Staff reporter MARKETS

Beef

NEW Zealand’s beef producers are likely to continue a “golden run” of top farmgate prices until 2025 on the back of tight global beef supplies, according to a new Rabobank report.

However, new ideas and strategic investment will be needed to address the upcoming challenges of greenhouse gas emissions and bobby calf processing requirements, the report warns.

In the report, “Capitalising on tailwinds through to 2025”, Rabobank says the beef industry has performed exceptionally well over recent years.

“The New Zealand beef industry has grown exports by 94,000t or 21% over the last five years and enjoyed a golden run of pricing during this period,” said report author Rabobank agricultural analyst Genevieve Steven.

Growing demand from China has been the key factor, with its share of export beef almost doubling from 20% to about 40% in the past five years.

Steven said the outlook for New Zealand beef exports over coming seasons remains strong, despite the prospect of increased competition.

“Although beef production in Australia and Brazil is forecast to increase, we expect global beef production will remain tight

through to 2025 due to the re-build of the US beef cow herd,” she said.

“We also expect consumption of ground beef in the US will grow as consumers trade down to lowervalue beef cuts, in response to economic tightening. And this will play into New Zealand’s favour as we’re a key supplier of lean trimmings into the US for ground beef production.”

While the outlook remains positive, the beef industry needs to prepare for change.

The Paris Agreement is driving global markets to reduce supply chain emissions – the majority of which occur at the farm level.

“New Zealand farmers are experiencing these market signals via increased regulatory pressure. And afforestation plus emissions and freshwater regulations are also expected to drive a decrease in New Zealand beef production by 4% over the next three years.”

On top of regulatory challenges, the report says, the sector will also have to find ways to manage the increased need for bobby calf processing.

Fonterra is set to bring in new rules in mid-2023 that specify all non-replacement calves must enter a value stream such as dairy beef finishing, veal production or the pet food industry.

FMG and Melanoma New Zealand recently visited rural locations around the country with the FMG Spot Check Roadie, sharing life-saving information and giving FREE skin cancer spot checks. Thank you rural New Zealand for booking out every stop on the roadie, here are the surprising results.

Melanoma New Zealand checked 759 spots. Of those spots, 113 suspicious lesions were identified and referred for further analysis that’s 15% of all the spots checked.

14 potential melanomas were referred on for clinical review. Check out the stat map to see how many families now have the information they need to act.

It just shows how important it is to keep up to date with your skin checks. To find out more, head to fmg.co.nz/mnz or go to melanoma.org.nz/book-a-consultation

THESE RESULTS MIGHT SURPRISE YOU. 113 SUSPICIOUS LESIONS IDENTIFIED & REFERRED TOTAL 759 213 47 SPOTS CHECKED 216 17 SPOTS CHECKED 132 31 SPOTS CHECKED 198 18 SPOTS CHECKED WE BROUGHT THE FMG SPOT CHECK ROADIE TO TOWN. 1

must build on

run One country,

summers While the North Island mops up, South Island farmers like Jon Pemberton of Edendale could use some rain.

Beef

golden

two

Bee booze with a side of biodiversity Two mates set out to show New Zealand and the globe that all of NZ’s native honeys – and not just mānuka – can make premium products. PEOPLE 20 Vol 21 No 2, January 23, 2023 View online at farmersweekly.co.nz $4.95 Incl GST Down does not mean out 9 District’s new farmer buys top animals for ‘farm that is not going to trees’. NEWS 7 Insect pest fall armyworm found on West Coast after jumping the strait. NEWS 13 Premium fibre, say promoters of cashmere relaunch, is the G.O.A.T. NEWS 15

Photo: Natwick

NEWS 5

Continued

page 5

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page

Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570 Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

SALES CONTACTS

Andy Whitson | 027 626 2269 Sales & Marketing Manager andy.whitson@agrihq.co.nz

Steve McLaren | 027 205 1456 Auckland/Northland Partnership Manager steve.mclaren@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Donna Hirst | 027 474 6095

Lower North Island/International Partnership Manager donna.hirst@agrihq.co.nz

Omid Rafyee | 020 4087 9489

South Island Partnership Manager omid.rafyee@agrihq.co.nz

Debbie Brown | 06 323 0765

Marketplace Partnership Manager classifieds@agrihq.co.nz

Grant Marshall | 027 887 5568

Real Estate Partnership Manager realestate@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 0800 85 25 80 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

News in brief

Dry ice runs dry

New Zealand exporters are unable to source enough liquid carbon dioxide and dry ice, used to keep exports such as seafood and dairy fresh, following the closure of the Marsden Point refinery.

The Northland refinery produced CO2 as a byproduct of its refining operations.

Todd Energy’s Kapuni plant was the sole domestic producer of food-grade CO2 but it was shut down last month.

Gallagher expands

The Gallagher Group has expanded into Australia, purchasing Norton Livestock Handling Solutions.

Norton LHS, founded in 1989, offers Australian-made high-quality sheep and cattle handling equipment, under its family-values brand.

The purchase was finalised at the end of 2022, when the Norton team of about 45 people joined Global Gallagher.

SFF slots open

Applications for Silver Fern Farms’ next two farmer-elected directors are now open.

Incumbents Richard Young and Dan JexBlake both retire in May after completing their maximum three terms. Candidates must be a current shareholder of the cooperative and have supplied a minimum of 400 stock units to Silver Fern Farms for each of the past two years.

Scholarship win

Lincoln University student and AgriHQ cadet Emma Blom has been named as the first recipient of the Align Farms agriculture scholarship.

The scholarship covers one year’s worth of tuition in a food and fibre-related undergraduate program. Blom grew up in rural Southland and is studying for a Bachelor of Environment and Society at Lincoln University.

Need Help? Give us a call on 0800 787 254 www.rural-support.org.nz Rural people Supporting rural people 2 Contents New Zealand’s most trusted source of agricultural news and information Contents Advertise Get in touch HELPING HAND: Inspector Paul Carpenter, strategic adviser with New Zealand Police Operations Group, says the rural policing model is not broken but can be improved to support rural officers so they can do their job better. STORY P14 News . . . . . . . . . . . . . 1-15 Opinion . . . . . . . . . 16-19 People . . . . . . . . . . . . . 20 Technology . . . . . . . . . 21 World . . . . . . . . . . . . . . 22 Real Estate . . . . . . 23-31 Marketplace . . . . . . . . 32 Livestock . . . . . . . . . . . 33 Markets . . . . . . . . . 34-39 Weather . . . . . . . . . . . . 40

PRINTER Printed by Stuff Ltd Delivered by Reach Media Ltd

Labour woes may cost meat industry $600m

Neal Wallace NEWS Meat industry

MEAT processors expect to lose $600 million of export income this season by not being able to fully process carcases due to a second consecutive year of labour shortages.

The sector needs about 2000 workers, a situation processors describe as chronic, similar to last year and compounded by staff absenteeism due to covid.

Companies have recruited about 1000 staff from abroad for this season with more arriving, but this is already causing delays for farmers wanting stock processed.

The Meat Industry Association and Federated Farmers said more meat workers must be allowed into New Zealand.

“Ultimately, we will need overseas workers to make up the shortfall,” association chief executive Sirma Karapeeva said.

Alliance Group manufacturing manager Willie Wiese said low unemployment and insufficient labour in the regions where it operates means it cannot run plants at the desired capacity or meet all its customer orders.

This is especially significant in filling its chilled lamb programme

from page 1

“This will result in a significant jump in the number of bobby calves to process annually from mid-2023, and the meat industry is concerned about its ability to process increased volumes of bobby calves due to labour constraints and the highly condensed bobby calf season,” Steven said.

She said industry participants will need to keep an open mind

to the United Kingdom and Europe.

“We are leveraging our processing network to reduce the impact on capacity and have recruitment plans underway to help make up the shortfall, including promoting opportunities to work at the co-operative in our local communities and employing approximately 200 migrant workers from the Philippines, Indonesia and China,” Wiese said.

Silver Fern Farms has redeployed some North Island staff to its Finegand plant in South Otago to alleviate the shortage, as well as recruiting 360 offshore workers so far in addition to 250 already working here.

Delays in processing visas and uncertain flight availability has hindered their arrival, but they will be deployed to where there is the greatest demand.

A further 265 offshore workers will be joining Silver Fern Farms in the coming months.

Karapeeva also wants changes to immigration settings to address the shortage along with more timely processing of visas to ensure workers arrive at the right time of the season.

Halal butchers have been added to the government’s immigration Green List work-to-residency tier, but Karapeeva would like a special halal butcher visa category established.

to different solutions aimed at addressing these issues.

The report identifies two strategies that could reduce both emissions and bobby calf processing requirements – closer integration of the dairy and beef industries and capturing more value through net-zero carbon attributes.

“One benefit of closer integration is it would allow the beef sector to capitalise on the lower emissions profile of dairy

“The system needs to be significantly more aligned and responsive to the needs of our businesses,” she said.

Karapeeva said despite recruitment campaigns, investment in attracting and retaining talent and supporting training and development opportunities, companies are still finding it difficult to attract people.

SFF’s chief supply chain officer, Dan Boulton, said contrasting weather patterns mean higher numbers of animals are coming off farms earlier than previous seasons, which has been compounded by the labour shortage.

“Most of our processing sites are now running at planned capacity, and we will be moving livestock across our network to maximise the available capacity,” said Boulton.

“It will however take some time to work through the backlog from disruption over the past few months, and we will be prioritising areas affected by the dry conditions and our fully shared and loyal suppliers.”

Federated Farmers board member Toby Williams also wants a loosening of the border restrictions so more workers can be recruited abroad.

“From a farmer’s perspective, opening the borders is crucial to

beef cattle. Dairy beef cattle have significantly lower emissions per kg CWT than straight beef cattle, due to dairy cow emissions attributed to milk production,” she said.

Another opportunity, Steven said, is to more closely align dairy beef genetics with market premiums for beef.

“Improved feedback loops between the beef and dairy industries will help to ensure that the beef genetics being used

get workers in and it means more money for the country at a time when we need it,” he said.

AgriHQ senior analyst Mel Croad said demand for killing space will increase in the coming months, and this could

in the dairy industry align with market premiums, and that dairy beef animals meet finishers’ requirements,” she said.

A further opportunity, Steven said, was the development of a rose veal industry for New Zealand.

“Rose veal – the term given to beef cattle slaughtered at age 8-12 months – is a niche industry in New Zealand, with veal not commonly consumed domestically,” she said.

be accentuated by the staffing shortages.

A wet summer means North Island farmers have options but the South Island is starting to dry, which could create pressure for space.

Steven said the first step in developing a rose veal industry would be to find customers who are prepared to pay a premium for New Zealand veal over that of European competitors.

In addition to greater industry collaboration, the report says, there is an opportunity to capture more value across the carcase, particularly with regard to the development of net-zero carbon products.

www.wairererams.co.nz | 0800 924 7373

release! Wairere Nudie Auction March 1, Masterton 1pm Solway Showgrounds From the best hair sheep flocks in the UK 80 ram lambs, 30 first cross. February 1, Pahiatua Viewing day by private appointment. Rob Stratton 027 271 0206 Andrew Herriott 027 240 0231 Wairere Office 06 372 5784 News 3 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 3

First

Continued

CUT: Alliance Group manufacturing manager Willie Wiese says a lack of workers in the regions means the company cannot run plants at the desired capacity or meet all its customer orders.

O’Connor seeks rethink on weather relief

current environment”, O’Connor said in a recent cabinet paper.

MORE frequent adverse weather events have racked up pressure on the Ministry for Primary Industries’ relief funds –and Agriculture Minister Damien O’Connor is calling for a rethink.

“With climate change, severe weather events are becoming both more frequent and intense, and these have tested the resilience of rural communities. We want to front-foot this as much as possible,” he said.

“I have asked my officials for advice on what and how we best respond to adverse events in rural communities in the future, including what funding needs to be in place, and continue to encourage rural proofing across government.”

That would include a suitable suite of support measures with appropriate funding arrangements in place so the Ministry for Primary Industries (MPI) could be responsive in future years, he said.

The current budget appropriation is “inadequate in the

Budget 2022-23 had an appropriation of $530,000 for response and recovery assistance, which was used up in the first two months of the financial year, he said.

Funds were used after the August 2022 Nelson, Tasman, Marlborough and Northland flood events as well as for ongoing recovery from events of the previous year.

According to O’Connor, over the past two years MPI had reprioritised an average of $4.6 million baseline appropriation each year towards response and recovery.

“This is not sustainable,” O’Connor said.

According to the minister, the $530,000 appropriation was set by the cabinet 15 years ago and is now “inadequate” to respond to adverse events which are happening more regularly and with greater severity.

Once funding is exhausted, any extra money has to be sought either from the cabinet or reprioritised from baseline funding.

“This delays my ability to get timely financial assistance and welfare support to communities and industries where it is needed,” O’Connor said.

Cyclone Hale – which hit earlier this month – was classified as a medium-scale adverse event in the Tairāwhiti/Gisborne district, unlocking $100,000 in government support.

O’Connor extended the classification to include the Wairarapa, which unlocked another $80,000.

The storm left waterlogged fields, slips, flood debris and silt,

fallen trees and surface water in its wake.

“The debris on farms, hill slippage, road closures and damage to culverts, farm tracks and other infrastructure, means farmers and growers will face many months of work to get back on track,” he said.

In the paper, dated November 10, O’Connor sought cabinet approval for an additional $1.5m for the rest of this financial year for small and medium events, noting that “funding for larger-scale events that require a high level of support will still be sought from cabinet”.

However, a longer-term solution is needed because the $1.5m was a one-off and the appropriation will stay at $530,000.

“New Zealand has faced many adverse events in recent years ... The high number of events needing recovery support has put the MPI adverse event recovery programme under significant pressure.

“There is a pressing need to increase response agencies’ overall capacity to help communities respond to, and recover from, future adverse events,” O’Connor said.

Soggy soils plague East Coast fruit, vegetables

NEWS Horticulture

VEGETABLE growers on the river flats around Gisborne have been saturated for spring and summer and are heartily sick of the problems caused, the chair of the Gisborne Growers Association, Calvin Gedye, says.

“The prolonged wet weather and lack of sunshine are taking their toll and crops are not growing as they should,” Gedye said.

“We have produced perhaps half of what we planned, being both plant failures and lack of bulk and quality.

“Even the weeds look sick in some of the crops and we haven’t been able to side-dress nitrogen.”

Longer-growing vegetables like

cucurbits, tomatoes and egg plants haven’t grown properly and the fruits are unformed.

After a La Niña season last year Gedye said fellow growers were joking that they have had five winters in a row suffering a chronic lack of sunshine and cooler-than-normal temperatures.

Gisborne growers’ problems might not have an impact on national vegetable availability, because industry giant Leaderbrand has diversified geographically and is using a 10ha glasshouse.

Growers of field crops for processing have been impacted by the near-continuous soil saturation and inability to use machinery.

Ex-tropical cyclone Hale did not flood the Gisborne flats but every

10mm of rain that falls tops up field saturation, Gedye said.

But “Gisborne growers will survive; they always have”, he said.

About 50 kiwifruit growers on the East Coast have nagging problems from continual wet weather and lack of sunshine, local Kiwifruit Growers Incorporated representative Tim Tietjen said.

Some have lost up to 10-20% of vines through waterlogging and these will have to be replanted, probably with a Bounty rootstock that is more resistant to wet feet.

Fruit is sizing well, because of the additional moisture, but taste will be a concern without plenty more sunshine, Tietjen said.

Growers on the Gisborne flats have not been able to work machinery for spraying or orchard maintenance.

Tietjen had not heard from two growers further north in the Tologa Bay and Whāngārā districts as to the extent of flood damage.

Chair of NZ Apples and Pears Richard Punter said there is no question that the weirdness of the summer is going to produce mixed results for Hawke’s Bay growers.

“Lack of sunshine is a concern for fruit colour, and we have rather too much water everywhere in the orchards,” Punter said.

“The weather is not our friend right now.

“Growers are concerned that the bad outcome for last season now has the potential to be two seasons in a row.”

Citrus NZ spokesperson Matt Carter, a grower and marketer of citrus and persimmons in

Gisborne, said so far the fruit has been unaffected by storms and sizing is good in the lead-up to the start of harvesting in autumn.

However, trees are putting out a lot of new, soft growth – a haven for white fly, mealy bugs and thrips – and growers are battling to get insecticides sprayed because of wet ground conditions.

Fungicides to combat skin diseases are also overdue.

Gisborne is the centre of citrus growing, with 120 orchards supplying Carter’s company Fruit Fresh for export and the local market, and up to 250 growers out of New Zealand’s 300.

Harvesting of mandarins and lemons begins in mid-to-late April, followed by oranges, grapefruit, tangelos, limes and persimmons.

27 March, Christchurch Town Hall.

Earlybird rate $395+GST. (valid until 31 Jan 2023).

Learn more or book at ruralleaders.co.nz/forefront/

Platinum Gold

4 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 4

RURAL LEADERS WISH TO ACKNOWLEDGE THE SUPPORT OF FONTERRA FARM SOURCE AND CLAAS, PLATINUM SPONSORS OF THE 2023 RURAL LEADERS AGRIBUSINESS SUMMIT.

BusinessDesk NEWS Weather

Hugh Stringleman

TRYING TIMES: The increasing number of weather events needing recovery support has put the MPI adverse event recovery programme under signi cant pressure, says Damien O’Connor.

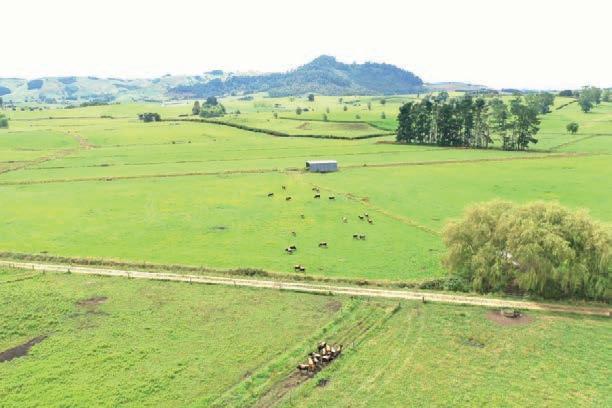

One country, two summers

Neal Wallace NEWS Weather

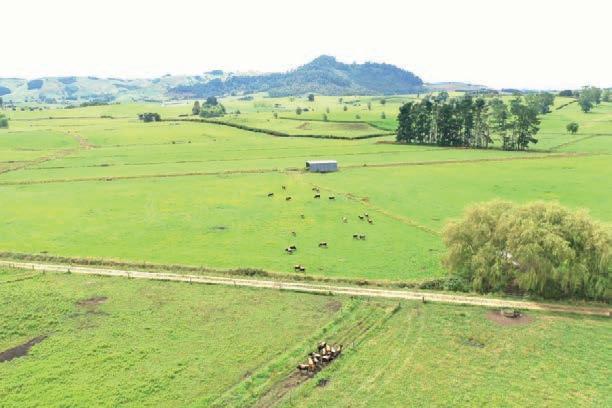

NEW Zealand is experiencing a summer of contrasts – wet throughout much of the North Island and what many in the South Island are describing as the best summer in years.

The NIWA soil moisture deficit map as at last Wednesday highlights the contrast between the two islands: most of North Island soil at or close to field capacity and the south at or below capacity.

Rain has been regular for most parts of the South Island, but farmers west of Nelson and in Otago and Southland would welcome a shower.

A lack of rain and continued forecast dry weather has prompted warnings from Environment Southland that water take restrictions could be imposed within a month.

A parade of cyclones have saturated the upper and eastern parts of the North Island but rain has been variable in the

southern half of the island, with coastal Taranaki, Tararua and Horowhenua getting dry.

Thunder-associated downpours have been a feature of summer, but rainfall totals have been distorted and isolated.

Manawatū Federated Farmers chair Murray Holdaway said a recent downpour near Hunterville caused flooding but further south it is dry.

Feed supplies in the Manawatū are adequate and there is plenty of supplementary feed.

His Taranaki counterpart, Mark Hooper, said 10 days of heat and wind have dried parts of the province.

“For this time of year crops are looking good and pasture is good but we are heading down the track of getting dry.”

Marlborough feds chair Evan White said parts of the province recently had a deluge of 139mm and others none or just a few millimetres.

White said there are concerns that as abundant growth dries off, it could create a heightened fire risk.

Soil moisture levels are high through Canterbury, creating

abundant supplementary feed.

Mid Canterbury president David Acland said it has been a favourable season for cropping farmers, but growers are looking for sunshine to complete the maturing and as the first crops are harvested.

Environment Canterbury reports that the alpine-fed Waimakariri and Rakaia rivers are flowing about half the long-term average for January but others, such as the Selwyn, are flowing at twice the January rate.

It has been a fickle summer in Otago and Southland, with most areas enjoying an abundance of pasture growth, but farmers in some areas would welcome some rain.

The Otago Regional Council reports the region’s rivers are approaching traditional summer low levels, but that could change without rain in the next month.

Lloyd Brenssell, who farms at Moa Flat in West Otago, describes the season as surreal and, in terms of growth, one of the best he has experienced, with parts of his farm dry and others quite wet.

One area had a rain event in which 120mm fell taking out a

fence and farm track, but a few kilometres away it was dry.

Southland Feds president Chris Dillon agreed, saying the normally summer-dry northern part of the province is relatively

wet compared to eastern and southern parts, which are drier.

“The province has a lot more feed than at this time last year but it’s got dry quite quickly.”

‘Don’t blame forests for flood havoc’, says NZFOA

THE NZ Forestry Owners Association has hit back at calls for a review of forestry practices in the wake of extensive flood damage on the East Coast, calling such demands “way out of line”.

The region was battered by heavy rain earlier this month, causing damage to property, roads and infrastructure. Some have laid blame on the forestry industry, a major player in the region, as log debris, or slash, blocked streams and rivers and added to the flooding woes. The government, which classified the cyclone as a medium-scale event, has made $100,000 available to help farmers and growers in the

region recover from the cyclone. The Environmental Defence Society (EDS) is demanding a commission of inquiry into forestry industry practices, and environmental forestry company Ekos says there is a need to move away from clear-cut forestry to continuous cover forestry methods.

EDS chief executive Gary Taylor said the flood damage is “yet again the consequences of inadequate controls over exotic plantation forestry operations, with massive inundation of private property by slash and debris from upstream forestry land”.

“It is time for a full-blown, independent commission of inquiry to take a fresh look at the sector, the rules that govern it, whether clear-felling with its adverse consequences should

continue, and where liability should lie for any and all off-site damage such has occurred at Tolaga Bay.”

NZ Forest Owners Association (NZFOA) president Grant Dodson said his heart goes out to those affected by the flooding but said Taylor’s claims “are way out of line”.

“This isn’t happening all over the country. It is the East Coast, north of Gisborne, and Separation Point at Motueka,” Dodson said.

It is “a legacy problem” on highly erodible land that has been cleared of native forest to make way for sheep and beef farming, he said. The land was returned to forestry 30-40 years ago to try to stabilise it, but erosion has continued.

Dodson said forestry companies are trying to address the forestry

slash issue by improving road access to sites and removing more debris. Forests are valuable assets and no one wants to see them washed down rivers.

The reality is, this was a cyclone and the government has recognised it a medium-scale event.

Dodson NZFOA

Dodson said forestry is an easy target, but it is important to note public roading and other farmland also failed during the latest storm. “Should we be reviewing public roads, as well? The reality is, this was a cyclone and the government

has recognised it as medium-scale event.”

Dr Sean Weaver, chief executive of Environmental forestry company Ekos, said the industry needs to stop clear cutting on erodible lands and transition to continuous cover forestry and permanent forests in vulnerable parts of New Zealand.

He said continuous cover forestry for erodible lands is common practice in many countries and undertaken on a small scale in NZ. Continuous cover forestry involves a range of practices, from single tree extraction to patch or strip felling, through to not harvesting timber at all.

Dodson, however, said continuous cover forestry is unrealistic in NZ’s economic environment.

Follow us

Be a part of NZ’s biggest agricultural community and help create a better future

5 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 5

farmersweekly.co.nz

GETTING DRY: It has been a bumper summer for most of the South Island but parts such as Jon Pemberton’s Edendale dairy farm in Southland would welcome a shower. Photo Natwick

Craig Page NEWS Forestry

Grant

RAV23JAN-FW 0800 73 73 73 www.hawkeye.farm Start ordering with HawkEye

With increasing national regulations and compliance, knowing where and when your nutrients have been applied on-farm is vital. From ordering to recording to reporting, we have you covered. Ensure you have the data you need when you need it. Order your fertiliser nutrients through HawkEye today. Order your Ravensdown fertiliser nutrients Record your proof of placement and activities Reporting made simple for nutrient tracking and compliance 6

HawkEye by Ravensdown

Ewes stay around as farm goes to trees

Stringleman MARKETS Beef and

COOPWORTH-Romney capital ewes sold at premium prices in the Dannevirke Ewe Fair and more than half the 4000 featured offering will be staying in Central Hawke’s Bay.

The vendor was the Te Maire equity partnership of farming leader Sam Robinson and Jason Wyn-Harris, son of Farmers Weekly columnist Steve WynHarris, also principal of Marlow Coopworths, Waipukurau.

The purchaser of the largest number of Te Maire ewes was a new farm owner in the district, who had stock agent Roger Watts buying on his behalf.

“The purchaser has shown his faith in sheep farming by paying for top quality sheep and taking on a farm that is not going to trees,” he said.

Watts said he was the underbidder on the two highest-priced lots – $245 for 300 two-tooths in very good condition, and

$250 paid for 500 four-tooths.

In total he bought 2438 ewes, concentrating on the younger lines of two-tooths, four-tooths, sixtooths and four-years.

Premiums of $20 to $40 over recent ewe values were paid at Dannevirke, the highlights being $240-$245 for two-tooths and $180-$195 for five-year ewes.

Buyers came from many districts of the North Island but competition for most lots of Te Maire sheep came down to two bidders, one represented by Watts.

“Before Christmas few would have picked such an intense clamour for what was admittedly a top-quality line up of ewe, the majority carrying strong reputations for their breeding potential.”

The Robinson family Te Maire property of more than 1000ha at Flemington, near Waipukurau, has been sold to Ingka Investments Forest Assets NZ, a foreign buyer that is largest franchisee of Ikea stores in the world.

The Hawke’s Bay market had strengthened by $20 at Stortford earlier in the week and Dannevirke added a further $20, Watts figured.

AgriHQ analyst Reece Brick, who attended the Dannevirke fair, said the top cut of four-tooths that made $250 went to the King Country.

Ingka told Land Information it proposes to subdivide and sell off the house and 280ha suitable for pastoral farming, and plant approximately 570ha with rotation forest during the 2023 and 2024 planting seasons.

The property already has 63ha of forestry.

The remaining 147ha will be unplanted, comprising native bush, buffer land, setbacks,

VALUE: The top cut of 2-tooth RomneyCoopworth ewes from the capital stock consignment at Dannevirke last week sold for $245.

Blackdale ram tops out the Texels

Neal Wallace MARKETS Livestock

A TEXEL ram bred by the Black family’s Blackdale Stud at Riverton topped this year’s Gore Ram Sale, selling for $15,500.

Callum McDonald, PGG Wrightson genetics livestock representative for the lower South Island, said the purchasers were Brian and Nola Howden from Waikaka in Southland and Sam Holland from Culverden in North Canterbury.

The next highest price fetched by a Texel ram was $9200 for a sire bred by the Busby family from Cromarty Texels, Invercargill. It was sold to Nathan and Joy Dodd from Glenvale Texels.

All 13 Texels offered at the fair sold, at an average price of $4146.

The top-priced Perendale ram was $12,000, bred by David and Malcolm McKelvie of the Kylemore Stud Wyndham.

It was bought by a syndicate of breeders, Gowan Braes, Snowden and Mt Guardian studs.

The next highest price for a Perendale was $10,500 for a Hinerua Stud ram bred by Julie Wilson and Peter Christie from Gore.

There were 33 Perendale rams offered, of which 27 sold for an average of $3404, $130 less than last year.

Quality sheep were chased, which is great to see people investing in top genetics.

McDonald said the prices paid for the top rams was refreshing, given the uncertain climate for sheep farming.

“Quality sheep were chased, which is great to see people investing in top genetics,” he said.

About 90 rams were offered, including Romney, Poll Dorset, Dorset Down and South Suffolk.

riparian areas, roads and tracks, Land Information said in releasing its overseas investment decision in August last year.

At the same time Land Information released another Ingka investment decision covering 285ha for forestry in adjoining Wanstead district.

Ingka purchased over 15,000ha of farm land and existing forestry in seven consents by the Overseas Investment Office during 12 months from August 2021 onwards.

In addition to the two properties near Waipukurau, there are two at Porangahau, Central Hawke’s

Bay, two stations totalling over 6000ha on the East Coast (Huiarua and Matanui), 5500ha on Wisp Hill Station, Owaka, in the Catlins, and 1120ha at Waimumu, near Gore.

After the Wisp Hill purchase, Ingka forestry manager Andriy Hrytsyuk told the Otago Daily Times that the company’s objective was production forestry, not carbon farming.

“Our approach to responsibly managed forestry provides jobs and economic growth on the same land while also making a positive impact on the climate, through carbon sequestration and biodiversity.”

Grass helps fatten lamb clearance rates in Te Anau

Neal Wallace MARKETS Lamb

AN ABUNDANCE of grass in Southland helped ensure a full clearance of 14,000 lambs from on-farm auctions at three properties in Te Anau in Northern Southland earlier this month.

PGG Wrightson agent Andre Yule said prices for lambs from the Plains Station, Cheviot Downs and Whare Creek were stronger than expected, with demand assisted by abundant feed.

The best lambs sold from $118$138, better stores $100-$115 and small to medium $78-$95 with most sold to Southland buyers.

Prices were back on last year but Yule said not as much as expected.

There are fewer store lambs on the market this year with some traditional sellers taking advantage of the abundant feed to finish lambs they would previously have sold.

7 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 7

Hugh

sheep

The purchaser has shown his faith in sheep farming by paying for top quality sheep and taking on a farm that is not going to trees.

Roger Watts Stock agent

SELL-OFF: The second cut of 4-tooth Romney-Coopworth ewes from a capital stock consignment at Dannevirke, in the nearest pen, made $242.

Callum McDonald PGG Wrightson

APPETITE: Prices for lambs from the Plains Station, Cheviot Downs and Whare Creek were stronger than expected, with demand assisted by abundant feed.

Wool may fill a need in soft upholsery

Annette Scott NEWS Wool

ANEW wool product could fill a hole in farmers’ pockets and provide an alternative to soft upholstery.

A project seeking an alternative to synthetic fillers has earned government backing via the Ministry for Primary Industries (MPI) Sustainable Food and Fibre Futures (SFFF) fund, which has committed $790,000 over three years to the project aimed at increasing the market potential of woollen knops – the small, light fluffy balls used as a furnishing filler ingredient.

Wisewool was established in April 2021 by the Gisborne Wool Company, a fifth-generation, family-owned business that brokers and procures wool from 200 growers in the greater Te Tai Rāwhiti region.

Through SFF Futures, MPI has invested more than $14.69 million in 15 strong wool projects to date, from strong wool acoustic wall panels to strong wool-based adhesive bandages.

It has also helped to set up the industry organisation Wool Impact, which is charged with driving innovation and demand for NZ strong wool.

“This project has the potential

to improve returns to our strong wool producers and provide an environmentally friendly alternative to existing products made from synthetic materials,” MPI director of investment programmes Steve Penno said.

“Woollen knops can be used in baby bedding and insulated clothing, as well as mattresses, so it’s a versatile product with plenty of scope.

“Wisewool will also conduct research and development of needle punched wool blanketing, which can be used in residential and commercial furniture upholstery, insulation for the apparel industry, bedding and futon markets.”

Wisewool chief executive Henry Hansen said the woolly knop project will predominantly focus on working out the right components and blends to create a range of woollen knops for different products.

“We’ve discovered that when

SUDDEN DEATH:

Five ewes and seven lambs were killed by lightning on a Central Otago farm earlier this month.

See the wood for the trees

used in large quantities as a filler ingredient, woollen knops increase the bounce-back and compression resilience of the fibre.

“We’ll continue researching and comparing the compression resilience of both wool and synthetic fibres and will adjust our carding machines to produce various wool knop blends.

“We’ll also conduct an environmental impact analysis and in-market testing,” Hansen said.

Penno said one of the main drivers for funding the project was its potential to provide an alternative, high-value use for NZ strong wool.

“We’ve asked Wisewool to research consumer price preferences to see if the knops can be sold at a price that gives a good return to farmers.

“The project also aligns with the goals of the sector and the government’s Fit for a Better

World roadmap, which aims to boost sustainability, productivity and jobs over 10 years.

“This includes finding high value uses for NZ strong wool and new industries to boost the earnings of our food and fibre producers.

“By working together with industry leaders and innovators and thinking outside the box, we have the opportunity to turn our homegrown wool industry around,” Penno said.

Lightning kills Naseby sheep

Neal Wallace NEWS Weather

TWELVE sheep were killed and tree bark scattered up to 10m when lightning struck a tree on a Central Otago farm earlier this month.

Naseby farmer Phil Smith said the five ewes and seven lambs were sheltering fromthe storm under the tree when it was struck by lightning on the afternoon of January 6.

“It must have been a hell of whack,” Smith said.

The strike ripped the bark from the tree and scattered

it. This is the first time Smith has had lost stock in this manner, but a neighbour told him lightning had killed stock on their farm in the past.

Smith said it has been a busy season for thunder and lightning in Central Otago, but he has not heard of it killing livestock.

FORESTRY

8 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 8

REPORTS Subscribe from only $100* per month agrihq.co.nz/our-industry-reports

Be across domestic & international markets by subscribing to NZ’s most authoritative forestry analysis. * Prices are GST exclusive

By working together with industry innovators we have the opportunity to turn our homegrown wool industry around.

Steve

Penno MPI

INNOVATION: Wisewool woolly knops will put a sustainable bounce back into soft upholstery and woolgrowers’ bank accounts.

Down does not always mean out, says study

Richard Rennie PEOPLE Community

GROUNDBREAKING social research in rural New Zealand has identified that just because a rural community is deprived, it does not always mean it lacks the inner strength and resilience to help it rise above its outwardly difficult situation.

Research by NZ Institute for Economic Research economist Bill Kaye-Blake and former AgResearch social scientist Margaret Brown, for an Our Land and Water project, has helped identify communities that can take the punches even if they may appear already down, and brought out lessons for those needing to become more resilient in coming years.

For many years policymakers have tapped into New Zealand’s well-established Deprivation Index to get a profile of those communities most at risk, and in need of proportionately greater government input to help them improve their lot.

The researchers agreed that trying to define “resilience” can seem hopelessly vague, compared to the empirical, defined metrics used in the Deprivation Index.

But Kaye-Blake said it has proven possible to turn resilience into a meaningful metric, one they defined using an index similar in methodology but differing in content to the Deprivation Index.

“We included aspects of the community’s profile like the rate of volunteering, religious affiliation and identification as a Māori, for example,” he said.

The team applied their index across 300 rural communities nationally, typically with populations ranging from 1000 to 5000 people. They found by simply comparing deprivation values against resilience values, there was often a close correlation.

“However, when we went into communities, we found the statistics did not always align with how community members felt about their communities, often the view from inside differed from that outside.”

Volunteer participation often goes hand in hand with religious affiliation, between them becoming the “glue” that underpins community resilience. Including Māori identity captures iwi’s tendency to offer nonmonetary koha for payment or support, and the big part extended families play in community contribution.

“Wairoa is one community that really highlights how the indices and reality can be quite different.

When we went into communities, we found the statistics did not always align with how community members felt about their communities. Often the view from inside differed from that outside.

Bill Kaye-Blake NZIER

“Outwardly the level of deprivation is quite high, but when you talk to them, we find a whole informal economy, a volunteer economy that is paid in kind or in koha with strong social networks that are not captured by the numbers.”

With volunteering comes leadership within communities, and the researchers identified champions who were prepared to pick up the mantle on big projects, inspiring others to follow.

But this alone has a life limited by the enthusiasm, commitment and energy of those individuals, and requires a sustained succession plan to keep momentum up for the many years often needed on projects.

“You can see those projects fall over after that person moves on, so there is a need to have others coming through to continue that leadership after the original leader moves on,” said Brown.

Policymakers touting programmes need to be aware, too, that the people championing projects can be subject to burnout after a couple of years.

Succession plans are even more important when funding for community projects is only for a limited time. They require momentum and proof of commitment to take to the government when seeking further funds beyond that time frame.

The government’s Rural Community Hubs programme, backed by $1.12 million in funding, is aiming to build resilience in remote and deprived rural communities, with allocation already made to 20 hubs around NZ.

“So there is money there, communities just need to put their hands up for it, but it relies on champions, and with some funding it is only there for two years,” said Brown.

She said women had often played a key role in voluntary type community work, but this has changed with many more heavily involved in daily farm operations, or with their own careers in town.

“You have got to have time, and we all know that is increasingly challenged today.”

She noted in some of the larger communities’ funding provisions can also bring their own tensions, with disparate groups having their own ideas on where the money needs to be spent.

“It is the smaller communities that seem to be able to get a better consensus, and work through their priorities.”

Kaye-Blake cited one small community that had drawn up a list of dream projects back in 2007.

“They have managed to

National Open Farm Day

Sunday 12 March, 2023

We’re bridging the urban-rural divide. One open day at a time. Host an open farm day.

consistently work through that list for the past 15 years, and the success of one project builds on the success of the last.”

The next challenge is to try to move the dial in those highly deprived/low resilience communities identified by the research.

Brown said she is optimistic,

but pragmatic about the reality of turning some rural communities around.

“Every community has the potential, but some need a lot of hand-holding and financial support. Others can be more standalone. If we truly want some rural communities to remain, then we will have to work harder at it.”

Visitor registrations open soon Nationwide Numbers Your weekly update on Open Farms events and visitor numbers. 21 Farms hosting an open day Sign-up to host at WWW.OPENFARMS.CO.NZ Ministry for Primary Industries Manatū Ahu Matua Agriculture & Investment Services OUR LAND AND WATER Toitū te Whenua, Toiora te Wai 9 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 9

INNER STRENGTH: Work by Bill Kaye-Blake (pictured) and Margaret Brown found that deprived communities can have a resilient core.

Safety caution as farm accidents rise

Craig Page NEWS Safety

FOUR people have died in farm vehicle accidents in New Zealand in the past month and WorkSafe says variable weather conditions could be a factor.

WorkSafe confirmed it has been notified of seven incidents in NZ during the past

month involving farm vehicles, where people have died or been injured.

These involved quad bikes, a tractor, a side by side, a front-end loader and a harvester. “Sadly there have been four deaths,” said WorkSafe spokesperson Paul West.

“We have initial inquiries underway, and part of these inquiries will establish whether each incident occurred at a workplace or as a result of work activity.”

The fatalities occurred in Southland, Taumarunui, Tokoroa and Opotiki.

According to WorkSafe statistics, 11 people died in agriculture-related incidents between November 2021 and October 2022. Six of those deaths involved vehicles.

West said the latest accidents are a reminder for those working on farms to make health and safety a priority.

Protecting your ewes against abortion storms takes two vaccines.

Farmers are trying to do more and more in less time, and when you add the labour shortage it’s not helping.

Wayne Langford Federated

Farmers

“This is a time of year where we are experiencing variable weather and growth, and variable ground surface conditions.

“Slope surfaces can be especially problematic at this time of year.”

West said farm work consists of “a never-ending list of tasks and constant reprioritisation as weather, commodity prices and other factors within the farmer’s influence change”.

He said some farmers will be doing work that usually a contractor might do with equipment better suited to the task.

“We cannot let these challenges contribute to loss of life or injury. The people with the most power to influence this are those on the ground each day doing the work.”

Federated Farmers national vice-president Wayne Langford echoed calls to make health and safety a priority on the farm.

Recent weather conditions in some regions have put added pressure on farmers and at times only provided small windows for harvesting and planting crops.

“Farmers are trying to do more and more in less time, and when you add the labour shortage it’s not helping.”

Langford, who has responsibility for the Feds health and safety portfolio, said it is vital that health and safety remain “front of mind”, no matter how busy farmers were.

Safety tips

WorkSafe recommendations for reducing harm on farms include:

CONTROL THE RISK OF

Toxoplasma and Campylobacter are widespread on New Zealand farms1. These diseases can cause abortion storms with losses up to 30%, or more, of lambs2,3

Preventing them takes two vaccines. Maiden ewes require 1 dose of Toxovax ® and 2 doses of Campyvax ® 4 ahead of mating. Mixed age ewes require an annual booster of Campyvax4 prior to mating.

Protect against abortion storms, and improve flock performance.

ORDER TOXOVAX AND CAMPYVAX4 FROM YOUR VET TODAY.

• Choose the right vehicle for the job and ensure the operator is competent to drive it.

Think about safety outside of work activities. Farms can be dangerous for visitors and during recreation activities. Prioritise tractor and machinery maintenance. This should include attachments, good tyres and brakes.

• Tired people make mistakes. Do difficult things earlier in the day – save the easy stuff for later.

If your vehicle is fitted with a seatbelt, use it. Consider installing crush protection on your quad bike.

• Ensure the vehicle is safely stopped and brakes are fully engaged before leaving the vehicle.

CONTROL THE RISK OF CAMPYLOBACTER AVAILABLE ONLY UNDER VETERINARY AUTHORISATION. ACVM No’s: A4769, A9535. Schering-Plough Animal Health Ltd. Phone: 0800 800 543. www.msd-animal-health.co.nz NZ-CVX-220900001 © 2022 Merck & Co., Inc., Rahway, NJ, USA and its affiliates. All Rights Reserved. 1. Dempster et al (2011), NZ Veterinary Journal 59:4 155-159. 2. Wilkins et al (1992) Surveillance, 19:4, 20-23. 3. Sahin et al (2017) The Annual Review of Animal Biosciences. 5: 9.1-9.22 VAXIPACK® RECYCLING LEARN MORE

TOXOPLASMA

10 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 10

are

SAFETY

FIRST: A spate of recent accidents

a

reminder for those working on farms to make health and safety a priority.

Five Star stands empty for M bovis clean-up

Annette Scott NEWS Disease

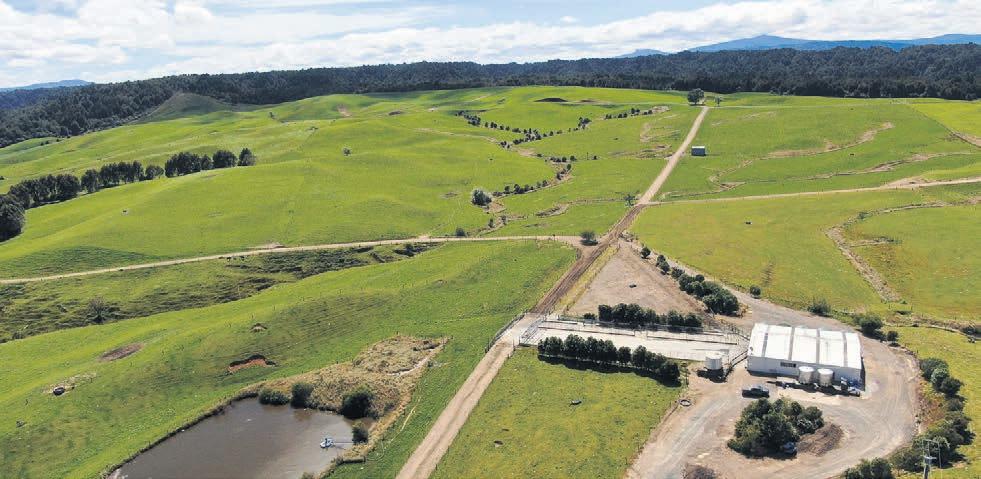

NEW Zealand’s largest commercial cattle feedlot is empty and in a stand-down period for a Mycoplasma bovis cleaning and disinfecting process.

As part of the Ministry for Primary Industries’ (MPI) eradication programme for M bovis, Five Star Beef was empty of cattle by the end of 2022.

From the start of January the operation has been subject to a stand-down cleaning and disinfecting process.

The cleaning process is expected to be complete by mid-March.

ANZCO general manager systems, supply and sustainability Grant Bunting said ANZCO Foods has worked closely with MPI since M bovis was found at the Five Star Beef feedlot near Ashburton in 2018, a year after the disease was first found in NZ on a farm in South Canterbury.

He said Five Star Beef has followed all MPI’s advice and implemented and complied with all MPI’s biosecurity requirements, always knowing that eventually the feedlot would be emptied to clear the disease.

MPI said Five Star Beef practises a high standard of biosecurity that is well managed.

MPI made the decision to hold off depopulating the feedlot until close to the end of the eradication programme based on the risk of reinfection at the feedlot, which had been able to continue operating because from there all cattle go directly to slaughter.

The feedlot depopulation started on October 13.

Bunting said Five Star Beef has an important role in the community and this was considered when developing the depopulation and repopulation plans.

To minimise the impact on its suppliers, Five Star Beef has continued to buy cattle and is finishing them on grass on contract-grazing properties to help with the repopulation process when it takes place from mid-March.

Established in 1989 to finish Angus steers for the Japanese market, Five Star Beef is the single largest supplier of chilled beef exports, with up to 20,000 cattle at any one time.

“Five Star Beef is part of a significant supply chain and the depopulation will have widespread impact on the feedlot’s business, its many cattle and feed suppliers

US exec to headline Rural Leaders summit

Staff reporter NEWS Leadership

Staff reporter NEWS Leadership

UNITED STATES-based global food executive Devry Boughner Vorwerk (pictured right) will head this year’s Rural Leaders Agribusiness Summit.

The theme of the event, to be held on March 27 at the Christchurch Town Hall, is “Forefront”, focusing on businesses making change and those that provide solutions to the sector’s and the world’s biggest agribusiness challenges and opportunities.

“The summit will discuss and debate the topical agribusiness challenges globally and locally with a solution-based case studies and learnings,” summit chair Murray King said.

“The day is designed for farmers, growers and associated industries with a focus on real and practical answers.”

Morning Report co-host Corin Dann will host the event and the keynote speaker is Vorwerk, a global food executive and corporate officer, sustainability entrepreneur, international business development and diplomacy strategist, and an expert in international trade relations.

Other guest speakers include Lain Jager (Te Puna Whakaaronui chair), Volker Knutzsch (Cawthron CEO), Vangelis Vitalis ( Trade and Economic Group deputy secretary), Tom Sturgess (Lone Star Farms), Traci Houpapa MNZM (company director and business advisor), and Angus Brown (CEO and co-founder of Ārepa).

as well as the wider community,” Bunting said.

The business is a key part of the local Ashburton economy, being directly responsible for 300 jobs, with 30 people employed at the operation and the others involved in processing the niche product at nearby ANZCO Foods Canterbury.

The operation annually takes up to 40,000 head of cattle from farms all over the country as well as 50,000t of grain and 18,000t of maize from local suppliers.

This accounts for 90% of South Island maize and 8% of NZ’s grain production.

Meanwhile M bovis programme director Simon Andrew said the programme remains on track to eradicate the disease from NZ with the current focus targeting a sole pocket of confirmed infection in Mid Canterbury.

A Controlled Area Notice (CAN) was declared in the Wakanui area of the Mid Canterbury district from October 13 2022, restricting the movement of cattle in an effort to stop M bovis circulating in the area.

The CAN defines two areas: a high-risk area of properties immediately surrounding the feedlot and an at-risk area, taking in properties immediately outside of the high-risk area.

To date, no infection has been

found in the at-risk area and therefore at present none of these properties require depopulation.

“We are making good progress towards clearing infection from the high-risk area of the controlled area,” Andrew said.

The high-risk area of the CAN is expected to be free of cattle by mid-January.

All confirmed properties in the high-risk area will undergo cleaning and disinfection as well as a stand-down period as part

of removing infection from the controlled area.

The CAN will remain in place until about mid-March, or until testing confirms infection is not present in the area.

“Although we are at the tail-end of this outbreak it is possible we may find other infected properties in other parts of the country in the future and so we must remain vigilant and maintain our nationwide surveillance programme,” Andrew said.

Robot boosts biosecurity testing

Annette Scott TECHNOLOGY Biosecurity

THE arrival of an Explorer G3 robot is set to boost animal disease testing in the event of a biosecurity emergency.

The $580,000 high throughput diagnostic robot is the first of its kind in New Zealand and will increase testing accuracy and consistency during future biosecurity responses.

The robot is set up and in action now at the Biosecurity NZ Animal Health Laboratory.

Animal Health laboratory manager Joseph O’Keefe said the Mycoplasma bovis outbreak provided useful insights into how the laboratory could increase its capacity during a response.

In particular, it highlighted the need for automation.

“If an exotic disease such as foot and mouth disease (FMD) arrived here, our people could need to test some 3000 and up to 7000 samples a day.

“Automating this process will speed

our delivery of results making the whole process faster for farmers, better for the wellbeing of our people and for the animals involved too.”

The Explorer G3 workstation was manufactured in Germany and is designed to test samples for antibodies to FMD and other exotic diseases.

NZ’s international markets,” O’Keefe said.

“If there is an exotic disease outbreak in NZ’s animals, automation will allow us to recover faster.”

The 750kg robot took a week to set up, with each part individually delivered safely into the biosecure containment area.

Once it was assembled, the team ran it through stringent testing and calibration to ensure the tests were as accurate as the current manual process.

Joseph O’Keefe Animal Health Laboratory

The robot doesn’t require frequent attention or intervention, freeing up the animal health laboratory staff for other testing, and providing stability throughout intense response periods.

The robot can even run tests overnight without staff present.

“Testing delays can affect our economy as antibody testing is essential for maintaining the access and security of product exports to

Now that this has been confirmed, the robot has begun day-to-day diagnostic testing, O’Keefe said.

The machine achieves its efficiency through moving test plates around. Each plate can contain about 90 samples and the robot manages up to 40 plates at once.

Simultaneously it adds samples and different reagents, washes and incubates the test plates.

Outside of responses, the robot is used to perform antibody tests for surveillance programmes and for testing groups of animals for import or export purposes.

11 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 11

IN THE WINGS: Five Star Beef has continued to buy cattle and is nishing them on grass on contract-grazing properties in anticipation of the eventual repopulation process.

If there is an exotic disease outbreak automation will allow us to recover faster.

TOP TECHNOLOGY: The Explorer G3 robot is set up and in action at the Biosecurity NZ Animal Health Laboratory.

Wanted: sunny days to get the harvest in

Annette Scott NEWS Arable

CROPS are slow to come off this season as harvest drags the chain and arable farmers look to the weather gods for a run of sunny summer days.

Across New Zealand, harvesting is being hampered by the lack of sunshine and, while crops are generally looking good, farmers fear a repeat of last season’s disastrously wet harvest.

Up until the past couple of weeks summer conditions had helped crops across the country with optimism in the North Island and promising crops in the South, where the weather had set up Canterbury and Southland for a good season.

“We need some settled weather now. The crops don’t need any more rain and we don’t want to end up in a harvest season like last year,” Mid Canterbury Federated Farmers arable chair Darrell Hydes said.

“Last year’s harvest was a disaster, it was a tough season with the rain right through and this year crops are doing well and generally looking all right but we want settled weather to get them in.”

Early cereal crops are ripening but the region is not alive with harvesters yet.

Clover crops are beginning to suffer the effect of recent rain with bulky foliage smothering the flowers, but Hydes said grain is holding up so far.

With rapeseed harvested this week, Hydes, like many farmers, is now cutting grasses. Fescue and cocksfoot are the first to go down.

“After a tough one last year we really need a good harvest this season as we are all battling the forever rising input prices especially with seed, fertiliser, diesel and ongoing compliance costs.

enough to cover the extra costs this season.

“There is a worry that grain might go the same way depending on the Australian harvest and international pricing,” Hydes said.

and is expected to increase output from the previous forecast of 13 million tonnes to a record 16 million tonnes.

to farmers and add competitive prices to whatever is left for NZ domestic spot contracts.

Darrell Hydes Feds arable

“Hopefully grain will hold up, we know the northern hemisphere has had a really good [herbage] seed harvest in ryegrasses and while we are in a better position here now with the seed companies given a lot of work that has been done there, we are not likely to get

The latest Grain and Feed Insight reports Australia’s harvest for the 2022-23 season has yet again been forecast up and is anticipated to break records with the nation set for significant yield increases.

Australia’s wheat production forecast has increased another 5.4 million tonnes to a record 42 million tonnes.

Agribusiness economists at National Australia Bank said the harvest’s increase can be attributed to higher yield. Western Australia, the largest exporting state, has “performed very well”

It is being reported that ports are preparing for the exports, with many ports reportedly fully booked for wheat shipments in March through April, pushing buyers into the months further ahead.

Despite the increased yield, heavy rain through much of the nation, particularly the east coast, has led to many growers reporting a decrease in wheat quality, pulling away from milling wheat into average or below average feed wheat.

With much of NZ’s grain already contracted out for the upcoming harvest, this will be welcome news

Profarmer’s current price for H1 milling wheat sits at AU$412/t, AU$78/t lower than October’s price.

In comparison, prices for feed wheat have remained unchanged since December at AU$305/t.

NZ grain prices are holding up with Canterbury milling wheat last week sitting on a high of $680/t, with feed wheat at $660 in Canterbury, $640 in Southland and $680 in Manawatū.

Feed barley is holding highs of $650/t in Canterbury, $680 in Southland and $760 in Manawatū.

Maize grain has climbed to $800/t in Manawatū and $639 in Waikato.

Dodgy news erodes GM uptake in Africa

period from January 2019 to collate 535 articles on the technology.

COUNTRIES that could benefit the most from genetically modified crops are also those most likely to be subject to mistruths about it, according to research on the level of misinformaton clouding the technology.

In a study published in the journal GM Crops and Food, researchers used a two-year

They found 9% of the articles published in that time were factually inaccurate. These had a potential readership audience of a quarter of a billion. The angle of the misinformation tended to be largely negative-neutral in sentiment.

The proportion of misinformation exceeded even that about covid-19 vaccines,

the subject of earlier work by the researchers.

In the vaccine work, they found only about 0.1% of articles in mainstream media contained misinformation, but had the capacity to reach large numbers of readers and affect the conversation about it.

But John Caradus, CEO of Grasslanz, said what is of even greater concern is that a disproportionately high level of misinformation is published in Africa.

Researchers found that almost a fifth of Africa’s GMO content consists of misinformation.

“That compares to 5% in North America and 7% in Europe,” he said.

The study focused only on mainstream media publications, rather than social media postings that have proven so problematic for spreading covid-19 vaccination misinformation.

Caradus has been researching global and domestic perceptions of GMO and highlighting the overarchingly positive impact the technology has delivered in the 20-plus years of use. He has other papers on GMO uptake and regulatory challenges in the pipeline.

Of the misinformation published,

the greatest amount related to “human health” topics, at 40% of the volume of articles published. This was followed by 25% each for “environment” and “pesticides” related articles.

“A lot of the information in Africa is not just false information, but also reflects an attitude separate countries are taking towards GM, particularly out of Europe,” Caradus said.

While GM technology’s use is approved and ramping up in South and North America, Australia and parts of Asia, Europe continues to remain ambivalent about its application.

A number of countries, including Germany and France, are choosing not to run with the technology.

Caradus said there is irony in the level of misinformation, given the benefits developing countries have experienced from the technology.

The report’s authors highlight how the adoption of “Bt brinjal” (eggplant or aubergine), a transgenic crop resistant to some insects, has contributed to a six-fold increase in profits to smallholder farmers in Bangladesh, while also significantly reducing the use of pesticides by them. Similar claims have been attributed to farmers in India and Pakistan.

Caradus said despite “human health” stories being highest on the list of misinformed articles, this is one area where the technology has proven to be safe. His earlier meta review of GM technology across over 800 studies found no proven human health impacts over the past 25 years from ingestion of GM foods.

The use of the technology has also contributed to 37% lower use of pesticide use over GM crop area. GM crops have a 23% lighter environmental footprint due to significantly lower pesticide use and less tillage area requirements.

He takes heart from another finding by the researchers – the high level of factual information that was published over the period under review. “So, I don’t think this is completely damning,” he said. In New Zealand there are 90 GM foods approved under NZ and Australia food safety regulations for consumption. There is a gap between what NZ consumers can buy and the techniques NZ farmers may and may not use in the absence of GMO production being allowed in the country.

“It comes back to a balance between benefit and risk, and I don’t think we have had that discussion in a sensible way here,” Caradus said.

12 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 12

After a tough one last year we really need a good harvest this season.

Richard Rennie NEWS GMO

QUALITY CONCERNS: Heavy rain through much of Australia has led to a decrease in wheat quality – welcome news to New Zealand farmers as it should add competitive prices to whatever is left for NZ domestic spot contracts.

FAKE NEWS: John Caradus, CEO of Grasslanz, says poorer nations in Africa could bene t greatly from GMO but are often subject to the greatest levels of media misinformation.

Fall armyworm crosses to South Island

Gerald Piddock NEWS Pests

Gerald Piddock NEWS Pests

FALL armyworm has been found in the South Island for the first time, with the Foundation for Arable Research confirming it has been discovered in three locations on the West Coast.

Early this week a find was confirmed in a paddock of maize near Hokitika, and since then other finds in the region suggest several maize crops are affected.

Members of a FAR and Seed and Grain Readiness and Response team, along with Dr Scott Hardwick from AgResearch/B3, visited the Hokitika property on January 12 to assess crop damage and the efficacy of control.

Nationally, the Ministry for Primary Industries has received 117 inquiries about the insect pest since September 1. The total number of confirmed positives is now at 56, up 11 from last week. Three of these finds were on the West Coast of the South Island.

The worm is thought to have been carried on storm fronts from Australia and arrived in New Zealand around February 2022.

FAR general manager of business operations Ivan Lawrie said most of the finds so far have been larvae feeding on maize crops.

Going forward now, the main thing is to continue reporting. We need growers to be walking their fields and finding any signs of damage and reporting any finds to the MPI.

Ivan Lawrie Foundation for Arable Research

Primary sector groups with government support have installed 200 traps on farms within the affected area to capture the insect in its moth stage, he said.

“We have had a few moth detections so far but mostly what we observed in the lead-up to Christmas was direct damage from caterpillars in paddocks,” Lawrie said. This has led him to believe the insect survived the winter due to mild weather conditions, which has been backed up by modelling.

Those insects at the moth stage will also be travelling south, seeking warmer temperatures.

“The earlier sown maize crops will have a certain degree of escape because as the season progresses and the crop outgrows the presence of the pest you have less of a chance of getting severe economic damage.”

Lawrie said there was concern that the wet conditions in the upper North Island and subsequent delay in maize being sown this season meant the early development stages of the crop could be at higher risk from the insect.

One positive development is the approval of the insecticide spinetoram, commercially known as SpartaR, which can be used to control fall armyworm.

There are also promising signs that a native parasitic wasp is attacking fall armyworm. While research is still in its early stages, it could mean a degree of natural control available to farmers in the near future, Lawrie said.

The worm has been found in all of the areas discovered last season including Northland, Waikato, Bay of Plenty and Taranaki. Lawrie said they are processing reports from other regions where it is

suspected the insect has spread.

“Going forward now, the main thing is to continue reporting. We will continue to collect the data from the moths from the traps but we need growers to be walking their fields and finding any signs of damage and reporting any finds to the MPI.”

This helps FAR build a better picture for modelling and understanding the insect.

“There is no downside for a grower to report any finding, only an upside. There’s no chance of the crop being destroyed or notices being put on paddocks. There should be no fear in reporting a new find.”

With our new E Series Hybrid Rotaries you can milk safely and efficiently with one operator. IS I T T I M E TO MILK SOLO? Upgrade Specialists Talk to the 0800 222 228 delaval.com 13 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 13

STORM TOSSED: The worm, which arrived in New Zealand this time last year, is thought to have been carried on storm fronts from Australia.

New rural policing strategy launched

Neal Wallace NEWS Community

THE launch of a new rural policing strategy aims to better support the 165 officers responsible for maintaining law and order over more than half of New Zealand.

NZ Police has launched its Rural Policing Enhancement Project (RPE) to ensure rural policing is fit for purpose, responsive to changing rural needs and to improve support for rural officers.

This includes appointing Inspector Karen Ellis as NZ Police’s first rural manager, with responsibility for providing a rural perspective at governance level at national headquarters.

Currently a senior sergeant and the victims manager with the prevention group, Ellis will be conduit for the flow of information between on-the ground rural police officers in the 12 police districts, and police headquarters.

Inspector Paul Carpenter, the strategic adviser with NZ Police Operations Group, says the model is not broken but can be improved to support the isolation of rural police officers so they can do their job better.

“Tangibly the public may not

see anything different but police officers involved will feel better supported and knowing they are backed up whether it be with specialist units or when dealing with an incident or accident,” Carpenter said.

He says there are 104 stations in NZ manned by between one and three officers.

Those 165 officers are responsible for policing half the country’s land mass, an environment that covers forestry, bush, coast, alpine and farming.

“They require different types of policing, they each have a different dynamic.”

Recruiting officers to work in these stations is not usually a challenge, but he says those keen to work there require certain qualities and need to know what the role involves.

“They have to deal with isolation, remoteness so we need to make sure when they go into these rural environments they understand they are often working on their own.

“So they need to be able to build relationships and be good communicators.

“The majority of the time they’re going to be attending incidents on their own.”

This plan is designed to ensure they have adequate support or

back up depending on the nature of the incident.

“It’s always been there, but we want to improve it,” Carpenter said.

In 2018 the Independent Police Complaints Authority (IPCA) launched a review into policing of small communities, but Carpenter said before this was released, NZ Police initiated its own review into the topic.

It was prepared jointly and the recommendations were agreed by both entities.

One issue was the pressure and expectations of spouses or partners of rural officers who often have to in deal with the public when police are away from the station.

“We don’t expect partners to be pseudo police officers and we want them to be safe.”

A Rural Police Families Induction Booklet has been prepared for spouses or partners outlining what to expect when based in a rural station, what is expected of them, how to deal with situations and what support is available.

Carpenter said they similarly want the public to feel safe but to also engage with police and to remove the perception that minor crime is not important.

He said there have been

occasions where victims have waited until their local police officer returned from leave to report an incident rather than deal with a reliever.

Carpenter said rural people prefer talking to police officers in person, so a challenge for the strategy is having new ways for the public to communicate with their local police officers, such as using social media.

This means giving users the confidence that when using those avenues, it will reach local police officers.

RESULTS

“We want to make sure rural communities know how to contact police whether the medium is social media or an emergency line, that it will reach their police officer.”

For officers, the initiative also includes regular interaction, including speakers, between rural police so they can learn from the experiences of each other, changes to relief policies so staff can more easily have time off and to extend and upgrade of communication technology to reduce black spot areas.

Right now, with a finance rate starting from 0.99%*, there has never been a better time to invest in the quality and performance of Fendt. It is an acquisition that pays dividends when it comes to reliability and return on investment. And right now, you’ll also enjoy exclusive deals on haytools. Now is the time to talk to your local Fendt dealer.

*Offer ends April 14th, 2023 while stocks last. Finance with an interest rate of 0.99% p.a available on a Hire Purchase agreement based on a minimum 30% deposit cash deposit, the GST component repaid in the fourth month and 12 equal monthly repayments in arrears, or 1/3 deposit, 1/3 payment after 6 months and 1/3 payment after 12 months. Fees and lending conditions apply to approved GST number holders who use the equipment for business purposes. Finance is approved by AGCO Finance Pt Ltd, GST number 88-831-861.

www.fendt.com/au

It’s bold – It’s Fendt.

Now BIG

0.99%

RATE 14 FARMERS WEEKLY – farmersweekly.co.nz – January 23, 2023 News 14

Early Order Program On

SMALL

HELPING HAND: Inspector Paul Carpenter, the strategic adviser with NZ Police Operations Group, says the model is not broken but can be improved to support the isolation of rural police officers so they can do their job better.

Calling all farmers keen on cashmere

Annette Scott MARKETS Fibre

ATHREE-year ultrapremium fibre project calling for farmers keen to explore the potential of the $2 billion global cashmere industry has attracted overwhelming interest.

Sustainably Beautiful, a programme to restart the cashmere industry, is led by New Zealand Cashmere and backed by the government, which has committed $900,000 over three years through the Ministry for Primary Industries’ Sustainable Food and Fibre Futures fund.