Park butter to better woo India

population, and it is one of the world’s fastest-growing economies,” Rattray said.

MAJOR dairy commodities like butter and skim milk powder need to be parked for now if New Zealand wants to avoid being relegated to the back of the queue for a trade deal with India.

That’s the view of former Fonterra director and Indian dairy farm investor Earl Rattray, who led a delegation of most of NZ’s major primary exporters to India earlier this month.

India this year signed a free trade agreement with Australia – and other countries, including those of the European Union, are scrambling to gain a similar foothold in the market of more than a billion consumers.

“It is now the fifth biggest economy in the world, it is going to have the world’s largest

We have to secure our place in the queue and not go in there with unrealistic expectations ... India needs to see we are value-adders rather than competitors.

Earl Rattray Dairy investor

“Given the Australia FTA and possibly more other potential suppliers to the Indian market who may achieve a competitive advantage because of the lack of tariffs, that is not going to be a good place for NZ exporters to be in the future.”

Talks for a free trade agreement began in 2011 but stalled six years ago.

Despite starting its talks a year later Australia clinched a deal with India in April.

Some exporters have questioned Trade Minister Damien O’Connor’s ruling out NZ following Australia and parking demands for access for dairy products.

The meat industry worries NZ’s dairy demands are holding up the talks and blocking potential gains for other exporters.

Rattray agrees NZ’s default position of demanding tariff elimination on all of its major export commodities as a starting point is not suitable for the current negotiation with India.

But he said that does not mean dairy should be excluded altogether in the current talks.

“There are elements of our export product mix that are extremely sensitive for India but there are significant and

Farmers and politicos scrum down

Tim Mackle, Mark Mitchell, Richard Luxton, Greg O’Connor and Quinn Morgan ready to take to the field at the John Luxton Memorial rugby match in Morrinsville last week. Visit farmersweekly.co.nz for the full story.

Flock House orphans remembered

Alasdair Bettles-Hall, the son of a Flock House orphan, is on a mission to paint the full picture of the farm training school’s history.

PEOPLE 26

Scales Corporation is to invest more than $30 million in two Australian pet food processing ventures.

NEWS 11

Homeowners are turning their backs on synthetics says farmer-owned co-operative Wools of New Zealand.

NEWS 11

Stockpiles of both mānuka and non-mānuka honey are the downside of a decade of double-digit growth.

MARKETS 16

Meet the people behind the farm gate

online at farmersweekly.co.nz

Nigel Stirling MARKETS Dairy

online at farmersweekly.co.nz

Nigel Stirling MARKETS Dairy

1

Vol 20 No 38, October 3, 2022 View

$4.95 Incl GST Thumbs up for Fonterra 19 Subscribe on YouTube

On Farm Story is a celebration of farmers and farming - told in under five minutes.

Continued page 5

touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Claire Robertson Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240 Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 07 552 6176 Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570 Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS 0800 85 25 80 subs@agrihq.co.nz

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269 Sales & Marketing Manager andy.whitson@agrihq.co.nz

Steve McLaren | 027 205 1456

Auckland/Northland Partnership Manager steve.mclaren@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Donna Hirst | 027 474 6095

Lower North Island/international Partnership Manager donna.hirst@agrihq.co.nz

Grant Marshall | 027 887 5568

South Island Partnership Manager grant.marshall@agrihq.co.nz

Debbie Brown | 06 323 0765

Marketplace Partnership Manager classifieds@agrihq.co.nz

Grant Marshall | 027 887 5568

Real Estate Partnership Manager realestate@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 0800 85 25 80 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand

Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Contents

New

most trusted source of agricultural news and information

News in brief

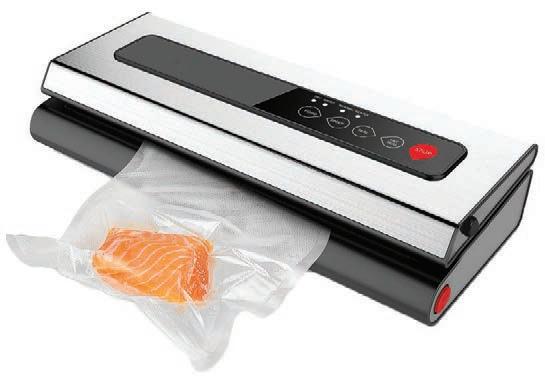

Salmon sinks

New Zealand King Salmon Investments saw a net loss after tax of $24.5 million in its half-year earnings. The world’s largest aquaculture producer of King salmon said the loss was mainly due to the company being forced to close three of its four fish farms in Pelorus Sound due to high summer water temperatures.

Funds for farmers

The a2 Milk Company has announced grants to 15 farms in Canterbury and Southland under its New Zealand Farm Sustainability Fund, a partnership with Lincoln University. a2MC made $500k available to the fund for the inaugural year. Grants of up to $35,000 have been made to farms demonstrating an integrated approach to a sustainable future, enabling positive and meaningful impact across the community and the environment.

No profit, no fees

Otago landowners or individuals can now line up alongside catchment and community groups to apply for their resource consent fees to be covered for not-for-profit environmental projects. The Otago Regional Council updated the existing Environmental Enhancement Projects Policy, broadening the criteria for applicants and the type of consent costs now covered to improve delivery of environmental enhancements around the region.

HB targets reductions

In its final decision before October’s local elections, Hawke’s Bay Regional Council agreed to develop the region’s first Emissions Reduction Plan, supporting a path to regional carbon neutrality by 2050. Council chief executive James Palmer said the net-zero carbon goal by 2050 would not be easy, but could be reached through a plan of targets and measures supported by strong stakeholder input, collaboration and community buy-in.

BY COMPLETING YOUR FENCING AND WATER REPAIRS

Visit your local PGG Wrightson store or purchase online to take care of your farm maintenance and repairs.

Helping grow the countryFreephone 0800 10 22 76 store.pggwrightson.co.nz

4 Contents

Zealand’s

PRINTER Printed by Stuff Ltd Delivered by Reach Media Ltd

Get in

BUYING TIME: Lewis Tucker general manager Colin Jacobs says forestry buys New Zealand’s emitters and policy makers a bit of time to get to a low-carbon economy. STORY P23 News . . . . . . . . . . . . . 1-21 Opinion . . . . . . . . . 22-25 People . . . . . . . . . . . . . 26 Technology . . . . . . . . . 27 World . . . . . . . . . . . . . . 28 Ag&Ed . . . . . . . . . . . . . 29 Real Estate . . . . . . 30-37 Marketplace . . . . . 38-39 Livestock . . . . . . . . 40-41 Markets . . . . . . . . . 42-47 Weather . . . . . . . . . . . . 48

National vows to review live export ban

Annette Scott NEWS Exports

AFUTURE National government would review the law banning live cattle exports, National’s animal welfare spokesperson Nicola Grigg says.

In terms of a bill passed last week, livestock export trade by sea will cease from April 30 next year, cutting New Zealand’s gross domestic product by $472 million and closing off a lucrative market for export cattle breeders.

Agriculture Minister Damien O’Connor said the ban will protect NZ’s reputation for world-leading animal welfare standards.

“The Animal Welfare Amendment Bill future-proofs our economic security amid increasing consumer scrutiny across the board on production practices,” he said.

from page 1

meaningful parts of dairy exports out of NZ which represent zero threat.

“It does not have specialty in some of the more concentrated whey proteins or fractions of proteins, for example.”

Rattray said India’s demographic trends could turbocharge future demand for such products.

Getting alongside local manufacturers now could pay big dividends in the future.

As could lowering any tariffs on those products.

“I personally think there is an economic miracle unfolding there…[as the] working age population completely overwhelms the size of the dependent population and more women join the workforce, that is going to have a massive economic dividend.

The government started a review of the livestock export trade in 2019 in response to concerns the trade could be a risk to NZ’s reputation.

“Our primary sector exports hit a record $53 billion last year, delivering us economic security. That result is built on our hardearned reputation and this is something we want to protect,” O’Connor said.

He said the effects on export flow will be small in the context of total primary sector exports, suggesting the two-year transition period has allowed those affected by the ban sufficient time to adjust their business models and supply chains to account for the removal of the trade.

But Grigg and industry stakeholders disagree, saying the decision signals more economic pain for farmers, rural communities and consumers, while also putting NZ at risk with key trading partners.

“Those products that have specific health attributes beyond basic nutrition which is fat and protein…the market for those kind of things are likely to continue to grow and there is unlikely to be a bigger market anywhere else in the world for them than India.

“For Indian businesses that are building up their product portfolio I would say there would be some elements of NZ’s export mix that would be very attractive to them.”

In the meantime NZ needed to be careful it did not blow its chances by making demands India could not agree to.

“We have to secure our place in the queue and not go in there with unrealistic expectations about timeframes or be too demanding.

“We have to work through what we can do which is achievable and can add value to the relationship.

“India needs to see we are valueadders rather than competitors.”

Grigg said the government failed to carry out its own robust economic analysis, or consider any of the proposed amendments put forward by industry and the National Party.

set world-leading compliance standards, like built-for-purpose ships, maximum stocking densities, vet and stock handler training, more robust reporting, exporter licensing and an importer quality assurance programme,” Grigg said.

Exporters have implemented a Gold Standard with the improvements recommended being evidenced based, using the latest information, knowledge and scientific developments.

Animal Genetics and Trade Advisory Council chair Jim Edwards said the overall view needs to be from a global perspective.

“Livestock exporting allows us to maintain tight trading relationships with some of the largest importers of NZ agricultural products and that provides a significant source of export revenue for our small country.

She cited an Infometrics Economic Impact Report that said the ban will reduce NZ’s GDP by $472m and cost export cattle breeders between $49,000 and $116,000 a year per farm.

“Rather than an outright ban on live exports, the government should legislate for a Gold Standard programme that would

“The Gold Standard is unprecedented internationally in scope and depth and when fully implemented would position NZ as a world leader in animal welfare regulations and reform,” Live Exporters NZ (LENZ) spokesperson Mark Willis said.

“We set out a clear and evidencebased 12-point regulatory plan to Minister O’Connor that would further improve and modernise the live animal export system. We did not receive any response.”

“Our reputation will be damaged if we refuse to help other nations with their food security.”

Edwards said NZ has long been helping China with its food security.

“To say we are not going to do it anymore is an insult, there is risk and there will be reaction.

“We can only wait now with bated breath and hope [live export] trade will be reinstated and meantime hope not too much harm is done,” Edwards said.

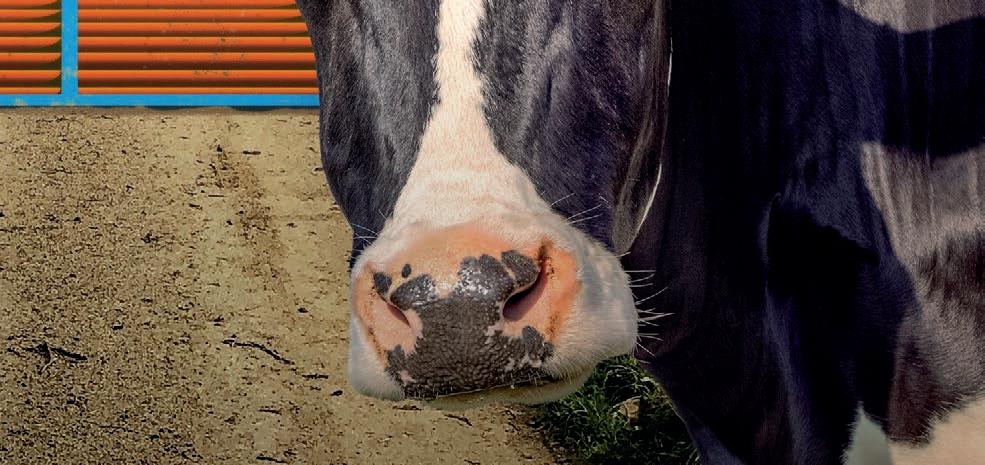

New Delhi dairy

THERE can be few New Zealanders with a better feel for India’s dairy sensitivities than Earl Rattray.

The Waikato dairy farmer has visited the country four or five times a year for a decade, establishing a dairy farming joint venture 70km from New Delhi with three Indian tech entrepreneurs.

Binsar Farms’ aim has been to introduce scale and New Zealand farming principles as an example to raise productivity in the world’s largest milkproducing country.

While Binsar’s 380-strong herd might be on the small size by NZ standards it is large in India, where 80% of an estimated 70 million dairy

farmers own fewer than 10 animals.

Rattray said the income from those animals can be crucial for rural families and explains the sensitivity to increasing imports from lower-cost producers.

“For them that [income] is the difference between having the cash to send their daughters to school or not. NZ shouldn’t underestimate that sensitivity.”

Rattray believes there will be opportunities for NZ’s bulk commodities in the longer term but it needs to bide its time.

“More of the children of village farmers will move to town. They can’t take their cow or buffalo with them, but they still need milk, so the supply gap widens.”

Advertise with us

Reach hundreds and thousands of rural New Zealanders every week

GHEE WHIZ: Earl Rattray has visited India scores of times in the past decade, helping to set up a dairy farming joint venture 70km from New Delhi with three Indian tech entrepreneurs.

To say we are not going to do it anymore is an insult, there is risk and there will be reaction.

Jim Edwards Animal Genetics and Trade Advisory Council

5 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 5

Call 0800 85 25 80

Continued

Norwegian firm on hunt for long Merino

WOOL clothing company Devold of Norway is offering New Zealand farmers a premium contract for longer Merino wool.

This comes amid concerns about Merino bloodlines coming into NZ based on estimated breeding values for fats and eye muscle, focused on the meat factor rather than quality wool.

“We are losing the focus on the quality of wool,” NZ-based general manager of buying arm Devold Wool Direct, Craig Smith, said.

Devold owner and company general manager Knut Flakk and the general manager of the mill based in Lithuania, Tor Jonsson, were in NZ last month visiting growers and offering a premium to specific wool breeders.

Devold has 38 contracted growers from Marlborough to Central Otago and into the Mackenzie region. All are eligible for the premium, but just 17 are currently sheep-to-shop growers.

Devold recently opened its flagship NZ store in Wānaka, operating under a vertical model where every step of the process from the wool to the yarn, to the final finished garment, is managed and controlled entirely by Devold. The model redefines how clothes are made from the ground up, but it needs top-quality, purposegrown wool.

Under the new incentivised contract growers will receive a fixed price per kilogram, higher than the market average, with a bonus payment above the new contracted base rate for wool meeting the longer quality criteria.

Devold 18.7-micron wool is currently achieving $24.00/kg clean, against the average market of $19.00/kg.

On top of the $24.00/kg, Devold growers selected for the new contract incentive are getting an additional $2/kg for longer length wool in the 95mm–105mm range.

“This is when growers are generally discounted $2/kg for long wool,” Smith said.

“Our contracts are already ahead of the market, in this case $5 ahead, and we are then rewarding through our contract structure growers who are growing longer wool, but still maintaining the quality to get the $2 premium, effectively better now by $7.”

The longer wool enables better processing and ultimately a better end fibre going into premium garments.

The five-year contracts are underway now and will be in place through to the 2026 season.

“The contracts are offered to specific growers growing the style of wool we are after,” Smith said.

“We are very selective of the

growers we are picking with the bottom line being it all comes down to quality.”

Flakk said the premium for longer quality wool is aimed at encouraging breeders to prioritise breeding for wool over meat.

Devold and its partners then it will not work,” Flakk said.

“Partnerships must be transparent on both sides with clear and precise understanding in the contracts formed and reward accordingly.

“That’s the key to importance for us.”

Jonsson said everyone appreciates that costs are going up for everyone and it is important that this is recognised in partnerships.

been growing wool under contract for Devold for several years and this year are among the growers selected for the premium longwool contract.

As growers they have developed a close partnership with Devold including having visited Devold in Norway and the mill in Lithuania.

“It’s about showing an interest in our business, and they have visited us,” Martin Murray said.

Know the market

A comprehensive, easy-to-read, weekly summary of NZ’s agricultural markets including sheep, beef, venison, dairy, grain, and wool.

Devold has an aggressive growth strategy that means it needs the wool in greater volumes going forward, but it can only meet the demand with quality wool and quality wool suppliers.

“If it is not a win-win for both

“We know that. The gas price at the mill [in Lithuania] has gone up from €14 [about $23.80] a kilowatt to €270/kw so we know very well about costs going up but we must keep the quality so we have to keep paying,” Jonsson said.

The wool grown in NZ under the new contract structure is all destined for Devold garments globally.

Maryburn Station farmers Martin and Penny Murray have

A self-confessed “wool man”, Murray said growing quality wool is his priority. “Any meat value is an added bonus.”

Shearing 8000 Merino ewes, including hoggets, Maryburn Station this year produced 400 bales of wool with more than 80% of the clip supplied to Devold.

“The premium contract suits the micron of our sheep, it fits our basket, and the long term is good value, giving five years’ guaranteed certainty,” Murray said.

MARKET REPORT

Subscribe from only $100* per month

agrihq.co.nz/our-industry-reports

Annette Scott NEWS Fibre

LONG STORY: Penny Murray and husband Martin Murray, second from right, check the quality of their premium contracted wool with Devold executives Tor Jonsson, Knut Flakk and, far right, Devold Wool Direct NZ general manager Craig Smith.

The premium contract suits the micron of our sheep, it fits our basket, and the long term is good value, giving five years’ guaranteed certainty.

Martin Murray Woolgrower

6 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022 News6

* Prices are GST exclusive

Red meat cuisine from a vending machine

Staff reporter NEWS

Beef and lamb

CHINESE consumers can now get a fix of New Zealand beef or lamb from a vending machine.

Beef + Lamb New Zealand (BLNZ) has joined forces with Alliance Group and Silver Fern Farms (SFF) to pilot two Pure Box vending machines in Shanghai that will serve ready-to-eat meals featuring NZ beef and lamb to Chinese consumers.

The meals, co-developed by BLNZ and well-known Shanghai chef Jamie Pea, fuse traditional Chinese ingredients and flavours with Western food trends.

Each of the six recipes has been designed to highlight either Pure South lamb from Alliance or beef from SFF.

The vending machines, which are marketed under BLNZ’s Taste Pure Nature country of origin brand, will be located in Shanghai’s top business districts where time-poor consumers are known to seek out convenient and healthy food options.

BLNZ global manager for the NZ red meat story Michael Wan said the pilot is just one of the strategic marketing initiatives designed to build awareness for NZ grass-fed beef and lamb in China.

“The Chinese market is strategically important for New Zealand’s red meat sector. Our research shows a growing number of Chinese consumers are seeking nutritious and healthy food. The unique attributes of New Zealand grass-fed beef and lamb can meet this need.

“We must also offer these consumers a range of eating

options such as Pure Box, which are convenient to access and consume, in addition to supermarkets and dining in restaurants.

“We want more and more consumers in China to get to know and recognise the benefits of New Zealand grass-fed beef and lamb through this Pure Box initiative and choose our grass-fed beef and lamb in the future.”

Alliance general manager sales Shane Kingston said the pilot aims to help generate interest in New Zealand beef and lamb.

“This is another great example of disrupting consumer purchasing activity to create both consideration and conversion to our high-quality New Zealand beef and lamb products.”

SFF general manager growth Nicola Johnston said taking part in the trial is an important way of establishing the opportunities for red meat in growing convenience trends such as ready-to-eat.

“We know that Chinese consumers love the core attributes of our red meat, but there’s more we can do to challenge the way our products are delivered and consumed that better suit our consumers’ varied lifestyles. By trialling initiatives such as the Pure Box, we can also glean insights that apply across our growing branded offering in China.”

The Consul-General of New Zealand in Shanghai, Stephen Wong, unveiled the Pure Box to media and the public at a launch event in Shanghai on September 22.

‘Agile contract’ aims to ease cost upsets

Staff reporter NEWS Arable

Staff reporter NEWS Arable

A NEW agreement between farmers and rural contractors has been created to account for input price volatility over the growing season.

Called the Forage Trading Agreement, it is a template that aims to provide certainty for both parties in the midst of uncertain fuel and fertiliser prices. It was developed by Federated Farmers in conjunction with Rural Contactors New Zealand.

The federation’s arable chair, Colin Hurst, said it gives growers and harvesters and purchasers an agile contract that can cater for spikes in costs and help ensure no one is unfairly out of pocket.

This has not been an issue in the past but covid-19, the disruption to supply chains and consequent roller-coaster prices for fuel and fertiliser sparked the problem, he said.

“Then we had the curveball of the war in Ukraine and those impacts. Last year the price of fuel went through the roof, and some rural contractors running expensive machinery with fixed costs basically lost money.”

Federated Farmers and Rural Contractors NZ contracted NZX to develop and regularly update fuel and fertiliser cost-reference indices.

This data will be available to members through both organisations’ websites later this month, and growers and contractors can take advantage of the flexibility of the new agreement to select what variable costs they want to move, and at what rate.

FAIRER: The new contract provides certainty for farmers and contractors navigating volatile input prices, Colin Hurst says.

“It doesn’t tell either party how to price, as everyone has their own cost model and pricing model. The template provided with the agreement is a guide to assist with being able to calculate the change in price,” Hurst said.

“The reaction from farmers/ growers and contractors has been very positive and we would be keen for any feedback to ensure suitability for all forage crops and also to cater for other key input costs.

“We think this is a valuable tool for the sector, one that offers a bit more certainty in these uncertain times.”

The new agreement and template to assist in calculating the variable costs are available now.

AUTOMAT FOR THE PEOPLE: The six dishes on offer at the Pure Box vending machine in Shanghai, China, feature either Pure South lamb from Alliance or beef from Silver Fern Farms.

AUTOMAT FOR THE PEOPLE: The six dishes on offer at the Pure Box vending machine in Shanghai, China, feature either Pure South lamb from Alliance or beef from Silver Fern Farms.

We want more and more consumers in China to get to know and recognise the benefits of New Zealand grass-fed beef and lamb through this Pure Box initiative.

Michael Wan BLNZ

PROUDLY NZ OWNED alleva.co.nz TURBO® is a registered trademark of Alleva Animal Health Ltd. TURBO Initial (A011703) is a registered pursuant to the ACVM Act 1997. See www.foodsafety.govt.nz for registration conditions. INITIAL Stage one of the TURBO 3-stage Cattle Drench Programme. Exclusive to veterinary practices nationwide. THE PROVEN WAY TO WEAN. COMBAT Parasites + Coccidiosis in a single dose 7 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 7

Start ordering with

With increasing national regulations and compliance, knowing where and when your nutrients have been applied on-farm is vital. From ordering to recording to reporting, we have you covered. Ensure you have the data you need when you need it. Order your fertiliser nutrients through HawkEye today.

HawkEye by Ravensdown

HawkEye by Ravensdown

RAV03OCT-FW 0800 73 73 73 www.hawkeye.farm

HawkEye

Order your Ravensdown fertiliser nutrients Record your proof of placement and activities Reporting made simple for nutrient tracking and compliance 8

Butcher bot pays in dollars per carcase

cutting system to be installed at its Finegand plant will allow 10 staff to be relocated to other roles.

THE introduction of robotic technology to the meat industry is driven by the need to recover more high quality meat – not the desire to replace people.

Scott Technology Automation and Robotics chief executive John Kippenberger said its fully automated lamb processing system does mean staff can be relocated, but the resulting improved meat yields achieved by using the technology can be measured in dollars per carcase.

Silver Fern Farms recently estimated that a new primal

Health and safety concerns and the current shortage of labour in the meat industry have made automated systems more attractive, but Kippenberger said the system’s $10 to $15 million cost means greater yield recovery is the primary driver.

The industry estimates it was short 2500 workers last season and it is not expecting much of an improvement this season.

Scott’s Dunedin plant is the global company’s meat centre of excellence from which it designs and builds lamb primal cutting systems.

It is developing a similar system for beef with Meat and Livestock Australia and has developed an automated system for trussing legs and wings of chickens for a US customer.

Kippenberger said robots are ideal for efficiently and consistently processing large, common cuts from a lamb carcase, but not for making variable or fine cuts.

“We will always need fine knife work on smaller cuts by skilled butchers,” he said.

The primal cutting system uses three xrays to take a 360-degree image of the carcase, from which it designates millions of reference points.

In less than a second a computer uses that information to determine the optimal cutting points and angles to allow the recovery the highest value meat.

All of this is done at 600 carcases an hour.

The systems have been installed in 14 plants throughout New Zealand and Australia, but the cost means processors need scale and size to make them viable.

Kippenberger said Scott is now selling some individual processing components that are incorporated in the primal cutting system, to smaller processors to perform

specific roles such as removing the chine bone.

This makes it affordable for smaller companies.

Developing a beef primal cutting system is potentially huge.

“Beef has all the value distinction of high-value cuts, chains operating at high speed, an industry ravaged by labour shortages and a need to keep people safe,” he said.

Through a client in the United States, Scott was asked to develop an automated system for trussing the legs and wings of chickens with string, preparing the birds for being cooked for sale in supermarkets.

The system replaces a task performed by hand and, depending on the model, can handle between 24 and 96 birds a minute.

Scott also owns a business developing an automated robotic material handling systems for warehouses.

Kippenberger said Alliance Group has bought a 10,000-carton handling system for its Lorneville plant and it is in the process of installing a 100,000-carton system for a client in the US.

Scott employs 650 workers globally, of whom about a third are in Europe and the remainder in the US, Canada, China, Australia, South America and NZ.

Other business units handle appliance manufacturing and sample preparation for the mining industry.

“Meat processing will continue to play a very large part in the next 10 to 20 years’ growth of Scott due to industry drivers not expected to go away,” he said.

Neal Wallace TECHNOLOGY Meatworks

BEEF’S NEXT: A fully automated primal lamb processing system in action.

We will always need fine knife work on smaller cuts by skilled butchers.

John Kippenberger

Scott Technology Automation and Robotics

SLICE: Scott Technology Automation and Robotics chief executive John Kippenberger.

Designed for strength. Built to last. Distribution Centres: Whangarei, Hamilton, Levin, Taupo, Christchurch, Gore 0800 347 259 greenwoodinfo.co.nz SHEDS YARDS BRIDGES GREENWOOD Calf Sheds Covered Yards Lifestyle Block Sheds Bells & Whistles Sheds GRW0004 9 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 9

Kiwi growers hail increase in RSE visas

Richard Rennie NEWS Horticulture

THE kiwifruit industry has welcomed the announcement by the government that it will lift the number of Recognised Seasonal Employer (RSE) workers eligible to come into New Zealand this season, adding 3000 more to the current quota.

New Zealand Kiwifruit Growers Incorporated (NZKGI) CEO Colin Bond said the decision by the government to lift the numbers to 19,000 will go some way to supporting labour supply for the preparation and harvest of the 2023 crop.

The workers are eligible to enter NZ from next month.

The move comes at a time when the kiwifruit sector alone estimates it is more than 3500 workers short at peak harvest time.

Typically, the sector employs about 2000 RSE workers and 6000 backpackers every season.

“NZKGI alongside our

colleagues in the horticulture and viticulture industries have worked closely with the minister of immigration throughout this process,” he said.

The RSE workers have been held in high regard by the sector for their off-peak pruning skills. This is an area where growers have experienced significant shortages in the past two seasons and where labour rates have pushed pruning costs from $10,000/ha to as high as $16,000/ha in some areas.

through the industry’s labour attraction campaign.

The shortage in workers has been held partly responsible for the quality issues experienced by the kiwifruit industry in the past season.

Zespri launched an industry-wide programme of improvement after experiencing record levels of fruit write-downs this season, resulting in growers having as much as $2.80 a tray wiped off returns for high-value SunGold fruit.

Expectations are this season that almost half of Green growers will either just break even or even suffer a loss partly as a result of the unexpectedly high fruit write-downs.

Growers also deliberately throttled back crop volumes this year in expectation of a labour shortage, pushing anticipated volumes down by almost 20%.

confidence to continue to invest heading into the 20222023 harvest.

“Any decision that helps our industry address its chronic labour shortage is good news,” she said.

In increasing RSE numbers from 16,000, Immigration Minister Michael Wood said, the government wants to strike the right balance to incentivise local employment, also requiring working conditions to be improved.

Government pressure on the industry to either bring in even more locals, or to automate processes further, appears likely to remain.

Pressure to further lift working conditions has also been applied by requiring employers to provide sick leave entitlements to RSE workers, in addition to the minimum wage requirement of $22.10 an hour introduced during the covid pandemic.

Bond said the RSE workers’ productivity results in employment growth generally, with NZKGI also continuing to run programmes to train and attract more New Zealanders to the industry, including

The wider industry has also welcomed the arrival of more RSE workers after supply was stifled by covid restrictions over the past two seasons.

Horticulture NZ CEO Nadine Tunley said the decision should give growers

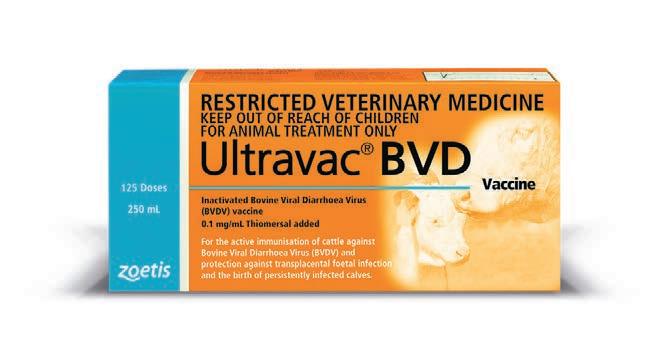

Stop BVD in its tracks.

The RSE numbers will also be backed by the 6200 working holidaymakers in the country now, twice as many as were here last year. Wood said he is confident that number will increase heading into summer.

A BVD outbreak could cause:

The most devastating impacts of BVD are on pregnant cattle and their unborn calves, so protecting heifers and cows from infection during mating and gestation is critical.

Protect the health of your herd by keeping your herd BVD free with Ultravac BVD®. A premium foetal protection vaccine proven in New Zealand.1 See your vet today.

Any decision that helps our industry address its chronic labour shortage is good news.

Nadine Tunley Hort NZ

BOOSTED: NZKGI chief executive Colin Bond said the additional RSE workers are a welcome boost to a sector well short of staff for the past two years.

• Decreased milk production • Poor conception rates • Persistently infected calves • Abortions, mummies, and stillbirths R Packianathan, WJ Clough, A Hodge, DK Holz, J Huang, GL Bryant & C Colantoni (2017): Prevention of fetal infection in heifers challenged with bovine viral diarrhoea virus type 1a by vaccination with a type 1c or type 1a vaccine, New Zealand Veterinary Journal, DOI:10.1080/00480169.2017.1291376. Zoetis New Zealand Limited. Tel: 0800 963 847; www.zoetis.co.nz. ULTRAVAC is a registered trade mark of Zoetis Inc. or its subsidiaries. ACVM No. A10730: RVM; Available only under Veterinary Authorisation.

10 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022 News10

‘NZ wants wool underfoot’

Annette Scott NEWS Fibre

NEW Zealand homeowners are turning their backs on synthetics, according to farmer-owned co-operative Wools of New Zealand (WNZ).

WNZ chief executive John McWhirter said wool carpets account for a greater proportion of WNZ’s partners’ retail sales than ever before.

“This rising demand is a clear indicator that more New Zealanders are considering sustainable floor options for their homes,” McWhirter said.

WNZ has launched a major consumer campaign to drive carpet sales as it prepares to mark 12 months since joining forces with the Primary Wool Cooperative-owned CP Wool.

“We are looking to leverage the increasing demand for wool

carpets in NZ as more and more Kiwis turn their back on synthetic carpets produced with fossil fuels.

“Most importantly, our wool carpets don’t cost the earth, they’re planet friendly and people friendly,” McWhirter said.

partnership with Flooring Xtra and other retailers last year.

“Retailers are clearly telling us that consumers want sustainable, renewable and biodegradable carpet made from wool grown right here in NZ.

“Kiwis are waking up to the fact wool carpets are now competitively priced compared to synthetic carpets.

“New Zealanders have a genuine choice between a synthetic product or a natural product direct from WNZ’s farmer-growers.”

Meanwhile, McWhirter said the merger between WNZ and the Primary Wool Co-operative-owned CP Wool has been a success.

The wool for the company’s carpets is grown by the more than 2000 kiwi farmers who own the WNZ co-operative business.

WNZ continues to welcome additional independent and retail chains to market wool carpets following the launch of a

“We now have over 80 staff, 11 wool stores, a carpet manufacturing partner, a NZ carpet distribution warehouse, over 150 carpet retail store partners in NZ, a UK office, many offshore customers, a strong well recognised Wools of NZ brand and loyal grower suppliers.

“For the first time we now have an integrated value chain from the grower through to the consumer.”

Scales goes big into Australian pet food processing

Hugh Stringleman NEWS Processing

SCALES Corporation is to invest more than $30 million in two Australian pet food processing ventures, expanding its currently very profitable Global Protein division.

Scales is subscribing for 33% interest in a new processing plant in Melbourne with two industryestablished partners who have extensive supply relationships.

At the same time it will purchase 50% of the Australian operations of Fayman International, including a 42.5% interest in ANZ Exports.

The combined cost is estimated at A$27m (about $30.7m), to be funded out of Scales’ existing cash reserves.

Scales has been cashed up since the divestment of the Polarcold cool storage business in 2019.

Scales’ half-year results in August contained a very good contribution from the newly named Global Proteins division,

which lifted underlying earnings to $30.4m, up 88% on the previous corresponding period.

It sits midway in the supply

chain of meatworks by-products to pet food manufacturers.

Scales operates in New Zealand, Australia and in the United

States, where very good operating margins were gained this year.

The NZ partner is Alliance Group in a partnership called Meateor, and the use of that name will now be extended to Australia.

Scales managing director Andy Borland said in August mainly offshore opportunities existed to grow the Global Proteins division, currently providing just under half of group revenue.

The Fayman International partnership announcement has been made just one month on.

“Australia’s product mix, growth and proximity to Asia make it a strategically important supply base for both our pet food customers and edible by-products markets.

“The partnership that we have entered into significantly strengthens our diversity of proteins and our supplier base. The investment also unlocks potential synergies in our seafreight logistics activities.”

Scales said it is investing in state-of-the-art equipment to

develop a high-quality processing facility.

The facility is expected to be operational in Q1 2023 and will scale up to full production later in the same year.

The partnership we have entered into significantly strengthens our diversity of proteins and our supplier base.

Andy Borland Scales Corporation

“Our partners include the Fayman family, who bring extensive supply relationships to the operation,” Borland said.

“Fayman International has been successfully developed and grown over the past 40 years and has strong relationships with suppliers and customers.”

The new Australian businesses are not expected to contribute to FY23 earnings.

“Our strategy to capture more value for our grower shareholders is on track as we ramp up branded consumer product sales, drive operational excellence into the

new business and really connect with our growers and customers.

DEMAND: WNZ chief executive John McWhirter says the company is looking to leverage the increasing demand as more Kiwis turn their back on synthetic carpets produced with fossil fuels.

PET FOOD: Scales managing director Andy Borland says Australia’s growth and proximity to Asia make it a strategically important supply base for its pet food customers.

For the first time we now have an integrated value chain from the grower through to the consumer.

John McWhirter Wools of NZ

11 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 11 Delivered to the farm gate of more than 24,000 Kiwi dairy farmers every month Advertise with us Call 0800 85 25 80

Cell survey has wrong number, say firms

Richard Rennie TECHNOLOGY Connectivity

AFEDERATED Farmers rural connectivity survey has been challenged by wireless internet providers on how representative it is of farmers’ cellular and internet links.

The report says that a third of farmers surveyed reported a decline in their cellular coverage in the past year, despite internet service providers frantically erecting additional towers under the government’s Rural Connectivity Group (RCG) initiative.

The annual survey suggests mobile coverage for many rural users is standing still or even falling behind where it was a year ago.

The survey also found that just over half the 1200 farmers surveyed had download speeds of 20Mbps or below, and 20% of farmers were still only experiencing 1-2 “bars” of signal on their phones, with the majority of that 20% regularly experiencing dropped calls.

But Wireless Internet Service Providers (WISPA) CEO Mike Smith said the negative results of the survey failed to gel with his experience on the ground in hooking up rural users to both cellular networks and the internet.

“There is a bit of a repeating trend in this survey. You will not get mobile coverage everywhere, and I wonder if it’s the same areas coming up every year.”

Over the past three years the RCG, which consists of the big three providers Spark, Vodafone

and Two Degrees, had installed 350 new cell towers by August. The target is to have 500 towers up by next December.

Smith said at some point the government and telco funding would cease for tower construction, and emerging “voice over” internet technology is starting to provide a means of filling in the gaps towers would not be able to achieve economically.

“We have clients up the Rangitata Gorge who can now make cellphone calls using Wi-Fi internet. Two Degrees have had it for a number of years, Vodafone launched this year and Spark have just gone live with it in the last month, although it’s not on iPhones yet.”

This technology can represent a $10,000-plus investment for a farm property. But Smith said it may also prove an easier funding option to install such tech for a rural community to share, providing the last link, rather than erecting another costly cellphone tower for relatively few users.

“You could also argue that in some areas where populations are growing the increased use is outstripping the investment.”

Federated Farmers telecommunications chair Richard McIntyre agreed that the increased use of newly installed infrastructure could be hamstringing rural cellular performance, but predicted this may only get worse, despite the investment.

“The sector has a fair few challenges ahead of it and in order to meet those we need to have connectivity similar to what urban users have.”

He pointed out that despite 5G’s arrival, a third of farmer respondents reported only 2G or 3G connectivity, and only a third had 75%-100% coverage across their farm.

Smith said Vodafone intends to switch off its 3G network in a

year’s time, but this will have a positive impact on 5G provision to rural users.

“It means they can just focus on 5G and 4G services, freeing up the spectrum and delivering it further.”

provider for over 10 years.

“It says you never know what is out there until you look. But it also suggests for some users there simply is no other choice to go looking for,” McIntyre said.

Both also welcomed the shakeup satellite technology has given the rural market.

The survey found satellite broadband use has increased 35% on last year to account for 19% of users, equal to high-speed copper, with wireless broadband accounting for a steady 52%.

Mike Smith WISPA

Both Smith and McIntyre highlighted the winners in rural connectivity stakes tend to be those farmers who regularly review their internet-cellular agreements and are not afraid to hunt out and shift to better technology.

Of those farmers reporting super-fast speeds of over 100Mbps, 70% had been with the provider less than a year. In contrast, of those reporting speeds of less the 5Mbps, 43% had been with the

Smith was confident the rural connectivity landscape would look even more robust in a year’s time, with significant gains in backhaul infrastructure coming since WISPA providers have been incorporated into network systems.

This year’s Budget included $60 million for rural internet upgrade, accompanying the additional $47m in Rural Capacity Upgrade announced in February, with the entire expenditure to be rolled out over the next three years.

A further $15m is destined for a Remote Users Scheme, targeting particularly remote locations with no coverage at present.

Be a part of NZ’s biggest agricultural community and help create a better future

OPTIONS: WISPA chief executive Mike Smith says there are an increasing array of tech options available to help overcome farmers’ internet and cellular issues.

NOT A BAR OF IT: Federated Farmers telecommunications chair Richard McIntyre says that despite 5G’s arrival, a third of farmer respondents reported only 2G or 3G connectivity, and only a third had 75%-100% coverage across their farm.

You could also argue that in some areas where populations are growing the increased use is outstripping the investment.

12 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022 News12 Follow us

farmersweekly.co.nz

ANDREW AND LYNNORE TEMPLETON, BEEF FARMERS, STRATH TAIERI

2019 OTAGO REGIONAL SUPREME WINNERS

“

The motivation that comes from seeing what’s happening in farms across NZ is just mind-blowing.“

AL BROWN, CHEF

13

BAL13643_BFEA_Muster_Campaign_FW_FP_Press_Ad_262x380mm_Templeton_FA.indd 1 19/09/22 12:33 PM

Synlait back to profit with record milk price

Hugh Stringleman NEWS Dairy

SYNLAIT Milk has returned to profitability while at the same time making an average payout to its farmer-suppliers for milk of $9.59, a little more than fully shared-up Fonterra suppliers.

The FY22 season base payout for Synlait matched Fonterra at $9.30/ kg milksolids plus the average incentive payment of 29c.

The incentives were paid for a2 supply, Lead With Pride and winter milk payments, and the average increased 2c on the season before.

Synlait has signalled a milk price in the current season of $9.50, which would be a new record for the company’s 285 farmers if achieved.

In the North Island, Synlait’s Pōkeno plant has 65 suppliers, up six in that season.

In the South Island the 2022 season began with 212 farms and some supply departures but subsequently a further nine farms have been recruited and the current number is 220.

The Lead With Pride certified farms have increased to 191.

In the year to July 31 Synlait increased revenue by 21% to

$1.66 billion but its total dairy production dropped by 4% to 206,000t.

Ingredients production fell by 12%, nutritionals jumped 47% but are still lower than the 50,00060,000t of previous years, and beverages, cream and consumer products were steady on the year before.

Because of higher inventories at balance date in FY21, ingredient sales in FY22 were up 5% to 132,500t and more milk went into production of infant base powders (nutritionals).

The milk collected was down 4.5% to 82.86 m kg, a result of a challenging season for farmers with poor weather conditions.

Adjusted net profit after tax (NPAT) was up $62.4m, turning a loss in FY21 to a profit of $34m in FY22.

Net debt was reduced by $137.5m as operating cash flows improved significantly and the debt-toearnings ratio has returned to 2.9x.

This financial year a range of 2.0x to 2.5x is being targeted.

Half of the capital expenditure during the financial year went on the Pōkeno plant in preparation for the as-yet undisclosed multinational consumer brands customer.

Production will begin early in 2023 and an investor day and site

Grant Watson Synlait

tour is planned for May 8. Products will be ready for southeast Asian markets in Q2 and

will be extended into Australia and New Zealand by the end of the year.

Chair John Penno said FY22 was a year of rebuilding revenue, reducing unnecessary costs, releasing working capital and reducing capital expenditure.

“Our ingredients business returned to its historical profitability, and our nutritionals business returned to growth, while we continued to invest in customer development across all business units.”

LOOKING UP: Synlait has signalled a milk price in the current season of $9.50, which would be a new record for the company’s 285 farmers if achieved.

Chief executive Grant Watson said Synlait is well positioned entering the second year of recovery.

“We have progressed our strategy, structure, capability, and culture and lifted our execution, but there is much more to do.”

He said the challenges of covid-19 had been managed in both Dunsandel and Pōkeno with hard work, commitment and innovation and that no more than 5.8% of the staff team were out of action at any one time.

J o i n o u r d i r e c t o r s a n d m a n a g e m e n t f o r a n u p d a t e o n t h e c o o p e r a t i v e ’ s p e r f o r m a n c e , p r o g r e s s o n o u r s t r a t e g y , e x c i t i n g p l a n s f o r t h e f u t u r e a n d t h e o u t l o o k f o r t h e y e a r a h e a d W e ' r e t h r i l l e d w e c a n m e e t f a c e t o f a c e a g a i n t h i s y e a r a n d l o o k f o r w a r d t o s e e i n g y o u a n d a n s w e r i n g a n y q u e s t i o n s y o u h a v e I f y o u k n o w a n y o n e e l s e w h o i s i n t e r e s t e d i n t h e c o o p e r a t i v e , p l e a s e e n c o u r a g e t h e m t o a t t e n d .

D I S T R I C T D AT E T I M E V E N U E

Omihi

Akaroa Darfield Blenheim Nelson Fairlie Oamaru Ranfurly Cromwell Balclutha Gore Heriot Tuatapere Winton Fortrose Mossburn

Monday 3 October

Tuesday 4 October

Tuesday 4 October

Wednesday 5 October

Wednesday 5 October

Monday 10 October

Monday 10 October

Tuesday 11 October

Tuesday 11 October

Wednesday 12 October

Wednesday 12 October

Thursday 13 October

Monday 17 October

Monday 17 October

Tuesday 18 October

Tuesday 18 October

7pm 1pm 7pm 1pm 7pm 1pm 7pm 1pm 7pm 1pm 7pm 1pm 1pm 7pm 1pm 7pm

Omihi Community Hall

Akaroa Golf Club

Darfield Recreation & Community Centre

Scenic Hotel

Beachside Nelson

Fairlie Golf Club

Brydone Hotel

Ranfurly Bowling Club

Heritage Collection Lake Resort

South Otago Town & Country Club

Heartland Hotel Croydon Heriot Rugby Club

Waiau Town & Country Club

Midlands Rugby Club

Tokanui Golf Club

Mossburn Community Centre

We have progressed our strategy, structure, capability, and culture and lifted our execution, but there is much more to do.

J o i n u s a t a n A l l i a n c e G r o u p R o a d s h o w m e e t i n g i n a t o w n n e a r y o u ! P r o u d l y N e w Z e a l a n d ’ s o n l y 1 0 0 % f a r m e ro w n e d r e d m e a t c o o p e r a t i v e . For further roadshow details and to register visit: events.alliance.co.nz

14 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022 News14

New global dynamics roil meat exports

certainty and longevity of frozen.

THE new export meat season is facing vastly different global dynamics to what has been experienced in the past few seasons.

After a record 258,000t beef arrived in August, China has eased back, while ongoing drought in the United States is forcing farmers to quit cattle, which is impacting that market.

For the coming season, meat companies are likely to reduce their reliance on exports of chilled lamb with customers wanting the

It’s not game over [in China], but it is switching down a gear.

Mel Croad AgriHQ

Silver Fern Farms (SFF) reports the influx of domestic beef production in the US has sharply increased red meat inventory.

The US Department of Agriculture said red meat stocks as at August 1 were 23% higher than a year earlier despite strong export volumes.

AgriHQ senior analyst Mel Croad said softer demand from the US saw plenty of beef shipped to China in recent months, but that market is now showing signs of slowing.

That is due to distribution issues as China enforces lockdowns to contain the impact of covid.

“It’s not game over, but it is switching down a gear,” she said.

Cold storage in the US is at a premium due to increased stocks of beef, chicken and pork, which the latest SFF newsletter warns creates a potential challenge for new-season beef exports.

New Zealand beef exports to the US in the year to date are down

sharply, with tariff rate quotas issued to August 31 25% lower by volume than the same period last year.

SFF reports only 51% of NZ’s US quota was used to the end of August due to stronger demand into north Asian markets.

Australian beef exports for August are also recovering, reaching 92,000t – a 23% lift over July exports of 75,000t.

“The next 4-6 weeks will be important to provide a direction in pricing and demand leading into end of year,” the meat company says.

Cost of living issues in the United Kingdom are expected to

worsen over the coming months as temperatures cool and energy costs and usage lift and spending habits continue to be impacted.

Any post-covid economic bounce is well and truly over, says SFF.

A shortened export window on the back of supply chain disruptions, coupled with apprehension about market performance over the Christmas period, has seen demand for chilled product reduce.

The company is picking a move towards more frozen lamb this coming season.

Commitments towards the Christmas chilled period have been mixed.

“Whilst some markets continue to operate in line with traditional volumes, others have taken a more cautious approach,” SFF notes.

Croad agreed, saying staffing and shipping issues have seen volumes decline in recent seasons, and those issues remain.

She said for both lamb and beef, demand in the upcoming Chinese New Year market will be closely watched.

Shipments will have to on the water in late November, early December.

SFF also notes that an increase in cheaper lamb out of Australia is affecting prices in North America, the Middle East and east Asia.

GENERATOR MAINTENANCE

Powerserv has developed class-leading systems to allow for robust standardized maintenance programs and load testing. Our trained generator technicians are trusted by major institutions, government agencies, and critical infrastructure clients.

GENERATOR SALES

Powerserv generators come from our partners in the UK, Europe and Asia. We select the best combination of engines, alternators and control system to suit your requirements. We only provide these from major respected brands to ensure quality and longevity.

Neal Wallace MARKETS Beef and lamb

CUT: Silver Fern Farms reports that a sharp rise in domestic beef production in the US has increased red meat inventory there.

Neal Wallace MARKETS Beef and lamb

CUT: Silver Fern Farms reports that a sharp rise in domestic beef production in the US has increased red meat inventory there.

GENERATOR Service, Sales & Support INSTALLATION - DESIGN - MAINTENANCE - MONITORING - REMEDIAL WORK HEAD OFFICE CHRISTCHURCH OFFICE 1/1Hotuhotu Street, Tauiko, Tauranga 3171 Unit 3, 62 Factory Road, Belfast, Christchurch 3051 www.powerserv.nz

Your single point of contact for all Emergency Power Systems 0800 679 800 24/7 Emergency Backup LK0113095© 15 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 15

Massive honey stockpiles as Mānuka buzz loses volume

Richard Rennie MARKETS Apiculture

MASSIVE stockpiles of both mānuka and non-mānuka honey are the downside of a decade’s worth of doubledigit growth as producers face the reality of disposing tonnes of product at severe discounts just to stay afloat.

Jane Lorimer, Waikato beekeeper and president of New Zealand Beekeeping Inc, said she expects to witness a lot of pain before any real gains come out of the industry’s current situation.

The country’s total stock of honey in storage is estimated to exceed one year’s entire production.

“There will be pain before we see any real gain, most definitely.

There are people who came into the industry thinking they would

make money relatively easily out of mānuka, only to find they now have to exit.”

Lower prices for blended and non-mānuka honeys have been prevalent for the past two years, but Lorimer said in the past six months mānuka is also feeling the sting of price pressure, particularly on the mid-range UMF mānuka grades.

Multi and mono-floral mānuka honey forms about 75% of NZ’s honey production, accounting for about 11,000t a year of exports.

Industry sources confirmed mānuka in the mid-range, which would have made $65-$85 a kg in 2018, is now struggling to make $25/kg. South Island mānuka of lower grade that used to fetch $36/ kg is now down to $20/kg.

Lorimer said the entire sector is being challenged on what constitutes a sustainable production scale.

Bee researcher Dr Mark Goodwin

has described NZ as being overstocked with bees, with total hive numbers peaking in 2019 at 900,000 – more than Australia has.

That total has now fallen to 800,000 in 2021 survey data, but is still double what it was 10 years ago.

Lorimer said she believes a more sustainable level is about 600,000 hives, and NZ’s current annual production of about 25,000t of honey is well in excess of the country’s ability to sell it in a timely manner.

I estimate there is probably at least 14,000t of honey sitting in storage around NZ, and some estimate it could be as high as 35,000t.

10 UMF rating selling for $22/kg, take it or leave it, and they have to take it.”

If storage temperatures are low enough honey can keep for years, but if not cooled adequately it can become suspect after only two to three years before a breach in quality levels renders it unsuitable for export to China and the European Union.

production in the past year.

IN AND OUT: NZ Beekeeping Inc president Jane Lorimer says there are people who came into the industry thinking they would make money relatively easily out of mānuka, only to nd they now have to exit.

“I estimate there is probably at least 14,000t of honey sitting in storage around NZ, and some estimate it could be as high as 35,000t.”

As a country, NZ consumes only 0.5kg per head a year, or 2500t.

“I understand a number of big corporates have dropped hive numbers and closed depots. There is going to continue to be a downward trend,” Goodwin said.

Cheltenham honey beekeeper and honey processor Jason Prior echoed Lorimer’s concerns about the sector’s immediate future.

He said blended and pasture type honeys had increased slightly from their lows of about $4/kg recently, to nearer $7/kg for clover honeys, but the brakes have been on

“We would normally have processed 100t, but only did 15t last year. People just stopped harvesting it.”

He said bank pressure on beekeepers and processors to move long-stored honey is ramping up as they seek working capital to kick off a new season with.

“I know of one beekeeper with 100t in storage and they have sold none of it.”

Retail prices in overseas markets remain firm, with distributors reporting solid sales in United States and United Kingdom.

“The issue is someone else is making the money. Brokers are not selling at a discount offshore, they know they can buy it from people here who have to sell it.

“There is mānuka honey with a

Prior said the impact on the sector has been worsened by a lack of focus on research and development. Lorimer acknowledged the industry’s failure to get a commodity levy over the line, but cited concerns over where the funds may have been focused if it had.

John Rawcliffe, spokesperson for the UMF Honey Association, said despite the challenges exporters have faced with covid and shipping, China, the US and UK all remain positive and growing.

But he acknowledged as an industry an adjustment to lower supply volumes is coming.

“During any boom a number of players have found it quite difficult when previously it may have been easy. Hives have dropped from 900,000 to an estimated 730,000 this year and will probably go lower still.”

AFTER THE GOLD RUSH: Cheltenham beekeeper and honey processor Jason Prior says in the past year production dropped from the usual 100t to 15t as ‘people just stopped harvesting it’.

Jane Lorimer NZ Beekeeping Inc

“Just a bit of feedback – they have survived... it’s a real kick seeing what they do to paddies...“ Peter Barrett – Linnburn Station, Central Otago (first release 2018). AVAILABLE NOW Boost Your Profits. Improve Water Quality. Contact us Dung Beetle Innovations Shaun 021 040 8685 shaun@dungbeetles.co.nz For more information or to order online go to www.dungbeetles.co.nz LK0113290© Farming For Our Future Generations 16 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022 News16

DINZ gives nod to new deer welfare code

minimum standards for milking deer, an initiative that has been developed since the last code was written.”

AREVISED Code of Welfare has been given the thumbs-up by Deer Industry New Zealand.

DINZ chief executive Innes Moffat described the draft of the updated code as positive and forward-looking.

“Most of the proposed changes to minimum standards are based on good farming practice.”

However, he said there are a few changes that will need further consideration by deer farmers and veterinarians who have experience with farmed deer.

Moffat said the deer farming industry is known for its high animal welfare standards, so the release of the revised code is not a reflection of welfare concerns.

The code, which had a minor update in 2018, has been revised by the National Animal Welfare Advisory Committee (NAWAC) after consulting with DINZ, deer veterinarians, the Ministry for Primary Industries (MPI), animal welfare lobby groups and experts in animal welfare.

“We are pleased the code clarifies the duties and responsibilities of farmers with proposed changes to include

There’s more guidance on mating management, managing deer in enclosed spaces and a

requirement for all farmers to have a written, up-to-date animal health plan based on veterinary advice.

As part of its review NAWAC is proposing a regulation prohibiting the use of electro-

immobilisation devices on deer.

DINZ will support this change as these devices are not suitable for deer and their use has long been discouraged, Moffat said.

“We will also support the NAWAC recommendation that there

be a new regulation requiring that, where deer are managed in intensive winter grazing systems, clean drinking water is available in the grazing area at all times.

“This is simply a reflection of good farming practice.”

During October DINZ will be consulting with deer farmers before drafting a submission on the code.

Moffat strongly encourages farmers and others whose work involves handling deer, such as deer vets, transport operators and stock agents, to read the draft code and to make their own submission.

Once consultation is complete and the code is gazetted, DINZ will ensure everyone in the industry has access to the new code and is familiar with the expectations and requirements for handling and managing animals.

MORE:

Full details are in the consultation documents available at https://www. mpi.govt.nz/consultations/proposedcode-of-welfare-for-deer/

Consultation closes at 5pm on November 10, 2022.

Submissions can be made online via the survey at https://www. surveymonkey.com/r/XNS37HW or by email to animal.consult@mpi.govt.nz

New disease prevention resources for sheep born in the digital age.

Up-to-date animal health information for New Zealand farms Vaccination options and product comparisons:

Detailed ROI calculators

Annette Scott NEWS Deer

DOING IT RIGHT: Most of the proposed changes to minimum standards in a revised Deer Code of Welfare are based on good farming practice.

Annette Scott NEWS Deer

DOING IT RIGHT: Most of the proposed changes to minimum standards in a revised Deer Code of Welfare are based on good farming practice.

17 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 17

Visit sheepvax.co.nz ACVM No’s A934, A11311, A11766, A9028. Schering-Plough Animal Health Ltd. Ph: 0800 800 543. www.msd-animal-health.co.nz © 2022 Merck & Co., Inc., Rahway, NJ, USA and its affiliates. All rights reserved. NZ-MUL-220800001

Awards on track for bumper crop of entries

Staff reporter SECTION Awards

BALLANCE Farm Environment Awards organisers are hoping for a record number of farmers to enter the 2023 awards.

Entries are open until October 15.

Run by the New Zealand Farm Environment Trust, the awards celebrate farmer and grower achievement and

VAXIPACK

RECYCLING LEARN MORE

showcase good practice enabling the sharing of positive growing and farming stories within the industry for the ultimate benefit of all New Zealanders.

Assessment considers the farm system including animal and plant care, biodiversity, business health, climate, people and wellbeing, soil, water and waste management.

The regional awards programme was adjusted to fit lockdown and level parameters, and was ultimately completed, but covid-19 affected not only the number of farmers choosing to enter but also the timing of the judging visits and the awards events.

New Zealand Farm Environment Trust chair Joanne van Polanen said the response from farmers, sponsors, and supporters to the recently held regional award events indicates there will be a strong number of entries to the 2023 awards.

It isn’t until you can’t, that you realise how important it is to connect with industry peers in a supportive and positive setting.

Joanne van Polanen New Zealand Farm Environment Trust

Joanne van Polanen New Zealand Farm Environment Trust

“The overwhelming consensus was that not only did the entrants really value the attention and positive feedback throughout, but those attending the awards functions and the resulting winners’ field days were grateful for the chance to connect with their peers and to be able to hear others’ stories,” Van Polanen said.

“It isn’t until you can’t, that you realise how important it is to connect with industry peers in a supportive and positive setting.”

The awards programme is designed to be a positive way to receive productive feedback on the entrant’s business to help identify strengths and to learn from others about the food and fibre sector.

“We have weathered the storm of covid-19, and early indications hint that conditions are now ripe for a bumper crop of award entries.”

The National Sustainability Showcase, which celebrates the Regional Supreme Winners of the Ballance Farm Environment Awards and announces the national winners of the Gordon Stephenson Trophy, will be held in Christchurch on Thursday, November 24.

MORE: Entries can be made online at nzfeawards.org.nz

Ballance Farm Environment Award categories 2023:

Ballance Agri-Nutrients Soil Management Award

• Bayleys People in Primary Sector Award

• Beef + Lamb New Zealand Livestock Award

your flocks’

and/or Selenised, the MULTINE ® range can

• DairyNZ Sustainability and Stewardship Award

needs. You can get exactly what your sheep require, right when you need it. That’s why MULTINE ® is New Zealand’s leading 5-in-1 clostridial vaccine range1

mineral and clostridial

more at www.sheepvax.co.nz

• Hill Laboratories Agri-Science Award

Norwood Agri-Business Management Award

NZ Farm Environment Trust Biodiversity Award

• NZ Landcare Trust Catchment Group Award

RECOGNITION: The national winners of the Gordon Stephenson Trophy for 2021, Linda and Evan Potter.

18 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022 News18 ACVM No: A934, A935, A11311 & A11766. Schering-Plough Animal Health Ltd. Phone: 0800 800 543. www.msd-animal-health.co.nz ©2022 Merck & Co., Inc., Rahway, NJ, USA and its affiliates. All Rights Reserved. NZ-MUL-2201700001. 1 Baron Audit Data, June 2022 Whether standard, boosted with Vitamin B12

cover

essential vitamin,

protection

Learn

Available from leading veterinary clinics and rural retailers. With a range of supplementation options to choose from, using MULTINE® ensures you get everything you need – and nothing you don’t. 5-in-1 + 2mg Vitamin B12 + 2mg Selenium 5-in-1 5-in-1 + 2mg Vit. B12 5-in-1 + 5mg Sel. Your farm, your solution. The MULTINE® range lets you manage how you protect and supplement your sheep.

®

Protein powers Fonterra’s FY22 earnings

Hugh Stringleman NEWS

FONTERRA’S earnings in nine channel and geographic divisions in the 2022 financial year differed widely from those in the previous financial year as high milk prices made it more difficult to capture added value.

Also, non-reference, proteinbased commodities like cheese and casein sold at steadily increasing premiums over reference products like milk powders and butter, thereby generating profits over the farmgate milk price.

Those two big influences on payout and profitability have been explained by Fonterra chief financial officer Marc Rivers after the annual results were published.

Both reference and nonreference products began the financial year, in August 2021, at or around US$4000/t.

The average contract price for reference products increased by 24% during the year, and that covers about 70% of the volume of Ingredients (or commodities) that Fonterra makes.

Non-reference products also increased in value, about 50% by the end of the financial year, and have kept on increasing beyond $6000 into this dairy season.

Ingredients revenue from NZsourced milk was $16 billion, up 10% from the previous financial year.

Price increases during the year for all ingredients generated earnings before interest and tax (EBIT) of $916 million, up an arresting 140% on the year before.

Rivers said the price relativities between reference and nonreference products show up strongly in the earnings in the Ingredients channel.

On the flip side, sale prices for Foodservice and Consumer products did not rise quickly and Fonterra’s gross margins were squeezed.

Foodservice and Consumer volumes and revenues were similar to FY21 but their earnings fell 60% and 55% respectively.

“That is because higher prices are slow to respond in those channels and consumers may resist paying, even stop buying,” Rivers said.

“But when dairy prices come down again the lag effect will benefit Foodservice and Consumer earnings.”

Fonterra reports earnings in three channels – Ingredients, Foodservice and Consumer – for each of three world divisions, Asia/ Pacific, Africa/Middle East/Europe/ North Asia/Americas (Amena), and China.

The biggest falls were Consumer earnings, down 70% in the Asia/ Pacific division and 150% in China, where Foodservice earnings were also down 43%.

Rivers said these big movements in earnings from year to year demonstrated the benefits of the spread of Fonterra’s products and market channels and its ability to change products streams.

Fonterra’s tightly regulated and heavily scrutinised farmgate milk price is based on a most-efficient notional competitor that turns all milk into reference products – milk powders, butter and anhydrous milk fat.

“Returns from non-powder commodities such as cheese and casein have largely been irrelevant in driving investment in the dairy industry over the past 10 years and are therefore not taken into account when determining the farmgate milk price,” Fonterra said in its farmgate milk price statement for 2022.

But last year non-reference protein products out-priced milk powders and fats and Fonterra captured higher margins, which flowed on to EBIT and profits.

such as futures markets, fixed milk prices matched to customer contracts, and more production optionality.”

Within the strategy and the 2030 targets is the expectation that Ingredients will take less of the milk pool and added-value

products will rise.

“How do we get more value for every drop of NZ milk – to show up in milk price and earnings.”

Analysts like most of Fonterra’s results

Hugh Stringleman NEWS Dairy

PROTEIN price relativities to powder products underpin Fonterra’s guidance for earnings per share of 45 to 60c for the 2023 financial year, Craigs Investment Partners says.

“Fonterra’s Ingredients earnings are clearly very sensitive to dairy price movements it has little control over, though it can capitalise on opportunities as they present themselves.”

dividend, they say.

The lower earnings from Foodservice and Consumer channels in FY22 were disappointing but Fonterra was able to divert volumes into higher returning streams in a high milk price environment, Jarden head of research Arie Dekker said.

Fonterra should have published more details of its review decision to retain the Australian business, he said.

targets, but they needed to see more successful execution.

“Contrary to history, current earnings remain elevated despite record high global milk prices that are typically a material drag on margins.

“The primary driver of the strong earnings performance and resilience is ongoing favourable price relativities between reference products and nonreference commodity products.

Rivers said such price relativities may not be sustainable in future and Fonterra’s 2030 performance targets for earnings and dividends did not rely solely on favourable stream returns.

However, it is true that pricing relativities between reference and non-reference products produced the main structural volatility in earnings, he said.

“We have improved tools to be able to lock in these margins,

If milk input costs remain elevated, the prices for Foodservice and Consumer products may adjust and earnings improve, Craigs said in a note to its clients after the Fonterra FY22 results.

Craigs analysts expect FY23 to be a supernormal profit year for Fonterra because of the favourable pricing relativities, forecasting $1.2 billion in earnings compared with $991 million in FY22.

That should flow into 51c a share earnings and 26c

“We would have liked to have seen more colour on review findings and importantly expectations for performance and investment in Australia over the next three to five years,” Dekker said.

However, without any selldown of Australia, the $1b capital return to shareholders was recommitted at a “significant level”.

Dekker seemed satisfied that could be executed in FY24.

Forsyth Barr analysts Matt Montgomerie and Andy Bowley said Fonterra appeared to be making solid progress to its long-term earnings and returns

“While a positive, we view this as lower quality earnings given the volatile nature of product pricing movements that is unlikely to be sustained at the same levels in future periods.”

Fonterra Co-operative Council chair James Barron said it was encouraging to see the business hit its targets for return on capital and earnings per share.

The council will want to see reduction of debt in FY23 as soon as the interim results in March.

Barron also noted the decision to retain the Australian business and yet still pay a significant capital return to shareholders and unitholders in FY24.

Mark Copeland LLB, CMInstD, AAMINZ

Available throughout NZ to assist with resolving rural disputes, including as an appointed Sharemilking Conciliator, Rural Arbitrator or Farm Debt Mediator

Rural Disputes Expert Ph: 07 345 9050 for an appointment e-mail: copeland@copelandlawyers.com

When dairy prices come down again the lag effect will benefit Foodservice and Consumer earnings.

Marc Rivers Fonterra

SPREAD: Fonterra chief nance o cer Marc Rivers, here with CEO Miles Hurrell, says big movements in earnings from year to year show the bene t of the spread of Fonterra’s products and market channels.

19 FARMERS WEEKLY – farmersweekly.co.nz – October 3, 2022News 19

Dairy

20

Aerial view opens eyes to wilding scale

Joanna Grigg NEWS Forestry

Joanna Grigg NEWS Forestry