3 minute read

On-the-field Experiences PL, high added value: the European Context

PL, high added value: The European Context

Similar to branded products in quality, PL has always competed, at a price around 20% lower, with the leading brand in terms of volume. However, in recent years, PL has also become a benchmark for measuring retailer competitiveness against discounters, and, to do so, it sacrifices part of its marginality.

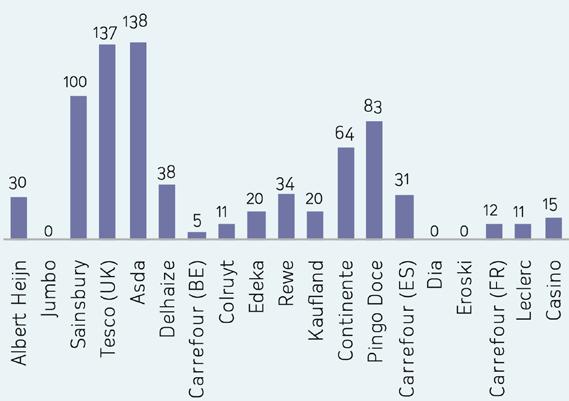

The research, Opportunities in the Value-Added Private Label Market (IPLC 2018), carried out in 9 European countries among 25 retailers assessed how vast and well-structured PL architecture is, in order to meet buyers’ expectations when it comes to points of sale. The largest European retailers have, on average, around 3,000 SKUs of Mainstream PL (table 1).

Tab. 1 Distribution and coverage of PL positioning in major European retailers

In recent years, the mainstream supply has been enriched with an ever-increasing number of Premium PL SKUs (tab. 2) to help retailers make their supply even more distinctive and, at the same time, seek greater customer loyalty and better margins.

Tab. 2 - Nr. Sku’s MDD Mainstream Tab 3 - Nr. Sku’s MDD Premium

Tab. 4 - Nr. Sku’s MDD Bio

Tab. 5 - Nr. Sku’s MDD Free From

The number of products in the Organic PL (Table 4) and Free-From PL (Table 5) ranges has also increased exponentially, both to ensure an ever wider selection, and to recover part of the margins lost by mainstream PL lines.

The development of PL architectures and, above all, of Value-Added PL product lines have led to double-figure positioning with respect to those of Standard Private Labels (Table 6). Tab. 6 - Average prices of European Value-Added PL compared to mainstream PL

In particular, the PL lines with the highest value encompass products: • Free-From, still more competitive than branded products and/or products marketed in other and different distribution channels. • Regional, a PL positioning difficult to compare with branded products. • Organic, in many countries PL is the market share leader, both in quantity and value. • Premium, products with specific claims and positioning in terms of quality and/or origin. • Eco-Friendly, products that nevertheless allow for greater comparison with branded products

It is also worth comparing the different values of Value-Added PLs in the various European countries (table 7): • In the Netherlands, UK, Belgium, Portugal, France it is Free-From products that ranks first. • In Germany, as in many Northern countries, Eco-Friendly products boast the highest value recognition. • In Spain and Italy, raking first in terms of value are the Regional products, not present in the gastronomic culture and, therefore, in the selection of Northern European PLs, excluding Germany. • In Ireland, Organic products are on the podium in terms of value, and these products are also positioned higher than the Premium PL in the Netherlands, Portugal and Italy.

Tab. 8 Price premium for food brands, Journal of Product & Brand Management, 2014 Retailers, faced with limited shelf space, focus on optimizing category performance of the point of sale. With a better understanding of buyers’ preferences, managing Added-Value PL across different levels of architecture is therefore instrumental in increasing sales and, more importantly, profits. Finally, the retailer in most cases uses the store image to support the private label range in terms of quality and positioning. Therefore, in addition to helping the buyer in the decision-making process during his/her shopping experience, Value-Added private labels will increase PL awareness for customer loyalty to the brand.l

Stefano Ghetti - Partner IPLC Italy