28 minute read

International News

by Eurofish

Sweeping digitisation of Croatian fi sheries data systems

Over the last few years, Croatia has set a path to introduce electronic data delivery for the entire fi sheries sector. Th e progress is evident and the introduction of electronic data delivery is very well accepted by the end-users - fi shers, farmers, buyers and the administration itself. Commercial fi shers can deliver catch and landings data on paper (logbooks or reports), electronically through e-logbooks, via an app, or by email. Up until now, nearly 40 of the fi shing fl eet delivers daily catch and landing data electronically/digitally or by mobile application. What is even more signifi cant is that these data cover nearly 98 of the catch.

Advertisement

By scanning the bar code or entering it on the website stakeholders are provided with information about the species, area of catch, fi shing gear, and about the fi shers themselves.

Regarding freshwater and marine aquaculture, farmers deliver yearly production and sale data, electronically through the Commercial Fisheries Portal. Th e same portal is used by transporters and fi rst buyers, and by benefi ciaries of the support measures in fi sheries and aquaculture. Documentation on transport, weighing and fi rst sale is fi lled in on the portal enabling the cross checking of all documents in real time. In addition, the fi sheries administration has established a traceability system for bluefi n tuna (Th unnus thynnus) and swordfi sh (Xiphias gladius) that obliges every fi sherman to mark the fi sh and introduce the barcode in the electronic system that will be passed to the fi rst buyer and afterwards to any additional buyer in the distribution chain until the fi nal consumer. By scanning the bar code or by entering the bar code on the web page https://ribarstvo. hr/hriba/, the consumer can trace the fi sh and get the information about the species, area of catch, fi shing gear, and about the fi sherman her- or himself. Sports and recreational fi shing are also accounted for. In addition to the already established online sale of permits for marine sport and recreational fi shing, a new web application has been developed allowing fi shermen to buy fi shing permits/licence as well as to enter catch (caught and retained) data. Future plans for upgrading the system include cartographic presentation of all inland fi shing areas, including on-site number of fi shermen in real-time. In addition, new application for marine sport and recreational fi sheries is being planned for future development. Th e various electronic/ digital systems are simpler for users and provide more accurate and effi cient reports and analyses for the decision makers as well as for the scientifi c community. In terms of surveillance and control, major advances are also visible, like fi sheries inspectors’ use of drones and access to real time data. Th e benefi ts of using digital solutions are evident and encourages continued focus on this path.

Turkey launches world’s largest wellboat

The innovative wellboat Gåsø Høvding has been launched at the Sefine Shipyard in Turkey. The wellboat is 83.2 meters long and 30.9 meters wide and unlike any other. Møre Maritime designed the boat and Cflow delivers everything relating to fishing. They have both worked closely with Frøy on the innovative wellboat project for about a year when it was commissioned. “Our customer needed a large boat. We worked on several different options, but eventually landed on this one. Design and flexibility are the way our customer wants it,” says project manager Einride Wingan from Frøy. It is a good feeling to finally get her to sea. On such projects, there will always be challenges, but they could be solved along the way. The wellboat has a total holding volume of 7,500 cubic meters and is equipped with systems for sorting and removal of all types of cleaning fish, reusable freshwater treatment, 12-line hydrolicers and an advanced and automated hygiene system. Frøy has an additional five more wellboats under construction, four of which should be completed this year.

Froygruppen.no

The wellboat Gåsø Høvding has just sailed out from the Sefi ne shipyard in Turkey and is with its 7,500 m3 holding tank currently the largest wellboat in the world.

Italians fi rst to market certifi ed carbon neutral aquafeed

Denmark: Shrimp bites—from shrimp shells to pet food

Understanding that positive climate actions make both environmental and economic sense, Skretting Italy has had its ‘Carbon Footprint Systematic Approach’ certifi ed to ISO 14067:2018, the international standard that provides globally agreed principles, requirements and guidelines for the quantifi cation and reporting of the carbon footprint of a product. Th is means that the company is now able to provide certifi ed carbon footprint fi gures on all of the aquaculture feed products in its portfolio, giving aquaculture operations of all sizes the means to calculate the carbon footprint of their products and a better understanding of ways in which these can be reduced.

Skretting Italy is the fi rst feed producer to attain this status, with the certifi cation covering the entire production process from material procurement, to fi nal product shipment. Certifi cation of the Carbon Footprint Systematic Approach is the latest step in Skretting Italy’s CarbonBalance set of supportive services for fi sh farmers and its carbon neutral feed concept Feed4Future, launched in 2020. Th is fi rst-to-market off ering has paired Skretting’s knowledge of the nutritional requirements of aquaculture species with sustainable, lower impact feed ingredients responsibly sourced from carefully selected suppliers. By fi nding innovative raw materials and high-quality by-products sourced from the food industry that do not compete with human consumption, Feed4Future diets have a

With the line of feeds under the Feed4Future label, customers are getting a carbon neutral feed, which in turn can help promote their environmentally friendly stance.

Residues from shrimp processing such as these shells are typically left unused. A Danish project, however, has discovered they can profi tably be processed and added to pet food.

10 lower carbon footprint that standard diets, with the remaining CO2 emissions compensated for by carbon credits. Buyers of the feed can make use of the company’s marketing support to promote share their carbon neutrality stories.

Th ree Danish companies Launis, Nordic Seaweed Feed and Mosegaarden have worked closely with the Danish Technological Institute and Aarhus University School of Engineering to demonstrate a profi table bio-processing method for the sustainable utilization of shrimp shells. Th e project has demonstrated the profi tability of bio-processing shrimp shells with subsequent value addition to create new sustainable pet food products. Historically, residues such as shells and irregular shrimp meat have had limited value, and the majority of residues is not utilised today. Shrimp shells have a high content of protein with a favourable amino acid composition, good digestibility, low ash content, chitin, lime, and a favourable content of omega 3 fatty acids, all of which can be utilised in pet food. To exploit these valuable ingredients, Nordic Seaweed Feed has added shrimp shells to their fermented seaweed-based “Pet Food” products.

Th e project, which was funded by INBIOM (supported by the Danish Ministry of Higher Education and Science), has developed diff erent bio-processing methods for shrimp shells and a concept for upscaling has been modelled with on-site pre-treatment of side streams. Th e project results include the complete characterization with selected biomarkers (protein and glucosamine) and the testing of fermented shrimp shells, fi shmeal and seaweed in various mixtures. In addition, experiments have been performed with approx. 600 cats where certain mixtures seem to solve some of the virus problems cats can have. Th e project concludes that there is a market potential for these products and that there is a demand for Danish produced pet food and dog treats. For more information contact Bjarne Ottesen at +45 50 40 94 70 or bjarne@nordisktang. dk or Karin Loft Eybye, +45 72 20 28 38, klt@teknologisk.dk

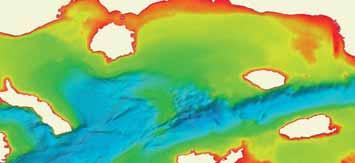

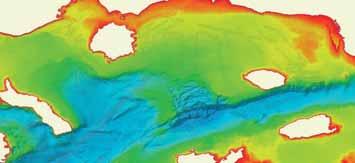

Improved bathymetry of the European seas

EMODnet Bathymetry, an initiative of the European Commission, is pleased to announce the release of the latest version of the EMODnet Bathymetry Digital Terrain Model (DTM). With over 33,000 individual tiles downloaded in 2020, this bathymetric product is already widely used in a whole range of applications, from marine science to sustainable ocean governance and blue economy activities. Th e product benefi ted from signifi cant developments and expert inputs in 2020, including new data gathering, reprocessed data, thorough selection of the best data source and use of innovative bathymetric sensors such as satellite derived bathymetry. It allows users to visualise bathymetric features with greater detail, in addition to providing a powerful 3D visualisation functionality covering all European seas, the Arctic and Barents Sea, and greater accuracy along European coastlines, thanks to the integration of both in water and satellite datasets. It is available for free for viewing and downloading, from the EMODnet Bathymetry portal.

Th is improved DTM provides users with even greater resolution and coverage of bathymetry which are used in real-life settings such as improving society’s ability to forecast storm surges, lowering the risks of damage to coastal and off shore installations and increasing public safety. EMODnet Bathymetry is now the place to go for oceanographers in providing a base geometry for hydrodynamic models, for marine geologists studying morphological processes, and for biologists and conservation managers who require trusted and high-quality seabed habitat maps, which rely on accurate and high-resolution bathymetry. It also supports a wide range of marine and maritime activities, including the Blue Economy,

The latest digital terrain model from EMODnet Bathymetry contains highly detailed information of the seabed.

from the marine dredging sector to the planning of pipeline trajectories, locations of off shore wind farms and planning of harbour extensions. It is available here: www.emodnet-bathymetry.eu

Greenland and EU reach agreement

Greenland concluded negotiations with the EU for a new Sustainable Fisheries Partnership Agreement (SFPA) that will strengthen cooperation between the two partners for the next four years with the possibility of a twoyear extension. Th e agreement is an important milestone in the long-standing bilateral cooperation between the two in fi sheries and renews the commitment to promoting the sustainable use of marine resources. Financially, this is the third most important agreement in place for the EU and will allow the EU fl eet (12 large-scale trawlers) to continue fi shing in Greenland waters for at least the next 4 years while continuing to contribute to the development of the fi sheries sector in Greenland.

Fishing opportunities have been negotiated for the same species as in the previous agreement (cod, redfi sh, Greenland halibut, northern prawn, capelin and grenadier). Fishing opportunities for mackerel have also been included in the agreement. Any mackerel quota transferred by Greenland in the future will be rely on Greenland signing the Coastal States Sharing Arrangement on the management of mackerel with the EU. All reference prices have been updated in agreement taking current market prices into account. Based on the fi shing opportunities and the new pricing scheme, the EU will provide Greenland with an annual fi nancial contribution of EUR 16,500,000, of which EUR 2,900,000 per year, is specifi cally assigned to promote the development of the fi sheries sector in Greenland. If the duration is extended from 4 to 6 years, the total value amounts to EUR 99,000,000. EU ship-owners will, in addition, pay license fees for the fi shing opportunities.

The new agreement between Greenland and the EU is worth nearly EUR 100 million of which more than 17% is specifi cally allocated to the development of Greenland’s fi sheries sector.

Norway exported the second-highest value ever despite corona pandemic

Norway exported 2.7 million tonnes of seafood worth NOK 105.7 billion (~EUR 10.2 billion) in 2020. Th is is the second-highest value ever and is the equivalent to 37 million meals every day throughout the year or 25,000 meals per minute. Th e total volume of seafood exports increased by 2 per cent in 2020, while the value was reduced by 1 per cent, or NOK 1.5 billion, compared with the record year of 2019. Seafood exports for the second year in a row exceeded the ‘magical’ NOK 100 billion mark and that this was achieved during the corona pandemic in 2020 was fantastic, said Odd Emil Ingebrigtsen, Minister of Fisheries and Seafood. 2020 began with high values and optimism for the year, but then the corona pandemic hit markets worldwide and Norwegian seafood exports lost the important sales segment of restaurants and hotels. Th ere were challenges in logistics, and sales of seafood were largely transferred to supermarkets, online sites and takeaway services. Exports varied with positive development for herring and mackerel products, while clipfi sh and stockfi sh showed declines. Th e Norwegian Seafood Council attributes the positive result to fi ve factors: a weakened Norwegian krone, an adaptable seafood industry, strong growth in mackerel and herring exports, second-highest salmon exports ever, and that Norwegian seafood is highly sought-after globally.

Measured in value, the top ten countries Norway exported

For the second year in a row Norwegian Seafood exports hauled in more than the magical NOK 100 billion despite the pandemic.

seafood to in 2020 were: Poland, Denmark, France, the USA, the United Kingdom, the Netherlands, Spain, Japan, Italy, and China. More information is available on www.seafood.no.

US seafood hard hit by pandemic

Th e US fi shing and seafood sector has generated more than USD 200 billion (~EUR 165 billion) in yearly sales and supported 1.7 million jobs in recent years. Th e year 2020, however, saw broad declines due to the COVID-19 public health crisis, according to a new NOAA Fisheries analysis. Th e protective measures introduced in March across the United States and around the world had an almost immediate impact on seafood sector sales. 2020 started strong with a three percent increase in commercial fi sh landings revenue in January and February. Revenues, however, declined monthly from a 19 decrease in March to a 45 decrease by July, resulting in a 29 decrease for the fi rst seven months compared to 5-year averages and adjusted for infl ation.

Restaurant closures, social distancing protocols, and other safety measures contributed to losses in other seafood economy sectors and by the end June, 78 percent of aquaculture, aquaponics, and other related businesses reported being aff ected with 74 percent experiencing lost sales. Outdoor seating at restaurants in the warm months and a shift to direct delivery by some supermarkets provided an outlet for some aquaculture sales. NOAA Fisheries estimates that in the southeast, charter revenues relative to the preceding 3-year period fell 72 percent in March through April due to local and state COVID-related closures and protocols. In May-June, revenue was down 4.5 percent as businesses began to re-open. In contrast, charter operations in Alaska and Hawaii, which rely heavily on out-of-state tourism, continue to experience severely depressed sales due to the sharp decrease in tourism. Hawaii is estimated to have lost 99 percent of charter trips between April and July. In addition, many fi shing tournaments have been postponed or cancelled.

On the trade front, international markets were negatively aff ected by disruptions in harvesting, processing and shipping. US seafood exports declined 18 percent in value in the January to June period, when compared to the past fi ve years. Fresh product exports experienced steeper declines than frozen product exports. Th e value of seafood imports into the United States declined 4 percent in value in this period. Th ese declines were off set by US consumer demand for tuna imports (canned and in pouches), which increased 25 in this 6-month period, peaking to 49 in June.

Wirestock–Freepik

The COVID-19 pandemic caused a 29% decrease in revenue for the fi shing and seafood sector during the fi rst seven months of 2020 compared to the average of the last fi ve years’ fi rst seven months.

Th e report notes that some US industry losses may be off set by the infusion of emergency federal relief funding. In May, NOAA allocated $300 million in fi sheries aid to states, territories, and tribes as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Th ey, with the help of interstate commissions, are distributing these much-needed funds to eligible fi shery participants. Furthermore, in September, the Secretary of Agriculture made $530 million available through the Seafood Trade Relief Program to support fi shermen and industries impacted by retaliatory tariff s from foreign governments. More information is available at www. fi sheries.noaa.gov.

Thai Union invests in cell-based seafood

Th ai Union Group PCL has invested in California-based BlueNalu through its venture fund, joining other industry-leading strategic and fi nancial partners in backing the start-up. BlueNalu, is one of the leading cell-based seafood companies in the world, innovatively producing premium fi sh products from the cells of fi sh which equal conventional products in terms of texture, nutritional profi le, and taste. Th e company plans to introduce a wide variety of cell-based seafood products, including mahi mahi and bluefi n tuna. BlueNalu will leverage this fi nancing to complete the world’s fi rst commercial pilot facility for producing cell-based seafood, and for market launch plans in late 2021. In 2019 Th ai Union’s launched its venture fund with an initial commitment of USD 30 million (~EUR 25 million) to focus its investments on three strategic areas: alternative protein, functional nutrition and new technologies along the food value chain. Th ai Union is investing in early-stage entrepreneurial companies that are active in these areas and will actively partner with these companies to support and accelerate their development.

BlueNalu

Menu items that demonstrate BlueNalu’s whole-muscle, cell-based yellowtail prepared three ways.

One in every two seafood workers is a woman, yet women are over-represented in the lowest paid and lowest valued positions and are seldom seen in leadership positions. Women are essential contributors to this important food industry, but they remain invisible. Th e need to increase awareness about women’s role in this industry and to recognize the value they bring is the objective behind the organisation Women in the Seafood Industry (WSI). Among its initiatives is an annual video competition started in 2017 inviting men and women to tell their story of women in the seafood industry. Th e goal is to bring attention to the gaps and challenges experienced by women in seafood and to cast light on positive stories. Th e 2020 competition received 23 fi lms from 15 countries and saw the introduction of a new category, ”Life under Covid” as the Covid-19 virus has severely aff ected seafood workers, especially women. Th e winning fi lm ”Move Forward” from Indonesia portrays the uplifting story of a young girl using education and technology to help support her family.

Th e strong stories from all over the world are highly individual yet refl ect universal values. Th ey describe struggles, discrimination, and opportunities that women face in the seafood industry. All the fi lms emphasise the paramount role women play in the seafood supply chain. Without them, seafood would never

The Women in Seafood video competition was held for the fourth year running in 2020 and portrayed woman from all over the world. Arma Anti from Indonesia won with her compelling story “Move Forward.”

reach the consumer and it is time for the industry to include them in their policies, private and public, says Marie Christine Monfort, WSI Executive Director. Th e videos from 2020 can be found on Youtube under Women in Seafood or on the www.womeninseafood.org website and WSI is already accepting entries for the 2021 video competition which is titled, ”Let it be known.”

Greek and Spanish companies unite to become the largest aquaculture producer in the Mediterranean

A union of four companies from Greece and Spain have joined forces to start a new era in Mediterranean aquaculture, Europa Azul reports. Avramar is the result of the union of the aquaculture companies Andromeda Group, Nireus, Selonda, and Perseus, specializing in fish feed. With a total production volume of more than 70,000 tonnes and a presence in more than 30 countries and more than 2 300 employees, Avramar is a leading brand for seabass and sea bream and the largest fish producer in the Mediterranean. Each of the four has been a pioneer and leader in Mediterranean aquaculture for decades, farming Greek fish in the Aegean and Ionian Seas and Spanish fish along the Mediterranean coast and around the Canary Islands. Innovation through value-added products that are easier to prepare and cook will reinforce the company’s goal of becoming the preferred fresh fish supplier on the market. In terms of operations, the company plans to apply new technologies and methods to achieve more efficient and competitive costs. Avramar’s commitment to sustainability, local communities, customers and partners is its top priority, alongside long-term investments in research and development.

With four companies joining forces AVRAMAR will be a leading brand for seabass and sea bream but will also offer additional species like croaker and pink snapper to consumers around the world.

Spain’s IFAPA concludes work decoding the sole genome

Th e Spanish Institute for Agricultural and Fisheries Research and Training (IFAPA) under the Andalusian Ministry of Agriculture, Livestock, Fisheries and Sustainable Development has concluded mapping the sole genome. Th is work could represent a qualitative leap in the farming of this commercially valuable species. IFAPA led the work that combined very long DNA sequences and genetic markers and will serve as the basis for mapping markers and their distribution throughout the genome. Th e integration of the physical and genetic map opens up new possibilities for farming sole, a species of high economic value in Europe. Th is research is of great interest, since it off ers detailed information about genes that determine important traits such as growth rate. In addition, tools for chromosome mapping and kinship assignment, which are essential for genetic selection programs, have been validated. Th e results of this work, which has been carried out in collaboration with national institutions including the National Center for Genomic Analysis (CNAG-CRG), the National Institute of Toxicology and Forensic Sciences (INT), the University of Malaga and the University of Las Palmas de Gran Canaria, have been published in the prestigious Scientifi c Reports magazine. IFAPA has been working in the fi eld of sole aquaculture for 20 years in the hope of optimising production, in technological developments, strategies for disease prevention, improvement of diet and growth, and morphological quality parameters. Th e work carried out so far has been in close collaboration with the industry to help it optimise production and select the ideal fi sh for recirculation farms.

The mapping of the sole genome could benefi t famers of this valuable species since it offers detailed information on genes that determine traits like growth rate.

Russian fi sheries event will extend focus to aquaculture

Russia has recently started to pay more attention to aquacultural issues. Over the last fi ve years fi sh and shellfi sh farming has become an important part of the national development strategy for fi sheries with particular focus on the Russian Far East. Early in 2020, for example, Russia simplifi ed the rules for obtaining land to be used for fi sh farming. Since then, breeding volumes have increased and capacity in salmon farming has doubled. Growth, however, is still limited by administrative barriers and the sector is dependent on imported feeds and equipment. Unlike in Europe where there are many industry-oriented events, Russia lacks a united platform to maintain a dialog on aquaculture issues and international cooperation.

In 2020, Expo Solutions Group, the organiser of Russia’s leading fi sheries event, Seafood Expo Russia, announced that it would devote a separate section of the exhibition to aquaculture. It will attract all parts of the supply chain including fi sh farmers, equipment producers and netmakers, feed, additives, and medicine producers, along with packaging and logistics services. Freshwater and marine aquaculture issues will be also highlighted in the business programme. An international conference on aqua- and mariculture will highlight the development of the sector in Russia and internationally. Experts and representatives from the administration will discuss the current state and prospects of aqua- and mariculture in Russia and speakers from China, Norway, Japan, Denmark and other countries will share their knowledge of the industry, measures for state support, and best practices for working during the pandemic. Participants will also have an opportunity to discuss practical issues in the breakout sessions. Topics would include the challenges off ered by fi sh farming, new technological products, fi sh feeds, and success stories from selected fi sh farms.

Seafood Expo Russia welcomes speakers, exhibitors and visitors to the event on 6-8 July 2021 at Expoforum in St. Petersburg, Russia.

With Russia’s increased focus on aquaculture, Seafood Expo Russia has decided to dedicate a section of the exhibition to fi sh farming to which all stakeholders are invited.

Th e largest study to date of the cod stock in the eastern Baltic Sea shows that the fi sh has never had it worse. Behind the study are, among others, researchers from DTU Aqua, and according to senior researcher at the Department of Aquatic Resources, Stefan Neuenfeldt, the situation looks bleak. “I do not think we can save the stock as it looks now. But we can help the cod to survive, so that in 10-15 years it will have a second chance in a Baltic Sea, which hopefully is easier to live in by then.” Twice a year, researchers in Denmark and its neighbouring countries catch cod in the Baltic Sea to investigate how the stock is doing. Less than 20 years ago, the largest cod were up to 80 centimeters long, and healthy and strong fi sh were generally caught. But today the reality is harshly diff erent, says Stefan Neuenfeldt—there are no more large cod in the eastern Baltic Sea. Th ey are a maximum of 40-50 centimeters long, and most of them are in a bad shape. In general, there is also much less cod. Lack of oxygen makes it impossible to survive—there is simply not enough oxygen along the seabed, where the cod live. Th ere are two diff erent layers of water in the Baltic. A top layer of fresh water and a lower layer of more saline water. Between the two layers there is a kind of invisible barrier, which means that oxygen cannot pass from the water surface and all the way down to the seabed. Th erefore, the Baltic Sea needs to be oxidized by ocean currents, which bring in new, oxygen-rich and salty water and remove some of the old water. But that process has almost come to a standstill in the last ten years, says Dr Neuenfeldt. Th e oxygen in the eastern part of the Baltic Sea is essentially not replaced. It creates a lack of oxygen in many places on the seabed, and therefore it becomes virtually impossible to survive. On top of this nutrients such as nitrogen and phosphorus are fl ushed into the Baltic Sea from, for instance, agriculture and wastewater. Large amounts of rain typically increase the amount of nitrogen in the Baltic Sea, making the seabed even less inhabitable because the nutrients deplete the oxygen. Without oxygen, the seabed is neither habitable for cod nor its prey. Worms from seals make a bad situation worse. Liverworms from Baltic seals weaken the already struggling cod. Together, the circumstances are pushing the cod so much that they have lost their place at the top of the food chain, says Stefan Neuenfeldt. Cod has dominated the Baltic Sea as a top predator, but in most areas its importance in the food chain is now gone. Th ere are far too few cod and those that are left are small and weak. Th is can also be seen through their thriving prey. Fishing on the seabed also plays a negative role for cod, but it is a very diffi cult matter because it also provides many people with food on the table, he says. Stefan Neuenfeldt does not believe that the current cod stock in the eastern Baltic Sea can be saved. But we can help the species not disappear completely from the area, he assesses. Emissions of nitrogen and other nutrients need to be reduced to a much lower level and areas where cod can live undisturbed with zero trawling and angling need to be created. Th at way, the cod can survive and hopefully be ready to move and spread to the rest of the Baltic Sea when conditions have improved.

A lack of oxygen in the water, parasitic worms, and fi shing pressure are among the factors threatening the very survival of the cod stock in the eastern Baltic. The priority should be to ensure that it does not disappear completely.

EU fl eet remained profi table in 2020

The latest Annual Economic Report on the EU Fishing Fleet has been released showing a profitable fishing fleet in 2020, despite the effects of COVID19. In 2008, the EU fishing fleet was barely breaking even and ten years later it registered a net profit of EUR 800 million. This significant progress was the result of higher average fish prices, lower fuel costs, and improved stocks of important species. This trend continued into 2019. The COVID-19 outbreak in 2020 interrupted the trend with estimates suggesting that the economic performance of the EU fleets decreased by 17 in landed value, 19 in employment and 29 in net profits compared to 2019.

Despite the impact of COVID19, projections indicate that the EU fleet is resilient and would end 2020 with a reasonable level of profitability as a result of the efforts made by the sector in the previous years. This includes fishing to the maximum sustainability yield combined with low fuel prices. The large-scale and distant-water fleets performed economically better than the small-scale coastal fleet segments and the fleets operating in the North Eastern Atlantic, where most fished stocks are sustainable managed, registered higher profits than fleets operating in the Mediterranean, where numerous stocks still face overexploitation.

The Annual Economic Reports on the EU Fishing Fleet is produced by economic experts from the Scientific, Technical and Economic Committee of Fisheries (STECF) and the European Commission. The report is available here: https://stecf. jrc.ec.europa.eu/reports/economic/-/asset_publisher/d7Ie/ document/id/2788167

New minister is old hand

Kaja Kallas, Estonia’s fi rst female prime minister, formed a new government at the end of January 2021. Included in her cabinet is Urmas Kruuse, who returns as Minister of Rural Aff airs to work for the sustainable development of rural Estonia with responsibilities extending to agriculture and fi sheries. Mr Kruuse, a member of the Estonian Reform Party, was Minister of Rural Aff airs in 2015-2016 and before that was Minister of Health and Labour for a two-year period following twelve years as mayor of fi rst Elva and then Tartu.

agri.ee

Urmas Kruuse, Minister of Rural Affairs, returns to the offi ce he held from 2015 to 2016. His responsibilities include the fi sheries portfolio.

Icelandic seafood exporters bypass UK

Icelandic shipping companies, Eimskip and Samskip, now transport fresh fi sh to Rotterdam rather than Immingham, close to Grimsby, in the UK, Fiskifrettir reports. Icelandic seafood exporters have had to adapt to the changed situation in the UK following Brexit, where there have been considerable delays and disruptions in the transport of seafood from the UK to the European Union following the UK exit from the European Union at the turn of the year. Th e Icelandic freight companies have not been spared this and have had to adapt to changing circumstances, especially with regard to seafood that previously has been transported through the UK on its way to the European Union. Until now, fresh fi sh has been regularly transported to Immingham in the UK, where it was loaded onto trucks and driven to France. According to Björn Einarsson, Eimskip’s Director of Sales and Trade Management, customers have stopped using the UK as a transit port for mainland Europe due to delays in the Channel Tunnel and also due to delays in customs matters on the border with France. So fresh fi sh is going straight to Rotterdam now instead of going through the UK. He stresses that this has not had any eff ect on intra-UK deliveries, all of which have proceeded normally. Þórunn Inga Ingjaldsdóttir, director of Samskip’s Marketing and Communications department, says it is too early to draw long term conclusions so early in the year. “We had changed our system some time ago to be able to continue serving our customers who are sending to the fi sh market in Europe,” she says. Samskip is emphasizing that the situation is temporary. At least for now.