Storage Unlocks the Hydrogen Economy CENTRICA ENERGY STORAGE+

CENTRICA ENERGY STORAGE+ STORAGE UNLOCKS THE HYDROGEN ECONOMY PRODUCTION:

2 / www.energy-focus.net

Tommy Atkinson

Embracing the challenges around net zero, Centrica –the UK’s leading vertically integrated energy business – is underway with multiple projects to deliver the hydrogen economy of the future, starting in the country’s largest industrial cluster around the Humber. Decarbonising here will be a major triumph for those involved in the energy transition. Martin Scargill, MD at Centrica Energy Storage tells Energy Focus more about progress in the northeast.

MARTIN SCARGILL MANAGING DIRECTOR

MARTIN SCARGILL MANAGING DIRECTOR

www.energy-focus.net / 3

INDUSTRY FOCUS: STORAGE INFRASTRUCTURE

Arapidly changing energy industry is moving at such a pace that many stakeholders are left behind. Consumers, companies, governments – all have faced shocks over the past five years. The energy market, and all of its sub-sectors are volatile, characterised by risk, innovation, original thinking, and uncertainty.

Against this backdrop, it’s hard to plan. For energy giant Centrica, adapting and changing in nimble fashion is no easy feat. With over 21,000 employees, more than two centuries of history, 10.3 million customers, and a vertically integrated portfolio of companies that operate across the entire value chain, keeping up with a changing market is challenging.

But Centrica has positioned itself as a pioneer. Not a follower, but a creator

of change. Intentionally doing things differently to achieve new outcomes as it embraces the net zero journey ahead.

Centrica Energy Storage (CES+) is part of the infrastructure division responsible for long duration energy storage within the group. Responsible for the reopening of the Rough gas storage facility, and operation of the Easington Gas Terminal, this vital business is busy planning for long-term energy security, that meets net zero requirements, at an affordable level.

“We have so many things going on. We have big ambitious plans,” smiles MD Martin Scargill

HYDROGEN STORE

Traditionally, CES+ (rebranded to include the + in 2023) has been a gasfocused business, and the company is now looking beyond the horizon

towards 2050 and UK Net Zero. This means hydrogen production and storage are within Scargill’s remit, and he is pushing hard for project progress. Hydrogen offers so much as an energy carrier – abundant, emission-free, powerful – and so it is an obvious choice when it comes to decarbonising at scale, especially in industrial areas like the UK’s northeast and Humber regions.

Longer-term, Scargill believes that CES+ facilities can be used as part of the emerging hydrogen economy, kickstarting major economic opportunities through hydrogen while at the same time furthering UK energy security and affordability.

“The long-term ambition is to use Rough as the UK’s largest hydrogen store,” he says. “But, at the moment, the hydrogen economy is not moving at the

The Global Shipbroker

4 / www.energy-focus.net

Brokering - Offshore and Renewables Marine Logistics Software Sale & Purchase Vessel Valuations Make Waves Tel: +44 1224 74 77 44 chartering@seabrokers.co.uk www.seabrokers.co.uk

Seabrokers Chartering is an independent shipbroking firm focused on the offshore sector, renewable energy as well as aquaculture.

pace that people thought it could. Our proposition to government is to have a hydrogen-ready redevelopment project shovel ready for this year. We have moved that into front end engineering design (FEED) this year, and that is a significant commitment from Centrica without certainty, to showcase our belief in the value of storage to the UK.”

Currently, Rough is the largest energy storage site, capable of storing 54 billion cubic feet of gas – half of total UK storage capacity. Balancing the system when demand is high, Rough was a diamond in the UK energy system for decades before closure in 2017. In 2022 the facility was reopened, before a doubling of capacity project was completed in 2023.

“We are pleased with what we have been able to do,” says Scargill adding that Rough has been very reliable,

filled to capacity last year. “For energy security and keeping bills down, we did everything we could. We filled it to the max by October, and we have been producing that gas back to the system from November. It continues to do its

Controls, Automation & Instrumentation Services

Control & Distribution Systems

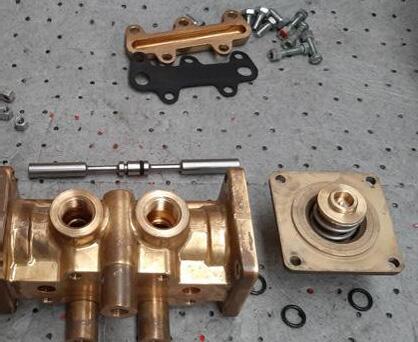

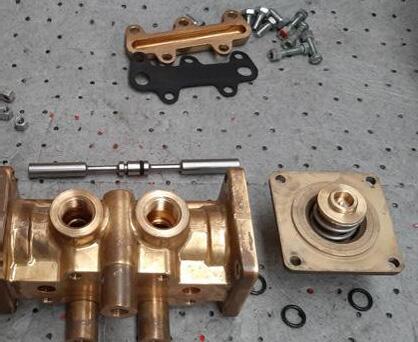

Wellhead Controls, Valve Actuation Controls, Hydraulic Power Units

Component Supply

Control Valves, Isolation & Block and Bleed Valves, Safety Relief Valves, Pressure Monitoring Equipment, Instrument & Pipe Fittings

Bespoke Engineering / Manufacturing Services

Service Support / Site Services

Control Component Repairs, Spare Parts Supply www.dycos.co.uk

job, and we set some very high targets for our teams to keep it as reliable as possible. We are very pleased with that.

“In terms of expansion, we are at the limit of what we can do with the infrastructure that we have. We

www.energy-focus.net / 5

info@dycos.co.uk Dynamic

Process Control

ENERGY STORAGE+

Control Solutions Ltd Supporting Centrica Energy Storage Ltd with

CENTRICA

INDUSTRY FOCUS: STORAGE INFRASTRUCTURE

SPECIALIST SERVICES UNDERPINNED BY TECHNOLOGY AND GLOBAL MOBILITY

OCCMS’ long standing relationship with Centrica Storage at their UK onshore Gas Processing & Storage terminal, was formed to provide Completions & Commissioning oversight and execution support services. The high-level summary of the scope requirements are as follows:

• Execution oversight of handover from principal contractor.

• Commissioning Test Procedure development and implementation.

• FAT Support.

• Plan and execute pre-commissioning and dynamic commissioning.

• Technical delivery of processes and competence assessed personnel.

• Support handover to client operations for start-up and ongoing production.

During this project, OCCMS have safely delivered commissioning and completions services for Phases 1 to 4 at our client’s UK based terminal which receives separate and condition natural gas and associated liquids from two separate offshore fields to meet the required specification before transfer of natural gas into the national transmission system (NTS). The processing facilities consisted of an inlet area/separation, onshore compression, dewpointing, filtration and fiscal metering with associated utility and auxiliary supplies.

During the initial period, various brownfield modifications were undertaken within the onshore plant and included, but not limited to, F&G system modifications which were updated to accommodate the changes within the gas plant.

Following this initial phase, additional gas compression, additional F&G, and methanol recovery and injection facilities were upgraded and or modified as part of the new Humber Gathering System (HGS) and included upgrading receiving facilities for the new Tolmount offshore field.

All construction completions and commissioning execution was controlled and managed through OCCMS’ ORBIT™ completions management system on premise with a dedicated database administrator at the clients facility.

The total onshore hours expended on life of project, including a small proportion for senior leadership oversight, are ~60,000 without a lost time incident, including during the Covid 19 pandemic. “This strong track record is demonstrable of OCCMS’ strong safety leadership & inherently positive behaviours which are prevalent throughout all levels of management and delivery teams alike” stated OCCMS’ Operations Director – Jamie Japp.

For further insights or information on how OCCMS can assist you with your Brownfield Projects, please contact us at: Aberdeen@occms.com

are looking for opportunities, but we are around 54bcf right now but we think we could get it to around 58bcf. The facility is nearly 40 years old and that is why we are looking to develop new infrastructure that can quadruple capacity at Rough. We would be delighted to sanction something this year if the economic certainty is provided.

“It’s a big platform and it’s busy. We have around 100 people there at any time,” he says of the atmosphere on site, 18 miles off the East Yorkshire coast, 20 minutes in a helicopter. “We are investing all the time in terms of extending the life of the facility. For its age, it is in really good condition, but we must keep on top of everything. We are always upgrading, replacing, and

repairing. The team is always busy.”

THE CENTRE PIECE

Planning is well underway to build new infrastructure around Rough, modernising the facility and enabling it to become a centrepiece of the hydrogen economy of the future.

Continues on page 8

6 / www.energy-focus.net

The Safe and Timely Start-Up of our Client’s Assets Specialist services underpinned by technology and global mobility occms.com o mpl

INDUSTRY FOCUS: STORAGE INFRASTRUCTURE

REWS INTEGRATED VESSEL MONITORING & COLLISION SOLUTION

Often difficult to envisage on a vast expanse of water; shipping accidents are all too common. In the past decade, the second most common cause of shipping incidents reported globally is collision (3,098). In the oil and gas industry particularly, a maritime incident can be catastrophic with detrimental environmental consequences.

The aftermath of these incidents is well documented, but there is a lesser-known theme behind the cause. Reports show that almost 96% of maritime accidents are caused by human error, with fatigue the top cited issue.

With the UK oil and gas workforce expected to decline from 120,000 to around 87,000 by 2030 (in line with production decline and decommissioning activities), significant pressure is placed on the fewer vessels and crews that are left behind. With fewer staff and crews often being placed on unfamiliar vessels, the risk of human error will likely increase.

Ultra provides an integrated collision avoidance monitoring solution, our Radar Early Warning System (REWS) directly improving maritime safety. By using multiple platform-based radar early warning systems the Ultra REWS monitors marine traffic, protecting offshore installations and avoiding maritime incidents.

REWS provides protection 24/7, 365 for one or more platforms with alarm data instantly available to operators strategically located at onshore control centres, on platform, or Emergency Response and Rescue Vessels (ERRV) that react to any incident.

ULTRA REWS:

• Proven radar early warning system (REWS)

• Round the clock monitoring, 365 days a year

• Integrated system with Radar, Automatic Identification System and CCTV for 360° surveillance

• Capable of protecting multiple assets from an onshore control centre

• VHF voice communications enables control centre operators to contact offshore assets and passing vessels

• 24/7 technical support and help line available

PROTECTING:

• Offshore assets from collision

• Subsea systems from fishing activity

• Man overboard

• 500m safety zone

• Emergency response coordination Legal obligation to have a collision risk avoidance system

• Protection around renewable and new energy platforms

This technology is a step change in marine operation safety, providing a full audit trail for incidents, near misses, and learning opportunities. Operational costs are reduced by consolidation/sharing of ERRV and Guard Vessel fleets and removing thousands of personnel risk exposure hours, with potential for multi-client control-centre monitoring for maximum cost efficiency. Simply, offshore operators cannot afford to risk devastating collisions. Ultra REWS provides real-time vessel monitoring that improves marine safety, reduces offshore risks, cuts operational costs, and allows for informed decision making in the most challenging environments.

Continued from page 6

In a nutshell, Centrica sees a system that produces hydrogen at sites onshore around Easington, transports it for use in the heavy industries of the Humber and northeast region,

before excess being pumped back offshore to Rough for storage. At the same time, storage could be developed onshore at other existing infrastructure sites, and other sectors can be connected through a pipeline network. Ultimately, these projects

will fuel decarbonisation efforts as Centrica, its customers, its supply chain as the country pursues net zero.

“The storage project at Rough is the centre piece for us in the northeast

Continues on page 10

8 / www.energy-focus.net

REWS Integrated Vessel Monitoring & Collision Solution Fully aligning with Marine Safety legal requirements Number 1 defence solution for offshore assets in the North Sea; reducing risks and costs Autonomously monitors marine traffic; protecting offshore installations and avoiding maritime incidents FIND OUT MORE Contact Phil Williams Business Development Manager E phil.williams@ultra-sss.com T 01489 557373 W www.ultra-ic.com

INDUSTRY FOCUS: STORAGE INFRASTRUCTURE

Continued from page 8

Humber region, but the challenge with hydrogen is that there is not enough being produced,” Scargill explains, “our idea being that we could have up to 1GW of hydrogen production at Easington. We could have that as green or blue or a mix, depending on how national strategy develops.”

As a concept, onshore production with offshore storage at volume makes sense in the northeast. The Humber Industrial Cluster is the

“WE

biggest CO2 emitter in the UK with two large oil refineries and an integrated steelworks operation alongside other heavy industry applications.

“In the Humber, 12 million tonnes of CO2 per year need to be removed. There is an opportunity there for us to look at building green hydrogen production capacity, perhaps later supplementing with blue. That is a 50/50 JV with our strategic partners at Equinor.”

In November 2022, the two companies signed a co-operation

agreement to develop a low-carbon hydrogen production hub at Easington, securing existing jobs, creating new jobs and developing skills while moving away from fossil fuel reliance.

“Under our rebranding as part of our future hydrogen strategy, we want to take forward hydrogen production projects for Centrica and our business unit. We are going to be submitting a number of projects into the next hydrogen allocation rounds and that is a positive development for us as we are leading Centrica’s hydrogen production and storage businesses,” says Scargill, adding that the vision goes beyond decarbonising its own operations and supports customers also navigating emission reduction journeys.

“It is needed in industry, and it is needed to keep the lights on when the wind is not blowing and

10 / www.energy-focus.net

BETTER ENERGY TOGETHER A leading asset lifecycle and engineering technology company delivering sustainable solutions. www.three60energy.com Subsurface Wells Subsea EPCC Operations Products & Solutions

ARE GOING TO BE SUBMITTING A NUMBER OF PROJECTS INTO THE NEXT HYDROGEN ALLOCATION ROUND AND THAT IS A POSITIVE DEVELOPMENT FOR US”

the sun is not shining. Our area, in the Humber, with the best geology for storing hydrogen in salt caverns or in gas fields, has everything we need. The demand, the geology, the skilled workforce, the businesses that want to invest – it’s all here.”

Currently, the company and other stakeholders are waiting for a clear investment case, with long-term certainty, to be positioned by both industry and government. While the engineering side of hydrogen production is not new, the technology required for green hydrogen is yet to be deployed at scale and so is relatively expensive while the sector develops. In the UK, the government has already opened various project avenues for those interested in building out new infrastructure. Hydrogen Allocation Rounds (HAR) promote funding

CENTRICA ENERGY STORAGE

mechanisms to support low carbon hydrogen production, and Centrica has been active within HAR1 and HAR2.

“Industry has continually requested some form of intervention from government to allow investors to be able to have sight of a return in a nascent market. There is so much upfront capital required to build these things, and then an uncertain market,” says Scargill.

The vision for hydrogen in the UK, as part of its Energy Security Strategy, is to realise 10GW of low carbon hydrogen in construction or production by 2030, with at least 50% being green.

VITAL CONNECTIONS

Before the end of this decade (as close as 2026 according to some reports) connecting pipelines will start to be developed across the

northeast to connect industrial clusters. 100km of pipes will be rolled out in what National Grid has labelled ‘Project Union’.

Eventually, 2,000km of pipeline will bring hydrogen to other sites around the country following the example from the Netherlands where hydrogen network infrastructure is set to start operating in 2027.

“We now have the hydrogen

“THE DEMAND, THE GEOLOGY, THE SKILLED WORKFORCE, THE BUSINESSES THAT WANT TO INVEST –IT’S ALL HERE”

www.energy-focus.net / 11

SAFE MINDS SOUND DECISIONS LINKING PSYCHOLOGY TO HEALTH, SAFETY AND WELLBEING We supported culture and behavioural change, and helped to significantly improve business performance at Centrica Energy Storage. tuaoptimum.co.uk

INDUSTRY FOCUS: STORAGE INFRASTRUCTURE

“HYDROGEN

STORAGE UNLOCKS THE WHOLE HYDROGEN ECONOMY AS

YOU CAN THEN BALANCE

SUPPLY AND DEMAND FLUCTUATIONS BETWEEN PRODUCERS AND OFF TAKERS, ULTIMATELY MAKING THE SYSTEM CHEAPER”

production business in with the storage business and we want to build a leading UK hydrogen production, storage, distribution hub in the Humber to help decarbonise industry while storing hydrogen for use when required. The modern system requires flexible, dispatchable, low carbon power and that is the way we will have the system balanced in the future,” details Scargill.

“We have big storage at Rough, and we are certain that it will eventually play an important role in the UK, and we think we could even access export markets. In the short term,

the government have been pushing ahead with the hydrogen storage business model for smaller sites. We have fantastic salt strata – the best in the country – in East Yorkshire, and that is where the government is initially comfortable supporting projects around hydrogen storage. Hydrogen storage unlocks the whole hydrogen economy as you can then balance supply and demand fluctuations between producers and off takers, ultimately making the system cheaper.”

Scargill, an engineer by training and seasoned business leader, is confident that the first UK hydrogen

Leading Energy Transformation.

- supporting CES+ and the UK transition to clean energy.

the wells expertise to deliver a sustainable Carbon Zero future The world’s largest independent well and reservoir management company, providing a uniquely integrated service trusted by leading operators and suppliers across the globe.

ecosystem will emerge from the Humber and a system could be running by as early as the end of the decade.

GREEN INVESTMENTS

Across the wider Centrica business, so much is happening as the company looks to provide security of supply, at an affordable rate, in line with environmental expectations and net zero goals. The group developed a People & Planet Plan which looks to support customers at all times while promoting sustainability.

“We are now investing £600-800 million per year over the next five years

12 / www.energy-focus.net

Discover more at www.xcd.com

EXCEED

Providing

CENTRICA ENERGY STORAGE+

© SGS Société Générale de Surveillance SA. (2024) SGS24-715

Valve Management

Trusted valve maintenance from a leading provider

With technical expertise across more than 400 different valve manufacturers gained over more than 125 years we can supply refurbishment, certification and overhaul for all your valve needs giving a cost effective and reliable service to our customers.

CONTACT US: 0151 350 6666 ukenquiries@sgs.com sgs.com

on energy transition infrastructure,” highlights Scargill, speaking of the group’s green-focused investment plan, launched in 2023. “We want to invest in the UK and Ireland, we want to invest in energy security, and we want to invest in low carbon assets that keep the lights on and bills down.”

Success here does not come through one single project but an integrated approach including customers and suppliers. “Energy transition is a huge task,” he admits.

“There are so many things being worked on at the same time. Developing the business models and

bringing things forward takes a long time. We have voiced our opinion that things might not be ambitious enough at times. We must decide where to spend money – every penny counts, and we get that we must show value for money. When the Department for Energy Security and Net Zero takes all these schemes to Treasury, there is understandably a discussion about affordability and value for money, and that is where the speed of deployment is determined. We’re confident that our projects will unlock clean growth and inward investment that is good news for the regional and national economy.”

Alongside the focus on natural gas and hydrogen, the company is also actively engaged with partners around CCS to ensure emissions that continue will eventually find a safe forever home deep underground.

Industry commentators mostly agree that, alongside renewable energy and hydrogen, CCS is essential in a net zero strategy for the Humer Industrial Cluster.

“Centrica majority owns Spirit Energy and through that we have a facility in Morecombe Bay where we can store a billion tonnes of CO2 and we have a license for that,” says

“WE WANT TO INVEST IN THE UK AND IRELAND, WE WANT TO INVEST IN ENERGY SECURITY, AND WE WANT TO INVEST IN LOW CARBON ASSETS THAT KEEP THE LIGHTS ON AND THE BILLS DOWN”

www.energy-focus.net / 13

INDUSTRY FOCUS: STORAGE INFRASTRUCTURE

Scargill. “We are pursuing that project, and we will be looking keenly at the expansion process for projects in the Humber region to see when the Humber gets a connection to a CO2 store as that will allow all of the emitter projects to connect into the system and reduce emissions.”

Many modern systems, including hydrogen and CCS, are being developed to be less labour intensive and cheaper to maintain. This means engineering complexity out of

machinery and moving infrastructure onshore where possible. Rough is an example – a facility built to be manned, more than 40 years ago. In the future, Centrica and others will look to have smaller, simplified systems in place, easily controllable from a central location, and with minimal scheduled maintenance.

“This will mean offshore can be unmanned and will just be pipes,” says Scargill who worked offshore earlier in his career. “People only

“ULTIMATELY THAT WILL REDUCE BILLS FOR PEOPLE. DECARBONISING THE UK’S LARGEST INDUSTRIAL CLUSTER IS ALSO OUR TASK AND WE ARE LOOKING AT HYDROGEN PRODUCTION AND STORAGE IN THE LONG-TERM”

need to go offshore for intervention campaigns on short day trips. Ultimately it would create more jobs as we maintain the onshore equipment as the industry grows.”

IN A GOOD PLACE

With so much happening, now is an extremely exciting time. For CES+ and the wider group, there is a missiondriven culture which is deep-rooted, and the solutions being developed internally will have a big impact on the net zero journey. With more than profits on the line, the company has an all-important mandate and is making strong progress.

“We’re in a good place and we have turned the business around,” says Scargill who joined Centrica in 2007. “We were almost entirely focused on the downstream market

14 / www.energy-focus.net

but our new Chief Executive has changed our strategy to realign with the energy transition and maintain a degree of vertical integration between various market segments. Through the energy crisis, we saw the successful companies were those that had assets to back their positions.”

“WE NEED A BALANCE OF TECHNOLOGIES TO GET THIS RIGHT AND THAT IS WHY WE ARE INFLUENCING WHEREVER WE CAN TO DRIVE THE INDUSTRY”

Right now, CES+ is nimble and flexible, and this is encouraging and motivating for the industry, and for customers. The Centrica group is ambitious and healthy, and this makes for a real force when it comes to navigating challenges – certainly not a business being left behind.

“We have the best long duration energy store in the UK and our challenge is to grow its capacity, and that is our primary focus,” says Scargill. “Ultimately that will reduce bills for people. decarbonising the UK’s largest industrial cluster is also our task and we are looking at Hydrogen production and storage in the long-term. In the meantime, while that market develops, we can provide energy security by having more storage on the system.

We are importing more energy

than ever – 40% last year. And we need to embrace long duration energy storage for security of supply and price. As we move further in the energy transition, we need to keep the lights on and balance the grid, and that is not a challenge we have faced in the past. There is certainly a bright future for our assets as we play our part in Energising a Greener, Fairer Future, but we need more than Rough for the UK. We need a balance of technologies to get this right and that is why we are influencing wherever we can to drive the industry,” he concludes.

www.energy-focus.net / 15

Expert Well Examination Well Integrity Verification Engineering Consultancy info@cdint.co.uk | 01224 636420 WWW.CENTRICA.COM

ENERGY STORAGE+

CENTRICA

Published by CMB Media Group Chris Bolderstone – General Manager E. chris@cmb-media.co.uk Kiln House, Fuel Studios, Pottergate, Norwich NR2 1DX T. +44 20 3097 1743 www.cmb-media.co.uk

real persons, living

dead

effort

ensure the accuracy of the information contained within this magazine, no legal responsibility will be accepted by the publishers for loss arising from use of information published. All rights reserved. No part of this publication may be reproduced or stored in a retrievable system or transmitted in any form or by any means without the prior written consent of the publisher. © CMB Media Group Ltd 2024 AS FEATURED IN ENERGY FOCUS MAY 2024 Worley Centrica Energy Storage+ / Alabama Shipyard / Heathrow Airport Integrated Solutions for the Hydrogen Revolution ALSO IN THIS ISSUE: Exclusive Interview with NEUMAN & ESSER Managing Partner Alexander Peters, together with Managing Director Jens Wulff

CMB Media Group does not accept responsibility for omissions or errors. The points of view expressed in articles by attributing writers and/ or in advertisements included in this magazine do not necessarily represent those of the publisher. Any resemblance to

or

is purely coincidental. Whilst every

is made to

MARTIN SCARGILL MANAGING DIRECTOR

MARTIN SCARGILL MANAGING DIRECTOR