1 minute read

Currency outlook: US dollar slumps amid fading Fed rate hike bets, Euro underpinned by ECB interest rate speculation

USD/GBP: Down from $0.82 to $0.80

Euro

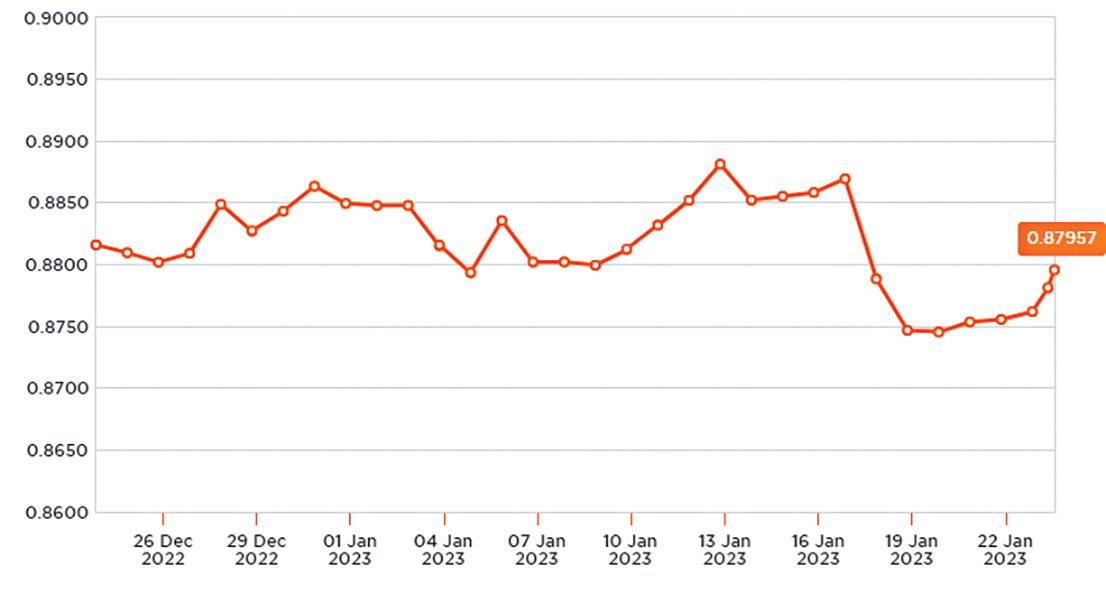

EUR/GBP: Unchanged at £0.88

EUR/USD: Up from $1.06 to $1.09

Recent movement in the euro has been largely tied to European Central Bank (ECB) rate hike expectations, helping the single currency rally since the start of 2023.

This helped to underpin EUR demand through the first half of January as hawkish ECB rhetoric bolstered expectations the bank will continue to deliver 50bps rate hikes through the first half of the year.

However this also led to some volatility in the second half of the month following a Bloomberg report in which it was suggested the ECB might be considering slowing the pace of its monetary tightening following its February meeting.

Elsewhere the euro also faced some headwinds as a result of weaker-than-expected German economic data as well as fears of an escalation of the war in Ukraine.

In light of the recent Bloomberg report, the ECB’s next interest rate decision will be the primary focus for EUR investors over the next month. If the ECB confirms it will ‘stay the course’ with the current pace of rate hikes, the euro is likely to strengthen.

Business Extra

Hard times

AMAZON workers in the UK recently went on strike, protesting over pay and conditions. Employees said they were constantly monitored and warehouse robots received better treatment.

Deaf ears

ANTONIO GARAMENDI, president of the Spanish Confederation of Business Organisations (CEOE), warned that the government’s ban on one use plastics would hurt the agrifoods industry.

Heavy duty

A NEW £100 million (€113.6 million) customs inspection site at (Sevington (Kent) with space for 1700 lorries is underused and the only regularly inspected imports are household pets arriving from Ukraine.

Pound

GBP/EUR: Unchanged at €1.13

GBP/USD: Up from $1.20 to $1.24

After a muted end to December, the pound spent the first half of January struggling to find any sustained support.

Sterling initially wavered this month on the back of some mixed PMIs. While an upwardly revised manufacturing PMI buoyed the pound, these gains were swiftly reversed after the subsequent services index printed below forecast.

An increasingly gloomy outlook for the UK economy then kept the pressure on GBP exchange rates through the second week of Jan- uary, with only some modest relief being seen after the latest domestic GDP figures bolstered hopes the UK avoided a recession in 2022.

However, the pound then bounced back as we entered the second half of the month.

Stronger-than-expected UK wage growth and inflation figures bolstered Bank of England (BoE) interest rate hike expectations and propelled Sterling to a one-month high.

Looking ahead, the BoE’s February policy meeting could trigger some GBP selling pressure if the bank’s forward guidance indicates appetite for further hikes remains limited.

US Dollar