Global online route to market opens for wool

AN ONLINE global wool trading platform based on the Global Dairy Trade system is being launched by Wools of NZ.

The first of what will be monthly auctions hosted by the new Natural Fibre Exchange (NFX) is being held on April 2. Wools of NZ (WNZ) chief executive John McWhirter said it will be open to wool buyers from around the world.

As with the Global Dairy Trade (GDT), McWhirter said the larger pool of buyers and the way the NFX auction operates will create better price transparency than the current auction system. He said he believes it will eventually lead to better prices and greater demand.

“Now we have 6000 farmers selling their wool to hundreds of international buyers so it changes the dynamics of the auction system in the favour of farmers.

“We will make NZ farmers’ wool available to buyers around the world.”

NFX was built by and will be run by CRA International, which built and runs the GDT platform.

As with the dairy trading platform, McWhirter said one of the strengths of the NFX is that its global audience will reveal the actual price customers believe the fibre is worth.

“We want the world to know the true cost and value of NZ fibre by offering wool directly to the world

Neal Wallace MARKETS Food and fibre Continued page 3

in an open and transparent market platform.”

McWhirter said the NFX will operate the same as the GDT, which differs from a conventional system in that it is a circular auction.

Unlike a conventional auction, potential buyers continue to bid on all lots offered until prices are finalised for the whole offering or lots are withdrawn.

“We are shaping the future of wool trading by offering fair and competitive market pricing through efficient price discovery,” he said.

This should help unlock increased returns for wool growers.

John McWhirter Wools of NZ

“NFX will simplify the trading process, provide real-time price insights, and encourage collaboration between growers, buyers, and processors.”

For a handling fee, WNZ tests and collates its clients’ wool into lines with the same specification.

Significantly, it is then sold in 20 tonne lots suitable for containerised shipping, making it convenient for buyers.

McWhirter said individual farmers may sell their clip on the platform, but the reality is they will require an export licence

Sheep farmers roll up for Rollesby

This year’s Rollesby Valley Lamb Sale, in Burkes Pass, saw six farms participate, with 16,000 lambs sold at auction. Established in the mid-1990s by Bruce Dunbar of PGG Wrightson Livestock and the Munro family at Airies Station, the sale has grown from a single-farm event into a major annual fixture.

Photo: PGG Wrightson

Historic high prime stock prices reflect markets, demand and

Dynamic duo redefine the way they farm

Pushing boundaries and challenging what’s possible is how Michael Phillips and Andrew Evans from Waka Dairies plan to become one of New Zealand’s leading producers.

Photo: Yield Marketing

Ageing tech leaves rural households on notice over phone service.

Breathtaking shift from Ukraine supporter to profiteer, says Ben Anderson.

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor

bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469

Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

News in brief

Positive forecast Hemp review

Fonterra’s latest forecast earnings update shows a bullish outlook on the back of a strong first half of the dairy season. It anticipates forecast earnings for the 2025 financial year will be in the upper half of the previously announced forecast earnings range of 40-60 cents per share. The co-operative is currently forecasting a 2024-2025 milk price midpoint of $10/kg MS.

The government’s Ministry for Regulation will review outdated and burdensome regulations around industrial hemp production.

Industrial hemp is currently classified as a Class C controlled drug under the Misuse of Drugs Act, despite containing minimal THC. The Ministry is working with MedSafe and the Ministry of Health to reassess the nearly 20-year-old regulations.

Funding secured

Fonterra and DSM-backed Dutch ingredients startup company Vivici have secured €32.5 million ($58.89m) in funding, which it will use to turn its precision fermentation technology into commercial reality.

The funding was led by APG on behalf of ABP, one of the largest pension funds in the world, and Invest-NL. The funding will be used to expand access into new international markets and launch a second dairy protein ingredient.

Kūmara resilience

Horticulture New Zealand and Kaipara Moana Remediation are partnering on a programme to build resilience across the Northland/Te Tai Tokerau kūmara industry. The pilot programme will see the organisations working together to support kūmara growers in the northern Wairoa catchment to achieve best management practice on the land and restore local waterways.

Meat prices maintain their lofty levels

Neal Wallace MARKETS Production

HISTORICALLY

high prices for prime lamb and beef reflect strong markets and demand as well as tighter supplies, says AgriHQ senior analyst Mel Croad.

Prices usually start to ease at this stage of the season, but Croad said there is little sign of that happening with both lamb and beef markets remaining buoyant, helped by a low exchange rate.

Prime lamb prices are $2/kg higher than last year at $8 to $8.20/kg and store lamb prices are over $1/kg higher, averaging $3.90-$4/kg compared to $2.50$2.80/kg last year.

Meat companies say they have been offering procurement premiums in the South Island.

Prime beef prices are about $1.50/kg higher.

“It’s not all procurement, it’s balanced as opposed to one thing driving these higher prices,” said Croad.

“The Easter chilled lamb trade has just finished and market prices were higher than expected.”

The average export value for lamb in January was $12.11/kg, $2/kg higher than January last year but 50c/kg lower than last December.

“We are seeing good support in terms of export value and the exchange rate is also helping.”

Lamb prices were higher in 2022 as the world spent up large post covid, but Croad said market conditions are more grounded this year.

“This is more stable because it is driven by supply and demand fundamentals instead of a world awash with cash.”

Continued from page 1

and have to arrange testing and handling.

He is buoyant about the future of the fibre, saying demand is growing for wool 50-100mm in length, which is suitable for wool carpet manufacturing, but volume is limited as farmers cut costs by stretching out shearing to every eight or 12 months.

“Given the current rising market, which is seeing demand for wool exceeding supply, this should help unlock increased returns for wool growers,” he said.

“We expect the NFX platform to have a positive impact on the global wool trade, leading to better outcomes for growers.”

WNZ has staff in China, India and eastern and western Europe, and feedback indicates growing interest in wool.

He does not expect a sudden jump in prices in the early auctions.

“Initially I believe prices will be as well as they are currently but I have no doubt we will deliver better pricing in the medium to long term.”

The NFX trading platform could eventually attract wool from growers around the world.

Croad said AgriHQ forecasts are for lamb prices to stay buoyant through to spring but without the sharp jumps in winter prices experienced last year.

However, a shift in the exchange rate or tumultuous world trade politics could alter those prospects, warns Croad.

China remains our largest volume market for lamb and it is paying higher prices than last year, but she said the real drivers are Europe and the United Kingdom, where prices are high.

It’s not all procurement, it’s balanced as opposed to one thing driving these higher prices.

Mel Croad AgriHQ

Eighteen weeks into the season the South Island kill was 735,000 or 20% behind last season and Croad said that raises questions whether those animals were ever born, succumbed to poor spring conditions or are being kept back to put on condition.

There were 2.95 million lambs processed in the first 18 weeks, well below the 3.5 million fiveyear average for that period and the 3.7 million processed last year.

The North Island kill is 8.5% ahead of last season, which was very slow to get going.

Croad described ewe prices as mediocre compared to where they have been previously but the South Island ewe kill is 200,000 ahead of last year, which could be a consequence of the poor spring.

Demand from the United States is underpinning high beef prices, with its domestic herd at a 64-year low and little talk of rebuilding it.

of NZ chief executive John McWhirter says having 6000 farmers selling their wool to hundreds of international buyers ‘changes the dynamics of the auction system in the favour of farmers’.

McWhirter said it will be open to any producer of natural fibre, be it Australian, Argentinian, British wool or even cashmere.

“We are happy for it to be an exchange for any natural fibre in the world excluding plastic.”

Beef prices are averaging $1.50/kg ahead of last year but significantly the market hardly shifted with the seasonal influx of cull cows.

Croad said companies are looking for cattle.

Alliance Group’s livestock manager Murray Behrent said the lower South Island kill reflects fewer lambs born and farmers holding back stock to add weight.

“However, large volumes of lambs from the North Island were sent south for finishing following last year’s extreme dry conditions.”

Behrent said processors offered procurement premiums to South Island farmers through February to attract lamb, prices he said that were not always aligned with global market signals.

“We are closely monitoring the situation and will adjust processing capacity as needed.”

Prospects for lamb were bright.

“Looking ahead, the prime lamb market is forecast to remain firm with good demand from all our inmarket customers.”

Silver Fern Farms chief supply officer Jarrod Stewart said demand for lamb has lifted and

HOLDING BACK: Alliance Group’s livestock manager Murray Behrent says the lower South Island kill reflects fewer lambs born and farmers holding back stock to add weight.

the company has used the lack of supply “to leverage some tension into market pricing”.

“At present, there’s around a 30% lift in farmgate pricing for lamb compared to the same time last year.”

Industry gives thumbs up to product review

Richard Rennie TECHNOLOGY Regulation

CROP treatment companies say there is a glimmer of hope in the just-released government report that includes wideranging recommendations for overhauling how their products are approved for use in New Zealand.

Ministers David Seymour, Penny Simmonds and Andrew Hoggard released the Ministry for Regulation’s first major report on red tape reduction.

The pastoral and horticultural sectors are likely to be the biggest beneficiaries if its 16 recommendations become reality.

The report estimates gains of over quarter of a billion dollars over 20 years are on the table to be made by cutting product approval times by half.

That compares to the ticking clock of more stringent European Union regulations that risk NZ being left out in the cold with obsolete banned treatments, also estimated to cost the sector a similar amount over the same time frame.

The report prioritises three key recommendations out of the 16 demanding immediate attention to help speed up a clogged approval pipeline.

Average application times under the Hazardous Substances and New Organisms (HSNO)

process almost tripled from 402 days in 2015 to 1048 days in 2023.

The report recommends “light touch” assessment pathways, and greater reliance on and use of assessments already made by other international regulators.

The third recommendation priority is drawing more on industry knowledge held by commercial operators by establishing a sector leaders forum.

Dr Liz Shackleton, head of Animal and Plant Health NZ, said industry knowledge is there to help, but remains untapped at present.

She has also had clear signals from her members that the approval delays have become untenable and timelines are increasingly tight, with changes in overseas markets’ approved treatments list looming.

“To meet those 2030 targets less than five years away, if they filed a new active in parallel, that takes 5.5 years to approve and 8.3 years if sequential. That does not even include the years of trial work needed.”

She said the industry welcomes all but one of the 16 recommendations. It challenges the recommendation on cost recovery, which has the approving agencies themselves determining how much those costs are.

With biosecurity threats increasing, the recommendation

He said the slow South Island lamb kill is due to deferred processing as farmers hold animals on farm but with short work weeks looming around ANZAC day and Easter, space is expected to tighten.

WELCOMED: Animal and Plant Health NZ head Dr Liz Shackleton says the regulatory review is a glimmer of hope, but the real test is how quickly the ship can be turned around.

With fall armyworm there are alternative treatments that have been sitting in the queue for four years.

Dr Liz Shackleton

Animal and Plant Health NZ

to enable faster emergency approvals under HSNO Act is welcomed.

“With fall armyworm there are alternative treatments that have been sitting in the queue for four years. It is about having the tools to respond to these emergencies,” she said.

Seymour said the cabinet had accepted all 16 recommendations.

It is expected to receive the formal details on the reforms by May.

“We are looking for some urgency on this,” Shackleton said.

DYNAMICS: Wools

Hot, dry winds hit maize ahead of harvest

Gerald Piddock NEWS Arable

LACK of rain in the new year has taken the shine off this year’s maize crops as harvest gets underway in the coming weeks.

Waikato Federated Farmers arable chair Don Stobie said he expects yields to be average this year after a challenging growing season.

Strong, hot westerly winds throughout January meant crops struggled to grow, he said.

“They stunted plant growth and they really sucked a lot of the water out of the ground and the transpiration levels have been higher than normal,” he said.

He expects crops to average around 21 tonnes/hectare for silage and 11t/ha for maize grain.

The rainfall that did occur was patchy at best with more farmers missing out rather than getting it.

On the positive side, the drier weather has kept most insect pests away, he said.

Corson Maize national business manager Graeme Austin said preChristmas, it was very dry for east coast growers while Waikato maize crops were looking great.

This has flipped with the dry

weather affecting Waikato crops while east coast areas received good rain over the past month.

“We’re probably looking at [silage] yields being at least 1520% down on average whereas

Marnco gets to try for Fertmark

Richard

Rennie NEWS Fertiliser

A YEAR after entering the New Zealand market, Australian fertiliser company Marnco is set to be registered for Fertmark, the industry’s quality assurance standard.

Company director Mark Been acknowledged the lengthy time taken for the Fertiliser Quality Council to confirm the company could register its products.

“But it is better late than never, the council is coming to the table. We welcome the opportunity to be able to verify our products to the same standards as the two main competitors,” he said.

Verification from independent

council audits would put the company on an even footing with the six other fertiliser companies that have certified Fertmark products.

Last year the company had a rocky entry into the NZ market. Its first shipload of largely super phosphate drew fire from the Fertiliser Association on the grounds it was not up to the Fertmark standard to label as superphosphate. It sought a court injunction against selling it as such.

This prompted Marnco to rename the product “SulPhos”, and to compensate any farmers who had purchased the product on the grounds it was advertised as superphosphate. Been confirmed that products

tick

Marnco will seek Fertmark registration on will include SulPhos, along with urea, sulphate of ammonia and sulphate of potash.

Fertiliser Council executive director Tyler Langford confirmed Marnco’s application.

She said having Fertmark certification is a competitive advantage in the market, giving farmers peace of mind the product is what manufacturers claim it is.

There are six companies with multiple products registered with Fertmark in NZ at present.

Langford said the council is keen to raise the profile of Fertmark and its certification value among non-certified companies.

“It is good to see Marnco can

the east coast has had rain from Christmas on and their crops have bounced back incredibly well.”

The region is flourishing, he said.

In Waikato, for a crop that yielded 21t in a good year, that equates to around 3-4t back.

Maize grain crops are also starting to be impacted, and he expects yields on those crops to also be down.

The lighter yields should not mean a feed deficit for farmers after most made plenty of grass silage throughout spring, he said.

Northland maize crops are also getting dry, but are not as affected as those in Waikato. Bay of Plenty crops are looking good and some maize crops in isolated areas in the lower North Island are starting to get dried out, he said.

Gavins Grains’ Andrew Geddes said they are just getting started on the maize harvest around Waikato and are hoping for a spell of fine weather over the next period to get the crop off the ground.

Julie Clark of Clark Contracting in Otorohanga is about to start

They stunted plant growth and they really sucked a lot of the water out of the ground.

Don Stobie Federated Farmers

harvesting this year’s crop. In the meantime her company has been busy delivering bales of feed to farmers battling the dry weather. It made a stark contrast to last year where there was little demand because there was so much surplus feed around, she said.

Ag contractor John Austin of John Austin Ltd has just started harvesting maize around Waikato and said the crops so far look to be varied in yield.

“I think we’re going to see a mixture of crops this year. Some areas have had good rain and some haven’t. There’s going to be some disappointing crops and there’s still going to be some good crops. It depends on whether you had rain or not.”

see value in certification of their products,” she said.

One year since entering the NZ market, Marnco claims to have sold 35,000 tonnes of product

ranging across all main fertiliser types.

NZ’s total fertiliser market totalled 1.6 million tonnes in 2023, a particularly low year for sales.

AVERAGE: Waikato Federated Farmers arable chair Don Stobie says he expects crops this year to average around 21 tonnes/hectare for silage and 11t/ha for maize grain.

MARKED: Marnco founder and managing director Mark Been says he welcomes the opportunity to get his company’s products assessed to the same standard as Ballance and Ravensdown.

Old rural comms tech poised for withdrawal

Richard Rennie TECHNOLOGY Communication

MORE than 2000 remote rural households are on notice for their phone service as Chorus signals the withdrawal of aging communications technology.

March 31 marks the date when Chorus will be retiring its decadesold customer multi-access radio (CMAR) and Country Set technology. It is used to provide voice telephone services to rural locations where even copper does not extend. It comes as Chorus also works to retire its aging copper network entirely by 2030.

On its website Chorus has highlighted the increasing difficulty in maintaining the aging equipment, along with a lack of spare parts and diminishing expertise.

“Completely munted” is the description given by one industry insider about the technology’s condition.

A letter sent to affected households highlights that Spark as service provider does not have an alternative voice solution, but other providers do. These include

satellite services, which Chorus as network operator offers to help them find.

But the decommissioning has a farmer in the Fordell district east of Whanganui concerned that the loss of the technology and the transfer to satellite or wireless may leave rural users vulnerable.

The Telecommunications Services Obligations (TSO) aims to obligate Chorus as network provider and Spark as retail provider to continue guaranteeing voice services that remain affordable.

Johnny Tripe owns a family farm on Ohaumoko Road with several dwellings affected by the CMAR decommissioning.

“I have a lot of sympathy for Chorus having to turn this tech off. But I think we could be at risk that at some time the provider of the service replacing Spark’s TSO guaranteed service stops, and people cease to have access to voice services.”

A Spark spokesperson confirmed the company is referring impacted customers to Chorus to help find an alternative provider.

“We sympathise with Mr Tripe in this situation and our team has offered to support him as the CMAR services are withdrawn. However, as we do not

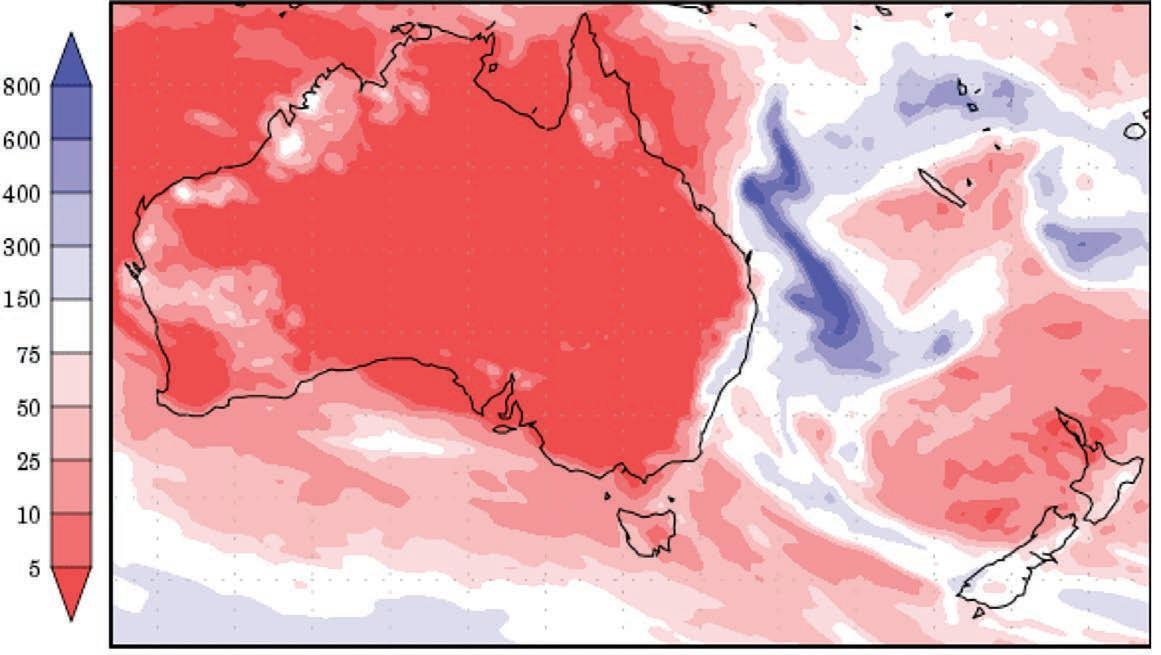

Taranaki drought relief kicks in

Staff reporter NEWS Weather

DROUGHT conditions in Taranaki have prompted Agriculture Minister Todd McClay to declare a medium-scale adverse event, recognising the challenging situation facing farmers and growers in the region. Conditions on the ground are becoming extremely difficult with limited feed and pasture available, he said.

The lack of any decent rain for several months ... is causing huge stress for farmers.

Leedom Gibbs Federated Farmers

“Taranaki is experiencing hot, dry conditions and below-average rainfall.

“This has affected pasture growth and farmers have had to feed out or sell livestock earlier to fill the gap.”

The decision was welcomed by Federated Farmers Taranaki president Leedom Gibbs.

“The lack of any decent rain for several months, compounding a year and a half of much lower than usual rainfall, is causing huge stress for farmers.

“That’s especially in the Manaia, Hāwera and Kakaramea hotspots. They’ve never seen it so extremely dry, so early.”

Water tables are very low, meaning wells and bores have dried up and farmers have had to truck in water as well as feed.

McClay said that the government is making $30,000 available to rural support groups who are working closely with farmers on the ground in Taranaki.

The adverse event declaration means extra funding for Rural Support’s counselling and advisory services, with flexibility around tax for affected farmers, and the potential for Rural Assistance Payments from the Ministry of Social Development.

have an alternative service option he will need to contact Chorus for assistance migrating to an alternative service,” the spokesperson said.

Correspondence from the Ministry of Business Innovation and Employment (MBIE) confirmed that under the Chorus TSO deed, Chorus is required to provide voice calling when the system is decommissioned.

Chorus is required to make the service available for the residents until such time the household cancels its TSO voice service. It also requires Chorus not charge the household any more than the TSO maximum price, linked to the CPI.

Tripe remains concerned that continuity of the service is not guaranteed.

“It is hard to see why Chorus would keep a contractual relationship with customers who it no longer has a supply relationship with. I am not sure this is commensurate with the TSO spirit, by Chorus removing itself from the situation.”

He acknowledges local wireless and satellite services exist to fill the gap but maintains their longterm service provision should also be locked in under a TSO agreement.

VOICEOVER: WISPA chair Mike Smith says a concern greater than TSO obligations being met is whether the replacement tech customers use is fit for purpose, and includes voice capability.

I think we could be at risk that at some time ... people cease to have access to voice services.

Johnny Tripe Farmer

Mike Smith, chair of Wireless Internet Services Providers (WISPA), said rather than any TSO failure, the greater risk for rural users having to replace the tech is failing to incorporate good voice services.

Tripe said one option could be that smaller providers pay into the levy scheme that contributes to maintaining rural services.

“I am not sure our members would want to pay into the levy scheme, and it really would only be a drop in the bucket,” said Smith.

The bigger concern with this transition is that not all satellite systems offer voice as part of their service, for example StarLink.

“This is why we urge anyone shifting to replacement technology to get a local provider for local expertise and location.”

VOLUME: Scales chief executive Andy Borland says the volumes of premium apple varieties accounted for 72% of export sales.

Hort companies return to full flavour

Hugh Stringleman NEWS Horticulture

MAJOR horticultural listed companies

Scales and Seeka declared strong rebound profits for the 2024 financial year, ended December 31.

Their annual results, announced on the same day, showed the growing strength of the horticulture sector now the two-year adverse effects of Cyclone Gabrielle have passed.

Scales Corporation reported a net profit of $30.7 million, compared with only $5.2m in FY2023.

Seeka’s turnaround was even more dramatic, with $30m net profit before tax compared to a $21m loss in 2023.

Seeka achieved earnings of 51 cents a share and will pay out dividends totalling 15c, split between January’s 10c and April’s 5c.

The return to profitability for Seeka came out of 37% increase in revenue to $411m as the post-harvest operations

handled 43 million trays of kiwifruit, up 44% from 2023.

“Record profit before tax was achieved during a period of high interest rates and higher debt levels,” said chief executive Michael Franks.

“Seeka is set to benefit from lower interest rates, having also lowered net debt by $35m in 2024.”

Scales benefited from strong demand in its global protein division producing wholesale products for the worldwide petfood market.

Its horticultural division, one of the biggest apple orcharding and packing businesses in the country, had a 150% increase in underlying earnings to $37.7m.

Mr Apple’s own-grown production was just over 3 million tray carton equivalents (TCEs), up 11% from the harvest before.

Scales chief executive Andy Borland said the volumes of premium apple varieties accounted for 72% of export sales.

“Horticulture’s performance is

returning to more normal levels with improved apple volumes and average prices.

“Picking and packing has commenced at Mr Apple for the 2025 apple season with initial current crop indications being positive.

“A crop of around 3.4 million TCEs is forecast, which includes a higher proportion of premium varieties due to the Bostock and Craigmore transactions.

“Positive pricing is also forecast.”

Scales has reconfirmed its FY2025 guidance of net profit between $35m and $40m.

Scales share prices have risen steadily over the past year, adding $1 to achieve the present level of $4.10.

It paid an interim dividend of 7.25c in January and will make a further distribution in May.

Seeka share prices have also risen about $1 from a low point of $2.30 midyear to $3.30 now.

An update will be provided at the annual meeting on April 16.

Right nutrients, right rate, right place, right time. Every time.

Ballance’s innovative, science-backed fer tiliser range is designed to work hard for your farm. Ever y granule is crafted for maximum e fficienc y, giving you the most bang for your buck

Bu t the product is only half the stor y. Your Ballance Nu trient Specialist will get to know your farm, ensuring you’re only using the fer tiliser you need, when you need it , so nothing is wasted.

Ballance. Make it count.

Watts: no hefty bill for missing targets

Gerald Piddock NEWS Climate change

CLAIMS that New Zealand will have to pay billions if it fails to meet international emissions targets are misinformation, Climate Change Minister Simon Watts says.

What matters is a country’s intentions, he told a group of farmers and local government leaders at an event organised by Waikato Federated Farmers.

These targets, as set under the Paris Agreement, aimed to get big players such as China and Russia to pull their weight and New Zealand had joined so it could be seen to do its part.

“Some will meet them, and some won’t just because [of] national circumstance. You have to have the intent to meet it and if you don’t meet it, no one sends you an invoice – and that’s why it’s not a liability on the government’s books.

“It’s not a liability on our books, it’s intent and there is no legal obligation in the context around that.”

That is not to say NZ and other countries will not do their best to achieve the Paris target, he said.

Watts said he and Finance Minister Nicola sought advice

from Treasury on this, and he was told it was not a liability on the government’s books.

The government is taking a practical approach to make sure that both domestic and international targets are achievable.

In late January the government announced a national target of reducing greenhouse gas emissions to 51-55% below 2005 levels by 2035.

On the United States decision to pull out of the Paris Agreement, Watts said New Zealand cannot do the same because it risks jeopardising trade.

“NZ is not the US, and we don’t have the ability to play as they do.

“We need to be committed to these international targets. The reality is that our UK free trade agreement and our EU FTA both have clauses that say we are expected to stay within those agreements.”

Watts, who was appointed energy minister in the government’s recent cabinet reshuffle, said he had significant concerns about NZ’s energy resources.

“We went to the wire last year in terms of lack of energy because of the dry. It’s tight again this year and the decision to stop oil and gas have really put us at a massive disadvantage.”

Watts was questioned on the

You have to have the intent to meet it and if you don’t meet it, no one sends you an invoice.

Simon Watts Climate Change Minister

government’s response to the growth of solar farms on farmland.

Those concerns were fair, he said, and it is something that the country will have to work its way

through and be thoughtful around the consideration for these farms.

“But as a country, if we want to grow and be competitive, we need to have affordable energy.”

Speaking more broadly, he said the government wants to put in place as many setting changes in as possible before the next election.

“In effect, plant the seeds so at least we can start to see that sprouting next year or the year after because these things don’t happen overnight.”

government’s books.

This week’s poll question: Have your say at farmersweekly.co.nz/poll Should New Zealand withdraw from the Paris Agreement on greenhouse gas reductions?

bays, 10m deep. Min 6 / SIX rows girts for extra wall strength. 4 bay lean-to shed*, barge, door stud & door lintel flashing. 134.4m2. 2 open-front bays, 2 fully encl bays, 2 x

bays, 8m

paper / netting to roof of encl bays. Minimum 4 rows girts for extra wall strength.

DEBIT: Climate Change Minister

Simon Watts says international climate targets are not a financial liability on the

PGW marks agricultural recovery underway

Hugh Stringleman MARKETS Agriculture

RURAL servicing company PGG

Wrightson has reported a sound set of interim results for the first half of the 2025 financial year, with operating earnings up 13% and net profit up 25% compared with the previous corresponding period.

Revenue for the six months to December 31 rose 2% to $570 million and net profit after tax was $16m.

The lion’s share of operating earnings for the financial year has been made, at $41.4m, and the guidance for the full year has been

reaffirmed around $51m.

That compares favourably with $44m in FY2024.

Chair Gary Moore said strong demand has underpinned livestock results and the real estate market has shown a positive rebound.

Agricultural input prices stabilised in the past six months but remain above historical norms.

Gary Moore PGG Wrightson

“Economic conditions are showing early signs of improvement, with several indicators

pointing to a healthier outlook with lower inflation and interest rates easing.

“Agricultural input prices stabilised in the past six months but remain above historical norms.

“In addition, a higher forecast milk payout, strong beef export returns, and generally solid commodity prices are beginning to positively impact farmer and grower sentiment.”

The board of directors has declared an interim dividend of 2.5c a share fully imputed, to be paid on April 3.

Chief executive Stephen Guerin said that as farmer confidence levels gradually return, the PGW rural supplies division has seen a positive impact.

REBOUND: PGG Wrightson chair Gary Moore says strong demand has underpinned livestock results and the real estate market has shown a positive rebound.

Nearly all categories have grown compared to last year and this has been most evident in animal health, seed, stock food, fertiliser, water and fencing.

Favourable growing conditions across most regions have produced excellent crop estimates, he said.

Over the rest of the financial year price pressures on overseassourced goods can be expected from the fall in the value of the NZ dollar, he said.

“Our business is seasonal with the strongest demand in spring and summer, where we make the

majority of earnings.

“That is also reflected in higher seasonal debt levels, covering payments from customers and the Go-Stock products.

“We are seeing strong interest in farm and orchard purchasing, but that has yet to play out during the autumn activity window.”

In FY2024 the rural company suffered its first drop in revenue in six years and Guerin said the recovery now seems to be underway, although velvet sales were delayed by the late reopening of China’s market.

‘Relevant’ Wānaka Show gets tails wagging again

Neal Wallace MARKETS Events

ONE of New Zealand’s largest A&P shows continues to evolve to attract an increasingly diverse audience.

Last year the Wānaka A&P Show drew 44,000 people. Upper Clutha

A&P Society board chair Keith Cooper says that constant evolution has not been at the expense of compromising traditional A&P events.

He said while the show stays true to its roots, it has tried to appeal to the diverse Wanaka and Upper Clutha community.

“We have focused on remaining

attractive and relevant to the high country farmers, tradies and their families in Wānaka as well as those who have relocated from Auckland to Wānaka.”

Trade space is fully booked and livestock entries are similar to last year. Alongside the usual family events, rides, food trucks and the annual Jack Russell race, several

new events make an appearance.

They include the Local Larder, which features artisan food and drink exhibitors alongside live cooking demonstrations from leading New Zealand chef Peter Gordon.

A new hub, the Agri Exchange, combines on one site rural innovation organisations along with

future thinkers, available to engage with those in the agri sector.

Home industry competitions are once again being held, including photography, arts, crafts, flowers, paintings, homebrew, vegetables and baking.

The show is being held on March 7-8 at Pembroke Park on the Lake Wānaka waterfront.

Photo: File

Vietnam a land of opportunity for NZ ag

Richard Rennie NEWS Trade

AS PRIME Minister Christopher Luxon visited Vietnam last week an Asia-New Zealand Foundation report on the country highlights the valuable trade opportunities within the young, tech savvy nation.

Vietnam is New Zealand’s 14th largest trading partner, with bilateral trade valued at $2.68 billion in 2024. That compares to the likes of Thailand, with a similar period of diplomatic relations, that enjoys $4bn in bilateral trade.

The report, Vietnam and New Zealand at 50: the next chapter, has been published in conjunction with a celebration of 50 years of diplomatic ties with the country.

Following Vietnam’s reunification, NZ was one of the first countries in the world to form diplomatic ties.

The report notes Vietnam’s move from a traditional agrarian economy to a hi-tech, industrialised nation whose smart phone exports in 2024 were almost five times NZ’s dairy exports.

Samsung looms as a giant in Vietnam’s tech landscape, having channeled $37bn into the country and exporting $97bn worth of

smartphones and tech gear, making it Vietnam’s largest single exporter.

This makes Vietnam the second largest exporter of smartphones globally after China. With the links to Samsung, South Koreans are proving particularly inclined to now make Vietnam home.

The report also notes Vietnam is one of the most digitally connected countries in the region, with superior digital infrastructure and a digital economy growing at 20% a year.

Our exporters will need to do their homework and build market-specific knowledge of trade with the likes of Vietnam.

Warrick Cleine NZ Chamber of Commerce Vietnam

It is experiencing the highest rate of economic growth in the Asia Pacific region, and one of the highest in the world, forecast to be 6.3% for 2026.

Asia-New Zealand Foundation CEO Suzannah Jessep said NZ has a trade deficit with the country at present, with plenty of room to grow exports there. In 2024 NZ exported about $840 million there,

with the main exports being dairy, fruit and timber.

The main imports from Vietnam were electrical equipment, machinery and footwear.

Almost two-thirds of the NZ businesses active in Vietnam are in the food and beverage sectors.

Report author Haike Manning said the pace of change in Vietnam has been remarkable, with increasingly wealthy consumers who trust NZ’s high-quality, safe food underpinning much of NZ’s export growth in recent years.

Ministry of Foreign Affairs and Trade data shows trade between the two countries has grown by a solid 44% in the past five years.

With 55% of its population under the age of 35 and 40% of the country urbanised, cities like Ho Chi Minh City and Hanoi are exhibiting disposable incomes significantly higher than the rural hinterland as inhabitants adapt more western-style dining habits, and spend more on imported food and drink.

Warrick Cleine, chair of the NZ Chamber of Commerce in Vietnam, said Vietnam represents a disproportionately greater opportunity for NZ in the future, given its exceptional level of growth. He said the challenge is for NZ exporters to set up and take the opportunity.

“Our exporters will need to do their homework and build marketspecific knowledge of trade with the likes of Vietnam. They will need to be clear on their channel to market and articulate why a Vietnamese consumer should buy their product.”

LARGE: Vietnam is New Zealand’s 14th largest trading partner, with bilateral trade valued at $2.68 billion in 2024.

Photo: Pexels

QEII Trust welcomes budget reprieve

THE government’s decision to grant the QEII National Trust $4.5 million over three years has been greeted with thanks and relief by environmentalists and farmers alike.

The trust had faced the prospect of losing funding of $2 million a year when its Jobs for Nature funding ended come June.

This had it staring into a financial hole, unable to continue to accept a growing queue of farmers and landowners keen to protect land of high environmental value on their properties.

Trust CEO Dan Coup said he is grateful for the funding. He acknowledges it still leaves the trust short on annual funding by about $500,000 a year but is “better than zero” in a tight government funding environment, and gives the trust breathing space.

“It is a lifeline. We had a board meeting coming up where some tough decisions were going to have to be made. It won’t be back

to full steam ahead now, but it does mean we can continue to take on more covenanted properties.”

For the financial year ending in June 2024 the trust also earned $295,000 through donations and other grants.

Coup said the trust will be

exploring ways to lift that portion of income to help make up the gap.

Nationally the trust oversees over 180,000 hectares of covenanted land, almost the equivalent of Arthur’s Pass and Aorangi Mt Cook national parks combined.

Weed zapper remains on target

Richard Rennie TECHNOLOGY Pests

THE New Zealand developers of a laser-fired weed-killing system remain confident about their technology’s prospects in the face of a similar United States concept emerging.

Map and Zap head developer and AgResearch scientist Kioumars Ghamkhar attended the evokeAG agritech conference in Brisbane to showcase the technology to potential investors. He and AgResearch business development manager John Morris said there has been strong interest from within Australia and further afield. That included traditional broad acre cropping and horticultural businesses wanting to reduce their herbicide

use by opting for laser-targeting weed infestations.

Both acknowledged the emerging presence of a US start-up called Carbon Robotics, also using laser technology to destroy weeds.

Jointly owned by growers from the US, Europe and Australia, the technology is incorporated into a tractor-drawn implement that hooks onto the tractor’s threepoint linkage.

“The main difference between

Our technology can be retrofitted to existing equipment at considerably less cost.

them and us is that our technology can be retrofitted to existing equipment, at considerably less cost. We also offer the flexibility of being able to incorporate other technology into it, for other applications,” said Ghamkhar.

This could include camera tech capable of determining moisture levels in the soil for early drought detection, or incorporating artificial intelligence to determine disease risk in plants, before it becomes a bigger issue.

Ghamkhar also pointed to longer operating life for the NZdeveloped system’s lasers, with significantly lower replacement costs compared to the US lasers, valued in the tens of thousands with an operating life that requires more regular replacement.

“Yes, we know they are there in the market, but we are quite

Otago claims the greatest area, with 65,000ha registered.

The trust’s base funding of $4.27m a year received through the Department of Conservation has been frozen for the past decade.

Coup said the trust’s efforts to secure more funding have been well supported by both farming and environmental interests.

Federated Farmers vicepresident Colin Hurst said the announcement is not the doubling the Feds had been seeking but is a positive step in the right direction.

The Feds had pushed the trust’s case in a 30-minute slot before a Parliamentary primary production committee, explaining its importance to farmers wanting to protect land.

Corina Jordan, CEO for Fish and Game NZ, said the support reinforced the successful partnership model that encourages farmers to protect biodiversity on their land.

Gary Taylor, chair of the Environmental Defence Society, said in a year that has distinctly lacked much good news for the environment it is good to see some positive news.

He is hopeful more work will also continue on developing biodiversity credits that farmers and landowners can claim, based off protected land, including QEII Trust titles.

It won’t be back to full steam ahead now, but it does mean we can continue to take on more covenanted properties.

“It is a work in progress. It was always envisaged there would be some financial incentives for farmers to protect and restore forests.”

Coup said he understands discussions about biodiversity credits are continuing but they will take time to develop and implement.

The Maungatautari ecological island trust sanctuary in Waikato, which was started by neighbouring farmers, also received a one-off injection of $750,000 over three years.

confident what we are offering is a better option,” he said.

The technology is picked to fit well with shifts in cropping methods that require a lower use of herbicides, and more

ON TARGET: Map and Zap developer Kioumars Ghamkhar, left, is confident the Kiwi-developed technology is on track for scaling up successfully, once further investment is secured.

incorporation of biological/nonsynthetic weed controls.

“We have proven the technology, and it’s really just a case of getting the funding to got to the next level,” Ghamkar said.

Richard Rennie NEWS Conservation

SUPPORT: Trust CEO Dan Coup says the trust’s efforts to secure more funding have been well supported by both farming and environmental interests.

Dan Coup QEII Trust

Kioumars Ghamkhar Map and Zap

Robotics Plus joins forces with Yamaha

Richard Rennie TECHNOLOGY Agriculture

THE head of New Zealand startup Robotics Plus has welcomed the purchase of his company by Japanese giant Yamaha to form Yamaha Agriculture, focusing on autonomous artificial intelligence-driven agri equipment.

Robotics Plus co-founder Steve Saunders said the longstanding partnership his company has enjoyed with Yamaha since 2017 has given the company the ability to take its innovative tech further and faster than many start-ups often achieve.

Yamaha invested $10 million into the Bay of Plenty start-up in the company’s early life stage.

Robotics Plus has since become a major player in automated apple grading with the Aporo fruit packer, a robotic log scaler and Prospr, its autonomous multi-purpose orchard machine.

“Yamaha have also acquired an Australian agri-tech company The Yield, a digital data company. The opportunity now is to merge data insights with autonomous machines,” Saunders said.

He said the near decade transition from start-up to ownership by a large-scale Japanese company highlights what a longterm game agri-tech development is.

“The key for us has been about finding the

right capital and setting shared targets. We had a global view from day one, knowing you won’t get scale in NZ. Our purpose and goal has always been ‘How to solve NZ challenges’, but having to scale globally to make that achievable.”

One of Robotics Plus’s United States apple growing clients grows more apples than the entire NZ crop.

Saunders said Robotics Plus had always scaled its team up every year, expanding from 28 to 130 today including a large R&D team based in the Bay of Plenty rural district of Te Puna.

Robotics Plus initially focused on a robotic kiwifruit picking machine but the company soon recognised what a small portion of global fruit crop kiwifruit comprised.

It evolved into the Prospr machine, a multifunctional autonomous platform for varying orchard work. The company is building the machines at its Tauranga factory site, with the attachable spray equipment built by Croplands Australia.

The machines sell for between US$245,000 (NZ$428,000) and US$300,000 and four can be controlled by one person via phone or tablet.

Saunders acknowledged the support Robotics Plus has enjoyed over the years with grants from the likes of the recently extinct Callaghan Innovation fund, the Ministry for Primary Industries and New Zealand Trade and Enterprise. He said the

Change s to consent fe e s and charge s

We’re proposing changes to consenting service charges that could impact both users and ratepayers, including:

Increasing the hourly charges for our consent ser vices

Simplifying the way we charge for processing consents

value of such funding agencies could not be underestimated.

ACC also invested in the company’s logscanner technology that removed the need for logging operators to make dangerous manual assessments of a truck’s log load.

“These grants have helped create a lot of

jobs and given NZ a lot of expertise.” He said the company remains committed to designing and manufacturing in NZ.

“Yamaha have recognised the talent that is here. We are not moving, our R&D remains here in NZ and we will continue to grow here.”

Workplace tests show uptick in opioid use

Neal Wallace PEOPLE Wellbeing

WORKPLACE drug testing has revealed 3.99% of samples taken in the last quarter of 2024 tested positive for the presence of drugs.

Cannabis was the most prevalent, accounting for 59.1% of cases but data released by the The Drug Detection Agency showed an increase in the use of amphetamine-type substances and opioids compared to the same quarter last year.

“This suggests shifting patterns in substance use that requires greater employer awareness and policy reinforcement, especially around nonmedical use of pharmaceuticals,” said Glenn Dobson, the chief executive of The Drug Detection Agency (TDDA).

Dobson said those living and working in the agricultural sector were similarly exposed to drug use but face additional pressures from living remotely, which can lead to mental health challenges and the use of drugs.

The 3.99% is down from 4.55% in the previous quarter, but testing rates reflect the volatility of the drug trade and the volume that makes it through customs, according to the TDDA. It notes that habits

can form over holiday breaks and continue when people are back at work, so the number of drug positive tests are likely to be higher in the next round of testing.

Wastewater testing reveals some rural communities have high drug use, which Dobson said can also be due to employment and socioeconomic pressures.

There has been anecdotal evidence that remote rural areas are favoured by methamphetamine manufacturers but Dobson said that, increasingly, ready-to-use drugs are being imported instead of made locally.

The report found amphetamine-type substances were detected in 24.4% of cases, up from 18.8% a year earlier, and opioids 12.1%, up from 11.9%.

The rates of other drugs detected were benzodiazepines at 3.5% and cocaine at 1.1%.

“The increase in amphetamine detections are a real issue, but opioid detections are what concerns me more,” said Dobson.

Globally the use of opioids is growing and can cause workplace accidents, long-term addiction and lead to the loss of life.

Opioids such as Tramadol can be legally prescribed by a doctor to control pain, but those using it need to be managed as it impairs the ability to function.

“Legally prescribed or illegally procured, they can cause workplace accidents, longterm addiction and lead to the loss of life in more ways than one,” said Dobson.

He recommends companies update their drug and alcohol policies to include stronger measures addressing opioids and amphetamines, train managers to recognise impairment, particularly the subtle signs of opioid use, and have regular and random drug testing to deter misuse and protect workplace safety.

Federated Farmers board member David Birkett said farmers and rural businesses are not immune from drug use and he urges farmers to assess whether to introduce testing as part of their health and safety plan.

“We’d certainly encourage farmers to look at drug testing as part of their health and safety plan for their business.”

TURNING JAPANESE: Robotics Plus co-founder Steve Saunders says the Japanese purchase reflects the strong partnership built with Yamaha since 2017.

TESTING: Farmers and rural businesses need to think about drug-testing staff, says Federated Farmers.

One NZ Satellite TXT is here.

Living the rural dream? There’s a new way to help you keep in touch while living and working in rural New Zealand.

Whether you’ve got a fence down, livestock on the loose, or a flat tyre on the 4x4, you can use One NZ Satellite TXT to stay in contact while living or working in areas traditional cell towers don’t reach (around 40% of our land mass).*

Our nationwide satellite TXT service is the first of its kind in the world and promises to be a game-changer, helping Kiwi be safer, better connected and more productive.

To TXT in the middle of nowhere, you’ll need an eligible One NZ mobile plan and phone. Messages can take a few minutes to send and receive^ (they’ve got a long way to travel, to space and back!), but it’s worth it knowing you’ve got an additional layer of communication alongside existing safety devices you carry. Best of all, it won’t cost you extra to use it if you’re on an eligible One NZ plan.

One NZ Satellite TXT – helping you work smarter not harder on the farm, even if you’re down in the back paddock! Visit one.nz/SpaceX for more info.

Youngsters focus of mental health study

Annette Scott PEOPLE Wellbeing

GROWING and supporting the mental health and wellbeing of future farmers has been a key focus for a research partnership between Massey and Lincoln universities.

Over the past four years the two universities have shared research resources as they aimed to normalise the conversation around mental health to make a difference for young farmers and their wider rural communities.

The lead researchers – senior lecturer at Massey University’s School of Social Work Nicky Stanley-Clarke, and senior lecturer in the School of Agriculture and Environment Dr Chris Andrews – presented the findings during a recent forum at Lincoln University.

Throughout the four years key factors in mapping landscapes of support for rural young people have been to gain an understanding of the mental health needs of those 18-24 years of age in the agricultural sector; to undertake a review of the existing landscape of

support; identify where there may be gaps in support for barriers to accessibility; and identify recommendations for the role of industry partners in supporting young people in the farming sector.

Research revealed that while young farmers are more open to talking about mental health than previous generations, the statistics remain concerning.

Rural communities have a higher suicide rate than urban communities with rural mental health programmes aimed more at the farmer and farm owner.

Stanley-Clarke presented data in a rural context that revealed 25% of people who died by suicide on farms between 2007 and 2015 were farm labourers younger than 25 years old.

Few of these young people had contacted a doctor prior to their death or had any involvement in a mental health wellbeing programme.

Kicking off the research programme, WellMates – a resilience and positive mental health workshop for students from or engaged with the rural community – was developed in 2020 and delivered both in person

and as an online module.

“Engaging with support early allows for intervention and can save lives,” Stanley-Clarke said.

“Wellbeing education can develop lifelong skills for students that will build resilience, supporting them through tough times, while also learning what to do to support others.”

The programme had mixed results between the two universities.

WellMates increased student’s mental health knowledge and skills but while in-person delivery was highly effective at Lincoln, it was less effective at Massey, where the online programme, allowing the flexibility to engage at their own pace, in privacy, found more favour with students.

“The stigma about talking up in the classroom was a real learning for us, as was the differing culture between the two universities,” Andrews said.

Learnings showed that while stigma tops the barriers to engagement, it is dissolving.

Addressing stigma, driven by the prevailing attitude of “she’ll be right”, still endured.

Communicating across generations can go two ways –

RESILIENCE: Wellbeing education can develop lifelong skills for students that will build resilience, says Nicky Stanley-Clarke.

it can either create barriers or provide support.

Social connection is important.

Some great support services and programmes exist, “but are we doing enough? It would be good to capture those students that don’t make it through universities,” Andrews said.

“There are tens of thousands that don’t come through unis such as those that go through Primary Industry Training Organisations.

“We are now having those wider conversations.”

Stanley-Clarke said it is pleasing after four years to see the research is making a difference.

“We don’t have all the answers, we are open to ideas. We have just been doing some research in this much-needed space.”

The next steps include working with other agribusiness faculties to integrate findings into the curriculum or support services while continuing data analysis to monitor implications and assess key priorities towards extending the programme.

At FMG, we’re here to help dairy farmers stay informed and get ahead. That’s why along with offering useful advice and tips, we support dairy workshops and seminars happening right across the country Because at the end of the day, learning the latest techniques and developing new skills will help you make positive changes and better decisions So take the opportunity to stay ahead at a dairy event near you Head to fmg co nz/dairyevents to find out more.

here for

of

Photos: Annette Scott

STIGMA: Dr Chris Andrews says that while stigma about mental health tops the barriers to engagement, it is dissolving.

Wasps fly in by plane to attack pest

Rennie in Brisbane TECHNOLOGY Pests

CASTING thousands of parasitic wasp larvae from the sky has proven a saviour for Australian cotton growers affected by the voracious silverleaf whitefly.

New South Wales cotton farmer, agronomist and farm consultant Anna Madden and her husband Steve began trying to deal with the pest by getting up at 2am to cast the parasitoid wasp Eretmoncerus hyati in fields to combat whitefly.

Realising that their application method was not sustainable, they graduated to using drones. These, too, were limited in their effective coverage area, in this case to about 4000 hectares. They also ran into issues with irrigation timing and weather conditions.

“We realised we needed a way that could treat the 600,000ha of cotton grown every year in Australia,” Anna Madden told delegates at the trans-Tasman Brisbane Biological Symposium.

Cotton has become an increasingly important crop for Australia, comprising almost AU$3 billion in exports and making the country one of the world’s largest exporters. The area in cotton has grown tenfold in only five years.

As an industry it has been doubling down on efforts to reduce its environmental impact and that has included using GE BT-resistant cotton, and drawing on biological solutions to pest problems. The whitefly is a major pest for the sector, tainting blooming cotton with honey dew.

As the Crop Capsule company, the couple developed a broad acre solution for spreading the parasitoid wasp that attacks whitefly using specially developed biodegradable plastic capsules that hold the wasp larvae.

On distribution via a low-passing

light plane, the capsules always land the right way up. Their release is timed to be only hours before the larvae are due to hatch, after which they reproduce and proceed to target their prey or its eggs.

“The use of the biological control fits with the industry’s goal to reduce chemical use by 25% by 2025 and also fits well with cotton manufacturers’ own environmental goals,” said Madden.

As the couple work to develop the technology for application against other target pests, she said demand is likely to continue to rise for such biological controls.

The biologicals market is expected to be equal to the conventional market by 2043, experiencing annual compounding growth of 12%, compared to only 3% for conventional synthetic treatments.

But Madden also had some valuable insights as a farmer, agronomist and product developer for companies entering the biologicals market.

“Exciting research does not always translate into a viable product,” she cautioned.

“Cost effectiveness is crucial. If it’s too expensive it simply will not be taken up.”

Her product worked out cheaper than controlling the fly using

conventional spray compounds.

She said collaboration across all stages of development and commercialisation is critical, and education of growers is particularly challenging but vital to help farmers adopt the technology.

“They must be able to integrate into existing farming systems. You cannot expect farmers to change their system.”

Proactive timing when applying biologicals – applying before the problem manifests, not when it is visible – is one key area where biologicals differ from conventional crop treatments.

“They are different to standard industry chemicals approach,

and we had to work on this really hard.”

There is also an inordinately long time between discovery to final commercial approval that could be reduced, even in Australia. Meantime, at an operational level biological treatments have a short shelf life, making logistics and planning vital.

Like other players Madden called for a biologicals industry group to give the emerging sector more voice.

• Rennie travelled to the Brisbane Biological Symposium at evokeAG with support from Plant & Food Research.

Richard

PEST: Silverleaf whitefly (Bemisia tabaci) is a major pest for the sector, tainting blooming cotton with honey dew. Photo: Wikimedia Commons

COTTON PICKIN’: As a farmer, agronomist and product developer, Anna Madden has some sharp insights on the challenges in developing an effective, affordable biological control product.

Queensland puts ag into overdrive

Richard Rennie NEWS Agriculture

QUEENSLAND’S primary sector is moving from strength to strength with its agricultural production now the largest by state in Australia. This year has the sector set to break another record, reporting AU$25 billion of earnings as the state government doubles down on a target of achieving AU$30bn earnings by 2030.

Addressing the Agriventures evokeAG conference in Brisbane, Queensland’s Minister for Primary Industries Tony Perrett said his government aims to supercharge the primary sector to make the state a national leader in primary production.

Late last year his government announced a state-first “sowing the seeds” fund of AU$30million aimed to boosting agritech innovation and development in the state, which is seven times the size of New Zealand and 2.5 times bigger than Texas.

“The fund will promote new tech and farming techniques, supporting the next generation of farmers, and boost agri tech adoption. We want our primary producers to achieve their best productivity with up-todate innovations,” he said.

The state support comes alongside grants from Australian’s enormous AU$5bn Future Drought Fund that kicked off in 2019. A condition of the fund was that at least AU$100million of grants be made every year to farmers and rural communities to increase their resilience to climate change.

A report released at the evokeAG conference also revealed Australia’s primary sector has enjoyed a lift in agritech funding investment of 140% since only 2022. Over 80% of the funding was directed to agri biotechnology, followed by novel farming systems.

Perrett predicted by 2030 one in three new jobs created in the state’s agri sector will be in new technology.

The state support comes alongside grants from Australian’s enormous AU$5bn Future Drought Fund.

He said the state’s diverse climate and productive farming systems have Queensland becoming a vast hub for agritech testing and proving. The state has a Smart Farms network that are test beds for new farming and supply chain practices and technologies to drive and support industry adoption.

With a population similar to NZ’s, seven times NZ’s land area and a GDP of NZ$550bn against NZ’s NZ$400bn for 2024, the state is enjoying solid growth with agriculture outperforming.

After coal and natural gas, beef was its highest earner for 2023-24, generating AU$6.7bn.

Meantime cotton has emerged as a valuable export crop, with land area nationally increasing almost tenfold in only five years, much of it within Queensland, where it generated AU$2bn income in 2023-

Everyone on Beef + Lamb New Zealand’s electoral roll should have received information in the post about voting as part of the 2025 Annual Meeting processes.

24, close to the state’s sugar earnings.

But smaller crops in the horticultural sector are also enjoying strong growth with the likes of apples increasing 55% and grapes by 33% in the past year.

Queensland’s primary sector growth heads up the broader growth that Australia’s entire primary sector has enjoyed since the

devastating drought period that ended in 2020, with most regions enjoying relatively reliable rainfall.

A sector that was traditionally expected to generate about AU$60bn a year is poised to push over the AU$100bn earnings mark by 2030, meeting an Australian government goal.

Big turns to small in biological startup race

Richard Rennie in Brisbane TECHNOLOGY Agrichemicals

BIG agrichemical companies are struggling to find new actives to deal with a growing array of plant pests, with cost and timing also pushing the likelihood of discovery further out.

Adrian Percy, director of North Carolina State University’s plant science’s initiative, says regardless of whether the pest is fungal, insect or weed, companies are struggling to find new modes of action to work against them.

He was addressing delegates at the Brisbane Biological Symposium, focusing on the emerging biological crop treatments industry.

“Many do not make it out of early discovery phase. It takes US$300 million

WITHDRAWAL: Adrian Percy says conventional ‘big ag’ chemical companies have withdrawn from owning the early stage startup business involving biologicals, preferring to partner up in co-development.

and 10 to 15 years to get to market. Only companies with deep pockets and a high appetite for risk can make that commitment.”

He said Brazil is the one exception globally where biologicals have made an impact in terms of their development and uptake. Part of the problem for the rest of the world is that conventional synthetic chemical companies are big, and find it hard to move nimbly in such an emerging research area.

“It is hard to be both a cruise ship and a speed boat.”

Initially, large chemical companies were expected to take over small biological startups, but over time that has not manifested.

“Instead, they have opted to go via investment companies, such as Finestra.

“We are seeing that they are looking instead to take up the tech over time, or partner with them and co-develop the technology.”

His university’s research approach focuses on five areas relating to crop production, incorporating biotech science to improve productivity and resilience while reducing pesticide and fertiliser use.

He emphasised that his institution is also very focused on grower outreach and increasing the understanding of this emerging science and treatments among growers.

He sees RNAi tech as one of the most exciting emerging biological technologies, rapidly advancing in the United States and increasingly linked to precision fermentation, another emerging area of innovation.

At a time when New Zealand’s academic and government funding for science hangs in the balance, Percy said funding from those two will remain the sources for more innovation, particularly for early-stage ideas that in certain cases those institutions can take to market.

Meantime the conventional “big ag” chemical companies still have a definitive role to play. Their huge networks are a way to test and promote the treatments developed by their small-scale startup counterparts.

COOKING: While many Kiwis may be familiar with the Gold Coast, it is Queensland’s hinterland that is starting to generate serious export earnings for the state.

Photo: Pexels

Your voluntary subscription is required.

Our target is 8000 voluntary subscribers.

So far we have 202.

We have 7798 to go.

Please activate yours today.

Thank you to the 202 who have already activated voluntary subscriptions.

Thank you for supporting the stories and market insights we produce for the website every day, the newspaper every week, and the podcast every Friday.

Keep firing questions and comments our way.

Thank you.

Dean Williamson. CEO and publisher 027 323 9407

BECOME A VOLUNTARY SUBSCRIBER

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterboxholder already receiving Farmers Weekly every week, free, and for those who read us online.

Choose from the following three options:

Call us on 0800 85 25 80 1. 2. 3.

Scan the QR code or go to www.farmersweekly.co.nz/donate

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice

Note: A GST receipt will be provided for all contributions.

From the Editor

A new way to sell wool

Neal Wallace Senior reporter

WHEN Fonterra launched its Global Dairy Trade platform in July 2008 there were plenty of doubters who thought the co-operative would be too exposed, and prices would be depressed. That has not been the case and today the fortnightly auctions provide real-time market information on global dairy prices.

Generating new interest and establishing fair and competitive global prices are the goals of the new monthly global Natural Fibre Exchange (NFX) trading platform being established by Wools of NZ (WNZ). It will operate exactly as the Global Dairy Trade does and could disrupt the current dominance of the traditional auction system, which for decades has been the main barometer for establishing strong wool prices.

The auction system’s effectiveness has diminished as sheep numbers have fallen but also as prices have collapsed, prompting some crossbred wool farmers to

enter into direct supply, forward contracts or tender.

Others have sold to private buyers in what has effectively become a low-cost disposal system.

Ironically, given the decline in strong wool prices, WNZ says there is a shortage of quality shorter wool for carpet manufacturing as farmers watch costs and opt for eight- or 12-monthly shearing.

WNZ says NFX will expose its monthly offering to hundreds more potential customers than current auctions.

The company is also making the offering more attractive by collating wool of the same specifications into container-sized lots on behalf of growers.

Should it prove popular, a likely casualty from this market disruption will be wool brokers and other middlemen.

For decades the auction system has been the primary process for selling wool and brokers the conduit between farmers and buyers, providing feedback on market conditions and clip quality.

The primary questions growers will be asking is whether the NFX will improve prices and grow interest in strong wool.

Improving wool prices and thereby returning sheep to being a multi-purpose animal is the quickest way to lift sheep sector profitability, but after decades of little to no promotion of wool’s attributes, such investment is needed.

Should WNZ claims that the NFX

LAST WEEK’S POLL RESULT

More than 100 people responded to the poll, with almost three-quarters saying the big co-op should keep its consumer businesses.

This week’s poll question (see page 7): Have your say at farmersweekly.co.nz/poll Should New Zealand withdraw from the Paris Agreement on greenhouse gas reductions?

One voter said New Zealand is too small to lose that much direct contact with overseas customers. With what is going on in the world at present, we could be forgotten very quickly.

However, another thought that it’s inevitable Fonterra will eventually need to scale back its collection routes to remain viable. Some cash in hand would help push this event out further until small rural communities have had time to disperse and find alternative incomes.

will expose more soft floor-covering manufacturers to wool prove correct, that will certainly help.

While New Zealand wool is not on the same scale as the country’s dairy offering, making up 1-2% of global fibre, if it can secure a fraction of the economic activity the GDT has generated, it will provide a significant boost.

It will operate exactly as the Global Dairy Trade does and could disrupt the traditional auction system.

The NFX was developed by CRA International, which also developed the GDT, and since 2008 it has had customers and stakeholders across more than 60 countries generating trade worth $3.5-$5.2 billion a year.

Demand for wool carpets is growing.

In the 1990s wool carpets constituted about 95% of global soft floor coverings.

By 2021 that had fallen to between 10% and 15%, depending on the market, but latest data shows that has increased to 18-19%.

Whether or not a disruptor such as NFX will provide a further boost to carpet use, there will be much interest.

The one measure farmers will be watching, however, will be the price of wool.

Last week’s question: Do you support Fonterra’s plan to sell its consumer businesses?

Letters of the week Co-ops’ freeloader problem

Mike O’Connor

O’Connor Partners

ON FARMERSWEEKLY.CO.NZ last week, respected New Zealand agribusiness academics James Lockhart and Hamish Gow put the case for continued 100% farmer ownership of co-operative meat processor and exporter Alliance Group, under the headline “The true value of the co-operative”.

They argue that continued 100% farmer ownership of Alliance achieves significant outcomes for its farmer owners:

The first is that its return for red meat produces a benchmark against which all other meat companies in New Zealand must then compete (a competitive yardstick); this return by virtue of bundling the meat price and the dividend ought to be highly competitive in the medium to long term; members retain capital within the cooperative enabling them to operate seasonal production systems on farm by holding excess processing capacity off farm and the benchmark provided by the co-operative reduces financial risk across the industry – making it more bankable than would otherwise be the case.

They conclude that if farmers lose control of the co-operative then they “need only be paid enough for supply and nothing more”. They make an important point. Cooperatives form in the first place because like-minded individuals with common interests club together to take direct control of some part of the value chain that is important to them. The co-operative provides critical mass that enables its members to capture value that could not otherwise be captured by those individuals acting alone.