–

– page

–

– page

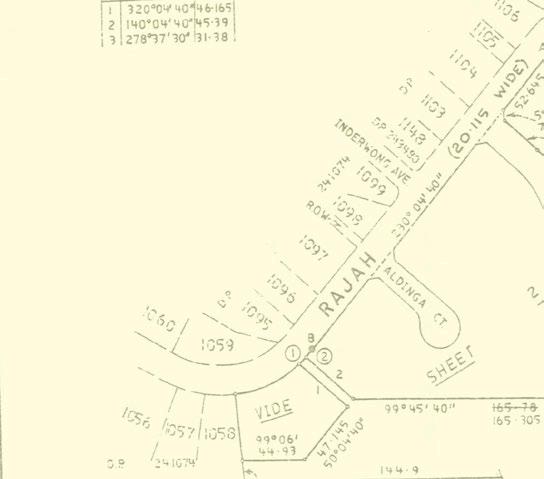

Positioned on a 270+ acre parcel of land, this incredible property has all there is to offer to a buyer searching for ultimate privacy and future development/income potential. Together with an existing main house and workers cottage, the property comes with approval for fifteen housing lots.

The decision of whether to purchase the land for private use or take advantage of the approved plans for future income, is yours entirely. Enjoy the sounds of clear running water creeks and waterfalls plus a choice of scenic walkways and drives, whilst being located close to the conveniences of the Eureka village amenities.

• 270 acres of NSW’s finest farming land

• Approval to sub-divide into fifteen lots

• Existing main house and workers cottage

• Sweeping views of the rolling green hills

• Fresh water streams, 25 acres of rainforest

• Huge future growth and income potential

Contact agent:

Grant Dale – 0499 199 122

Darren Perkins – 0428 660 324

42 Acres (17.31ha) of private, elevated country living, with stunning view.

5 Araluen Place is set in an elevated, north facing position, looking across farmland and the Springbrook and Numinbah ranges. Comfortable 3 /4 bedroom, 2 bathroom brick home with lots of storage.

Fully covered verandahs and a level backyard with rainforest trees, open lawn and a rustic garden shed.

The property is fully fenced and is suitable for cattle or horses.

The creek provides clean and reliable water for home and livestock.

A large farm shed with power is easily accessible.

Inspection by appointment only: Agents disclose interest in this property

Mark Zwemer: 0428 717 034 • mark.z@profking.com.au

Wayne Yeo: 0468 920 130 • wayne.yeo@atrealty.com.au

Bisque are designers and importers of fine furniture, lighting and homewares. Our stores, showcasing our latest collections, are located in Bangalow and now in Byron Bay. We offer a complete interior design, furniture rental and styling service, using our classic Bisque Luxe Range to bring your property to the next level.

We can help you arrange full project management, source builders and materials and also offer a full client consultation service.

All pieces are available wholesale. See our comprehensive range online.

4/60 Centennial Circuit, Byron Industrial Estate 0424 225 059 | Mon-Fri 11am to 4pm

12 Station St, Bangalow | 6687 1610 | 7 days www.bisquetraders.com.au | Insta: @bisque_ ralphbrauer@yahoo.com.au

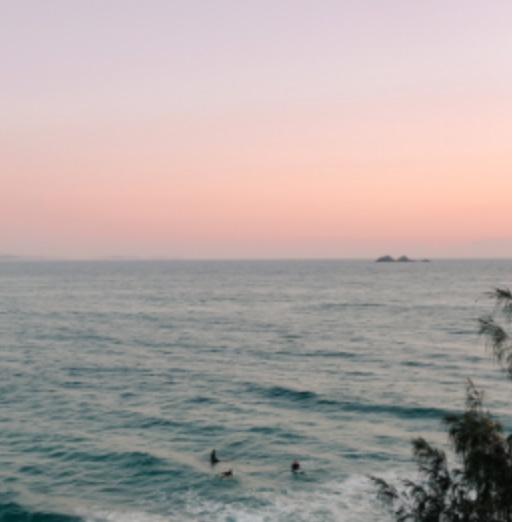

A less than 10 mins drive will have you at the renowned Harvest Cafe for your morning coffee and browsing the charming array of boutiques in Newrybar. This delightful 12-acre organic farm with beautiful distant ocean views and stunning rural vista offers the best in North Coast country living.

• Elevated, superb views across the hinterland to the ocean and amazing sunsets

• Ideal one level brick home with polished floorboards, two separate living areas and open fireplace

• Four-bedrooms, two bathrooms, functional modern kitchen, and double garage with office

• In-ground 6 m x 3 m salt chlorinated pool, covered shade

• Extra-large shed with mezzanine level, suitable vehicle/equipment storage/home business

• Groomed fenced paddocks with woodshed/carport and livestock shelter

• 358 macadamia trees, income producing

• Ample water storage 1 x 5000-gal tank and 1 x 10,000-gal tank, plus bore, 10 Kilowatt solar

• Lovely mature gardens with fruit trees, mango, avocado, bananas, and citrus

• Close to local schools and shops and medical centre

• 15 mins to Lennox Head beach and only 15 mins to Ballina/Byron

•

Regrets, we’ve all had a few, but misunderstanding the legal, taxation and financial implications of property transactions turns out to be quite common, even for reasonably savvy people – and it can be costly. It’s better to check with your advisor before it’s too late, even if you think you’ve got it nailed.

We asked local lawyer Adam van Kempen (from BVK Solicitors and Attorneys) and accountant Nick Moran (from Mayberry Meldrum Anderson Accountants and Taxations Consultants) to outline a few commonly misunderstood issues.

The federal First Home Guarantee (FHG), under which first home buyers can get a loan to purchase a property with as little as 5% deposit, is just part of one of what lawyer Adam van Kempes says is one of the best environments for first home buyers in terms of guarantees and concessions offered. However the caps on the house prices that this can apply to (in NSW $900,000 for capital cities and major regional centres and $750,000 for other areas of the state), whilst great for new home buyers, are less useful in the Northern Rivers, particularly Byron Shire, due to high house prices.

In addition to the First Home Guarantee, all states offer stamp duty exemptions and concessions for first home buyers. Some states in addition also offer a cash grant for new home purchases – in NSW $10,000. Stamp duty is exempt on homes up to $800,000 and reduced for homes between $800,000 and $1m. For vacant land, on which you intend to build as a first home owner there is no duty up to $350,000, and concessions on land between $350,000 and $450,000.

Adam points out that, unlike the federal guarantee, this is statewide and does not take into account the difference in prices between regional areas and capital cities – so while this will be great for some people, in some capital cities and regional areas the benefit of these concessions is diluted again by high real estate prices.

Adam says, ‘One of the advantages of the FHG scheme is that it removes the [lender’s] requirement for you to take out and pay for Lenders Mortgage Insurance (LMI) if you have a deposit of less than 20% of the purchase price. This can be a huge expense: for example, if you wanted to buy a property for $750,000 but only had a 10% deposit ($75,000) rather than 20% ($150,000) then the cost of the LMI would be a whopping $27,500.

‘With a small deposit, big loan and deteriorating labour market, there’s a potential to get into trouble in a falling real estate market. Most people assume that in paying for very expensive LMI, they are the ones who are insured if something goes wrong and they end up in default in their mortgage payments, but that is not the case. By paying for LMI, it is the lender who gets the benefit of the insurance. For example, if you were to default on a home loan, and the property was sold as a result – with the bank still owed, say $100,000, then the insurer would pay that money to the bank – but then would seek to recover the money paid from you – most people don’t realise that in this situation they are paying exorbitant insurance premiums to insure the lender –not themselves.’

Adam says, ‘At the other end of the spectrum is the consideration of real estate in Estate Planning terms. Historically, many people have appointed an overseas resident as the executor of their will in Australia, for various reasons including, commonly, ex-pats appointing an overseas sibling or family member. From 1 July 2016 (with certain changes) the federal government introduced a ‘Foreign Residents Capital Gains Tax’ of 12.5% on the sale price of the property.

‘In order to avoid paying this tax to the Tax Office on completion of a sale the vendor or seller must produce a “clearance certificate” issued by the ATO – and if the vendor is the estate executor, who is foreign, they will not be able to get such a certificate and the tax must be paid to the ATO, regardless of whether the original owner of the property was resident in Australia and could have produced a clearance certificate in their name. So if you own property in Australia and have a foreign non-resident executor – change your will!’

Adam says, ‘Land tax is levied on the unimproved land value – for most properties at 1.6% of the land value – that is it ignores that value of any building and improvements. It is the value set by the Valuer-General that is also used by councils to determine rates.

‘People often talk about purchasing property (or leaving property in a will) in or to a family trust for asset protection or other financial planning reasons, and sometime there are good reasons for doing so. Family trusts however are classed as ‘special trusts’ because of their discretionary nature; no beneficiary has a right to any distribution from the trust – it is up to the discretion of the trustee. Properties held in family trusts do not have the benefit of the land tax threshold in NSW (currently $1,075,000 for 2024).

‘The land tax threshold apply applies once – to the aggregate land value of all the taxable properties that are owned. This is commonly misunderstood; if you own two taxable properties, and each of them is below the threshold, you will still pay land tax to the extent that the combined value exceeds the threshold.

‘The mechanism by which land tax affects the commercial mix in towns like Byron Bay is poorly understood by the general public. One of the huge problems facing commercial landlords and tenants in Byron Bay in particular, but also throughout the region, is the massive increase in land values – many have doubled in the past year. Despite the ability to “average” increases over up to three years, this means that land tax – which is often paid by tenants as part of their “outgoings” in their lease – has in some instances more than doubled. So, in addition to very high retail rents in the Byron CBD and other areas, tenants are now being slogged with massive and unsustainable outgoings – through the landlord, but ultimately from the NSW state government.’

▶ Continued on next page

▶ Continued from previous page

Local accountant Nick Moran surprised us by saying that one of the most misunderstood issues for his clients was something they’d all heard about.

Nick Moran says, ‘Almost everyone who owns or has owned property is aware of the main residence exemption: that is you do not pay capital gains tax on the sale of your main residence. The basic case can be very simple –you own a property which is where you and your family live, and when you sell this property for more than you paid for it you will not declare or pay tax on the gain. However for something that can be so simple, there are numerous factors that can turn the simple into the very complex. We talk to so many clients about main residence exemption and it is not uncommon to hear the phrase “I wish I had known that before”.’

‘Here are some of the common factors that vary the basic main residence exemption, and importantly some tips to get the most out of the exemption:

‘If you have a main residence and stop living in it, you can elect to continue treating this as your main residence for up to six years while it is generating income, or indefinitely if it is not. Importantly you need to vacate the home –renting on AirBnb over the summer will not count and WILL impact your main residence exemption.

‘If you move from one home to the next, and rent out your former home, this gives you the flexibility to choose which property will be treated as your main residence.

‘Another example is property owners who are ‘rentvesting’ i.e. you rent where you live and own a property which you rent to tenants. If you had lived in that property even for a short period before renting, it may qualify for the full main residence exemption on sale,’ says Nick.

‘If you rent out part of your home, or holiday let your home for small periods, or run a business from home, you will impact your ability to apply the main residence exemption in full. You may still qualify for a partial exemption depending on the length of time you generated income and the percentage of your property used to generate income. It is important to understand this before using a home to generate income as the capital gains tax cost may outweigh the income received.’

‘Where you are not entitled to the full main residence exemption, any property holdings costs that have not been claimed as a deduction can reduce the future capital gain on sale by increasing the property cost base. Say you rent out your home every school holidays, or 25% of the year. This means 25% of your future capital gain will be taxable and you will likely have claimed a tax deduction for 25% of your holding costs: mortgage interest, rates, insurance, etc. The remaining 75% of these holding costs can increase your cost base and reduce your taxable capital gain. It is important to keep a record of these costs, even if you stop using your home to generate income. Doing so can make a huge difference to your future tax bill.

‘Any time you are considering purchasing or selling property, or using your property to generate income, it is highly recommended to seek advice before you take action so that you can understand and make the most out of the concessions available.’

•

•

•

•

•

•

•

•

•

•

•

•

FROM COUNTRY TO COAST – CENTURY 21 BYRON BAY AND ALSTONVILLE HAVE GOT YOU COVERED!

With over 60 years combined experience and an extensive portfolio spanning idyllic countryside retreats to stunning coastal residences, our trusted team of experts is committed to helping you achieve your goals.

EXPERT GUIDANCE: Experienced real estate professionals ready to guide you through the process.

WIDE RANGE OF LISTINGS: Explore our diverse portfolio of rural, residential and lifestyle properties.

HIGH IMPACT MARKETING CAMPAIGNS: Dynamic marketing solutions are all part of our commitment to supporting you through your future investment decisions.

LOCAL MARKET INSIGHTS: Stay ahead with our team’s in-depth knowledge of local market trends. Ready to make a move? Contact the award-winning team at Century 21 Byron Bay and Alstonville and start unlocking your real estate goals today!

What is the right home size for you? It is an important question for people to ask at all stages of their lives. They may have families, or look after ageing parents or, as they themselves age, decide they want to travel, or simply that they just don’t need as much space as they used to.

There are a wide range of considerations as to what type of housing will best suit you. In the Northern Rivers 23.8 per cent of households are single-person households and 66.9 per cent are family households, according to the Northern NSW District Data Profile. According to www.profile.id.com.au the majority of people in the Northern Rivers live in either separate houses, 74.2 per cent, or medium-density housing, 18.8 per cent. This then drops to only 3.5 per cent of people living in high-density housing. Yet the age cohort that changed the most in the region between 2016 and 2021 were those aged between 70 and 74 (increased by 4,662 people or 6.6 per cent). And it is as people age that they often consider downsizing. Their kids have left home, they might want to travel or perhaps the maintenance and costs of running a larger property are becoming too expensive or overwhelming.

As I’ve watched friends age, many of them have realised the challenge of maintaining properties the older they get. It is harder to do the labour to maintain the house and gardens or the property, and it is expensive to pay someone else to do it. This has seen many people who have enjoyed years of raising families, creating communities and living in the hinterland of the region, decide to downsize to smaller properties closer to local towns or move into over-50s independent living environments.

Some friends have extolled the virtues of being in an over-50s independent living as they are able to lock up and go travelling and not have to think about maintenance, risk of theft, or just maintaining the garden and house while they are away. They talked about how amazing it was to just jump on a bike and head into their local pub for a drink – it definitely hadn’t been a possibility living over 10km from any local towns previously.

Other considerations also involve financial stability and safety as people age. For some families it is feasible to have multiple generations of a family live together and care for one another. This can be beneficial to ageing parents and grandparents who have someone to care for them as well as

parents who get a bit of childcare mixed into the arrangements. For everyone the company is certainly (hopefully) an added boon.

However, in today’s global environment children and relatives don’t always live nearby one another and having a multigenerational household might not be everyone’s cup of tea. So with a large house there often comes a point where it is more financially viable to look at selling and downsizing to something that is more manageable and can also help secure your retirement. If you are over 55 years of age and sell the family home you are able to make a tax-free contribution to your superannuation of up to $300,000 as part of the downsizer super contributions scheme. The rest can be managed for your future security as you age.

The key to downsizing is looking at what your needs are now and as you move into the future. For some, an independent retirement village is perfect, for others just a smaller residence and less land and garden to maintain is what is required. When you are looking at your options make sure that you get good, independent financial advice so that you can make your downsizing work to your best advantage.

Tara

hard work out of selling our home and kept us informed every step of the way. We got a fantastic result in an amazingly short time and we couldn’t be happier.

0412 057 672

“Vicki has been a phenomenal Real Estate agent. She is reliable, fast, affective and efficient. She replies’s to text and emails promptly, and is supportive and caring. I would highly recommend Vicki for her services. She is very easy to work with and it feels like we’ve known each other for years! She is kind,

“Personal,

“Personal, Caring, Responsive”

0418 231 955

“Vicki has been a phenomenal Real Estate agent. She is reliable, fast, affective and efficient. She replies’s to text and emails promptly, and is supportive and caring. I would highly recommend Vicki for her services. She is very easy to work with and it feels like we’ve known each other for years! She is kind, supportive and wise with her extensive experience.”

“Vicki has been a phenomenal Real Estate agent. She is reliable, fast, affective and efficient. She replies’s to text and emails promptly, and is supportive and caring. I would highly recommend Vicki for her services. She is very easy to work with and it feels like we’ve known each other for years! She is kind, supportive and wise with her extensive experience.”

“Vicki has been a phenomenal Real Estate agent. She is reliable, fast, affective and efficient. She replies’s to text and emails promptly, and is supportive and caring. I would highly recommend Vicki for her services. She is very easy to work with and it feels like we’ve known each other for years! She is kind, supportive and wise with her extensive experience.”

vickicooper@atrealty.com.au

www.vickicooper.com

VICKI COOPER

VICKI COOPER

0418 231 955

0418 231 955

vickicooper@atrealty.com.au

vickicooper@atrealty.com.au

www.vickicooper.com

www.vickicooper.com

Echo

Echo

The Byron Shire Echo published each month.