2 minute read

Bubble trouble?

Beware of “the hype”

Remember December 1999? After a couple of years of very large investor inflows into technology, media and telecoms companies, the ‘tech bubble’ ended in frenzied speculation followed by a crash.

Whilst we have not had the frenzy (yet?), the massive surge of investors’ money into ESG-related investments means that a large measure of caution is required.

In July of this year, 90% of all equity investments went into ESG funds with Calastone, the research company, calling it a “gold rush”. The pool of assets under management with an ESG mandate is expected to rise to $50tn by 2025, from $35tn last year, according to a survey by Bloomberg Intelligence.

We completely agree that there is urgency in solving problems such as climate change but in asset markets this force of money has consequences in terms of pushing prices higher. We are not saying that all ESG stock valuations are in bubble territory, but some are definitely overvalued.

As this money has flooded in, it has tended to be concentrated in a relatively small number of stocks which ESG funds feel safe to buy.

A good example is the darling of the ESG funds, Ecolab. Ecolab is a good company that sells water management

Chart one

S&P 500 index

S&P global clean energy index solutions to a wide array of industries and is expected to grow earnings by around the same level as the wider equity market over the long term. Yet it trades on more than twice the market’s valuation.

We are not alone with these concerns.

The highly regarded Bank of International Settlements (BIS) in September wrote, “Assets related to fundamental economic and social changes tend to undergo large price corrections after an initial investment boom… given the very fast growth of the new asset class, there are questions about the possibility that a bubble might develop unless market transparency can be ensured.”

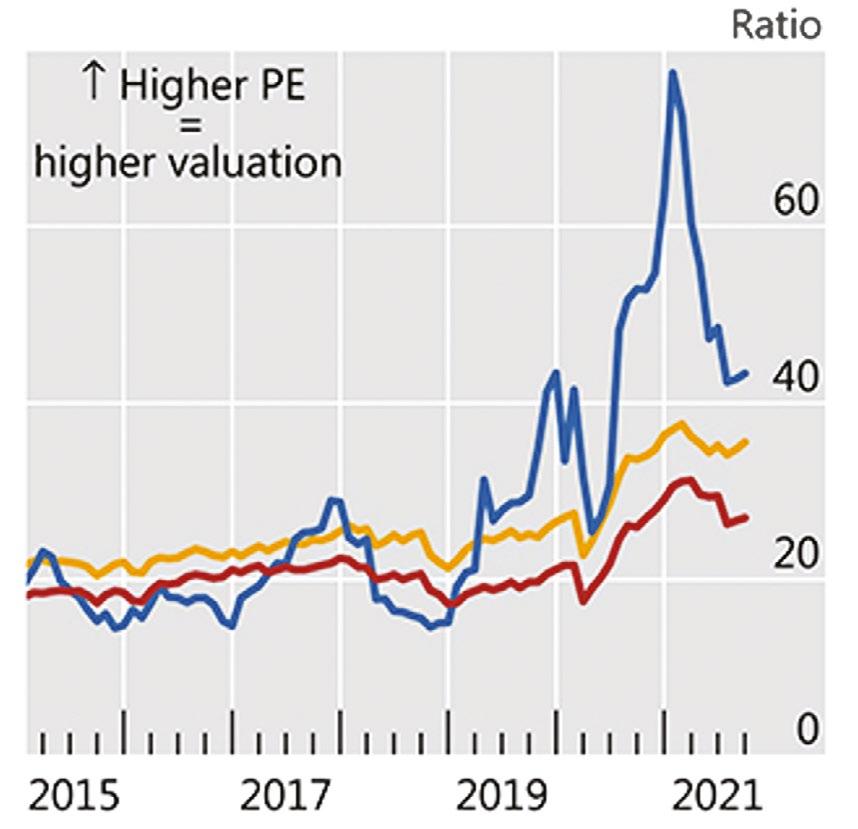

They cite the example of the global clean energy index which even after their decline from a peak earlier this year, “are still well above those of already richly valued growth stocks”.

In chart one, the global clean energy index is the blue line which remains well above the valuation of growth stocks, shown as the orange line, which are themselves at a premium valuation to the broader US market, the red line.

Part of the issue for many ESG funds is that they opt to invest heavily in just a few sectors, notably technology stocks. Refinitiv, the data provider, calculates that ESG funds, on average, have just under 30% of the funds in technology compared to around a quarter for the market.

Whilst we agree that technology is part of the solution to ESG issues, we are concerned that these highly valued stocks are being added blindly because they are new and relatively ‘clean’. We would contend that buying some Apple or Facebook shares is not going to move the needle in solving the climate change challenges the planet faces.

When looking at ESG investing, therefore, we need to keep our eyes open to the valuations but also ensure they are fulfilling the ESG goals, not just defaulting to the easy solutions. We believe the answers lie in looking beyond the obvious and loved stocks and looking at a broader universe of investments that can deliver the results we all want.