6 minute read

Markets

Overview

Facial eczema (FE) numbers are going up instead of down due to warmer than average airflows across northern New Zealand, and an uptick in wetter weather too. Downpours in the upper North Island along with humid northerlies have combined to see spore counts jump up, and may continue to remain high for another week or two. Elsewhere, we’re basically in the early phase of autumn where it still feels like summer some days, and other days feels like winter is coming. A few more colder mixes are in the forecast over the next couple weeks but, generally speaking, many places are still leaning a bit warmer and drier than usual for mid to late April.

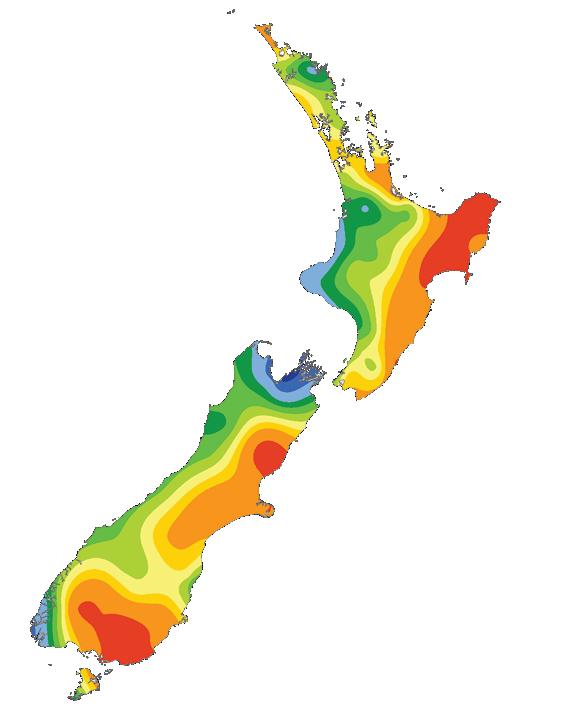

Soil Moisture

15/04/2021

Source: NIWA Data

Highlights

Wind

Not overly windy this week considering we’re in mid-autumn, but a storm in the Southern Ocean this weekend will graze the lower South Island with a surge of westerlies, potentially gale nor’westers by Sunday.

Temperature

While some colder air is getting into the country now – along with the longer, darker, nights making for cooler mornings – we are still receiving a lot of westerly and northerly airflows keeping temperatures up a little above normal for most of this week.

Highlights/ Extremes

Drier than average weather continues in the east but, in saying that, we do expect a little wet weather. Expect windy weather this weekend with a chance of gales south of Cook Strait on Sunday/next Monday and a possible nationwide storm next Monday/Tuesday.

14-day outlook

High pressure slides off NZ to the east this week, allowing a fairly large Tasman Sea low to move in. The low isn’t overly deep air pressure-wise, but will be dragging down mild, humid sub-tropical air, bringing some wet weather into both islands – mostly the north and west. After this, the westerlies return, surging off and on late week and into the weekend due to storms in the Southern Ocean. There is also potential for a storm next week over NZ – one to watch.

7-day rainfall forecast

0 5 10 20 30 40 50 60 80 100 200 400

We do have more showers and areas of rain for parts of NZ over the next week or two, but we’re still seeing a generally drier than average pattern in the east of both main islands for this week. To be fair, the first half of autumn often sees a lot of westerlies, which pile up rain clouds on the West Coast but leave many eastern areas, especially places like Hawke’s Bay, quite dry. A big low/storm in a week or so may bring better rain.

Weather brought to you in partnership with weatherwatch.co.nz

Pulse

US beef market upping the ante

Mel Croad mel.croad@globalhq.co.nz

THE US imported beef market has made strong gains since levelling off in February. Weekly price rises have pushed the market to levels only seen a handful of times in the past 10 years.

AgriHQ pegs the US imported 95CL bull at US$2.62/lb, about 45c/lb above this time last year. It’s difficult to draw many conclusions from this – covid-19 lockdowns last year were impacting global trade and depressing prices. However, compared to long-term trends, current prices are close to 40c/lb above normal. Interestingly, farm gate bull prices are at similar to year-ago levels, causing frustration for those with bulls to slaughter.

Heated market conditions in the US market are only part of the equation – the NZD is also sitting US11c higher than this time last year, almost completely negating any advantage of the stronger US market.

Previous spikes in the US imported beef scene have been limited. Last year prices peaked in May at US$2.65/lb, following a 40% drop in US beef production as covid-19 swept through processing plants. In late 2019, African swine fever and the subsequent rally in Chinese demand pushed US imported beef prices well over US$3.00/lb. Both spikes were short-lived.

To find a comparable season, when US imported beef prices experienced sustained upside, we must return to 2015. Back then the market was driven by herd rebuilding in the US post-drought. At that time, NZ capitalised on tighter supplies within the US. Then US imported prices hit mid US$2.60 in April, dipped as our own cull cow supply came on, and then soared as NZ and Australian supplies fell again through that spring.

This year, the US imported beef market has a very familiar feel to it. An optimist would comment that market dynamics are even stronger than six years ago. The US is heading into their busiest demand months, coinciding with the lifting of covid-19 restrictions and the return of the foodservice sector. While US supplies are sufficient this time around, their demand picture is significantly stronger, absorbing any extra production with ease. On the imported side of the ledger, the shortfalls in supply are well recognised. Australia is basically out of the running as their herd rebuild is under way. They simply don’t have the ability to service this market. There is little incentive for South American markets to up their volumes to the US either. This leaves NZ in the box seat, but even so, we are not yet in a strong position to capitalise on this growing demand.

The impending NZ autumn cow kill is dragging its heels, but at some point before June cow slaughter rates will increase. While it’s unlikely to pressure capacity like it did last year when covid-19 processing restrictions were in place, processors are still concerned. Any surge could create backlogs, more so when weather conditions in some regions are forcing extra stock into processing plants. It is becoming all too common that external factors are influencing market conditions, rather than simply supply and demand dynamics. Global shipping issues, that have been discussed at length in recent months, are still being cited as a major restriction to exporting. Based on data from the last two months, these issues have yet to impede on export volumes. However, if they intensify, that could impact our ability to capitalise on this strong US market. It is hoped exporters can work through these short-term issues. Market fundamentals over the mediumterm are shaping up for a strong recovery as covid-19 becomes a less dominant driver in our overseas markets. The key, however, is for this to translate back to improved farm gate prices.

South Island autumn livestock markets reflect prevailing confidence

Negotiating the uncertainty of a dry autumn and export markets that remain wary of Covid, South Island farmers are demonstrating quiet confidence, which is reflected in their recent demand for livestock.

PGG Wrightson South Island Livestock Manager Shane Gerken says this season’s South Island calf sales began positively. “Traditional steers are selling at auction between $3.10 and $3.20 per kilogram, with heifers selling between $2.50 and $2.60. “These values are in line with vendor expectations. After last year, when the selling season was seriously affected by the lockdown, we had little option other than to sell privately. With freedom from lockdowns this year, being able to revert to the status quo is therefore a relief for all concerned. Now that the bulk of calf transactions is once again undertaken through auction, vendors and purchasers can be confident that the market is arriving at true, open and transparent values for their stock,” he says. Meanwhile, with Canterbury cropping farmers purchasing store lambs to finish through the winter, Shane Gerken says that market is also steady. “Onfarm lamb sales are generating good demand. Market signals for sheep meat are positive, providing farmers with the confidence to buy lambs. “With anxiety about the lack of moisture starting to intensify in most South Island districts however, that positive mindset may be fragile and may not last without some decent rain in the next few weeks,” he says.