1 minute read

CURRENCY OUTLOOK: EURO WEAKENS AS MARKETS REIN IN RATE HIKE EXPECTATIONS, US DOLLAR REBOUNDS ON FRESH FED BETS

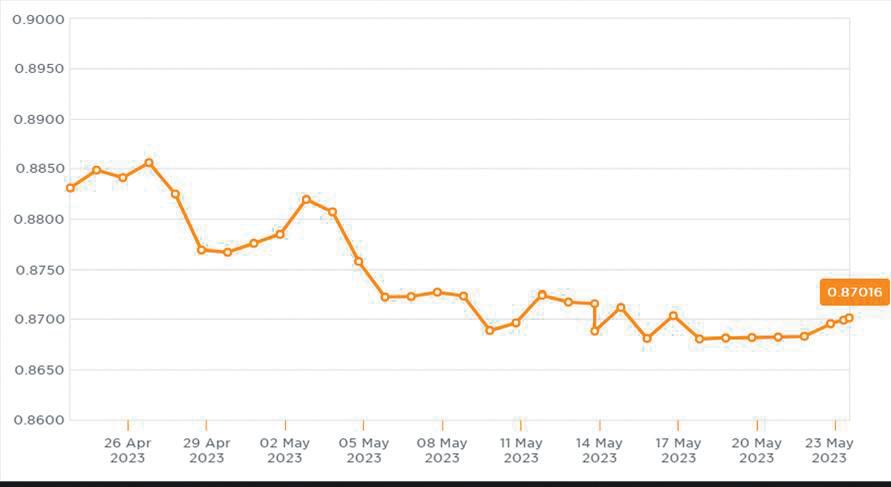

weighed on the euro due to EUR’s negative correlation with USD, although ongoing hawkish ECB rhetoric saved the single currency from steeper losses.

The ECB’s June policy decision is in the spotlight for EUR investors over the coming month. A 25bps hike is expected. But could a dovish outlook see the euro fall further?

Pound

GBP/EUR: Up from €1.13 to €1.14

GBP/USD: Down from $1.24 to $1.23

Sterling found success through late April and early May, despite a scarcity of impactful UK economic data. Market bets on another Bank of England (BoE) interest rate rise boosted the pound.

An upward revision to the UK’s final services PMI then lent GBP further support. Activity in the UK’s vital services sector hit a one-year high in April.

However, the middle of the month brought headwinds. Following the BoE interest rate decision, the bank’s Governor Andrew Bailey said inflation is set to fall sharply from April, which saw markets pare back expectations for further tightening.

Mixed GDP data then saw Sterling waver. The UK economy expanded by 0.1% in the first quarter of this year, but unexpectedly contracted by 0.3% in March.

The pound still rose against its weaker peers, despite a shock rise in UK unemployment, as concerns about second-round inflation effects kept BoE bets alive and GBP afloat.

The BoE will meet towards the end of June to set interest rates. If persistently high core inflation prompts the bank to raise rates again, Sterling could soar.

US Dollar

USD/GBP: Unchanged at £0.80

USD/EUR: Up from €0.91 to €0.92

A pullback in Federal Reserve rate rise bets put the US dollar on the backfoot through the end of April.

Fresh turmoil in the US banking sector saw markets revise their expectations for further policy tightening,