22 minute read

Tongan workers face tough choices

FARMERS WEEKLY – farmersweekly.co.nz – January 31, 2022 9 Tongan workers face tough choices

Richard Rennie richard.rennie@globalhq.co.nz

HAWKE’S Bay orchardist Mark Vesty appreciates more than most the human impact the Tongan eruption has taken upon the nation’s people. His ties to the island nation are strong, particularly to the tiny outlying island of Atatā, the nearest inhabited island to the volcano. Some of his workers have been coming from there to work on the family’s orchard for the past 15 years.

Overall, Tongan workers account for about 1000 of the 12,000 RSE workers coming to New Zealand every year.

Royal NZ Air Force (RNZAF) surveillance photos of the flower and stem shaped Atatā atoll are captioned in bleakly clinical style by RNZAF staff, categorising it as “catastrophic” damage.

Only a church remains standing of its 70 buildings.

“We have 12 workers from there who have been stuck here in New Zealand for the past two years unable to get home, and had another three coming over in February, but that will be quite uncertain now. Every day is a new day when it comes to RSE nowadays,” Vesty said.

Because the island is so close to the volcano, Tongan authorities are undertaking to permanently relocate Atatā’s 30 families.

He said the workers here in NZ, and those intending to come here, face a terrible quandary for their future.

Those here know that they don’t have a home to return to on the atoll and will need to try and start a new life, while those who were intending to come down to earn valuable income have no way of doing so at present.

“They have had videos sent and have now been in contact with families up there, and it is at least as bad as they thought, maybe worse,” he said.

With the summerfruit harvest just completed, and three weeks until the apple harvest begins, Vesty said he had been hoping the workers could finally return home by late May.

Like many orchardists he has built strong ties with the islanders, often visiting them during the quiet period here.

“And it is even tougher because they also lost the main employer on their island, the local resort,” he said.

The Royal Sunset Island resort has been wiped out, along with most of the island’s other structures.

The devastation from the Hunga Tonga-Hunga Ha’apai eruption also comes on the heels of Cyclone Harold that inflicted US$100million worth of damage on the kingdom in April 2020.

Vesty was personally funding supplies being put together to send up to Tonga, including dry food items and medical packs, while Watties has also donated canned goods.

While his primary concern was the welfare of his staff, he said the event had only added greater uncertainty to the supply of RSE workers, with the impending harvest looking like it may break all records for size, and staff in diabolically short supply.

Sefita Hao’uli, the NZ RSE liaison manager and a Tongan himself, said 700-800 Tongan workers have been in NZ long-term. Seventy had been intending to return home this month until the eruption cancelled all commercial flights to the kingdom.

“We have had a volcano, a tsunami, and it is still cyclone season. We can only hope these things don’t come in threes,” Hao’uli said.

He said relocating families was not a simple task, with the main island of Tongatapu already under population pressure.

“For some, it may pay for them to remain in NZ as hard as that is with what has happened at home. But for many from the islands of Mango and Atatā, they may prefer to be back home to sort out their new life,” he said.

So far 16 containers containing food and supplies have been donated in Auckland, while Katikati kiwifruit growers have put together a container, and growers in Hawke’s Bay are doing the same.

About 400 Tongan RSE workers were due to arrive in February, but there are logistical difficulties now in liaising with them scattered across the island group with communications damaged.

“We are hoping those numbers can be maintained but because of what has happened, some may need to remain at home, but others may come for six months here,” he said.

While the airport is now open for relief flights, there is no sign yet of when commercial arrivals and departures can commence.

The kingdom’s strict controls over covid-19 may also complicate RSE returns and requirements.

“A relief flight from Australia that had some unvaccinated people on board was required to turn around,” he said.

He is, however, heartened by Immigration NZ extending visas to workers stuck here and was confident this would continue.

Sefita Hao’uli NZ RSE liaison manager

IMPACT: Hawke’s Bay orchardist Mark Vesty says the ripple effects of the pandemic and now the recent earthquake and tsunami means that Tongan RSE workers on and offshore continue to face uncertainty. Photo: John Cowpland/Alphapix

LISTEN UP

A quick word in your ears please.

If you’re wanting to effectively promote your podcast to 100% of New Zealand’s farming audience, then you should have a word with us. Our tailored packages can advertise your podcast across GlobalHQ’s agripreneurial network of rural specific properties. You’ll be seen and heard, and get a greater opportunity to engage with your audience. heard, and get a greater opportunity to engage with your audience. Talk to us to find out more - we’re all ears. 06 323 0761 andy.whitson@globalhq.co.nz andy.whitson@globalhq.co.nz

New lending rules could benefit sector

Nigel Stirling nigel.stirling@globalhq.co.nz

NEW lending rules wreaking havoc on residential borrowers have not had any noticeable impact on farm lending and could even spur the banks to look favourably again at the sector after a lean couple of years.

Since the start of December, banks have been applying extra scrutiny to loan applications in response to legislation designed to protect borrowers from saddling themselves with unaffordable levels of debt.

While the Credit Contracts and Consumer Finance Act had seemingly been motivated by a desire to crack down on loan

sharks, it has ended up capturing a far larger share of the market than ever intended.

Bankers are being extra cautious under pains of fines of up to $200,000 if they are found to have failed to follow the letter of the new law when assessing loan applications.

“The banks are erring on the side of caution because nobody wants to be the first cab off the rank in a lawsuit,” KPMG bank audit partner John Kensington said.

Kensington had been told by one banker that at his own bank loan approvals had fallen by a quarter since the beginning of December when the legislation came into force.

However, the new rules show no signs of hitting rural lending, according to the Real Estate Institute’s rural spokesperson Brian Peacocke.

He’d completed farm sales in the lead-up to Christmas and had been marketing properties since early in January where he was having a lot of conversations with purchasers.

“Whether the holiday period means they have not caught up with such issues I do not know, but if they were in the market for lending they would have been talking to banks I would have thought … but at the moment it is not an issue,” Peacocke said.

The managing director debt of NZ Agri Brokers Scott Wishart said the ups and downs of farm incomes and a comparatively smaller pool of buyers for the underlying asset should the borrower get into trouble meant banks demanded a wider range of information to support loan applications from farmers.

By comparison, decisions to lend on houses had been made based on a much more limited set of measures.

“Rural lending has been assessed that way for nearly three decades … you had to provide profit and loss statements and balance sheets and budgets to access debt,” Wishart said.

“That is something you have never had to provide as a borrower for a (housing) mortgage.”

“For retail borrowers it is (now) about doing away with the general rules and specifically looking at every borrower to make sure their own situation fits the bill.”

Rather than creating the conditions for a rural credit crunch, Wishart said the new legislation could be supportive of more lending flowing to the sector after a lean couple of years when the main trading banks had encouraged farmers to reduce debt.

“If the banks cannot get money out the door in one area, they are going to be looking for more opportunities to lend (elsewhere) and there are a few things helping them with that at the moment,” he said.

“Obviously high commodity prices and significant amortisation (of debt) over the past 2-3 years is giving them a few tailwinds to invest more in agriculture without really increasing the portfolio risk a whole lot.”

He said where farmers might expect greater scrutiny was in borrowing to fund off-farm investments.

Wishart had already heard of one case where a farm succession had been disrupted by the new legislation.

“Part of that plan required borrowing against the farm to buy a small lifestyle block in the nearest town for Mum and Dad to move into,” he said.

“That got caught up … because what salary do Mum and Dad have?

“And what was their personal expense history … well, the farm had paid for everything.”

He said the loan for the parents’ new house had been turned down because they were not able to provide history of their spending habits to the bank.

“All the boxes they had to fill out they just couldn’t provide.

“Previously the banker would have approved the debt as a housing loan and everyone would have moved on.”

Scott Wishart NZ Agri Brokers

SO FAR, SO GOOD: Real Estate Institute spokesperson Brian Peacocke says the new lending rules show no signs of hitting rural lending.

Calciprill ®

leaves all other limes for dust!

Application rate guide (kg/ha)*

Soil type Topdressed 0.5 pH increase

Direct drilled or air seeded

Sand/loamy sand 300 75 Sandy/silt loam 500 125 Clay/loamy clay 625 150 10-15% organic matter 750 175 +25% organic matter 1000 200 *Omya recommends you soil test recularly and seek advice from independent agricultural professionals A 2-6mm lime granule made in Waikato from fi nely ground high purity limestone. • Cost effective • Low in dust, easy to spread • Breaks down rapidly in moisture • Can be applied using your own equipment • 95% < 75 microns

FARMERS WEEKLY – farmersweekly.co.nz – January 31, 2022 11 Calls to licence stock agents

Neal Wallace neal.wallace@globalhq.co.nz

ONE of the country’s largest stock and station firms believes all agents should be licenced to provide some protection against illegal activity as livestock values soar.

Rural Livestock director John Faulks and manager Jesse Dargue say given the increasing value of livestock and the size of transactions processed, farmer clients and companies need certainty and confidence these deals are handled correctly and ethically.

Faulks said unlike the finance, insurance and real estate sectors where participants must be licenced, currently anyone can become a stock agent and handle transactions worth hundreds of thousands of dollars.

“Anybody can enter the stock and station industry,” Faulks said.

“All they need is a phone, a car and a bank account.”

Introducing a licensing system for all agents could provide greater assurance and certainty.

Faulks has a background in banking and real estate, but says focusing on the future of the stock and station industry is driving his view that agents need to retain their integrity and social licence to act on behalf of farmer clients.

He acknowledged very few current agents acted unethically, but his concern is that as the amount of money involved from livestock transactions increases, it could attract people who are less ethical.

“I’m not saying there are lots of bad people, but there are large numbers of stock traded and large volumes of money involved, which can attract people who see the opportunity to thwart the system,” he said.

Dargue said a licensing system needs to be effective, workable and affordable and not simply add administration costs onto farmers.

Membership of the NZ Stock and Station Agents Association is voluntary and it tends to represent large firms, he said.

Industry regulation is currently via the Fair Trading Act, the Consumers Guarantee Act and the Auctioneers Act rather than standalone legislation.

He says his suggestion reflects a maturing of the industry, but it needs to be proactive and begin a discussion before regulation is imposed.

“Someone will do it, (someone) who has no understanding of the industry,” he said.

“What we need to have in place will allow good, open trading and will attract good people to the industry.”

He accepts regulation is not the total answer to unethical behaviour.

“Regulation is not going to stop bad behaviour, but licensing or regulation will keep the standard of personnel in the industry at a better level from the start.”

ASSURANCE: Rural Livestock director John Faulks and manager Jesse Dargue say a stock agent licensing system could provide greater assurance and certainty for farmers.

John Faulks Rural Livestock

BIG RESULTS

SMALL RATE 0%

Right now, with a finance rate starting from 0%*, there has never been a better time to invest in the quality and performance of Fendt. It is an acquisition that pays dividends when it comes to reliability and return on investment. And right now, you’ll also enjoy exclusive deals on haytools.

Now is the time to talk to your local Fendt dealer.

*Finance available with an interest rate of 0% p.a. available on a Chattel Mortgage agreement minimum 30% cash deposit, the GST component repaid in the fourth month and 12 equal monthly repayments in arrears over a 12 month term. Alternatively finance is available with an interest rate of 1.99% p.a. on a

Chattel Mortgage agreement minimum 30% cash deposit, the GST component repaid in the fourth month and 60 equal monthly repayments in arrears over a 60 month term. Offer ends April 15th 2022 while stocks last to approved purchasers for chattel mortgage finance who use the equipment for business purposes only. Subject to terms and conditions and credit approval by AGCO Finance Pty Ltd, ABN number 42 107 653 878. Fees and charges may apply.

Shearing marathon for southern charity

Neal Wallace neal.wallace@globalhq.co.nz

UP TO 10,000 lambs will shorn over 32 hours in a West Otago woolshed next week, raising money for the Southland Charity Hospital.

Four southern shearers Eru Weeds, Cole Wells, David Gower and Braden Clifford will each shear for 24 hours over a 32-hour period, including breaks, while 21 other shearers will share runs of between two and eight hours on the remaining three stands.

Event manager Jared Manihera, from PGG Wrightson Wool, says the shearathon starts at 6am on Saturday, February 5 and will finish at 2pm the next day.

It will be split over 12 two-hour runs, with either 30-minute or one-hour breaks.

Nelson and Fiona Hancox will supply the stock, which will be shorn on their Wohelo Station property at Moa Flat.

The four aiming to complete the long haul have been preparing by following strict diets and fitness regimes.

“The hardest time will be midnight when their bodies will want to give up, but the minds will need to take over to keep them going,” Manihera said.

Due a tightening in covid restrictions, the event will not be open to the public, with a limit of 100 volunteers and workers who must have a vaccine pass.

The event will be livestreamed at livestream.com/accounts72885/ shear4blair

Manihera says the 24-hour shearers will be shearing replacement ewe lambs without belly wool, while the others will tackle a combination of full shear wethers and fully crutched ewe lambs without bellies.

He estimates that potentially $100,000 could be raised based on the product and cash donated so far.

The final total depends on the final number of lambs shorn.

The Southland charity was established in Invercargill in 2019, a legacy of local farmer and cancer victim Blair Vining who, frustrated at the poor cancer treatment for regional people, devoted his last few months of life to improving services.

TEAM EFFORT: Twenty-five shearers will participate in a 32-hour shearathon for charity, with four aiming to each shear for 24 hours.

Rua expands reach across the Tasman

Hugh Stringleman hugh.stringleman@globalhq.co.nz

SHAREHOLDERS of the listed medicinal cannabis company Rua Bioscience have given the go-ahead to a $10 million purchase of Zalm Therapeutics to build a market position more quickly for Rua.

Zalm has a long-term supply agreement with Cann Group, one of Australasia’s largest GMPcompliant medicinal cannabis plant breeding, cultivation, production and manufacturing companies.

Zalm is majority owned by chief executive Michael Wilding, chair Rob Fyfe, director Jonty Edgar and Australian-listed Cann Group.

It is commissioning an indoor growing facility in Mildura, Victoria, for approximately 12.5 tonnes of annual dried flower capacity, making it one of the largest producers in the southern hemisphere.

The purchase will be funded by the issue of 24.4 million Rua shares at approximately 41c each, one-third immediately and the other two-thirds on achievement of earn-out milestones covering production and regulation.

Zalm’s former owners would then account for about 15% of Rua’s shareholdings, having an incentive for success.

Rua chief executive Rob Mitchell said the approval vote would be transformative for the East Coast, Māori-directed company.

“Between Rua’s unique kaupapa, expertise and innovation and Zalm’s globalscale GMP capability and experienced distribution partners, we have the potential to create a powerful global brand faster,” Mitchell said.

Rua’s directors say the company will develop its product range more quickly, which will allow faster access into global markets and generate more revenue sooner in a way that is both capital efficient and cost effective.

Rua listed in late 2020 at 70c and the share price spent most of last year around 40c, but it has risen recently above 50c.

You’re fully informed

or you’re not - the choice is yours.

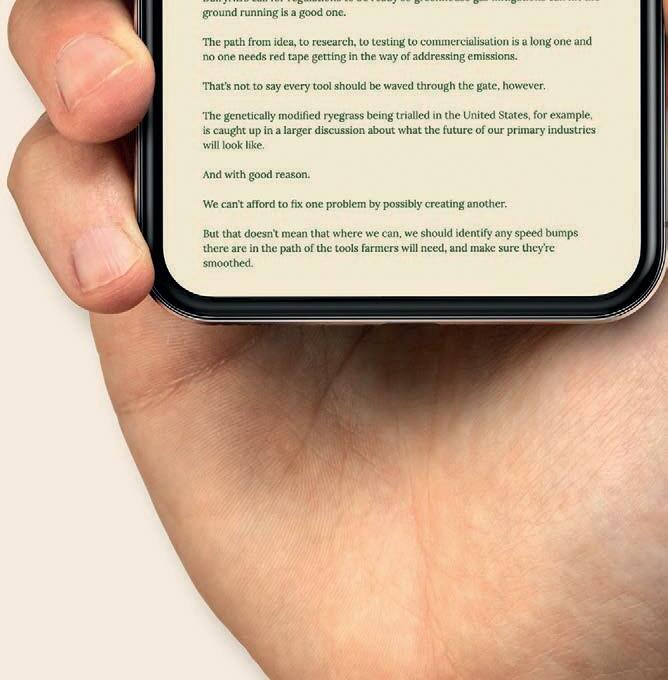

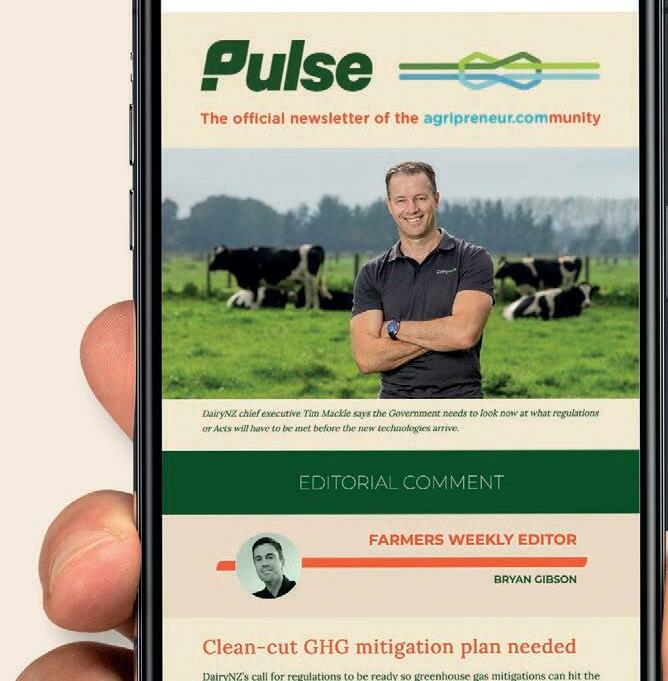

Pulse is the daily newsletter for those who choose to be fully informed on primary sector news, weather and insights. There’s also a weekly poll and quiz, valuable analysis, and a healthy diversity of opinion. Pulse is produced for you Monday - Friday by the combined newsroom resources of Farmers Weekly + AgriHQ + WeatherWatch and partners.

Choose to be fully informed. Subscribe now.

Subscribe online: www.agripreneur.com/pulse Multi-user and corporate rates: POA For more information: Email: belong@agripreneur.com Or freephone 0800 85 25 80 Scan the QR code to view a sample

News A2 Milk speculation abounds

Hugh Stringleman hugh.stringleman@globalhq.co.nz

CONTRADICTORY speculations about a2 Milk Company (ATM) have caused more sharp movements in its share price a month ahead of its interim results presentation in late February for the 2022 financial year.

An Australian newspaper report of a rumour that Canadian dairy giant Saputo might consider purchasing a2 Milk added 6% or 34c to the NZX share price.

But that movement only recovered a 5% loss on news of a falling birth rate in China, and presumed decline in need for infant formula, published a few days earlier.

Dairy industry analysts in Australia could think of no good reasons why Saputo, which already owns Murray Goulburn, would want to spend $4 billion or more on a2 Milk.

All share price movements of recent weeks and months come into the category of bumping along the bottom since last May after the repeated disclosures of a2 Milk’s market problems.

In August 2020, the ATM share price peaked at $21.50 before the first of the company’s four earnings downgrades caused by covid-19 disruption to its principal daigou distribution channel into China.

Daigou means NZ-made canned infant formula bought off the shelves here and in Australia and couriered to China to fulfil private internet ordering.

Not only did covid reduce the numbers of expatriate traders, but courier costs rose and price margins shrank, while Chinese authorities introduced import regulations aimed at boosting sales of local alternatives.

As highlighted in the blizzard of statistics ATM releases on reporting days, analysts and investors will expect some improvements in sales revenue and gross margins, but nothing like the heady days of runaway growth pre-covid.

Its sales revenue dropped from $1.7b to $1.2b last financial year and the company says it will take five years to rebuild to $2b.

It is ironic that ATM’s figures would be considered good for any other listed primary sector company, but not for the market darling in hard times.

Which is why ATM hovers in the $5 range and hasn’t fallen into the $3-range like a2 base formula supplier and part subsidiary Synlait.

Synlait has announced the effective appointments of founder John Penno moving from chief executive to chair of the board and of new chief executive Grant Watson, formerly of Miraka and Fonterra.

Both began their new roles on January 24 and Synlait will report interim results in late March.

When every other Australasian dairy company is cresting the wave of high world commodity prices, a2 Milk and Synlait are going to be late to the party.

RIPPLE EFFECT: A newspaper report of a rumour that a Canadian dairy giant might consider purchasing a2 Milk added 6% to the NZX share price.

Commodity prices drive down farm sale numbers

LANDOWNERS wanting to capitalise on high commodity prices are likely to be behind a drop of almost 50% in farm sales for the three months ended December than for the same period a year before, Real Estate Institute of NZ rural spokesperson Brian Peacocke says.

REINZ data shows there were 293 farm sales for the three months, 256 fewer than the same three months in 2020, a fall of 46.6%.

He says logic would suggest that due to the strong dairy payout forecast for the 2021-22 season, and strong prices for beef, lamb and horticultural products, fewer rural properties have been available for sale, as landowners retained properties to capitalise on current returns.

“Nevertheless, the total volume of farm sales for the 2021 calendar year increased considerably from 2020, again reinforcing the strong demand for continuing investment in rural land, that in itself being a reflection of confidence in the agricultural sector,” Peacocke said.

There were 1831 farms sold in the year to December 2021, 235 more than were sold in the year to December 2020, with 84% more dairy farms, 23.1% less dairy support, 7% more grazing farms, 10% more finishing farms and 14.7% less arable farms sold over the same period.

There was a significant increase in the median price paid per hectare in the three months to December than the same period the year before, with the median for the three months in 2021 $37,980 compared to $27,320 in 2020, an increase of 39%.

Despite the confidence in the farm sector and corresponding high demand, other factors are balancing that.

“While the banking sector is currently more amenable to backing soundly structured lending proposals, the inexorable grind of increasing costs, the shortage of quality labour and supply chain difficulties are well recognised constraints that continue to challenge the rural industry,” he said.

Rabobank appoints new research lead

RABOBANK has appointed Stefan Vogel to lead its food and agribusiness research division in New Zealand and Australia.

Vogel takes on the role after more than seven years with Rabobank in London, where he held two concurrent global positions with the bank – head of agri commodity markets research and global grains and oilseeds sector strategist.

Based in Sydney, Vogel will lead the NZ and Australian arm of the agribusiness bank’s highly-regarded global food and agricultural research division RaboResearch, which includes 10 analysts.

Rabobank NZ chief executive Todd Charteris said Vogel brought a wealth of knowledge and experience in the global food and agricultural industries to his new role.

“We’re very fortunate to have Stefan heading up our RaboResearch team as he brings with him an international perspective, as well as a proven track record of leading teams to deliver valuable, business-focused sector and commodity research for clients around the world,” Charteris said.

“In his new role, Stefan will oversee the bank’s research agenda and support the RaboResearch team in New Zealand and Australia as they provide market-leading knowledge and insights to our rural and wholesale clients in the region.”

Vogel takes over from Tim Hunt, who left the bank last year.

Prior to joining Rabobank, Vogel worked for more than a decade in strategy and market research positions with international agribusiness Archer Daniels Midland.