8 Leading Business Stories Across Europe - June 2024

13 The rush to adopt generative AI may have long term repercussions on technology

14 Tapping on the Realm of Multifarious Opportunities

18 Open Banking Payments for High-Value Purchases

20 Raj Brahmbhatt

24 Revolutionizing Identities, Governance, Intellectual Property, and Impact

28 Angelika Hellweger of Rahman Ravelli assesses the development of ESG-related litigation

30 New data begs the question - is an AI power struggle in the C-suite imminent?

32 Rytis Ulys, Analytics Team Lead at Oxylabs

36 Why growth-focused businesses must supplement ERP Systems with payments

38 An Overview of the Current Technology Landscape

40 Navigating the emerging AI cybersecurity risk

42 The current state of banking fraud

44 Navigating hidden ransomware pitfalls

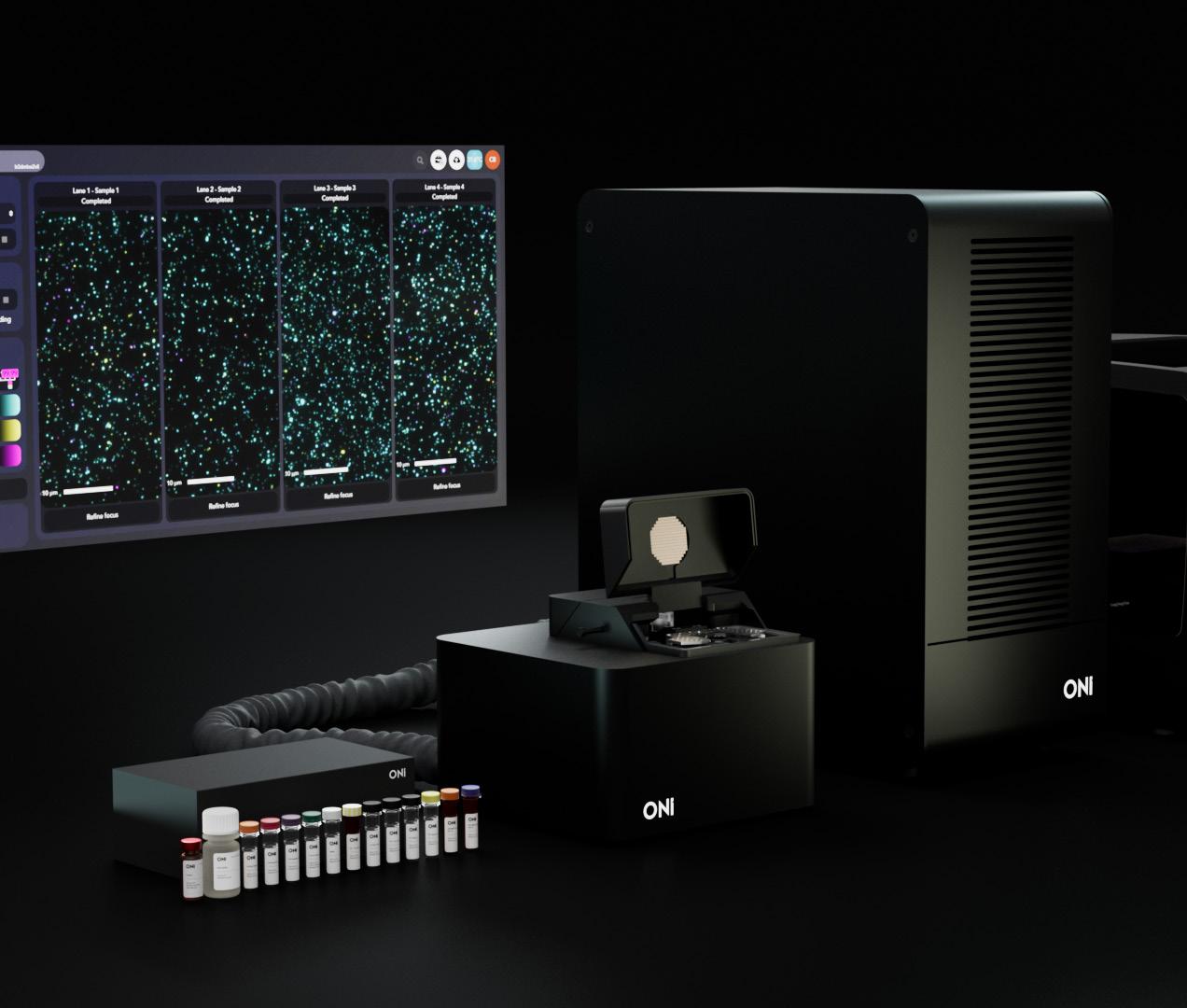

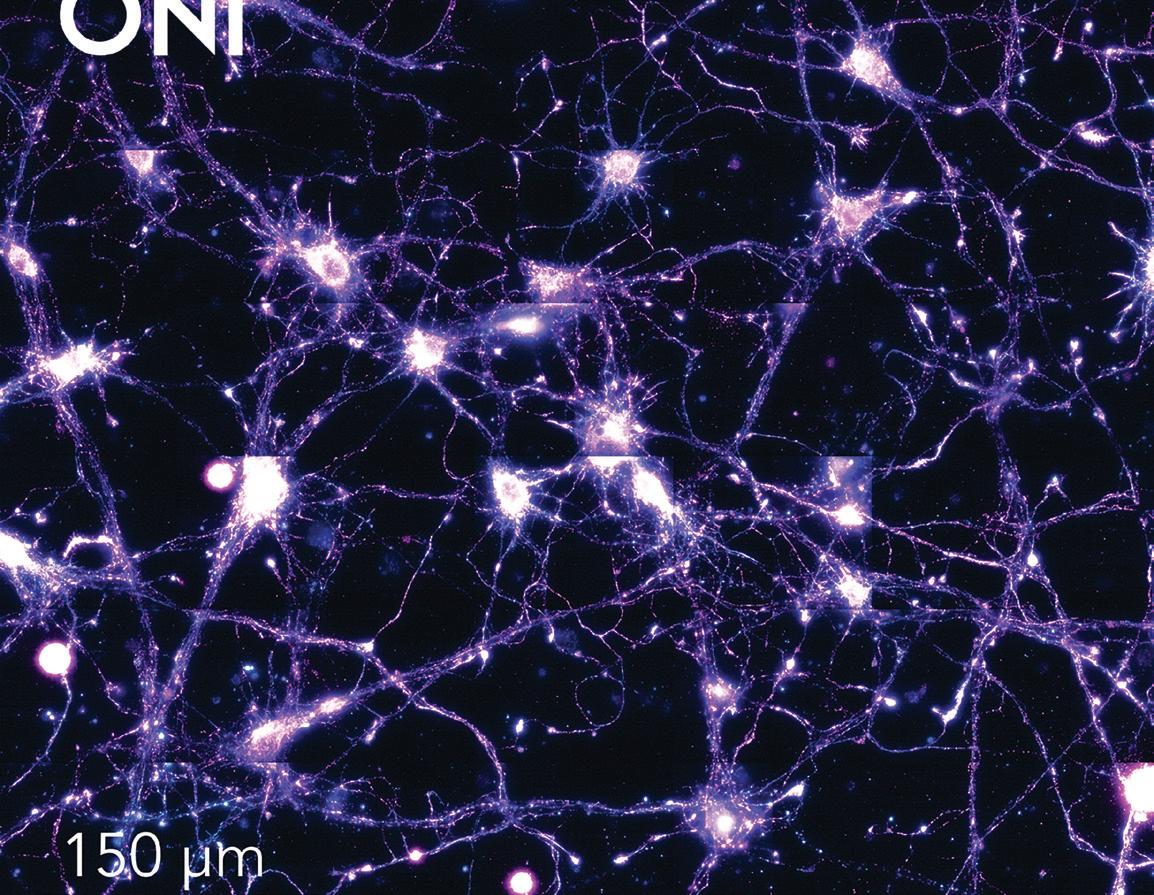

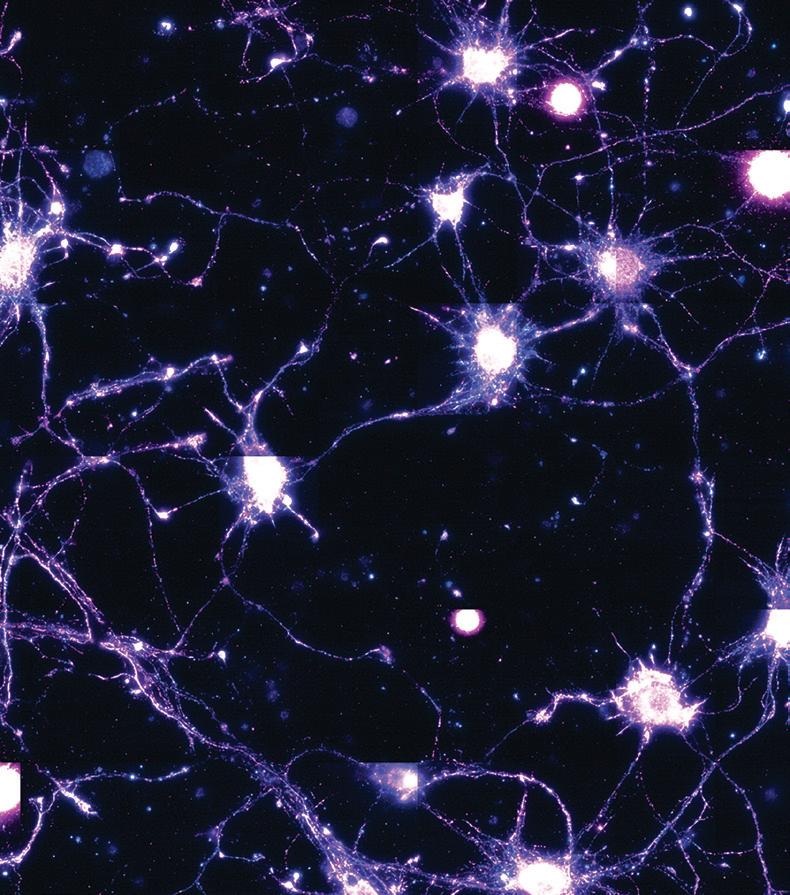

46 Paul Scagnetti Ceo of ONI

50 Advancements in Super-Resolution Microscopy and Personalized Medicine

54 DGFEZ, Dashing Toward 2030

56 One Year of Foreign Subsidies Regulation

58 Retailer Sunglass Hut Aims to Change Marketing Strategies

60 Revolutionary Technology or Overhyped Trend?

62 Exploring the Boundless Potential of Tokenization

64 Global Business Vanguards Aligning with 2045 Net Zero Goals

66 An Unsustainable Practice for the World’s Biggest Brands

68 Sustainability growing influence on financial due diligence process

70 Redefining Industries and Reshaping the Future

74 Operating Effectively when Crisis Hits

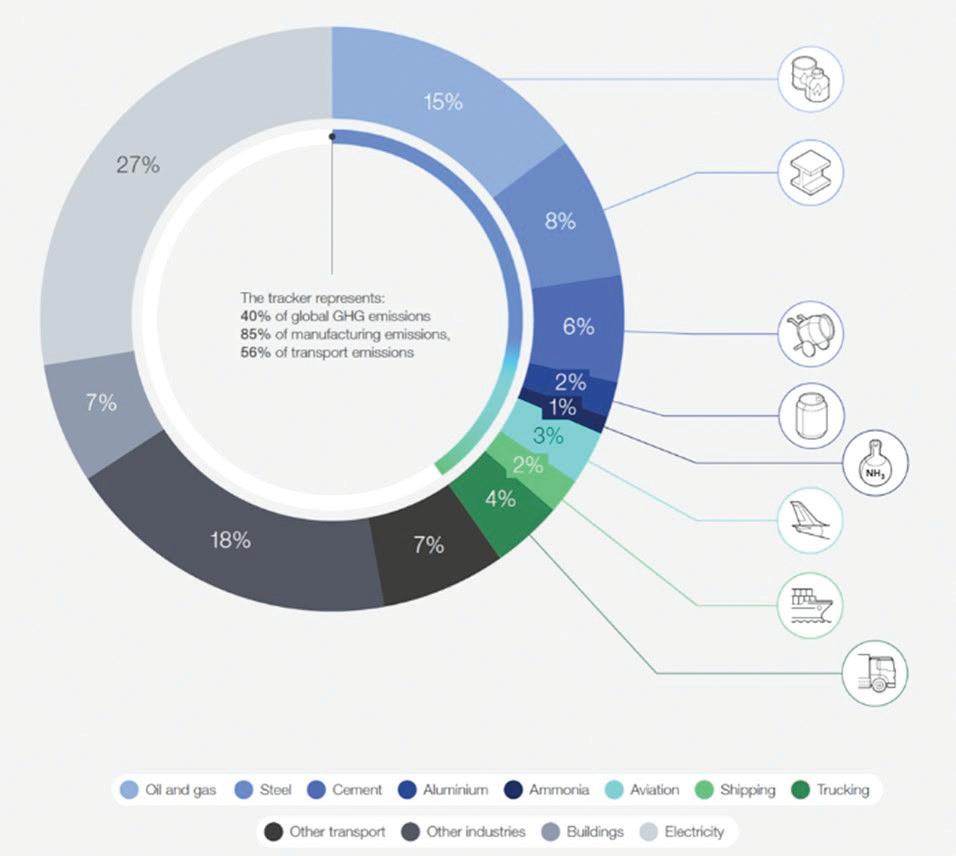

76 $13.5 Trillion Investment Needed to Fast-Track Decarbonization of Key Hard-to-Abate Industry Sectors

78 Sustainable Business Practices in Satellite Communications

80 Why Europe is catching the US in the cloud adoption race

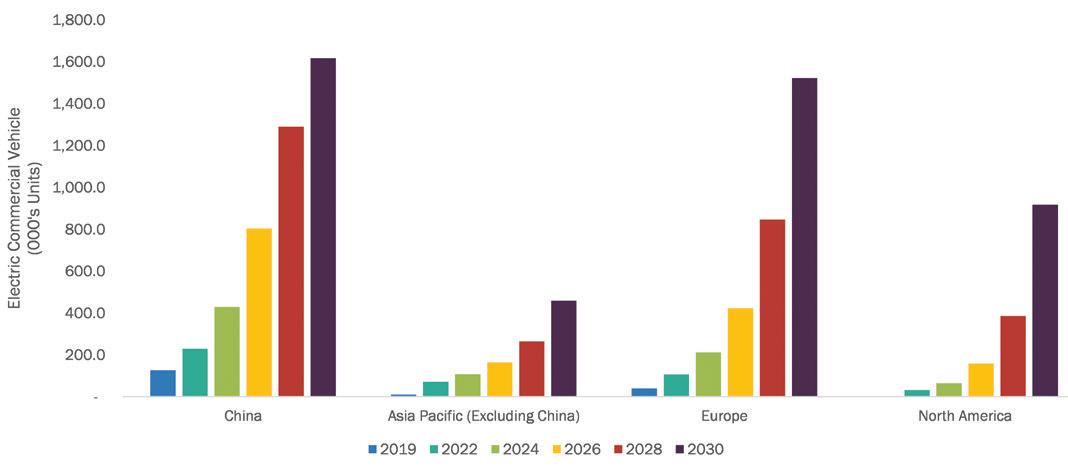

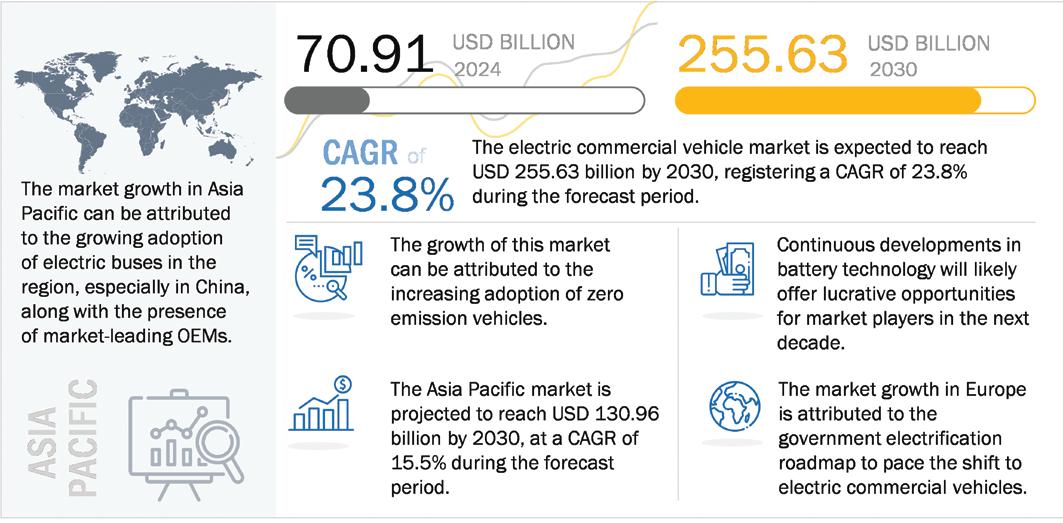

82 “Electrification of Automotive Industry: How Electric Commercial Vehicles Are Changing the Game”

86 Attractive opportunities in the Payment Gateway Market

88 Lamia Tazi

Secretary General of the Moroccan Federation of Pharma Industry and Innovation

90 A New Generation of Civil Servants Paving the Way for Industry 2.0

92 36 Pioneer Cities Chart a Course Towards a More Ethical and Responsible Future

Publisher Nick Staunton

Editor

Patricia Cullen

Deputy Editor

Anthony Gill

Associate Publisher Brad Adams

Features Editor Katie Winearls

Head of Production

Paul Rogers

Head of Design Vladimir Mladenovski

Subscriptions Manager

Rebecca Hill

Head of Business Development

Paul Matthews

Advertising Sales

Brad Adams Tara Duckworth

Advertising Sales

Tara Duckworth, Mike Ray, Andy Ellis, Mark Holburn

Contributing writers

Patricia Cullen, Richard Fitzpatrick, Bala Murali Krishna, Shilpa Meen, Argee Laraya, Aimee Ni Mhaolcraibhe, Gordana Ristic, Jonathan Hooker, Jose Ignacio Latorre

Head of Digital

Stephen Scott

Photographer Ben Fisher

NST Publishing Ltd, 19 Leamington Spa (studio 1) Leamington Spa,Cv324tf, UK

The information contained has been contained from sources the proprietor believes to be wholly correct however no legal liability can be accepted for any errors. No part of this publication can be reproduced without consent of the publisher.

Reclaiming duties means more money in your pocket. Discover how duty reclaim can significantly impact your bottom line, contributing to increased profitability.

Stay ahead of the competition by understanding the importance of duty reclaim. Gain a competitive edge and attract more customers with lower prices without sacrificing quality.

Duty reclaim is not just about savings; it’s about optimising your cash flow. Learn how this crucial piece of the puzzle can help you manage your finances more efficiently.

Wondering about the complexity of duty reclaim? Discover the simplified process that ensures you get the maximum from returns with minimal effort. Let duty reclaim work for you!

Chancellor Rachel Reeves unveiled a comprehensive fiscal assessment, revealing significant economic challenges inherited from the previous government. The report highlights a complex mix of high public debt, rising interest rates, and sluggish economic growth. Reeves indicated potential spending cuts and tax adjustments to restore fiscal discipline and stimulate growth. This assessment sets the stage for a pivotal autumn Budget, where tough decisions will be made to balance the public finances while prioritizing investment in infrastructure and public services to foster sustainable economic recovery.

The European Central Bank (ECB) announced that Eurozone inflation has fallen to its lowest level in two decades, sparking concerns about deflationary risks. The inflation rate dropped to 0.5% in May, driven by declining energy prices and weaker consumer demand. ECB President Christine Lagarde emphasized the need for continued accommodative monetary policy to support economic recovery. The ECB is considering further interest rate cuts and expanding its bond-buying program to boost liquidity and encourage spending. This unprecedented low inflation rate underscores the challenges facing the Eurozone economy in achieving sustainable growth.

Volkswagen announced a major expansion of its electric vehicle (EV) production, aiming to double its EV output by 2026. The German automaker will invest €10 billion in new factories and technology development, focusing on battery production and autonomous driving capabilities. This move aligns with the European Union’s stringent emission targets and the growing demand for sustainable transportation. Volkswagen’s CEO, Oliver Blume, stated that the expansion would create thousands of new jobs and solidify the company’s position as a leader in the EV market. The initiative is part of Volkswagen’s broader strategy to achieve carbon neutrality by 2050.

Air France-KLM posted record profits for Q2 2024, driven by a surge in post-pandemic travel demand and successful cost-cutting measures. The airline group reported a net profit of €1.2 billion, a significant turnaround from the losses incurred during the COVID-19 pandemic. CEO Benjamin Smith credited the strong financial performance to increased passenger numbers, higher ticket prices, and strategic partnerships. The company plans to reinvest profits into fleet modernization and sustainability initiatives, including the purchase of new fuel-efficient aircraft and the development of sustainable aviation fuels.

The UK and the EU have commenced renegotiations on the Brexit trade deal to address lingering issues and improve trade relations. Key topics include resolving disputes over fishing rights, Northern Ireland trade arrangements, and regulatory divergence. Both sides aim to reach a mutually beneficial agreement that enhances economic cooperation and reduces trade barriers. The renegotiations come amid growing pressure from businesses for more certainty and stability in post-Brexit trade policies. Successful talks could pave the way for stronger economic ties and boost investor confidence in both regions.

Siemens unveiled a €2 billion investment in a new green hydrogen initiative to support the EU’s climate goals. The project involves developing advanced electrolysis technology and building large-scale hydrogen production facilities across Europe. Siemens aims to produce 500,000 tons of green hydrogen annually by 2030, significantly reducing carbon emissions in industrial processes and transportation. The initiative aligns with the EU’s Green Deal and aims to position Siemens as a leader in the emerging hydrogen economy. CEO Roland Busch emphasized the importance of green hydrogen in achieving a sustainable energy transition.

Sorare, the French fantasy football platform, announced its global expansion plans after raising €500 million in a Series B funding round. The company will use the funds to enter new markets, enhance its platform, and expand its partnerships with major football leagues. Sorare’s blockchain-based platform allows users to trade digital player cards and participate in fantasy football competitions. The expansion aims to capitalize on the growing popularity of digital collectibles and fantasy sports. CEO Nicolas Julia highlighted the potential to revolutionize sports entertainment and engage millions of fans worldwide.

Gucci, the iconic Italian luxury fashion brand, announced its plans to go public on the Milan Stock Exchange. The initial public offering (IPO) is expected to raise approximately €4 billion, which will be used to expand the brand’s digital presence and global retail network. Gucci’s CEO, Marco Bizzarri, stated that going public would provide the capital needed to accelerate growth and innovation. The IPO marks a significant milestone in Gucci’s history and reflects the brand’s strong market position and continued demand for luxury fashion.

The Spanish government approved a €5 billion renewable energy mega-project, aiming to enhance the country’s clean energy capacity. The project includes the construction of large-scale solar and wind farms, expected to generate 3 GW of electricity annually. This initiative is part of Spain’s broader strategy to transition to a sustainable energy future and meet EU climate targets. Energy Minister Teresa Ribera highlighted the project’s potential to create jobs, reduce greenhouse gas emissions, and ensure energy security. The project is slated to begin construction in early 2025.

Deutsche Bank is under increased regulatory scrutiny following allegations of compliance failures and lapses in anti-money laundering controls. The European Central Bank and Germany’s financial regulator, BaFin, are conducting investigations into the bank’s practices. CEO Christian Sewing pledged full cooperation with regulators and announced a comprehensive review of the bank’s compliance framework. The scrutiny comes amid broader efforts to strengthen financial oversight and prevent illicit activities within the banking sector. Deutsche Bank faces potential fines and reputational damage, underscoring the importance of robust compliance measures.

Norway’s sovereign wealth fund, the world’s largest, announced a significant investment in green bonds, committing $2 billion to support sustainable projects globally. The investment focuses on renewable energy, sustainable infrastructure, and climate resilience projects. CEO Nicolai Tangen emphasized the fund’s commitment to aligning its investments with environmental, social, and governance (ESG) criteria. The move reflects a growing trend among institutional investors to prioritize sustainability and address climate change risks. Norway’s investment aims to promote global environmental sustainability while ensuring long-term returns for future generations.

IKEA, the Swedish furniture giant, announced plans to phase out all plastic packaging by 2028 as part of its sustainability strategy. The company will transition to renewable and recyclable materials, such as paper and biodegradable options. IKEA’s Chief Sustainability Officer, Lena Pripp-Kovac, stated that the initiative aims to reduce plastic waste and minimize the company’s environmental footprint. This move aligns with IKEA’s broader goals to achieve a circular business model and promote sustainable living. The company will work with suppliers to develop innovative packaging solutions that are ecofriendly and cost-effective.

European aerospace giant Airbus secured a $10 billion order from Turkish Airlines for 50 new A320neo aircraft. The deal, one of Airbus’s largest this year, reflects strong demand for fuel-efficient aircraft amid rising fuel costs and environmental concerns. Turkish Airlines CEO Bilal Ekşi highlighted the importance of the new fleet in enhancing operational efficiency and reducing carbon emissions. Airbus CEO Guillaume Faury emphasized the strategic partnership with Turkish Airlines and the growing market for sustainable aviation solutions. The first deliveries are scheduled for 2026, supporting the airline’s expansion plans.

Nokia, the Finnish telecommunications giant, announced the acquisition of FastMile, a leading 5G technology startup, for €600 million. The acquisition aims to enhance Nokia’s 5G capabilities and accelerate the rollout of next-generation networks. FastMile’s innovative solutions for fixed wireless access and small cell technology will complement Nokia’s existing portfolio. CEO Pekka Lundmark stated that the acquisition aligns with Nokia’s strategy to lead in 5G innovation and deliver high-speed connectivity solutions globally. The deal is expected to boost Nokia’s competitive position in the rapidly evolving 5G market.

Maersk, the Danish shipping conglomerate, announced plans to expand its green fleet with an investment of $1.5 billion in new eco-friendly vessels. The new ships, powered by methanol and other sustainable fuels, aim to reduce carbon emissions and meet stringent environmental regulations. CEO Søren Skou emphasized Maersk’s commitment to achieving carbon neutrality by 2050. The investment includes the construction of 10 new container ships and the retrofitting of existing vessels with green technology. Maersk’s initiative highlights the shipping industry’s efforts to transition to sustainable operations and combat climate change.

UBS Group, Switzerland’s largest bank, reported strong Q2 earnings, driven by robust performance in its wealth management and investment banking divisions. The bank posted a net profit of CHF 2.3 billion, surpassing analysts’ expectations. CEO Ralph Hamers attributed the success to increased client activity, favorable market conditions, and strategic cost management. UBS plans to reinvest the profits into digital transformation and expanding its global footprint. The positive earnings report underscores UBS’s resilience and adaptability in a challenging economic environment, bolstering investor confidence in the bank’s growth strategy.

Royal Philips, the Dutch health technology company, completed the divestment of its domestic appliances unit for €3.7 billion to a global investment firm. The sale aligns with Philips’ strategic focus on healthcare technology and innovation. CEO Frans van Houten stated that the divestment allows Philips to concentrate resources on its core health tech businesses, including medical imaging, patient monitoring, and digital health solutions. The proceeds will be used to strengthen Philips’ R&D capabilities and pursue strategic acquisitions in the healthcare sector. The transaction marks a significant step in Philips’ transformation journey.

EDP, Portugal’s leading energy company, announced a major renewable energy project in Brazil, investing €1 billion in new wind and solar farms. The project aims to add 1.5 GW of renewable capacity, supporting Brazil’s clean energy transition and EDP’s global expansion strategy. CEO Miguel Stilwell d’Andrade emphasized the importance of international growth and sustainable energy investments. The new facilities will supply power to millions of Brazilian households and contribute to reducing carbon emissions. EDP’s investment highlights the growing role of European companies in the global renewable energy market.

Alpha Bank, one of Greece’s largest financial institutions, announced a comprehensive digital transformation program, investing €500 million over the next five years. The initiative aims to enhance digital banking services, improve customer experience, and streamline operations.

CEO Vassilios Psaltis highlighted the strategic importance of digital innovation in maintaining competitiveness and meeting evolving customer needs. The program includes the development of a new mobile banking platform, advanced cybersecurity measures, and the implementation of AI-driven financial services. Alpha Bank’s digital transformation underscores the broader trend of digitalization in the European banking sector.

Anheuser-Busch InBev, the world’s largest brewing company, announced a €1 billion investment in sustainability initiatives to achieve carbon neutrality by 2040. The investment focuses on renewable energy, water conservation, and sustainable packaging. CEO Michel Doukeris emphasized the company’s commitment to environmental stewardship and responsible business practices. The initiatives include installing solar panels at breweries, reducing water usage in production, and transitioning to fully recyclable packaging materials. Anheuser-Busch InBev’s sustainability investment reflects the growing demand for eco-friendly products and the importance of corporate responsibility in the beverage industry.

London, UK – July 11, 2024 – Businesses who rush to adopt generative AI tools will encounter prolonged challenges with their existing infrastructure, new research from Console Connect, a global Network-as-a-Service provider, has revealed.

According to its latest global survey, more than three quarters of business IT leaders and CTOs (76%) agreed the fast adoption of generative AI (Gen AI) will have long-term repercussions on technology infrastructure planning for their organisation.

Additionally, two-thirds of CTOs (66%) said their network infrastructure does not have the capacity to embrace Gen AI to its full potential; while 76% believe their IT teams are under increasing pressure to adopt Gen AI within their organisation.

The large volumes of additional data being generated by Gen AI and the requirement to move this data to and between private and public clouds is already starting to introduce greater cost and complexity to enterprise networks.

As enterprises build hybrid and multi-cloud architectures to deliver and support generative AI, they need to re-examine how they access the cloud.

The survey conducted by Arlington Research engaged 1,000 CTOs and senior IT leaders across the UK, US, Australia, Hong Kong, and Singapore, providing a comprehensive perspective on the challenges and demands associated with Gen AI adoption.

The findings underscore a growing awareness among industry leaders regarding the potential long-term repercussions of embracing Gen AI without strategic planning.

“The rapid development of generative AI creates a demand on networks

that we

says Paul Gampe, CTO of Console Connect. “As CTOs and senior IT leaders adopt Gen AI tools within their organisation, they need to consider the short and long-term implications of moving larger volumes of sensitive data to and between private and public clouds.”

Security is also a big concern when it comes to the adoption of Gen AI. Seven-in-ten (70%) feared the use of Gen AI is going to put their organisation’s network at risk of cyberattacks or data breaches – a figure which rises to 90% in Australia.

Cybersecurity risks and lack of IT skills/expertise to support it are seen as the main barriers to adopting Gen AI in their organisations.

“These survey results demonstrate that when it comes to deploying mission-critical AI applications, businesses are growing increasingly concerned about the need to be securely connected and that the public internet is no longer suitable for handling many of these applications and workloads. Automation and the move to Network-as-a-Service presents a way for businesses to break away from traditional network infrastructure and the public internet, and instead utilise automated, private and secure network connections to the cloud that can be dynamically adapted to meet the needs of generative AI,” said Gampe.

You can read the full ‘2024 Interconnection Report: The impact of generative AI on networks.

As the world of social media is expanding, the creator economy is also flourishing like never before. The total number of internet users has reached a whopping 5.3 billion in the beginning of year 2024. Due to this, market players are reaching out to content creators, community builders, and curators to spread the message of their brands on a humongous level. Some of the below-written data is the testimony of the rising

importance of digital creators in the growth of business:

- Almost 25.1% of market players declared that they have got 2nd highest ROI in comparison to other marketing approaches.

- In the year 2022, it was estimated that almost 54.2% of 18-29-yearold social media users confess that social media influences their purchases.

- Almost 67.2% of the consumers acquired knowledge of a new

product through the creator’s videos.

- In the year 2021, YouTube paid more than USD 15.1 billion to content creators.

These statistics proclaim that the creator’s economy is playing a prominent role in today’s business operations. Before going forward, let us briefly understand the historical evolution of the creator economy.

Let us understand some of the factors contributing to the surge of the creator economy:

A plethora of factors are contributing to the rapid growth in the domain of the creator economy. Some of the key growth-propelling factors are:

1- Increase in internet users, high screen time and globalization.

A study conducted at the beginning of 2024 revealed that on average people render almost 3 hours

Beginning of 2000s Advent of blogging

- People initiated sharing content online

- Monetization was conducted mainly through sponsors and advertisements

Mid 2000s YouTube began operations in 2005

Ending of 2000s Mushrooming Social Media Platforms

Preliminary years of the 2010s

Middle of the 2010s

The initiation of other social media platforms

Diverse content formats were fabricated

2017 onwards Widespread expansion of platforms

The 2020s onwards Mainstreaming

- Video creators started monetizing through AdSense

- Expansion of platforms such as Twitter and Facebook

- Brand partnerships became widely popular

- Instagram, Tiktok, and Snapchat were launched

- Creators started getting money directly from fans

- Thriving of Live streaming and e-commerce integrated services

- Emergence of creator-focused start-ups

- The arrival of the pandemic raised the consumption of online content

- Creator economy valued at USD 104.2 billion

and 16 minutes on their smartphones every day. Other than this, the potential of Meta advertising garnered almost 2 billion people. As people are spending more time hovering over the internet, the scope of advertisement on social media platforms has increased exponentially. The wider access to the internet is narrowing the gap between products and consumer awareness. The last mile of internet reach is certainly giving economic thrust to the creator economy.

2- Mushrooming popularity of short-term video content

It has been estimated that almost 75.2% of people confessed that they

prefer marketing through video content. With almost 96.2% favoring videos of shorter duration for efficacious service or product education. Consumers are loving short form video content as these are highly effective in acquiring the attention of audience and raising brand visibility and awareness.

3- A rising number of creator economy tools and platforms

There has been a surge in the development of a myriad of creator economy tools such as All-in-one tools, community and engagement tools, and AI tools. Other than this, there is widespread availability of content creation courses. There is the

advent of numerous monetization platforms that are helping creators earn a decent income from their work. With the utilization of platforms such as Snapchat, Instagram, YouTube, TikTok, etc content creators can earn money through:

- Fan clubs

- Advertising revenue share

- Tipping

- Product placement

- Live and virtual event

- VIP meetups

- Merchandise

- Paid subscriptions

Moreover, Instagram has evolved as the most promising influencer marketing place for customers.

- About 89.2% of the marketers said that Instagram was essential for their influencer marketing strategy

- Almost 65.2% of consumer confessed that they follow their favorite influencers on Instagram.

- Moreover, 71% of women prefer using Instagram over other social media channels to follow their favorite influencers.

Let us enumerate the platforms that are most popular for influencer marketing:

The above data illustrates that content creator economy is going to thrive in the future. Let us now delve into the market analysis:

The creator economy market size is anticipated to reach almost USD 600 billion by the end of year 2036. Furthermore, the market garnered almost USD 200 million in the year 2023. Some of the prominent companies in the domain are Meta, YouTube, Bytedanc, Alphabet, Spotify AB, Netflix, Snap Inc, Pinterest etc. The creator economy holds enormous potential for growth in multiple aspects. Some of the key points are as follows:

- By the beginning of 2024, there were almost 206.9 million content creators present globally.

- Almost 10.1% of influencers earn USD 100,000 or more in a year.

- Approximately 46% of people identify as full-time content creators.

- Almost 1 billion accounts on Instagram have over 500k followers

- There were almost 42,000 YouTube channels with over 1 million subscribers in the year 2023.

- Almost 67.2% of the consumers learned about new products through creator videos.

Some of the future trends in creator economy domain are:

- Advent of Web 3 technologies is opening new opportunities for content creation

- Non fungible tokens are going to play a prominent role in creator economy

- Growth of the community based platform

- Huge future demand for the influencer marketing

The above information illustrates that the creator economy market is offering plethora of lucrative opportunities for the future. However, market players are required to understand the intricacies of the market by analysis market research reports. An exhaustive market research report include information related to the growth opportunities, market constraints, regional analysis, etc.

Source -https://www.researchnester.com/reports/reator-economy-market /5691

“As online shopping, live selling, and social commerce continue to grow, the luxury shopping experience must evolve to be more immersive, customised, and secure”

By Donal McGuinness, CEO of Prommt

Personalised experiences are the hallmark of luxury retail. When a brand tailors its offerings to match individual desires and tastes, it speaks directly to the customer, creating a unique and powerful connection. It’s not just about the product - it’s about how the customer feels when buying and using it.

Payments are a vital part of this experience. Often the final touchpoint, it can leave a lasting impression that can influence a customer’s decision to return. The payment journey is an extension of the brand, making it crucial to remove friction at checkout, and offer a choice of safe and convenient payment options.

By 2025, Gen Z and Millennials will drive 70 percent of luxury spending As hybrid shoppers, they easily move between physical stores, online platforms, and virtual experiences. In addition, they expect seamless payment options across all channels, allowing them to engage anytime, anywhere. As online shopping, live selling, and social commerce continue to grow, the luxury shopping experience must evolve to be more immersive, customised, and secure. Businesses can capitalise on this trend by integrating pay-by-link features into social media and messaging apps, allowing customers to make purchases directly from live videos hosted by influencers and brand reps.

Moreover, luxury retailers can offer remote personal consultations and follow up with secure, branded payment requests via SMS, email, web chat, and messaging apps, incorporating modern payment options like open banking.

To date, these payment links have largely been based on card transactions, however, more and more luxury retailers are now beginning to experience the transformational benefits that a Pay By Bank option offers. Based on the European Open Banking payments initiative, Pay by Bank is a game-changer for highvalue transactions. There’s no hassle of card limits and expensive processing fees. It is a safer, faster, and more cost-effective alternative to time-consuming manual bank transfers, drafts, or cheques.

Open banking payments are a winwin for customers and businesses. Backed by the EU Payment Services Directive and the CMA 9 banks in the UK, it helps retailers cut costs and protect margins by significantly reducing high transaction fees, card fraud, chargebacks, and payment operations costs.

Customers enjoy a quick, secure, and seamless way to pay directly from their bank accounts. With open banking payments, clients no longer need to worry about mistyping lengthy account details. In a few simple taps, they select their bank, log in to their mobile banking app, and authorise the payment in a native environment. They have more control over who accesses their personal data and

enjoy greater visibility into their transactions and account balances. Sensitive payment information becomes ‘invisible’, making it harder for fraudsters to exploit. Customers authenticate payments directly through their own banking app, with their personal information encrypted and safeguarded by industry-standard banking security. Unlike direct debits, the payment is initiated by the payer and pushed to the merchant, and not initiated by the merchant and pulled from the payer.

All providers of open banking solutions must adhere to stringent security standards to safeguard customer data. Open banking technology is safe because the banks themselves designed and built the API endpoints, which play a crucial role in verifying account information and facilitating

payments between accounts. Initially developed for online banking, this technology has seen substantial investments in security measures over time. The expertise gained from these investments forms the bedrock of open banking technology.

Traditional payment methods like manual bank transfers are slow and carry high operational costs. Merchants usually share their bank details in PDF format, making it necessary for customers to manually set them up as payees before making a payment. This process involves multiple authentication steps and the hassle of entering and verifying lengthy account numbers. Consequently, it causes delays in business communication, as sales

staff need to coordinate with the finance team to confirm payments before shipping goods. Moreover, sharing bank details in this way isn’t safe and exposes sensitive data to potential misuse by malicious middlemen.

Advanced pay-by-link solutions facilitate smarter invoicing with merchant-branded payment requests, providing a direct link for customers to settle bills effortlessly. With preset payee information, payments can be authenticated securely in just a few clicks. This highlights how open banking can significantly improve businesses’ accounts receivable processes. Furthermore, with SEPA Instant and Faster Payments in the UK, open banking transfers are immediate, and all parties are promptly notified, so deals can be completed more quickly.

With smart payment orchestration controls, luxury retailers can set automated thresholds to present their desired payment method, depending on factors such as the value, location, product, or transaction type. For instance, a jeweller could accept card payments for deposits and take the final balance through open banking. This enables customers to benefit from credit card protections, and the merchant to benefit from the lack of card fees on the larger balance payment.

Retailers can easily set automatic chase paths for failed transactions or where the cart has been abandoned, and present an alternative payment method to complete the transaction –via bank or card. This strategy allows them to achieve substantial savings on transaction fees and operational costs, while also mitigating card fraud and minimising chargebacks.

Open banking payments are the ideal choice for luxury purchases. Customers experience a seamless, secure payment process directly from their banking app, while merchants enjoy reduced processing and operational fees, as well as strengthened fraud prevention measures.

a trailblazer in the rapidly expanding tokenization market. As digital transformation accelerates across Europe, Zeebu stands at the forefront of leveraging blockchain technology to revolutionize how businesses operate and transact. Today, we are privileged to gain insights from the visionary leader driving this innovation.

Zeebu has distinguished itself by developing cutting-edge solutions that enable the seamless tokenization of assets, enhancing transparency, security, and efficiency in various industries. From real estate to finance, Zeebu’s platform empowers businesses to tokenize physical and digital assets, creating new opportunities for investment and liquidity.

In this session, we will explore the intricacies of the tokenization market, delve into Zeebu’s unique offerings, and understand the strategic vision guiding the company. Our discussion will cover the potential of tokenization to reshape traditional business models, the challenges and opportunities within this emerging market, and Zeebu’s role in shaping the future of digital assets.

Zeebu is focused on tokenization solutions across various domains. Can you explain what tokenization means and why it’s become such an important concept in recent years?

Absolutely. At Zeebu, we’re primarily focused on transforming the telecom carrier industry through

blockchain-based payments and settlement layer. Tokenization is central to this transformation. In simple terms, tokenization converts realworld assets, digital art, intellectual properties, and even processes into digital tokens that exist on blockchain networks.

For Zeebu, tokenization is about streamlining and securing transactions within the telecom sector using ZBU tokens. This integration ensures automated settlements and realtime transaction processing, making operations more flexible, secure, and efficient for telecom businesses. As the digital world evolves, Zeebu’s approach to tokenization is setting new standards in decentralization, security, and global accessibility.

Tokenization has become an important concept in recent years due to its transformative benefits in various sectors. One of the key advantages is fractional ownership, which allows assets that were previously illiquid, like real estate or fine art, to be divided into smaller, tradable units. This opens up investment opportunities to a broader audience and enhances liquidity in the market.

Efficiency is another significant benefit. Tokenization automates many processes through smart contracts, reducing the need for intermediaries and speeding up transaction times. This leads to lower costs and more streamlined operations.

Transparency and traceability are also crucial. Blockchain technology ensures

that every transaction is recorded in a secure, immutable ledger that can be audited in real-time. This transparency builds trust among all parties involved and reduces the risk of fraud and errors.

Overall, tokenization is revolutionizing how we manage and transfer assets, making these processes more accessible, secure, and efficient.

One of Zeebu’s areas of focus is DeFi (Decentralized Finance). How can tokenization contribute to the growth and adoption of DeFi applications and services?

At Zeebu, we’re passionate about the transformative potential of decentralized finance (DeFi). Integrating DeFi into traditional financial systems can create a faster, more affordable, and inclusive digital economy. DeFi empowers users with decentralized, permissionless protocols, reducing dependence on large institutions that have historically struggled to safeguard consumers during economic crises.

Speaking of tokenization, it lies at the heart of DeFi applications, acting as the crucial first step for bringing real-world assets into the DeFi space. This process not only opens new doors for asset utilization but also significantly propels the growth of DeFi. Tokenization enables innovative financial products such as decentralized insurance, lending and borrowing platforms, and synthetic assets. These advancements diversify and strengthen the DeFi ecosystem, making it more robust and versatile.

We believe in a future where financial services are faster, cheaper, and accessible to everyone, regardless of location or background.

Governance tokens are used to enable decentralized decision-making and voting within blockchain-based organizations. How does Zeebu facilitate the creation and management of governance tokens for projects built on its platform?

We’re actively developing our governance framework. Our goal is to create a democratic and decentralized ecosystem where community members can significantly influence the platform’s direction and decisions. The governance feature will allow users to participate in key processes like validation, deployment, and liquidity provision. This participatory model is crucial for driving the decentralization of telecom transactions and fostering an engaged, active community.

As Zeebu is operating in the Telecom Market, what is the biggest benefit for traditional companies leveraging blockchain technology?

Stemming from our experience in transforming traditional industries, the biggest benefit for traditional companies leveraging blockchain technology is the significant enhancement in automation, efficiency, and transparency. The telecom industry, involving numerous participants like operators, carriers, and service providers, faces chronic issues such as delays in settlements, lack of transparency, high transaction fees, and substantial FX conversion losses.

Blockchain technology directly addresses these inefficiencies. At Zeebu, we use blockchain to automate payment processes, ensuring realtime settlements that reduce transaction times from days to seconds. This automation minimizes operational costs and FX conversion losses.

Additionally, blockchain provides an immutable ledger that enhances transparency and security, eliminating the need for intermediary approvals and reducing the risk of fraud.

By integrating blockchain, traditional companies can streamline their operations, reduce costs, and improve the overall efficiency and reliability of their process. The applications for every industry must be unique and benefits are endless, ranging from enhanced data security and transparent supply chains to improved compliance and streamlined auditing processes. Each industry can tailor blockchain technology to address its specific challenges, thereby unlocking new levels of innovation and operational excellence.

There are many buzzwords such as tokenization, RWA, and DeFi; Where do you see these sectors going and what are you at Zeebu actually trying to achieve in the near future?

The financial landscape is undergoing a transformative shift with the integration of tokenization, Real World Assets (RWA), and Decentralized Finance (DeFi). These innovations are redefining various sectors by enabling more efficient use of traditional market liquidity and bringing capital markets on-chain. This movement is critical as it leverages the vast pools of liquidity in traditional markets, making assets more accessible and tradable.

In the trading and investment sector, DeFi is revolutionizing how trades are conducted, making them faster, more cost-effective, and globally accessible. Similarly, the lending and borrowing landscape is being reshaped by DeFi platforms, which offer easier access to loans and better returns, appealing to a wide range of users.

The potential of DeFi to disrupt the traditional payments and remittances industry is becoming increasingly evident. With the ability to conduct robust cross-border transactions seamlessly, DeFi protocols are providing a more efficient alternative to conventional methods.

The majority of the industries are moving towards greater integration of these technologies, with increased adoption in highly regulated

jurisdictions playing a pivotal role. As regulatory frameworks evolve to accommodate these innovations, we can expect to see substantial growth and mainstream acceptance. This regulatory clarity will foster an environment that supports innovative growth, efficient market participation, and provides more utility for asset holders to leverage on-chain capabilities.

At Zeebu, one of our most anticipated updates is the rollout of our liquidity protocol. This development will enhance our platform’s capabilities, facilitating smoother and more efficient transactions while introducing a greater degree of decentralization. By implementing these initiatives, we aim to drive innovative growth, enable efficient market participation, and provide more utility for asset holders to leverage on-chain.

In essence, the future of finance and beyond lies in the seamless integration of these technologies to create a more inclusive, transparent, and efficient system. At Zeebu, we are committed to being at the forefront of this transformation, continuously working towards setting new standards in the industry.

What is your biggest challenge and what do traditional companies need to change to take advantage of new technologies? Tokenization is a powerful tool as we know, but how can companies “get over the hump” and actually integrate it into daily operations?

We see the biggest challenge lies in bridging the gap between traditional business practices and the innovative potential of blockchain technologies,

including tokenization. While the benefits of these technologies are clear— greater efficiency, transparency, and cost savings—many traditional companies struggle with the complexity of integration and the inertia of established systems.

One major challenge is the need for greater understanding and awareness of tokenization among the public. Many people are still unfamiliar with the benefits and mechanisms of tokenization, which can hinder widespread adoption. Another challenge is navigating the complex and uncertain regulatory environment surrounding tokenization. Finally, making the technology more seamless and user-friendly is essential for broader acceptance.

To take full advantage of new technologies, traditional companies need to undergo a fundamental shift in mindset. Moreover, companies need

to adopt a phased approach to integration. Instead of a complete overhaul, businesses can start by implementing tokenization in specific, manageable areas where it can have the most immediate impact. It is crucial to leverage tokenization to bring assets and processes onto the blockchain while maintaining an easy-touse interface. The transition should not feel overwhelming; rather, it should involve simple, straightforward steps. Developing custom-built applications for different industries can ensure that these solutions are tailored to meet specific needs, making the adoption process smoother and more effective.

By focusing on making the technology accessible and user-friendly, companies can ensure that the transition to tokenization is as seamless as possible.

What factors are hindering the wider adoption of blockchain payments by online merchants and businesses? Are UI/UX issues or technological limitations the main obstacles? How is Zeebu addressing these challenges?

Yes, That still stands true, adoption of blockchain payments by online merchants and businesses is largely hindered by technical complexities and less intuitive user interfaces compared to traditional systems. The onboarding process, which includes steps like setting up digital wallets and using decentralized applications, can be daunting for many users. However, the core issue is the lack of enterprise-specific solutions tailored to the unique needs and workflows of businesses.

At Zeebu, we recognize that for blockchain payment solutions to be widely adopted, they must be as seamless and user-friendly as traditional systems. This means developing interfaces that are intuitive and easy to navigate, reducing the learning curve associated with new technologies.

Another focus of Zeebu has been to build tailored solutions for the telecom industry, addressing the unique challenges in their settlement processes. By providing custom-built applications that integrate smoothly with existing business operations, we ensure that the transition to blockchain payments is straightforward and efficient. Our solutions are designed to simplify the setup and use of blockchain technology, making it accessible even for those who may not be tech-savvy.

By prioritizing user experience and offering industry-specific solutions, Zeebu helps businesses overcome the technical and logistical barriers to adopting blockchain payments. This approach ensures that companies can easily leverage the benefits of blockchain technology while maintaining their existing workflows and processes.

The advent of blockchain technology has ushered in a new era of digital transformation, and at the heart of this revolution is the concept of tokenization. By converting rights and assets into digital tokens, we are witnessing a profound shift in how we manage identities, governance, intellectual property, and even our approach to environmental and social challenges. This 2000-word feature explores the multifaceted impact of tokenization on these critical areas, highlighting the

transformative potential and future prospects of this groundbreaking technology.

In our increasingly digital world, the need for secure and verifiable identities is paramount. Traditional methods of identity verification, often cumbersome and prone to fraud, are being challenged by the promise of tokenized identities. By leveraging blockchain technology, tokenized identities offer a secure, decentralized, and user-centric approach to managing personal information.

Tokenized identities involve the creation of a digital representation of an individual’s identity, which is stored on a blockchain. This digital identity can include a wide range of personal information, from basic details like name and date of birth to more complex data such as educational qualifications, professional credentials, and even biometric information. The use of blockchain ensures that this information is immutable, tamper-proof, and easily verifiable.

One of the most significant advantages of tokenized identities is their ability to provide users with full control over their personal data. In traditional systems, personal information is often stored in centralized databases, making it vulnerable to breaches and unauthorized access. With tokenized identities, individuals can manage their data through private keys, sharing only the necessary information with trusted parties. This approach not only enhances security but also fosters greater privacy and user autonomy.

The tokenization of credentials is revolutionizing the verification process across various sectors. In education, for instance, academic institutions can issue digital diplomas and certificates on the blockchain, which students can then present to employers or other educational entities. This method not only simplifies the verification process but also eliminates the risk of fraudulent claims.

Similarly, professional credentials can be tokenized to facilitate seamless verification in the job market. Employers can quickly verify an applicant’s qualifications and work history without the need for lengthy background checks. This efficiency is particularly valuable in industries where rapid hiring processes are essential.

Several projects and platforms are already pioneering decentralized identity solutions. Microsoft’s Azure Active Directory, for example, integrates decentralized identity technology to empower users with self-sovereign identities. Similarly, platforms like Sovrin and uPort are developing decentralized identity networks that allow individuals to manage and share their credentials securely.

The potential applications of tokenized identities extend beyond individual use cases. Governments can implement digital identity systems to streamline public services, while financial institutions can leverage them for more efficient KYC (Know Your Customer) processes. As adoption grows, tokenized identities are poised to become the cornerstone of a more secure and efficient digital ecosystem.

In the realm of decentralized finance (DeFi) and blockchain-based projects, governance tokens have emerged as a powerful tool for community-driven decision-making. These tokens enable token holders to participate in the

governance of a project, influencing key decisions and shaping the future direction of the platform.

Governance tokens are central to the operation of Decentralized Autonomous Organizations (DAOs). DAOs are entities governed by smart contracts and driven by community consensus rather than centralized leadership. Token holders can propose and vote on changes to the protocol, ranging from technical upgrades to financial decisions and community initiatives.

The use of governance tokens democratizes decision-making, giving stakeholders a direct say in the development and management of the project. This inclusivity fosters a sense of ownership and accountability among participants, aligning their interests with the success of the platform.

Several prominent DeFi projects have successfully implemented governance tokens. MakerDAO, for example, uses MKR tokens to govern its decentralized stablecoin platform. MKR holders can vote on proposals related to risk parameters, collateral types, and other critical aspects of the protocol.

Similarly, Uniswap, a leading decentralized exchange, introduced UNI tokens to enable community governance. UNI holders can participate in the decision-making process, influencing the future development and direction of the platform. This model not only empowers users but also enhances the resilience and adaptability of the project.

While governance tokens offer significant benefits, they also present challenges. Ensuring active and informed participation among token holders can be difficult, and the risk of concentration of power in the hands of a few large holders remains a concern. Additionally, navigating regulatory frameworks and ensuring compliance

is a complex task for projects operating in the decentralized space.

Despite these challenges, the potential of governance tokens to revolutionize organizational structures and decision-making processes is immense. As the technology matures and more projects adopt decentralized governance models, we can expect to see a shift towards more transparent, inclusive, and community-driven ecosystems.

The digital age has brought about new challenges in protecting and monetizing intellectual property (IP). Tokenization offers a promising solution by enabling the creation of digital tokens that represent ownership and rights to intellectual property. This innovation has far-reaching implications for creators, artists, and innovators across various fields.

Tokenizing intellectual property on a blockchain provides a secure and transparent record of ownership. This immutable ledger ensures that the provenance and ownership history of an asset are verifiable and tamper-proof. For creators, this means enhanced protection against infringement and unauthorized use of their work.

In the art world, for instance, tokenization allows artists to issue digital certificates of authenticity for their works. Collectors can purchase these tokens, confident in the knowledge that their ownership is securely recorded on the blockchain. This approach not only protects the artist’s rights but also enhances the value and marketability of the artwork.

Tokenization also opens up new avenues for monetizing intellectual property. Creators can issue tokens that represent fractional ownership of their work, allowing investors to purchase shares in a song, film, or invention. This fractionalization democratizes access to investment opportunities and enables creators to raise funds more efficiently.

Moreover, smart contracts can automate licensing agreements and royalty distributions. For musicians, this means receiving payments instantly whenever their music is streamed or used commercially. Smart contracts ensure that all parties involved in the creation and distribution of a work are fairly compensated, reducing the administrative burden and potential for disputes.

Several platforms are pioneering the tokenization of intellectual property. One notable example is Ascribe, a platform that allows artists to register their digital creations on the blockchain, ensuring proof of ownership and enabling secure transfers.

Another example is the Musicoin project, which uses blockchain to manage music rights and royalties, providing transparent and fair compensation for artists.

In the patent industry, platforms like IPwe are exploring the use of blockchain to create a global patent registry. By tokenizing patents, inventors can easily prove ownership, facilitate licensing, and attract investment. This approach has the potential to streamline the patenting process and foster innovation by making it easier to share and monetize intellectual property.

Beyond the realms of finance and commerce, tokenization holds significant potential for driving positive environmental and social impact. By creating transparent, traceable, and

efficient systems, tokenization can address some of the most pressing challenges facing our planet and society.

Tokenization can play a crucial role in environmental conservation efforts. One application is the tokenization of carbon credits. By representing carbon credits as digital tokens on a blockchain, we can create a transparent and efficient market for trading these credits. This approach enhances accountability and ensures that carbon offset projects are accurately tracked and verified.

Additionally, tokenization can support sustainable supply chains. By tracking the provenance of raw materials and products through digital tokens, companies can ensure that their goods

are sourced ethically and sustainably. Consumers, in turn, can make more informed purchasing decisions, driving demand for environmentally friendly products.

Tokenization can also promote social impact and financial inclusion. In the charitable sector, for instance, blockchain technology can enhance transparency and accountability in the distribution of funds. Donors can track their contributions through digital tokens, ensuring that their donations reach the intended beneficiaries and are used effectively.

Furthermore, tokenization can empower underserved communities by providing access to financial services.

In regions with limited banking infrastructure, tokenized assets and decentralized finance platforms can offer individuals and businesses access to credit, savings, and investment opportunities. This inclusivity fosters economic growth and resilience, particularly in developing economies.

Several initiatives are leveraging tokenization for environmental and social good. Veridium, for example, uses blockchain technology to tokenize carbon credits and other environmental assets, creating a transparent and efficient market for sustainable investments. Similarly, the Plastic Bank initiative uses blockchain to incentivize plastic recycling by issuing tokens to collectors, who can then exchange them for goods and services.

In the realm of social impact, the GiveTrack platform allows donors to follow their contributions in real-time, ensuring transparency and accountability in charitable projects. By tokenizing donations, GiveTrack enhances trust and encourages greater participation in philanthropic efforts.

Tokenization is not merely a technological advancement; it is a paradigm shift that has the potential to revolutionize various aspects of our lives. From secure digital identities and decentralized governance to the protection and monetization of intellectual property, and the promotion of environmental and social impact, tokenization offers a more transparent, efficient, and inclusive future.

As we continue to explore and embrace the possibilities of tokenization, it is essential to navigate the challenges and ensure that the technology is used responsibly and ethically. Regulatory frameworks, education, and collaboration will play critical roles in shaping the tokenized world and unlocking its full potential.

When it comes to the issue of ESG (environmental, social and governance) litigation, there seems to be plenty to report. But while developments show little sign of slowing down, the future may well depend on a number of factors. We are certainly seeing more courts worldwide issuing judgments in favour of protecting the climate. The recent example of Verein KlimaSeniorinnen Schweiz saw the European Court of Human Rights hold that the right to a private life imposes a positive obligation on states to ensure effective protection against the adverse effects of climate change. It was the first time an international court had definitively ruled on the intersection between climate and human rights.

In addition, Friends of the Earth, Client Earth and Good Law Project vs Secretary of State for Energy, Security and Net Zero saw the UK High Court rule that the UK government’s climate strategy was not fit-for-purpose and so was in breach of the UK Climate Change Act. We have also seen the US case of Held v Montana, in which the court found in favour of protecting the constitutional right to a healthy environment, and the French ruling, in Notre Affaire à Tous and Others v France, that the state needs to take immediate action to comply with commitments to reduce emissions under the Paris Agreement; the international treaty on climate change that was adopted in 2015.

Then there’s the Supreme Court of India’s ground-breaking ruling that recognised a right to be free from the adverse effects of climate change, and

South Korea’s constitutional court currently hearing the country’s first major climate litigation. There is certainly a move to the courts when it comes to the environment.

The future of ESG litigation is an intriguing proposition. The International Tribunal for the Law of the Sea recently confirmed that states are under a legal obligation to protect our oceans and seas from climate change. This includes an obligation to restore habitats and ecosystems where they have been damaged due to anthropogenic (man-made) emissions, and where restoration is needed to regain ecological balance. States are even under an obligation to anticipate risks

to the marine environment that may be created by climate change.

At present, the world is currently awaiting the outcome of further requests for advisory opinions from the International Court of Justice and the Inter-American Court of Human Rights. These bodies’ interpretations of states’ climate change obligations will not be binding, in the same way as the International Tribunal for the Sea opinion was not binding. But their opinions on matters such as protection of the marine environment, human rights and the environment, and greenhouse gases will carry substantial legal weight. They may be decisive in defining the human rights

obligations of states (and possibly corporations) regarding the climate crisis.

Against this backdrop, we can also expect an increase in climate-related litigation against non-financial institutions and a more diverse range of corporate actors. Cases based on the principle of polluter pays and citing the Paris Agreement could become more commonplace. Claims based on tort law, action brought under corporate due diligence legislation, use of consumer protection and competition law, and challenges to directors over breaches of fiduciary duties under company law are all viable options for those looking to hold to account companies or individuals.

But there are hurdles to be overcome by those looking to bring such cases. The most prominent of these is that rights enshrined in constitutions and regional conventions impose obligations on the state but not on private actors. In many jurisdictions, powerful constitutional rights, most notably the right to a healthy environment, can be asserted vertically against the State but not horizontally against private actors.

The issue of insufficient direct legal rights and procedural Issues is a serious challenge to those looking to bring ESG cases. This applies both to the aforementioned climate-related issues as well as to other matters

such as greenwashing, modern slavery and poor health and safety in supply chains.

English law needs to adapt to the complexities of group litigation. The current arrangements can make bringing action an unbelievably challenging exercise in paperwork, while also giving scope to corporate defendants to do what they can to avoid having to answer for their actions. It is proposed that the UK needs a legal framework for human rights and environmental violations, modelled on the Bribery Act 2010 and Criminal Finances Act 2017; which contain failure to prevent offences.

There can be little argument that something needs to be done. Currently, applicants are usually the ones having to shoulder the burden of proof while up against corporates that can boast large legal teams who face few obligations to disclose information that could be crucial to the case. This has been why a number of claims have been unsuccessful. Added to this, the often slow pace of such proceedings can mean that the harm to people or the environment that is at the heart of the legal action can continue unchecked for long periods of time.

Applicants will often struggle to raise the funds to bring a legal action. Even if they do manage this, they then face the daunting prospect of having to keep finding funds to keep it going. All this has to be done while their opponent is likely to be a sizeable company that can find all the money that is necessary to thwart the case. It is a far from level playing field, which probably explains why the biggest UK group litigation – relating to the Mariana Dam disaster case – required third-party litigation financing.

As a result, many individuals have extremely limited access to justice, which can often only serve to perpetuate injustice. So while we can see signs of progress, much needs to be done to ensure such advances do not remain the exception rather than the rule.

Recent research from Dialpad found that over 69% of executives in the C-suite reporting to the CEO - or what is commonly known as CxOs - are expecting to spearhead their organisation’s AI efforts. The research also found that three quarters (75%) of respondents believe AI will have a significant impact on their roles in the next three years, and more than 69% are already using the technology. Does this mean that an AI power struggle is imminent in the C-suite?

It’s no surprise that AI is top of mind for the C-Suite, but with everyone expecting to lead the charge - does this risk confusion, duplication of efforts, and even a power struggle over who holds the keys to an organisation’s AI-related decisions? And

what can help tackle these challenges and cut out confusion?

Whilst most (69%) of executives are already using AI, this doesn’t mean they all feel comfortable with the technology. In fact, there are some notable concerns, with 54% of leaders worried about AI regulation and 38% moderately to extremely concerned about AI in general. In light of this, the case for Chief AI Officers (CAIOs) is a strong one - something which the Biden administration in the US has called for recently. In theory, a CAIO will be able to take on these concerns and act as the main point of contact and the final authority on all things AI. It will be their responsibility to understand regulatory developments,

shielding other executives and teams, and to dictate how AI is used across the business. Crucially, a CAIO can also stop any AI ‘power struggle’ from forming, acting as a figurehead for AI-related decisions and planning in a business.

“We will likely begin to see other governments echo the Biden administration’s call for more Chief AI Officer roles to be created,” said Jim Palmer, CAIO of Dialpad. “The CAIO role is one that can manage and mitigate much of the risk that comes with AI development, ensuring privacy and security standards are met and that customers understand how and why data is being used. The specifics of the CAIO role are far from fully mapped out, but as the AI boom continues, this will no doubt change in the coming months and years.”

The research also found that, often, leaders across the business are using multiple AI solutions - 33% executives are using at least two AI solutions, 15% are using three, and 10% are using four or more. If multiple different AI solutions are being used across a business, it runs a real risk of duplication across different departments - meaning companies are often unnecessarily paying for tools with the same functionality. Disparate tools and solutions can also tamper with a single source of truth, making it harder to align teams around the same data, goals and objectives - fuelling the potential AI power struggle among executives even further.

This is another area where the role of a CAIO can be so important, reducing

duplication and ensuring the business invests smartly into AI.

Half (50%) of executives are moderately to extremely concerned about the possibility of a data leakage. On top of this, they have security concerns (22%), accuracy worries (18%), and fears over the cost of models, compute power, and expertise (12%). Additionally, 91% of companies will determine they do not have enough data to achieve a level of precision their stakeholders will trust.

It’s clear that, for all its value, AI is still full of unknowns for many leaders. A CAIO can, again, take on the responsibility to tackle these concerns head on. Alongside this, partnering with AI native companies that develop their

own, proprietary AI services can offer much reassurance. Companies built upon their own proprietary AI stack will have greater control over data, privacy, security, performance and cost – key topics of discussion by organisations and regulators currently. Additionally, partnering with an AI native should, in theory, ensure more accuracy. Why? Because, while public AI is trained off the entire world wide web of data, AI natives can train their models on data that is relevant - making it faster and more accurate. It’s like writing a history book with guaranteed facts versus a combination of facts and lies, with no way to distinguish between the two. By embracing distributed leadership, fostering alignment, and standardising AI tools, businesses can navigate the evolving landscape of AI with confidence and clarity.

What key trends do you see shaping the future of data analytics in business intelligence?

In a little more than a decade, data analytics went through several big transformations. First, it became digitized. Second, we witnessed the emergence of ‘big data’ analytics, driven partly by digitization and partly by massively improving storage and processing capabilities. Finally, in the last couple of years, analytics has been transformed once again by emerging generative AI models that can analyze data at a previously unseen scale and speed. Gen AI is becoming a data analyst’s personal assistant, taking over less exciting tasks— from basic code generation to data visualization.

I believe the key effect of generative AI—and the main future trend for data analytics—is data democratization. Recently, there’s been a lot of activity around “text to SQL” products to run queries in natural language, meaning that people without specialization in data sciences get the possibility to dive deeper into data analysis. However, we shouldn’t get carried away with the hype too quickly. Those AI-powered tools are neither 100% accurate nor error-free, and noticing errors is more difficult for less experienced users. The holy grail of analytics is precision combined with a nuanced understanding of the business landscape—skills that are impossible to automate unless we reach some sort of a “general” AI.

The second trend that is critical for business data professionals is moving towards a single umbrella-like AI system capable of integrating sales, employee, finance, and product analytics into a single solution. It could bring immense business value due to cost savings (ditching separate software) and also help with the data democratization efforts.

Can you elaborate on the role of machine learning and AI in next-generation data analytics for businesses?

Generative AI somehow drew an artificial arbitrary line between next-gen analytics (powered by Gen AI) and “legacy” AI systems (anything that came before Gen AI). In the public discourse

around AI, people often miss the fact that the “traditional” AI isn’t an outdated legacy; Gen AI is intelligent only on the surface; and both fields are actually complementary.

In my previous answer, I highlighted the main challenges of using generative AI models for business data analytics. Gen AI isn’t, strictly speaking, intelligence—it is a stochastic technology functioning on statistical probability, which is its ultimate limitation.

Increased data availability and innovative data scraping solutions were the main drivers behind the Gen AI “revolution”; however, further progress can’t be achieved by simply pouring in more data and computational power. Moving towards a “general” artificial intelligence, developers

will have to reconsider what “intelligence” and “reasoning” mean. Before this happens, there’s little possibility that generative models will bring to data analytics something more substantial than they have already done. Saying this, I don’t mean there are no methods to improve generative AI accuracy and make it better at domain-specific tasks. A number of applications already do it. For example, guardrails sit between an LLM and users, ensuring the model provides outputs that follow the organization’s rules, while retrieval augmented generation (RAG) is increasingly employed as an alternative to LLM fine-tuning. RAG is based on a set of technologies, such as vector databases (think Pinecone, Weaviate, Qdrant, etc.), frameworks (LlamaIndex, LangChain, Chroma), and semantic analysis and similarity search tools.

How can businesses effectively harness big data to gain actionable insights and drive strategic decisions?

In today’s globalized digital economy, businesses don’t have a choice of avoiding data-driven decisions, unless they operate in a very confined local market and are of limited size. To

drive competitiveness, an increasing number of businesses are collecting not only consumer data they can get from their owned channels but also publicly available information from the web for price intelligence, market research, competitor analysis, cybersecurity, and other purposes.

Up to a point, businesses might try to get away without using data-backed decisions; however, when the pace of growth increases, companies that rely on gut feeling only unavoidably start lagging behind. Unfortunately, there are no universal approaches to harnessing data effectively that would suit all companies. Any business has to start from the basics: first, define the business problem; second, answer, very specifically, what kind of data might help to solve it. Over 75% of data businesses collect ends up as “dark data.” Thus, deciding what data you don’t need is no less important than deciding what data you need.

In what ways do you envision data visualization evolving in the context of business intelligence and analytics?

Most data visualization solutions today have AI-powered functionalities

that provide users with a more dynamic view and enhanced accuracy. Further, AI-driven automation also allows businesses to analyze patterns and generate insights from larger and more complex datasets while freeing analysts from mundane visualization tasks.

I believe data visualization solutions will have to evolve towards more democratic and noob-friendly alternatives, bringing data insights beyond data teams and into sales, marketing, product, and client support departments. It is hard to tell, unfortunately, when we could expect such tools to arrive. Up until now, the focus of the industry hasn’t been on finding the single best visualization solution. There are many different tools available on the market, and they all have their advantages and disadvantages.

Could you discuss the importance of data privacy and security in the era of advanced analytics, and how businesses can ensure compliance while leveraging data effectively?

Data privacy and security were no less important before the era of advanced analytics. However, the increased scale and complexity of data collection and processing activities also increased the risks related to data mismanagement and sensitive data leaks. Today, the importance of proper data governance cannot be understated: mistakes can lead to financial penalties, legal liability, reputational damage, and consumer distrust.

In some cases, companies deliberately “cut corners” in order to cut costs or gain other business benefits, resulting in data mismanagement. In many cases, however, improper data conduct is unintentional.

Let’s take an example of Gen AI developers who need massive amounts of multifaceted data to train and test ML models. When collecting data at such a scale, it is easy for a company to miss that parts of these datasets contain personal data or copyrighted material that the company wasn’t authorized

to collect and process. Even worse, getting consent from thousands of internet users who might be technically regarded as “copyright” owners is virtually impossible.

So, how can businesses ensure compliance? Again, it depends on the context, such as the company’s country of origin. US, UK, and EU data regimes are quite different, with the EU having the most stringent one. The newly released EU AI Act will definitely have an additional effect on data governance as it tackles both developers and deployers of AI systems within the EU. Although generative models fall in the low-risk

zone, in certain cases, they might still be subject to transparency requirements, obliging developers to reveal the sources of data the AI systems have been trained on as well as data management procedures.

However, there are basic principles that apply to any company. First, companies must thoroughly evaluate the nature of the data they are planning to fetch. Second, more data doesn’t equal better data—deciding which data brings added value for the business and omitting data that is excessive or unnecessary is the first step towards better compliance and fewer data management risks.

How can businesses foster a culture of data-driven decision-making throughout their organizations?

The first step is, of course, laying down the data foundation—building the Customer Data Platform (CDP), which integrates structured and cleaned data from various sources the company uses. To be successful, such a platform must include no-code access to data for non-technical stakeholders, and this isn’t an easy task to achieve.

No-code access means that the chosen platform (or “solution”) must hold

both an SQL interface for experienced data users and some sort of “drag and drop” function for beginners.

At Oxylabs, we chose Apache Superset to advance our self-service analytics. However, there is no solution that would fit any company and would only have pros and no cons. Moreover, these solutions require well-documented data modeling.

When you have the necessary applications in place, the second big challenge is building data literacy and confidence of non-technical users. It requires proper training to ensure that employees handle data, interpret it, and draw insights correctly.

Why is this a challenge? Because it is a slow process, and it will take time away from the data teams.

Fostering a data-driven culture isn’t a one-off project—to turn data into action, you will need a culture shift inside the organization, as well as constant monitoring and refinement efforts to ensure that non-technical employees feel confident about deploying data in everyday decisions. Management support and well-established cooperation between teams are key to making self-service analytics (or data democratization, as it is often called) work for your company.

Attributed to: Brian Gaynor, VP of Product & EU CEO at BlueSnap

The B2B payments landscape is constantly changing. Maintaining pace is vital to keep up with buyer demands, payment trends, and new regulations. The right payment provider for your ERP System is key to this as it can provide a better buyer experience by offering more ways to pay. It also helps avoid costly fees, which in turn improves agility and gives an edge over competitors. At the same time, it provides businesses with better cash flow and accurate reporting and reconciliation. All this becomes particularly important when companies are looking to scale and need to cater to the differences in payment practices. Last year, 57% of businesses stated that their ERP System helped them become more agile. However, many businesses are still missing out. Business leaders should be incorporating the right payment provider with their ERP System so that it acts as a catalyst

for growth and increases Return on Investment (ROI).

ERP Systems are an excellent way to gather payment data, consolidate workstreams, maintain a growth trajectory, and get an accurate picture of the payment landscape. Adding a Global Payment Orchestration Platform to your ERP System can enable payment acceptance in multiple currencies and payment methods. This brings the dexterity firms need to cater to buyers’ preferences and makes it easier for buyers to complete transactions.