Everlake Approach to Investing

Contents Introduction ......................................................................................................................... 2 Our Approachto working with you ....................................................................................... 3 Developing your Investment Plan 5 Our Strategic Portfolio Management Process 6 Disclaimer............................................................................................................................. 8 1

Investing your savings is a very personal decision. Some of us are very comfortable talking about money and investing. For others the world of equities and bonds is very distant from our everyday lives. It is something that we hear in the business news and often the news is bad. It can be difficult to get a clear perspective.

In this guide we set out the key issues you need to consider in putting an Investment Plan in place. The key to a successful investment experience is to have clearly thought through what is important to you and what you want to achieve, and then document it as your plan.

We usually recommend that you undertake a full financial planning process before putting in place your Investment Plan. Full consideration of your financial needs and goals can have major implications for your investment planning. For further details on our Financial Planning services see our guide here.

Before designing an Investment Plan for you, we recommend that a full analysis and review of your existing circumstances is completed. You may be a professional, a senior executive, or participate in a family business, or you may be internationally mobile with interests outside Ireland. Whatever your circumstances you will have unique challenges and opportunities.

Over the years you will have entered-into various financial arrangements for good reasons at the time. With the passage of time, changes in your circumstances and the tax and regulatory environment evolving, your existing portfolio of assets may not be optimal.

There may be opportunities to restructure your personal or business assets to avail of favourable tax arrangements. We will always take the time to review your existing circumstances and make specific recommendations on your existing assets and liabilities.

As we look to the future, you may wish to consider new areas such as life and legacy planning. You may have children progressing through education or starting their career. We always take to time to consider the best way of deploying your assets with legacy planning in mind. We can facilitate a range of planning structures including loans, partnerships, trusts and corporate structures that may assist you to support your family as they progress through life.

The Irish tax and investment landscape is complex. We will help you to understand the issues and to articulate them by working through each of the issues you need to consider as laid out in this guide. Only when we have worked through and documented your preferences will we move to implementation.

Introduction

2

Once your Investment Plan has been put in place it is important to keep it under regular review Many things can change over the course a year; your personal circumstances, external circumstances such as tax and regulatory issues, or the performance of the markets may all impact on your plan. We monitor your plan on an ongoing basis and review its implantation as and when required

We hope you find this guide a useful tool to understanding the development of your Investment Plan. Please contact us if you wish to discuss any aspect in greater detail or if we can assist you with your financial planning or investment needs.

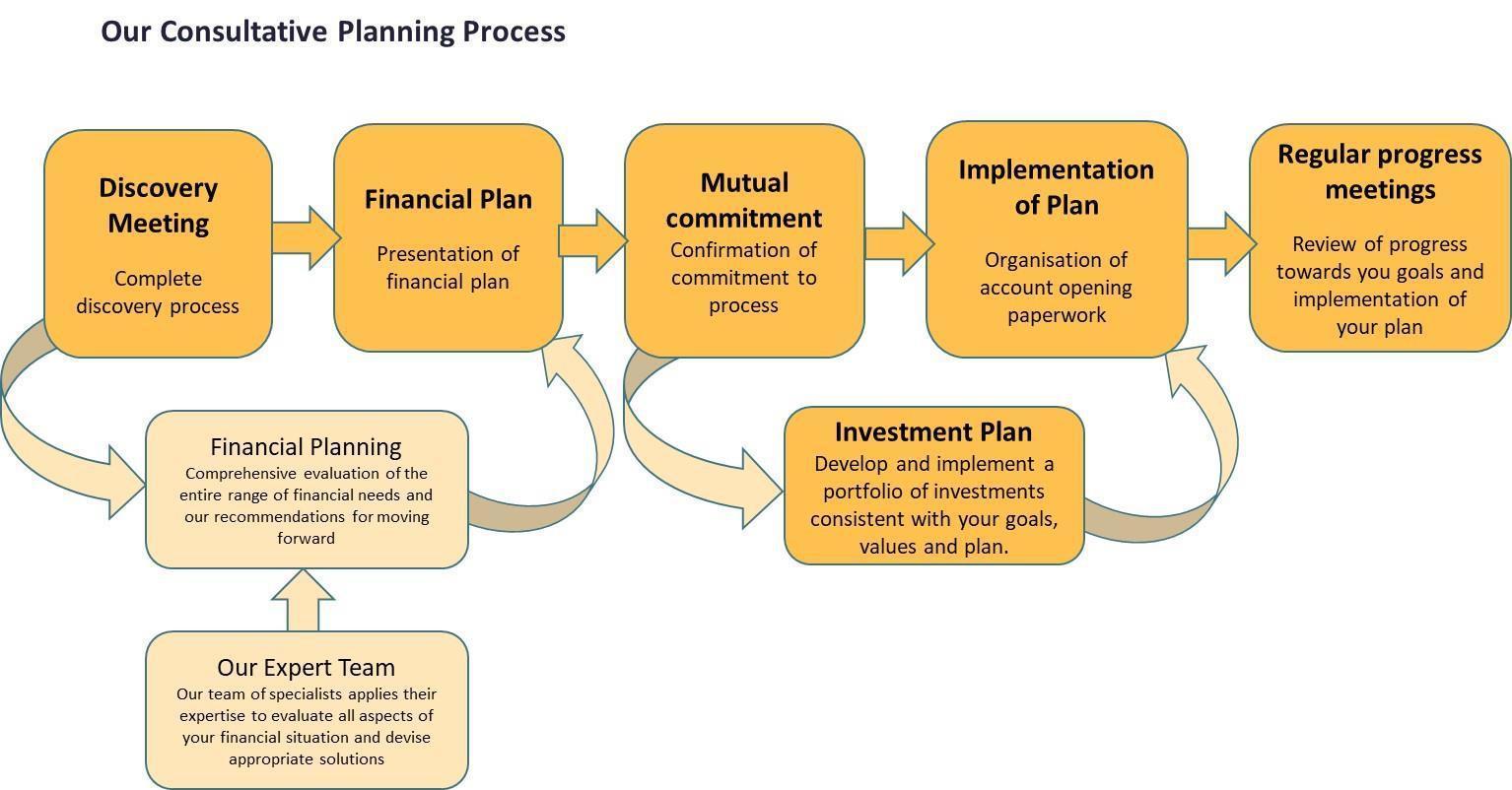

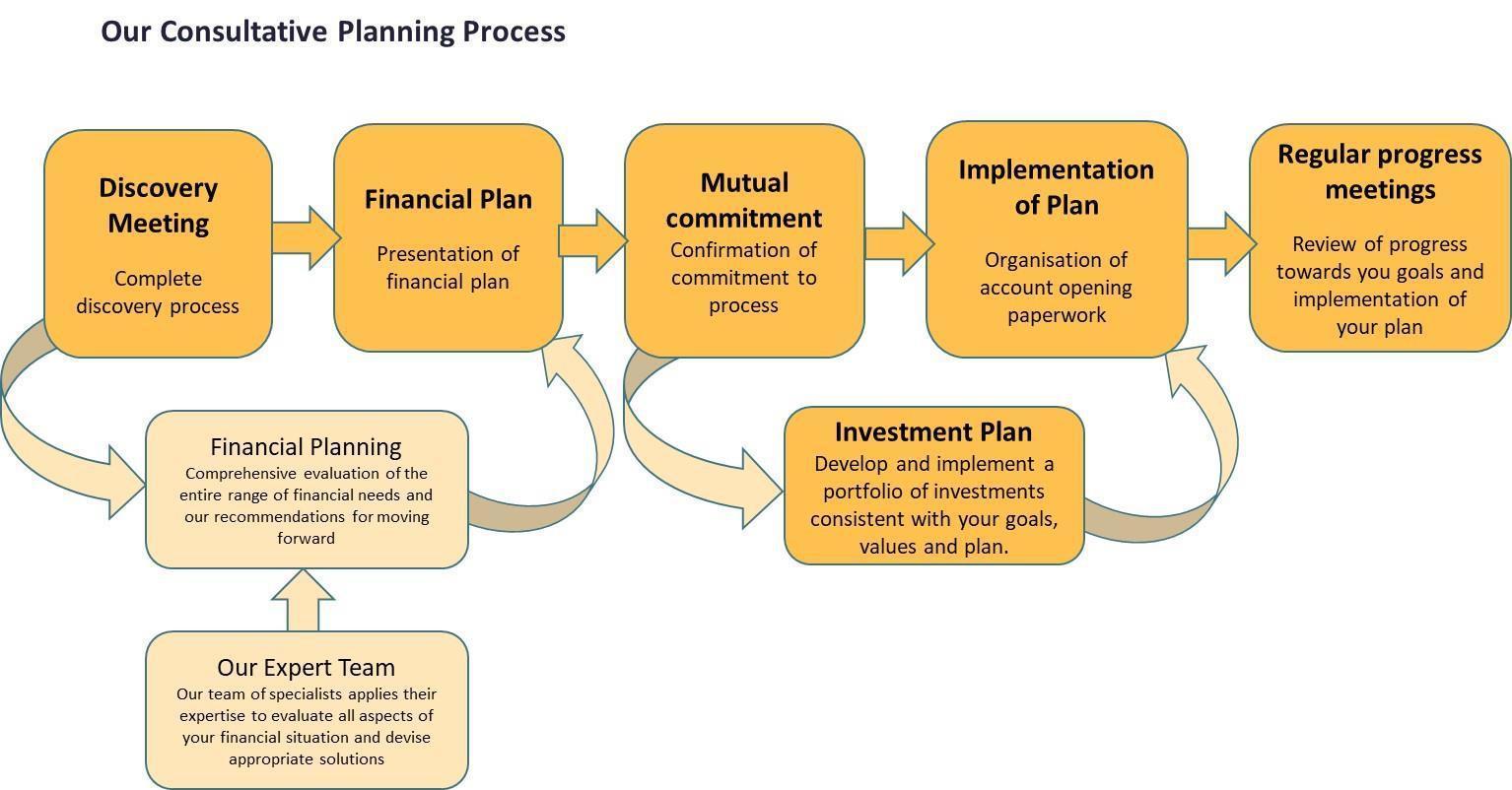

Our Approach to Working with You

Before embarking on your Investment Plan, we recommend a discussion to discover your circumstances, needs, objectives, values, and any other considerations that should be taken into account.

This discovery meeting is part of our consultative planning approach to ensure that all your relevant information and requirements have been considered.

Our consultative planning process includes the following steps:

1 Assess your current net assets. This involves listing all your assets and liabilities by reference to valuation, ownership structure, domicile, and tax status. Key assets and liabilities will typically include:

• Private Residence

• Private Motors

• Cash Savings

• Family Business

• Restricted Stock

• Investment Properties

• Investment Funds

• Equities

• Bonds

• Pension(s)

• Mortgages & personal loans

• Life Assurance & Protection Policies

We will tabulate these assets to understand the allocation between different asset classes and to assess the risk profile of your assets. This will be an important consideration when we move on to consider the asset allocation under your investment plan.

3

2. Consider opportunities for optimisation. There may be opportunities to restructure your current portfolio that make sense before you embark on designing your Investment Plan. Typical opportunities might include:

• Realising certain capital gains and losses which may be offset against each other

• Fully funding your pension

• Paying off some loans with surplus cash

• Consolidation of investment assets in one location

3 Consider planning opportunities

As you focus on the future there may be a range of actions that you could put in place. Some examples include:

• Wills & Powers of Attorney

➢ Including such areas as appropriate provision for foreign assets

• Legacy Planning

➢ Structured Loans

➢ Family Partnerships

• Business Succession

➢ Maximising Entrepreneurial Relief for all family members

➢ Ensuring shares are structured to avail of Retirement Relief

➢ Passing on a participation in the business to children and family members in a tax efficient way

➢ Key-person insurance

4

Developing your Investment Plan

Once the information gathered in the steps above has been considered, we can move on to consideration of how to invest your investable assets. Our investing process centres around six steps:

1. Assessyourinvestment goals. The investment plan process begins during the Discovery Meeting with a discussion of your financial values and goals, as well as your key relationships, existing assets, other professional advisers, preferred process and important interests.

2. Set long-term investment objectives. Taking into account the long-term nature of successful investing, we help set objectives for your portfolio that are appropriate for your willingness, ability and need to take risk, and the investment horizon(s) you identify.

3 Optimise TaxStructure. The tax treatment of your investments will be dependent upon their legal form. For example pension asserts are not taxable within a pension a structure but are taxable on withdrawal. Investment assets may be subject to either Exit Tax (most funds) or income and capital gains tax (equities).

4. Plan your asset allocation. Because it is so important, asset allocation is the first investment decision. During this process, we decide how much of your portfolio to invest in each of the different investment types, or asset classes, including equities, bonds and real estate.

5 Select your investment approach. With an asset allocation in place, we now select the investment vehicles that you will use to implement your portfolio strategy. Two key investing principles guide these decisions: the importance of diversification and the benefit of staying invested in the markets.

6. Build your portfolio. Building on the first five steps, we construct a portfolio suited to your needs, goals, and investment horizon and risk capacity. The building blocks for the portfolio are generally institutional asset class funds as an excellent way to implement a diversified portfolio investment so as to maximize the probability of achieving your goals.

The result of this process is a diagnostic report of your current situation with our recommendations for repositioning your portfolio to maximize your probability for success. In addition to the above considerations, these recommendations take into account portfolio costs as well as the potential tax impact of the restructuring.

5

Our Strategic Portfolio Management Process

The financial goals and values you shared with us at our Discovery Meeting have become the basis for your investment plan, as well as our Strategic Portfolio Management Process. This is not a one-time event, however. The Strategic Portfolio Management Process that we use is constantly ongoing to ensure that we are on track to achieve those goals and values. It is vital in managing the investment component of your overall investment plan The process has four distinct parts, as illustrated below.

Gap Analysis Current Situation Financial Values and Goals

Asset Allocation

Investment Objectives

Risk Tolerance

Asset Class Selection

Rebalancing and Reporting Progress

Fine-Tuning of Portfolio Performance Report Portfolio Activity

Manager Selection

Cost Effectiveness

Tax Efficiency

This is an iterative process that involves an annual review, report and rebalancing of your portfolio as required.

6

Our Investment Philosophy

Our investment philosophy is client centric. Everything we do is built around seeking to act in the best interests of our clients:

1. Your Investment Portfolio should be built around your goals and values. Your circumstances and preferences are the most important considerations when designing investment portfolios. We also treat as a priority your unique need, willingness, and capacity to take investment risk.

2 Ownership of Assets and Taxation We believe that for all investors how you own your assets is one of the most important considerations when building an investment portfolio.

3. Asset Allocation. Time and time again the mix between safe (cash and bonds) and risky (equities and real estate) assets have been shown to account for the lion’s share of investment returns. Getting the right mix for you is vital.

4. Diversification. Diversification is the closest thing there is to a free lunch. Proper diversification increases the likelihood of earning expected returns and may reduce risk by eliminating risks you are not paid for taking. Markets are drawn to a state of equilibrium where risk and return are related Only non-diversifiable risks are rewarded with higher expected returns.

5. Rebalancing. Over time your portfolio will drift away from the desired asset allocation. Rebalancing by selling things that have gone up and buying things that have gone down is an important activity and emotionally difficult for investors to do themselves.

6 Costs Matter. All things being equal we prefer to invest in the lowest cost passive funds or low-cost “smart-beta” funds. However, as in all things, if client circumstances e.g., taxation or preferences e.g., Ethical investing, dictate, we will consider more expensive investments. However, keeping costs down puts the odds of success in your favour

7. Emotions. Investors often exhibit behavioural biases that can lead to poor investment decisions. Overconfidence, self-attribution, mental accounting, searching for patterns, hindsight, regret, and fear are cognitive biases and emotions that an advisor can help overcome in order to promote both wealth and well-being.

8 Working with an adviser helps investors achieve their goals. Because we are emotional, studies show that DIY investors tend to do worse than investors working with an adviser. The media is partially to blame; but in the face of that marketing noise, investors must maintain their discipline and stick to a long-term investment strategy. Some studies conclude that individual investors underperform the market by as much as 3%, likely due to a lack of discipline that results in chasing hot stocks or hot funds or by attempting to time markets.

9. Capital markets do a fairly good job of pricing risks. Capital markets are not perfect, and prices are not always right, but markets are so competitive that it is unlikely an investor can systematically profit from mistakes in the market at the expense of other investors. It’s a zero-sum game with costs, where the amount by which the winner wins, is equal to the amount by which the loser loses.

10. We invest, we don’t speculate. Our approach to investment is based on academically proven principles that are at the core of a successful investment strategy You are not paying us to act on our hunches or attempt to predict the future.

7

Our Solutions

We provide a wide range of investment solutions which are designed to accommodate your values, your risk appetite and your tax status.

Our solutions range from conventional market-based portfolios to portfolios that focus on Sustainable Investing. Sustainable Investing spans the range from portfolios incorporating consideration of Environmental, Social and Governance (ESG) to those focused on Impact Investing and Philanthropy. Both conventional and ESG investing are designed to achieve an optimum balance between risk and return. They put financial return first without consideration of social outcomes. Impact Investing and Philanthropy on the other hand consider financial return only after the investors’ values have been satisfied

We can structure your portfolio to avail of traditional Income Tax and Capital Gains Tax treatment or Exit tax treatment depending on your individual tax circumstances.

The Next Step

Schedule some time to talk to us about our Investment Consulting service and how we can tailor investments suit your individual circumstances and requirements.

This document has been prepared for educational and information purposes only and does not represent a specific recommendation for an individual to follow.

Taxation

References to Taxation have been obtained from sources which we believe to be reliable and are based on our understanding of Irish Tax legislation at the time of writing. We cannot guarantee its accuracy or completeness. The rates and bases of taxation may change in the future We recommend that you obtain specific tax advice for your own personal situation We will refer you to a suitably qualified tax consultant on request.

Investments

As with any investment strategy, there is potential for profit as well as the possibility of loss. Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors’ interests.

Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken

Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. We do not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk and investment recommendations will not always be profitable.

Warning: the value of your investment may do down as well as up. This service may be affected by change in currency exchange rates. Past performance is not a reliable guide to future performance.

Printing

Please consider the environment and only print this guide if necessary.

Disclaimer

9

5 Marine Terrace, Dun Laoghaire, Co. Dublin, A96 H9T8 +353 1 539 7246 enquiries@everlake.ie everlake.ie