EURASIA Zhang Jun

Dean of the School of Economics at Fudan University

The global economy is big enough for China to re-emerge

The global economy is big enough for China to re-emerge

18. The pioneering role of the digital yuan

– Alexandra Zoltai

2-4.

19. The Thai experiment

– Péter Klemensits

NEW AGE – NEW ROAD

6-8.

20-21.

The steady rise of BRICS

– the road to the Johannesburg summit

CULTURE AND INNOVATION

26. A peak into the history of money in China

RHYMES IN HISTORY

28-29.

Geography is the key to history

– Norbert Csizmadia

ANCIENT KNOWLEDGE IN A MODERN WORLD

30-31.

challenge the dollar

– Dániel Szakács

15. Is China Africa’s only chance?

– Mátyás Kohán 16-17.

A slow, gradual dedollarisation is expected: interview with economist Philip Pilkington

– Mariann Őry

2T2C: TALENT, TECHNOLOGY, CAPITAL, COGNITION

23. ”We want connections, not blocs”

24. China builds the harbour of the future

– Zoltán Pataki

– Orsolya Péntek

“If you weaponize a currency enough times, other countries will stop using it.”

Elon Musk on dedollarisation

Eighty years ago, in 1944, the US dollar's hegemonic role was established at Bretton Woods. The Bretton Woods system fell apart a quarter of a century later, but the dollar's leadership had by then become unchallenged - even beyond its peg to gold. Everyone invested and traded in dollars, and in the 1970s, the concept of the petrodollar was born, meaning that oil could only be paid for in dollars. By the early 21st century, the US dollar accounted for 70 per cent of global foreign exchange reserves.

The beginning of the 21st century saw the beginning of a change, a forerunner of a shift in the world order. The role of the dollar began to decline very slowly, with the share of the dollar falling below 59 per cent in the last quarter of 2022, according to IMF data on the currency composition of official foreign reserves. The euro rose to 27.7 per cent until 2009 before falling back to 20 per cent. The Japanese yen (5.51 per cent) and the pound sterling (4.95 per cent) were joined by the Chinese renminbi (2.69 per cent), which from 2016 also appeared in the SDR basket of currencies as the third most important currency in international trade (12.28 per cent).

Nowadays, there is even more news about the strengthening of the renminbi (RMB): the end of the petrodollar or the birth of the petroyuan, as China, the world's largest oil importer, can pay Saudi Arabia in RMB for crude oil; the RMB became the most used currency in China's cross-border transactions

Levente Horváth, Ph.D., Director of the Eurasia Center, Editor-in-Chief of the Eurasia Magazine

in March, surpassing the dollar, according to China's State Administration of Foreign Exchange (SAFE); Brazil's government announced that the country reached an agreement with China to trade in their own currencies, ditching the dollar as an intermediary, not to mention that China, the world's second-biggest economy has made similar agreements with a number of countries, including Russia or Pakistan. The list of such news is growing every day.

And, of course, the RMB's most innovative development is the digital yuan, which has been researched for almost ten years and tested for four years.

In the financial world, which also defines the world order, the hegemonic power of the USD has been steadily declining while the RMB has been on a rising path. This tendency could replace unipolarity in the financial world with yin and yang, supporting the strengthening of other currencies and thus creating a multipolar harmony.

The yin and yang of the financial world – Levente Horváth The global economy is big enough for China to re-emerge – Mariann Őry Joint venture with China – Mariann Őry GEOGRAPHY 9. China Construction Bank opens Hungarian branch 10-13. Budapest to play key role in renminbi internationalisation – Levente Horváth 14. The renminbi could The dragon, the tiger and the phoenixPROFESSOR ZHANG JUN ON US-CHINESE RIVALRY AND THE RENMINBI’S PROSPECTS

by Mariann Őry

Photos: Róbert Hegedüs

by Mariann Őry

Photos: Róbert Hegedüs

CHINA’S INEVITABLE ECONOMIC RISE CAN BENEFIT EUROPE, ACCORDING TO ZHANG JUN, DEAN OF THE SCHOOL OF ECONOMICS AT FUDAN UNIVERSITY. THE ECONOMY MATTERS MORE THAN POLITICS IN THE LONG RUN, THE PROFESSOR TOLD US.

- While the gravity of the economy is clearly shifting towards the East, the United States is becoming increasingly aggressive towards China, treating it as a rival. Is this inevitable?

- Many people think it is but don’t think it’s necessary. Looking back to the 1990s, even American politicians regarded China’s economic rise as beneficial for all. I think it’s quite difficult to understand why the attitude has changed so rapidly. The global economy is big enough for China to reemerge. Even though China is now the world’s second-largest economy, I think most Chinese consider themselves a middle-income country, and also

American politicians tend to exaggerate China’s strength. The country still has a lot to catch up on.

- How do you see the prospects of the renminbi’s internationalisation?

- Eventually, the renminbi is definitely going to be one of the major global currencies in fifteen-twenty years. The two fundamental determinators are the size of China’s GDP and its share of global trade. We should also look at the country’s financial system; the minimum requirement is that the currency can be used to pay for purchases in investment.

Europe’s point of view is very different from the US’s when it comes to China’s growing economic power.

- How do you evaluate French President Emmanuel Macron’s trip to China? Was it a sign that Europe was articulating its interests independent from the US?

- I think his visit to China reminded us that there should never be one single voice speaking for the Western world. Europe’s point of view is very different from the US’s when it comes to China’s growing economic power. In the very short run, politics determine the economy, but in the long run, I think the economy matters much more.

- What is Europe’s interest in its relations with China?

- Europe can benefit from China’s rise, and its increasing capacities can improve the living standards in Europe too. Europe’s current problems, like the high inflation or the energy crisis, may not

be simply solved without China’s participation. One of the European countries, France or Germany, needs to play the leading role in maintaining the ties. The economic rise of China is a phenomenon that is inevitable. Nobody can stop the process of modernising the Chinese economy. But China also needs Europe because even though its GDP is almost the same as the EU’s, the per-capita GDP is only about a quarter of the EU’s.

The author is editor of Eurasia Magazine

www.mnb.hu\eurasia

Nobody can stop the process of modernising the Chinese economy.

ASIA HAS REALISED THAT, CONTRARY TO WESTERN THINKING, IT IS NECESSARY TO COMBINE STATE AND MARKET LOGIC, SAYS MIHÁLY PATAI. WE SAT DOWN WITH THE DEPUTY GOVERNOR OF THE MAGYAR NEMZETI BANK (THE CENTRAL BANK OF HUNGARY) TO DISCUSS THE IMPORTANCE OF DIGITALISATION AND GREENING, THE INTERNATIONALISATION OF THE RENMINBI AND THE REGIONAL ROLE OF BUDAPEST.

- During your career, you have gained a wealth of experience in the financial world, both in the East and the West. What is different about negotiating with Eastern and Western partners? What do you need to succeed?

- The most important thing is to be able to represent your interests very clearly. This is valued by both types of thinking. An important difference is that in Eastern business, it is more important how long the relationship has been established, how well it has been tested, and how durable and consistent it is. In the West, rationality is usually the deciding factor. If a business proposal suits the client, it is easy to close the deal. In the East, it takes more time.

- What do you see as the main reason for the rise of Asia today?

- In Western economic thinking, there has always been a pendulum effect - mainstream economic thinking has stuck to a doctrine for decades and then changed it. From the mid-1930s to the mid-1970s, the thinking was dominated by a mindset that attached great importance to the role of the state. Then, from the mid-seventies, when Hayek and Friedman were awarded the Nobel Prize, a new phase began, which lasted until 20082009, when the market was seen as the dominant factor. The issue is always the relationship between the market and the state, ultimately, the primacy of the ‚invisible hand’ and the ‚public hand’. In this

way of thinking, Asia has broken new ground in the last thirty or forty years, showing that the state mindset must be combined with the market mindset. I think this is the key to the success of Japan, Korea and especially China. In Asia, they have combined these two mindsets, which have always alternated in the West.

- How is Hungary involved in promoting the internationalisation of the renminbi?

- After the Hungarian government announced the policy of Eastern Opening thirteen years ago, the Magyar Nemzeti Bank has also stepped in, having signed an agreement with the Chinese central bank ten years ago and launched its renminbi programme in 2015. In other words, we use the renminbi as a world currency. So the Monetary Council has decided that we will also hold renminbi assets in our reserves. From the same year onwards, we will also organise the Budapest Renminbi Initiative Conference.

- Today, the renminbi accounts for about three per cent of total world reserves and total world trade, while the largest trading nation in the world today is China. They are also by far the largest exporters and importers; for some thirty countries, China is the most important export market, including the major Euro-Atlantic countries, and for some seventy countries, China is the largest import market. But the function of money does not support this. So there is an inevitable need for the renminbi to internationalise.

OF THE HUNGARIAN BRANCH OF CHINA CONSTRUCTION BANK (CCB), THE WORLD’S SECOND-LARGEST BANK, WAS HELD IN BUDAPEST ON APRIL 20.

Tian Guoli, President of CCB, said that the strong and deep friendship between China and Hungary has a long history. He expects the financial institution to contribute to the further expansion of Chinese-Hungarian economic, financial, and trade relations.

According to Mihály Patai, Vice President of the Magyar Nemzeti Bank (Hungary’s central bank), the opening of a new branch results from the increasingly close interconnection between the Hungarian and Chinese financial systems. Bank of China already established itself in Hungary in 2014, he reminded.

Yang Chao, Chargé d’Affaires of the Chinese Embassy in Hungary, said that Hungary plays a pioneering role in China’s Belt and Road Initiative, and its unique location makes it a strategically important location.

Wang Yanyun, General Manager of CCB Hungary, Sun Jianbo, General Manager of CCB's Internationa Business Department, Yang Chao, Chargé d'Affaires, of the Embassy of China in Hungary, János Csák, Minister of Culture and Innovation,Tian Guoli, Chairman of CCB, Márton Nagy, Minister of Economic Development, Mihály Patai, Deputy Governor of MNB, Hungary's central bank, Barnabás Virág, Deputy Governor of MNB

In an interview with Eurasia Magazine last year, Tian Guoli said that CCB considered three aspects when considering opening a branch in Hungary. The first is that Hungary has a favourable business environment, being a hub for Eastern and Western Europe. The second is that China and Hungary have deepened cooperation in the internationalisation of the renminbi (RMB). The third aspect is that China and Hungary should capitalise on the growing momentum of digital cooperation.

Asia has broken new ground in the last thirty or forty years, showing that the state mindset must be combined with the market mindsetPrime Minister Viktor Orbán also received Tian Guoli and his delegation at a working lunch at his office in the Carmelite Monastery.

THE CENTRAL AND EASTERN EUROPEAN REGION, AND BUDAPEST IN PARTICULAR, IS PLAYING AN INCREASINGLY IMPORTANT ROLE IN THE INTERNATIONALISATION OF THE RENMINBI. PARTICIPANTS AT THE SEVENTH BUDAPEST RENMINBI INITIATIVE CONFERENCE 4 DISCUSSED THE RESPONSIBILITY OF CENTRAL BANKS IN ADDRESSING THE CHALLENGES OF OUR TIME, SUCH AS THE GREEN TRANSITION AND MAINTAINING THE STABILITY OF THE FINANCIAL SYSTEM.

Magyar Nemzeti Bank (MNB), Hungary’s central bank hosted the seventh Budapest Renminbi Initiative Conference on „Financial Interconnectivity and the Green Transition” on 4 May. Launched in 2015, the initiative further strengthens cooperation between the Chinese and Hungarian central banks, as well as Chinese-Hungarian economic diplomacy relations. It aims to help promote the internationalisation of the renminbi, enhance Budapest’s role in economic cooperation between China and the Central and Eastern European region, and expand the sources of investment and financing in Hungary.

Speaking at the opening ceremony, Mihály Patai, Deputy Governor of the MNB, recalled that China was one of the first countries to recognise the importance of green finance and the People’s Bank of China is at the forefront of the development of central bank digital currency (CBDC). He stressed that the Hungary’s central bank also prioritises digitalisation, financial innovation and sustainability, and is similarly committed to the internationalisation of the renminbi.

Yang Chao, Chargé d’Affaires of the Embassy of the People’s Republic of China in Budapest, highlighted the role of the MNB in the development of financial cooperation between the two countries. The acceleration of multipolarisation and the internationalisation of the renminbi, Yang Chao said, offered the countries of the world stability and a reliable new alternative to the US dollar. The diplomat said China is interested in strengthening connectivity, and the Belt and Road Initiative (BRI), which is ten years old this year, is a tool for this.

Xu Chen, Chairman of Bank of China (Europe) S.A. pointed out that those who advocate decoupling the Chinese and EU economies cannot hinder Chi-

na’s development, but are depriving Europe of valuable opportunities. He warned that using the dollar as a foreign policy weapon undermines confidence in the global financial system.

The centre of gravity of the world economy is clearly shifting eastwards, and China’s economic weight is also becoming increasingly important, said Zhang Jun, Dean of School of Economics at Fudan University, in his speech. In this context, he highlighted the cooperation with the Central and Eastern European region, the ASEAN countries, and the role of the BRI.

The author is the Director of Eurasia Center

- Which scenario is more likely: renminbi taking the place of the dollar or a kind of multipolarity with several currencies?

- We already almost have a financial multipolarity to some extent, with the Euro being 20 percent globally. And so there are already two players, two large currencies. In China, there’s less debt available than in the US and it’s less clear if there’s going to be growth fiscally in the future. I think these are the two main differences which stop making the renminbi more important just now. ■

- What issue would you highlight from the cooperation between the French and the Chinese central bank?

- One way we cooperate closely with China is in the network of central banks for the greening of the financial system. We also work together in the framework of the Sustainable Finance Working Group of the G20. There are a lot of synergies there and we’re always very happy to work without Chinese counterparts on this. China is also very important for Europe’s green transition because it has many of the materials we need for that.

- In your opinion, how effectively is the internationalisation of the renminbi is proceeding?

- I think, for now, China does not want to internationaise the renminbi but is rather preparing all the necessary steps leading towards this goal. All these steps have not been used to their full potential yet. Without the liberalisation of the capital account there is no possibility to completely internationalise the renminbi, but there is definitely room for doing more than where we are now.

- How do the Ukraine war and the subsequent sanctions change the dynamics of international cooperations?

- Both the conflict and sanctions complicate the dynamics of international cooperation. Conflict has inspired countries such as Finland and Sweden to scamper to join NATO, not in the best interests of these countries or of NATO, definitely anathema to the interests of the Russian Federation as perceived by Russian leadership.

- According to recent reports, 19 countries expressed an interest in joining the BRICS ahead of its annual summit. What conclusions can we draw from this development?

- Enthusiasm for joining BRICS is interesting, most are not European except Belarus already aligned with Russia. Brazil and Argentina are contentious similar to India and Pakistan, so one wonders how delighted Brazil is with Argentina joining, India is with Pakistan joining. From this development we can suspect China is less happy than Russia because it flies in the face of China’s “Belt and Road” initiative, benefitting Russian Federation more than China’s objectives.

- How do all these recent changes impact China’s role in world economy?

- In my judgment if so many countries join BRICS, actually this sets back China’s aim to become more dominant in trade and influence, simply because with a larger BRICS Bloc China becomes one of many members, not necessarily the leading nation. ■

Woo Wing Thye, Distinguished Professor of Economics, University of California, Davis

- What role can central banks play in reaching climate and sustainability goals?

- In order to reach the climate goals, there have to be very large-scale investments because we have to change the way we generate electricity, the way we travel and the way we make things. This means that the production techniques have to be completely rebuilt. This cannot be done without the mobilisation of private finance. So the role of the central bank is to be able to provide creative schemes like blended finance in order to attract private finance into these investment programmes.

- Do these goals mean the same everywhere?

- When people talk about green transformation, they usually have in mind net zero emissions of CO2 or the protection of biodiversity. That definition of sustainability is really not adequate for poor, developing countries. How can you tell a person not to cut down trees if this is how he feeds his family? So for these countries, economic growth is key. Green energy costs more. If it wasn’t, we’d already use it everywhere.

- Which Eurasian city do you expect to become the next dominant financial centre of the world?

- It could be Beijing, Shanghai, Tokyo, Sydney, or even Bombay. I expect it to be Shanghai, largely because the Japanese economy is shrinking in relative size, whereas China has been expanding tremendously, first overtaking Japan in economic size and coming to equal the US in purchasing power. Also, it’s among the biggest traders in the world. So it is quite natural that a financial centre would be located there. ■

by Dániel Szakács

by Dániel Szakács

China’s long-term plan is to make the renminbi, like the dollar, an increasingly widespread currency in international payments. While Brazil and Russia have begun to move away from the dollar, a similar, but much slower, trend is underway in Saudi Arabia, where oil exports to China may be paid for in renminbi in the near future.

Saudi Arabia is currently in active negotiations to have part of its oil sales to China in renminbi. This initiative is a move that could break the dominance of the US dollar in the global oil market and would be a clear sign of a shift by the world’s largest crude exporter towards China and the Asian market.

Should Saudi Arabia actually trade with China in Chinese currency, the economic impact would be significant. On the one hand, it would strengthen the Chinese currency against the dollar and, on the other, it would increase China’s international eco-

nomic influence. At the same time, Saudi experts warn the Saudi leadership that such a major decision should not be taken prematurely as it would cause significant damage to the Saudi economy. This is because Saudi Arabia’s currency, the Saudi riyal, is pegged to the dollar.

It is worth noting that economic relations between China and Russia have also strengthened in recent months. A spokesman for the Russian finance ministry said the renminbi was playing an increasingly important role in the state asset fund, which doubled its renminbi share to 60 per cent in December.

While Russia’s use of the renminbi does not signal the end of dollar supremacy, it could herald the beginning of a more fragmented regime that could ultimately blunt the ability of the United States to weaponize financial sanctions.

The author is a junior international expert at the Magyar Nemzeti Bank, the central bank of Hungary

To China, Africa is the land of opportunity along the lines of what America used to be to Europe: a place where they can fetch resources, export goods and surplus workforce, get a local economy up to speed while supersizing their own, and then leave it up to the co-opted local elites to make of it what they will.

The possible outcomes are the same old ones, too: in Rwanda and pre-war Ethiopia, with average GDP growth rates of 5.23 per cent and 9.1 per cent respectively, Chinese investment has fuelled the take-off phase of the same capitalist miracle that made Canada and the US great. And in other, more resource-rich African countries, where corrupt local governments are handing over their countries’ treasures to China for a pittance to the budget and fat bribes for themselves, it’s hard not to see the parallels with some less lucky polities in Latin America that are strangled by their dependent capitalism.

We are often too quick to write off China’s African adventures as “neocolonialism” or “debt-trap diplomacy”. But that’s a fallacy, and so is the example most used to back it up: the case of recently-defaulted Sri Lanka. Despite having struck gargantuan infrastructure deals with China, Chinese creditors only held around 20 per cent of Sri Lanka’s public debt when it defaulted last spring. Chinese lending was hardly to blame for the woes of a state that had been mismanaged for so long at that point.

China has actually offered to this long-ignored continent, cynically abused by its own colonial masters as testing grounds for the Cold War development industry, a path towards substantial

Source: OEC, World Bank, Statista research Graphic: Alexandra Érsek-Csanádi

change. It’s far from perfect, of course: it’s lined with the interests of an overpopulated superpower that’s vying for hydrocarbons, rare earths and arable land. But it’s a viable offer. And for many African countries, it’s the only one on the table at this time. No one keeps other powers from sketching up a better one.

The author is a foreign policy journalist

WHILE CHINA APPROACHES ITS ALLIANCES IN A WHOLLY PRAGMATIC MANNER, THE UNITED STATES HAS BECOME INCREASINGLY MORALISTIC, POINTS OUT MACROECONOMIST PHILIP PILKINGTON. WE SPOKE TO THE HOST OF THE MULTIPOLARITY PODCAST ABOUT THE CHANGING ROLE OF THE DOLLAR AND THE EMERGING MULTIPOLAR WORLD.

- How do you see the tendency of dedollarisation?

- The tendency started on February 26th 2022 when the United States and its close allies issued a joint statement pledging to freeze the reserve assets of the Russian central bank.

The moment this happened, people working in financial markets –where I spent ten years of my career – immediately started speculating that this could be the end of the dollar’s hegemony. The asset seizure, which was unprecedented in terms of scale, signalled to the world that their US dollar reserve assets were only safe insofar as the US State Department approved of their foreign policy. This has led many countries to start to shift away from the dollar. The shift away from the dollar is already happening and the pace at which it occurs only seems to be accelerating. That said, I do not expect the dollar to decline dramatically. Rather, it will be a gradual process.

- Is the end of the dollar’s extraterritoriality a realistic scenario in the near future?

- I think that this will be a slow, gradual shift away from the dollar over the next five to ten years. There is no fundamental reason for countries to use the US dollar in global trade. The financial architecture around the dollar is impressive, but it can easily replicated – as Russia and China have shown. Countries used the dollar mainly due to custom and habit.

- Malaysia’s prime minister recently revived the idea of an Asian monetary fund. Do you think it can accelerate the building of a multipolar world?

- Right now, the most likely outcome looks like the emergence of a multipolar monetary system. There is a desire amongst the BRICS+ to try to build a true multilateral currency system. As this new regime emerges though, I would not be surprised if we see greater usage of the renminbi in the interim.

Source: South China Morning Post, May 2023

- According to a recent Bloomberg article, former Treasury Secretary Lawrence Summers said he sees “troubling” signs that the US is losing influence as the pace of globalization fades. Why is the US-led bloc losing its attractiveness?

- America’s economic power in the past three or four decades has increasingly been its financial power. But that power was tied to the global use of the dollar. The second component is that the Americans are mismanaging the transition. American policymakers seem confused about the strength of the United States as an economic power. They appear to think that they possess the most important economy in the world. But they do not.

- How is China’s approach to its alliances different from the US’s?

- China approaches its alliances in a wholly pragmatic manner. The Chinese do not care much about the internal governance of a country, so long as this does not impede China’s interests. The United States, on the other hand, has become increasingly moralistic about its alliances. America seems to expect that its allies adhere to American values. This would be problematic in and of itself, but it is made vastly worse by the fact that, frankly, American values appear to be in a constant state of flux and become more unusual and exotic every year.

The author is editor of Eurasia Magazine

There is a desire amongst the BRICS+ to try to build a true multilateral currency systemChinese President Xi Jinping and his US counterpart Joe Biden

E-CNY, OR DIGITAL YUAN, IS A CENTRALISED, CASH-LIKE DIGITAL CURRENCY USED PRIMARILY FOR RETAIL PAYMENTS IN CHINA. THE PEOPLE’S BANK OF CHINA (PBOC), THE CENTRAL BANK, HAS CONDUCTED LARGE-SCALE PILOT PROGRAMMES FOR THE DIGITAL YUAN IN SEVERAL CITIES IN RECENT YEARS. THE INTRODUCTION OF THE DIGITAL YUAN SERVES TWO DISTINCT BUT RELATED PURPOSES.

The first, longer-term goal is to create a digital currency that can compete with other digital currencies, such as Bitcoin while ensuring that the yuan remains the dominant currency in China. Unlike cryptocurrencies like Bitcoin, the digital yuan is issued directly by China’s central bank and does not rely on a blockchain. The value of the currency is the same as its analogue counterpart, the yuan, and for consumers, using the digital yuan is no different than using other mobile payment systems or credit cards.

The second, more immediate goal is to transform China’s current payment system by providing a cash-like digital payment method: accessible to all, inexpensive, reasonably anonymous, and encouraging competition among payment service providers. In the PBOC’s pilot programmes to date, the e-CNY wallet only requires a cell phone number.

The successful launch of e-CNY can accelerate the pace of currency digitalisation worldwide. If e-CNY catches on in China, it will prompt other central banks to redouble their efforts to develop their own digital currencies.

The author is a researcher at the Eurasia Center and the director of the Confucius Institute at the University of Szeged

by Péter KlemensitsMaintaining monetary stability is a priority in many countries, and it is no coincidence that major powers such as China, Russia and Brazil have been experimenting with central bank digital currencies (CBDC) for some time. In addition, of course, a number of smaller countries have made significant progress in this area, such as Thailand in South-East Asia.

In Thailand, experiments with digital central bank money date back to August 2018, when the Bank of Thailand (BOT) developed a CBDC prototype in partnership with R3 and Wipro, and with the involvement of commercial banks, to launch a project called Inthanon. The Inthanon project aimed to enable domestic money transfers within the country’s interbank system by issuing CBDC tokens.

The first phase of the project focused on building basic payments infrastructure, while subsequent phases explored the application of blockchain technology to other functions. In August 2022, the central bank had already announced that it expected to test the retail digital currency as an alternative payment option from the end of the

1. Technological efficiency

2. Financial inclusion

3. Cost efficiency

4. Reduction of illegal activities

5. Proof of transactions

year until mid-2023. During the testing, the retail CBDC will be used to conduct cash-like transactions, such as payments for goods and services, in limited areas and among around 10,000 retail users, the central bank said.

The Central Bank of Thailand is fully aware of the advances in the digital economy and it is no coincidence that it has been among the first in the world to start experimenting with CBDC, while not underestimating the difficulties associated with its implementation. Last October, the Governor of the Central Bank of Thailand, Sethaput Suthiwartnarueput, stressed that the institution was keen to gain as much experience as possible with the CBDC and that it would probably take several years before the currency was ready to be introduced, given the risks and dangers.

The author is a senior researcher at the Eurasia Center

1. China and Brazil signed an agreement in March on trade in mutual currencies, abandoning the US dollar as an intermediary.

2. The yuan became the most widely-used currency for cross-border transactions in China in March, overtaking the dollar for the first time. Cross-border payments and receipts in yuan rose to a record USD 549.9 billion in March from USD 434.5 billion a month earlier, according to Reuters.

3. BRICS countries are expected to outpace the G7 in terms of their contribution to the world’s economic growth this year, according to the IMF. They will contribute 32.1 per cent of the world’s growth, compared to the G7’s 29.9 per cent.

4. China will be the top contributor to global growth over the next five years, with its share set to be double that of the US, IMF data shows. China’s slice of global GDP is expected to represent 22.6 per cent through 2028, followed by India (12.9) and the USA (11.3).

5. BRICS has surpassed G7 in terms of GDP calculated on purchasing power parity. According to Acorn Macro Consulting, BRICS countries now contribute 31.5 per cent to the global GDP and the G7 30.7 per cent.

6. Argentina will pay for Chinese imports in yuan instead of US dollars in order to preserve its dwindling foreign reserves, Economy Minister Sergio Massa announced.

7. Nineteen countries expressed an interest in joining the BRICS, among them Saudi Arabia, Iran, Argentina, the United Arab Emirates, Algeria, Egypt, Bahrain and Indonesia, but also African countries.

8. The idea of the BRICS adopting its own currency is likely to be on the agenda of the meeting of heads of state in Johannesburg on August 22.

9. Saudi Arabia is in talks to join the Shanghai-based New Development Bank, also known as the „BRICS Bank,” Financial Times reported on 28 May.

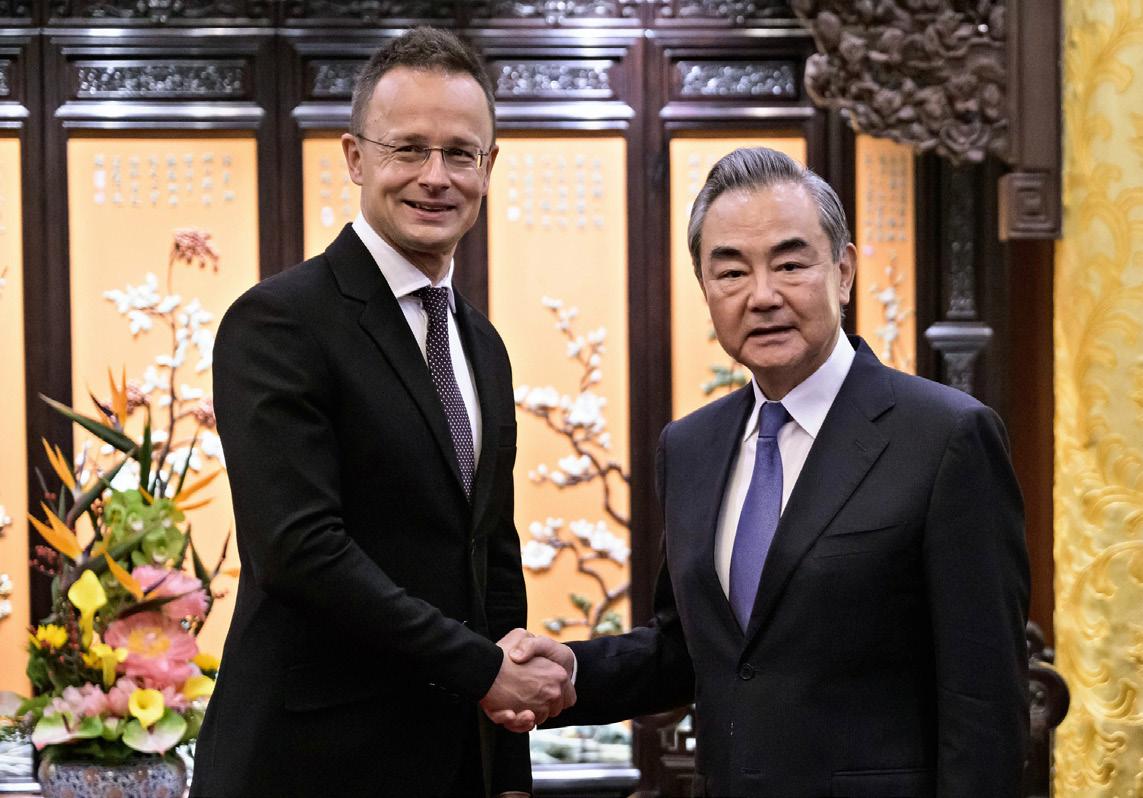

HUNGARY IS A LEADER IN DIGITALISATION IN WHICH HUAWEI PLAYS A DECISIVE ROLE, MINISTER OF FOREIGN AFFAIRS AND TRADE PÉTER SZIJJÁRTÓ SAID AFTER THE SIGNING OF AN AGREEMENT ON THE SEEDS SCHOLARSHIP SCHEME BY REPRESENTATIVES OF THE COMPANY AND HUNGARY’S NATIONAL UNIVERSITY OF PUBLIC SERVICE (NKE) IN BEIJING ON MAY 15. “HUNGARY WILL CONTINUE TO PROVIDE AN OPEN AND FAIR ECONOMIC AND BUSINESS ENVIRONMENT FOR FOREIGN INVESTORS IN WHICH THE ONLY POWERFUL VIEW IS THAT COMPANIES MUST RESPECT HUNGARIAN LAWS AND REGULATIONS. HUAWEI APPRECIATES ALL OF THIS AND CONSEQUENTLY OUR COOPERATION IS FURTHER EXPANDING,” SZIJJÁRTÓ SAID.

China is investing 3 billion euros in Hungary’s automotive industry in the coming period, Péter Szijjártó said after talks with Minister of Commerce Wang Wentao in Beijing. The projects will further strengthen Hungary’s position as a top investment destination in central Europe, he stressed.

Hungary and China have concluded a new agreement on air transport, which could double the number of flights between the two countries to 42 a week, Szijjártó announced at the China-Central and Eastern European Countries (CEEC) Expo in Ningbo.

The European Union will lose out “if it sees China as its rival” because China has gained an advantage in many areas in recent years, according to Péter Szijjártó. “We want connections, not blocs, to be a basis on which the world operates in the coming period. We think that China’s global initiatives serve to achieve this goal, so we support these,” he said.

AS THE MANUFACTURER OF THE WORLD, 70 PER CENT OF COUNTRIES COUNT CHINA AS THEIR TOP TRADING PARTNER. CHINA OPERATES 34 MAJOR AND 2000 MINOR PORTS ACROSS THE COUNTRY.

They are some of the world’s most important pieces of our global supply chain. However, one of the biggest problems currently facing the industry is labour; disruptions at world ports quadruple as discontent grows. Finding reliable workers is a problem for seemingly every industry since COVID-19.

Tianjin Port which is one of the most important in the global supply chain is located 60 kilometres away from down-town Tianjin, a coastal metropolis south-east of Beijing. It maintains trade with more than 500 ports across more than 180 countries around the globe. But there is something absolutely different in Terminal C in Tianjin. On the surface, it

looks like any other shipping harbour filled with cranes and containers. But instead of workers, this terminal is operated by fully automated computers using 5G cloud computing, AI and robots.

Smart ports require only 25 per cent of the human workforce of a traditional port. Most of these employees are located in offices and simply manage the entire port’s operation through their computer screens. Due to the automation, the port has saved millions in labour costs, but this also provides other huge benefits.

Huawei, China’s leading tech company, has come under intense pressure from US sanctions in recent years and because of these sanctions Huawei is pivoting to new industries. This project in Tianjin has become a new priority for the company, which is now seeking to tap into a global smart port market that is expected to reach 11.5 billion dollars by 2030.

The author is a foreign policy journalist

Tianjin has the world’s first smart, zero-carbon port terminal.

The China Numismatic Museum (CNM) was founded in 1992, as the national numismatic museum directly under the People’s Bank of China. It is seated in Beijing. The museum has two buildings under national-level protection, which were formerly the Commercial Guarantee Bank of China and Central Bank of China Peking Branch respectively, serving as witnesses of the development of the modern financial industry of China.

Our recent volumes:

We are witnessing a transition from the 500-year-old Atlantic era to a new Eurasian era based on longterm sustainability, so if one wants to understand the future, they should look to the East.

Geographical factors also explain why the West has dominated the world for the past 500 years. Although the West lost its leading role for a thousand years after the fall of the Roman Empire, it rose again in the 1500s.

Due to its east-west orientation, the Eurasian continent lies in one of the “lucky latitudes”, i.e. in climatic zones with good conditions for agriculture and grazing. This “lucky zone” stretches from southern Europe to southern China.

Arnold J. Toynbee, in his “A Study of History”, identifies the basic patterns of the emergence of civilisations as patterns of interaction. He examined the rise and fall of 28 civilisations over the course of history, and concluded that “they rose by responding successfully to challenges under the leadership of creative minorities composed of elite leaders” and that civilisations follow cycles and that the study of history was based on commercial and scientific observation”. Of the four remaining civilisations of the 21st century, two

are of paramount importance: the Western and the Far Eastern civilisations.

In 2013, Thomas L. Friedman had already said that “there is no point in talking about developed or underdeveloped countries, but about those that capture people’s imagination and those that do not”. Meanwhile, our world has moved from a single-centred to a multi-centred (multipolar) world order. Hans Rosling, in his world-famous book Factfulness, argues that if you look at statistics, there are now only 13 developing countries. China, for example, was one of the underdeveloped countries in the 1980s, but has now become the world’s number one economic power. Geographical locations are becoming increasingly valued and are in constant competition with each other.

The author is geographer and Chairman of the Board of Trustees of the Pallas Athene Domus Meriti Foundation and the John von Neumann University Foundation

THE COURSE OF HISTORY HAS VARIED ALONG EACH LATITUDE, MEANING THAT THE CAUSE OF DEVELOPMENT IS PRIMARILY GEOGRAPHICAL, RATHER THAN CULTURAL, RELIGIOUS, POLITICAL OR GENETIC.

THE MOST COMMON PERCEPTION OF FENG SHUI AMONG EUROPEANS IS THAT IT IS NOTHING MORE THAN THE CHINESE ART OF SPACE ARRANGEMENT. THIS IS TRUE, BUT BEHIND THE METHOD LIES THE ENTIRE CHINESE PHILOSOPHY AND WORLD VIEW, THE HARMONISATION OF THE OPPOSING FORCES OF YIN AND YANG AND THE KNOWLEDGE OF THE EIGHT CHINESE TRIGRAMS.

According to Chinese mythology, feng shui, which literally means “wind” and “water” in English, is derived from a turtle that carried the description of the world on its shell. Not only did the system of symbols found on the shell become the basis of spatial arrangement and I Ching, Chinese “book of divination”, but it also told of the continuous shaping of the world by opposing forces.

According to the Chinese – which is of course a somewhat broad concept, let’s say rather according to the Chinese philosophy of existence, which is also influenced by Taoism, Confucianism and Buddhism – the world was originally inhabited by a kind of primordial force, the dragon’s celestial breath, which is referred to as chi, life energy, and the term may also be familiar to European readers in this form.

Chi works in all beings, bringing harmony, peace and happiness; it is an active energy that can also become stronger and weaker depending on where it passes through.

This is where the feng shui method comes in: when designing spaces, care must be taken to ensure that the vital energy is not dispersed or trapped, as in the case of arrow-straight paths or valleys. Where the chi is weakened, feng shui practitioners say that there appears the sha chi, the harmful energy associated with the image of stagnant water, heavy soil, cold.

In the Chinese art of spatial arrangement, all five elements are represented in some form: wood, fire, earth as the centre, metal and water. These elements are in constant interaction with each other.

While real feng shui experts often make complicated calculations – the two main schools are the space-form and the compass school, the latter using the lo-pan compass, which is made up of concentric circles – it is generally true that if you’re struggling with challenges in any area of life, it’s good to look at the right corner of your home to see if there is a spatial arrangement cause for stuck energies...

The author is fine artist and writer

ISSN 2939-8789 (Online)

ISSN 3003-9339 (Print)

Published by Neumann Lapkiadó

és Kommunikációs Kft.

Publisher's Headquarters: 1117 Budapest, Hungary, Infopark sétány 1.

Responsible Publisher: Levente Horváth, Ph.D., Managing Director

Editor-in-Chief: Levente Horváth, Ph.D.

Managing Editor: Mariann Őry, Péter Petán

Text Editor: Erika Koskocki

Editor: Joakim Scheffer

Photo Editor: Róbert Hegedüs Graphic Design and Layout: Alexandra Érsek-Csanádi, Anita Kónya

Eurasia Magazine Online Editorial Board

Members:

Ágnes Bernek, Ph.D., László Csicsmann, Ph.D., Norbert Csizmadia, Ph.D., Mózes Csoma, Ph.D., Prof. Zoltán Dövényi, Ph.D., Béla Háda, Ph.D., Prof. Imre Hamar, Ph.D., Eric Hendriks, Ph.D., Prof. Judit Hidasi, Ph.D., Dr. Máté Ittzés, Ph.D., Péter Klemensits, Ph.D., Kristóf Lehmann, Ph.D., Csaba Moldicz, Ph.D., Prof. Erzsébet N. Rózsa, Ph.D., Borbála Obrusánszky, Ph.D., Prof. József Popp, Ph.D., Sándor P. Szabó, Ph.D., Prof. Zsolt Rostoványi, Ph.D., Gergely Salát, Ph.D., Péter Szatmári, Ph.D., István Szerdahelyi, Ph.D., Prof. István Szilágyi, Ph.D., Prof. István Tarrósy, Ph.D., Prof. István Tózsa Ph.D., Prof. László Vasa Ph.D., Zoltán Wilhelm, Ph.D., Alexandra Zoltai

The rise of China – and of Asia – will, over the next decades, bring about a substantial reordering of the international system.

Copyright :

All rights of use of the databases of Eurasia Magazine Online are granted to the Neumann Lapkiadó és Kommunikációs Kft. The written material and photographs used on this website are protected by copyright. They may not be published, broadcast or transmitted in any form or by any means, or stored in whole or in part on a computer, whether in their original or transcribed form.

Across the world, 1.31 billion people are speaking Chinese as their native language, either in one variation of Chinese or another. Mandarin, as the most widely spoken variant, is spoken by 955 million people primarily living in China, Taiwan, Singapore, Malaysia, and Indonesia.