7 minute read

The Coordinated & Non-Coordinated Strategy

The Three Buckets

Of Retirement Income

The three bucket infographic above is a visual aid to help show how accessibility of retirement funds works. The first bucket (monthly income) makes contributions towards buckets two (nest egg) and three (home equity). The difference between them is that bucket three represents a brick wall to accessing the cash while bucket two is a lot easier to withdraw from. Contact your local reverse mortgage planner to receive the three bucket video that explains this process in detail. This has been a great educational tool for us to share with our clients to explain why it makes more sense to have money in investments than locked away in home equity.

We’ve all heard cash is “King”, which is why it is so important to convert equity into cash. With equity, your clients are not able to rip apart their house in order to pay grocery or utility bills — trying to cash in a front door to pay bills is a ludicrous thought. Would they rather leave a life insurance policy, bank account or an investment account to their children that have a guaranteed amount or would they rather leave a home with an uncertain value that must be sold in order to realize the cash? Have you ever heard of family feuds starting over children disagreeing on the specifics of trying to convert equity into cash to divide up between the heirs? Would you recommend putting an entire investment portfolio into one stock? That’s what it’s like with home equity. Most people invest hundreds of thousands of dollars into one house in hopes of the value going up. We all remember what happened nationally in 2008 when the housing market crashed, but things happen locally also. Neighborhoods change, schools become less desirable, and the home value can change dramatically. The bottom line is that equity is good, but cash is great and in retirement cash is the only thing you can use.

Equity vs. Cash

A Powerful & Flexible Tool

Safety

• Because HECM reverse mortgages are federally insured by the Federal

Housing Administration (FHA), there is no required repayment of the loan until the borrowers fail to meet the loan terms; or the last borrower moves out, sells or passes away. • When a reverse mortgage loan becomes due, the borrower or their estate has up to 12 months to repay the loan.

• No penalty for early payment (may vary in some states). • This loan is a non-recourse loan (if the balance on the loan exceeds the home value when the loan is due and payable and the home is sold,

HUD/FHA makes up the difference). • The borrower or their heirs keep any excess proceeds, from the sale of the home, after payment of the reverse mortgage loan and costs of sale.

Planning Ahead

With Your Client’s Mortgage:

Do you have any clients with a 15-year mortgage? Have you noticed a decrease in contributions to their retirement plan because they are in a rush to pay off their house before they turn 62? People with 15-year mortgages often decrease retirement contributions because they are paying more towards the equity of their house. Oftentimes, these people will make extra home mortgage payments instead of investing in a retirement plan. You can have them refinance to a 30-year mortgage to increase contributions to investments sooner.

Refinance at Age 62

(Eliminate Payments – Increase Cash Flow)

Refinance standard mortgage to make monthly mortgage payments optional (client is still required to pay taxes, insurance and maintenance). Cash flow increases, preventing having to pull assets under your management to make mortgage payments that are no longer necessary. Anybody over the age of 62+ and still making a mortgage payment needs to take a serious look at refinancing their mortgage into a reverse mortgage loan. If they take out a line of credit they can allow for guaranteed increase in the credit line.

Buying A New Home With A Reverse Mortgage: A Case Study

Historically, there have only been two ways to buy a new home: in all cash or with a mortgage that requires monthly principal and interest payments. Now your clients aged 62+ may be able to downsize, upsize, or right-size into their dream home using a Home Equity Conversion Mortgage (HECM) for Purchase (H4P) loan. A HECM for Purchase enables the borrower to buy a new home by putting as little as 45% to 65% of the purchase price down from their own funds — the remainder is funded by the H4P loan. The big advantages are that your clients get to keep more of their assets to use as they wish (compared to paying all cash) and unlike a traditional mortgage they won’t have to make monthly mortgage payments so long as they reside in the home. Of course, they do have to pay the property-related taxes, insurance, and upkeep expenses. For example, let’s say your clients, both 65, plan on selling their home for $250,000 and plan to purchase a retirement home closer to their children. They informed the Realtor that their budget was $250,000; however, they found an irresistible property that was $350,000 and decided to do a HECM for Purchase loan.

Sell Current Home

Sell Your Client’s Home for $250,000 Pay off $0 mortgage = $250,000 Cash $250,000 - $0 = $250,000

Sell Home Pay Off Cash

Purchase New Home

Client uses $200,000 as a down payment Client uses $150,000 for a HECM for Purchase Loan Client finds a NEW home for $350,000 $200,000 + $150,000 = $350,000

Down Payment HECM New Home

$250,000 - $200,000 = $50,000

Cash Down Payment Remaining Funds

Client still has $50,000 cash available and NO monthly mortgage payment – Still Responsible for taxes, insurance and maintenance.

This information is provided as a guideline; the actual reverse mortgage available funds are based on current interest rates; current charges associated with loan; borrower date of birth (and/or that of non-borrowing spouse, if applicable); and standard closing costs. Interest rates and loan fees are subject to change without notice. The story and persons depicted in this scenario are fictitious and for demonstration purposes only.

Reverse Mortgage Line of Credit Growth

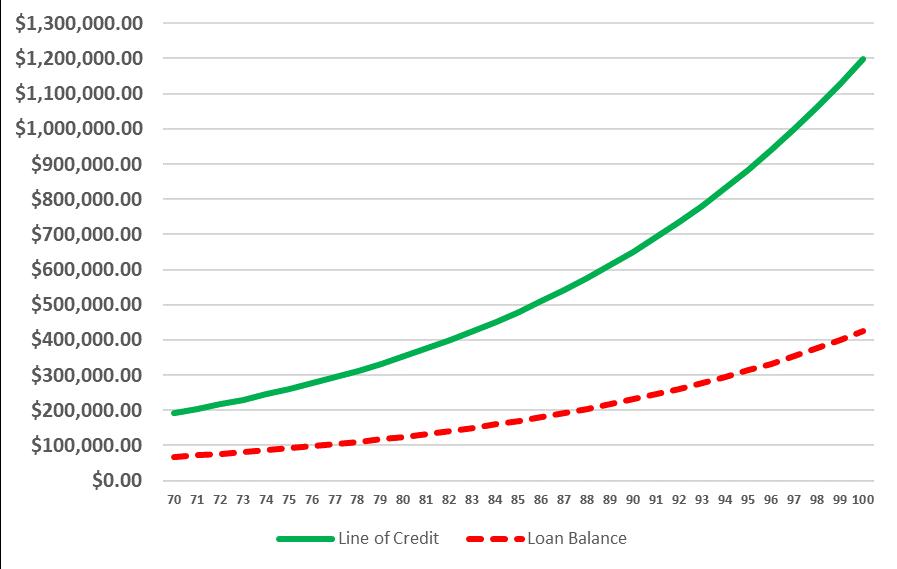

An increasing number of advisors and consumers are now viewing the reverse mortgage in a financial planning sense — not only because it offers the borrower access to emergency funds, but also because of the long-term financial planning opportunities its growing line of credit presents. Naturally, the loan balance on a reverse mortgage grows over time. The HECM line of credit loan balance grows at the selected Constant Maturity Treasury (CMT) rate, plus a fixed lender’s margin set in the contract, and a fixed mortgage-insurance premium of 0.5 percent. This combination of three factors is called the effective rate. More broadly, the effective rate is applied to growth not just for the loan balance, but for the overall principal limit. In other words, the borrower will have greater capacity to borrow more funds in the future, if needed. For this reason, it can be wise to establish the HECM line of credit sooner rather than later. The HECM line of credit cannot be capped, reduced, frozen, or eliminated, so long as the borrower complies with the loan terms.

Here’s an example of how an unused line of credit grows over time versus a loan balance in which no voluntary prepayments are made:

Home value: $600,000 Age: 70 Expected Interest Rate: 5.625% Initial Principal Limit: $249,800 Initial loan balance: $68,000 including payoffs and closing costs Initial Line of Credit: $191,800

This information is provided as a guideline and does not reflect the final outcome for any particular homebuyer or property. The actual reverse mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth (or non-borrowing spouse, if applicable), the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice. Following the closing of the home purchase, no further principal or interest payments will be required as long as one borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan. Borrower must remain current on property taxes, homeowner’s insurance (and homeowner association dues, if applicable), and home must be maintained.

To learn more about the advantages of the HECM Line of Credit, visit Fairwayreverse.com/LOC