EDITOR Joe Forshaw joe@enterprise-africa.net

SENIOR PROJECT MANAGER Sam Hendricks sam@enterprise-africa.net

SENIOR PROJECT MANAGER James Davey jamesd@enterprise-africa.net

PROJECT MANAGER Harry Webster harry@enterprise-africa.net

PROJECT MANAGER Chris Bolderstone chris@enterprise-africa.net

LEAD DESIGNER Aaron Protheroe aaron@enterprise-africa.net

CONTRIBUTOR Manelesi Dumasi

CONTRIBUTOR Timothy Reeder

CONTRIBUTOR Benjamin Southwold

CONTRIBUTOR William Denstone

Published by

Chris Bolderstone – General Manager E. chris@cmb-multimedia.co.uk

Fuel Studios, Kiln House, Pottergate, Norwich NR2 1DX +44 (0) 20 3097 1743 www.cmb-media.co.uk

CMB Media Group does not accept responsibility for omissions or errors. The points of view expressed in articles by attributing writers and/or in advertisements included in this magazine do not necessarily represent those of the publisher. Whilst every effort is made to ensure the accuracy of the information contained within this magazine, no legal responsibility will be accepted by the publishers for loss arising from use of information published. All rights reserved. No part of this publication may be reproduced or stored in a retrievable system or transmitted in any form or by any means without the prior written consent of the publisher.

© CMB Media Group Ltd 2025

Sub-Saharan Africa is at the forefront of so many things, but digital finance has to be the headline. From digital wallets to easy money transfer to cash to wallet solutions and so many other things, popular money tech solutions in markets all around the world originate on the continent. The challenge in this space is keeping up with development, something that so many big businesses fail to do because of their sheer size. However, one of the biggest, Absa, has committed to being at the sharp end of innovation while taking care of customers as a strong corporate citizen. The key, according to the business, is to be close to customers. Understand how they work and what they need to thrive, and then tweak and adapt products to suit these often overlooked issues. In 2025, Absa is listening to stories with the view that every story matters and laying out a product portfolio to help clients as much as possible.

Similarly, the SKAO megaproject rolls on, bringing benefits to all its touches. Antennas are up, the big lift of satellite dishes is underway, and connections to the rest of the world are in place. Soon, sub-Saharan Africa will become the world’s radio astronomy epicenter. In this process, education and opportunity is opened up like never before. The UK, Germany, China, the Netherlands, Italy and more are all sending finance and expertise to southern Africa to ensure the long-term sustainability of this impressive science and technology marvel.

In local business, so many continue to show why sub-Saharan Africa is a creative and exciting place to be for business. Medscheme, South Africa’s medical aid administrator, is developing new digital solutions to make the industry more streamlined. Kagiso Tiso Holdings is investing in modern technology businesses to bolster its strong portfolio. Buscor is training people and upskilling communities across its presence in Mpumalanga and the surrounding area. And the University of Pretoria and its Enterprises:UP business is driving skills adoption in a big way, opening up the market for personal development like never before.

It’s an exciting time, and 2025 already looks set to be a boomer, building on the hard work that so many have contributed in the tough times since the reemergence of an economy after the pandemic.

Get in touch and tell us how your business is doing things better, faster, strong, and more sustainably in 2025. We’re online at LinkedIn

Joe Forshaw EDITOR

GET IN TOUCH

+44 20 3097 1743

joe@enterprise-africa.net www.enterprise-africa.net

Absa is changing and adapting. The bank, with roots going back to 1986 in South Africa and a legacy of over 100 years across the Absa Regional Operations (ARO) countries, has been a frontrunner in the financial services sector for decades. An innovative spirit, and a willingness to push pioneering ideas, have helped Absa to grow and build. All the while, the bank has maintained strong ties with clients, and now more than ever Absa recognises that every story counts as it looks to broaden its product and service portfolio to meet the needs of a changing Africa.

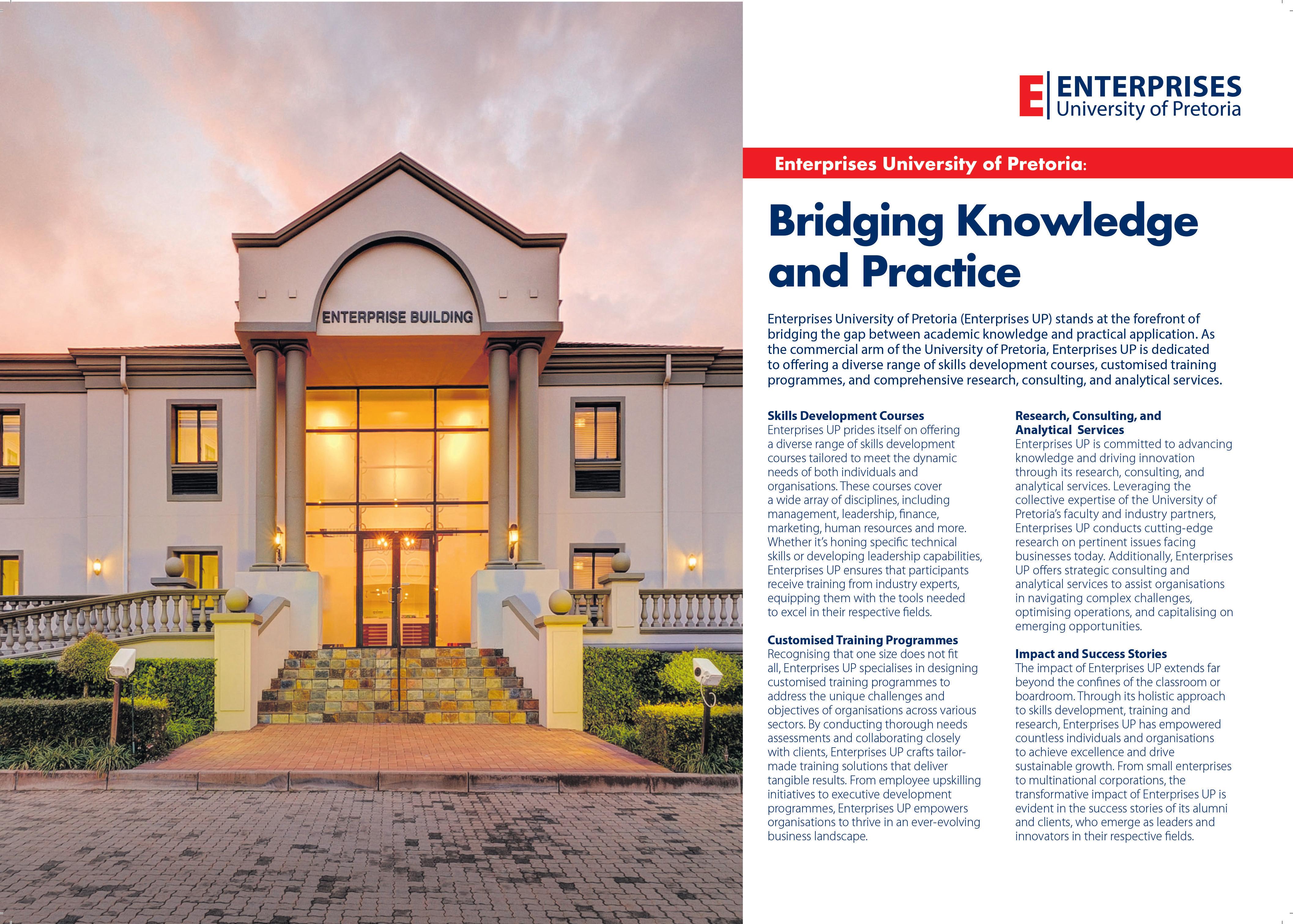

Enterprises University of Pretoria (Enterprises UP) stands at the forefront of bridging the gap between academic knowledge and practical application. As the commercial arm of the University of Pretoria, Enterprises UP is dedicated to offering a diverse range of skills development courses, customised training programmes, and comprehensive research, consulting, and analytical services.

Turn your business story into a success story

At Absa, we believe in your story and are committed to supporting its growth and success. We offer a diverse suite of business solutions, covering transactional banking, secured and unsecured lending, trade and working capital solutions, vehicle and commercial asset finance, and more, all aimed at allowing you to start and expand your business ventures.

The critical intergovernmental science and technology project taking place across a global stage with a focus on South Africa’s Northern Cape is advancing quickly thanks to collaboration unlike that seen in any other industry. New infrastructure, original systems, fresh skills, and brilliant ideas are helping to drive this historic project towards its full potential.

Africa’s Big

Small and medium enterprises are engines of empowerment and the backbone of Africa’s economies. With the right support from financial institutions, they could drive unprecedented growth and transformation across the continent through an ecosystem approach.

Through its legacy companies Kagiso Trust Investments and Tiso Group, Kagiso Tiso Holdings (KTH) is an investment group champion with a range of quality assets across multiple sectors, boasting a proven track record of peerless investment performance and creating sustainable shareholder value for the long-term.

Dealing in award-winning health risk management solutions, Medscheme has consistently delivered comprehensive solutions and innovative medical aid administration for over four decades. Strong customer focus, state-of-the-art technology and an unbending emphasis on quality of care define this leader in sustainable healthcare.

Buscor is a leading passenger bus company, operating in the Lowveld region of Mpumalanga Province, South Africa with head offices in Nelspruit. Transporting nearly 40 million passengers per annum and covering a similar number of kilometres, “Buscor is totally committed to providing safe, reliable and affordable transportation to the community we serve,” the company opens.

Absa is changing and adapting. The bank, with roots going back to 1986 in South Africa and a legacy of over 100 years across the Absa Regional Operations (ARO) countries, has been a frontrunner in the financial services sector for decades. An innovative spirit, and a willingness to push pioneering ideas, have helped Absa to grow and build. All the while, the bank has maintained strong ties with clients, and now more than ever Absa recognises that every story counts as it looks to broaden its product and service portfolio to meet the needs of a changing Africa.

By delivering customer-centric design across its product suite to bring real life impact for clients, Absa is innovating and adapting to ensure it remains deliberately different from other banks across sub-Saharan Africa. Omar Baig, Managing Executive: Retail & Business Banking for Absa Regional Operations, explains that the bank is consistently and curiously listening to client stories to ensure it can serve effectively.

There’s been a big emphasis on moving away from what we think clients want to getting a much deeper understanding of what clients are looking for, understanding their specific pain points and how we can solve for them. We’ve tried to

“What is absolutely critical is to be close to the client and be extremely responsive”

Omar Baig Managing Executive: Absa Regional Operations (ARO), Retail & Business Banking

reestablish ourselves as more of a local bank that understands its customer’s needs, an African bank, and I think we’ve been successful. We have become more relevant regionally and are focusing on specific client needs and less on homogeneous offerings. This has been the mindset that we’ve taken to enhancing our product suite and bringing new capabilities into the market.

One example is Absa’s Women in Business. We recognise that women are significant drivers of the economy and society and have a large role to play on the economic and social development of the continent. We’ve come up with an offering that is specifically tailored to women entrepreneurs, with dedicated relationship managers who have a comprehensive understanding of what this specific segment might need, and we have broadened our offerings to include things like training and networking to help open new markets. We are now live with this in six of our markets and we will embed in the remaining markets soon.

We are also active in the payment space, trying to get more SMEs into the formal payment system. One of the barriers to entry has been the cost of being part of that payment acquiring ecosystem. So, we launched an innovative product called Mobi Tap, which converts an Android phone into a payment acceptance device.

Not only do we provide the capability, but we also sourced the devices in bulk and this enables us to offer them to our SME merchants at a fraction of the cost of a regular point-of-sale (POS) device. In many of our markets, we are providing the tech free of charge based on merchants hitting certain activity thresholds. We have also expanded our payments acceptance to accept digital wallet payments as that is what the users wanted from us. It’s a much larger channel of payment for a lot of consumers compared to plastic. This has been well received, both with the SME clients that we serve as well as their customer base.

you supporting

Our approach is to make sure that we are as close to our clients as possible so that we can understand their pain points and innovate quickly to launch the solutions they want.

With Women in Business and our other programmes, we provided training for about 30,000 SMEs in 2024 across our markets. We even took a client delegation to China to connect with suppliers as part of one of our Absa Business Clubs, and we do this with the help of strong partnerships. Similarly in Ghana, we’re working with the MasterCard Foundation which enables us to lend to SMEs at significantly below market interest rates and that has been extremely successful.

In some of our other markets, we’re partnering with the likes of DHL, where we’ve just established a regional partnership with two primary objectives. One is to provide training, business development, and support for SMEs. The second priority is access to underlying trade products and services, leveraging DHL’s capability across the continent.

We also have strong ties with various Development Finance Institutions (DFIs) as well as the International Finance Corporation (IFC) and the wider World Bank that enables us to broaden the base of customers we serve and provide relevant financial products and services.

What is absolutely critical is to be close to the client and be extremely responsive. Only then can you understand what their needs are and adapt and tailor your products and services to come up with new solutions for specific needs. This is the commitment our new brand positioning – Your Story Matterslaunched in early 2024 speaks to. It’s our commitment to being empathetic to our customers’ needs, while delivering seamless intuitive banking experiences.

A lot of our focus is on digitising, which makes a lot of sense in the context of the markets we play in and given the fact that Africa is the leader in digital banking globally.

We are currently working on a Super App for SME clients and our merchant base which will allow them to start with a payment acceptance device at its core, but then expand into banking services and value-added services. They can choose from a whole host of services without necessarily having to become a primary account holder. We can then layer it with, for example, a reward or an incentive programme. This concept is currently in development and testing in one of our markets before we roll out further afield.

We also recently launched a wealth offering catering for the sub-Saharan region in Africa. It was initially focused on South Africa, but we’ve rolled out our first offshore centre in Mauritius and that’s a nice tie in because we see a lot of our business clientele as the primary customers.

We’ve also just taken our new Absa Business Banking Credit Card to market in Kenya – it will be going live in the rest of our markets in Q1 2025 following the successful pilot. There’s a lot of work happening in making sure that we continue to stay relevant. We continue to innovate so that we are always responsive to our customers’ needs and are putting significant investments in our business going forward.

At Absa, we believe in your story and are committed to supporting its growth and success. We offer a diverse suite of business solutions, covering transactional banking, secured and unsecured lending, trade and working capital solutions, vehicle and commercial asset finance, and more, all aimed at allowing you to start and expand your business ventures.

Omar Baig

Managing Executive: Absa Regional Operations (ARO), Retail & Business Banking

“Small businesses are pivotal to the expansion of African economies. They are the leading creator of jobs, spark innovation, and strengthen communities. Our mission is simple: to help SMEs reach their maximum potential because we understand their vital role in Africa’s growth. Your success story matters to us, and that’s why we’re the best bank to support your ambitions.”

For your convenience, you can open an Absa Business Banking account seamlessly online, in just a few steps.

Don’t let financial constraints hold back your dreams. Explore our range of short-term and medium-term finance options to get the funding your business needs.

Our savings and investment choices are designed to help your business thrive in a dynamic market. Choose your notice period, the portion of your investment you need on demand, plus earn high interest rates for maintaining high balances.

Business Banking customers gain free access to Absa Cashflow Manager, a digital accounting system seamlessly connected to your transactional account to manage your finances effortlessly online.

Absa Online for Business and the Absa Mobile Banking App simplify your payment processes. Avoid branch fees by making payments and inter-account transfers easily, and send money to unbanked recipients with a click.

With Absa QR payments, customers can simply scan the QR code displayed by the merchant (in store or online) to make a payment.

Take charge of your business journey with our Absa Business Debit Card and manage transactions and expenses with ease. Our Absa Business Credit Cards offer global acceptance, lost card protection, data and reporting services, and extensive travel insurance, giving you peace of mind as you grow your business.

With Absa Mobi Tap, say goodbye to maintenance fees and simplify your end-of-day sales and monthly reconciliations. Easily accept card payments on the go, from anywhere, by letting customers tap their cards on your NFC-enabled Android smartphone for fast and secure transactions.

With Absa’s Merchant Portal solution, accept credit and debit card payments securely on your website, reaching customers worldwide, 24/7. Whether your business is big or small, tap into the global economy effortlessly.

We’re focused on unlocking your potential, that’s why our programs are aimed at driving SMEs towards economic growth. Get access to finance, products, services, and lucrative business opportunities. Join mentoring and incubation programs in key markets backed by Absa. Plus, benefit from tailored training, comprehensive business support, and valuable market access to fuel your entrepreneurial journey.

Judah Mphela

Head: Business Banking, Absa Regional Operations (ARO)

“Starting a business demands abundant courage and determination. As an entrepreneur, you’ve got what it takes, and Absa wants to help you reach your goals. We’re ready to empower you with tailored financial and investment solutions and support your success with the right strategic partnerships. Let’s turn your ambitions into a legacy because your story matters and we’re in to help you thrive.”

We proudly backed African business connections at the Absa-sponsored 2024 Made in Africa event, the largest virtual buyers-meet-sellers showcase on the continent.

We empower female entrepreneurs across six African markets with Absa Women in Business propositions, offering tailored mentorship programs and more to fuel the rising tide of women transforming Africa.

Absa Bank Ghana’s dynamic SME Clinic Series boosts SME efficiency through expertise sharing.

Premium support at Absa Bank Botswana SME Banking Centres, offering workspace, meeting rooms, and Wi-Fi – all the essentials for budding businesses.

Join the exclusive Absa Business Club in Kenya, Botswana, Ghana and Uganda designed to help SME customers build strong networks, increase market exposure, and benchmark against global industry standards. Experience annual business trips to diverse destinations to broaden horizons and gain invaluable insights into targeted industries.

At Absa, we are passionate about the part we play in shaping the many SME success stories on the continent.

PRODUCTION: Sam Hendricks

The critical intergovernmental science and technology project taking place across a global stage with a focus on South Africa’s Northern Cape is advancing quickly thanks to collaboration unlike that seen in any other industry. New infrastructure, original systems, fresh skills, and brilliant ideas are helping to drive this historic project towards its full potential.

//The Square Kilometre Array Observatory (SKAO) continues to catalyse the science and technology industries in South Africa. An intergovernmental mega project, with input from the world’s leading minds, the SKAO will be the world’s most powerful radio telescope, capable of addressing some of the most important questions in human history.

Co-located across southern Africa and Australia, the infrastructure is taking shape and the systems continue to link up from global headquarters in Manchester, UK. A number of lowfrequency radio antennas, spread across a large site in Western Australia, combine with a mid-frequency array across South Africa’s Northern Cape Karoo region. Both large projects in their own right, the two are already underway and doing great scientific work. Joining into existing infrastructure from around the world, the project has delivered surprising imagery.

South African and Australian

sites were chosen because of their remote nature and low levels of radio interference.

On the ground, construction continues, with new equipment being deployed, new software being developed, and upskilling of people that will provide benefits long into the future.

An impressive list of partner nations has delivered the project to its current status as a powerful tool of science and education, and good news came in November 2024 when Germany officially announced its official joining of the global partnership. Now, the list of countries involved as official partners sits at 12 with more in the process of joining. Australia, Canada, China, Germany, India, Italy, the Netherlands, Portugal, South Africa, Spain, Switzerland, and the UK are busy working together to advance the project. France, Japan,

South Korea, and Sweden are all expected to join the organisation soon, and many more are already affiliated or contributing partners.

Germany is a hub of technology and innovation, and has been involved in the project for many years. A site, currently in development, will be deployed in Görlitz as an SKAO hub in Germany. The German Center for Astrophysics (DZA) will provide access to SKA data for astronomers in the country.

The government of Germany and the science community were happy to finalise their membership.

“There is still much to discover and explore in our universe. As the world’s largest radio telescope arrays, the SKAO super telescopes in South Africa and Australia will revolutionise our understanding of the universe in the coming decades,” said Federal Research Minister Bettina Stark-Watzinger.

“Germany has a great history of

Continues on page 20

In 2012, Diesel Electric Services was awarded the contract to provide backup power to the prestigious Square Kilometer Array project.

The solution for this site was the integration of a rotary UPS system at 22000V, which caters not only for uninterrupted power supply but also integrated power conditioning:

Since 1993 Diesel Electric Services (Pty) Ltd is a turnkey power solution provider based company and can add value by keeping all power infrastructure requirements under one umbrella.This includes: design, manufacture, delivery, installation, commissioning, service, repairs and maintenance of generator sets, distribution boards, UPS and associated products to suit the needs of any organization.

The total scope of the contract included for the engineering, procurement, delivery, installation and commissioning of the 33kV and 22kV medium voltage switchgear, 2 x 2500kVA 33kV dry-type step-down transformers, and a 22kV rotary UPS solution, phase 1 rated at 3000kWe.

The design allows for five rotary UPS units, with three units installed in phase one. This allows for the upgrade path from 3000kWe to 5000kWe (N+1), without control system, MV import panel and MV output panel upgrades.

The rotary UPS farm is generating power at 400V and stepping up to 22kV via dry-type transformers. Also included was a 22kV drytype step-down transformer for the power supply to the 400V distribution network.

This power solution was successfully commissioned in July 2014, and it has been maintained by Diesel Electric Services since the date of practical completion.

Continued from page 18

achievement in radio astronomy and has been a valued partner in the SKA project for many years,” added Chair of the SKAO Council Dr Catherine Cesarsky. “I’m delighted that this has now resulted in SKAO membership, which reflects the hard work of many people across the community.”

Germany’s membership confirmation comes at an exciting time for the project. The initial pathfinder projects have all demonstrated early successes, but in July 2024 the first dish of the SKA-Mid telescope in South Africa achieved first light. Funded by Germany’s Max Planck Society, the

single dish will form part of the larger 197-dish array. The first light image of the southern sky at 2.5 GHz showed the technology to work as it should, much to the delight of the team. The single dish is known as the SKAMPI prototype, was manufactured in China to international design specifications.

“Tests of the SKAMPI prototype have already provided invaluable measurements of key performance parameters. These have been used to refine the design of the SKA-Mid dishes to ensure that they meet our demanding requirements for pointing and surface accuracy,” said SKAO Head of System Science Dr Robert Laing.

Buoyed by this success,

// THE PROGRESS THIS YEAR ACROSS THE OBSERVATORY HAS BEEN AMAZING, AND SEEING THE FIRST SKA-MID DISH BEING ERECTED IS A SIGNIFICANT MOMENT AS WE HEAD TOWARDS THE FIRST STAGE OF TELESCOPE DELIVERY //

construction of the first SKA-Mid dish began in July 2024. The first dish proper was lifted on to its pedestal by a local team in South Africa on July 4. After rollout of SKA-Low antennas in Australia in March, the South African Radio Astronomy Observatory (SARAO) was keen to keep pace.

Eventually, all 197 dishes will stretch over 150 km in the Northern Cape and will be able to study the universe in detail, from small radio bursts to gas distribution in far-off galaxies. Installed in a phased programme, the current construction will become part of Array Assembly 0.5, with each phase being tested independently.

“The progress this year across the Observatory has been amazing, and seeing the first SKA-Mid dish being erected is a significant moment as we head towards the first stage of telescope delivery,” said SKAO Acting Director of Programmes Luca Stringhetti.

“There’s a lot of work ahead of us, but for everyone involved, this is a special moment that represents years

of toil by people all over the world, so I want to thank them for their dedication in getting us here. Special thanks must go to our partners at SARAO and CETC54 for their professionalism and commitment – this collaboration is really bearing fruit,” added SKA-Mid Senior Project Manager Ben Lewis.

“The first of anything is always the most challenging, and we have learnt a huge amount from a logistical and technical perspective from this first dish. That will inform our planning going forward as we prepare to deliver a four-dish array early next year, before ramping up to ‘full speed’ construction later in 2025,” he said.

Away from building structures, the global SKAO organisation continues to develop human capital. Without appropriately skilled people, this is a project that will not live into the next generation. Specifically focused on Africa, the SKAO recently signed an MoU

with the UK Science and Technology Facilities Council (STFC) to establish an SKAO African Programme designed to create expertise in computer science, radio astronomy, and related fields.

Before South Africa was granted the right to host the SKA Project, the SARAO – a National Facility of the National Research Foundation – and the South African Department of Science, Technology and Innovation (DSTI) were already collaborating with eight African partner countries (Ghana, Kenya, Botswana, Namibia, Zambia, Madagascar, Mozambique and Mauritius) on human capital development.

In the longer-term, SKAO will produce big data in need of analysis to assist in the ambitions of understanding the foundations of the universe, and without local and global talent, this will not be possible.

“The SKAO Africa programme supports our long-term desire to see a broader involvement in the

Observatory across Africa. Our aim is to help develop the astronomy communities in countries across the continent; something that will add to the SKAO, but also enhance capability in STEM areas in those countries,” said SKAO Head of International Relations Thijs Geurts of the partnership.

International collaboration of this kind, at this scale, across such a broad range of subjects is hard to come by in modern society. Without the partnerships and shared values that transcend the SKAO, and without the willingness to innovative and advance together, many highly significant questions would remain distant. Through the SKAO and its groundbreaking work, answers are a little closer, coming into focus more so each year.

By Saviour Chibiya

Small and medium enterprises are engines of empowerment and the backbone of Africa’s economies. With the right support from financial institutions, they could drive unprecedented growth and transformation

across the continent through an ecosystem approach.

In October 2020, a partnership between Absa and the Mastercard Foundation set out to redefine the role of small businesses in Ghana’s economic transformation. At the heart of this initiative - the Absa Young Africa Works project - was a bold ambition: to create thousands of jobs by 2025. It was a deliberate investment in the country’s entrepreneurial ecosystem, positioning small- and medium-sized enterprises (SMEs) as engines of empowerment and economic resilience.

Since its inception, the project has trained over 6,700 SMEs in entrepreneurship, financial management, and digital tools, equipping them to attract investment and scale their operations. It has delivered US$100 million in subsidised loans to more than 6,000 businesses, prioritising women- and youth-led enterprises in sectors like agribusiness and fintech. By mid-2024, these efforts had created nearly 25,000 jobs and facilitated an investment of GHS1.1 billion in 6,296 SMEs.

The Absa Young Africa Works project is a case study in what can happen when financial institutions step beyond traditional banking to become enablers of inclusive growth. Similar initiatives by the bank are underway across the continent, providing trade finance, working capital, tailored lending solutions, innovative banking services, access to markets, and business development programmes in countries like Zambia, Botswana, Tanzania, Kenya, Uganda, and South Africa. This focus on SMEs is not incidental - it is imperative.

Across sub-Saharan Africa, SMEs represent over 90% of all registered businesses and contribute approximately 50% to the region’s total GDP, according to the African Union. They are the critical interface where macroeconomic policy meets grassroots impact, serving as nodes through which economic opportunities are decentralised, wealth is redistributed, and innovation is catalysed at scale.

But their significance also lies in their potential to stabilise Africa’s economies. According to the International Labor Organization, nearly 83% of employment in Africa and 85% in Sub-Saharan Africa is informal, absorbing many of the continent’s young employment seekers - an informality that also, however, complicates financial inclusion and exacerbates inequality. SMEs, when nurtured, represent the bridge between informal survivalist activities and structured economic participation which has the potential to create a ripple effect of socioeconomic transformation uniquely positioned to leverage Africa’s inherent comparative advantages.

Providing support, however, is not the only means of fostering an environment for more SMEs to emerge. While Africa is home to countless entrepreneurs innovating across sectors, many start businesses out of necessity rather than opportunity, driven by the lack of access to formal employment. The challenge, therefore, is not only to create more small businesses but to enable the existing ones to scale. Africa needs its SMEs to evolve into larger enterprises capable of generating high-value jobs, integrating into global markets, and fostering a multiplier effect across industries.

To achieve this, financial institutions must rethink their role in empowering African SMEs - not as lenders or service providers, but as strategic enablers of economic transformation. A deliberate shift is then needed toward designing solutions that address the financial and non-financial barriers SMEs face, while recognising that these businesses are not at all monolithic.

Absa, for example, combines tailored financial solutions with capacity-building programmes, access to digital platforms, market-linkage initiatives, and advisory services that help SMEs across Africa start up or scale their operations - a multidimensional approach that aligns capital with capability.

“SMEs, when nurtured, represent the bridge between informal survivalist activities and structured economic participation”

The end goal is not simply the growth of individual enterprises but the development of interconnected ecosystems that catalyse structural change across industries and borders.

Consider the potential of SMEs in agribusiness or renewable energy. Their success often hinges on their ability to integrate into supply chains, access new markets, or adopt innovative technologies. A bank that understands this doesn’t just offer capital - it works to create the conditions in which that capital becomes catalytic. This might mean enabling partnerships with logistics providers to ensure products reach global markets, or working alongside governments to streamline cross-border trade processes under initiatives like the African Continental Free Trade Area (AfCFTA). Whether through digital platforms that link SMEs to buyers or regional forums that bring together entrepreneurs across industries, the focus would be on building the relational infrastructure that underpins successful ecosystems.

At the same time, banks should embed knowledge and capacitybuilding into their strategies. This means equipping SMEs with the tools to innovate and compete. For example, through SME hubs or innovation centres, banks can provide training in export readiness, access to intellectual property expertise, or support in adopting sustainable business practices. These hubs can also foster collaboration between SMEs, enabling them to co-create solutions and share resources.

But banks cannot build these ecosystems in isolation - they must work alongside governments, development finance institutions, and private sector actors to align incentives and resources. Public-private partnerships (PPPs) are particularly effective in sectors like renewable energy or infrastructure, where largescale projects require both public oversight and private capital. By acting as intermediaries, banks can bridge the gap between policy objectives and market realities, ensuring that SME development is both inclusive and commercially viable.

Saviour Chibiya Chief Executive for Absa Regional Operations

One should also consider that these ecosystems are dynamic, shaped by changing market conditions, technological advancements, and shifting consumer demands. Banks will need to design interventions that evolve alongside these realities, as the tools and support mechanisms that African SMEs need today may differ entirely from those required tomorrow.

What emerges from this approach is not only the success of individual businesses but the strengthening of industries, the acceleration of innovation, and the creation of resilient economies that transcend borders.

For African banks, this is not a deviation from their purpose - it is an expansion of it, aligning their operations with the broader goal of sustainable, inclusive growth across the continent.

PRODUCTION: Sam Hendricks

Through its legacy companies Kagiso Trust Investments and Tiso Group, Kagiso Tiso Holdings (KTH) is an investment group champion with a range of quality assets across multiple sectors, boasting a proven track record of peerless investment performance and creating sustainable shareholder value for the long-term.

//With a legacy that can trace its origins back to 1993, Sandton-based Kagiso Tiso Holdings (KTH) was borne of a merger between Kagiso Trust Investments (KTI) and Tiso Group in 2011, creating a sizeable investment company of “critical mass”, according to KTH, with access to larger transactions and increased investment portfolio

diversification. CEO Paballo Makosholo was appointed in 2020, joining from Kagiso Capital and bringing more than 17 years’ experience at executive and board level.

“Today,” the company says, “we are a leading black-owned and managed investment holding company which has created long-term sustainable value for shareholders. KTH has a

strong and diversified asset portfolio comprising market-leading companies in the media, financial, education, and technology sectors, among others.”

This portfolio is replete with some of the biggest names in their respective fields, and includes integrated facilities management giant Servest and Me Cure

// WE ARE A LEADING BLACK-OWNED AND MANAGED INVESTMENT HOLDING COMPANY WHICH HAS CREATED LONG-TERM SUSTAINABLE VALUE FOR SHAREHOLDERS //

Healthcare, one of the leading human therapeutics company in West Africa’s pharmaceutical segment providing innovative healthcare solutions with the power to restore health and save lives.

Financial services also feature prominently in the KTH suite, not least in the form of Momentum Metropolitan, one of the largest long-term insurance

companies in South Africa with over 140 branches throughout the country, as well as centres of service in Namibia, Botswana, Kenya, Ghana, Lesotho and eSwatini. INCA Portfolio Managers (IPM), meanwhile, is a niche portfolio management and advisory services company with more than 25 years of experience in the municipal sector.

One of KTH’s most recent, and most significant, acquisitions has been a majority stake in Futurewise, a digital-first education financial services provider and licensed insurer whose purpose is to guarantee a prosperous future through access to quality education. “Dedicated to establishing educational attainment and financial inclusion, we offer innovative solutions tailored to families’ needs,” Futurewise summarises.

Today wholly-owned by KTH, it is Kagiso Media (KM) and the brands

falling under its umbrella that is arguably the standout in a packed KTH roster, now the largest blackowned media corporation in South Africa formed in 1997 by Kagiso Trust Investments to manage its media portfolio which, at the time, included industry leaders in broadcast media, specialist publishing, and exhibitions and events companies.

“Our acquisition of all of the shares of Kagiso Media represented a significant milestone for transformation on the South African landscape,” KTH expands, with its core interests today spanning new media, content production, specialised publishing, research, radio broadcasting and television. “KM’s heritage stems from one of the oldest black-led organisations, namely Kagiso Trust,” the company details, “whose aim, since inception, is to channel

funds to uplift and empower disadvantaged communities.”

The group’s interests, KM goes on, include controlling investments in East Coast Radio (ECR), one of KwaZulu-Natal’s top commercial radio stations, and Jacaranda FM, one the biggest independent radio stations in South Africa, as well as strategic stakes in OFM, Heart, Gagasi, along with a substantial economic interest in Kaya FM. Furthermore, KM has a controlling interest in Mediamark a specialist media sales and solutions company, while Urban Brew Studios is a leading facilities provider known as a bastion of creativity when it comes to entertaining content.

“Our mission is to continuously deliver innovative media and information solutions that facilitate beneficial

human connection,” says this media monolith. “The KM purpose is to develop a mix of cash generative and growth media assets that deliver attractive net returns that exceed expectations. Our assets are leading companies with good growth opportunities.”

KTH’s current portfolio of investments comprises market-leading companies across key sectors, and these are, generally, high-growth or cash generative and meet strict investment criteria aligned with KTH’s own core values and generating market-related returns. “Our values are at the core of our business philosophy and frame the way we conduct our business,” KTH stipulates.

“Two vital and inter-related principles of our business philosophy differentiate KTH as we strive to become a pan-African investment

champion,” summarises this company of endless ambition and prospect. “The first is our commercial approach, defined by our desire to be long-term shareholders who play an active and influential role in the strategic direction and sustainability of the companies in which we invest. The second is to be recognised as a company defined by its intention to create social value in the markets in which we operate.

“Our vision is explicit in defining our strategic approach and our ambition to become a leading blackowned investment company.”

PRODUCTION: James Redwell

Dealing in award-winning health risk management solutions, Medscheme has consistently delivered comprehensive solutions and innovative medical aid administration for over four decades. Strong customer focus, state-of-the-art technology and an unbending emphasis on quality of care define this leader in sustainable healthcare.

//Today South Africa’s largest health risk management services provider - and its second largest medical aid administrator - Medscheme reaches over three million people through an exhaustive network of branches in prime positions throughout South Africa, as well as those in Botswana, Namibia,

eSwatini, Zimbabwe and Mauritius.

“We have also acquired a specialist healthcare and insurance business in Mauritius that allows us to offer highly competitive business process outsourcing solutions to both local and international clients,” Medscheme furthers. “Our approach is to develop partnerships with our clients where we use local resources to develop

unique solutions and we constantly seek to collaborate with potential partners to develop appropriate healthcare solutions for the continent.

“Our proven combination of client-centricity and expertise is founded on excellence in corporate governance and world-class information technology,” Medscheme details. “These attributes position Medscheme as the

ideal business partner for corporate clients and medical aids who seek to offer quality health risk management and affordable health insurance to their members and employees.”

“Touching more than 3.8 million lives, we form close partnerships with our clients who include leading medical aids and large corporate companies in South Africa, Africa and internationally.”

One of the most challenging and universal issues facing the world today is sustainability, a challenge to which the healthcare sector is far from immune. In response, Medscheme is driven by the vision to create a world of sustainable healthcare, and has been known for delivering innovative medical aid administration and health risk management solutions of exceptional quality nonstop for more than 40 years of operation

within the private healthcare sector.

A comprehensive range of fully outsourced quality solutions span managed healthcare, medical aid administration and health risk management, offerings which cater to both medical aids and corporates.

“Our insight into sustainable healthcare allows us to develop customised programmes that achieve better solutions and deliver enhanced healthcare value,” Medscheme states. “Our approach is built on informed decisions, which prioritise the use of sustainable healthcare resources.” In the absence of such a healthy, disciplined approach, the company points out, health risk management can find itself reduced to random cost-cutting which ultimately results in inferior health outcomes and a lack of sustainability.

“It is our mission to innovate a new integrated model of sustainable healthcare that measurably improves

access to quality healthcare and enhance quality of life.” In order to succeed in its bid to create healthcare intelligence, Medscheme clarifies, the ability to access and analyse data intelligently is crucial, to enable strategic decision-making within a context of sustainability.

“For this reason, Medscheme’s Health Intelligence Unit has developed robust data management systems and analytical models that manage data intelligently in order to generate insightful information and identify trends. The data is then used to interpret and understand the value of healthcare provision and to focus interventions on enhancing healthcare value.”

“The goal of sustainable healthcare will be increasingly supported by information-sharing, and we used the

latest communication technologies to support this trend.” Medscheme is equally renowned for its comprehensive, integrated healthcare management solutions, “which recognise that flexibility and differentiation are crucial to remain competitive in the highly dynamic medical aid industry,” the company pronounces.

“Our priority is therefore to meet medical aid needs through service excellence, quality, differentiation and personalised solutions. Customer-centricity enjoys top priority at Medscheme, while we have made substantial investments in developing and maintaining a world-class technology platform that complies with international best practice for the industry.

“We achieve excellence through our policy of continuous improvement,”

Medscheme adds of a unique business philosophy, and in the spirit of this ethos has recently unveiled a new Healthcare Professional Portal (HCP), designed especially for healthcare providers and medical practice staff.

“We have completely revamped our portal and included intuitive features and sleek design to make interactions with Medscheme and our medical aid partners streamlined, and faster than ever,” the company says of the initiative.

“Featuring over 40 functions, we have developed this fresh start built on fresh ideas, ensuring that it is relevant to the needs of our valued healthcare professionals and delivers real value.” Medscheme indicates that, as a result, relevant member, medical aid and administration information are now immediately at the fingertips.

“We are on a transformative

journey at Medscheme,” concludes COO Mujeeb Bray, “intent on developing integrated, intuitive digital solutions for our valued clients that are seamless, provide realtime information to enable informed decisions and offer dynamic client experience that is best in industry. The launch of the provider portal is a demonstration of our commitment to achieving this goal, and we look forward to sharing further iterations of innovative platforms long into the future.”

PRODUCTION: James Redwell

Buscor is a leading passenger bus company, operating in the Lowveld region of Mpumalanga Province, South Africa with head offices in Nelspruit. Transporting nearly 40 million passengers per annum and covering a similar number of kilometres, “Buscor is totally committed to providing safe, reliable and affordable transportation to the community we serve,” the company opens.

//Since 1980 Buscor has operated in the Lowveld and today covers the Mbuzini and Mgobodi areas to the east, Barberton to the south, Hazyview to the north and Ngodwana in the west. “We take pride in serving and driving our community with dignity,” Buscor states. “Thus, we are dedicated to providing people in Nelspruit and surrounding areas with affordable, accessible, safe and convenient buses.”

Catering for workers, casual passengers, contracts and even special hires for organised parties, Buscor operates some 400 buses consisting of

bus trains, rigid and semi luxury buses and has gained renown as a pioneer of technological development in the passenger transport industry, along the way garnering the title of the largest bus train operator in Africa.

“Buscor shares the vision of the Department of Transport to become a world class bus service company offering first class transport system for Mpumalanga Province,” the company delineates. “As a responsible operator, Buscor works together with the department to

// WE HAVE EMPHASISED AND RECOGNISED THE FUNDAMENTAL IMPORTANCE OF PROVIDING TRANSPORTATION OPTIONS FOR

achieve this goal. Our motto is clear: passenger safety is our passion.”

Matsebula’s Bus Service was incepted in the late 1960s by Samuel, Michael and their father, Mpopoli Matsebula, later joined by their younger brother Joseph. Operating services between Pienaar, Daantjie and Lekazi to Nelspruit, Matsebula’s Bus Service also covered the Nkomazi area. Meanwhile, Sticks Nyalunga Bus Service was operated by the Nyalunga brothers Solomon, Ben and Paul, whose services spanned the Kabokweni and Pienaar areas to White River.

“The two companies amalgamated in 1980 to form what is today known as Buscor,” the resultant entity details, proudly the first bus service in Africa to introduce the groundbreaking

Continued from page 34

bi-articulated bus and today operating in excess of 40 within its fleet. In 2012 Buscor became the first passenger bus commuter operator to be fully black-owned, and to this day is strictly guided by its core tenets of reliability, transparency, safety, cost effectiveness and convenience.

“Buscor takes the utmost pride in serving the community to which it offers its services,” this transportation giant effuses. “We value

the communities we operate in and want to ensure that we cater to their needs in the best way possible.”

Long known as a most forwardthinking of companies, Buscor has been rightly pinned as a trailblazer in creating accessibility and inclusivity within transportation systems to the benefit of commuters. “Furthermore,” Buscor adds, “we have also emphasised and recognised the fundamental importance of providing transportation

// WE ARE EXCITED TO EMBARK ON A JOURNEY TOWARDS A FUTURE OF ENHANCED CONVENIENCE AND UNRIVALLED EXCELLENCE //

options for all individuals, leading to the implementation of a range of initiatives.

“These initiatives are to ensure that services are accessible to everyone, regardless of physical abilities or socio-economic status.”

This has entailed the introduction of wheelchair-accessible buses, designed to not only enhance the overall travel experience for people with disabilities, but also to highlight the importance of inclusivity in public services, alongside sensitivity training to ensure that drivers and support staff are positioned to help when required.

“In addition to physical accessibility, Buscor has also embraced technological innovations to enhance inclusivity,” the company stresses, last year reaffirming its commitment to delivering

exceptional bus travel experiences through the implementation of digital payment methods within the Nelspruit and White River Divisions.

“By implementing this advanced payment technique, we hope to not only streamline the ticket purchase process but also guarantee that our customers reach their destinations on time,” Buscor commented.

“We are proud to announce this innovative project and do this to reinforce our dedication to being the top bus transportation company in Mpumalanga. We are excited to embark on this journey towards a future of enhanced convenience and unrivalled excellence.”

Leveraging technology is inarguably critical to Buscor’s successes,

and it continues to pioneer new developments to revolutionise the way that commuters enjoy its bus services.

In June last year, Optibus, the leading provider of AI-powered planning and scheduling software solutions for the public transportation industry, joyfully announced its expansion in Africa with a new client in the form of Buscor.

It was revealed that Buscor will henceforth deploy Optibus’ Planning, Scheduling and Rostering software products to digitise urban and interurban services which had to date used traditional manual methods. “Using Optibus signifies Buscor’s commitment to passenger satisfaction,” said Buscor MD Timothy Mathebula. “This is a significant step forward in elevating the quality of

public transportation services, not just in the Mpumalanga Province, but across all of South Africa.

“We cannot wait to use Optibus to create a better travel experience for millions of passengers and ensure they reach their destinations safely and on time.”

“As we pursue excellence in every aspect of our operations,” Buscor rounds off, “our company supports the ideals of affordability, safety, dependability, efficiency, and convenience to ensure that our customers may look forward to first-rate travel experiences.”

IMPORTANT EVENTS AND EXHIBITIONS TAKING PLACE ACROSS SUB-SAHARAN

AFRICA, GIVING BRANDS A PLATFORM TO TELL THEIR STORY.

AGRO & POULTRY AFRICA

JAN 23 – 25 | DAR-ES-SALAAM, TANZANIA

Agro & Poultry Africa 2025 provides a unique opportunity to expand your brand in one of the most astonishing business destinations in Africa. Tanzania has a huge potential for Agriculture & its related products as it plays a vital role in country’s growing economy. The Exhibition would attract exhibitors from around 18 countries. Agro & Poultry Africa 2025 attracts visitor from different countries as a mass visitor is launched to make a fruitful event. The visiting countries include Kenya, South Africa, Congo, Sudan, Uganda, Rwanda, Botswana, Nigeria, Mali, Ethiopia, India, Egypt, UK, Germany etc.

DIGITAL RETAIL AFRICA 2025

JAN 30 | CAPE

The retail industry is evolving at an unprecedented pace. Are you ready to lead the transformation? Join us on 30 January 2025 at the CTICC for Digital Retail Africa 2025, where you’ll gain the insights and tools to outpace disruption and thrive in the New Age of Retail. Digital Retail Africa 2025 is a mustattend event that brings together the brightest minds in the retail industry to explore revolutionary ideas and cuttingedge technologies to ride the new wave of consumerism in Africa. With over 20 presentations from industry experts and retail gurus, you will learn how best to improve your business. Covering a wide range of topics including using AI, big data, and creating the perfect customer journey.

Food Kenya Trade Show 2025 is the International Trade Event. Setting new highs for participation from over 12 countries & visitors from over entire east & central african region, the event is all set for its exhibitors to meet serious buyers within the 3 days. The event continues to to lead the way in showcasing the new products & technology not only to Kenya but also to its surrounding countries. It is held in conjunction with Kenya Trade Show 2025.

AGRO & POULTRY AFRICA

DAR-ES-SALAAM, TZ | JAN 23 – 25

DIGITAL RETAIL AFRICA 2025 CAPE TOWN | JAN 30

FOOD KENYA TRADE SHOW 2025 NAIROBI | JAN 31 - FEB 2

SOLAR POWER AFRICA 2025 CAPE TOWN | FEB 10-12

UGANDA PHARMA & HEALTHCARE KAMPALA | FEB 13-15

WORLDVIEW EDUCATION FAIR JOHANNESBURG | FEB 27

At Sealand we've taken on the challenge to transform the gifting industry by upcycling advertising banners that would otherwise be deemed as waste. This material, Polly Twill, lines each Sealand bag, making our product unique and vibrant. We are future proofing our circular economy approach by o ering you a partnership to gift with a conscience, divert waste from landfill and empower our team of local machinists who hand make every Sealand bag. Contact us for more information.