25 minute read

Sabrina Kristobak, Air Liquide

During that program I worked for four different Air Liquide entities and gained experience in both engineering and business roles. My roles were in Philadelphia, Houston which is our US corporate office, and Paris, France our global head office. This exposure so early on in my career allowed me to grow my network and quickly develop an in-depth understanding of the company. The structure of the program challenges you to learn quickly to become a valued added asset.

EC: Currently, what is your role at Air Liquide, and what activities does this position involve?

SK: I am currently a Business Development Manager for Air Liquide Large Industries. I am responsible for developing large-scale business across the US with chemical, petrochemical, refining, cement, and metals customers to build new Air Liquide facilities. Along with identifying new business and working with prospective customers, this role includes negotiating contracts and getting the project approved internally. I am also actively involved in developing solutions to support our customer’s energy transition goals.

EC: Part of your work includes supporting Air Liquide’s customers to achieve their energy transition goals. In this sense, what is the relevance of boosting female participation in the industry in this transitioning context?

SK: Yes, almost every active project I’m on is related to the energy transition in some capacity. This is both an exciting and challenging time. We are facing new situations that require us to think differently. In that sense creativity and differing perspectives are critical for developing innovative solutions. For the energy transition to be successful it will require a collective effort and engagement of the best talent from all backgrounds. I think it’s not just gender diversity but diversity in all forms that will enable companies to adapt by bringing their unique perspective to the conversation.

EC: What do you think about the number of women in your workspace and industry?

SK: Similar to my response from the last question, I really believe it is important to champion diversity in a variety of forms, not just gender diversity. However, from a gender diversity perspective there is still a significant amount of work to be done. The US Department of Labor data shows that only 15% of full time engineers are female and that women make up just over 25% of all STEM fields. McKinsey’s “Women in the Workplace 2020” article echoes this same message with statements that “At the beginning of 2020, the representation of women in corporate America was trending in the right direction. This was most pronounced in senior management: between January 2015 and January 2020, representation of women in senior-vicepresident positions grew from 23 to 28 percent, and representation in the C-suite grew from 17 to 21 percent. Women remained dramatically underrepresented— particularly women of color—but the numbers were slowly improving”

“Before 2020, research had consistently found that women and men leave their companies at comparable rates. However, due to the challenges created by the COVID-19 crisis, as many as two million women are considering leaving the

Employees Who Believe Senior Leaders Are Supportive Of Their Flexibility Needs Are Less Likely To Considering Downshifting Their Carriers Or Leaving The Workforce. ”

workforce.Ifthesewomenfeelforcedtoleavethe workplace, we’ll end up with far fewer women in leadership—and far fewerwomen on track to be future leaders. All the progress we ’ ve seen over the past six years could be erased”

EC:Fromyourperspective,whatcouldcompanies do to increase female participation, especially in leadership positions? (policies, programs, initiatives)

SK: I really appreciate this question because I think it is extremely important that we don ’t just dwell on the numbers as they stand today but that we shift the conversation to focus on what we can do to bring about change. In this context, I feel extremely grateful to work at a company like Air Liquide where we have programs and initiatives that address these types of issues. For example, -We have business resources groups,one of which is our women ’ s resource group. That holds events and organizes a mentoring program. - We recently had a company wide survey called ‘ women in the workplace’ to gauge our experience as a female employee and how Air Liquide can improve. - We also have a strong number of talented and driven women in leadership positions which is extremely encouraging.

That being said, going back to the McKinsey article I referenced earlier, we are in unprecedented times and some of the most critical things that companies can do are: support employees facing burnout, eliminate the stigma around flexible work arrangements, minimize gender bias through bias training, and adapt or educate on resources available to employees.

Only 15% Of Full-Time Engineers In The Us Are Female

McKinsey states: “Even when these flexible options are available, some employees worry there may be a stigma attached to using them. To mitigate this, leaders can assure employees that their performance will be measured based on results—not when, where, or how many hours they work. Leaders can also communicate their support for workplace flexibility. Better yet, leaders can model flexibility in their own lives, which sends a message to employees that it’s OK to take advantage of flexible work options. When employees believe senior leaders are supportive of their flexibility needs, they are less likely to consider downshifting their careers or leaving the workforce.”

In my opinion, these practices not only impact gender diversity but companies that adapt this mindset and flexibility will far outperform their competition in the long run because they will attract and maintain the best talent from all backgrounds.

EC: Could you tell us about your work as Co-Director of Educational Programming at Women’s Energy Network Houston Chapter?

SK: Of course! Our work at the Women’s Energy Network also known as WEN is something I am very proud of and passionate about. WEN is an international organization with 20 chapters across the US and Mexico. We have over 6000 members. Of those 6000, ~2000 are here in Houston. Our mission is to develop unique programming that provides networking opportunities and fosters career & leadership development to women who work in the energy value chain. For the past three years I’ve led a team to organize ~20 educational luncheons per year. Our luncheons feature industry speakers that can provide

insights into energy trends, emerging strategies and technology, global energy outlook, market influencers, etc.

We have featured women like Helen Currie, Chief EconomistatConocoPhillips;LeesRodionov,Global DirectorSustainabilityatSchlumberger;RobinFielder, President,CEO&DirectoratNobleMidstream;and KimberlyWatson,PresidentofInterstatePipelines forKinderMorgan.We aim to highlight companies that are committed to diverse work forces and promotingprofessionalwomenintheenergyindustry.

EC: In your opinion, how do organizations like WEN help increase gender equality awareness andadvancement?

SK:OrganizationslikeWENincreasegenderequality awarenessandadvancementbycreatingaspace forwomentolearnandaskquestionsabouttopics they may not be exposed to in their current role. What attracted me toWENwas the caliberof the events. It is a highly intellectual group and their events provide a broad exposure to the energy industry to support the development of business acumen. I’ ve been to talks onwhat makes a good deal for a private equity firm, the business of pipelines from a midstream company, and the similarities of skill sets required fordeep sea and spaceexploration.Thesetopicsarenotnecessarily tied to industrial gases, the business I’ m in, but they helpmetobetterunderstand my customers and the markets they’re a part of.

WEN also creates a network of peers and establishes mentoring relationshipswithwomen who are more advanced in their career. These personalconnectionshelpustonavigatedifficult situationsandknowthatwehavechampionsinthe industrythatwanttohelpussucceed. Whichcanbe invaluablewhenwearemovingthroughchallenging times in ourprofessional and personal lives.

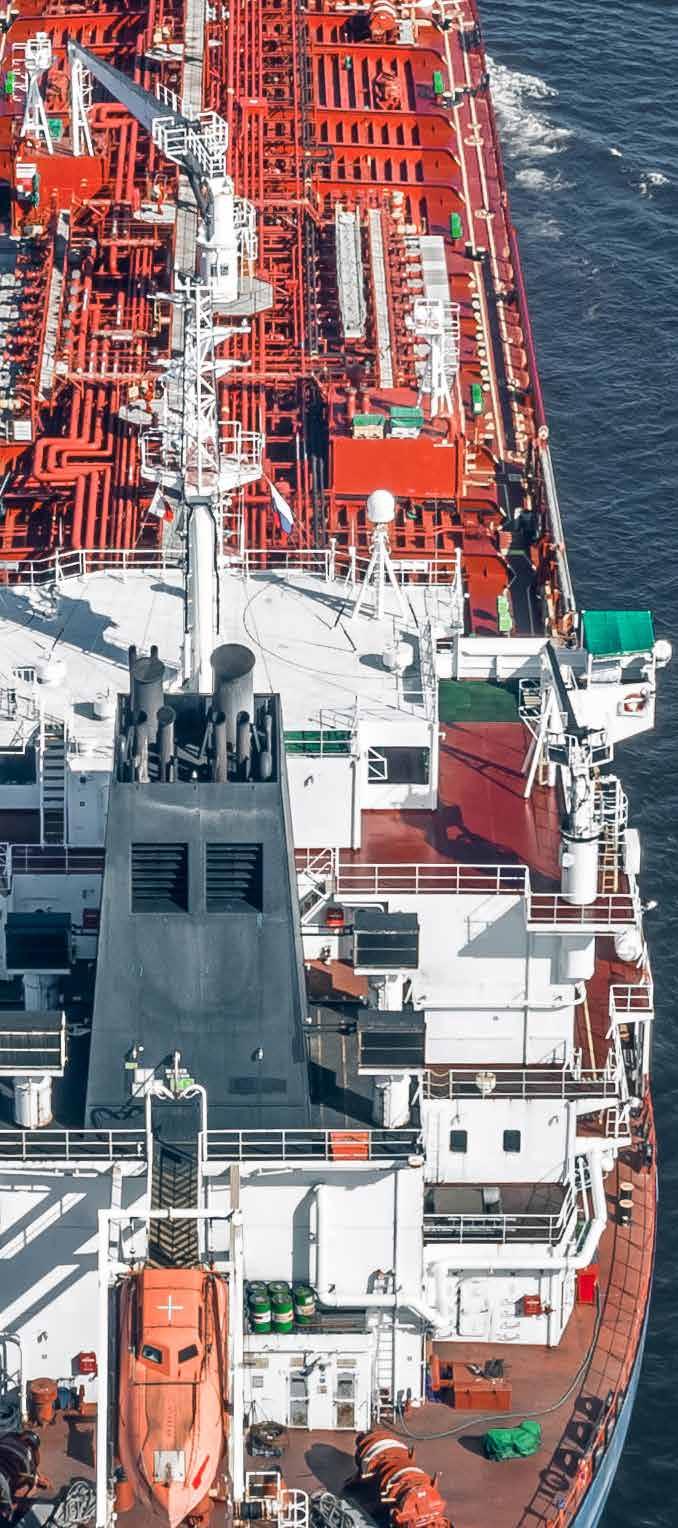

Vantage Market Research (VMR), provided a quantified research on the last quarter of 2021, regarding the expectations about the 2028’s demand for Floating Production Storage and Offloading Market; its size would reach USD 33.61 billion, exhibiting a CAGR of 6.29% during the forecast period.

By Saul Olvera

VMR considers this is attributable to the increase in deep and ultra-deep-water oil & gas production coupled with technological advancements of FPSOs over other production systems. In addition, increasing oil & gas demand, especially in the power generation and transportation sector, is expected to change the global market for floating production, storage, and offloading.

It’s known that the COVID-19 outbreak has affected various industries worldwide, which implied totally new measures, as the strict lockdown and social distancing norms in order to avoid the spread of the pandemic.

Around the world, production facilities were shut down during the initial stages of the health crisis, resulting in an economic downturn that could lead to a significant delay in the commercial deployment of floating production storage and offloading production in the upcoming years.

Nevertheless, for technology providers whose revenues have dropped since the emergence of the pandemic in 2020, things will improve in the second half of 2022 as more supplies will come online.

VMR’s overview of the Offshore Market

Offshore production currently accounts for one-third of the world's crude oil production and one-quarter of the world's gas production, playing a crucial role in the world's energy demand. Oil & gas exploration and production continue to be carried out by developed countries such as the United States, the United Kingdom, Denmark, Norway, and the Netherlands.

In their research, VMR states that in Europe, 178 exploration wells were estimated to be drilled in 2018 which was slightly more than 169 in 2017, and in 2016, 137 exploration wells were projected to be drilled. Furthermore, in 2019, CNOOC Company discovered large volumes of gas/condensate in the Central Graben Glengorm well; around 250 MMboe recoverable resources were estimated.

Thus, the increasing production and exploration activities are expected to open new opportunities for floating production storage and offloading market.

Global Energy Demands: shift for the Floating Production Storage and Offloading Market

It is important to emphasize that the emerging demand from developing economies is the main driver of the floating production, storage, and offloading market, as such energy demand is critical to economic and social development and, consequently, to the improvement of a country's economic conditions.

According to the IEA's World Energy Demand report, global energy demand was estimated to increase by 4.6% in 2021, more than offsetting the 4% contraction in 2020; it forecasts that most of the increase in electricity demand would come from China and India.

Speaking of the North American region, unlike Canada and the United States, Mexico lacks abundant coal generation, but the country's emissions intensity is higher than other countries in the region, as there are more fossil sources to produce energy.

On top of that, the current economic outlook for global GDP is expected to exceed 2019 levels, which will further increase global energy demand.

Advancements in Technologies to Support the Growth of the Market

The world is facing a context in which digital transformation is becoming a real and tangible necessity. In this regard, the oil & gas sector is embarking on the digitization of operating procedures to boost efficiency and reduce costs.

Increased integration of technologies such as big data, analytics, and IoT has led to improved efficiency. This is why it is important to look for solutions that facilitate connectivity for facilities and information monitoring, which helps to create analytical data that plays an essential role at the decision-making levels for corporate and manufacturing operations.

To VMR’s view, analytical tools and predictive analytics can be used to determine success rates, range, and also estimates of topside components. Likewise, technological advances in FSPO have helped extend the service life of many older vessels and also help measure vessel fatigue.

To wrap up this topic, VMR asserts that with the use of data technologies, companies can have data on mooring systems, hulls, processing equipment, and other components; taking into account that companies are adopting drone technologies to reduce costs, which will result in accelerated market growth.

World's prominent regions in the floating production, storage, and offloading market in 2028

The Middle East & Africa is expected to be the largest region in the global floating production, storage, and offloading market during the forecast period.

This is reinforced by the fact that 65% of the world's proven reserves are located in the Middle East. Furthermore, the region's reserves of natural gas, the energy with the highest growth potential, are also significant, accounting for 36% of the world's proven reserves.

Considering that other producing countries have fewer reserves and more mature fields, it is clear that the trend for the coming years is for the Middle East to gain market share in oil supply.

In addition to the evident increase in investments in oil and gas exploration and production and the discoveries of deep-water oil fields in the region, it is also clear that the Middle East will gain market share in oil supply in the coming years.

On the other hand, Brazil also shows significant lucrative growth in the coming years. This is due to government measures and initiatives to support the development of exploration and production operations, including energy and electricity.

According to the country's Ministry of Energy, the estimated 12 billion barrels of oil contained in the Sepia and Atapu fields are equivalent to Brazil's current proven reserves and one-eighth of the country's probable reserves, which are estimated at 100 billion barrels.

With this tender, this nation could become the fifth largest hydrocarbon producer in the world. "This auction will raise our oil reserves by about 12%, which is not little for a country that is already the seventh-largest crude oil producer in the world, and that will allow us to enter among the five largest world producers in 2030," said Brazil's Minister of Energy.

VRM estimates that, during the forecast period, due to growing energy demand from economies such as China, Japan, and India, Asia-Pacific and Europe are likely to register substantial growth in the floating production, storage, and offloading market.

In conclusion, this type of research, such as that provided by VMR, helps to put on the table some of the factors that could determine the course of the markets in the coming years, and, no doubt, to be forewarned with different action plans that can solve, to various levels, the coming challenges.

Wind Power

Eneti’s commitment with environment: Wind Turbine Installations Vessels

Eneti’s main activities are to invest in the next generation of wind turbine installation vessels. This commitment was demonstrated by the recent announcement that it entered into a binding agreement for the construction of a Wind Turbine Installation Vessel (WTIV).

By Paola Sánchez

Eneti Inc. (previously called Scorpio Bulkers Inc.), was incorporated in the Republic of the Marshall Islands on March 20, 2013. The Company’s principal executive office is in Monaco with an executive office too in New

York, NY.

In December, 2013, the Company completed its underwritten first public offering on the New York Stock Exchange, or NYSE. Following the Company’s change of name in February 2021, its common shares were listed for trading on the NYSE, under the ticker “NETI”.

Eneti’s transition to marine-based renewable energ

On August, 2020, Eneti announced its intention to transition away from the business of dry bulk commodity transportation. This to move towards marine-based renewable energy, including investing in the next generation of wind turbine installation vessels. As the name suggests, the WTIVs are

dedicated equipment for installing wind turbines. With wind farms moving further out to sea and increasing in size, WTIVs are getting larger, with a need for advanced dynamic positioning to make sure vessels stay in place in demanding conditions. Depending on the application, WTIVs can be either jack-up or floating, with weight considerations critical for jack-up vessels. As they are working in the renewable energy sector, the environmental footprint of these vessels is a key consideration with high-efficiency and low-carbon emissions. These ships should also be fully digitized, connected and highly automated to be ready for the challenge of the future. For this new strategy, the Company has exercised an option it held with Daewoo Shipbuilding and Marine Engineering for the construction of one WTIV. The contract price is $326.0 million, and the Vessel will be delivered early in the second quarter of 2025.

The Vessel is an NG-16000X design by Gusto MSC and includes a 2,600 Ton Leg Encircling Crane from Huisman Equipment B.V. of the Netherlands. This ship is capable of installing up to 20 Megawatt turbines at depths of up to 65 meters of water, and it can be adapted to work on the alternate fuels of LNG or Ammonia.

New alliances for Eneti

In the same sense, Eneti Inc. reports that Seajacks UK Limited has signed a contract with Dutch marine contractor, Van Oord. Seajacks UK is a whollyowned subsidiary of Eneti and a leading provider of installation and maintenance vessels to the offshore wind sector.

As for Van Oord, it is a Dutch family-owned company with more than 150 years of experience as an international marine contractor. Their roots go back to 1868 in the Netherlands. Its history is entwined with the country’s biggest marine engineering works, including the Nieuwe Waterweg Canal, the Delta Works, and the Port of Rotterdam Maasvlakte II expansion.

Van Oord has selected the Seajacks Scylla, the largest and most capable vessel in the

Seajacks fleet. Currently employed through 2022 in Taiwan, the vessel will move to Europe upon completion of its existing turbine installation contract with Orsted on the Greater Changhua Offshore Wind Farm.

Orsted is a renewable energy company that takes tangible action to create a world that runs entirely on green energy. They’re “fighting climate change by transforming the global energy system”, through energy solutions like offshore wind, renewable hydrogen, onshore wind, solar and storage, bioenergy and work in markets. The duration of the Van Oord contract will generate about $60 million of revenue in 2023.

Eneti’s leading perspectives

For Emanuele Lauro, CEO of Eneti, “securing this charter will bring the Scylla back from the AsiaPacific to the European market by the end of 2022”. For a large and highly capable installation vessel like Scylla, “we are seeing many opportunities in the UK and Europe in 2024 and 2025 as wind turbines increase in size and weight and are located further offshore”, he commented. In the same way, Arnoud Kuis, Managing Director, Van Oord Offshore Wind, talked bout how they are delighted with this constructive collaboration with Seajacks. “This cooperation gives us the ability to make real our growth ambitions in the offshore wind market both in, and outside, Europe”.

Additionally, Blair Ainslie, CEO of Seajacks, says “All of us here at Seajacks UK are once again thrilled to be working alongside Van Oord. The Scyllla was previously chartered by Van Oord in 2019 to install monopile and transition pieces at the Deutsche Bucht Offshore Wind Farm in Germany”. She also mentioned that they had a positive experience there, and they look forward to another safe and efficient installation project. To date, Seajacks have installed over 500 offshore wind turbines in Europe and most recently in Taiwan. Seajacks UK owns and operates a fleet of 5 GustoMSC designed vessels: Seajacks Kraken, Seajacks Leviathan, Seajacks Hydra, Seajacks Zaratan and the above-mentioned Seajacks Scylla; all capable of installing and maintaining offshore wind farms in harsh conditions.

Challenges for vessels operations

Eneti also pointed out that these forward-looking statements are based on the most updated information available to the date; as well as current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties.

“Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible

EMANUELE LAURO, CEO OF ENETI.

to predict and are beyond our control”, they said; “we cannot assure that we will achieve or accomplish these expectations, beliefs or projections”.

Among the main factors that may influence the results are their future operating or financial results; changes in demand for WTIV capacities; the strength of world economies and currencies; and the length and severity of the recent novel coronavirus (COVID-19) outbreak. Other elements to consider are the pandemic effects on demand for WTIVs and the installation of offshore wind turbines. This includes Eneti’s capacities to successfully use their existing and newbuilding vessels, and the availability and suitability of their equipment for customer projects. In legal and financial matters, this situation implies a strategy to determine a

EUROPEAN MARKET BY THE END OF 2022,

LAURO, CEO OF ENETI. ”

successful plan for achieving Jones Act Compliance and securing Jones Act vessels; and their ability to compete successfully for future chartering and newbuilding opportunities. Equally, the agreement and its activities will need to be adapted to fluctuations in interest rates and foreign exchange rates, early termination of customer contracts, the difficulties to win new contracts for the vessels or the failure of counterparts to fully perform the contracts.

Enetis commitment on sustainability

For Eneti, the concept of sustainability is not new. Their concern for the environment, for robust governance, and for social empathy are part of its history and its future.

With the disposal of their dry bulk fleet and acquisition of Seajacks International, Eneti Inc. defines itself as a “now fully engaged [company] in marine-based renewable energy”. In making this significant green shift, they’re committing to the enablement of low and zero-carbon energy systems to meet global climate goals.

For example, some of their commitments are to reduce the greenhouse gas emissions (GHG) of their fleet operations; to add ballast water management plans in all the vessels in accordance with the IMO’s Ballast Water Management Convention; and finally, the commitment for sustainable and socially responsible recycling of ships in accordance with their proper Environmental Policy and, in the future, with the Hong Kong Convention.

In order to keep up an efficient network for their activities, Eneti have offices in different countries like Monaco, New York, Houston, London, Riga, Istanbul, Athens, Dubai, Mumbai, Singapore, Manila and Vladivostok.

Midstream, Logistics and Transportation

Targa Resources Corp., overview of their financial and sustainable operations in Midstream segment.

On November 18th, Targa Resources Corp. announced that Targa NGL Pipeline Company, a wholly owned subsidiary of the company, submitted an open season, started in December 9th and closed Dec 17th.

BY: ZYANYA ELIZABETH GARCÍA

This open season was launched for test support for natural gas liquids (NGL) pipeline transportation capacity in Stephens and Grady counties, Oklahoma, to Mont Belvieu, Texas. This auction supplied the chance for shippers to secure firm capacity for NGL transportation related to the terms of their transportation service agreements. In addition, the final results in the open season resulted the final volume of capacity for committed and uncommitted service as determined by Targa.

According to Targa's website, it was recommended that interested potential shippers submitted a Non-Disclosure Agreement ("NDA") on November 23, 2021, so that the open season documents could be properly evaluated. Targa Resources Corp. is a leading provider of midstream services as one of the largest independent transport infrastructure companies in North America. This sector covers transportation, storage, and trading of crude oil, natural gas, and refined products. In its unrefined state, crude oil is transported by pipelines, ships, road and rail.

Gathering and Processing segment

The Houston firm links NGL gathering and processing infrastructure in the Permian Basin, Bakken Shale,

Barnett Shale, Eagle Ford Shale, Anadarko Basin, Arkoma Basin, onshore Louisiana and the Gulf of Mexico. Gas gathering is collecting gas from the wellhead and moving it to a processing plant or to a major transmission line. From the well, the natural gas goes into gathering pipelines. The gathering lines become larger in diameter closer to the central collecting point. This application uses either small, individual wellhead compressors or large central units handling several wells or an entire field.

The search for new supplies of natural gas and crude oil enables the company to increase production volumes. As a result, Targa obtains these extra hydrocarbon supplies by contracting production from new wells or by capturing existing production currently being gathered by others.

Natural gas processed in this segment is delivered through its gathering systems, which collectively consist of approximately 28,700 miles of natural gas pipelines. And also include 42 by their owned and operated processing plants.

Downstream Business: Logistics and Transportation

Similarly, Targa operates in the Logistics and Transportation segment, called "Downstream Business". This segment includes the activities and

assets necessary to transport and convert mixed NGLs into NGL products as well as other value-added assets and services. The Logistics and Transportation segment includes Grand Prix, as well as its interest in GCX. Downstream Business include approximately 2,100 miles of company-owned pipelines to transport mixed NGLs and specification products.

In this regard, Targa Resources Corp. is widely known in the country for its reliable and efficient operations that ensure a greater supply of hydrocarbons in the USA and the world. Its assets connect natural gas and natural gas liquids (NGLs) to domestic and international markets with growing demand for cleaner fuels and feedstocks.

Grand Prix NGL pipeline

One of its massive tools used to transport crude over long distances is the Grand Prix NGL pipeline, which connects G&P to the Mont Belvieu fracking and export volumes. This pipeline began service in 2019, moving liquids from West Texas' booming Permian Basin to the Houston area.

Grand Prix helps to relieve pipeline shortages from the Permian. Natural gas liquids include products like propane, butane and ethane, which is a major petrochemical feedstock. The NGLs are separated into their individual components at processing facilities, called fractionators, in Mont Belvieu.

This pipeline transports NGLs from the Permian Basin on a 24-inch diameter pipeline with a capacity of 410 MMBbl/d, expandable to 550 MMBbl/d. And from North Texas and Southern Oklahoma via pipeline of varying capacity, which both connect to a 30-inch diameter segment into Mont Belvieu. The final segment has a 450 MMBbl/d capacity, which is expandable to 950 MMBbl/d.

10% OF REDUCTION IN EMISSIONS OF ALL CRITERIA POLLUTANTS IN 2020: TARGA RESOURCES CORP.

Importantly, Targa has a 50% interest in Cayenne Pipeline, LLC. As such, the company owns the Cayenne Pipeline, which transports mixed NGLs from VESCO in Venice, Louisiana, to an interconnection with a thirdparty NGL pipeline in Toca, Louisiana.

Working for sustainable operations

One of Targa's major objectives is to develop midstream oil and gas operations that provide cleaner energy. To achieve this, the U.S. company publishes an annual Sustainability Report, in which it indicates its main objectives to carry out less polluting tasks. In 2020 Sustainability Report, there are three main goals of cleaner operations: 1. lowering their GHG intensity, and in particular lowering our methane intensity, and 2. reducing flaring. On this point, the results of achieving greater corporate sustainability are positive. Targa achieved an overall reduction of 10% in emissions of all criteria pollutants. Also that year, the midstream firm has achieved a 34% decrease in emission event combustion volumes and a 16% decrease in the total number of combustion incidents. This result represents its commitment to reduce polluting emissions and work towards building a better country.

Another of its goals achieved was the investment in more than 130,000 horsepower of electric compression. The result was 77% of the installed power in 2020, avoiding 263,350 Tm/year of CO2e compared to gas compression. Methane emissions are 84 times more polluting than carbon dioxide. Since 2000, Targa has been a member company of the Environmental Protection Agency (EPA) Natural Gas STAR Program, a voluntary partnership between the EPA and oil and gas companies to reduce methane emissions. As a member of this Program, the company is committed to reducing the methane intensity to 0.08% by 2025 in their boosting segment. And a reduction of methane intensity to 0.11% in their processing segment by the same year.

Financial Results

Similarly, Targa’s financial results were really satisfactory. Third quarter 2021 net income attributable to Targa Resources Corp. was $182.2 million compared to net income of $69.3 million for the third quarter of 2020. It represents a more than doubling of revenue growth for the first quarter of 2021 compared to last year.

As for its forward financial projections, TRC expects to continue to grow at satisfactory levels through growth in its midstream projects. The company now estimates that average Permian natural gas inflow volumes in 2021 will exceed the upper end of its previously disclosed 5 to 10 percent growth range with respect to average Permian natural gas inflow volumes in 2020. According to Matthew J. Mellow, Chief Executive Officer of Targa Resources Corp., the company's positioning was excellent during the first quarter of 2021. In August 2021, Mathew increased 2021 EBITDA estimate to between $1.9 billion and $2 billion. "2021 EBITDA is estimated to be 19% higher than last year, based on the midpoint of our new guidance range”, he told.

There is no doubt that the firm will continue to lead the market, not only in the United States, but also internationally, for gathering, processing, logistics and transportation in oil & gas segment. Committed to driving the energy transition, Targa Resources Corp. transports and stores cleaner energy, reducing the world’s greenhouse gas emissions.