We’re the go-to IDNO because we make everything easier.

Eclipse Power is all about making electricity connections simpler.

When you talk to Eclipse Power, you’re talking to a team of friendly experts who offer class-leading support to developers, ICPs and consultants.

From initial design to energising and managing the network, you can count on us to guide you through the entire process.

Which means you can always rely on us to come up with innovative and flexible solutions – all based on an in-depth understanding of industry regulations and technical standards.

Better still, you always deal with the same individuals so that the service you get is personal. Make it easy on yourself. Talk to Eclipse.

EDITOR Joe Forshaw

joe@energy-focus.net

PROJECT MANAGER Tommy Atkinson

tommy@energy-focus.net

PROJECT MANAGER David Hill

david@energy-focus.net

PROJECT MANAGER Chris Bolderstone

chris@energy-focus.net

PROJECT MANAGER Terry Hanley

terry@energy-focus.net

PROJECT MANAGER Ekwa Bikaka

ekwa@energy-focus.net

FINANCE MANAGER Isabel Murphy

isabel@energy-focus.net

LEAD DESIGNER Aaron Protheroe

aaron@energy-focus.net

CONTRIBUTOR Manelesi Dumasi

CONTRIBUTOR Karl Pietersen

CONTRIBUTOR David Napier

CONTRIBUTOR Timothy Reeder

CONTRIBUTOR Benjamin Southwold

CONTRIBUTOR William Denstone

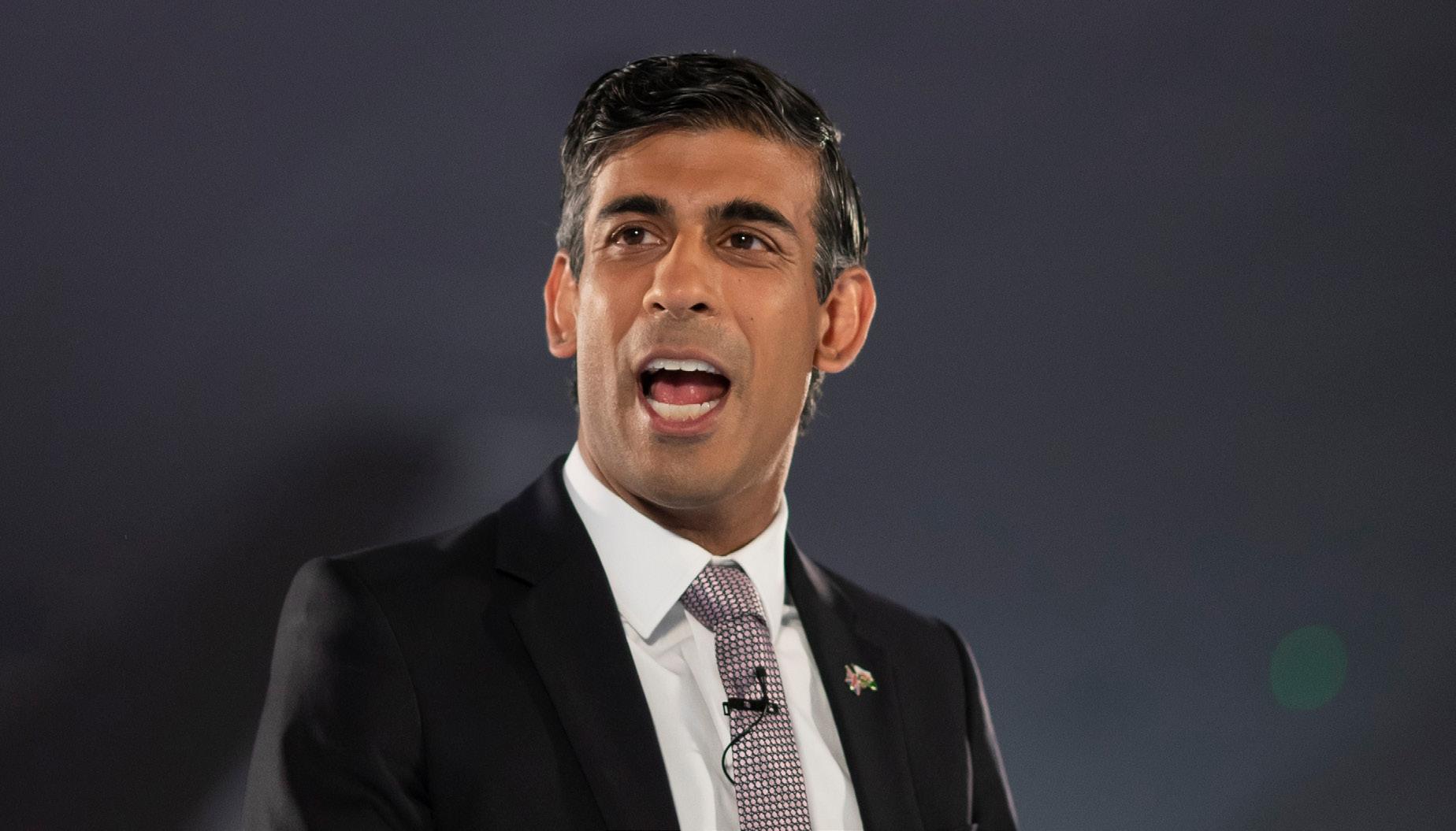

May is exciting as Innovation Zero takes London by storm. The clean climate tech conference and exhibition gets underway at London Olympia on May 24 and, endorsed by Prime Minister Rishi Sunak and chaired by Rt Hon Dr Liam Fox MP, the event will bring some of the world’s greatest minds together to advance and develop clean technology ideas.

Free-to-attend the access-all-areas international cleantech congress will host 7,000 policymakers, innovators, funders, and leaders from the public and private sector to gain the knowledge and tools needed to take action and make a difference at a crucial time in the fight against climate disaster.

The clean energy theme continues away from Innovation Zero, and is exacerbated by news that it is all-but-confirmed that we are likely to miss 1.5°C global temperature warming targets as meaningful change in CO2 emissions is yet to be achieved.

At Sonnedix, a global renewable energy producer, heavy expansion in Europe –particularly Spain - is ongoing as the company looks to build on the significant presence it has built globally. Working hard to build solar installations that make real difference in the communities where they sit, the company is on a strong growth trajectory.

For Ferroglobe, the leading metallurgical products business, a fresh focus on sustainability and innovation as part of a transformation journey is helping the business to achieve record financial results. After a wide-ranging review of existing operations, the company has developed a strategy based on technology and ESG principles which will take it forward over the next five years.

BMO Capital Markets in Canada is a financial institution taking the climate transition seriously, offering investment opportunities in companies and industries that are active in change and driving down emissions with each year. Promoting a just and balanced transition, the bank has become a leading partner in acquisition and divestiture activities.

In the USA, Phoenix Tailings has drawn a line in the sand and is using new technology to effectively process mining waste to generate exciting new rare earth metals, used in many transitional technology including electric vehicles and batteries.

Published by

Chris Bolderstone – General Manager E. chris@cmb-multimedia.co.uk

Fuel Studios, Kiln House, Pottergate, Norwich NR2 1DX

+44 (0) 1603 855 161 www.cmb-media.co.uk

CMB Media Group does not accept responsibility for omissions or errors. The points of view expressed in articles by attributing writers and/or in advertisements included in this magazine do not necessarily represent those of the publisher. Whilst every effort is made to ensure the accuracy of the information contained within this magazine, no legal responsibility will be accepted by the publishers for loss arising from use of information published. All rights reserved. No part of this publication may be reproduced or stored in a retrievable system or transmitted in any form or by any means without the prior written consent of the publisher.

© CMB Media Group Ltd 2023

Clearly, those that see opportunities instead of challenges, and choose optimism over pessimism are those that will reap the rewards that are clearly available in this exciting time.

Get in touch and let us know how you are changing, transitioning, and inventing in the energy space to ensure long-term sustainability. We’re on LinkedIn.

32 38 44 54

PHOENIX TAILINGS Engineering Innovation to Meet Demand with Domestic Supply

EQUITIX

Sustainable Financial Force Fuelling Transition

BMO CAPITAL MARKETS

Powering Canada’s Balanced Energy Transition

INNOVATION ZERO Opportunity and New Chances to Grow from London

32

Now is the time to take a stand – or a rowing seat – and make a difference in the fight against ocean degradation and pollution. A team of three ambitious athletes are set to leave nothing on the water as they row more than 2800 miles unaided across the Pacific Ocean to raise funds and awareness for the Ocean Cleanup. Team HODL member Luca Feser tells Energy Focus more about this epic sustainability exercise.

PRODUCTION: Sam Hendricks

PRODUCTION: Sam Hendricks

Often overlooked, the oceans cover almost 75% of the earth’s surface. They are part of the lifeblood of this planet, fiercely connected and ferociously energetic, but like the other key nature nurturers, they are being forgotten. Absorbing carbon, oxygenating the air, regulating temperature, providing food and economic opportunity, and home to significant life – the water is powerful.

However, its vastness gives an aura of indestructibility. The immenseness of the oceans dilute problems and challenges, and the results is less than 8% being protected in any form.

Support is growing for ocean conservation work, and new ideas and technologies are being developed quickly as the battle to protect marine life and ocean ecosystems intensifies. Over land, the decarbonising of various industries is underway – especially in the automotive and power generation spaces – to help clean our air. Now, the defence of the world’s water is coming to the fore as an equally essential challenge. Driving political, industrial, commercial, and public attitude-change is the first challenge.

The weight of the problem is heavy – and growing each week. The

major threat? Plastic waste. Right now, human activity results in large amounts of plastic waste ending up in rivers and floating into seas. The rubbish breaks down slowly, cracking, separating, fracturing into smaller pieces. After some years in circulation, small plastic pieces are moved on the tides to concentrated areas of the ocean. In the pacific, this area is known as the Great Pacific Garbage Patch – an enormous site that traverses the curvature of the earth and is estimated to be three times the size of France. The problem is mind boggling in scope and scale, and will take tidal ambition to address.

The Ocean Cleanup, a global non-profit organisation founded by Dutch investor Boyan Slat, is leading the conversation, aiming to rid the world’s oceans of plastic. “Our aim is to put ourselves out of business once the oceans are clean,” is the organisations mantra as is seeks to ‘turn off the tap and mop the floor’ at the same time.

Raising awareness and funding for this noble and essential cause, three young changemakers are undertaking the challenge of a lifetime, pitting their physicality, mental strength,

emotional intelligence, and desire for revolution alongside Mother Naure in a race across the Pacific Ocean, rowing past the garbage patch.

Luca Feser, Cutu Serruys, and Matt Siely will live aboard a Rannoch R45 - a specially designed fibreglass vessel, just 8.64m in length - as they try to cross from Monterey, California to Nawiliwili Harbour in Hawaii – a 2800-mile journey with no support, and only six oars to power each push.

To add extra flavour, the group will compete against other teams as part of the World’s Toughest Row challenge – and aim to break a world record for a trio crossing the stretch. To date, just 82 people have successfully rowed from mainland USA to a Hawaiian island – more than 600 people have travelled into space.

Under the flag of Team HODL (Hold On For Dear Life), preparations are complete, training is done, the boat is primed. From June 12, the ocean (and the plastic) is the horizon.

“An incredible atmosphere of apprehension and excitement is guaranteed during the pre-race period as teams complete their final preparations to set off to row across the Pacific Ocean. A finish line as unique as

that person must first eat, then clean themselves, wash their clothing and conduct any boat repairs. In reality, that means we’ll get 60 mins of sleep. These are potential risks and variables partially in our control,” acknowledges Feser. “However, there are factors which we cannot control. For example, famously there has been an increase in marlin attacks, where marlins use their spear-liked bill to pierce boats. Storms are also a major challenge. Our boat will most likely be capsized multiple times during our crossing because of the size of waves.”

But crashing over the crest of a wave, tumbling and bumping around in battering rain, and keeping an eye open for sharks, whales, and marlins is punishment worth taking for the longer-term goal. Standing in front of a crowd at a farewell event in May, Feser eloquently dived deeper into the plastic problem.

Nawiliwili Bay on the stunning island of Kauai is hard to beat as the backdrop to what will be the most incredible, once in a lifetime adventure,” smiles Feser, telling Energy Focus more about the unique and exhilarating journey.

“The exact route we are taking will go through The Great Pacific Garbage Patch. This is the collection of marine debris in the North Pacific Ocean,” he details. “Marine debris is litter that ends up in the ocean, seas, and other large bodies of water. For many people, the idea of a ‘garbage patch’ conjures up images of an island of trash floating on the ocean. In reality, these patches are almost entirely made up of tiny bits of plastic, called micro plastics. Microplastics can’t always be seen by the naked eye. Even satellite imagery doesn’t show a giant patch of garbage. The microplastics of the Great Pacific Garbage Patch can simply make the water look like a cloudy soup. This soup is intermixed with larger items, such as fishing gear and shoes.”

The deepest ocean in the world, and volatile in weather and climate, the row will be unpredictable and dangerous. The average time to cross by row teams is 62 days, but this is largely dictated by nature – and luck. With wind and strong currents, the team could get off to a strong start, but in storms or high waves, progress will quickly slow.

“Concerns come in all shape and sizes,” admits Feser. “Individual concerns will mainly come from lack of sleep and nutrition. On average, each rower will consume 5,500 calories per day. This amount of food becomes difficult to consume on an ongoing basis. Further, being in a constant state of stress, the lack of sleep, and the duration of sleep becomes a major challenging factor when making good decisions.”

Rowing three hours on, 90 minutes off, the physical challenge is colossal. The trio – Feser and Siely CrossFit experts, and Serruys a rugby player – are strong, but harnessing mental muscle is an essential component on the lonely sea.

“Within the 90 min rest period,

“One million seabirds and 100,000 marine mammals are affected every year, as well as many other species. For example, turtles often mistake plastic bags for prey such as jellyfish. Abandoned fishing lines, fishing nets and equipment can ensnare and drown dolphins, porpoises, and whales,” he highlighted.

“These examples may not always be close to home for people in the UK, but through a process called bioaccumulation, chemicals in plastics will enter the body of the animal feeding on the plastic and as the feeder becomes prey, the chemicals will pass to the predator – making their way up the food web that includes humans; in the long run, affecting our consumption of seafood and fish. Not only diet, but ocean plastic pollution greatly affects our economy. According to a study conducted in collaboration with Deloitte, yearly economic costs due to marine plastic are estimated to be between US$6-19 bn. The costs stem from its impact on tourism, fisheries, aquaculture, and (governmental) clean-ups. These costs do not include the impact on human health and the

marine ecosystem (due to insufficient research available). This means that intercepting plastic in rivers is much more cost-effective than dealing with the consequences downstream.”

Complimented for his public speaking ability, there is a reminder that when you’re passionate about something, you don’t have to remember your lines. There is no financial reward for completing this challenge – the only prize is increasing awareness and donations around a critical issue.

Helping to power Team HODL is a set of sponsors aligned with the sustainability theme of the entire project. Alongside an intensive training programme, PR responsibilities (including an appearance on Sky News, meeting Sir Steve Redgrave), and day jobs, the group has been required to source partnerships and sponsors to help drive the challenge, but ensuring a fundamental shared value around sustainability.

“We have two types of partners,”

Feser explains. “Those that financially support us and others who provide resources. Having a mixture of the two, has allowed the journey to go ahead. For example, ON supply our crew with training gear, while SunGod - a performance glasses and goggles Certified B Corp™ – supplied the crew with eyewear alongside supporting the sustainable cause. We’ve been very fortunate to have global partners, especially, our lead sponsor, eEnergy. eEnergy is a public company that is empowering organisations to achieve net zero by tackling energy waste and transitioning to clean energy, without the need for upfront investment. eEnergy is a leader in the sustainability and this is important to the HODL team.”

Asked if projects like this – smaller in nature compared the global problem – can have a truly meaningful impact and create lasting solutions, the team is in no doubt. “Simply, yes.”

Feser emphasises reasons beyond financial inflows as significant on this journey.

“Smaller sporting projects like

running a marathon can raise small donations and collectively they make a big change for charities. But our adventure is not just about raising money for the charity, it’s to gather data for them. The microplastics in the water cannot always be seen from satellites and therefore, we are able to get up-close footage. We hope to share this with the world and visually show the issue of ocean plastic.”

With 80,000 tonnes of plastic in the Garbage Patch, there is a lot of work to do. The Ocean Cleanup aims to remove 90% of floating ocean plastic by 2040 and money and awareness raised from undertakings like that of Team HODL are vital in generating ongoing support.

This is a daring test of bravery and endurance, and it will be treacherous. Less than 10% of the Pacific Ocean is explored or mapped, only 35% of US coastal waters mapped with modern methods. Is the team looking beyond the horizon to another international adventure? “One ocean at a time,” Feser smiles.

Ponticelli UK is busy growing its presence in the vital UK Continental Shelf energy space. With construction, engineering, and maintenance capabilities that allow for industrial processes to succeed, this is a business that guarantees safety and performance. UK MD, Olivier Renaud explains more about their fantastic growth story so far.

Activity on the UK Continental Shelf, in the cold and deep waters that surround the island, is changing. With the country still largely powered by natural gas and oil, reserves are prized and precious but becoming more elusive. At the same time, the energy transition is gathering momentum with significant investment being made to secure the UK’s position within the developing renewables marketplace. It’s a complicated environment and challenging when

planning longer-term strategies.

The skills required to grow in this changing energy marketplace are extensive. Engineering, construction, and maintenance will remain key to successful and sustainable energy production. Drawing on decades of expertise enabling change across the energy sector, Ponticelli UK is fully committed to leading the energy transition and supporting businesses to develop innovative energy projects.

Part of the global Ponticelli Group,

family-owned and headquartered in France, Ponticelli UK represents the regional arm of this multinational organisation, with operating turnover of €1bn in 2022.

“We established our UK operations in 2019, leading Aberdeen-based consortium PBS by Ponticelli, alongside Brand Energy & infrastructure Services and Semco Maritime. February 2020 saw the award of a five-year General Maintenance and Operating Contract to PBS by TotalEnergies E&P

Olivier Renaud, Managing Director

Olivier Renaud, Managing Director

UK,” explains MD Olivier Renaud.

Renaud, moved with his family from France to Scotland after 18 years with the company managing projects cross Africa, responsible for project Zinia in Angola.

He details more about a key job where PBS by Ponticelli’s service portfolio has proved invaluable.

“We recently completed a specific project to change a compressor where we engineered the internal mechanism to change the process of exporting gas.

“This project was completed at the Shetland Gas Plant (SGP), operated by TotalEnergies, where the PBS by Ponticelli consortium successfully executed a £5m+ engineering, procurement, and construction project to allow the plant’s operating mode to be switched from High-Pressure to Low-Pressure.”

“All Ponticelli Freres Group operations are fully aligned in terms of corporate strategy, and whilst Ponticelli UK welcomes uncompromising expertise and competencies from the Group’s global headquarters in France, it enjoys the autonomy to make its own decisions based on local market forces and requirements in line with the energy transition. If we identify opportunities that bring value to the Group then there is no reason we cannot pursue them,” says Renaud.

“Expansion beyond oil and gas will likely come in the booming UK offshore wind energy sector, where turbines are being erected weekly and feeding into the grid as part of a renewable and green policy which hopes to produce 50GW by 2030. With multiple construction and

engineering projects underway, this is an attractive market for Ponticelli UK.

“In the floating offshore wind sector, we plan to be involved in construction and this is a very similar skillset to that which we already offer in terms of engineering and construction. Whilst there are some differences in maintenance requirements in the wind industry, we are members of the ECITB (Engineering Construction Industry Training Board), which helps us to stay abreast of the necessary competencies as we transfer our skills from oil and gas,” says Renaud.

“We are targeting offshore wind projects, bringing Ponticelli Freres Group experience in offshore wind farm pilot schemes to the UK. We will draw on the knowledge gained from

Continues on page 14

Continued from page 12

these pilots in a bid to support the ScotWind and INTOG projects. There is also the potential to electrify oil and gas utilising offshore wind, and we are in conversation with several parties about developing hydrogen infrastructure.”

These are part of Ponticelli Freres Group’s global strategy to ensure the relevance of the business in emerging industry sectors,

adapting as the company has done, through its more than one century of successful operation.

“Our strategy will continue to shift in line with changing environmental priorities,” confirms Renaud. “We are already preparing for these developments, putting our people first by ensuring they are Connected Competence compliant. Connected Competence commands a base level of technical competence assurance and aims to recognise skills transfer which will support a resilient, transferable workforce and aid the energy transition.”

According to some reports, North Sea oil and gas production might only have 10-15 years left before pressure from climate targets and environmental activism becomes too much. But

even after this point, engineering and maintenance will be ongoing, and subsequent decommissioning will open up a new market for Ponticelli UK (with experts suggesting 600 installations will be decommissioned in the North Sea over the next four decades). There is also the reengineering process – turning platforms into carbon capture, utilisation and storage (CCUS) stations – where the company’s vast skillset will prove invaluable.

“Repurposing assets is a new concept within the industry. We are seeing this in the Netherlands and Denmark, using old platforms to inject carbon into disused wells and we expect to see more of this in the UK.

“We remain positive and expect growth in both oil and gas and renewables within the UK market,” states Renaud.

// WE REMAIN POSITIVE AND EXPECT GROWTH IN BOTH O&G AND RENEWABLES WITHIN THE UK MARKET //

The family ownership of the business allows for longer-term thinking and means the business can look beyond profits for the next quarter.

Ponticelli Freres Group is an evolving brand and continuing their move into the renewable energy space is only logical over the coming decades.

“Our vision is much more longterm,” Renaud highlights. “In 2021, we celebrated our 100-year anniversary. The family of the founders that sit on the Board today talk about wanting their grandchildren to be involved in the company in the future, not about wanting a certain profit forecast for the end of Q1. Of course, we have financial targets to be sustainable, but we hold a longer-view on strategy compared to a shareholder-driven organisation.

“We are committed to being around 100 years from now,” he reinforces. “The long-term strategy - already underway - will see continued global investments to support change in the world.”

Like most organisations active on the UKCS, and in the industries served by Ponticelli UK, sustainability is only outweighed as a long-term goal by safety. At Group level, Ponticelli is proud of its safety record and has created a culture where safe operations are non-negotiable and ‘zero harm’ is the focus of all daily operations.

“Safety, People, Wisdom, Performance, and Integrity are long-standing principles of the company, still held today. These are the foundations upon which our success is built,” says Renaud.

“Safety is good business,” he emphasises. “Safety is an integral part of the Group’s DNA and Ponticelli UK is committed in the pursuit of a zero-accident working environment to ensure that our workforce thinks safe, works safe, and stays safe. Our dynamic safety culture lends itself to operational excellence and the retention of our talented workforce.”

Their focus on safe working

conditions was swiftly and dramatically tested following the onset of Covid-19, just three months after the company was established in Aberdeen. Renaud was forced to adjust quickly and manage his new team in a completely new way. Digital meetings and communication, and effective protection of people on and offshore was quickly delivered thanks to the company’s already robust safety policies.

“We support energy transition and also recognise the prevailing need for oil and gas for years to come. We still need gas to heat homes and fuel to drive cars until there is a complete change, and we’re not there yet. We will not stop working in oil and gas and focus only on renewables. Of course, we want to be efficient and sustainable, but for as long as there is production on the UKCS we are here to

support our customers,” says Renaud. Even with the long-term changing nature of the UKCS and the constant review of North Sea strategy, there will be construction, engineering, and maintenance projects, and the UK’s onshore facilities will require overhaul, renovation, and preservation. Here, Ponticelli has always been one of the best. Renaud is confident that Ponticelli’s plans will safeguard a sustainable long-term future for its employees, clients and partners.

“There are of course difficulties, but we are looking forward with positivity. We are investing in business development, and we believe in the market,” he concludes.

PRODUCTION: Tommy Atkinson

A new strategy has been carefully implemented at international metallurgy business Ferroglobe as it aims to increase profit and ESG goals while becoming the reference for safe, secure, and efficient operations across the industry. CEO Marco Levi talks to Energy Focus about the company’s significant progress in recent years.

Marco Levi, CEO

Marco Levi, CEO

//The mineral products world is changing alongside the global energy transition. What we mine, how we do it, how we process, and where it goes has been a tried and tested route for decades. But the journey is changing as the international community looks to the future. Global mineral demand is likely to undergo significant changes as countries and businesses work to achieve climate targets. In general, the shift towards a low-carbon economy is likely to result in a more diverse and complex mineral demand landscape. Minerals that are expected to see increased demand include those that are used in renewable energy technologies such as the production of electric vehicles, wind turbines, and solar panels. Here, Ferroglobe is an industry leader, with an international presence and a supreme product range.

Nasdaq-listed, with a workforce of

around 3,500 employees spread over more than 25 sites, and production centres and mines located in Spain, France, Norway, Canada, the United States, Argentina, South Africa, and China, Ferroglobe’s product range includes silicon metal and ferroalloys based on silicon and manganese. Vital in consumer and industrial applications and supporting the sustainable advancement of society, these metallurgical products are carefully created utilising the company’s more than 100 years’ experience. But it hasn’t been easy, and there have been challenges, hurdles, changes, and adjustments to bring the company to its position today as an industry leader.

In 2019, the company posted -$29 million Adjusted EBITDA. This was a problem for all stakeholders and a

transformation plan was put in place that embraced future aspirations, setting the company on a solid footing.

“In 2020, we embarked on an ambitious strategic transformation plan known as the Value Creation Program, aimed at achieving three main objectives: regaining global competitiveness and efficiency; ensuring long-term sustainable profitability; and strengthening trust with all its stakeholders,” explains Marco Levi, CEO Ferroglobe.

The turnaround plan covered all the functional areas of the company, targeting operations, commercial, procurement, supply chain, and working capital. The creation of a single strategic objective - to become the reference in silicon metal and ferroalloys by innovating and creating value to all our stakeholders - has helped this large corporate pull in a single direction.

• Energy saving

• Reliability

• Safety

www.cometva.com

After three years, significant progress has been made and the company is well positioned to drive the multiple critical industries it serves.

In 2022, financial results were presented by a jubilant CEO, Dr Marco Levi, who said: “The prospects for Ferroglobe have never been stronger. We have optimised the cost structure of the company to enable us to outperform throughout the cycle. In addition, we are well positioned to capitalize on several trends taking place in the market that will drive growth in the coming years.”

Posting revenue of $2.6 billion – the best in the company’s centurylong history - and +$860 million Adjusted EBITDA have helped the business to retake control of the market and poise for future growth.

Success in financial results,

high-quality products, first-class standards around health and safety across operations, strong focus on environmental impact, and positive contributions in the communities in which it is active shows that the strategy is working.

“These efforts make Ferroglobe a value-creating company that strives to generate sustainable profit and add value to all our stakeholders, positioning us closer to becoming the global reference in silicon metal

and ferroalloys,” says Marco Levi. “Together, with everyone’s support, we have made great progress in building the new Ferroglobe and the 2022 financial results show that we are moving in the right direction.”

The aim of the transformation plan was for Ferroglobe to address competitiveness and efficiency issues. “After three years of transformation, we have shown that our strategic plan works,” says Levi. She highlights the creation

The brand for your tailor-made genuine forged copper equipments:

LEADER IN FORGEDCOPPER

SOLUTIONS TO CONTRIBUTE TO OUR CUSTOMERS SUSTAINABLE FOOTPRINT

// ALTHOUGH WE FIND OURSELVES IN A CHALLENGING GLOBAL CONTEXT, OUR STRATEGY IS MEETING OUR FINANCIAL TARGETS, POSITIONING FERROGLOBE IN A STRONG FINANCIAL POSITION TO KEEP GROWING. //

of a sustainable and clearly understood culture as a key element in the company’s strategy.

In 2015, Ferroglobe became the business we know today through a merger between Grupo FerroAtlantica and Globe Speciality Metals. A major global corporate was the end result, headquartered from London and Madrid. Ensuring a thriving company culture came out of the merger was difficult, but it was achieved, and this allowed for the implementation of the strategic plan underway now.

“Mergers are always complex, because they involve reorganising different business projects, with different corporate environments and legacies, and this is always a challenge at the operational, financial and people management levels. This complexity is even greater in global companies,” admits Levi.

“With everyone’s efforts, we have

worked on reaching the necessary internal engagement to achieve the desire for the new Ferroglobe cultural change with a fundamental principle: we are One Company, One Brand, One Team. In the last three years, the Communication and People & Culture departments have promoted multiple initiatives to achieve this objective, related to the engagement of our people and their active participation in the company.”

Both Grupo FerroAtlantica and Globe Speciality Metals saw the potential for significant growth in the renewable energy space – specifically silicon used in solar panels. Used as a semiconductor material in solar cells and computer chips, silicon is immensely popular but requires an expensive manufacturing process. When complete, this process turns raw materials into products in high demand, at high value. For example, ferro alloys products are used to strengthen steel products

while also reducing fatigue and improving corrosion resistance. Manganese is used for similar reasons but has applications across rubber, glass, ceramics, fertiliser and more. The range of uses for Ferroglobe products, and the global appeal from manufacturers and end-users is one of the key elements in the company’s attractiveness. Internally, the importance of operations is not lost on those on the front line.

“We have made sure to generate awareness among our employees of how Ferroglobe’s advanced metallurgical products are contributing to create a greener industry and a more sustainable society,” highlights Levi.

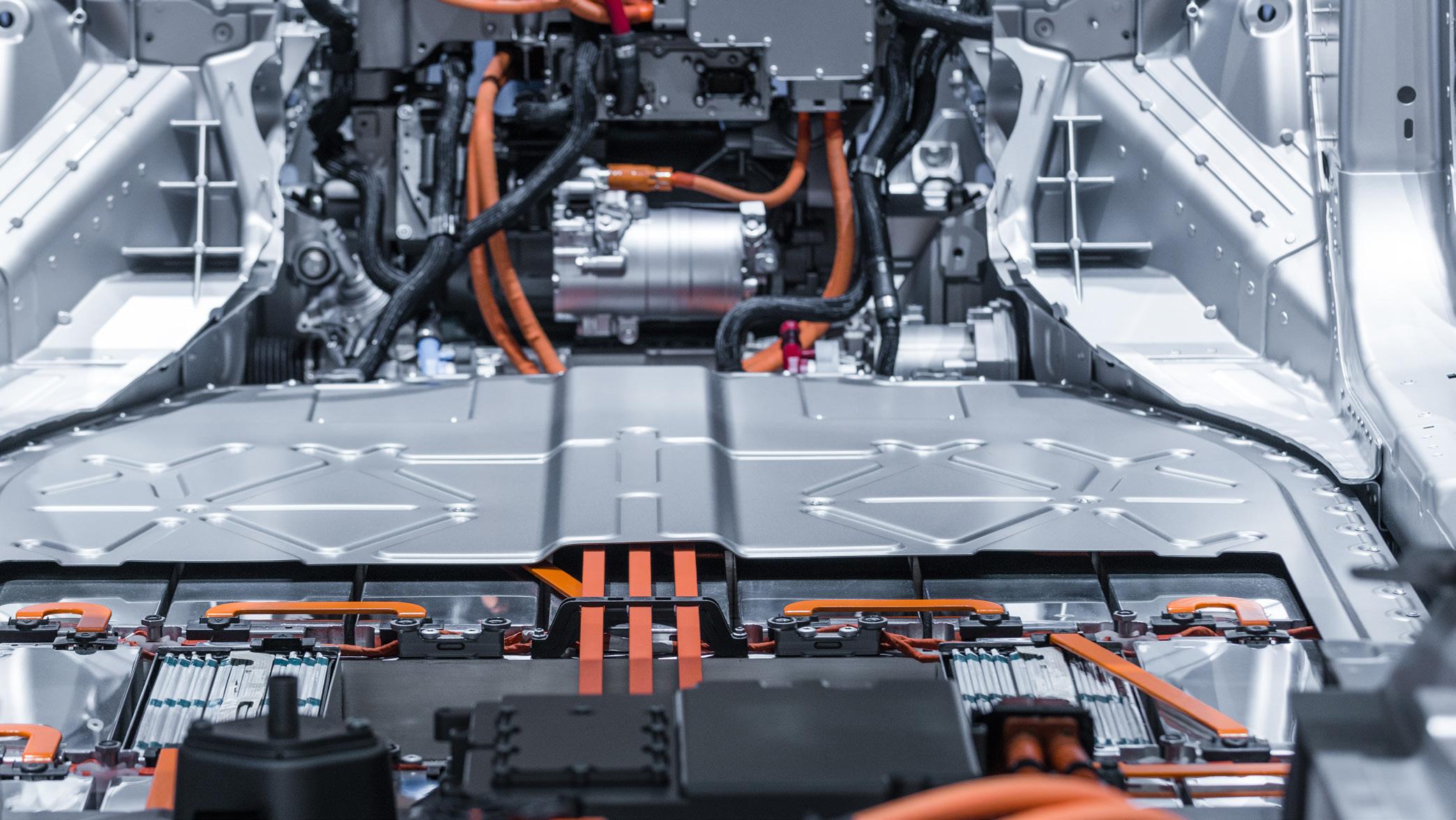

“Thanks to a fluid relationship with all employees on a global level, we believe to have managed a new perception that we are a company that creates value in major industries such as aluminium, chemical and steel, which are then destined to crucial end-products for the energy transition

such as lithium batteries, semiconductors and solar photovoltaics.”

Clearly, the new strategy and the Value Creation Program has been embraced by employees, customers, suppliers, shareholders, and all stakeholders. The plan now is to achieve further growth and make the most of positive momentum.

“Although we find ourselves in a challenging global context, our strategy is meeting our financial targets, positioning Ferroglobe in a strong financial position to keep growing,” confirms Levi.

AMBITION: SUSTAINABILITY

Growth for Ferroglobe will be aligned with the development of new industries in power, automotive, construction, manufacturing, and others – all with the energy transition and sustainability in mind. The company is keen on not only market share improvement and leadership, but also becoming the reference in health and safety and innovation.

“Innovation and sustainability were established as crucial commitments within Ferroglobe’s

transformation and strategic plan, aligned with the historical commitment of our company,” details Levi.

She adds that a current focus is the production of high-purity silicon metal to assist in becoming the marketleading supplier for batteries and solar.

“Through innovation and our expertise, we are producing a critical material for the advancement of cost-effective and low-carbon footprint solutions, which are contributing to accelerate the energy transition in sectors such

as electric mobility and solar power.”

To aid this growth, two previously idled plants have been restarted, the first in Alabama, USA, in early 2022, and the second in Polokwane, South Africa at the end of 2022. The company is also busy starting silicon production at its Puertollano facility in Spain, using advanced technology and robotic automation.

Also at the end of 2022, Ferroglobe signed a partnership agreement with Trinseo – a specialist materials

solutions provider – to develop highsilicon anode solutions for electric vehicle batteries together. Sales of EVs were up by 75% in the first quarter of 2022 against the same period in 2021. That year, sales doubled on 2020. The market is booming, and the supply chain is adapting to meet demand and drive performance.

“Since our MOU with Trinseo, we have commissioned and started up our first industrial milling facility, enabling us to produce and deliver samples, of up to several tons, to major partners to continue the path towards

commercialisation of new siliconcontaining materials for the anode of lithium-ion batteries,” explains Levi.

“At the same time, steady progress on our R&D program is being made to use micrometric silicon in silicon dominant anodes, which is grabbing the attention of main cell and EV players. We are enhancing electrochemical capabilities with our local partners and developing new materials within the partnership with Trinseo and ongoing funded research projects.”

Recently, the company finalised

its ESG strategy – a five-year plan which promotes Ferroglobe’s sustainability focus as a fundamental strategic pillar within the fabric of the business globally. Part of this means reducing CO2 emissions, become more energy efficient, supplying into energy transition-based industries, and investing ethically.

“As part of our path to become a more sustainable company, we are working on different primary levers to lower our CO2 emissions without compromising our growth objectives,” says Levi. “As part of our

// IN OUR EUROPEAN PLANTS, WE HAVE ONGOING PROJECTS OF HEAT RECOVERY WHICH ARE ALREADY REDUCING ENERGY SPECIFIC CONSUMPTION BY 10%, WHICH WE INTEND TO EXTEND TO OUR OTHER HIGH INDIRECT EMISSIONS COUNTRIES IN THE FUTURE //

decarbonisation ambition project, reducing CO2 emissions is our main objective via replacing coal by using charcoal or biocarbon in our production processes across the plants.

“We are also implementing key technical metrics in all our plants, to systematise and boost energy efficiency. In our European plants, we have ongoing projects of heat recovery which are already reducing energy specific consumption by 10%, which we intend to extend to our other high indirect emissions countries in the future.”

The future looks bright for Ferroglobe. Embracing change and looking to do things differently, this is a business that has proven its commitment to a different outlook. Through its

history, change has been constant. Acquisitions, mergers, divestitures, economic and political ups and downs, and financial challenges that blight many have been effectively traversed by Ferroglobe for a long time. “We have a strong track record of successfully navigating economic downturns thanks to operational flexibility and the settlement of plants in competitive locations, in terms of cost and reliability. This experience has provided the company with the skills and knowledge needed to succeed in challenging economic environments,” suggest Levi.

“Although we are facing challenging market conditions, we believe that investing in the development of high-quality, innovative products for growing end markets, such as green mobility or solar

photovoltaics, will bring great longterm benefits not only for Ferroglobe, but also for society as a whole,” he adds.

If the past three years is anything to go by, Ferroglobe is not only embracing change but actively driving it. A new strategy, new clients, new industries, new materials; fantastic financials – it’s a positive journey.

“Together, with everyone’s support, we have made great progress in building the new Ferroglobe and the 2022 financial results show that we are moving in the right direction,” he concludes.

Sonnedix is an international renewable energy producer with the vision of powering a brighter future. In the markets it operates, it acts as a responsible and respectful corporate citizen, fuelling progress for local communities. Particularly in Chile, Italy and Spain, the company has achieved major success recently. CEO Axel Thiemann talks to Energy Focus about progress.

are in a relatively young industry that is growing rapidly and requires strong alliances. We want to be a long-term reliable partner on this journey.”

Demonstrating the ability of rays and gusts to replace fossils, Sonnedix is sure of the power of renewables, but is looking to combine systems to diversify and include more storage. It is becoming more vital for renewable energy sources to be made available consistently, easing their integration into the current grid where possible, to drive the energy transition forwards.

“As we are going towards a world with a lot more solar and wind in the generation stack, we must bring them together with storage. We have intermittent supply in the renewable space, but we must be able to supply electricity as and when it is needed so we are moving towards diversifying our portfolio from purely solar to add wind and storage. Chile is the first big example of that,” explains Thiemann.

//Leading international renewable energy producer, Sonnedix is glowing following an exceptional year in 2022. Last year, CEO Axel Thiemann told Energy Focus about the company’s ambition to aid the global energy transition in a meaningful way. This year, he explains that conditions have never been more favourable for sparking an acceleration in this vital industry.

Sonnedix is home to more than 500 team members across 10 countries, leading more than 475 projects with a total capacity of 9.4 GW. It is a solar and wind energy business, participating in the identification, development, construction, financing, and rollout

and operation of hybrid renewable energy projects – providing green, affordable electricity to its customers.

“We’ve grown the portfolio to an impressive size, and we are at a very important point in the industry where economic viability and attractiveness meets political support. We are looking to take that opportunity and continue to grow aggressively,” Thiemann smiles. “The themes are growth, hybridization, customer focus, and digitalisation which makes the business more efficient. We are achieving that through a focus on the team. Ultimately, we are a business of people that do solar, wind, and storage. The other big enablers are the focus on long-term partnerships. We

In South America, oil, natural gas, and coal still make up the majority of energy supply. Hydro, wind, and solar are important growing elements, but remain smaller in terms of the overall mix. Chile, a liberal space where private investment in generation, transmission and distribution is enabled and encouraged, is aiming for 60% of total energy consumption to be delivered through renewables by 2030. These ambitions and conditions

// AS WE ARE GOING TOWARDS A WORLD WITH A LOT MORE SOLAR AND WIND IN THE GENERATION STACK, WE MUST BRING THEM TOGETHER WITH STORAGE //

Axel Thiemann, CEO

are attractive for Sonnedix.

In October 2022, the company acquired one of Chile’s largest independent renewable producers, ARCO to add to its own sizeable business in the country. Established by Arroyo Investors to make the most of Chilean renewables market opportunities, the company held 290 MW of exciting energy projects. Vitally for Sonnedix, the company’s portfolio was a hybrid of solar and wind.

“Since we began in Chile ten years ago, we have been deeply committed to helping the country to meet its renewable power targets, playing an active role in the energy transition,” said Sonnedix Executive Chairman, Carlos Guinand.

“The acquisition allowed us to meet the needs of the customer better rather than just producing solar electricity. From our perspective, Chile is one of the most advanced and liberal energy markets in the world, so we are pushing our advanced hybridisation activity with wind, solar and storage,” adds Thiemann.

Today, Sonnedix has more than 1.7 GW capacity in Chile – and just completed its Meseta 160MW solar PV plant – the largest close to Santiago, the capital and important load center, and is learning much from its operations on the ground.

In 2023, Sonnedix is flexing its power in Europe, clearly demonstrating its growth ambitions, on the one hand side acquiring a 136 MWp solar PV portfolio from Qualitas Energy, on the other hand side moving forwards with the conversion of its sizeable pipeline – having connected more than 100MW over the last 12 months and starting construction of another 150MW in Q1 2023.

The country has abundant resources and is already home to a strong solar industry. Spain is also hoping to reform its energy markets and transition further towards renewables, like much of Europe. Long-term

contracts with renewable energy producers are providing predictable revenues for investors and more stable prices for consumers, and Spain is the leader in corporate Power Purchase Agreements (PPAs) in Europe – with Sonnedix being active in the market and having signed the first PPA with an Electro-intensive customer backed by a state guarantee in April 2023.

“The 136 MW from Qualitas Energy is a portfolio of regulated PV plants, built between 2008 and 2012. They are not new plants but they really help us to balance our portfolio. They have a good fit with our existing operating base in Spain, and I believe we are the largest solar PV producer in Spain at the moment, with more than 800 MW operational. We have a diversified footprint in the country, and this portfolio fits very nicely,” says Thiemann.

In April, Sonnedix unveiled its latest venture in Spain, a 50 MW solar PV plant – Los Frailes – in the southwest of the country. Covering 111 hectares, with 110,000 monocrystalline solar panels, and the ability to power 36,500 homes (avoiding 24,000 tons of CO2), Los Frailes was developed, built, and managed by Sonnedix, with ongoing operation and maintenance also handled by the company. “It is a symbol of our consolidation in the market as a leading renewable energy producer. We are very proud

to be sharing and celebrating this milestone with so many partners, clients, and friends today,” said Director of Sonnedix España, Gerson González.

Active across Europe, in the UK, France, Germany, Poland, Italy, and Portugal, there is no doubt that Sonnedix will continue to search for opportunities in this market. Thiemann describes aspirations, despite tough conditions, for impressive expansion.

“We are facing very volatile conditions globally, but especially in Europe. The energy crisis has introduced much volatility in power pricing,” he explains. “In that context, we still believe that pushing renewable energy forward is the way to go, especially when supported at EU level by the European Renewable Energy Plan which is dramatically increasing ambitions of the EU to deploy renewable energies – solar, wind, and storage. That is why we are investing heavily in Europe, in Spain, Italy, Poland, Germany, the UK, and Portugal. We are doing that through conversion of our development pipeline, where we have seen big success with construction starting across multiple sites. In parallel, we keep acquiring operating assets.”

Important for Sonnedix going forward (and the wider renewables industry) is that the market now

enjoys a favourable position when it comes to energy generation from an economic perspective. Long gone are the carefree days of coal and gas burning as the cheapest generating methods, and the build of nuclear generating capacity is incomparably difficult to renewable (particularly solar) – not to speak of the long-term

risks. Today, renewable energy is not only the ‘environmental’ alternative.

“We now have a sweet spot in the rollout of renewable energy,” smiles Thiemann. “Firstly, we have widespread political support now which is different from when we started. This is because of the awareness of climate change and the acceptance of the requirement for energy transition in the public. Secondly, we are now economically the smart choice alongside being green. When we started, most of our generation was subsidised but there is no longer a need for subsidy. We have an opportunity to rapidly troll out renewable energy and we are trying to do so as fast as possible.”

There are, of course, challenges. Primarily for Sonnedix is the volatility of power pricing and the lengthy permitting process which differs across

borders alongside the well-documented challenges in global supply chains.

“The main bottle necks that we are challenged with are pricing volatility with regulatory issues, and also the ability to develop projects easier and quicker. That is a problem from a permitting perspective – being able to develop the land and real estate –and also being able to gain access to interconnection to existing grids. From our perspective, we have big plans, but we need the right economic and political environment, and we need to work on streamlining permitting and building out the electricity grids to drive the energy transition forward allowing the renewable energy industry to grow,” details Thiemann.

In this growth, the CEO

Continues on page 30

// WE HAVE AN OPPORTUNITY TO RAPIDLY ROLL OUT RENEWABLE ENERGY AND WE ARE TRYING TO DO SO AS FAST AS POSSIBLE //

Sonnedix is an international Renewable Energy Producer with over a decade-long trajectory of sustainable growth. We develops, builds, and operates renewable energy projects for the long-term, with a focus on providing green, affordable electricity to our customers, and acting as a true social citizen there where it operates.

Continued from page 28

sees Sonnedix as not only a lead innovator but also a long-term partner to both communities in which projects are situated as well as the various different stakeholders involved in the success. Whether it is governments, financial institutions, or hardware suppliers, or local people,

partnerships are the foundations on which the company builds.

“We want to be there for 20, 30 or 40 years and so we participate in a number of ways. Through the development process, we strive to have a really close connection with the local community and understand needs and concerns. We make sure we identify the right mitigating actions if there are

any required from an environmental perspective in terms of traffic and noise, right through to dust and dirt. We look to ensure our construction activities minimize disruption and provide local jobs. A large part of our mandate is around providing jobs for the local community for men and women. It’s not just any type of work, it’s work that brings skills and promotes diversity. This is the same during the long-term operation of the site - we must provide environmental and social benefits,” he says, highlighting the importance of partnerships.

Looking to the future, Sonnedix is confident about further growth, with the burning of coal in Europe to supplement energy systems that have

THAT IS OUR JOURNEY FOR THE NEXT COUPLE OF YEARS, BUILDING THE PORTFOLIO AND, ULTIMATELY, CREATING A TEAM THAT THRIVES IN AN ENVIRONMENT OF HIGH GROWTH AND COMPLEXITY //

been needy since ending supplies from Russia not sustainable. A rapid increase in the share of renewables used in final energy consumption is hoped to reach 45% before 2030, helping on the Net Zero journey, but also ditching Russia as a power player.

According to SolarPower Europe research, the EU installed 41.4 GW of solar capacity in 2022 – a 47% increase on 2021. In the UK, 40% of electricity came from solar, wind, biomass, and hydro in 2022, according to Imperial College London. The appetite is there. Now, people must deliver the push.

“We are in a special place. We have political support and economic sense to drive the transition forward and accelerate growth. For me, the

priorities are to enable that by building capabilities to drive it,” Thiemann reiterates. “We don’t want to continue on the trajectory that we were but accelerate through hybridization and shifting our customer focus to really understand their needs. The portfolio that we build out must meet these needs and contain solar, wind, and storage. That is our journey for the next couple of years, building the portfolio and, ultimately, creating a team that thrive in an environment of high growth and complexity. It is one of the things that differentiates us. We have built a team over the past 10 years of 500 people globally that is highly capable. They develop, build, finance, contract, and operate these

plants, and the team must be grown and upskilled to allow us to face the large challenges that we have.”

According to the IEA, the EU’s renewable goals, outlined in the REPowerEU plan, are achievable but the private sector has an undoubted part to play. Sonnedix is playing its part.

“We continue on our journey developing, building, and operating renewable energy projects,” Thiemann concludes.

Phoenix Tailings - a US-based circular economy, re-mining organisation – is growing quickly to help fill a desperate need in the market for domestically supplied rare earth metals that help to build the technologies and energies of the future. CEO Nicholas Myers tells Energy Focus about the company’s extraordinary journey to date, as the first commercial scale rare earth metal refiner in the USA.

PRODUCTION: Tommy Atkinson

“As we shift away from fossil fuels, we are not moving away from natural resources - we are shifting to using more specialty metals that have never been heard of before - neodymium, praseodymium, dysprosium, terbium, lithium, cobalt etc. We realised we needed to find a way around the challenge of accessing these materials because the way we do it today is very hazardous, toxic, and detrimental to the environment – but we need these materials,” says the CEO.

He adds that the discussion ended up pinpointing sustainability as an overlooked key focus area. If a business could be based around sustainability, with a moral and ethical culture running through its core, then it could potentially catalyse change globally.

Rare earth metals are used in almost all high-end technologies – computers, phones, chips etc. 17 metals make up the classification, and they can be worth around £4000 per kg. But the majority of the supply comes from China.

//From a global innovation city behind so many modern startups, Cambridge Massachusetts-founded Phoenix Tailings is growing quickly as it takes steps on its journey towards being the world’s most sustainable precious metals business. Perhaps it’s the proximity to Harvard University or Massachusetts Institute of Technology, or maybe there is something in the water, but from here innovation thrives.

Established in 2019 by an ambitious group of founders, Phoenix Tailings is scaling fast. Core services include the production of rare earth metals from mining waste. It’s a treasure from trash story, and CEO Nicholas Myers tells Energy Focus that it has been tough ride. Sticking to the mission has been essential in a fluid startup environment as the business has journeyed through innovation and funding rounds, desperate to get its pioneering ideas out of the ground.

“It was a personal challenge – I

was competing against people twice my age with twice the experience and I had to be better and more knowledgeable – that is tough, double the work in half the time,” he says.

A physics graduate of the University of Vermont, and a MBA holder from Northeastern, this busy US entrepreneur is no stranger to the startup world. He worked in manufacturing for 10 years before switching focus to finance. In the banking space, he realised his passion was for young, agile businesses with fresh ideas, but to achieve his own goal of significant impact, he knew he must start his own business to tackle a long-standing issue.

“Things have gone well, we have a lot to do yet, but it has been successful so far,” he smiles.

A chance meeting with his Cofounder, Dr Thomas Villalón, led to the discussion around what Myers calls ‘the big problems in the world today’.

“We said instead of destroying a new mountainside or community to access the materials, harvesting them in a toxic way, we should go after the waste that our ancestors already produced and harvest that – cleaning that up while creating raw materials from that waste. It’s

// AS WE SHIFT AWAY FROM FOSSIL FUELS, WE ARE NOT MOVING AWAY FROM NATURAL RESOURCES - WE ARE SHIFTING TO USING MORE SPECIALTY METALS THAT HAVE NEVER BEEN HEARD OF BEFORE //

sitting there, we just need to process it in the right way,” says Myers.

Taking the waste from mining or quarrying operations – often dumped in landfill, labelled tailings ponds - and refining to extract valuable mineral deposits left behind after traditional processing is where the company is built strong. These materials are often rare earth minerals used across multiple consumer and industrial applications.

Some estimates suggest that mining produces 84 billion tons of hazardous waste material annually, with land, water, and air all included in the fallout.

Myers, Thomas Villalón (CTO), Michelle Chao (COO), and Anthony Balladon (VP Partnerships) Co-founded the business, building the first prototype in a backyard in Cambridge, Massachusetts with help of the University of Connecticut’s Wolff New

Venture competition which Phoenix Tailings won a $20,000 prize fund to invest in proprietary technology.

“Initially, we were processing bauxite residue as a by-product from alumina production, pulling out a little bit of iron and other rare earth metals that are needed to power wind energy and electric vehicles. We moved away from bauxite residue, although we do still work with some bauxite tailings, and we now focus on iron ore, nickel, copper, and other tailings. Our mission is to be the world’s first fully clean metals and mining company, with zero waste, zero carbon emissions, entirely sustainable all the way through.”

The popularity of this idea, and the culture developed by the leadership team was clearly appealing to investors. Funding from the National Science Foundation helped Phoenix Tailings to expand to aa point where it could talk

to corporate clients and understand their needs. A capital raise through pre-seed investment firm Techstars in 2020 helped achieve further scale.

In January, the company officially announced the start of commercial scale refining of critical rare earth metals – a first for the USA. Product viability was proven through the pilot stage and world-class R&D is helping to meet growing demand.

“At Phoenix Tailings, we are solving this critical gap with our technology in order to reduce America’s dependence on foreign governments. That’s one of the reasons we are so excited about the commercial production capacity at our facility,” says Myers.

Demonstrating the hunger in the market, he highlights that the company had sold its entire 2023 neodymium

production by the end of January. Currently selling heavily in Europe, capitalising on the booming EV market, Phoenix Tailings is busy planning for new products. “Processing is where we are the best in the world,” smiles Myers.

“European auto manufacturers are key clients, but we are also looking

to scale up our market in the USA. We know of a few specialist producers that are starting up here, and we are looking to supply them in the near future,” he suggests. “We started off with neodymium metal cells which is a commodity-based product and we are shifting, because of the deposits

that we have, into terbium and dysprosium. Terbium in particular will be one of the major metals that we will offtake as it is key as almost 100% of supply comes from China today.”

The challenges in this fast-growth sector surround the supply chain. Here, there has been a need for constant review and micromanagement, with Myers praising the leadership team for developing a robust system from the ground up. To process at scale, valuable inputs are needed, and this requires planning. “Sourcing materials can be a challenge,” he admits. “We are sometimes looking at between six weeks and six months for certain chemicals. In a start up environment, that is an eternity. The company will be totally different in six months. Our supply chain is really helpful in that, and we have been deliberate in the way we source and procure.”

By partnering with the very best across all disciplines, the company’s reputation is growing. In 2022, Phoenix Tailings received $1.2 million from the US Department of Energy as part of the Advanced Research Projects AgencyEnergy Mining Innovations for Negative Emissions Resource Recovery program. The funding is powering pioneering innovation within the business and Myers hopes more will be encouraged to enter the market.

“Innovation is important in critical minerals production, and moving fast and scaling up in the right way is absolutely essential,” he explains. “Rare earth processing is a big gap in the world today and that is what we are honing in on but we do need others in the market – it can’t just be us. Working with the right players and partners is vital in growth.

“There will be others that come to the market, but the key is to do it sustainably and that is our mission. We want to make sure that by being the first ones to do it, and doing it in a sustainable way, others will come in with sustainability in mind.”

If the company can continue on its strong growth path, and the industry can follow while opening up fresh opportunities for US-businesses, Myers and Phoenix Tailings will be on track to achieve visions. His advice for others is to remain, or learn to be, versatile.

“My whole mission in life has been to build a technology company that can have a deep impact across the world at a fundamental level,” he smiles. “I would certainly recommend that every executive takes some time at some point to work in a startup environment as it allows for a different way of thinking, without the imagined

barriers and structures that have been perceived to exist before. With that, we would see a lot of change.”

Perhaps it’s the pioneering nature in the region. Perhaps its in the water. What we know for sure is that with Phoenix Tailings it is what has already been taken from the ground that brings progress. Sustainable engineering and reimagination of existing processes will help to design the companies and industries of the future.

“A reliable, sustainable domestic supply chain of critical materials that power longer-lasting batteries and other next-generation energy technologies is crucial to reaching our clean energy future,” said US Secretary of Energy Jennifer M. Granholm.

A long-term investor, developer, and infrastructure fund manager, Equitix has been pivotal in the ongoing success of the energy transition. Involvement in some of the biggest and most important energy projects comes as a result of 16 years of building trust. MD Asset Management Nathan Wakefield talks to Energy Focus about the company’s opportunities going forward.

Creating valuable propositions, with true return potential, has been both a challenge and opportunity in the renewable energy transition space. Without money, the transition halts. Even with the best ideas and intentions, there has to be financial clout to power the progress.

Fuelling this whole industry is not easy and does require infrastructure investment on a significant scale.

Since 2007, Equitix has been leading the charge. An international investor, developer, and infrastructure fund manager, the company has more than 360 assets under

management, valued at around $12 billion. 200 people across 10 countries help the business to drive value for investors, while working towards the vision of ‘creating a lasting legacy for generations’.

Today, the company has six focus areas: social infrastructure,

Nathan Wakefield, MD Asset Management

Nathan Wakefield, MD Asset Management

renewable energy, transport, environmental services, network utilities and data infrastructure.

In the renewable energy sector, the company has significant interests across a number of projects with a total electricity generating capacity of 7.1GW and over £3.5 billion of AUM. MD Asset Management, Nathan Wakefield, tells Energy Focus more about the strategy which will position the company on a strong path for advancement of the space while generating returns for investors and general improvements for local communities and stakeholders.

“Our renewable power sector, which I head, is focussed on wind, solar, and hydro, and we are looking into net zero assets including storage,” he says.

Working across different applications, and gaining a strong portfolio, Equitix is embracing the missing links in the system, including storage.

In July 2022, the company acquired an additional stake in the Hornsea

One offshore windfarm – the largest operating offshore wind farm in the world – which powers more than one million UK homes and businesses. In September 2022, Equitix acquired the Westfield EFW plant from Brockwell Energy. Westfield Energy Recovery Ltd is under construction in Fife and will process 240,000 tonnes of nonrecyclable residual waste each year, saving from landfill and generating 23 MW of low-carbon electricity. In January 2023, Equitix welcomed one of the UK’s largest recycling businesses to the Westfield Energy Recovery ecosystem when it signed a JV with Viridor to invest and deliver the project by 2025. Highlighting its commitment to renewables, the company showcased its co-owned Beatrice offshore wind farm to politicians in March – explaining the impact of the site which powers 450,000 homes. A significant agreement was inked in April, when Equitix acquired Macquarie’s stakes

in 8 operational offshore windfarms. This acquisition increases Equitix’s interests to 11 offshore windfarms in the UK and one in Europe, contributing to more than 33% of the UK’s installed offshore wind capacity, and making Equitix one of the largest financial investors in offshore wind.

In a deliberate and considered approach, Equitix has been investing into green energy for more than 10 years, now with more than £2.1bn invested into carbon-reducing, renewable power-generating projects across Europe and the UK with 6GW capacity AUM.

Storage is one of the few sticking points in the sector – how can you efficiently make the most of energy produced during times of maximum generation, making it available at times of peak demand? Battery storage is a growing space, and Equitix is busy here.

“We have entered into a strategic partnership with the UK Infrastructure Bank (UKIB) to invest into UK electricity storage projects, which presents a great opportunity for us. This will be the first major foray into storage specifically,” explains Wakefield. Further into the future, the company holds the vision of deploying longer-duration technologies and electricity storage technologies

// WE HAVE ENTERED INTO A STRATEGIC PARTNERSHIP WITH THE UK INFRASTRUCTURE BANK (UKIB) TO INVEST INTO UK ELECTRICITY STORAGE PROJECTS, WHICH PRESENTS A GREAT OPPORTUNITY FOR US //Hornsea One Offshore Wind Farm Credit: Ørsted

with superior discharge rates and degradation levels, while investing into local skills development and sustainable management of projects – critical for Equitix.

CEO Hugh Crossley, was buoyant about the opportunities in storage, saying: “Investing in the development of critical energy infrastructure and supporting the UK Government’s net zero targets and energy security objectives… firmly aligns with our own strategic objectives and offers attractive opportunities for like-minded investors.”

While the storage market has seen some positive jumps in terms of technology in recent years, there is still much to be understood about the investment and yield process. Thankfully, Equitix takes a long-term view in its investment strategy.

“We are typically a buy and hold investor with our core funds typically having a 25-year term,” says Wakefield. “The challenge we’ve had is to understand how the revenue stacks are put together for storage

projects. It is clear over the short term, but we need to understand what happens over a longer time horizon.”

Getting new projects off the ground in a sustainable manner is also a priority for Equitix. Involvement from the early stages allows for deeper exposure and understanding, and larger investment opportunities.

Wakefield says: “We have recently launched a sustainable greenfield strategy on the back of strong track record in this space across the UK and Europe which

is an exciting new phase for us.”

These new initiatives and investment opportunities are ultimately built, delivered, and managed by people and the industry remains a people-focussed space. There is a level of trust required that is created over long periods of time, based on proven ability and ambition. Equitix is a people business – investors, employees, and communities are at the heart of decision making. For Wakefield, the future of the renewable energy transition is absolutely about the development of people just as much as it is about

boosting returns for investors.

“We have the largest asset management team, on a pound for pound basis. We have a vast amount of different technical expertise, whether that is financial, commercial or technical, and that is a depth and breadth of resource that other investors don’t have,” he says of the company’s competitive advantage. “We have been really careful with growing the business and the type of projects and assets that we have acquired. We have a low loss rate, and that supports our credibility in the marketplace.

“In renewable power, the biggest challenge is growth in the market,” he continues. “Offshore wind has

huge growth targets in the UK and Europe and the challenge of building the assets in the medium term, and maintaining them in the longer term, is large. There is a lot of expertise in the older generation. We need to bring through the younger generation and get that experience into those guys. It’s how you support development to reduce the skills gap that is going to make the big difference.

“Typically in the past, it would take a cable jointer 10 years before they moved into dealing with the higher voltage ranges. Today, that is being fast tracked and one of the highest costs in offshore wind is power cable failure. We are moving into higher

voltages and that is a skills gap that will need supporting as array cable installations continue at 66kV and move into 132kV connections.”

The founding principles behind Equitix are Partnership, Excellence, and Trust. These are people-focussed values and, with two of the founders still active in the company, trusting in human relationships is part of the underlying success the business. Where skills gaps exist, the company will work with partners to supply. There is no ‘parachute in and jump straight out’ mantra around the investments. “Connections between

Infrastructure systems must become resilient against climate change if they are to be sustainable.

Owners, operators and investors need to have confidence that infrastructure can withstand and recover from the extreme weather that is becoming increasingly frequent, in a way that minimises disruption and repair costs and protects its performance. Users need to know that they can rely on the vital services these systems provide.

Organisations that fail to protect themselves, their customers and society from harm resulting from climate impacts are exposed to a rising level of financial and reputational risk. Conversely, those that build climate resilience will find opportunities: by withstanding, responding to and recovering rapidly from climate impacts, they will maintain operational continuity and strengthen their competitive edge.

And yet, investment in infrastructure resilience lags well behind what is needed. Part of the reason for this has been a lack of evidence about where and how to invest. But this is now changing, with tools and data available to help measure and manage risk.

In 2020 Mott MacDonald began working with the Coalition for Climate Resilient Investment (CCRI) to equip infrastructure owners and operators to demonstrate the benefit of investment in resilience.

The result is the Physical Climate Risk Assessment Methodology (PCRAM). It is an open-source resource created for the public good, to improve consistency in risk assessment and provide a common language between the infrastructure and financial industries.

PCRAM is the world’s first framework that brings together climate science, asset management, resilience practitioners and financiers to assess, design and quantify the resilience needs of infrastructure assets.

It can be used to identify material physical climate risks to an organisation’s assets and build resilience to improve performance and protect revenue. PCRAM helps decision-makers understand benefit-to-cost ratio, target investment, and plan programmes of investment that align with existing organisational and regulatory investment cycles.

PCRAM’s guidance documents have been published online and are freely available to download. Our hope is that the availability of this new methodology, and the ongoing activities of the CCRI legacy programme, will unlock the capital we need to deliver a resilient world.

Find out more: mottmac.com/pcram

people are crucial and our people make our business what it is. We are hugely conscious of those that live in the communities that we serve – the millions of lives that we touch, in the real world, using real assets,” says Crossley.

Understanding what plans are made by authorities in key markets is the long-term hurdle for the Equitix people, as well as learning more about the ongoing market changes resulting from global economic and political shifts.

“The challenge we face across renewable power and environmental services is that all of this growth needs to be supported by appropriate regulations and subsidies from government,” states Wakefield. “The last two or three years have been chaotic with Covid – we saw a collapse

in the power price and then a spike in power prices over the last six months of 2022, and the impact of market intervention that has taken place across Europe in different ways. There is a lack of consistency across approaches, and we are responding to how the Electricity Generator Levy and the price caps in Europe will affect our business. Governments across Europe, and eventually across the world, will drive this investment and we are keen to continue investing. We have been successful through the three-year period and there is significant interest in the space.”

Today, according to the International Energy Agency, renewable power is still only 5.2% of the global mix. Clearly, there is a long and strong upward trajectory for the technologies that are already in

place, and there remains significant attractive prospects for investors across the industry. With Equitix, there is proven reliability and success, and the company continues to hunt for expansion while achieving its vision of lasting legacy.

“We are exploring if there are other parts of the supply chain that we can invest in. In the past, we have looked at deals involving provision of service operation vessels for offshore wind –we can see there is a huge gap in the market in the UK, Europe, and further afield as the markets in the US and Far East take off,” Wakefield concludes.

Empowering infrastructure owners and investors to manage climate risks and maximise opportunities from the transition to a resilient, low-carbon world.

mottmac climate change to find out how we can help you.

One of the largest banks in North America, BMO is working hard to position itself, and the business of its clients, on a path towards net zero, as a leading advisor in merger, acquisition, and divestiture activity for energy assets. A key goal is to position Canada as a globally leading partner for energy importers.

PRODUCTION: Sam Hendricks

PRODUCTION: Sam Hendricks

Rich in nature, the second largest country in the world, heavily exposed to adverse climate impact such as flooding and wildfire, Canada is an advocate of the global energy transition. Shifting from fossil fuels to renewable energy sources to reduce CO2 emissions and limit global temperature increases, the country is ambitious, aiming for greenhouse gas emissions reductions

of 40 45% by 2030 from 2005 levels, and to reach net zero emissions by 2050. The diverse plan to achieve these goals includes major policy changes such as a modern carbon pricing system, clean fuel legislation, commitments to phase out unabated coal use in the next seven years, nuclear plant expansions, upstream methane regulations, energy efficiency programmes, and decarbonising

activity in the transport sector.

Of course, like everywhere else in the world, these targets and concepts require funding. Not just grants and subsidies, but monumental financial figures – Deloitte predicts 6% of GDP. There will also be significant M&A activity as the majors look to align with the journey. Acquisition and divestiture activity will increase, and the requirement for stringent review and advice will be significant.

The story of Denmark’s Ørsted is perhaps the most famous organisational transition, taking a decade to shift entirely away from coal and conventional generation, becoming the world leader in offshore wind and delivering financial results that surpassed the expectations of most. Initially, the aim was to upend the generation mix from 85% conventional and 15% renewable to 85% renewable over a 50-year period. After just 10, the business has achieved its goal and is continuing to invest in green energy all over the world.

For Canada, significant deals have been done in recent times. Supporting the health of the North American economy, working closely with its big neighbour, the USA, the country is a hive of transactional activity.

In 2019, Shell Canada Energy sold its Foothills Assets – Waterton, Jumping Pound and Caroline gas plants, associated wells and pipelines and the gas fields which feed them – to Pieridae Alberta Production Ltd. In the same year, Devon Energy Corp sold its Canadian business to Canadian Natural Resources Limited for CAD $3.8 billion. In Imperial Oil and ExxonMobil Canada agreed to sell their Montney and Duvernay shale oil and gas assets to Whitecap Resources in a $1.47bn deal. TotalEnergies also announced that it planned to sell its interests in Alberta-based, Suncor Energy-operated Fort Hills mining project, and the ConocoPhillipsoperated Surmont thermal project, alongside associated midstream and trading-related activities.

To complete these types of transactions, banks must understand the environment. thankfully, Canada’s leader – BMO (Bank of Montreal) –has decades of experience in A&D for the energy sector, and the bank has taken a balanced approach to benefit the future clean vision for the country as well as the interests of its clients. In 2017, the company was hired by Petronas to sell oil and gas drilling rights, wells, pipelines and three gas processing plants mainly located in north-western Alberta.

Last year, Cheryl Sandercock –Co-Head, Energy A&D Advisory and a Managing Director in BMO Capital Markets – told Energy Focus that the company had fantastic people power internally and was the obvious choice for large, complex sales. “Our team members are predominantly technical specialists, including geologists and engineers, who understand the energy assets and technical aspects related to owning and operating these assets.

“Banks have an important role

to play helping our clients manage the impact of the energy transition on their business. Helping our clients adapt and thrive through the coming transition requires a thoughtful, balanced, and accelerated approach.