerance and respect have taken a back seat as people seek Maslow’s “Safety and Security” and as a means of self protection, can react irrationally and poorly. Whilst there are still strong memories of the pandemic we have learnt to deal with its consequences and are growing from it. The real impediment to regaining normality is now the situation in Ukraine.

To put this into context, there have been 15 pandemics since the Black Death (1331-1353) and which recorded at least 100,000 deaths. The Black Death for example, wiped out over 30% of the population. The death toll due to Covid-19 in the UK has been smaller than some other pandemics, due to better public health measures and more rapid communications. The government

In economic terms and from historical data, the effect of pandemics (in general) is to modestly reduce the natural rate of inflation, with actual recovery thereafter taking decades rather than a few years. In the UK the loss of life has been predominantly in the older population although we await to see the unknown effects of long covid on the wider population. Pandemic “survivors” may well be seeking to consolidate their personal security for example by risk aversion, retention of wealth, more modest investments and frugal behaviour.

If we can now please be excused a comment on inflation, then pandemics are in general associated with a reduction in inflation, a more restricted labour force and this in turn leads to an increase in real wages. So having weathered the three or so waves of viral infection, we might have expected to come out of it into a low inflation, cautious environment. A war is a significantly different event, unlike a pandemic, it is both the destruction of life and of capital (crops, land, building, machinery, factories) and is inherently a cause of inflationary increases. Whilst Ukraine bears the brunt of the economic damage, the inflationary effect in a global economy, reaches rapidly to other nations. It is now the Ukraine war, rather than the aftermath of the Covid-19 pandemic, that is having the most significant effect upon our well-being. It is driving inflation and it is the source of national insecurity as people again seek safety and security.

As a company we played a significant role in outbreak testing for Covid-19 and during this rather intense time, as

the government focussed on mitigation and containment, the demand for professional commissioned human identity DNA testing reduced significantly. Social services and solicitors were struggling to keep case work going and home working, in terms of client contact, was simply not the answer. However, the latent demand for DNA testing has now released and significant cost pressures are with us all (e.g. cost of living wage increases, rent, utilities). Pressures on the legal aid system still exist and need attention if we are to mitigate this high inflation environment, hold down our costs and still (as a sector) provide great service to families.

There is a specific sector in family services that has been badly affected, by the war in Ukraine. Until Russia invaded, Ukraine was the centre of the surrogacy industry (estimated 25% market share) and of the countries that allow surrogacy, is the most permissive (with clear legal rules) and reasonably priced. It is estimated that before the war, around 2500 babies were born to Ukrainian surrogates per annum. Many surrogates and intended parents were trapped by the war and of course, the immediate reaction was for the Ukrainian surrogate to leave the country. Some made it, others have remained but have been moved to cities further West in Ukraine.

Undoubtedly, the surrogacy clinics are struggling to function in this environment and this is compounded by desires to help the surrogate into a neighbouring country. This course of action may invalidate a surrogacy contract made under Ukrainian law where surrogates do not have parental rights over the children that they carry. Altruistic surrogacy is allowed in the UK, but the birth mother is recorded as the legal parent at birth, until a parental order is made in order to change the parentage – a DNA test is required for this and around 400 of such orders are made each year. Other countries are less permissive regarding altruistic surrogacy and

it may even be banned completely. We of course continue to advise our UK clients with DNA testing in this difficult situation.

Global inflationary pressures need to be brought under control and all economies will take a while to adjust. With sensible fiscal policy, predictions of an eventual lower inflationary environment next year seem robust. Post pandemic we see UK society evolving with a renewed evaluation of human connection, family and gainful employment, there is indeed a great deal to be positive about.

About the author

Dr Neil Sullivan , BSc, MBA (DIC), LLM, PhD is General Manager of Complement Genomics Ltd (trading as Dadcheck®gold).

Complement Genomics Ltd (trading as Dadcheck®) is accredited by the Ministry of Justice as a body that may carry out parentage tests directed by the civil courts in England and Wales under section 20 of the Family Law Reform Act 1969.

Please see: http://www.dadcheckgold.com. Tel: 0191 543 6334 e-mail: sales@dadcheckgold.com

An Introduction to Finders International

Finders International is a professional probate genealogy company, established in 1997 by Managing Director Danny Curran and is now one of the world’s largest firms in our field. We are best known for tracing missing heirs and identifying lawful and entitled next of kin, having worked extensively with lawyers, probate practitioners, banks, deputyship teams, trust companies and state trustees.

Finders have offices in London, Edinburgh, Dublin and Sydney and over 150 personnel, enabling us to complete searches quickly across multiple jurisdictions. When complex estates need to be dealt with, we have a proven track record of tracing beneficiaries globally.

We support the legal profession and know our research forms part of a serious legal process that reflects on your firm. Therefore, we will work efficiently and in the best interests of your company, the personal representatives, and beneficiaries at all times.

We do more than Trace Heirs We are aware of the need to support the services of sole practitioners when dealing with Estate administration matters. In addition to tracing missing heirs or Executors, we can assist with a range of legal support services; searching for missing Estate assets, obtaining missing documents, carrying out overseas bankruptcy searches, and conducting thorough insurance-backed Missing Will Searches, as well as a range of probate property solutions, and offering insurances to enable safe distribution of funds.

Estates with an International element

We are here to provide consultative and practical support to practitioners and estate administrators with the liquidation, disposal and return of a variety of assets located overseas.

We have a range of International Asset Services to assist with complex multi-jurisdictional estate matters, offering Medallion Signature Guarantees, the sale and transfer of overseas stock, closure of overseas bank accounts and obtaining overseas Grants of Probate. These specialist services are designed to assist sole practitioners with overseas estate elements they may not encounter on a regular basis.

UK Estates are much more likely to contain at least one overseas asset these days. From a bank account opened in Australia for work, to a holiday home purchased while on holiday in Spain, to tax planning investment accounts opened in the USA and offshore in places like the Isle of Man and Jersey, to accounts in Ireland or beyond, to shares that, due to corporate action, have ended up listed in all sorts of places worldwide – it’s quite possible that an estate may feature one or more of these scenarios. What unites them is that they’re often surprisingly time-consuming and challenging to deal with – whether that involves closing

an account, liquidating a portfolio or selling an individual shareholding. Numerous legal and bureaucratic obstacles spring up which must be navigated before the value can be restored to the estate in the UK. The sheer variety of scenarios is something that an estate practitioner may not have encountered often, or at all. Another scenario is that you may be pressed for time and anxious to progress multiple aspects of the estate administration at once. That is where Finders’ International Asset Service comes in.

We apply a practical, problem-solving approach to a range of asset services, helping to sell, transfer or recover a range of overseas assets including shares, bank accounts, and investment portfolios, assisting estates with the necessary administrative and legal paperwork. With a combination of specialist knowledge, contacts, and experience, Finders will get the job done.

Our Credentials – A tried and trusted firm Reputation is critical in the probate world, and we will safeguard yours as closely as our own.

We are founder members of the International Association of Professional Probate Researchers www.iappr.org, which provides regulation, a Code of Conduct and a complaints procedure for a network of elite international companies. The IAPPR is one of many respected and recognised organisations we have chosen to belong to, or qualified as members of, to complete an impressive list of accreditations. In an unregulated industry, Finders International is a name to trust.

For 4 years running, we have been awarded ‘Best UK Probate Research Firm’ at the UK Probate Research Awards and won the same award at the 2020 British Wills and Probate Awards.

Our Managing Director, Danny Curran, is known as the industry spokesman with over 100 media contributions. From Forbes Magazine, The Times, and all the UK nationals, to appearances on ITV’s This Morning and numerous Radio interviews, positively promoting the probate research profession.

We also complete hundreds of pro-bono cases every year, helping with stories of reunions of family separated by war or forced adoption and reuniting people with family heirlooms such as their ancestors lost war medals or long-lost books.

For free advice or a no obligation quote, contact us today: +44 (0)20 7490 4935 quotes@findersinternational.co.uk www.findersinternational.co.uk

Relationships remain key in the age of technology

Winning friends and influencing people is all about understanding their situation and being empathetic to their challenges while excelling at service delivery

Personal relationships are still the heartbeat of business success, despite the increasing use of technology. Personal relationships convey how we value one another. Personal relationships enable us to have empathy with one another’s situations.

In his seminal book, “How to win friends and influence people,” Dale Carnegie wrote

“If there is any one secret of success, it lies in the ability to get the other person’s point of view and see things from that person’s angle as well as from your own.”

Business relationships then are as much about understanding the challenges we all face in our daily encounters.

The search industry has seen significant changes in recent years. Massive consolidation has seen so many of the traditional search companies swallowed up into larger corporates. We have to find ways of differentiating our service offerings, building that trust in client relationships, and delivering services

which conveyancers feel add value to their business.

Don’t get me wrong, consolidation has brought with it huge advances in technology and customer experience. Gone are the days of endlessly calling suppliers to order reports, collating them manually, printing off reams of paper and hand delivering the search to the office…. and good riddance too! With the exception of local authority searches, most of the reports are now available same day, with many returned in minutes.

The delivery platforms are slicker, smarter, more intuitive and spot potential risks that might need to be accounted for, and errors in search requests. But some of this technological advancement has come at the expense of good, old-fashioned customer service. The personal touch.

Do we rely on technology too much? Are chat bots, apps and portals what our clients really want and need? What happens when things go wrong? People need reassurance, they need to be able to pick up the phone, or send an email, and feel as though somebody is taking a personal interest in resolving their issue rather than “chat” to a faceless bot or send messages via portals.

I recently won back a client from a rival supplier. When I asked what it was that brought them back to us they said that they felt as though they were a number, rather than a client. It was the personal touch that was missing from their communications; they didn’t feel as though they ever spoke to the same person twice. There wasn’t a familiar voice at the end of phone when things went wrong (as things inevitably do in conveyancing!).

In our experience 90% of orders go through with little to no intervention required. But that 10% is where relationships are made and broken. This is where knowledge, experience, and expertise really make a difference. Recognising that the conveyancer is almost certainly under pressure, whether it be from the client, agent or the other side, and being able to take that weight off and deal with the issue through to completion is a critical part of the business relationship.

Whether it’s a query on a report back which requires clarification, or chasing up an expedited service. It’s about trusting that the job is going to get done right, first time.

A legacy for future generations

Sadly, 1 in 2 of us will receive a cancer diagnosis at some point in our lifetime and most of us will know someone who has been affected by the disease.

East Anglian cancer charity, Big C, is committed to providing outstanding support for those in the local community, now and for future generations. Funds received from legacies are a fundamental source of income for Big C and vital to enable the charity to continue the crucial role it plays in supporting those in need.

From its first small, but important, fundraising project providing chemotherapy equipment at the Norfolk and Norwich Hospital in 1980, Big C has grown into an impressive organisation which funds specialist support and information services, life-saving equipment and internationally significant research projects. This research greatly benefits local people and has a global impact on our understanding and treatment of the many types of cancer.

A recent addition to the charity’s services is Big C’s Virtual Support and Information Centre, which enables people to access crucial support from the comfort of their own home. Online help is offered via Big C’s Virtual Support Centre,

offering 1:1 video support, virtual groups and wellbeing classes, or support by telephone for those who do not have online access.

Dr Chris Bushby, CEO at Big C says, “Sadly most people in our local community will be affected by cancer at some point in their lives, whether that be their own diagnosis, or that of a loved one or friend. As a local charity, we are often overwhelmed by how people express their gratitude for the support we offer and the investments we make in research and medical equipment. One of the most significant ways they do this is by leaving a legacy to Big C in their will. The difference that legacy giving makes to Big C cannot be overstated. It is vital to our ability to invest in research and equipment in our region’s hospitals and to provide outstanding and accessible support and information close to where people live. It can literally change the future for people facing cancer now and in years to come.”

Leaving a legacy to Big C is a precious gift for future generations.

For more information on leaving a legacy to Big C please contact Katherine Morgan at katherine.morgan@big-c.co.uk or call 01603 964490

‘Basis Period’ reforms will impact on most legal practices

The long-delayed HMRC reforms which will see sole traders, partnerships and LLPs assessed for tax on a ‘tax year basis’ are finally due to come into effect in April 2024 – but those practices whose current accounting year-end does not coincide with the tax year need to start thinking about how they are going to cope with the change sooner rather than later.

Under current rules, unincorporated businesses (including LLPs) are taxed on a ‘current year basis’. Now HMRC wants to ‘simplify’ matters (for themselves, at least) so that the results of any given year are taxed in that year, regardless of the accounting date.

The main driver for this is Making Tax Digital which is due to be introduced for income tax in 2024, but it will also mean that profits will be taxed sooner, which of course has implications for cashflow. If a practice’s accounting year is anything

other than 31st March or 5th April, the 2023/24 tax year will be a transitional year when as much as 23 months’ worth of profit will be taxed and from 2024/25 practices will need to report the taxable profits for that tax year, regardless of the accounting period year end.

There are several issues that affected practices will have to consider, amongst which:

• Profits might have to be estimated and then revisited once the accounts are finalised causing additional administration (and costs) preparing or reviewing a later set of accounts every year.

• Overlap profit for each member/partner needs to be researched as it can be used to reduce personal tax payments, though it is often relatively small.

• If profits in 2023/24 are higher than usual, this could have a compounding impact on tax bills and cashflows.

• Additional profits brought into charge are spread over the 5 tax years beginning

2023/24, however a practice can elect not to spread.

• Those practices maintaining tax reserves ought to ensure they are holding enough behind from profits to support future increased tax payments.

One obvious solution is to change a practice’s accounting year end date to coincide with the tax year end. There are special rules about doing this, so taking advice is essential – and timing of the move is also important.

April 2024 may seem a long way away, but these are significant things to think about, and it really is no good waiting until the last minute. Every practice whose accounting year end is not 31st March or 5th April needs to take professional advice sooner rather than later.

Shaun Mary Partner, Lovewell Blake