4 minute read

Market data

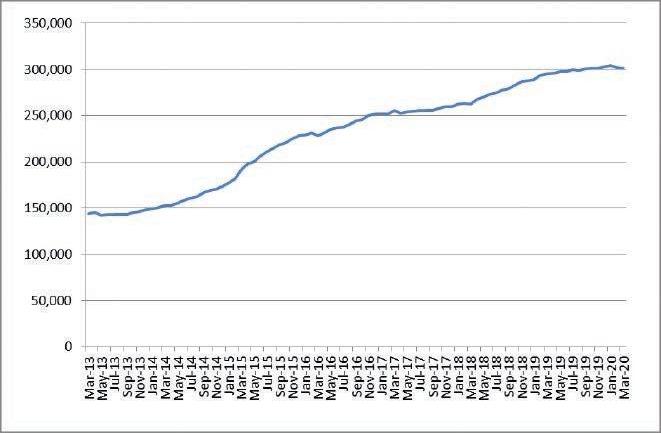

Existing Dwellings

In each edition of Energy Matters we will provide you with a snapshot of this data, with a brief commentary, which we hope you find of interest, and maybe help you prepare for the future. Covid-19 has obviously had a major impact on the construction, housing and energy assessment markets since March 2020. Due to the lag in published statistics these graphs are notor are only slightly, impacted by this current crisis. Volume of EPC lodgements and residential house

Advertisement

Here at Elmhurst we collect and analyse data from many sources in the belief that it helps us make better business decisions. Turning this data into a digestible form takes time and requires a detailed understanding of context.

sales on a rolling 12 month basis (by quarter).

n n Volume of EPC lodgements on a 12 month rolling basis Volume of Residential housesales on a 12 month rolling basis

Commentary

House sales spiked in March 2016 on the back of changes to stamp duty and then quickly fell back to a run rate of under 1.16 million. Since January 2018 the volume has been relatively constant.

The volume of EPCs peaked in the 12 months to May 2014, driven in a large part by ECO. This fell back sharply to a low of 1.2 Million in March 2018. Two years of recovery peaked again in February 2020 with year on year growth of 11% largely due to Minimum Energy Efficiency Standards in the private rental sector. Since March 2020 the volume has dropped by 85% as Government policy dictated that where possible house sales should be paused and assessments undertaken only on empty properties.

Outlook

Covid-19 has impacted everybody and made long term planning very difficult, however:

n

n

Construction and housing were the last to be “locked down” and this may be because Government perceive them as relatively low risk and their financial importance to the country. Hopefully that means they will be amongst the first to recover.

There is a pent-up demand for EPCs and house sales that were paused.

New Build / On Construction

Volume of residential house starts and completions on a rolling 12 month basis (by quarter)

n n

Volume of residential house starts on a rolling 12 month basis Volume of residential house completion on a rolling 12 month basis

Volume of residential house starts and completions on a rolling 12 month basis (by quarter)

UK issued on a rolling 12 month basis Commentary Using data up to December 2019 completions are now at recent record of 213,000. Unfortunately, and nothing to do with Covid-19, home starts have fallen back dramatically from their 204,000 peak in December 2018 to a three year low of 188,000. The most significant fall off relates to private housing in England. Volume of EPCs has now plateaued at just over 300,000. Outlook

It is worrying that house starts have fallen so rapidly especially with a government indicating that house building needs to increase to 300,000 per annum. The impact of Covid will undoubtedly push that figure lower still.

With completions now significantly ahead of starts “work in progress” is falling and this is bound to impact completions. The volume of On Construction EPCs is at an all-time high but with new starts slowing this is likely to fall.

Non-Domestic / Commercial buildings

Non residential (commercial) property sales in the UK on a 12 month rolling basis. Volume of Commercial property EPCs in the UK on a

n

Volume of on-construction (new build residential) EPCs in the

rolling 12 month basis.

n

n Volume of Commercial property EPCs in the UK on a rolling 12 month basis Non residential (commercial) property sales in the UK on a 12 month rolling basis

Commentary

Commercial property transactions haven continued to fall since October 2017 and are now at 120,070, 7% down from the peak and 4.3% down year on year, The surge in EPCs that started in November 2017 has held up well at around 102,000. Unfortunately Covid19 impacted lodgements in the last weeks of March and throughout April 2020. Outlook

With massive uncertainty in the business community, it is difficult to imagine that there will be any major improvements in the commercial property sector. The impact of minimum energy efficiency standards and the ten year anniversary are both well established and should maintain current volumes.

www.elmhurstmarketplace.co.uk

Elmhurst Marketplace www.elmhurstmarketplace.co.uk

MARKETPLACE

Access training and CPD courses on Elmhurst’s dedicated online training platform. There’s a wide variety of courses to choose from, including our popular Retrofit Assessor and Legionella Control for Property Management courses.

Create your own training schedule. Access a catalogue of high quality online courses. Save money on transport and accommodation costs. Watch as many times as you like within a 30 day period.

www.elmhurstmarketplace.co.uk

For further information about the services that Elmhurst Energy provides please visit: www.elmhurstenergy.co.uk or call: 01455 883 250