1 minute read

Currency outlook: US dollar firms in risk-off trade, Pound rocked by fluctuating BoE rate expectations

Euro

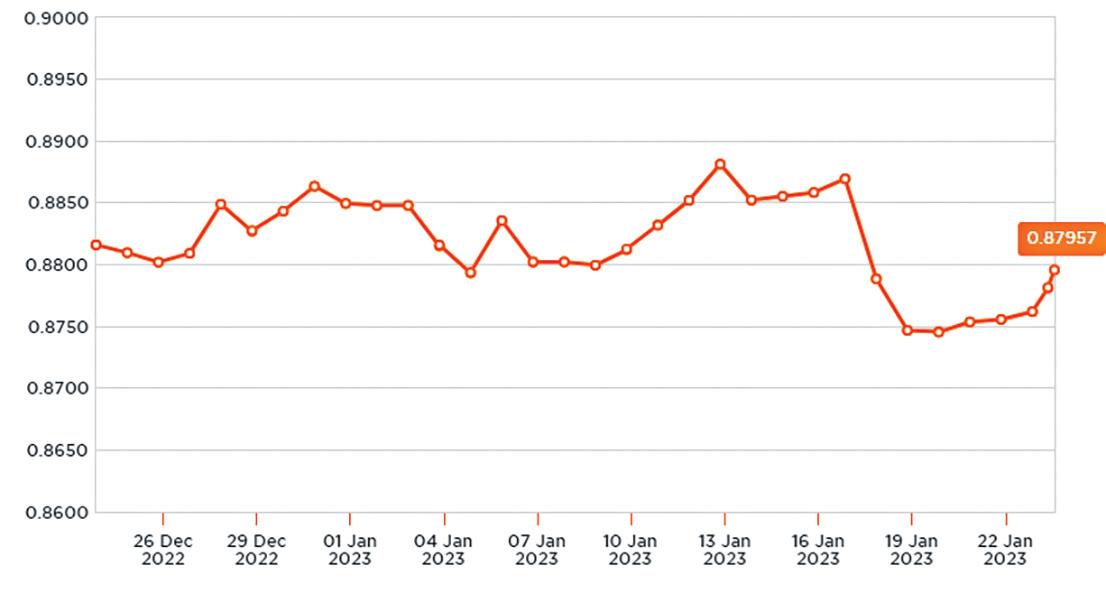

EUR/GBP: Unchanged at £0.88

EUR/USD: Down from $1.08 to $1.06

Trade in the euro has been erratic over the past month amid a repricing of European Central Bank (ECB) interest rate expectations and concerns over the conflict in Ukraine.

EUR investors were confident going into the ECB’s February policy meeting that the bank would deliver several more hikes this year.

While the bank delivered a 50bps hike and signalled it would pursue another increase of equal size in March, it indicated it’s March hike might be its last for now. Triggering a slump in EUR exchange rates.

The euro was then subsequently pressured by concerns over Russia’s next moves in Ukraine, amid considerable speculation Vladimir Putin would launch a new ground offensive to coincide with the first anniversary of the war.

Coupled with the single currency’s negative correlation with the US dollar this kept the pressure on EUR exchange rates.

Going forward it’s likely that events in Ukraine may continue to dictate movement in the euro. Any escalation of the conflict is likely to exert more pressure on EUR exchange rates.