Growth plan sees forestry boom ahead

Rennie NEWS Forestry

Rennie NEWS Forestry

ATRANSFORMATION plan to move forestry’s focus from logs to high-value wood products will nudge it up the ranks in export earning values if its goals become reality in coming years.

So said Minister for Forestry Stuart Nash at the launch of the forestry and wood-processing Industry Transformation Plan (ITP) at Fieldays.

He hailed it as an aspirational document providing a roadmap that includes lifting the sector’s export earnings for value-added wood products by $600 million by 2040.

With its broad cross-industry support from processors, iwi and politicians, Nash said, the plan is not “some document dreamt up by the Beehive”.

“We are talking about a concept not of volume, but of value,” he said.

He outlined the plan’s key initiatives, which include diversifying away from pinus radiata to alternative types, to account for 20% of plantings by 2030.

At present only about 10% of New Zealand’s exotic plantations are non-radiata. The plan sees planting as a means to improve the sector’s resilience to climate change and to reduce the

biological risk of monocultural plantations.

Another initiative is to invest in research identifying how the use of wood products can be increased in mid-rise and commercial construction.

At present about 1.4 million cubic metres of wood products are used in construction in NZ every year, and the plan is to lift this by an additional 400,000 cubic metres a year by 2030.

The plan also aims to have overall wood processing increase by 3.5 million cubic metres, or 25% by 2030, significantly scaling up domestic processing of underused lower grade logs and reducing the number of unprocessed logs exported.

The plan aims for the sector to help reduce national emissions by becoming a source of lowcarbon bio-alternatives to coal.

This includes providing over 16 million tonnes of wood fuel to replace coal, producing alternative fuels for transport, and providing 50 million cubic metres of wood biomass to replace 9 billion litres of fossil fuels.

Ray Smith, director-general for the Ministry for Primary Industries welcomed the ITP’s launch as critical to the sector’s future.

“MPI is keen to grow and support some of what we have lost over time from the sector,” he said.

Family fun at Fieldays

Nick and Hope Reid and their boys soak up the sunshine at Fieldays at Mystery Creek as what is traditionally a wintry day out took place in early summer.

Fully woolly fill makes for warm fuzzies

Wilson & Dorset’s industry-first fully woolly furnishing series has Amanda Dorset overflowing with excitement.

The

BLNZ.

OPINION 23

New Zealand’s first largescale vertical farm will soon start production in Hamilton.

1

PEOPLE 24

government’s U-turn on sequestration shows it is listening to farmers, says

NEWS 7

It was an outstanding year for the meat industry, but has it resolved all of its issues?

TECHNOLOGY 25 Vol 20 No 47, December 5, 2022 View online at farmersweekly.co.nz $4.95 Incl GST Communicator of the year 5

Continued page 7

Richard

SCOTT (ORCHARD MANAGER) OF WHIRITOA ORCHARDS, BAY OF PLENTY

CREATING OPPORTUNITIES FOR WHĀNAU AND THE LAND

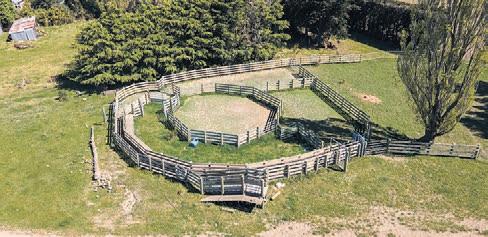

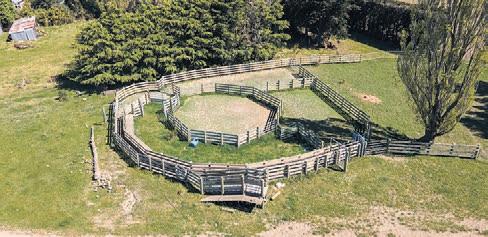

The whānau behind this Whakatāne property has transformed a struggling kiwifruit orchard into a top performer while also caring for and improving the land.

Whiritoa Gold and Whiritoa Organic orchards grow both conventional and organic gold kiwifruit across a total of nine hectares. Led by orchard manager Helen Scott, the team is striving to leave the land in a better state than it was found, for the enjoyment of future generations – whether or not they’re growing kiwifruit.

Since purchasing the land in 2017 and 2019, Māori Investments Limited has extensively developed the orchards. Whiritoa Gold was bought as a struggling, flood-damaged orchard and has since been transformed into a healthy, well-performing business.

A key priority was establishing good drainage and restoring soil health across the orchards and it has paid off. Most recently, they’ve lifted production so they’re harvesting an additional 10,000 trays of kiwifruit per hectare – up to a maximum of 21,000 trays.

Whiritoa is focused on carrying a sustainable, good-quality crop that cares for both land and plants. The team is trialling a mixture of cover crops and using fertigation to ensure the plants get the right nutrients.

and empowered so their work becomes a career rather than just a job. In addition, fresh vegetables are grown for the whānau to help improve their personal health.

The company’s overarching mission is to maximise the land’s potential, while acting as a guardian of its taonga – and this strategy guides all parts of the business. They see Whiritoa as a great opportunity to improve both whānau and land into the future.

As well as receiving this year’s Regional Supreme Award, Helen also received:

• Bayleys People in Primary Sector Award

• Norwood Agri-Business Management Award

• ZESPRI® Kiwifruit Orchard Award

Whiritoa entered the Ballance Farm Environment Awards to demonstrate the career opportunities they have created for their whānau. Hiring local is a priority, in particular creating employment opportunities for shareholders and their descendants. All employees are trained, upskilled

“The team is striving to leave the land in a better state than it was found.”

BAL13758_BFEA DPS Series Farmers Weekly DPS_Bay of Plenty_Taranaki_380x545mm_FINAL3.indd 1 2

HELEN

Congratulations to our 2022 Regional Supreme Winners

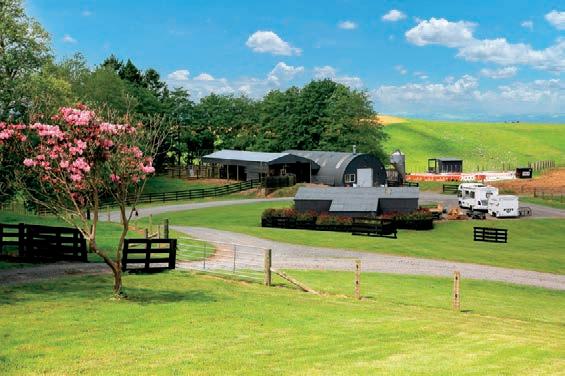

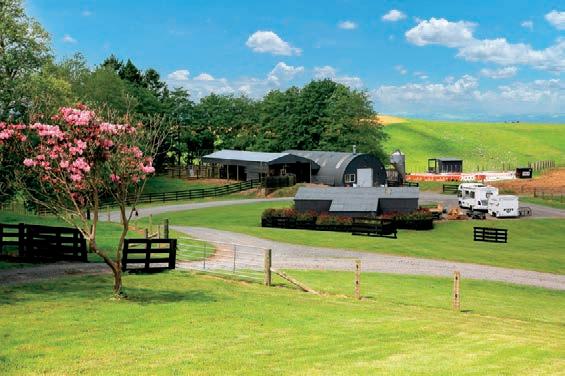

DAVID & SAMANTHA TURNER OF THE GRANGE, TARANAKI

THIS ELTHAM PROPERTY HAS SPECIAL MEANING FOR THE TURNERS

David’s great grandfather George Turner bought The Grange in 1880, cleared the land and established it as a successful farm that is now being managed by the family’s fourth generation. It’s no wonder that the Eltham property has special meaning for the Turners and that they feel privileged to be making daily decisions that aim to continually improve the property.

Twenty years ago, David returned from the UK with his wife Samantha and joined his parents in managing the sheep, beef, and dairy support farm.

Owned by a family trust, about half of the business is comprised of heifer grazing on a weight-gain payment system, with the balance split between sheep and beef.

300 dairy heifers are grazed for 12 months and leave the property in-calf. About 800 Romney ewes are mated to Romney or Polled Dorset rams, with female Romney lambs kept as replacements and the remainder sold prime.

The beef aspect of the business sees weaner calves purchased, farmed for about two years and usually sold prime, providing resilience to the farm.

classes to land carrying capacity as well as pest monitoring and control.

The family is focused on staff welfare, minimising waste, and increased biosecurity and putting time into increasing the farm’s biodiversity.

Looking to the future, they’re keen to further improve pasture management, particularly by replacing old pasture species.

With the farm’s significant family history, David and Samantha are most proud of being able to involve their children in the day-to-day running of the business and the work they are all doing to ensure its sustainability into the future.

Several sustainability initiatives are underway at The Grange, including the planting and management of riparian areas, where fencing is used to exclude cattle from many areas of the farm and a comprehensive weed management programme has allowed the riparian planting to flourish. The team has also had good success with the management of soils and matching livestock

As well as receiving this year’s Regional Supreme Award, David and Samantha also received:

• Ballance Agri-Nutrients Soil Management Award

• Beef + Lamb New Zealand Livestock Farm Award

• Taranaki Regional Council Sustainability Award

“The children are involved in the day-to-day running of the business.”

Visit nzfeawards.org.nz to learn more. 2023 AWARDS 28/11/22 4:39 PM

PROGRAMME UNDERWAY

3

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594 Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256 Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570 Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS 0800 85 25 80 subs@agrihq.co.nz PRINTER Printed by Stuff Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269 Sales & Marketing Manager andy.whitson@agrihq.co.nz

Steve McLaren | 027 205 1456

Auckland/Northland Partnership Manager steve.mclaren@agrihq.co.nz

Jody Anderson | 027 474 6094 Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Donna Hirst | 027 474 6095

Lower North Island/International Partnership Manager donna.hirst@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Debbie Brown | 06 323 0765

Marketplace Partnership Manager classifieds@agrihq.co.nz

Grant Marshall | 027 887 5568

Real Estate Partnership Manager realestate@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 0800 85 25 80 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print)

ISSN 2463-6010 (Online)

News in brief Fonterra changes

Legislation enabling Fonterra to undertake its capital restructuring has passed its final reading in parliament.

Under the Dairy Industry Restructuring (Fonterra Capital Restructuring) Amendment Act the new structure, which should be in place by March, will set out a new minimum shareholder requirement of one share per 3kg of milk solids produced, down from the current one-for-one requirement.

New McCain boiler

The McCain Foods plant in Timaru has converted its coal-fired boiler to one using woodchips.

The project has cost $5.6 million, of which McCain received $2.9m from the government’s Decarbonising Industry Fund. The new boiler will remove 30,000t of carbon from the atmosphere, 95% of the plant’s total carbon emissions. McCain has also implemented a heat-recovery system, using mechanical vapour recompression to reduce steam demand.

Woolhandling success

The rookie New Zealand woolhandling team of Angela Stevens and Cushla Abraham scored a win over Australia in a recent transTasman test match in Bendigo, Australia.

NZ’s Allan Oldfield and Tony Dobbs also won a bladeshearing test, maintaining NZ’s unbeaten record since 2010, but veteran Nathan Stratford and Leon Samuels and Stacey Te Huia were unable to break NZ’s sequence of defeats in machine-shearing tests in Australia since that year.

Ballance award winners

Ashburton father and son Phillip and Paul Everest are the new National Ambassadors for Sustainable Farming.

The pair received the accolade at the 2022 Ballance Farm Environment Awards in Christchurch. The Everests run Flemington Farm in Ashburton, a 255ha property they have expanded into a sustainable dairy and beef farm.

Back in 1860, exporting meat to the other side of the world seemed about as easy as nailing gravy to the ceiling. But a few determined kiwis took the bull by the horns and now our grass-fed beef and lamb is sought-after all around the globe.

At AFFCO, we see the same pioneering spirit alive and well in farmers today. We’re playing our part too – exploring every opportunity to take New Zealand’s finest farm-raised products to the world.

WWW.AFFCO.CO.NZ 0800 233 2669 our pioneering spirit tells us nothing’s out of reach WAVE200472 AFFJ200472 NZ Farmers Weekly Strip Ad FA.indd 1 24/08/22 3:22 PM 4 New Zealand’s most trusted source of agricultural news and information Contents Advertise Get in touch POLL POSITION: Global head of agribusiness for KPMG Ian Proudfoot says the food and fibre sector will become an election campaign battleground next year. STORY P14 News . . . . . . . . . . . . . 1-17 Ag&Ed . . . . . . . . . . 18-19 Opinion . . . . . . . . . 20-23 People . . . . . . . . . . . . . 24 Technology . . . . . . . . . 25 World . . . . . . . . . . . . . . 26 Real Estate . . . . . . 27-32 Marketplace . . . . . 33-34 Livestock . . . . . . . . 35-37 Markets . . . . . . . . . 38-43 Weather . . . . . . . . . . . . 44

Delivered by Reach Media Ltd

Gibson recognised for telling it like it is

Staff reporter PEOPLE Awards

FARMERS Weekly managing editor Bryan Gibson has been named Ravensdown Agricultural Communicator of the Year.

Given each year by the New Zealand Guild of Agricultural Journalists and Communicators, the award honours individuals or groups that have contributed to the agricultural industry

and community by communicating issues, events and information.

Gibson has edited Farmers Weekly since 2014, leading its editorial team through coverage of numerous contentious issues.

Ravensdown chief executive Garry Diack praised Gibson as a sought-after commentator on NZ agriculture.

“At such a tumultuous time for the rural sector, having a cool-headed, courageous and clear communicator at the helm of rural media is more

important than ever,” Diack said.

Guild president Neal Wallace said Gibson leads a team that is a trusted source of information and balanced stories.

“In a year that has been dominated by confronting issues for rural communities, we’re delighted to see Bryan recognised for his role in tackling deeply divisive issues with courage and wisdom,” he said.

The award was announced at a function at the National Fieldays.

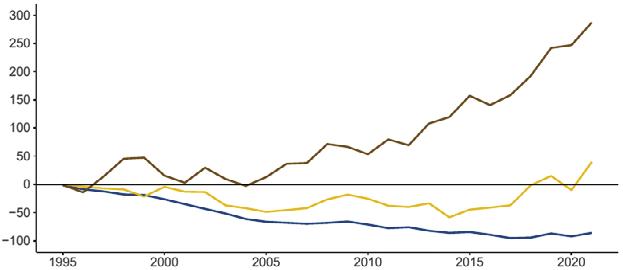

Land use has to change to meet targets

Neal Wallace NEWS Climate Change

FARMERS have the technology to achieve 2030 methane reduction targets but meeting the 2050 goals will require a combination of improved technology and land use change.

That is the conclusion of a report by Lincoln University’s Agribusiness and Economics Research Unit for Westpac, which focuses on the farm-level risks and opportunities expected from climate change.

“Importantly, the report finds there is already a range of existing management options available to assist farmers in strengthening the physical resilience of their farming systems and meeting NZ’s 2030 agriculture climate targets, with only a few requiring an initial investment of capital,” said Westpac’s head of agribusiness, Tim Henshaw.

He said the report is a summary of research for farmers on the

impact of climate change on agriculture.

Henshaw was enthusiastic that fine-tuning management means farmers can meet their first methane reduction targets, saying the key is to share knowledge and formulate a plan.

“There is no one answer here, no silver bullet but there are a bunch of things we can do,” he said in an interview.

The report found that changes to the management of feed, pasture, stock, effluent, crops and soil should enable farmers to meet 2030 targets, a 10% reduction below 2017 levels, but this may require increases in labour and upskilling. Fact sheets are included to provide guidance on what changes may be required.

Meeting 2050 targets will require new technology.

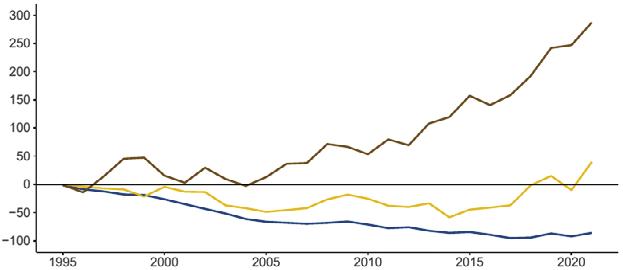

The authors warn New Zealand to expect ongoing warming throughout this century, with extreme heat and heatwaves likely to be more common and extreme cold temperatures and frosts likely to decrease.

Rainfall patterns may change, with the west and south of NZ wetter and the north and east of the North Island drier.

The intensity of extreme rainfall is likely to increase and winds more prevalent across central NZ, particularly in winter.

There is no one answer here, no silver bullet, but there are a bunch of things we can do.

Tim Henshaw Westpac

Tim Henshaw Westpac

Pasture growth is likely to increase but pests and disease may worsen and irrigation become less reliable due to water variability and drought.

Climate change is likely to increase heat stress in animals and plants and drought is set to become more frequent.

Dealing with these challenges requires a mix of cutting production costs through

efficiency, low-emission energy sources and farm equipment, increasing productivity through techniques such as precision agriculture, or grasping the opportunities presented by a warmer climate.

Cutting livestock numbers will require an accompanying improvement in per head productivity to ensure financial stability.

The authors say transitioning to low-carbon agriculture will create opportunities from increasing profitability from diversifying farm systems, product differentiation, preferential market access, securing intellectual property or earning higher prices from climate-related disruption in global markets.

Some farms are likely to be unprofitable in drought years.

Case studies show a Canterbury dairy farm facing a year-long moderate drought could have a 30% decline in operating profit widening to a 42% reduction from severe drought.

A two-year drought on a North

Island hill country farm could cause a 10% cut in operating profits for the first year, rising to 46% in the second.

Higher winter temperatures may affect the feasibility of growing green varieties of kiwifruit in the Bay of Plenty by 2050.

Transitioning to gold is climatically feasible but Zespri, which holds the licence and regulates the supply of licences for the variety, could limit the ability to transition from green to gold fruit.

Kiwifruit is the highest performing land use type in terms of gross margin per hectare, outperforming pipfruit and viticulture by over $15,000/ha and avocados by over $22,000/ha.

Henshaw said the report will help the bank finalise the shape of its Sustainable Agribusiness Loans project, which is being piloted this year with a small group of farming customers.

To qualify for discounted finance, customers must meet sustainability criteria.

5 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 5

EDITORIAL EXCELLENCE: Ravensdown chair Bruce Wills and the Ravensdown Agricultural Communicator of the Year, Farmers Weekly managing editor Bryan Gibson.

Photo: Emma McCarthy

Zespri moves to reset after bruising year

Richard Rennie NEWS Horticulture

THE COMING kiwifruit season will provide a reset opportunity for Zespri as it strives to lift crop quality and restore a bruised reputation after last season’s problems.

Zespri CEO Dan Mathieson said the company is pulling out all the stops to revisit its entire supply chain to eliminate the risk of another season where quality issues saw it pull $3.36 a tray off SunGold kiwifruit’s value and $2.10 a tray off Green’s value.

All up, growers have borne the cost of poor-quality fruit downgrades to the tune of almost $500 million, well up on typical levels of $120m-$150m.

Speaking to growers at Fieldays in Hamilton, Mathieson acknowledged efforts to look for greater transparency through the supply chain.

Covid’s corrosive effect throughout the economy was

highlighted by the kiwifruit sector’s struggles to harvest the year’s crop, at a time when it was already 6000 workers short.

Covid pressure right at harvest peak not only left growers without enough harvesters, but also left Zespri short on auditing crews.

The problems were also attributable to pressure on growers to deliver early-harvested fruit in an attempt to manage covidinduced staff shortages. The resulting volumes of long-stored fruit exacerbated the quality problems, with fruit eventually decaying.

“We know we incentivised growers for early-harvested, long-stored fruit. We are looking at how do we incentive better behaviour at harvest – if the fruit being picked is damaged, it doesn’t matter what happens after that, the damage is done.”

Similar pressures were experienced further down the supply chain and New Zealand staff had to work hard to remove as much damaged fruit as possible before it hit the shelves.

We are looking at how do we incentive better behaviour at harvest – if the fruit being picked is damaged, it doesn’t matter what happens after that, the damage is done.

Dan Mathieson Zespri

This year’s harvest of 167 million trays represented a step back in volume from the previous year’s 178 million trays.

Mathieson said he expects 2023’s harvest to be “flat at best”.

This was in part thanks to the October frost event that came hard on the heels of a below-average bud burst, the result of a lack of winter chilling.

Initial survey work indicates frost losses of 10-20%, and they are “more likely” to tend towards 20%.

The new Ruby Red fruit is likely to have incurred losses of 15-25% on its early commercial plantings.

Mathieson said the second year of lower-than-expected volumes did at least give the sector an

Nestlé-Fonterra partnership sets the stage for net zero

Richard Rennie NEWS Emission

A FONTERRA-Nestlé partnership to run a net-carbon-zero dairy unit in Taranaki ratchets up expectations on New Zealand dairy farmers to fall in line with growing pressure from global food giants to meet customer demands.

A bevy of political and industry heavyweights announced the launch of the Fonterra-Nestlé initiative at Fieldays at Mystery Creek, with Prime Minister Jacinda Ardern heralding the project as a

first for NZ and one that will give farmers the tools to meet zerocarbon expectations.

“We know we have to reduce our biogenic emissions from agriculture if we are to meet our global obligations and our customers’ demands,” she said.

She said her recent experiences travelling with assorted trade delegations and Minister of Agriculture Damien O’Connor had allowed her to see first-hand the expectations held in those markets when it comes to meeting zerocarbon goals.

“We have to lead the charge and the rest of the world is waiting for

us to show them how it is done,” she said.

Fonterra CEO Miles Hurrell told the gathered shareholders the dairy unit, which is being run with partner Dairy Trust Taranaki, will have some tough and ambitious goals to meet in coming months and years.

“This new partnership will look at ways to further reduce emissions, increasing the country’s low-emissions advantage over the rest of the world,” he said.

Nestlé is Fonterra’s largest and most important global corporate customer and has declared the goal of reducing its Scope 3

emissions as part of its goal of netzero emissions by 2050.

Scope 3 emissions are those emissions beyond the company’s immediate processing operations, extending to suppliers including farmers.

The Taranaki project will last five years and be run on a 290ha demonstration farm surrounding Fonterra’s Whareroa factory site.

It’s the first of its type in NZ, but Nestlé has more than100 pilot projects running with partners around the world, including 20 net-zero demonstration dairy farms in places as varied as South Africa and Germany.

opportunity to catch its breath as it reset quality parameters.

He advises growers to look further out to 2024 when Zespri anticipates a surge in SunGold volumes.

With an additional 750ha coming on stream between 2018 and 2021, and each 750ha tranche representing about 10 million additional trays, the sector is running behind on crop volume growth and well overdue for that volume surge.

Green growers are anticipating a particularly tough year with about half likely to either only break even or be in the red.

“Our goal here is to try and get orchard gate returns up to a consistent $7/tray.

“We are looking at opportunities to bring new Green kiwifruit to market.”

There are four varieties being trialled with the possibility a new one, offering a sweeter taste, will go commercial in 2027.

Despite problems at home, Mathieson was upbeat about market prospects. After an initial drop in Shanghai sales due to lockdowns, volumes have since lifted to pre-lockdown levels for both SunGold and Green.

Meantime the United States is showing growing promise with SunGold kiwifruit the fastest growing fruit item across the country’s fruit category for the past three years, and now totalling about 8 million trays.

Dung is a free gold mine of fertiliser and carbon, if buried. There is only one way to do that rapidly and sustainably. AVAILABLE NOW Boost Your Profits. Improve Water Quality. Contact us Dung Beetle Innovations Shaun 021 040 8685 shaun@dungbeetles.co.nz For more information or to order online go to www.dungbeetles.co.nz LK0113016© Farming For Our Future Generations 6 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 6

BETTER: Zespri CEO Dan Mathieson says Zespri is auditing its entire supply chain to resolve quality issues experienced last season.

Photo: Jamie Troughton/Dscribe Media

MORE: P13

WATCHING: PM Jacinda Ardern says the rest of the world is watching New Zealand to learn how we will manage emissions reductions in our farming systems.

Beef + Lamb hails sequestration victory

Wallace & Gerald Piddock NEWS Emissions

THE government’s U-turn on sequestration being included in a farm emissions pricing package shows it is listening to farmers, Beef + Lamb chair Andrew Morrison says.

It also indicates that the government understands the depth of ill-feeling that erupted among farmers following its response to the He Waka Eke Noa (HWEN) emissions pricing proposal.

“They have understood the angst that’s been caused and they have legitimately tried to address this,” Morrison said.

The announcement at Fieldays by senior government ministers will see recognition for more classes of vegetation that sequester carbon.

Prime Minister Jacinda Ardern, Agriculture Minister Damien O’Connor and Climate Change Minister James Shaw announced that from 2025 the government will start the process of collating all “scientifically robust forms of sequestration”.

Introducing more classes of vegetation into the Emissions Trading Scheme (ETS) will follow later. Ardern said submissions on the government’s response to HWEN confirmed sequestration

was a top priority for farmers and critical to making it work.

The HWEN partnership recommended amending the ETS to recognise more vegetation categories that sequester greenhouse gases, but the government’s initial response removed many of those proposed classes.

“It’s something the industry’s asked for but it does have to have a scientific basis. We are confident that we can work with industry on a strategy about how we can account for that on a farm-byfarm level.”

Ardern said the government will be releasing its full response to the HWEN consultation at a later date.

Morrison said it is important for New Zealand Inc that sequestration is recognised.

“Anything you’ve got on farm that’s legitimately sequestering carbon and is incorporated into the national inventory is one less carbon farm that’s going to go in,” he said.

For many extensive farmers, sequestration is the only tool they have available to mitigate the impact of emissions pricing.

“It was good to hear the prime minister reaffirm that.”

“You have to get it scientifically verified that it is actually sequestering carbon – and that’s what the government has announced – and sometimes that takes time.”

The process to jump into the ETS has not always been the easiest and this announcement means those areas of vegetation on farms are recognised until it becomes workable, he said.

He said he understands that it means vegetation on farms such as riparian planting and land in indigenous biodiversity will fall under the “transitional arrangements” definition cited by the government.

Exactly how long the transition will be is impossible to say, but it is less of a concern if a specific piece of vegetation is recognised.

Ardern said the latest move reaffirms a commitment that sequestration will be part of a farm-by-farm strategy on climate change mitigation.

Asked to elaborate on what the government meant when it said it would bring in all “scientifically robust” forms of sequestration into the ETS, Ardern said: “We have to make sure it’s credible, we have to make sure that it stands up internationally, so we have committed ‘yes’ to sequestration as being part of a farm-by-farm approach.

Morrison said it is pivotal that the government is committed to sequestration being recognised from 2025 and that “transitional arrangements” will be in place from 2025 with entry into the ETS to follow later.

That transition is important because scientific validation of different tree species takes time.

“But during that transition time, meanwhile that stuff you know that hand on heart is sequestering even before it goes into the ETS – we still would like that recognition.

Farming leaders – including Morrison – met with the prime minister and ministers at Fieldays on Wednesday, when details of the sequestration were further revealed.

Morrison believed that meeting prompted the prime minister to issue a clarification later in the day.

Rather than chalking it up as a win for the sector, Morrison said it needs to be done as it is in the best interests of the sector.

“If you want farmers to report their emissions and be liable for their emissions, they have to get their sequestrations recognised.”

exports can grow to over $11b by 2030’

Continued page 1

He was optimistic about prospects for NZ’s woodprocessing sector, looking across the Tasman at forecasts that Australia will be increasing its wood product imports from 16% to 30% by the end of the decade.

“Forestry is now sitting alongside horticulture, but exports can grow from $6 billion a year

to over $11b by the end of the decade,” Smith said.

Marty Verry, CEO of Red Stag Timber, NZ’s largest timberprocessing company, said the plan is a good initiative, but there are some significant hurdles for the sector to clear to recognise greater value.

“The biggest hurdle for processors will be getting the value of stored carbon returned to

processors, the same way the value of grown carbon has been returned to foresters, transforming that sector in the process.

Foresters are selling logs and carbon, but processors are only selling wood.”

The processing sector continues to face significantly subsidised offshore processors capable of paying a premium for raw logs from NZ.

Longtime forestry consultant Dennis Neilson said he is wary of the ITP’s plan to increase the variety of species grown for forestry.

“My experience is that most wood baskets around the world will only have one, maybe two species,” Neilson said.

“NZ is talking about diversifying away from [pinus radiata], the most productive, fast-growing

timber in the world. We should be coming back to that, back to doing what we do well.”

He was also concerned about the plan’s failure to address a forthcoming slump in NZ’s timber harvest, with volumes predicted to drop from about 35m cubic metres a year to 25m cubic metres in only a decade’s time.

Contact your local store or call us on 0800 288 558 Delivery time may vary depending on colour & location. NEED A WATER TANK? WE HAVE MAX™ TANKS AVAILABLE NOW. • Tapered walls for increased strength & durability. • Arag lid for easier access & better seal. • Multiple access points around the dome. • Fully accredited. 7 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 7

Neal

NATIONAL GOOD: Andrew Morrison says it is important for New Zealand Inc that sequestration is recognised.

‘Forestry

We have to make sure it’s credible, we have to make sure that it stands up internationally, so we have committed ‘yes’ to sequestration as being part of a farm-by-farm approach.

Jacinda Ardern Prime Minister

RAV05DEC-FW 0800 73 73 73 www.hawkeye.farm Start ordering with HawkEye

With increasing national regulations and compliance, knowing where and when your nutrients have been applied on-farm is vital. From ordering to recording to reporting, we have you covered. Ensure you have the data you need when you need it. Order your fertiliser nutrients through HawkEye today. Order your Ravensdown fertiliser nutrients Record your proof of placement and activities Reporting made simple for nutrient tracking and compliance 8

HawkEye by Ravensdown

Costs shadow SOPI’s upbeat revenue tale

Richard Rennie NEWS Agriculture

DESPITE a globally volatile trade environment and continuing supply line disruptions, New Zealand’s primary sector is forecast to continue on its strong growth trajectory – but cost pressures are also surging.

The latest Situation and Outlook for Primary Industries (SOPI) report, released at Fieldays at Mystery Creek near Hamilton, forecasts 4% year-on-year growth in the sector’s exports to achieve a record $55 billion by year end June.

The forecast comes in almost $3b ahead of expectations, with relatively strong growth across almost all key primary sectors.

But dairy continues to do the bulk of the heavy lifting for the growth figures, with estimates of a 6% lift in export revenues to a new high of $23.3b.

Horticultural gains are estimated at 5% to $7.1b, arable up 5% to $265 million, and meat and wool is expected to experience a more muted 1% lift to $12.4b.

Forestry is expected to gain less than 1%, to $6.6b of earnings.

The continuing gains amount to an increase of $12b in earnings over the past five years for the

primary sector, or an average per annum growth rate of 5.5%.

In announcing the report, MPI director-general Ray Smith said the sector has displayed a remarkable level of resilience over the past year given continuing challenges to global inventory levels and supply chain issues.

He also acknowledged some of the headwinds facing the sector, particularly around cost rises.

Farm expenses across all costs lifted 15%, with fuel surging 53%,

Campaign to launch new strategy for wool

fertiliser 37% and interest rates 34%. He also noted that while world food prices are coming back from their peak, they are not back to where they were prior to their surge.

He also pointed to a global economic slowdown to about 2.2% in 2023, while climatic conditions are starting to manifest in seasonal farming operations across New Zealand.

Heavy rainfall, unseasonal frost conditions and exceptionally warm summers are all playing a role,

with this winter’s high rainfall specifically cited by the report’s authors for its impact on pasture growth and crop production.

The biggest winner from shifting climatic conditions was wine, with a warmer-than-average summer delivering a record vintage and exports soaring 27% to $2.5b in value in the horticultural sector.

China’s predominance in NZ’s trade patterns is not expected to fade in coming months, continuing to dominate, dairy, meat and forestry.

But Smith said interesting developments in trade patterns included the United States eclipsing Australia to account for 10% of NZ’s export markets to June 2022, nudging ahead of Australia’s 8%.

THE launch of new strategy puts the Campaign for Wool in the best possible position to accelerate its support of the strong wool sector, new chair Ryan Cosgrove says.

The Campaign for Wool New Zealand (CFWNZ), a charitable trust tasked with advancing the education and promotion of NZ wool, has made a series of key appointments and launched an ambitious three-year strategy.

CFWNZ will narrow its focus to three primary strategic pillars, ensuring that NZ wool, in particular strong wool, is better understood both in NZ and abroad as a fully sustainable, natural, high-performance super fibre.

Excellence in wool education will be key to its growth as the fibre of choice for future generations.

Ryan Cosgrove CFWNZ

Apart from Cosgrove’s appointment, two new executive roles have also been created. Tom O’Sullivan, CFWNZ chair of the past three years, moves into the role of general manager advocacy, and strategic consultant Kara Biggs takes on general manager strategy.

“These are big years ahead, but these changes bring real depth to the Campaign for Wool team,” Cosgrove said.

“We exist to support our fantastic wool producers and achieve the best possible outcomes for them in terms of strong wool promotion and price. But just as important we’re focused on ensuring conscientious, climateminded consumers have access to, and information about, sustainable products they can not only wear but also build and furnish their homes with.”

The three strategic pillars are strong wool education, promotion and advocacy.

Wool in Schools, an initiative that has seen more than 25,000 primary-aged children learn about the benefits and uses of wool, will be revamped and reinvigorated through the use of digital technology with a plan to extend

the programme into secondary and tertiary settings.

“There is already so much innovation in the wool space, including major technical advancements in the application of wool. Excellence in wool education will be key to its growth as the fibre of choice for future generations.”

A new digital partner portal will be developed to give CFWNZ’s brand partners across the supply chain, from wool producers to the manufacturers of woollen products, the resources they need to tell their stories well.

Wool promotion is set to focus more keenly on the benefits of wool in housing and architecture, with CFWNZ committed to

developing better ways for those at the coalface to specify woollen products in the buildings and infrastructure they create.

“Our builders, architects, designers and developers are in a position to really move the dial when it comes to wool use, but their ability to choose wool ahead of synthetic products remains a challenge.

“We’ll support them with the development of a toolkit that will allow them to specify wool flooring, panelling and insulation at the click of a mouse.”

CFWNZ will advocate for NZ wool globally, working with its brand partners, growers, industry and international counterparts to develop a stronger and more

He cited the recently inked United Kingdom free trade agreement as an opportunity more exporters need to recognise, often having dismissed the UK on grounds it is a market that is simply too hard and too distant to deal with.

“Maybe we need to think about it as more of a foreign market than we do. A good target would be to get the UK to 10% in coming years to even up the trade ledger a bit.”

At present the UK separate to the European Union accounts for only 2% of export trade.

“This is a really good report but not a straightforward one. When you get under the numbers, there are a lot of cost increases in there too,” said Smith.

cohesive market.

It will also advocate locally, specifically targeting the government.

“If government buildings and housing projects were developed using wool, our government could take a huge step forward in its goal of reaching carbon zero, supporting our community of committed strong wool growers at the same time.”

Cosgrove acknowledged O’Sullivan’s successful tenure as chair.

“Tom has been a huge asset to the Campaign and it’s fantastic that now we retain his considerable knowledge, passion and networking skills as general manager advocacy.”

9 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 9

UPBEAT: MPI director-general Ray Smith is upbeat about the SOPI predictions but cautions all sectors are exposed to significantly higher costs.

A good target would be to get the UK to 10% in coming years to even up the trade ledger a bit.

Ray Smith Ministry for Primary Industries

Annette Scott NEWS Wool

DIAL IT UP: New Campaign for Wool chair Ryan Cosgrove says builders, architects, designers and developers are in a position to move the dial but their ability to choose wool remains a challenge.

Better ruler needed for emissions measure

Richard Rennie NEWS Emissions

Richard Rennie NEWS Emissions

NEW ZEALAND’S

targets for reducing agricultural emissions may overshoot what is necessary to hold global warming below 1.5degC based on current metrics, but changes to those metrics do not mean agriculture gets a free pass to do nothing.

So says Victoria University Climate Change Professor David Frame, who has expressed his concerns over the use of the GWP100 warming measurement for determining NZ agriculture’s 10% reduction in methane emissions by 2030 and 24-47% by 2050.

This is on the grounds that the targets fail to allow for methane’s more rapid decay in the atmosphere compared to carbon dioxide.

The GWP100 measurement overstates the longer-term impact of methane on global warming, given the gas’s lifespan is about nine years in the atmosphere, compared to hundreds of years for carbon dioxide.

An evolving alternative measurement, GWP* or the warming equivalent metric, helps overcome this problem by more accurately representing

the increased warming impact of additional methane, while also allowing for its shorter lifespan.

In the case of the NZ livestock population, which is essentially static, the pulse and decay of methane means the net emissions amount is close to a static level, rather than contributing more over time to global warming.

In contrast, due to its far longer life, continuing emissions of carbon dioxide will continue to accumulate for hundreds of years due to that gas’s far longer life.

“But we are starting to hear some using GWP* as grounds

for not having to do anything, but that fails to allow for the fact agricultural activity has contributed to the warming we have had to date,” Frame said.

Frame grew concerned after hearing GWP* bandied about at farmer meetings as a means for the sector to be let off the hook on any emissions reductions.

“You may not be contributing to additional warming, but the activity has still contributed to the warming experienced to date, and that has to be also accounted for,” he said.

Beef + Lamb NZ GM for engagement and communications Rowena Hume said GWP* is still very much an evolving metric but has some significant value in calculating emissions targets at an international and domestic policy level, but not farm gate at this stage.

“You have a warming target of no more than 1.5degC increase, which requires a warming metric. GWP100 is not accurate for methane, which is stable or decreasing from NZ livestock.”

Global, and NZ, targeting for emissions reduction has been based on GWP100 calculations, but the world is waking up to what NZ has already worked out, that methane’s lifespan is significantly shorter than carbon dioxide’s, and this needs to be recognised.

“When the rules were being worked out, it was all about carbon dioxide, but it was recognised GWP100 was not that good for methane reduction calculations. Now countries are just starting to recognise the need to also deal with methane.”

While NZ may be nervous about leading the charge to GWP* metrics, Hume said there is value in the government starting to report NZ’s emissions using both GWP100 and GWP* metrics.

“There is an issue here where many climate scientists globally just want to see emissions bought down as quickly as possible, and methane is the easy dial to turn for quicker results than [addressing] carbon dioxide.

“But doing so does not buy much more time to deal with carbon dioxide, only a couple of years.”

There is still a need for agriculture to reduce its methane emissions under GWP*, but it is closer to a 10% reduction by 2050, not the 10% by 2030 as set out in NZ’s GWP100-based target.

As it stands, the targets put an undue amount of weight on agricultural methane with no similar pressure upon longer-lived carbon dioxide, which continues to contribute to accumulated carbon up until it becomes net zero, not due until 2050.

Despite the disparity, Hume is

adamant this is no reason to walk away from He Waka Eke Noa. “We have ticked some of the boxes. NZ has recognised the split gas, and has kept it out of the Emissions Trading Scheme as a result.”

However, using GWP* at a farmlevel measurement is fraught at this point.

“To bring GWP* to farm-level measurements requires data traceable back 20 years, which would be almost impossible for individual farms to do,” said Hume. She said it would also require data for every year going forward, and individual farm methane figures tend to bounce around, depending on things like climatic conditions and stock numbers held at a certain time.

“But its [GWP*’s] principals fundamentally underpin HWEN.”

We’ve got a facial

for your farm SealesWinslow have got you covered with a range of zinc-based products to help prevent facial eczema. Contact your merchant store or SealesWinslow today. 0800 287 325 | sealeswinslow.co.nz Zincmax+ An effective zinc water treatment with added copper and flavouring for ease of use. Mineral Max with zinc* A balanced granulated mineral supplement with zinc, for easy blending and easy flow in silos. *Only available in the North Island

A consistent supply of pellets with zinc in every mouthful. 10 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 10

eczema solution

Bulk pellets with zinc

WARMING: Professor David Frame cautions that GWP* is not a get-out-of-jail-free card for the primary sector’s emission targets.

We are starting to hear some using GWP* as grounds for not having to do anything, but that fails to allow for the fact agricultural activity has contributed to the warming we have had to date.

Professor David Frame Victoria University

Knock down grass weeds for thriving forage crops

Remove grass weed competition in a wide range of forage crops and allow them to thrive. A combination of SeQuence ® and Bonza Gold ® will control over 20 grass weeds.

Contact your local Rural Supplier or Nufarm Territory Manager today for more information or visit us at nufarm.co.nz/sequence

ONF207188NF

®Sequence is a registered trademark of Nufarm Australia Limited. ®Bonza Gold is a registered trademark of Nufarm Limited.

11

NZC_SF_Advert380x262outlines.indd 1 8/11/22 5:06 PM 12

Growers urged to use seed costs calculator

Annette Scott NEWS Seeds

RAMPANT inflation and static pricing on the back of a poor harvest have seen growers move away from herbage seed production as others question its long-term viability.

But despite headwinds in international markets, the scene is set for change. With seed firms poised to release next year’s contract offerings, Federated Farmers is encouraging herbage seed growers to use its cost-ofproduction calculator.

Using the specifically designed calculator, growers can evaluate price and terms in relation to their own production costs.

Federated Farmers herbage seed subsection chair John McCaw said the spreadsheet, available on the Feds website, provides a valuable tool to compare the relative merit of seed production contracts from competing firms.

Feds worked with a group of growers to create the spreadsheet in response to concerns about a lack of profitability in the herbage seed industry.

Rather than simply demand a certain price for seed, Feds

was keen to work with industry to understand the true cost of production and quantify the extent of the problem.

In that, they have been highly successful, McCaw said.

The group held a roadshow, meeting individually with 11 seed companies to present and discuss the spreadsheet.

“In every case they were well received and the call for improved pricing and profitability was widely supported,” McCaw said.

He is cautiously optimistic.

“The industry has never been so united. We’ve had a series of similar conversations with all the major seed firms and we’re all on the same page.

“The scene is set for real change, but we face headwinds in international markets.”

Strong supply, particularly out of Denmark, combined with reduced demand due to sanctions against Russia and drought in China, has seen a correction in international pricing, while elevated freight cost and shipping

Zespri launches strategy to address climate change

ZESPRI has released a climate change strategy to help its industry deal with the impact of a more challenging growing environment, featuring dozens of actions required in coming years.

In launching the plan, Zespri’s industry and sustainability officer Carol Ward acknowledged the sector is already experiencing and responding to climate change, with growers adapting practices in response.

This includes greater use of totally enclosed orchard structures to offer hail protection, increased use of irrigation and the use of shelterbelts to dissipate higher winds. Meantime there is greater investment in the development of new cultivars capable of withstanding climatic changes.

Beyond the orchard gate the strategy has also incorporated transitional risks arising in post-harvest packing and marketing of kiwifruit in markets. These include market and regulatory changes including emissions pricing, environmental labelling, and changing consumer preferences.

Indications are the European Union will be considering a carbon-type tax on imports over time, possibly including food products.

“We know that beyond the physical impact climate change will have, we’ll also see changes at a regulatory level, along with a heightened expectation from our customers and consumers that we are adapting our approach,” Ward said.

The 40 current and future actions in the

plan include supporting growers to adopt climate-resilient practices like efficient water use, investing in climate-resilient cultivars and developing a future-focused climate research programme.

The strategy also aims to recognise climate impacts in industry planning, assessing the effects of climate change on productivity and profitability, and lessening exposure to carbon costs by reducing emissions.

This season the industry has already been hit hard by a late frost in early October, with estimates of crop losses ranging from 10% to 30% across the wider Western Bay of Plenty region. Last season Opotiki growers faced massive losses due to an unseasonably strong wind event.

In 2017 a NIWA report identified risks facing the sector in the Bay of Plenty, where 80% of New Zealand’s crop is grown.

Lead scientist Dr Andrew Tait said Green kiwifruit in the Te Puke district was expected to face steadily declining production levels, becoming marginal by 2050 and likely to be unviable by 2100.

Tait identified the decline in winter chilling as the main impact on productivity, with fewer nights under the required 10degC at critical times of the year.

At present the industry is partially countering the impact of warmer bud-break periods using hydrogen cyanamide, known as Hi-Cane.

However, the future of this treatment is uncertain, with the Environmental Protection Authority recommending a fiveyear phase-out period for the chemical’s use, with little indication of any suitable replacement available yet.

delays continue to erode NZ growers’ competitiveness.

Of particular concern are the high-volume international seed traders who dictate the price of commodity seed, trading on volume and margin with no consideration of cost of production.

“Put simply, international buyers will not pay what New Zealand growers need at this point,” McCaw said.

“NZ seed companies now face the difficult balancing act of increasing the grower price in line with industry expectations whilst not pricing NZ out of international seed markets.”

Meanwhile, the domestic proprietary market remains stable, returning relatively strong returns to seed companies and providing greater opportunity to address low grower returns.

However, McCaw warns increasing domestic proprietary prices too far will incentivise the grey market of uncertified overthe-fence seed trading to the detriment of the entire industry.

The message to growers is that there will be no quick fix.

The market will correct but it will do so in a number of steps rather than one leap.

“We expect a significant lift in pricing for next season but not in

Things are so far out of whack it’s going to take some time to unwind.

John McCaw Federated Farmers

line with what the spreadsheet indicates is required.

“Consecutive price increases and reduced input costs are needed to return strong profits.”

McCaw has confidence in seed merchants understanding that profitable growers are key to the success of their businesses.

“The current situation is unsustainable. Growers are hurting and our resolve is strong.

“We need to keep the pressure on but continue to work collaboratively with the seed companies.

“Unfortunately, things are so far out of whack it’s going to take some time to unwind.”

Growers should expect a considerable range in pricing and terms across firms and across cultivars for the 2024 harvest.

McCaw said the cost-ofproduction calculator is a powerful tool to unite growers and give them information they need to respond to these price signals and optimise their crop rotation.

Full training provided – earn while you learn. Call us on 0800 462 874 or visit www.gobus.co.nz/opportunities 13 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 13

BALANCING ACT: Feds herbage seed sub-section chair John McCaw says NZ seed companies face the di cult balancing act of increasing the grower price in line with industry expectations while not pricing NZ out of international seed markets.

Richard Rennie NEWS Climate Change

Carol Ward

Tough times ahead will ask much of sector

Hugh Stringleman NEWS Economy

THE latest KPMG Agribusiness Agenda focuses on growth and resilience during very difficult times for the food and fibre sector.

The agenda was released at the agriculture sector breakfast on the first day of the deferred Fieldays in Hamilton.

Global head of agribusiness for KPMG Ian Proudfoot expects the food and fibre sector to become a General Election 2023 campaign battleground given the existing tensions, particularly around climate change.

This risks entrenching divisions among farmers and growers and between rural and urban.

He said 2023 is looking like it will be a tough year economically as the world goes through a much more traditional demand-driven recession, which will be longer lasting than the initial supply-side shock because of the response to

the covid pandemic.

Food and fibre companies will have to adapt quickly to the effects of sustained recession on consumers’ purchasing.

Investments to support longterm growth and prosperity will be different from the yield and quality enhancements of the past.

Proudfoot spoke of the need to have infrastructure in place to secure and enhance the sector’s licence to operate with the environment, the local community and consumers around the world, and future-proof the value chains that align with the needs of the community and customers.

“If we fail to invest in our licence to operate and let it slowly erode over time, it will be close to impossible for future generations to restore this,” Proudfoot said.

The second chapter of the 2022 KPMG Agribusiness Agenda has case studies illustrating aspects of food and fibre sector growth and resilience.

The themes are: taking control of reconnecting with the world, accelerating towards the future

of work, capturing the unique opportunity in decarbonisation, collaborating substantively, bold steps now to benefit future generations, and a food system that works for all New Zealanders.

The final case study looks at Meat the Need, Feed Out and the New Zealand Food Network, with

its 60-100 foodbanks across the country.

Meat the Need co-founder Wayne Langford, also national vice-president of Federated Farmers, said the challenge is food insecurity across NZ, to be addressed by donations from farmers without creating new

systems and infrastructure.

“The pandemic really propelled us forward and forced us to look at how we could leverage existing supply chain infrastructure,” he said.

“Silver Fern Farms gratefully came on board, and they now pack and distribute all donated meat for us.”

Langford said changing the mindset in the sector would force accelerated innovation, tackling biodiversity loss and new product development.

KPMG co-author Ainslie Ballinger said changing mindsets would bring full understanding of the true value of growing and producing food – not just the economic cost and benefit, but the cost to nature, the benefit and cost to our health and wellbeing, and cultural and social benefits.

“Collaboration and partnership lie at the core of the food and fibre sector achieving new growth, while having the resilience to weather further shocks that are bound to come our way,” the KPMG report concludes.

Bill heads off building in ‘dumb places’

Annette Scott NEWS Politics

BUILDING and maintaining assets in “dumb places” at risk from climate change hazards should be about to change with the introduction of the Local Government Official Information and Meetings Amendment Bill.

Farm real estate listings surge as rural uncertainties spill over

by the trading banks are now emerging,” he said.

WIDESPREAD discontent in the rural sector has spilled over into the rural real estate market with a surge in farms being listed for sale.

Real Estate Institute of New Zealand (REINZ) rural spokesperson, Brian Peacocke, said reports indicate a high number of farms on the market.

This, along with a levelling-out in farm sales following a 53% fall the month before, indicates some concerning trends in the rural sector, he said.

“Just what is triggering this large surge of properties for sale is yet to play out,” he said.

“Tension in the farming ranks is palpable, discontent with central government policies is intense, frustration regarding inexorable cost increases is a dark cloud; and given the profits recently announced by the banking sector followed by spiralling interest rates, accusations of price-gouging

There is also a mood of caution in the sector given that marketrelated signals reflect an easing in price levels for beef, lamb and dairy products. This is sobering and food for reflection, he said.

“Land values will inevitably come under scrutiny, particularly for the range of properties other than those considered by virtue of location, contour and a high standard of improvements to be at the top end of the quality range.

“On the positive side, extended periods of rain over much of the country is providing great conditions for spring grass growth and crop emergence, which is really pleasing for those on the land.”

REINZ’s latest data for October showed farm sales were down by 97, or -35.9% for the three months ended October compared to the same period 12 months ago. Overall, there were 173 farm sales during those three months.

In the year to October, 1501 farms were sold, 284 fewer than

were sold in the year to October 2021, with dairy farm sales down 7.2%, dairy support blocks back 20.4%, 16.0% fewer grazing farms, 13.2% fewer finishing farms and the same number of arable farms sold over the same period.

The median price per hectare for all farms sold over the three months to October 2022 was $25,270 compared to $31,360 recorded for three months ended October 2021, a drop of -19.4%.

The median price per hectare increased by 9.8% compared to September 2022.

In the regions, ManawatūWhanganui and the West Coast recorded increases in sales, up by five and four sales respectively, while Waikato and Canterbury recorded the biggest decrease in sales, back by 21 sales each.

In comparison to the three months ended September 2022, six regions recorded an increase in sales with the most notable being Gisborne/Hawke’s Bay, Manawatū/ Whanganui and Southland, where three sales were recorded in each region.

The bill includes provisions that open the door to greatly improved information on natural hazards such as flood risk and coastal erosion for property owners and potential buyers. It specifically allows for projected climate impacts to be considered.

We have a real and ongoing problem with building and maintaining assets in dumb places that stand to cost many property owners and ratepayers dear as the impacts and costs of climate change continue to worsen.

Welcoming the bill, Insurance Council of New Zealand Te Kāhui Inihua o Aotearoa (ICNZ) chief executive Tim Grafton said:

“We have a real and ongoing problem with building and maintaining assets in dumb places that stand to cost many property owners and ratepayers dear as the impacts and costs of climate change continue to worsen.

“Clearer requirements for councils around the inclusion of natural hazard information on land information memorandums

and protection for them in providing that information are long overdue.

“Individuals, communities, councils and lenders all need to know the long-term hazard outlook when considering committing to long-term borrowing, investment and maintenance obligations.”

The outlook should cover at least the next 50 years when such information is available, he said.

In particular, Grafton said, lenders and borrowers should have access to, and look carefully at, all available hazard information when considering applying for, or writing, a mortgage.

Beyond the enhanced provision of hazard information, it is also long past time that councils do more to simply stop development in high hazard zones, particularly those identified around the coast and in known flood zones, Grafton said.

Local government is at the forefront of responding to climate impacts that already cost communities many hundreds of millions of dollars each year.

Beyond the monetary loss is the impact on community health and wellbeing, risks to life and safety, loss of amenity value and environmental and cultural loss.

“No matter how well current coastal, flood or landslip measures stand up to today’s climate-driven extreme weather events, we know to expect such events to get more frequent and their impacts and costs more severe,” Grafton said.

ICNZ said data to the end of the third quarter puts the running total for general insurance losses for extreme weather events in 2022 at $298 million. The 2021 full year total was $324 million.

14 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 14

ELECTION ISSUE: Global head of agribusiness for KPMG Ian Proudfoot says the food and fibre sector will become an election campaign battleground next year.

Gerald Piddock NEWS Real Estate

LISTINGS LIFT: Real Estate of New Zealand rural spokesperson Brian Peacocke says widespread discontent in the farming sector could be behind the rise in rural properties for sale.

NZ pressed to meet growing US beef hunger

Scott MARKETS Beef

Scott MARKETS Beef

THE US will be in the market for more beef from global markets over the next three years as its own domestic production declines, according to a newly released Rabobank report.

But while New Zealand is among the major global beef exporters that could help fill the gap, its own supply constraints mean it will be challenged to find additional export volumes.

The report suggests given production constraints in many of the world’s beef-producing nations, international markets will struggle to meet the gap left by the US contraction, potentially leading to an increase in global beef prices and the redistribution of trade volumes.

In its Q4 Global Beef Quarterly, the specialist agribusiness bank says the reduction in the size of the US cattle herd is nothing new, but with numbers declining rather than building in recent years, it has to date not affected the amount of domestically produced beef reaching US consumers.

But that is expected to change, with the bank forecasting the tipping point will be reached in 2023 when US beef production should fall by 3%, with annual declines of 2%-5% possible into 2026.

On average, that is the potential loss of 400,000t to 500,000t of beef from the US production system per year during this period.

Behind this decline, the report’s lead author, Rabobank senior animal protein analyst Angus Gidley-Baird, says, is a natural cyclical reduction in cow numbers after the US herd peaked in 2019, compounded by the impacts of recent drought conditions and high feed costs.

The country’s retailers and restaurants are expected to look to the global market to fill this void.

The question is which beefexporting nations will fill the gap.

“While neighbours Mexico and Canada, the two largest suppliers of beef to the US, are likely to take up some slack, Canada is going through its own cattle herd liquidation phase and likely limited in what it can supply,” the report says.

“Australia and NZ, the thirdand fourth-largest US suppliers,

are the logical next options, but Australia’s recovery from its own beef cattle liquidation phase is being drawn out with some questions as to whether it will have the cattle available to produce the same volumes it has done in the past.”

NZ beef production is also expected to be limited with a forecast to decline 4% between 2023 and 2025, while Europe, not a big supplier of beef to the US anyway, is set to continue to record a structural decline in production over that period.

“This leaves South America, which has volume, but lacks the trade access needed to fill the sizeable gap in US production.

“Brazil’s production is forecast to grow over the coming years, but we expect production in Argentina to decline then plateau.

“In combination, these two major South American exporters will not increase production enough to offset the drop in the US, even if trade arrangements are changed to increase exportable volumes from South America,” Gidley-Baird says. For NZ, the report says, the total beef kill for the 2022 season was 5.2% behind the previous season with fewer

steers, heifers and cows processed.

“Ongoing delays have contributed to the lower slaughter numbers with labour shortages and unfavourable weather conditions the main contributing factors.

“Processors are currently experiencing increased pressure for space due to the wet, cold winter delaying cattle finishing which has caused a lag effect,” report co-author agricultural analyst Genevieve Steven says.

“The industry is hoping that summer weather conditions are favourable as the sector could face a significant headache if regions start to dry out and processing

capacity remains tight.”

Steven says consumer demand for NZ beef is being impacted by cost-of-living challenges across the globe and this is likely to flow though to weaker pricing over coming months.

Processor backlogs, logistics challenges, and weaker demand for beef are all likely to contribute to some of the heat coming out of the farmgate beef schedule.

Rabobank anticipates the farmgate schedule will soften through quarter four, moving below 2021 pricing levels, but remaining above the five-year average price.

WHAT DOES YOUR FARM’S ESG JOURNEY LOOK LIKE?

GROWING

“We really seeourselves ascustodianstothefarm… ESG is a long-term journey and it’scriticaltoestablish a long-term partnership with atrusted business adviser.” Jasper Holdsworth, Paringahau Station, Gisborne.

From planting out water ways and registering forest into the ETS, to calculating their on-farm emissions and developing a succession plan, Jasper and the Holdsworth family are on a long-term journey with their environmental, social and governance responsibilities.

What’s the next step on your ESG journey?

IDEAS

SCAN THE QR CODE OR VISIT BDO.NZ/ESGINAGRI BDO AGRIBUSINESS

BDO New Zealand Limited, a New Zealand limited liability company, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO New Zealand is a national association of independent member firms which operate as separate legal entities. WATCH THE PARINGAHAU STATION STORY

| PEOPLE | TRUST

LONG-TERM RELATIONSHIPS WITH THE LAND AND ITS PEOPLE

15 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 15

Annette

ON THE MOVE: Rabobank agricultural analyst Genevieve Steven expects the farmgate beef schedule will move below 2021 pricing levels, but still remain above the five-year average price.

Tough winter hits dairy submission rates

Gerald Piddock NEWS Dairy

SUBMISSION rates among New Zealand’s dairy herd are down across the country after the cold, wet winter caused farmers to struggle to get cows in optimum condition for mating.

The seasonal difficulties meant farmers were unable to build adequate pasture covers on their farms. This, along with the high cost of supplementary feed, meant many cows went into mating below condition.

LIC general manager of NZ markets Malcolm Ellis said most farms are now through three weeks of mating and as of mid-November, data showed submission rates are 1.8% down nationwide.

Earlier data showed rates were down 2.4%.

Ellis said the 2.4% rate was substantial because generally there is little material difference in submission rates year on year.

“It might be up or down 0.5%.

“It’s significant and the biggest annual hit I have seen.”

He believed that rates shortening up to 1.8% is indicative of later cycling activity and the use of synchrony by farmers.

“At -1.8%. that’s still a material impact on submission rates.”

He said the early season milk production data, which was back in nearly every region except Southland, was a fair indication of what was to come once mating begun.

Early indications are that this will impact non-return rates and it appears that this will be back this season too.

“That’s logical because if the conditions on farm are negatively impacting submission rates, it is likely that there is a negative

If you look across the country, the weather over the winter – it’s been one of the wettest, coldest and I think what we have seen is that there was simply not a lot of high-quality feed available.

James Smallwood CRV

impact on those that are cycling and being mated.”

He predicted a -1% or -2% reduction in six-week in-calf rates nationally, which will transpire to a 0.5-1% increase in empty rates.

CRV managing director James Smallwood confirmed that submission rates are back in all regions except for Southland.

“But if you look across the country, the weather over the winter – it’s been one of the wettest, coldest, and I think what we have seen is that there was simply not a lot of high-quality feed available.”

Smallwood said it had led to some choosing to use CIDR

Government told not to fix unbroken NZUs

Richard Rennie MARKETS Emissions

GOVERNMENT proposals to make NZ Units a financial instrument are being challenged by carbon traders as attempts to try to fix a problem that does not exist in the trading market.

NZ Units, or NZUs, represent one metric tonne of carbon dioxide or equivalent greenhouse gas from industries covered by the Emissions Trading Scheme (ETS), and are traded on the ETS market.

The government is seeking consultation from industry on its proposals to effectively legislate the units’ sale through financial regulation, similar to that used in other financial instruments such as derivatives and bonds.

The move, which aims to increase transparency in transactions, will require market operators to be licensed as financial operators.

But Lizzie Chambers, founder, and director of NZU trading company Carbon Match, said she is unsure about what problem the government is trying to address in a market that has been operating smoothly for over a decade.

“It appears they [the government] want to potentially build some sort of central platform. Yet most of the market’s functionality is already there, three times over,” Chambers said.

Classifying NZUs as financial instruments will bring another layer of compliance and regulation that she sees affecting many everyday operators simply seeking out a spot purchase of NZUs either for offsetting, or through forestry operations.

“So, the risk is that for those operators you remove pathways to market for those operating in the ‘retail’ aspects of unit sales.”

She said as soon as an NZU owner starts to use the units in a way not intended, such as for debt security or financing, they become

subject to financial rules already in play.

Given that the NZUs were issued by the government and endorsed and vetted by the Ministry for Primary Industries, and have been sold across a relatively small market uneventfully for a number of years, the move seems over the top, she said.

However, Chambers said there could be some value in changing NZU reporting regulations to require sales data to be presented in a real time as traded updates, similar to what the likes of stock exchanges use.

“That could be the motivation for this review, but you could do that without having to go and re-invent the whole exchange.

“You just need to require operators to disclose more frequently.”

The consultation period was also of concern, given its short window between now and December 15, with submissions accepted until Christmas Eve.

strategically on their cows to try to get them in-calf.

He said the challenging conditions along with the high milk payout and lift in input prices have seen farmers becoming more discerning with their genetics.

“I would like to see genetics get onto the balance sheet and not the profit and loss statement because what you’re trying to do is create that asset that’s underpinning your business going into the future, and I think now because the tools are there – particularly with the likes of sexed semen – you can be deliberate and underwrite that and say, ‘That is the animal I want’.”

Smallwood said demand for

sexed semen has tripled.

Likewise, Ellis said demand for sexed semen from LIC’s clients has grown by 90,000-100,000 inseminations this season.

“Sexed semen went from 17,00033,000 to 110,000-208,000 and now it’s looking like 295,000.”

Smallwood said if the dairy industry is going to achieve productivity gains while reducing its carbon footprint, it has to be more selective and identify its best cows and make sure it mates those to the best bulls.

The national dairy herd’s rate of genetic gain could be lifted significantly if farmers could get their replacement cows from the top third of their cows and mate those with the best bulls.

As for the remaining herd, if the farmer chooses to use beef genetics, the resulting calf has to be robust. Research shows there are genetics available that meet the requirements of beef finishers, he said.

Ellis said the fluctuations around the dairy-beef market mean some farmers are also looking to shortgestation genetics rather than beef genetics, to earn money from the extra days in milk rather than take a risk with a dairy-beef calf.

Those dairy farmers who do use beef genetics often change their preferred sire year on year. This season there was a significant lift in demand for Charolais sires with straw sales lifting from 45,000 to 85,000, he said.

“They are citing Charolais as a desirable breed because it’s respectable for calving ease, gestation length, it has good growth characteristics and most importantly the marker – a Charolais calf can be easily identified in a pen of calves.”

Nigel Brunel, head of commodities at Jarden, said his company is also taking an “if it ain’t broke don’t fix it” view on government efforts to turn NZUs into financial instruments.

“However, if they insist on making them a financial product then we would want them to use existing regulations and regulate through the Financial Markets Authority, rather than

create an entire new one.”

He also said the four-week timeline for consultation, coming after two years of discussion and signalling by the government, is far too tight for such a significant shift.

A Forest Owners Association spokesperson said the association is taking a wait-and-see approach to any regulations the government might adopt.

16 FARMERS WEEKLY – farmersweekly.co.nz – December 5, 2022 News 16

NOT OPTIMAL: The tough winter conditions meant many dairy cows came into mating below condition, causing a drop in submission rates.

DOUBLING UP: Lizzie Chambers says government plans to turn NZUs into financial instruments will create unnecessary complexity for spot and retail trades in the ETS units.

‘Smarter funding needed to save local government’

Richard Rennie POLITICS Governance

LOCAL authorities risk becoming unsustainable in coming years unless smarter solutions are developed to help them meet the massive infrastructure and climate change costs they face.

So says an independent review report on New Zealand local government, which highlights the problems and presents some solutions for restructuring funding. The report is open to submissions until late February.